Key Insights

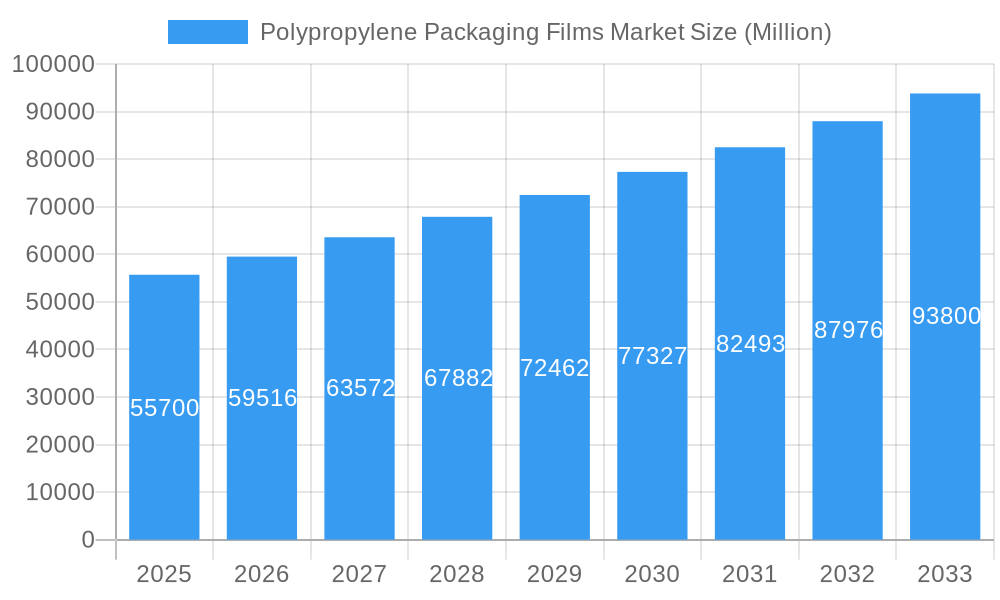

The global Polypropylene Packaging Films market is projected to reach 33.69 billion by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 4.69%. This growth is driven by the increasing demand for flexible, durable, and cost-effective packaging solutions across various end-use industries, including food & beverage, pharmaceuticals, and consumer goods. Enhanced product protection, extended shelf-life, and advanced barrier properties of polypropylene films are key factors propelling market expansion. Innovations in film technology and customization for specific applications further contribute to the market's upward trajectory.

Polypropylene Packaging Films Market Market Size (In Billion)

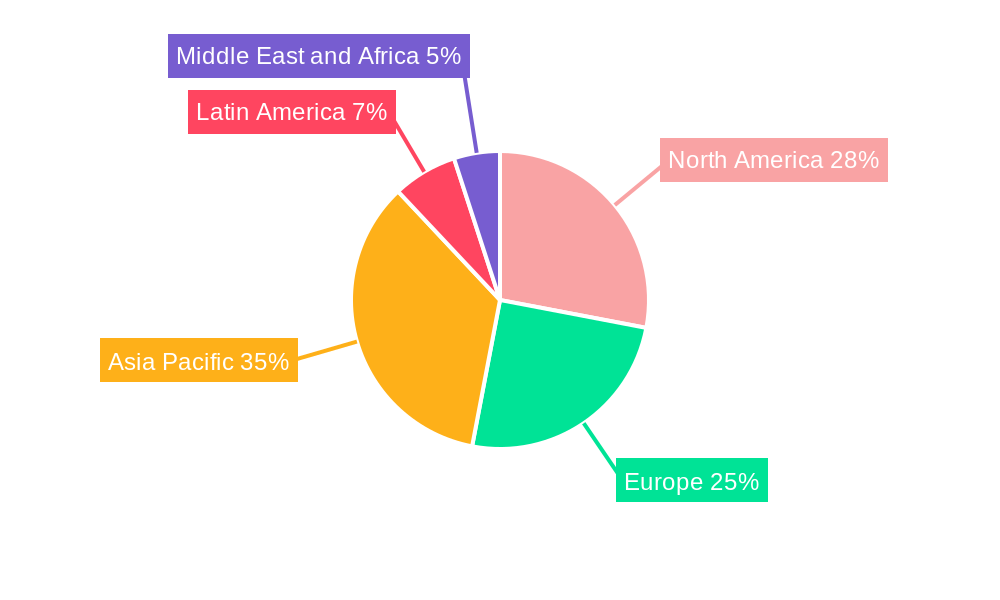

Evolving consumer preferences, including the surge in e-commerce and the demand for visually appealing packaging, coupled with stringent regulatory requirements, are shaping market dynamics. The pharmaceutical and healthcare sectors are significant contributors, requiring sterile and tamper-evident packaging. While raw material price volatility and environmental concerns present challenges, advancements in recyclable and biodegradable polypropylene films are mitigating these issues. The Asia Pacific region is expected to lead growth, supported by industrialization and a growing middle class, while North America and Europe remain key markets due to established demand and technological sophistication.

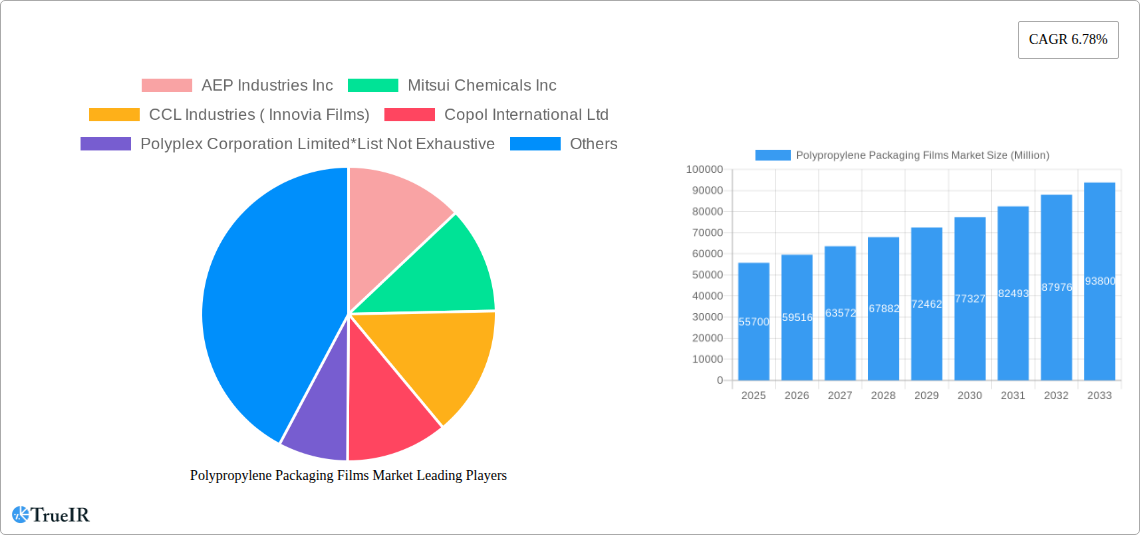

Polypropylene Packaging Films Market Company Market Share

Global Polypropylene Packaging Films Market: Analysis and Forecast (2019-2033)

This comprehensive report offers an SEO-optimized analysis of the global Polypropylene Packaging Films Market, providing stakeholders with insights into market structure, key trends, dominant segments, and future opportunities. Utilizing high-volume keywords, this report targets industry professionals, market researchers, and investors, delivering granular data on market dynamics, competitive landscapes, and technological advancements. The study covers the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, building upon historical data from 2019 to 2024. The market size is anticipated to reach 33.69 billion by 2033, with a CAGR of 4.69% during the forecast period.

Polypropylene Packaging Films Market Market Structure & Competitive Landscape

The Polypropylene Packaging Films Market is characterized by a moderately concentrated to fragmented structure, with key players investing heavily in innovation and capacity expansion. The market concentration ratio for the top 5 players is estimated at XX%. Innovation drivers include the development of advanced films with enhanced barrier properties, improved sustainability, and cost-effectiveness. Regulatory impacts, particularly concerning single-use plastics and recyclability, are increasingly influencing product development and market strategies. Product substitutes, such as polyethylene and other flexible packaging materials, pose a competitive challenge, but the unique properties of polypropylene – its strength, clarity, and heat resistance – maintain its competitive edge. End-user segmentation is diverse, with the food and beverage sector dominating consumption, followed by pharmaceuticals and industrial applications. Mergers and Acquisitions (M&A) trends are evident, with XX significant M&A deals valued at over $XX Billion recorded in the historical period, aimed at consolidating market share, expanding geographical reach, and acquiring innovative technologies. The industry is actively pursuing sustainability initiatives, leading to the development of recyclable and compostable polypropylene films.

Polypropylene Packaging Films Market Market Trends & Opportunities

The Polypropylene Packaging Films Market is poised for substantial growth, driven by a confluence of evolving consumer preferences, technological advancements, and expanding application areas. The global market size is projected to grow from an estimated $XX Billion in 2025 to $XX Billion by 2033, at a CAGR of XX%. Technological shifts are central to this expansion, with continuous innovations in film manufacturing processes, such as biaxial orientation (BOPP and CPP films), leading to superior mechanical properties, enhanced clarity, and improved barrier performance. These advancements cater to the growing demand for high-performance packaging solutions across various industries.

Consumer preferences are increasingly leaning towards convenient, safe, and sustainable packaging. This trend is a significant opportunity for polypropylene films, which offer excellent product protection, extended shelf life for food products, and are increasingly being engineered for recyclability and mono-material solutions. The rise of e-commerce and the corresponding growth in the logistics and shipping sectors also present a robust demand for durable and protective packaging films.

Competitive dynamics are intensifying, with manufacturers focusing on product differentiation through specialized films for niche applications. The development of high-barrier films, anti-fog properties, and printability enhancements are key areas of competition. Furthermore, the push towards a circular economy is creating opportunities for the development and adoption of recycled and bio-based polypropylene films, aligning with environmental regulations and consumer eco-consciousness. The market penetration rate for polypropylene packaging films in critical sectors like food and beverage packaging is already high, signifying an opportunity for value-added products and sustainable alternatives to further capture market share.

Dominant Markets & Segments in Polypropylene Packaging Films Market

The Food and Beverage segment stands as the dominant force within the Polypropylene Packaging Films Market, driven by the essential need for product preservation, extended shelf life, and attractive consumer presentation. This segment's market share is estimated at XX% of the total market value. Within this segment, both BOPP (Biaxially Oriented Polypropylene) and CPP (Cast Polypropylene) films play crucial roles. BOPP films are widely utilized for their excellent tensile strength, clarity, and printability, making them ideal for snack food wrappers, confectionery packaging, and dry goods. CPP films, on the other hand, are preferred for their superior heat sealability, flexibility, and moisture barrier properties, finding extensive application in lamination for frozen food packaging, retort pouches, and tea bags.

Geographically, Asia Pacific is the leading region, accounting for approximately XX% of the global Polypropylene Packaging Films Market. This dominance is attributed to rapid industrialization, a burgeoning middle class with increasing disposable income, and a large, growing food and beverage industry in countries like China and India. Government initiatives promoting manufacturing and export, coupled with expanding retail infrastructure, further bolster demand.

The Pharmaceutical and Healthcare segment represents another significant and growing application. The demand for sterile, tamper-evident, and protective packaging for medicines, medical devices, and diagnostic kits is substantial. Polypropylene's chemical resistance and barrier properties are highly valued in this sector.

The Industrial segment, encompassing applications such as tapes, labels, and protective wraps, also contributes significantly to market growth. Increasing infrastructure development and manufacturing activities globally fuel the demand for industrial packaging solutions.

Key Growth Drivers in Dominant Segments:

- Food & Beverage: Growing global population, demand for convenience foods, and stringent food safety regulations.

- Pharmaceutical & Healthcare: Aging population, increased healthcare spending, and the need for secure and traceable pharmaceutical packaging.

- Industrial: Global manufacturing output, construction projects, and the expansion of logistics and supply chains.

Polypropylene Packaging Films Market Product Analysis

Product innovations in the Polypropylene Packaging Films Market are primarily focused on enhancing performance, sustainability, and application versatility. Key advancements include the development of high-barrier films that significantly extend product shelf life by preventing oxygen and moisture ingress, thereby reducing food waste. Innovations in printability are enabling more vibrant and appealing packaging designs, crucial for consumer engagement. Furthermore, the industry is witnessing a strong push towards recyclable and mono-material solutions, addressing growing environmental concerns and regulatory pressures. For instance, films designed for recyclability or those incorporating recycled content are gaining traction. Competitive advantages are being built on superior mechanical strength, excellent clarity, heat sealability, and tailored barrier properties for specific applications, allowing manufacturers to meet the evolving demands of the food, beverage, pharmaceutical, and industrial sectors.

Key Drivers, Barriers & Challenges in Polypropylene Packaging Films Market

Key Drivers:

- Growing Demand from Food & Beverage Industry: Essential for product preservation, shelf-life extension, and consumer appeal.

- Technological Advancements: Development of high-barrier, sustainable, and printable films.

- Rising E-commerce Penetration: Increased demand for durable and protective packaging for logistics.

- Increasing Healthcare Spending: Need for sterile and secure pharmaceutical and medical packaging.

- Sustainability Initiatives: Development of recyclable and mono-material solutions to meet environmental regulations and consumer preferences.

Barriers & Challenges:

- Environmental Regulations: Increasing scrutiny and potential bans on single-use plastics, driving the need for alternative materials or enhanced recyclability.

- Fluctuating Raw Material Prices: Volatility in the price of polypropylene resin, impacting production costs and profit margins.

- Competition from Substitutes: Pressure from alternative packaging materials like polyethylene and paper-based solutions.

- Supply Chain Disruptions: Global supply chain vulnerabilities can lead to material shortages and increased lead times.

- Capital Investment: Significant investment required for advanced manufacturing technologies and R&D for sustainable solutions.

Growth Drivers in the Polypropylene Packaging Films Market Market

The Polypropylene Packaging Films Market is propelled by several interconnected growth drivers. The insatiable demand from the food and beverage sector, driven by population growth and evolving consumer lifestyles, remains a primary catalyst. Technologically, continuous innovation in film properties, such as enhanced barrier capabilities to combat spoilage and extend shelf life, coupled with improved printability for aesthetic appeal, are crucial. The e-commerce boom necessitates robust, lightweight, and protective packaging, a role polypropylene films excel at. Furthermore, the pharmaceutical and healthcare industries rely on polypropylene for its inertness and protective qualities. Increasingly, the global push towards sustainability is driving the development and adoption of recyclable and mono-material polypropylene films, aligning with stringent environmental regulations and consumer demand for eco-friendly packaging. Government policies supporting responsible waste management and circular economy principles are also indirectly fostering growth.

Challenges Impacting Polypropylene Packaging Films Market Growth

Despite robust growth prospects, the Polypropylene Packaging Films Market faces significant challenges. Environmental concerns and regulatory pressures surrounding plastic waste and single-use plastics are the most prominent hurdles, leading to potential restrictions and a demand for biodegradable or easily recyclable alternatives. Fluctuations in the prices of crude oil and natural gas, the primary feedstocks for polypropylene production, can lead to significant cost volatility, impacting profitability. Intense competition from substitute materials, including polyethylene films, paper-based packaging, and emerging bioplastics, necessitates continuous innovation and cost optimization. Global supply chain disruptions, exacerbated by geopolitical events and logistical complexities, can lead to raw material shortages and increased lead times, impacting production schedules and customer delivery. Finally, the substantial capital investment required for upgrading manufacturing facilities to produce advanced, sustainable films presents a barrier to entry and expansion for smaller players.

Key Players Shaping the Polypropylene Packaging Films Market Market

- AEP Industries Inc

- Mitsui Chemicals Inc

- CCL Industries (Innovia Films)

- Copol International Ltd

- Polyplex Corporation Limited

- SRF Limited

- Dupont Teijin Films

- Amcor PLC

- RKW Group

- ProAmpac LLC

- Berry Global Inc

- Cosmo Films Ltd

- Jindal Poly Films Ltd

- Taghleef Industries LLC

- Novolex Holding LLC

- UFlex Limited

Significant Polypropylene Packaging Films Market Industry Milestones

- August 2021: RKW Agri launched Polydress® FarmGuard, a next-generation e7 silage barrier film offering superior oxygen barrier, easier handling, and built-in sustainability, eliminating the need for vacuum film.

- December 2020: Cosmo Films developed TeploR, a novel transparent printable bi-axially oriented polypropylene (BOPP) film with increased heat resistance, designed as a printing layer for mono-material constructions.

Future Outlook for Polypropylene Packaging Films Market Market

The future outlook for the Polypropylene Packaging Films Market remains highly promising, driven by continued innovation and a growing demand for advanced packaging solutions. Strategic opportunities lie in the development and scaling of truly circular economy-compatible films, including those with enhanced recyclability and a higher percentage of post-consumer recycled content. The increasing focus on high-barrier properties for food preservation and extended shelf life will continue to be a significant market differentiator. Expansion into emerging markets, particularly in Asia and Africa, fueled by rapid economic development and a growing middle class, presents substantial growth potential. Furthermore, the pharmaceutical and medical sectors, with their stringent packaging requirements, will offer sustained demand for specialized polypropylene films. The market is poised to benefit from advancements in film manufacturing technologies that improve efficiency, reduce environmental impact, and enable the creation of sophisticated, multi-functional packaging.

Polypropylene Packaging Films Market Segmentation

-

1. Type

- 1.1. BOPP

- 1.2. CPP

-

2. Application

- 2.1. Food

- 2.2. Beverage

- 2.3. Pharmaceutical and Healthcare

- 2.4. Industrial

- 2.5. Other Applications

Polypropylene Packaging Films Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kindom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Polypropylene Packaging Films Market Regional Market Share

Geographic Coverage of Polypropylene Packaging Films Market

Polypropylene Packaging Films Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.69% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand of Cost-effective Packaging Formats; Environmental Regulation Paving Way for Flexible Packaging Requirements; Growth in Packaged Food Markets

- 3.3. Market Restrains

- 3.3.1. Fluctuation in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. BOPP is One of the Factor Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Polypropylene Packaging Films Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. BOPP

- 5.1.2. CPP

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.3. Pharmaceutical and Healthcare

- 5.2.4. Industrial

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Polypropylene Packaging Films Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. BOPP

- 6.1.2. CPP

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food

- 6.2.2. Beverage

- 6.2.3. Pharmaceutical and Healthcare

- 6.2.4. Industrial

- 6.2.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Polypropylene Packaging Films Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. BOPP

- 7.1.2. CPP

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food

- 7.2.2. Beverage

- 7.2.3. Pharmaceutical and Healthcare

- 7.2.4. Industrial

- 7.2.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Polypropylene Packaging Films Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. BOPP

- 8.1.2. CPP

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food

- 8.2.2. Beverage

- 8.2.3. Pharmaceutical and Healthcare

- 8.2.4. Industrial

- 8.2.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Polypropylene Packaging Films Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. BOPP

- 9.1.2. CPP

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Food

- 9.2.2. Beverage

- 9.2.3. Pharmaceutical and Healthcare

- 9.2.4. Industrial

- 9.2.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Polypropylene Packaging Films Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. BOPP

- 10.1.2. CPP

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Food

- 10.2.2. Beverage

- 10.2.3. Pharmaceutical and Healthcare

- 10.2.4. Industrial

- 10.2.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 AEP Industries Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Mitsui Chemicals Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CCL Industries ( Innovia Films)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Copol International Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Polyplex Corporation Limited*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SRF Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dupont Teijin Films

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Amcor PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 RKW Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ProAmpac LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Berry Global Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Cosmo Films Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Jindal Poly Films Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Taghleef Industries LLC

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Novolex Holding LLC

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 UFlex Limited

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 AEP Industries Inc

List of Figures

- Figure 1: Global Polypropylene Packaging Films Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Polypropylene Packaging Films Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Polypropylene Packaging Films Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Polypropylene Packaging Films Market Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Polypropylene Packaging Films Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Polypropylene Packaging Films Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Polypropylene Packaging Films Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Polypropylene Packaging Films Market Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Polypropylene Packaging Films Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Polypropylene Packaging Films Market Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Polypropylene Packaging Films Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Polypropylene Packaging Films Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Polypropylene Packaging Films Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Polypropylene Packaging Films Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Polypropylene Packaging Films Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Polypropylene Packaging Films Market Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific Polypropylene Packaging Films Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Polypropylene Packaging Films Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Polypropylene Packaging Films Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Polypropylene Packaging Films Market Revenue (billion), by Type 2025 & 2033

- Figure 21: Latin America Polypropylene Packaging Films Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Polypropylene Packaging Films Market Revenue (billion), by Application 2025 & 2033

- Figure 23: Latin America Polypropylene Packaging Films Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Latin America Polypropylene Packaging Films Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Polypropylene Packaging Films Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Polypropylene Packaging Films Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East and Africa Polypropylene Packaging Films Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Polypropylene Packaging Films Market Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East and Africa Polypropylene Packaging Films Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Polypropylene Packaging Films Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Polypropylene Packaging Films Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Polypropylene Packaging Films Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Polypropylene Packaging Films Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Polypropylene Packaging Films Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Polypropylene Packaging Films Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Polypropylene Packaging Films Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Polypropylene Packaging Films Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Polypropylene Packaging Films Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Polypropylene Packaging Films Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global Polypropylene Packaging Films Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Global Polypropylene Packaging Films Market Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global Polypropylene Packaging Films Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United Kindom Polypropylene Packaging Films Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Germany Polypropylene Packaging Films Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France Polypropylene Packaging Films Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Polypropylene Packaging Films Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Polypropylene Packaging Films Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Polypropylene Packaging Films Market Revenue billion Forecast, by Application 2020 & 2033

- Table 18: Global Polypropylene Packaging Films Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: China Polypropylene Packaging Films Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: India Polypropylene Packaging Films Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Japan Polypropylene Packaging Films Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Polypropylene Packaging Films Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Global Polypropylene Packaging Films Market Revenue billion Forecast, by Type 2020 & 2033

- Table 24: Global Polypropylene Packaging Films Market Revenue billion Forecast, by Application 2020 & 2033

- Table 25: Global Polypropylene Packaging Films Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Global Polypropylene Packaging Films Market Revenue billion Forecast, by Type 2020 & 2033

- Table 27: Global Polypropylene Packaging Films Market Revenue billion Forecast, by Application 2020 & 2033

- Table 28: Global Polypropylene Packaging Films Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Polypropylene Packaging Films Market?

The projected CAGR is approximately 4.69%.

2. Which companies are prominent players in the Polypropylene Packaging Films Market?

Key companies in the market include AEP Industries Inc, Mitsui Chemicals Inc, CCL Industries ( Innovia Films), Copol International Ltd, Polyplex Corporation Limited*List Not Exhaustive, SRF Limited, Dupont Teijin Films, Amcor PLC, RKW Group, ProAmpac LLC, Berry Global Inc, Cosmo Films Ltd, Jindal Poly Films Ltd, Taghleef Industries LLC, Novolex Holding LLC, UFlex Limited.

3. What are the main segments of the Polypropylene Packaging Films Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 33.69 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand of Cost-effective Packaging Formats; Environmental Regulation Paving Way for Flexible Packaging Requirements; Growth in Packaged Food Markets.

6. What are the notable trends driving market growth?

BOPP is One of the Factor Driving the Market.

7. Are there any restraints impacting market growth?

Fluctuation in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

August 2021 - Polydress® FarmGuard, a next-generation e7 silage barrier film from RKW Agri, offers a significantly better oxygen barrier to protect silage and easier handling, among other benefits. There's no need for a vacuum film anymore, which saves farmers time, labor, and money while minimizing waste. All of this implies that sustainability is built-in.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Polypropylene Packaging Films Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Polypropylene Packaging Films Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Polypropylene Packaging Films Market?

To stay informed about further developments, trends, and reports in the Polypropylene Packaging Films Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence