Key Insights

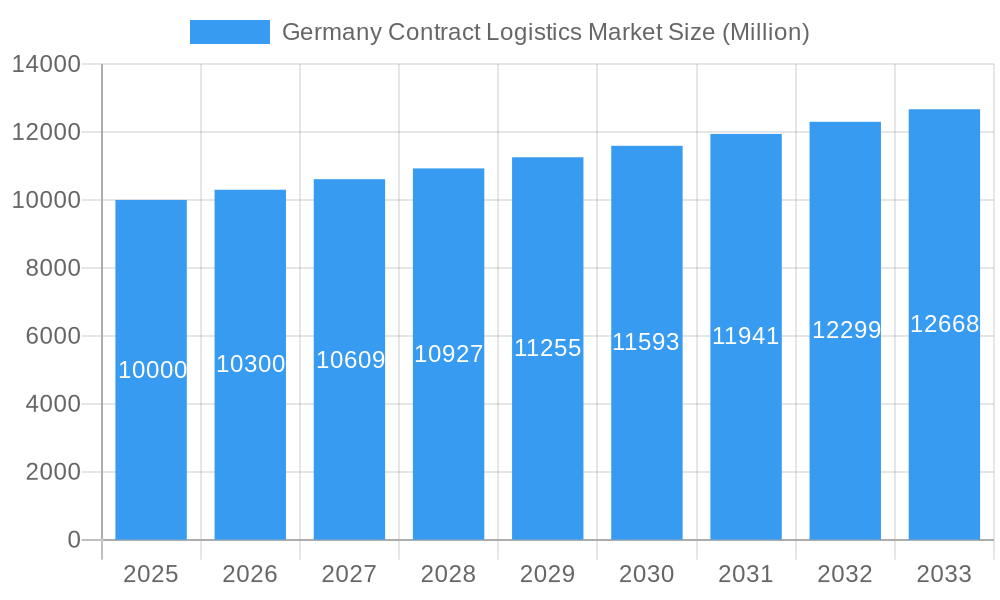

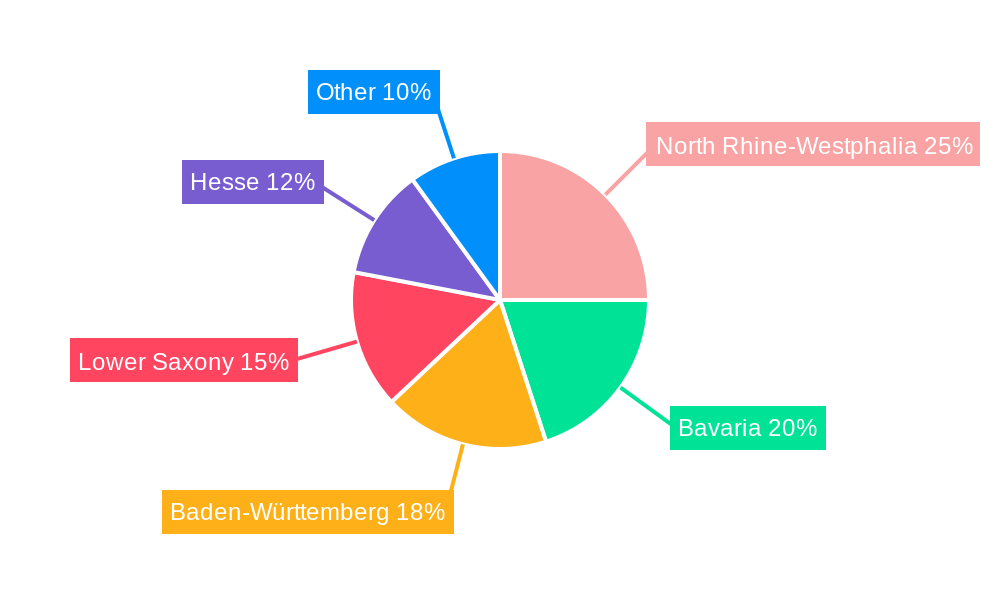

The German contract logistics market is poised for significant expansion, driven by a robust compound annual growth rate (CAGR) exceeding 3%. This growth is underpinned by Germany's strong manufacturing foundation, particularly within the automotive, industrial & aerospace, and technology industries. Surging e-commerce adoption across the consumer & retail sector further intensifies demand for advanced warehousing, transportation, and value-added logistics solutions. While in-house logistics operations maintain a substantial presence, the outsourced segment is experiencing rapid growth, propelled by cost-efficiency imperatives and the growing need for specialized logistical expertise among businesses. Key logistics hubs are concentrated in regions such as North Rhine-Westphalia, Bavaria, and Baden-Württemberg, highlighting the market's regional distribution. Leading industry players, including DB Schenker and DHL, are leveraging their extensive networks and technological innovations to capitalize on this dynamic market. However, potential market restraints include volatile fuel prices and persistent labor shortages. Despite these challenges, the long-term outlook remains highly positive, with sustained growth anticipated throughout the forecast period (2025-2033), fueled by advancements in automation and the increasing emphasis on supply chain resilience.

Germany Contract Logistics Market Market Size (In Billion)

Market segmentation reveals the sector's inherent diversity. While the automotive industry continues to be a primary driver, the expanding technology and healthcare sectors are generating new avenues for contract logistics providers. The increasing integration of sophisticated logistics management systems and supply chain visibility tools is also contributing to the upward growth trajectory. Businesses are prioritizing enhanced supply chain agility and resilience, particularly in response to global economic uncertainties. This strategic focus underscores the critical importance of forging partnerships with dependable contract logistics providers. The overall market size is estimated to be substantial, reflecting the robust growth rate and the presence of major global players. Future market expansion will hinge on effectively addressing current challenges, embracing technological innovation, and capitalizing on growth opportunities across diverse industrial verticals.

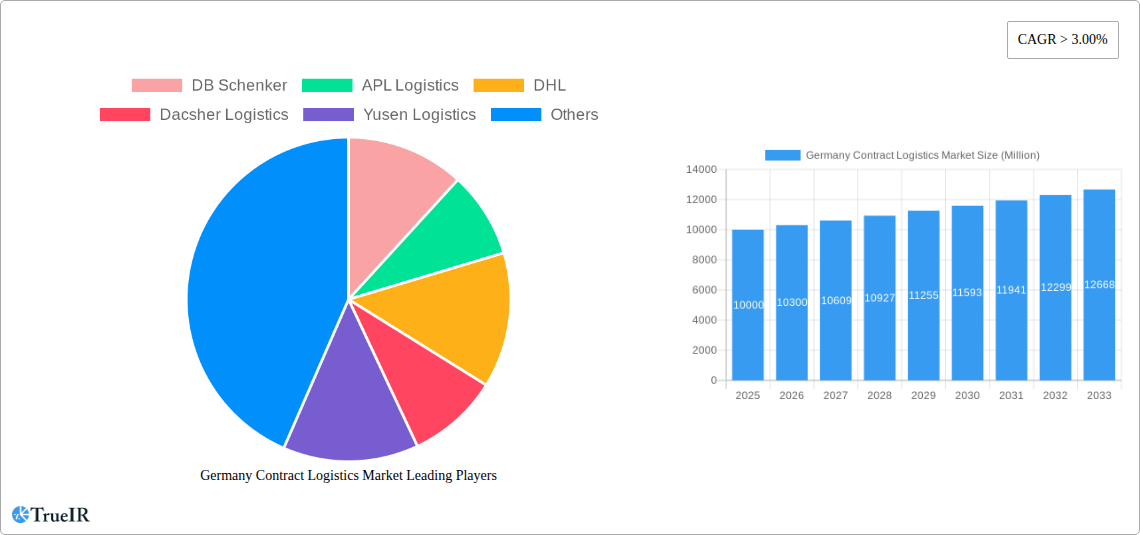

Germany Contract Logistics Market Company Market Share

Germany Contract Logistics Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Germany contract logistics market, offering invaluable insights for businesses, investors, and stakeholders seeking to understand this dynamic sector. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033, this report delivers a detailed examination of market size, trends, competitive landscapes, and future growth potential. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Germany Contract Logistics Market Structure & Competitive Landscape

The German contract logistics market is characterized by a moderately concentrated landscape, with several major players holding significant market share. Key players include DB Schenker, DHL, APL Logistics, Dacsher Logistics, Yusen Logistics, Hellman Worldwide Logistics, CEVA Logistics, BLG Logistics, Feige, and Agility Logistics. However, the market also accommodates numerous smaller, specialized providers. The Herfindahl-Hirschman Index (HHI) for the market is estimated at xx, indicating a moderately consolidated structure.

Innovation drivers within the market include advancements in automation, digitalization (including AI and IoT), and the increasing adoption of sustainable logistics practices. Stringent regulatory frameworks, encompassing environmental regulations and data privacy laws, significantly influence market operations. Product substitution is evident through the rise of alternative transportation modes and fulfillment solutions. End-user segmentation reveals significant demand from the automotive, consumer & retail, and industrial & aerospace sectors. The market has also witnessed several notable M&A activities in recent years, with a total transaction value of approximately xx Million during the historical period (2019-2024). This consolidation is expected to continue, driven by economies of scale and the need for enhanced service offerings.

Germany Contract Logistics Market Market Trends & Opportunities

The German contract logistics market is experiencing robust growth, driven by several key factors. E-commerce expansion continues to fuel demand for efficient warehousing, last-mile delivery, and supply chain management solutions. The increasing adoption of omnichannel strategies by businesses is further driving market growth. Technological advancements, such as automation, AI, and blockchain, are revolutionizing logistics operations, boosting efficiency and transparency. Changing consumer preferences, particularly a preference for faster and more convenient delivery options, are pushing logistics providers to adopt innovative solutions. Intense competition among market players is leading to price optimization and the development of value-added services. The market exhibits a high level of penetration in urban areas and is witnessing increasing penetration in rural regions.

Dominant Markets & Segments in Germany Contract Logistics Market

Within the German contract logistics market, the Outsourced segment dominates the market by type, accounting for approximately xx% of the total market value in 2025. This is primarily driven by the increasing outsourcing trend among businesses seeking to reduce operational complexities and leverage specialized expertise. Among end-users, the Automotive sector is the leading segment, accounting for approximately xx% of the total market share in 2025. This is due to the high volume of logistics required for the automotive industry's complex supply chains.

Key Growth Drivers for Outsourced Segment:

- Cost reduction through specialization.

- Access to advanced technologies and expertise.

- Improved scalability and flexibility.

Key Growth Drivers for Automotive Segment:

- Robust domestic automotive production.

- Growth in the automotive export market.

- Stringent supply chain requirements in the automotive sector.

- Development of advanced logistics infrastructure to support automotive needs.

The Industrial & Aerospace and Consumer & Retail segments also show significant growth potential. The geographical distribution of the market reveals a relatively even distribution across major regions within Germany, with no single region exhibiting overwhelming dominance.

Germany Contract Logistics Market Product Analysis

Product innovation in the German contract logistics market focuses on enhancing efficiency, transparency, and sustainability. This includes the implementation of advanced warehouse management systems (WMS), transportation management systems (TMS), and the use of robotics and automation in warehousing and transportation. The focus on providing end-to-end supply chain visibility through real-time tracking and data analytics is another key product innovation. These advancements deliver improved cost optimization, enhanced supply chain resilience, and increased customer satisfaction. The market fit of these innovations is excellent, aligning with the industry’s ongoing demand for better efficiency and transparency.

Key Drivers, Barriers & Challenges in Germany Contract Logistics Market

Key Drivers: The increasing adoption of e-commerce, advancements in automation and digitalization, and government initiatives promoting sustainable logistics are driving market growth. The robust German manufacturing sector and its extensive export activity also significantly contribute to the market's expansion.

Key Challenges: Regulatory complexities surrounding environmental regulations and data protection present challenges. Supply chain disruptions, particularly those experienced in recent years, have highlighted the need for more resilient supply chain networks. Intense competition necessitates continuous innovation and cost optimization for businesses to maintain competitiveness. Labor shortages in the logistics sector and rising fuel costs also impact the market.

Growth Drivers in the Germany Contract Logistics Market Market

Growth is fueled by e-commerce expansion, automation and digitalization, government support for sustainable logistics, and the strength of the German manufacturing and export sectors. These factors stimulate demand for efficient and innovative logistics solutions.

Challenges Impacting Germany Contract Logistics Market Growth

Regulatory hurdles, supply chain vulnerability, and competition pressure are key challenges. Labor shortages and rising fuel costs also pose significant obstacles. Overcoming these challenges requires investment in technology, skilled workforce development, and strategic partnerships.

Key Players Shaping the Germany Contract Logistics Market Market

- DB Schenker

- APL Logistics

- DHL

- Dacsher Logistics

- Yusen Logistics

- Hellman Worldwide Logistics

- CEVA Logistics

- BLG Logistics

- Feige

- Agility Logistics

Significant Germany Contract Logistics Market Industry Milestones

- 2021 Q3: DHL announced a significant investment in automated warehousing technology.

- 2022 Q1: DB Schenker partnered with a technology provider to implement AI-powered route optimization.

- 2023 Q2: A merger between two smaller contract logistics providers led to increased market consolidation.

- 2024 Q4: Several major players announced initiatives to improve their sustainability practices. (Specific examples would need to be researched for accuracy)

Future Outlook for Germany Contract Logistics Market Market

The German contract logistics market is poised for continued growth, driven by technological advancements, e-commerce expansion, and a focus on sustainable practices. Strategic partnerships and acquisitions will play a significant role in shaping the market's future. Opportunities exist for providers that can offer innovative, efficient, and sustainable solutions tailored to the evolving needs of businesses operating in Germany's dynamic market.

Germany Contract Logistics Market Segmentation

-

1. Type

- 1.1. Insourced

- 1.2. Outsourced

-

2. End-User

- 2.1. Automotive

- 2.2. Consumer & Retail

- 2.3. Energy

- 2.4. Healthcare

- 2.5. Industrial & Aerospace

- 2.6. Technology

- 2.7. Other End Users

Germany Contract Logistics Market Segmentation By Geography

- 1. Germany

Germany Contract Logistics Market Regional Market Share

Geographic Coverage of Germany Contract Logistics Market

Germany Contract Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Trade Activities

- 3.3. Market Restrains

- 3.3.1. Truck Drivers Protest

- 3.4. Market Trends

- 3.4.1. Climate Protection and Green Logistics

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Contract Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Insourced

- 5.1.2. Outsourced

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Automotive

- 5.2.2. Consumer & Retail

- 5.2.3. Energy

- 5.2.4. Healthcare

- 5.2.5. Industrial & Aerospace

- 5.2.6. Technology

- 5.2.7. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 APL Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DHL

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dacsher Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Yusen Logistics

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hellman Worldwide Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CEVA Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BLG Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Feige

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Agility Logistics*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Germany Contract Logistics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Contract Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Contract Logistics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Germany Contract Logistics Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: Germany Contract Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Germany Contract Logistics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Germany Contract Logistics Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Germany Contract Logistics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Contract Logistics Market?

The projected CAGR is approximately 2.18%.

2. Which companies are prominent players in the Germany Contract Logistics Market?

Key companies in the market include DB Schenker, APL Logistics, DHL, Dacsher Logistics, Yusen Logistics, Hellman Worldwide Logistics, CEVA Logistics, BLG Logistics, Feige, Agility Logistics*List Not Exhaustive.

3. What are the main segments of the Germany Contract Logistics Market?

The market segments include Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 30.43 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Trade Activities.

6. What are the notable trends driving market growth?

Climate Protection and Green Logistics.

7. Are there any restraints impacting market growth?

Truck Drivers Protest.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Contract Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Contract Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Contract Logistics Market?

To stay informed about further developments, trends, and reports in the Germany Contract Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence