Key Insights

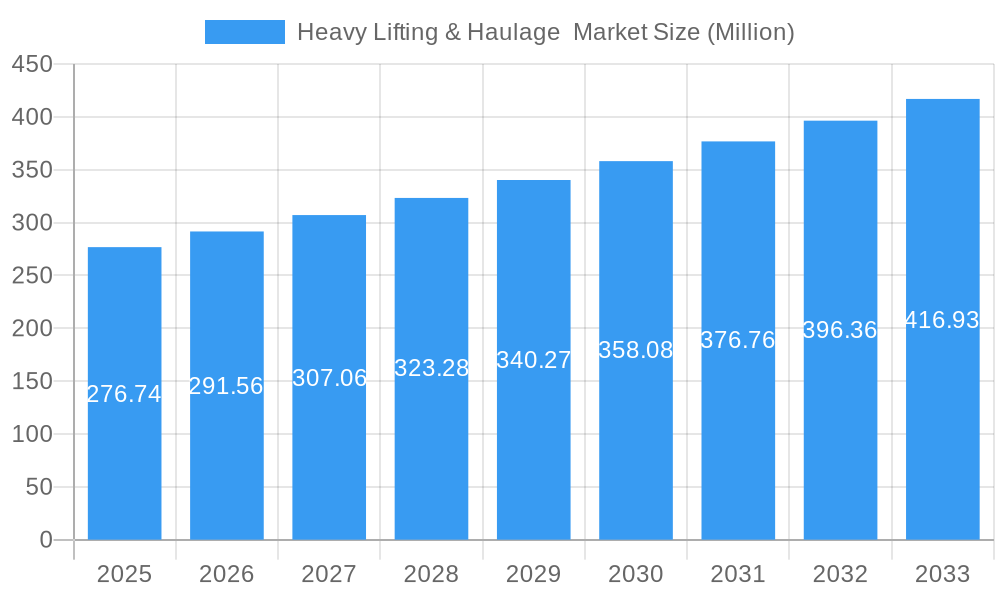

The global heavy lifting and haulage market is experiencing robust growth, projected to reach a substantial size, driven by several key factors. The market's Compound Annual Growth Rate (CAGR) of 5.17% from 2019 to 2024 indicates a steady upward trajectory. This growth is fueled by increasing infrastructure development globally, particularly in emerging economies experiencing rapid urbanization and industrialization. Expansion of renewable energy projects, necessitating the movement of heavy machinery and components, further contributes to market demand. Additionally, the growing demand for specialized heavy lifting equipment in sectors like oil & gas, mining, and construction fuels market expansion. The increasing complexity of projects and the need for efficient and safe heavy lifting solutions are driving innovation and technological advancements within the industry. This includes the development of more efficient cranes, specialized transport vehicles, and advanced lifting techniques.

Heavy Lifting & Haulage Market Market Size (In Million)

However, the market also faces certain challenges. Fluctuations in raw material prices and global economic uncertainties can impact project timelines and budgets, thus influencing market growth. Furthermore, stringent safety regulations and environmental concerns related to emissions and transportation logistics require companies to invest in advanced, environmentally friendly equipment and practices. The competitive landscape is dynamic, with established players such as Terex, Liebherr, and Mammoet competing alongside emerging companies, leading to price pressures and a focus on differentiated service offerings. Despite these challenges, the long-term outlook for the heavy lifting and haulage market remains positive, driven by ongoing infrastructure investment and technological advancements. The market's segmentation, while not explicitly defined, likely includes categories based on equipment type (cranes, heavy-duty vehicles), application (construction, energy), and geographic region. A thorough competitive analysis is critical for companies seeking to thrive in this expanding but competitive landscape.

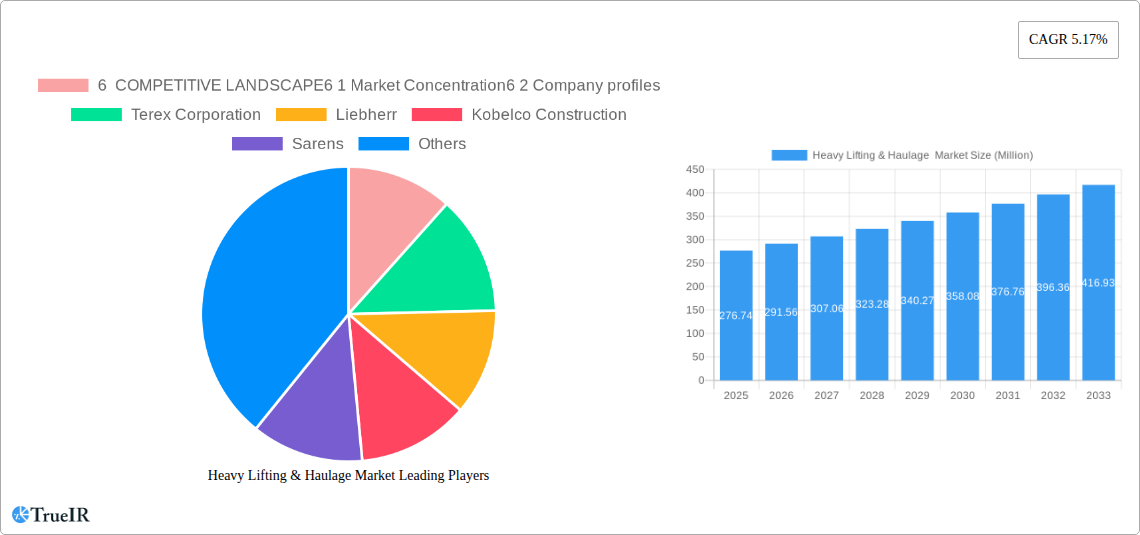

Heavy Lifting & Haulage Market Company Market Share

Heavy Lifting & Haulage Market Report: 2019-2033

This comprehensive report delivers a detailed analysis of the global Heavy Lifting & Haulage Market, providing invaluable insights for investors, industry professionals, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, competitive landscapes, and future growth trajectories. The report incorporates recent industry milestones, including key partnerships and product launches, to provide the most up-to-date view of this dynamic market.

Heavy Lifting & Haulage Market Structure & Competitive Landscape

The Heavy Lifting & Haulage market exhibits a moderately concentrated structure, with a Herfindahl-Hirschman Index (HHI) estimated at xx in 2025. This indicates the presence of several significant players alongside a number of smaller, specialized firms. Market concentration is influenced by factors such as economies of scale, technological advancements, and regulatory frameworks. Innovation plays a pivotal role, with companies continuously developing advanced lifting and haulage equipment incorporating automation, remote operation capabilities, and improved safety features. Regulatory compliance, particularly concerning safety and environmental standards, significantly impacts operational costs and market entry. Product substitution is limited due to the specialized nature of the equipment, although the increasing adoption of autonomous systems could lead to gradual substitution in certain segments.

The market is segmented by various end-users, including construction, mining, energy, and logistics. Mergers and acquisitions (M&A) activity has been moderate in recent years, with an estimated xx Million in M&A volume in 2024, driven primarily by strategic expansion and technological consolidation.

- Market Concentration: Moderately concentrated (HHI: xx in 2025)

- Innovation Drivers: Automation, remote operation, improved safety features

- Regulatory Impacts: Stringent safety and environmental regulations

- Product Substitutes: Limited, with potential for autonomous systems adoption

- End-User Segmentation: Construction, Mining, Energy, Logistics

- M&A Trends: Moderate activity, driven by strategic expansion and technological consolidation (xx Million in 2024)

Heavy Lifting & Haulage Market Market Trends & Opportunities

The global Heavy Lifting & Haulage market is experiencing a period of significant expansion, with an estimated market size reaching [Insert Market Size in Million] in 2025 and a projected Compound Annual Growth Rate (CAGR) of [Insert CAGR]% from 2025 to 2033. This robust growth is propelled by a confluence of factors: escalating infrastructure development across burgeoning economies, a sustained and increasing demand for specialized heavy lifting and haulage services within the pivotal energy and mining sectors, and continuous technological advancements that are consistently yielding enhanced operational efficiency and uncompromising safety standards. Market penetration rates exhibit considerable regional and end-user segment variability, with more advanced and established infrastructure in developed markets generally demonstrating higher adoption rates.

A discernible shift in consumer preferences is evident, with a growing emphasis on equipment that is not only highly efficient and exceptionally reliable but also at the forefront of technological innovation. This trend is directly stimulating the demand for cutting-edge autonomous and remotely operated systems, alongside equipment engineered for superior fuel efficiency and a minimized environmental footprint. The competitive landscape is defined by a dynamic interplay of established industry titans and agile, innovative startups. This intricate competitive environment is further sculpted by strategic alliances, collaborative technological ventures, and a relentless pursuit of product differentiation to capture market share.

Dominant Markets & Segments in Heavy Lifting & Haulage Market

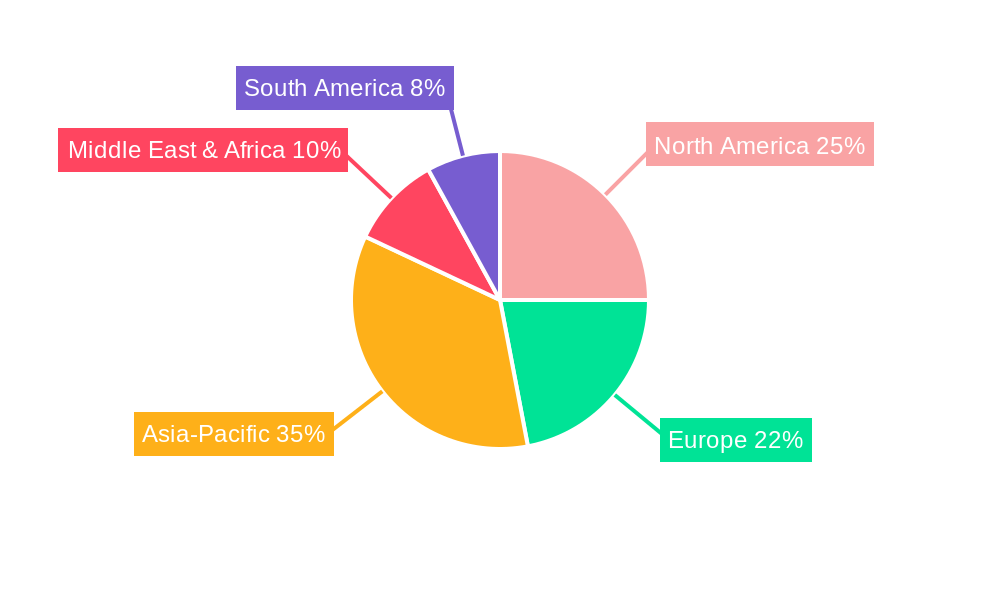

Currently, the North American market commands a leading position within the global Heavy Lifting & Haulage sector. This dominance is largely attributable to its extensive and ongoing infrastructure development initiatives, high levels of industrial activity, and substantial investments channeled into critical energy and mining projects.

-

Key Growth Drivers in North America:

- Comprehensive and ambitious infrastructure projects driving demand.

- Sustained high levels of industrial and manufacturing activity.

- Significant and ongoing investments in the energy and mining sectors.

- A supportive and favorable regulatory environment that facilitates business operations.

The construction segment is projected to emerge as the most dynamic and fastest-growing segment throughout the forecast period. This anticipated surge is directly linked to the escalating global construction activity, encompassing a wide array of infrastructure development projects such as highways, bridges, and commercial and residential buildings. The burgeoning demand for specialized heavy-duty cranes and bespoke lifting equipment further solidifies and propels the growth trajectory of this crucial segment.

Heavy Lifting & Haulage Market Product Analysis

Recent product innovations within the heavy lifting and haulage domain are strategically focused on augmenting efficiency, bolstering safety protocols, and advancing automation capabilities. The latest generation of cranes are engineered with significantly higher lifting capacities, enhanced maneuverability for complex operations, and sophisticated remote control functionalities. Concurrently, autonomous haulage solutions are rapidly gaining market traction, promising transformative improvements in both operational productivity and overall safety. The market fit for these advancements is exceptionally strong, directly addressing the escalating need for heightened efficiency and substantial reductions in operational costs across diverse heavy lifting and haulage applications.

Key Drivers, Barriers & Challenges in Heavy Lifting & Haulage Market

Key Drivers:

- The pervasive and increasing global infrastructure development initiatives.

- Continued robust growth in the energy and mining sectors.

- The relentless pace of technological advancements, particularly in automation and remote operation capabilities.

- Supportive government policies and initiatives that champion and facilitate infrastructure projects.

Key Challenges & Restraints:

- The substantial initial capital investment required for acquiring advanced and specialized equipment.

- Persistent supply chain disruptions that can impact equipment availability, lead times, and pricing dynamics.

- Stringent and evolving safety and environmental regulations, which can lead to increased operational overheads and compliance costs.

- Intense and multifaceted competition stemming from both well-established market players and agile new entrants.

Growth Drivers in the Heavy Lifting & Haulage Market Market

The key growth drivers for the heavy lifting and haulage market include robust infrastructure spending, particularly in developing nations. Technological innovations such as automation and remote operation are further boosting market growth. Stringent safety regulations are also indirectly fueling demand for more advanced and safer equipment.

Challenges Impacting Heavy Lifting & Haulage Market Growth

Challenges include the high capital expenditure required for equipment acquisition and maintenance. Supply chain disruptions, particularly in the procurement of specialized components, can significantly hamper market growth. Lastly, intense competition and evolving technological landscapes pose further challenges for players.

Key Players Shaping the Heavy Lifting & Haulage Market Market

- Terex Corporation

- Liebherr

- Kobelco Construction

- Sarens

- Mammoet

- Global Rigging & Transport

- HSC Cranes

- Volvo Construction

- XCMG Construction

- KATO

- Konecranes

- Other companies

Significant Heavy Lifting & Haulage Market Industry Milestones

- July 2024: Liebherr and Fortescue partnered to develop an Autonomous Haulage Solution, testing a fleet of autonomous trucks.

- June 2024: Terex launched the TRT 80 l rough terrain crane, highlighting its high lifting capacity and ease of transport.

Future Outlook for Heavy Lifting & Haulage Market Market

The Heavy Lifting & Haulage market is poised for continued growth, driven by ongoing infrastructure development, technological advancements, and increasing demand from various sectors. Strategic partnerships, investments in R&D, and expansion into new markets present significant opportunities for market players. The market's potential is substantial, particularly in emerging economies with rapidly expanding infrastructure needs.

Heavy Lifting & Haulage Market Segmentation

-

1. End User

- 1.1. Oil and Gas

- 1.2. Mining and Quarrying

- 1.3. Energy and Power

- 1.4. Construction

- 1.5. Manufacturing

- 1.6. Other End Users

Heavy Lifting & Haulage Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Singapore

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. South Africa

- 5.4. Egypt

- 5.5. Rest of Middle East and Africa

Heavy Lifting & Haulage Market Regional Market Share

Geographic Coverage of Heavy Lifting & Haulage Market

Heavy Lifting & Haulage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Infrastructure growth drives demand for heavy lift and haulage services4.; Industrial Growth Spurs Demand for Heavy Lift and Haulage Services

- 3.3. Market Restrains

- 3.3.1. 4.; Infrastructure growth drives demand for heavy lift and haulage services4.; Industrial Growth Spurs Demand for Heavy Lift and Haulage Services

- 3.4. Market Trends

- 3.4.1. Increased Demand From Energy and Power Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Heavy Lifting & Haulage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Oil and Gas

- 5.1.2. Mining and Quarrying

- 5.1.3. Energy and Power

- 5.1.4. Construction

- 5.1.5. Manufacturing

- 5.1.6. Other End Users

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. North America Heavy Lifting & Haulage Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Oil and Gas

- 6.1.2. Mining and Quarrying

- 6.1.3. Energy and Power

- 6.1.4. Construction

- 6.1.5. Manufacturing

- 6.1.6. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. Europe Heavy Lifting & Haulage Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Oil and Gas

- 7.1.2. Mining and Quarrying

- 7.1.3. Energy and Power

- 7.1.4. Construction

- 7.1.5. Manufacturing

- 7.1.6. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Asia Pacific Heavy Lifting & Haulage Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Oil and Gas

- 8.1.2. Mining and Quarrying

- 8.1.3. Energy and Power

- 8.1.4. Construction

- 8.1.5. Manufacturing

- 8.1.6. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. South America Heavy Lifting & Haulage Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Oil and Gas

- 9.1.2. Mining and Quarrying

- 9.1.3. Energy and Power

- 9.1.4. Construction

- 9.1.5. Manufacturing

- 9.1.6. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Middle East and Africa Heavy Lifting & Haulage Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User

- 10.1.1. Oil and Gas

- 10.1.2. Mining and Quarrying

- 10.1.3. Energy and Power

- 10.1.4. Construction

- 10.1.5. Manufacturing

- 10.1.6. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by End User

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 6 COMPETITIVE LANDSCAPE6 1 Market Concentration6 2 Company profiles

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Terex Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Liebherr

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kobelco Construction

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sarens

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mammoet

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Global Rigging & Transport

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 HSC Cranes

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Volvo Constructioon

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 XCMG Construction

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 KATO

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Konecranes**List Not Exhaustive 6 3 Other companie

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 6 COMPETITIVE LANDSCAPE6 1 Market Concentration6 2 Company profiles

List of Figures

- Figure 1: Global Heavy Lifting & Haulage Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Heavy Lifting & Haulage Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Heavy Lifting & Haulage Market Revenue (Million), by End User 2025 & 2033

- Figure 4: North America Heavy Lifting & Haulage Market Volume (Billion), by End User 2025 & 2033

- Figure 5: North America Heavy Lifting & Haulage Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Heavy Lifting & Haulage Market Volume Share (%), by End User 2025 & 2033

- Figure 7: North America Heavy Lifting & Haulage Market Revenue (Million), by Country 2025 & 2033

- Figure 8: North America Heavy Lifting & Haulage Market Volume (Billion), by Country 2025 & 2033

- Figure 9: North America Heavy Lifting & Haulage Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Heavy Lifting & Haulage Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Heavy Lifting & Haulage Market Revenue (Million), by End User 2025 & 2033

- Figure 12: Europe Heavy Lifting & Haulage Market Volume (Billion), by End User 2025 & 2033

- Figure 13: Europe Heavy Lifting & Haulage Market Revenue Share (%), by End User 2025 & 2033

- Figure 14: Europe Heavy Lifting & Haulage Market Volume Share (%), by End User 2025 & 2033

- Figure 15: Europe Heavy Lifting & Haulage Market Revenue (Million), by Country 2025 & 2033

- Figure 16: Europe Heavy Lifting & Haulage Market Volume (Billion), by Country 2025 & 2033

- Figure 17: Europe Heavy Lifting & Haulage Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Heavy Lifting & Haulage Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Heavy Lifting & Haulage Market Revenue (Million), by End User 2025 & 2033

- Figure 20: Asia Pacific Heavy Lifting & Haulage Market Volume (Billion), by End User 2025 & 2033

- Figure 21: Asia Pacific Heavy Lifting & Haulage Market Revenue Share (%), by End User 2025 & 2033

- Figure 22: Asia Pacific Heavy Lifting & Haulage Market Volume Share (%), by End User 2025 & 2033

- Figure 23: Asia Pacific Heavy Lifting & Haulage Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Asia Pacific Heavy Lifting & Haulage Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Heavy Lifting & Haulage Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Heavy Lifting & Haulage Market Volume Share (%), by Country 2025 & 2033

- Figure 27: South America Heavy Lifting & Haulage Market Revenue (Million), by End User 2025 & 2033

- Figure 28: South America Heavy Lifting & Haulage Market Volume (Billion), by End User 2025 & 2033

- Figure 29: South America Heavy Lifting & Haulage Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: South America Heavy Lifting & Haulage Market Volume Share (%), by End User 2025 & 2033

- Figure 31: South America Heavy Lifting & Haulage Market Revenue (Million), by Country 2025 & 2033

- Figure 32: South America Heavy Lifting & Haulage Market Volume (Billion), by Country 2025 & 2033

- Figure 33: South America Heavy Lifting & Haulage Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Heavy Lifting & Haulage Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Middle East and Africa Heavy Lifting & Haulage Market Revenue (Million), by End User 2025 & 2033

- Figure 36: Middle East and Africa Heavy Lifting & Haulage Market Volume (Billion), by End User 2025 & 2033

- Figure 37: Middle East and Africa Heavy Lifting & Haulage Market Revenue Share (%), by End User 2025 & 2033

- Figure 38: Middle East and Africa Heavy Lifting & Haulage Market Volume Share (%), by End User 2025 & 2033

- Figure 39: Middle East and Africa Heavy Lifting & Haulage Market Revenue (Million), by Country 2025 & 2033

- Figure 40: Middle East and Africa Heavy Lifting & Haulage Market Volume (Billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Heavy Lifting & Haulage Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Heavy Lifting & Haulage Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Heavy Lifting & Haulage Market Revenue Million Forecast, by End User 2020 & 2033

- Table 2: Global Heavy Lifting & Haulage Market Volume Billion Forecast, by End User 2020 & 2033

- Table 3: Global Heavy Lifting & Haulage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Heavy Lifting & Haulage Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Global Heavy Lifting & Haulage Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Heavy Lifting & Haulage Market Volume Billion Forecast, by End User 2020 & 2033

- Table 7: Global Heavy Lifting & Haulage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Heavy Lifting & Haulage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 9: United States Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United States Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 11: Canada Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 13: Global Heavy Lifting & Haulage Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Global Heavy Lifting & Haulage Market Volume Billion Forecast, by End User 2020 & 2033

- Table 15: Global Heavy Lifting & Haulage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Heavy Lifting & Haulage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United Kingdom Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Germany Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: France Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: France Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Spain Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Europe Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Global Heavy Lifting & Haulage Market Revenue Million Forecast, by End User 2020 & 2033

- Table 28: Global Heavy Lifting & Haulage Market Volume Billion Forecast, by End User 2020 & 2033

- Table 29: Global Heavy Lifting & Haulage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Heavy Lifting & Haulage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 31: China Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: China Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: India Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: India Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Japan Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Singapore Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Singapore Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of Asia Pacific Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Global Heavy Lifting & Haulage Market Revenue Million Forecast, by End User 2020 & 2033

- Table 42: Global Heavy Lifting & Haulage Market Volume Billion Forecast, by End User 2020 & 2033

- Table 43: Global Heavy Lifting & Haulage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global Heavy Lifting & Haulage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 45: Brazil Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Brazil Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Mexico Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Mexico Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: Rest of South America Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Rest of South America Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 51: Global Heavy Lifting & Haulage Market Revenue Million Forecast, by End User 2020 & 2033

- Table 52: Global Heavy Lifting & Haulage Market Volume Billion Forecast, by End User 2020 & 2033

- Table 53: Global Heavy Lifting & Haulage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 54: Global Heavy Lifting & Haulage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 55: Saudi Arabia Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Saudi Arabia Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: United Arab Emirates Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: United Arab Emirates Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: South Africa Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: South Africa Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 61: Egypt Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Egypt Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: Rest of Middle East and Africa Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Middle East and Africa Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Heavy Lifting & Haulage Market?

The projected CAGR is approximately 5.17%.

2. Which companies are prominent players in the Heavy Lifting & Haulage Market?

Key companies in the market include 6 COMPETITIVE LANDSCAPE6 1 Market Concentration6 2 Company profiles, Terex Corporation, Liebherr, Kobelco Construction, Sarens, Mammoet, Global Rigging & Transport, HSC Cranes, Volvo Constructioon, XCMG Construction, KATO, Konecranes**List Not Exhaustive 6 3 Other companie.

3. What are the main segments of the Heavy Lifting & Haulage Market?

The market segments include End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 276.74 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Infrastructure growth drives demand for heavy lift and haulage services4.; Industrial Growth Spurs Demand for Heavy Lift and Haulage Services.

6. What are the notable trends driving market growth?

Increased Demand From Energy and Power Segment.

7. Are there any restraints impacting market growth?

4.; Infrastructure growth drives demand for heavy lift and haulage services4.; Industrial Growth Spurs Demand for Heavy Lift and Haulage Services.

8. Can you provide examples of recent developments in the market?

July 2024: Liebherr and Fortescue partnered to develop an Autonomous Haulage Solution. Currently, they are validating a fleet of four T 264 autonomous trucks alongside the AHS at a dedicated facility in Fortescue's Christmas Creek mine. The AHS ecosystem will encompass creating and validating a fleet management system and a machine guidance solution.June 2024: In Italy, Terex Rough Terrain Cranes unveiled its latest offering, the TRT 80 l, boasting an impressive 80-tonne lifting capacity. Terex emphasizes its lifting prowess and transport convenience, which are standout features of this new two-axle model. With a width of 3 m, the TRT 80 l is well-suited for navigating tight spaces and busy job sites. Enhancing its setup efficiency, the crane features a self-mounting counterweight, ensuring quicker assembly and disassembly. With four steering modes, maneuvering and setup become more manageable. Once in place, the TRT 90 l can fully utilize its 47-m telescopic boom, complemented by jib options of 9 and 17 m. With its blend of advanced features and user-centric design, the TRT 80 l stands out as a valuable addition to any fleet.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Heavy Lifting & Haulage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Heavy Lifting & Haulage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Heavy Lifting & Haulage Market?

To stay informed about further developments, trends, and reports in the Heavy Lifting & Haulage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence