Key Insights

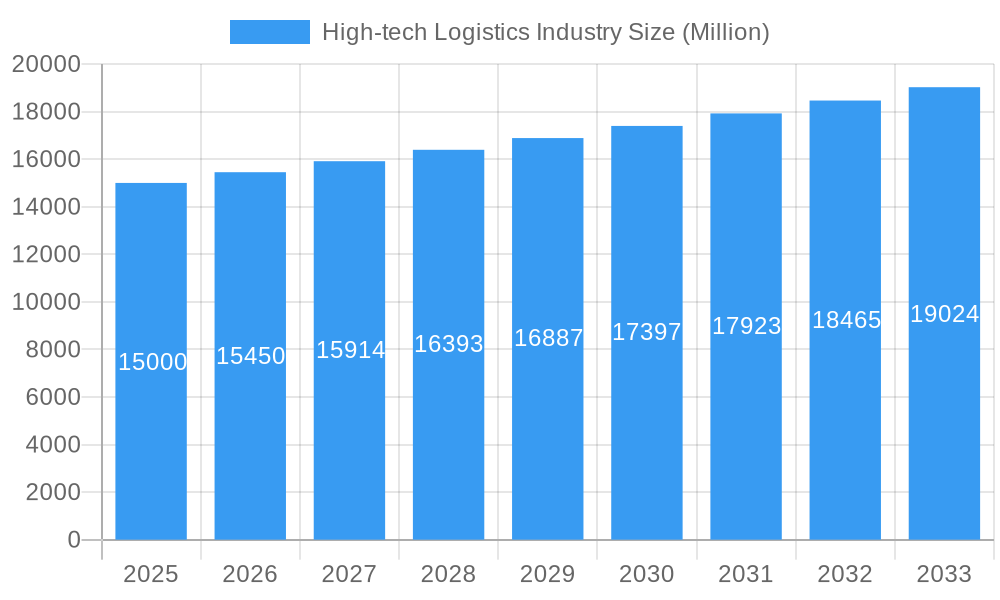

The high-tech logistics industry is experiencing robust growth, driven by the increasing demand for efficient and secure transportation and handling of sensitive technological products. The market, valued at approximately $XX million in 2025 (assuming a reasonable value based on typical market sizes for similar industries with similar CAGRs), is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 3.00% through 2033. This expansion is fueled by several key factors. The surge in e-commerce and the rapid proliferation of advanced technologies like AI and IoT are creating significant demand for specialized logistics solutions capable of handling fragile and high-value goods. The increasing complexity of global supply chains, necessitating sophisticated warehousing and inventory management systems, further fuels market growth. Furthermore, the growing adoption of value-added services, including customized packaging, reverse logistics, and temperature-controlled transportation, is driving market segmentation and creating lucrative opportunities for specialized logistics providers. Major players like DB Schenker, Maersk, and DHL are actively investing in technology and expanding their service offerings to capitalize on this growth.

High-tech Logistics Industry Market Size (In Billion)

However, the industry faces certain challenges. Fluctuating fuel prices, geopolitical uncertainties, and the ever-evolving regulatory landscape pose significant headwinds. Supply chain disruptions, as recently experienced globally, underscore the need for resilient and agile logistics networks. Competition is intensifying, requiring companies to continually innovate and differentiate their services to maintain a competitive edge. Despite these challenges, the long-term outlook for the high-tech logistics industry remains positive, driven by the unstoppable trend towards technological advancement and the globalization of commerce. The industry’s future hinges on the adoption of advanced technologies like automation, AI-powered route optimization, and blockchain for enhanced transparency and security. Strategic partnerships and mergers and acquisitions are likely to shape the competitive landscape in the coming years.

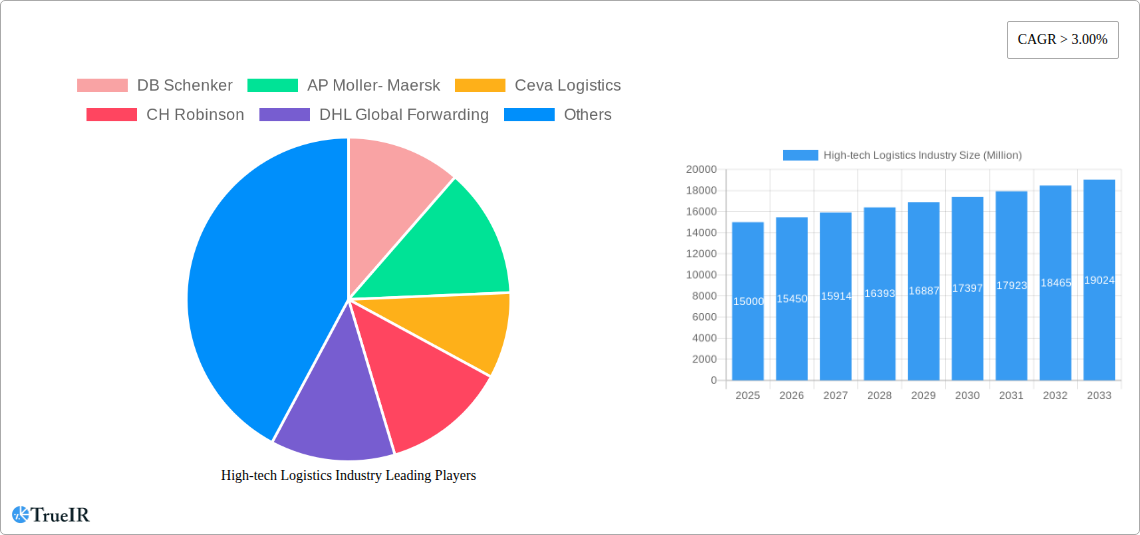

High-tech Logistics Industry Company Market Share

High-Tech Logistics Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the high-tech logistics industry, projecting a market value exceeding $XX Million by 2033. The study covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Key players like DB Schenker, AP Moller-Maersk, Ceva Logistics, CH Robinson, DHL Global Forwarding, Agility Logistics, and GEFCO Group, alongside other significant players, are analyzed to understand market dynamics, competitive landscapes, and future growth opportunities. The report segments the market by product category (Consumer Electronics, Semiconductors, Computers and Peripherals, Telecommunication and Network Equipment) and service type (Transportation, Warehousing and Inventory Management, Value-added Warehousing and Distribution), providing granular insights into market trends and regional dominance.

High-tech Logistics Industry Market Structure & Competitive Landscape

The high-tech logistics market exhibits a moderately concentrated structure, with a few major players holding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at XX in 2025, indicating a moderately competitive landscape. Innovation is a key driver, with companies continuously investing in advanced technologies like AI, automation, and blockchain to enhance efficiency and traceability. Regulatory changes, particularly regarding data privacy and cross-border trade, significantly impact market operations. Product substitution pressures are relatively low due to the specialized nature of high-tech logistics, requiring expertise in handling sensitive and valuable goods.

The end-user segmentation is diverse, encompassing manufacturers, distributors, retailers, and e-commerce companies. M&A activity has been significant in recent years, with an estimated $XX Million in deals closed between 2019 and 2024. This consolidation is driven by the need for scale, geographical expansion, and access to advanced technologies.

- Market Concentration: HHI estimated at XX in 2025.

- Innovation Drivers: AI, automation, blockchain technology.

- Regulatory Impacts: Data privacy regulations, cross-border trade policies.

- M&A Trends: $XX Million in deals (2019-2024).

High-tech Logistics Industry Market Trends & Opportunities

The high-tech logistics market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This growth is fueled by several factors, including the increasing demand for consumer electronics and technological advancements driving efficient supply chains. The market penetration rate for advanced logistics solutions is steadily rising, indicating a shift towards sophisticated technologies. The preference for faster delivery times and increased transparency in supply chains are driving demand. Competitive dynamics are characterized by strategic partnerships, technological innovation, and global expansion strategies. The rise of e-commerce and the increasing complexity of global supply chains present significant opportunities for specialized logistics providers.

Dominant Markets & Segments in High-tech Logistics Industry

The Asia-Pacific region is currently the dominant market for high-tech logistics, driven by the high concentration of electronics manufacturing and a rapidly expanding e-commerce sector. Within the product categories, consumer electronics and semiconductors constitute the largest segments, accounting for approximately XX% of the total market value in 2025. In terms of services, transportation dominates, followed by warehousing and inventory management. Value-added warehousing and distribution are experiencing rapid growth, driven by the need for specialized handling and customized logistics solutions.

- Key Growth Drivers (Asia-Pacific):

- Robust manufacturing sector.

- Expanding e-commerce market.

- Development of advanced infrastructure.

- Supportive government policies.

- Dominant Product Categories: Consumer Electronics, Semiconductors.

- Dominant Service Type: Transportation.

High-tech Logistics Industry Product Analysis

Product innovation in high-tech logistics focuses on improving efficiency, traceability, and security. This includes the implementation of real-time tracking systems, automated warehousing solutions, and advanced analytics for predictive maintenance. The competitive advantage lies in providing customized solutions tailored to the specific needs of high-tech clients, ensuring the safe and efficient handling of sensitive and valuable goods. Technological advancements such as IoT, AI, and blockchain are critical in achieving this competitive edge.

Key Drivers, Barriers & Challenges in High-tech Logistics Industry

Key Drivers:

The market is propelled by technological advancements (AI, automation, IoT), increasing e-commerce, and growing demand for consumer electronics. Government initiatives promoting digitalization and infrastructure development also contribute significantly.

Challenges:

Supply chain disruptions caused by geopolitical events and pandemics pose significant risks. Regulatory complexities, particularly concerning cross-border trade and data privacy, add to operational costs. Intense competition among established players and new entrants creates pressure on pricing and margins. These challenges impact profitability and necessitate strategic adaptation. The estimated impact of supply chain disruptions in 2024 alone resulted in a loss of $XX Million in revenue.

Growth Drivers in the High-tech Logistics Industry Market

Technological advancements (AI, robotics, IoT), e-commerce growth, globalization, and supportive government policies are key drivers. The rising demand for fast and reliable delivery further stimulates market growth.

Challenges Impacting High-tech Logistics Industry Growth

Supply chain vulnerabilities, stringent regulations, intense competition, skilled labor shortages, and cybersecurity risks hinder growth. These factors impact operational efficiency, profitability, and long-term sustainability.

Key Players Shaping the High-tech Logistics Industry Market

- DB Schenker

- AP Moller-Maersk

- Ceva Logistics

- CH Robinson

- DHL Global Forwarding

- Agility Logistics

- GEFCO Group

- Kuehne + Nagel

- Kerry Logistics

- Geodis

- Aramex

- BLG Logistics

- Rhenus Logistics

- DSV Panalpina

Significant High-tech Logistics Industry Milestones

- 2020: Increased adoption of contactless delivery solutions due to the pandemic.

- 2021: Significant investments in automation and AI by major players.

- 2022: Launch of several blockchain-based supply chain transparency initiatives.

- 2023: Growing adoption of autonomous vehicles for last-mile delivery.

Future Outlook for High-tech Logistics Industry Market

The high-tech logistics market is poised for continued expansion, driven by technological innovation and a growing demand for efficient and reliable supply chains. Strategic partnerships, investments in advanced technologies, and expansion into emerging markets will be key factors in shaping future growth. The market is expected to see continued consolidation, with larger players acquiring smaller companies to expand their service offerings and geographical reach. The integration of sustainable practices will become increasingly important, driving the adoption of eco-friendly logistics solutions.

High-tech Logistics Industry Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehousing and Inventory Management

- 1.3. Value-added Warehousing and Distribution

-

2. Product Category

- 2.1. Consumer Electronics

- 2.2. Semiconductors

- 2.3. Computers and Peripherals

- 2.4. Telecommunication and Network Equipment

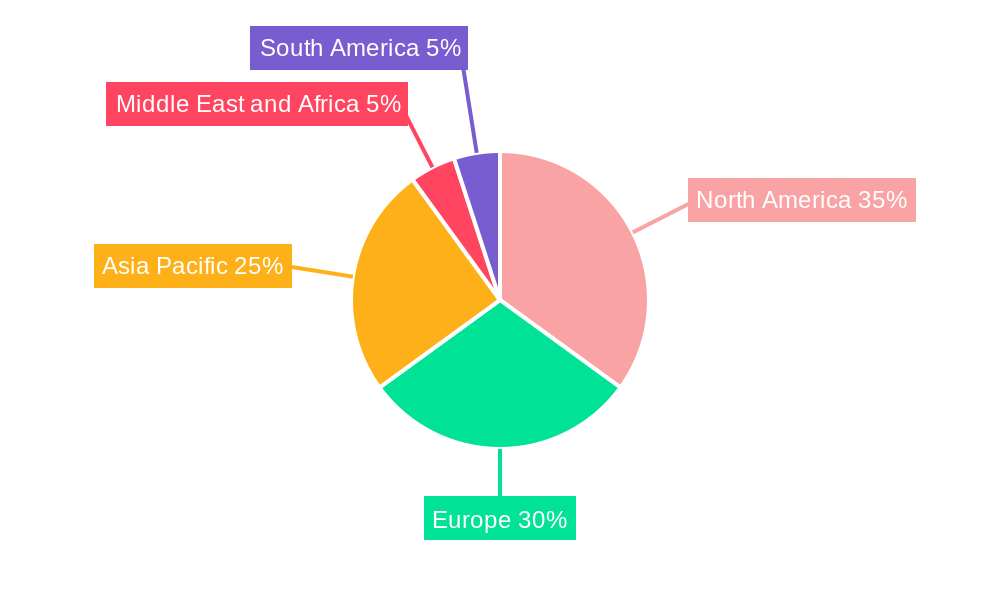

High-tech Logistics Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East and Africa

- 5. South America

High-tech Logistics Industry Regional Market Share

Geographic Coverage of High-tech Logistics Industry

High-tech Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Pharmaceutical Industry Demands Advanced Cold-Chain Services; E-commerce driving the cold chain logistics

- 3.3. Market Restrains

- 3.3.1. Damaged Goods; Increasing Transportation Cost

- 3.4. Market Trends

- 3.4.1. Growth in the High-tech Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global High-tech Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehousing and Inventory Management

- 5.1.3. Value-added Warehousing and Distribution

- 5.2. Market Analysis, Insights and Forecast - by Product Category

- 5.2.1. Consumer Electronics

- 5.2.2. Semiconductors

- 5.2.3. Computers and Peripherals

- 5.2.4. Telecommunication and Network Equipment

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America High-tech Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Transportation

- 6.1.2. Warehousing and Inventory Management

- 6.1.3. Value-added Warehousing and Distribution

- 6.2. Market Analysis, Insights and Forecast - by Product Category

- 6.2.1. Consumer Electronics

- 6.2.2. Semiconductors

- 6.2.3. Computers and Peripherals

- 6.2.4. Telecommunication and Network Equipment

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Europe High-tech Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Transportation

- 7.1.2. Warehousing and Inventory Management

- 7.1.3. Value-added Warehousing and Distribution

- 7.2. Market Analysis, Insights and Forecast - by Product Category

- 7.2.1. Consumer Electronics

- 7.2.2. Semiconductors

- 7.2.3. Computers and Peripherals

- 7.2.4. Telecommunication and Network Equipment

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Asia Pacific High-tech Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Transportation

- 8.1.2. Warehousing and Inventory Management

- 8.1.3. Value-added Warehousing and Distribution

- 8.2. Market Analysis, Insights and Forecast - by Product Category

- 8.2.1. Consumer Electronics

- 8.2.2. Semiconductors

- 8.2.3. Computers and Peripherals

- 8.2.4. Telecommunication and Network Equipment

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Middle East and Africa High-tech Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Transportation

- 9.1.2. Warehousing and Inventory Management

- 9.1.3. Value-added Warehousing and Distribution

- 9.2. Market Analysis, Insights and Forecast - by Product Category

- 9.2.1. Consumer Electronics

- 9.2.2. Semiconductors

- 9.2.3. Computers and Peripherals

- 9.2.4. Telecommunication and Network Equipment

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. South America High-tech Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Transportation

- 10.1.2. Warehousing and Inventory Management

- 10.1.3. Value-added Warehousing and Distribution

- 10.2. Market Analysis, Insights and Forecast - by Product Category

- 10.2.1. Consumer Electronics

- 10.2.2. Semiconductors

- 10.2.3. Computers and Peripherals

- 10.2.4. Telecommunication and Network Equipment

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DB Schenker

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AP Moller- Maersk

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ceva Logistics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CH Robinson

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DHL Global Forwarding

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Agility Logistics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 GEFCO Group**List Not Exhaustive 7 3 Other Companies (Key Information/Overview

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kuehne + Nagel

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kerry Logistics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Geodis

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Aramex

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 BLG Logistics

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Rhenus Logistics

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 DSV Panalpina

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 DB Schenker

List of Figures

- Figure 1: Global High-tech Logistics Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America High-tech Logistics Industry Revenue (Million), by Service 2025 & 2033

- Figure 3: North America High-tech Logistics Industry Revenue Share (%), by Service 2025 & 2033

- Figure 4: North America High-tech Logistics Industry Revenue (Million), by Product Category 2025 & 2033

- Figure 5: North America High-tech Logistics Industry Revenue Share (%), by Product Category 2025 & 2033

- Figure 6: North America High-tech Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America High-tech Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe High-tech Logistics Industry Revenue (Million), by Service 2025 & 2033

- Figure 9: Europe High-tech Logistics Industry Revenue Share (%), by Service 2025 & 2033

- Figure 10: Europe High-tech Logistics Industry Revenue (Million), by Product Category 2025 & 2033

- Figure 11: Europe High-tech Logistics Industry Revenue Share (%), by Product Category 2025 & 2033

- Figure 12: Europe High-tech Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe High-tech Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific High-tech Logistics Industry Revenue (Million), by Service 2025 & 2033

- Figure 15: Asia Pacific High-tech Logistics Industry Revenue Share (%), by Service 2025 & 2033

- Figure 16: Asia Pacific High-tech Logistics Industry Revenue (Million), by Product Category 2025 & 2033

- Figure 17: Asia Pacific High-tech Logistics Industry Revenue Share (%), by Product Category 2025 & 2033

- Figure 18: Asia Pacific High-tech Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific High-tech Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa High-tech Logistics Industry Revenue (Million), by Service 2025 & 2033

- Figure 21: Middle East and Africa High-tech Logistics Industry Revenue Share (%), by Service 2025 & 2033

- Figure 22: Middle East and Africa High-tech Logistics Industry Revenue (Million), by Product Category 2025 & 2033

- Figure 23: Middle East and Africa High-tech Logistics Industry Revenue Share (%), by Product Category 2025 & 2033

- Figure 24: Middle East and Africa High-tech Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa High-tech Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America High-tech Logistics Industry Revenue (Million), by Service 2025 & 2033

- Figure 27: South America High-tech Logistics Industry Revenue Share (%), by Service 2025 & 2033

- Figure 28: South America High-tech Logistics Industry Revenue (Million), by Product Category 2025 & 2033

- Figure 29: South America High-tech Logistics Industry Revenue Share (%), by Product Category 2025 & 2033

- Figure 30: South America High-tech Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: South America High-tech Logistics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global High-tech Logistics Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Global High-tech Logistics Industry Revenue Million Forecast, by Product Category 2020 & 2033

- Table 3: Global High-tech Logistics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global High-tech Logistics Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 5: Global High-tech Logistics Industry Revenue Million Forecast, by Product Category 2020 & 2033

- Table 6: Global High-tech Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global High-tech Logistics Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 8: Global High-tech Logistics Industry Revenue Million Forecast, by Product Category 2020 & 2033

- Table 9: Global High-tech Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global High-tech Logistics Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 11: Global High-tech Logistics Industry Revenue Million Forecast, by Product Category 2020 & 2033

- Table 12: Global High-tech Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global High-tech Logistics Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 14: Global High-tech Logistics Industry Revenue Million Forecast, by Product Category 2020 & 2033

- Table 15: Global High-tech Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global High-tech Logistics Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 17: Global High-tech Logistics Industry Revenue Million Forecast, by Product Category 2020 & 2033

- Table 18: Global High-tech Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the High-tech Logistics Industry?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the High-tech Logistics Industry?

Key companies in the market include DB Schenker, AP Moller- Maersk, Ceva Logistics, CH Robinson, DHL Global Forwarding, Agility Logistics, GEFCO Group**List Not Exhaustive 7 3 Other Companies (Key Information/Overview, Kuehne + Nagel, Kerry Logistics, Geodis, Aramex, BLG Logistics, Rhenus Logistics, DSV Panalpina.

3. What are the main segments of the High-tech Logistics Industry?

The market segments include Service, Product Category.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Pharmaceutical Industry Demands Advanced Cold-Chain Services; E-commerce driving the cold chain logistics.

6. What are the notable trends driving market growth?

Growth in the High-tech Industry.

7. Are there any restraints impacting market growth?

Damaged Goods; Increasing Transportation Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "High-tech Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the High-tech Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the High-tech Logistics Industry?

To stay informed about further developments, trends, and reports in the High-tech Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence