Key Insights

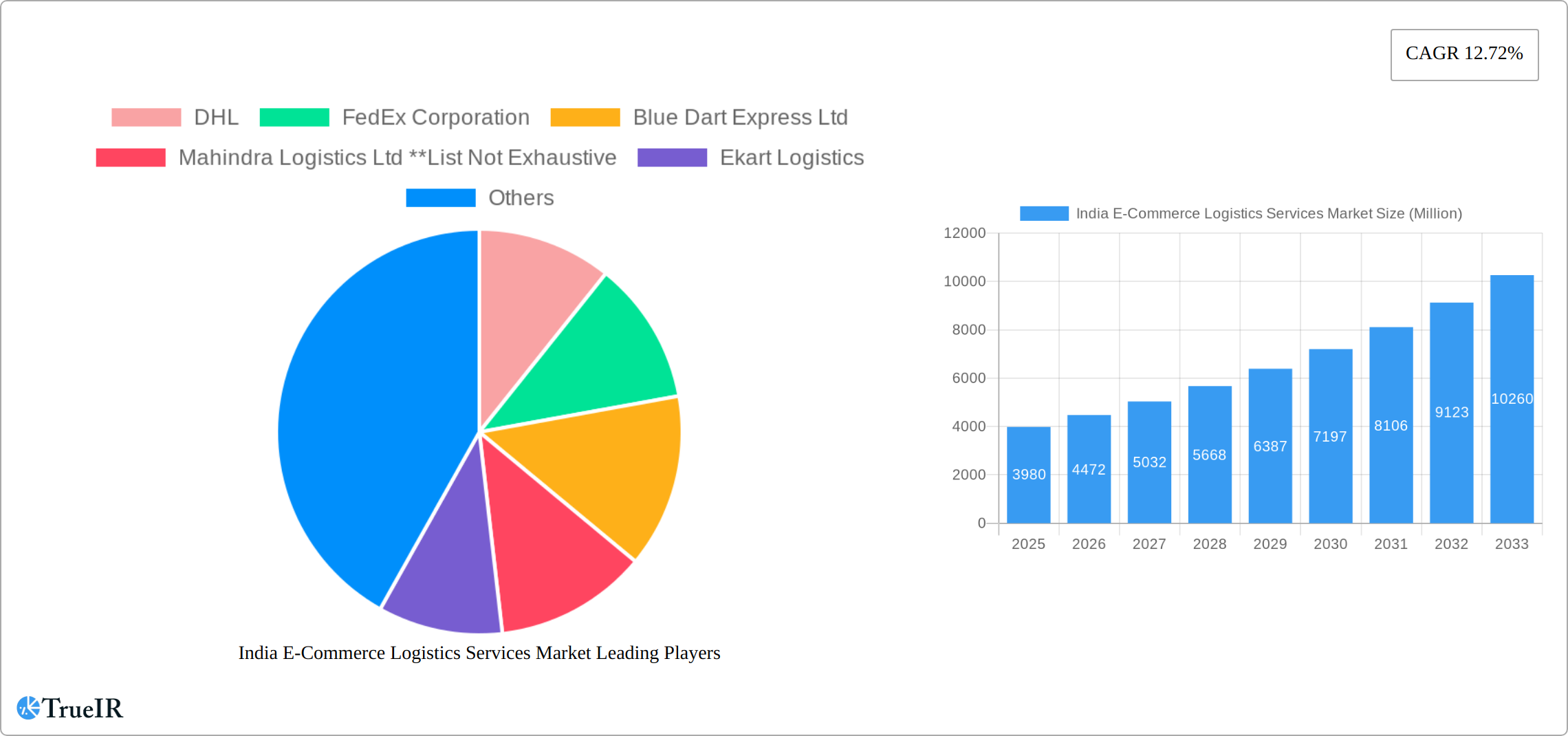

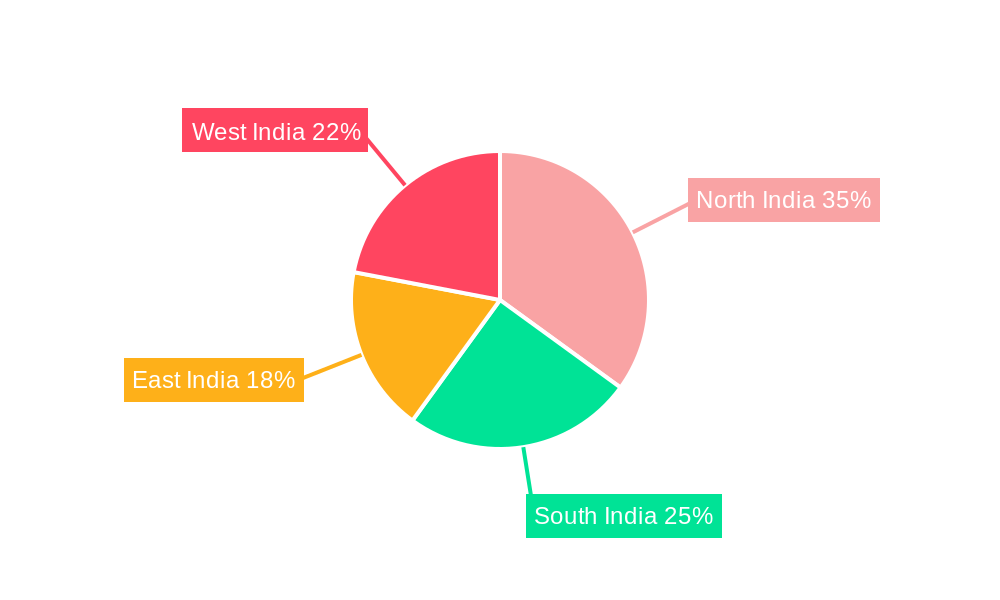

The India e-commerce logistics services market is experiencing robust growth, projected to reach \$3.98 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 12.72% from 2025 to 2033. This expansion is fueled by the burgeoning e-commerce sector in India, driven by increasing internet and smartphone penetration, rising disposable incomes, and a preference for online shopping convenience across diverse product categories. Key growth drivers include the increasing adoption of technology-driven solutions such as automation, AI-powered route optimization, and real-time tracking systems enhancing efficiency and delivery speed. The market is segmented by service type (transportation, warehousing, value-added services), business model (B2B, B2C), destination (domestic, international), and product category (fashion, electronics, home appliances, furniture, beauty, and others). While the dominance of established players like DHL, FedEx, and Blue Dart is undeniable, the rise of indigenous companies like Delhivery and Ecom Express reflects the evolving competitive landscape. The market's growth isn't uniform across regions; areas with higher e-commerce penetration like North and West India are expected to lead the expansion, while the South and East are anticipated to witness significant growth as infrastructure improves. Challenges include maintaining efficient last-mile delivery in a geographically diverse country with varying infrastructural capabilities and managing the complexities of cross-border logistics. However, continuous innovation and strategic partnerships within the logistics sector are poised to mitigate these challenges and maintain the market's strong growth trajectory.

India E-Commerce Logistics Services Market Market Size (In Billion)

The forecast period from 2025 to 2033 indicates continued market expansion, primarily driven by an expected increase in e-commerce transactions. The growing middle class, coupled with government initiatives aimed at improving infrastructure and digital connectivity, will significantly impact market growth. The rise of omnichannel strategies adopted by retailers and the increasing focus on providing superior customer experiences, including faster delivery options and enhanced return processes, will further stimulate demand for advanced logistics services. Competition will likely intensify, necessitating strategic acquisitions, technological advancements, and a focus on building robust and reliable supply chains. Companies offering specialized services targeting specific product categories or regions are likely to gain a competitive edge. The market will likely witness a greater emphasis on sustainability, with logistics providers implementing eco-friendly practices to meet growing consumer demands and regulatory requirements.

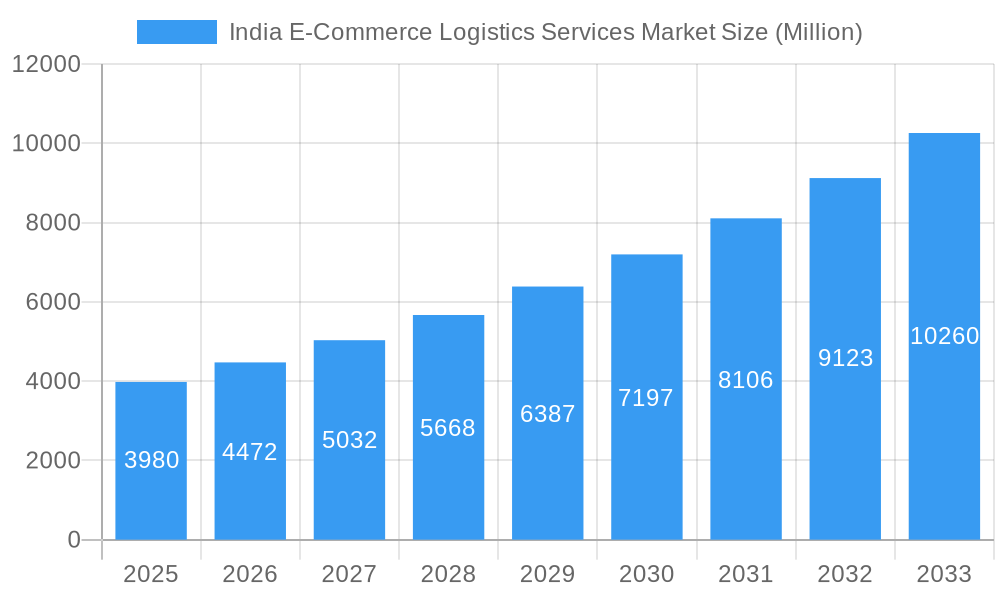

India E-Commerce Logistics Services Market Company Market Share

India E-Commerce Logistics Services Market: A Comprehensive Report (2019-2033)

This dynamic report provides a comprehensive analysis of the burgeoning India E-commerce Logistics Services Market, offering invaluable insights for investors, businesses, and industry stakeholders. With a detailed examination spanning from 2019 to 2033 (Study Period), including a base year of 2025 and a forecast period of 2025-2033, this report leverages extensive data and expert analysis to illuminate the market's current state and future trajectory. The market's size is projected to reach xx Million by 2033, representing a significant growth opportunity.

India E-Commerce Logistics Services Market Market Structure & Competitive Landscape

The Indian e-commerce logistics market is characterized by a moderately concentrated structure, with several major players holding significant market share. The market's concentration ratio (CR4) is estimated at xx%, indicating the presence of both large multinational corporations and rapidly growing domestic players. Key players include DHL, FedEx Corporation, Blue Dart Express Ltd, Mahindra Logistics Ltd, Ekart Logistics, Delhivery Pvt Ltd, Xpress Bees, Gati-Kintetsu Express Private Limited, Ecom Express Logistics, DTDC, and Shadowfax. However, the market remains dynamic, with continuous entry and exit of players, fuelled by intense competition and evolving consumer demands.

Innovation Drivers: Technological advancements such as AI-powered route optimization, automated warehousing, and drone delivery are significantly impacting the market. Furthermore, the increasing adoption of digital technologies for supply chain visibility and management is driving efficiency and transparency.

Regulatory Impacts: Government regulations related to e-commerce, taxation, and cross-border trade significantly impact market dynamics. Recent policy changes aimed at promoting ease of doing business are creating favorable conditions for growth.

Product Substitutes: The absence of readily available substitutes for core logistics services (transportation and warehousing) indicates a strong market demand. However, innovations in last-mile delivery (e.g., using drones, electric vehicles) are gradually challenging traditional approaches.

End-User Segmentation: The market caters to both B2B and B2C segments, with the B2C segment currently dominating due to the rapid growth of online retail. The report details market segmentation by service type (transportation, warehousing, value-added services), business type (B2B, B2C), destination (domestic, international), and product type (fashion, consumer electronics, home appliances, furniture, beauty and personal care, other products).

M&A Trends: The past few years have witnessed a moderate level of merger and acquisition activity, driven by the desire for expansion, consolidation, and technological integration. xx M&A deals were recorded between 2019 and 2024, with a significant portion focusing on technology-driven logistics firms.

India E-Commerce Logistics Services Market Market Trends & Opportunities

The Indian e-commerce logistics market is experiencing explosive growth, fueled by the burgeoning e-commerce sector, escalating smartphone penetration, and a rise in disposable incomes. Analysts project a Compound Annual Growth Rate (CAGR) of X% during the forecast period (2025-2033), with the market reaching a valuation of X Million USD by 2033. This remarkable expansion is driven by several key trends:

- Technological Advancements: The widespread adoption of automation, artificial intelligence (AI), machine learning (ML), and advanced data analytics is revolutionizing logistics operations, resulting in significantly increased efficiency, reduced operational costs, and enhanced supply chain resilience. The integration of Internet of Things (IoT) devices and blockchain technology further enhances supply chain visibility, security, and traceability, minimizing risks and improving transparency.

- Evolving Consumer Expectations: Modern consumers demand faster delivery times, real-time order tracking, greater transparency throughout the delivery process, flexible delivery options, and convenient return procedures. This necessitates the implementation of cutting-edge last-mile delivery solutions, optimized delivery routes, and proactive customer service strategies.

- Omnichannel Retail Dominance: The seamless integration of online and offline retail channels is driving demand for highly flexible and scalable logistics solutions that ensure a consistent and frictionless customer experience across all touchpoints.

- Direct-to-Consumer (D2C) Brand Explosion: The rapid proliferation of D2C brands is creating significant growth opportunities, requiring specialized logistics solutions tailored to efficient order fulfillment, inventory management, and timely delivery, often with personalized branding and packaging.

- Government Initiatives & Policy Support: Supportive government policies and significant investments in infrastructure development, including improved road networks, railway systems, and digital infrastructure, are creating a conducive environment for sustained market growth and attracting significant foreign investment.

- Expanding Market Reach: The market penetration rate of e-commerce logistics services is poised for significant expansion in the coming years, reaching X% by 2033. This growth is being driven by the increasing accessibility of e-commerce to smaller cities and rural areas, tapping into previously underserved markets.

- Intense Competitive Landscape: The market is characterized by intense competition among a diverse range of players, including large multinational corporations, established domestic logistics providers, and innovative startups. This competitive environment fosters innovation, efficiency improvements, and continuous service enhancements.

Dominant Markets & Segments in India E-Commerce Logistics Services Market

The Indian e-commerce logistics market is currently dominated by the domestic segment, accounting for X% of the total market share. The remarkable growth is fueled by the rapid expansion of e-commerce across both urban and semi-urban regions. The Business-to-Consumer (B2C) segment currently holds the largest market share, driven by the phenomenal surge in online shoppers.

By Service Type: Transportation services currently dominate the market, reflecting the high volume of goods movement. However, the warehousing and inventory management segment is exhibiting rapid growth, fueled by the increasing adoption of sophisticated Warehouse Management Systems (WMS) and automation technologies. Value-added services, such as customized labeling, specialized packaging, and reverse logistics, are gaining significant traction due to the growing need for enhanced product protection, efficient order processing, and improved customer satisfaction.

By Business Model: The B2C segment reigns as the leading market segment, mirroring the increasing popularity of online shopping. However, the Business-to-Business (B2B) segment is demonstrating substantial growth, driven by the expansion of e-procurement platforms and online marketplaces.

By Geographic Reach: The domestic segment currently enjoys a dominant position due to the high volume of intra-India e-commerce transactions. Nevertheless, the international/cross-border segment is experiencing accelerated growth, reflecting the increasing integration of the Indian economy into the global marketplace.

By Product Category: Fashion and apparel currently lead the market, followed closely by consumer electronics and home appliances. This growth is propelled by a combination of factors, including escalating consumer spending power, the expanding availability of a diverse range of products online, and the increasing preference for convenient online shopping experiences.

Key Growth Drivers (By Segment):

- Transportation: Government investments in infrastructure development (roads, railways, and improved port facilities), the development of efficient transportation networks, and the expansion of logistics hubs are key drivers.

- Warehousing & Inventory Management: The widespread adoption of advanced technologies such as WMS, automation, robotics, and cold chain storage solutions are significantly enhancing efficiency and reducing operational costs.

- Value-added services: Rising consumer expectations regarding product quality, safety, timely delivery, and personalized experiences are driving demand for enhanced value-added services.

- B2C: Growing smartphone and internet penetration, increasing online shopping adoption, and the rise in disposable incomes are key factors boosting B2C segment growth.

- Domestic: The extensive e-commerce network across the country, an increasing focus on local manufacturing and e-commerce businesses, and government support for domestic trade are propelling domestic segment growth.

India E-Commerce Logistics Services Market Product Analysis

The e-commerce logistics market is witnessing significant product innovations, including the adoption of advanced technologies such as AI-powered route optimization, automated sorting systems, and drone delivery. These innovations are enhancing efficiency, reducing costs, and improving customer satisfaction. The market is also seeing a rise in specialized services like temperature-controlled logistics for perishable goods, and customized packaging solutions for fragile items. These tailored offerings demonstrate a strong market fit by addressing specific customer needs and providing competitive advantages.

Key Drivers, Barriers & Challenges in India E-Commerce Logistics Services Market

Key Drivers: The Indian e-commerce logistics market is propelled by several key factors:

- Exponential Growth of E-commerce: The explosive growth of the e-commerce sector is the primary catalyst, creating massive demand for efficient and reliable logistics solutions.

- Government Support & Policy Initiatives: Proactive government policies promoting digitalization, infrastructure development, and streamlined regulations are creating a favorable environment for market expansion.

- Technological Innovation: Automation, AI, ML, and data analytics are driving significant efficiency improvements, cost optimization, and enhanced decision-making capabilities.

- Rising Middle Class & Increased Spending: A burgeoning middle class with increasing disposable incomes fuels the demand for online shopping and necessitates robust logistics capabilities.

Challenges: Several challenges hinder the market's full potential:

- Infrastructure Gaps: Inadequate infrastructure in certain regions, particularly in rural areas, poses a significant constraint, leading to increased delivery times, higher transportation costs, and logistical complexities.

- Regulatory Complexities: Navigating complex regulations related to taxation, permits, cross-border trade, and compliance requirements can be challenging and time-consuming.

- High Labor Costs & Skill Shortages: The rising cost of labor, coupled with shortages of skilled workers in certain areas of logistics, can impact operational efficiency and profitability.

- Last-Mile Delivery Challenges: Efficient and cost-effective last-mile delivery remains a significant hurdle, particularly in densely populated urban areas and remote regions.

Growth Drivers in the India E-Commerce Logistics Services Market Market

The market is experiencing remarkable growth driven by the rapid expansion of e-commerce, substantial investments in infrastructure development, and supportive government policies. Technological advancements, such as AI-powered route optimization, automated warehousing, and drone delivery technologies, further enhance efficiency and reduce costs. The rising disposable incomes and increasing smartphone penetration among consumers significantly contribute to market expansion.

Challenges Impacting India E-Commerce Logistics Services Market Growth

Significant challenges include infrastructural limitations in certain regions, resulting in uneven service delivery. Regulatory complexities and bureaucratic hurdles can impede operations, while the fluctuating cost of fuel and labor add to operational expenses. Furthermore, intense competition among numerous players can impact profitability margins.

Key Players Shaping the India E-Commerce Logistics Services Market Market

- DHL

- FedEx Corporation

- Blue Dart Express Ltd

- Mahindra Logistics Ltd

- Ekart Logistics

- Delhivery Pvt Ltd

- Xpress Bees

- Gati-Kintetsu Express Private Limited

- Ecom Express Logistics

- DTDC

- Shadowfax

Significant India E-Commerce Logistics Services Market Industry Milestones

- August 2023: Delhivery launched Delhivery One, a digital shipping platform designed to support SMEs and D2C brands, offering features like post-purchase communication, analytics, and international shipping.

- July 2023: Ekart introduced B2B air and surface transportation solutions, leveraging its extensive network of airports and trucks to provide end-to-end logistical services.

Future Outlook for India E-Commerce Logistics Services Market Market

The Indian e-commerce logistics market is poised for continued robust growth, driven by the sustained expansion of the e-commerce sector, ongoing investments in infrastructure modernization, and the accelerating adoption of innovative technologies. Strategic opportunities abound in last-mile delivery solutions, particularly in underserved areas, and in providing specialized services catering to niche product categories. The market's potential is immense, with significant room for expansion, innovation, and the emergence of new business models in the years to come.

India E-Commerce Logistics Services Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehousing and Inventory Management

- 1.3. Value-added Services (Labeling, Packaging )

-

2. Business

- 2.1. By B2B

- 2.2. By B2C

-

3. Destination

- 3.1. Domestic

- 3.2. International/Cross Border

-

4. Product

- 4.1. Fashion and Appareal

- 4.2. Consumer Electronics

- 4.3. Home Appliances

- 4.4. Furniture

- 4.5. Beauty and Personal Care Products

- 4.6. Other Products (Toys, Food Products, Etc.)

India E-Commerce Logistics Services Market Segmentation By Geography

- 1. India

India E-Commerce Logistics Services Market Regional Market Share

Geographic Coverage of India E-Commerce Logistics Services Market

India E-Commerce Logistics Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Internet and Smart Phone Penetration; Urbanization and Lifestyle Changes; Government Initiatives

- 3.3. Market Restrains

- 3.3.1. Poor Infrastructure and Last-Mile Delivery

- 3.4. Market Trends

- 3.4.1. Growth in e-Commerce Sales is Driving the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India E-Commerce Logistics Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehousing and Inventory Management

- 5.1.3. Value-added Services (Labeling, Packaging )

- 5.2. Market Analysis, Insights and Forecast - by Business

- 5.2.1. By B2B

- 5.2.2. By B2C

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International/Cross Border

- 5.4. Market Analysis, Insights and Forecast - by Product

- 5.4.1. Fashion and Appareal

- 5.4.2. Consumer Electronics

- 5.4.3. Home Appliances

- 5.4.4. Furniture

- 5.4.5. Beauty and Personal Care Products

- 5.4.6. Other Products (Toys, Food Products, Etc.)

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DHL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 FedEx Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Blue Dart Express Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mahindra Logistics Ltd **List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ekart Logistics

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Delhivery Pvt Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Xpress Bees

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Gati-Kintetsu Express Private Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ecom Express Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DTDC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Shadowfax

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 DHL

List of Figures

- Figure 1: India E-Commerce Logistics Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India E-Commerce Logistics Services Market Share (%) by Company 2025

List of Tables

- Table 1: India E-Commerce Logistics Services Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: India E-Commerce Logistics Services Market Revenue Million Forecast, by Business 2020 & 2033

- Table 3: India E-Commerce Logistics Services Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 4: India E-Commerce Logistics Services Market Revenue Million Forecast, by Product 2020 & 2033

- Table 5: India E-Commerce Logistics Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: India E-Commerce Logistics Services Market Revenue Million Forecast, by Service 2020 & 2033

- Table 7: India E-Commerce Logistics Services Market Revenue Million Forecast, by Business 2020 & 2033

- Table 8: India E-Commerce Logistics Services Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 9: India E-Commerce Logistics Services Market Revenue Million Forecast, by Product 2020 & 2033

- Table 10: India E-Commerce Logistics Services Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India E-Commerce Logistics Services Market?

The projected CAGR is approximately 12.72%.

2. Which companies are prominent players in the India E-Commerce Logistics Services Market?

Key companies in the market include DHL, FedEx Corporation, Blue Dart Express Ltd, Mahindra Logistics Ltd **List Not Exhaustive, Ekart Logistics, Delhivery Pvt Ltd, Xpress Bees, Gati-Kintetsu Express Private Limited, Ecom Express Logistics, DTDC, Shadowfax.

3. What are the main segments of the India E-Commerce Logistics Services Market?

The market segments include Service, Business, Destination, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.98 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Internet and Smart Phone Penetration; Urbanization and Lifestyle Changes; Government Initiatives.

6. What are the notable trends driving market growth?

Growth in e-Commerce Sales is Driving the Growth of the Market.

7. Are there any restraints impacting market growth?

Poor Infrastructure and Last-Mile Delivery.

8. Can you provide examples of recent developments in the market?

Aug 2023: Listed logistics giant Delhivery launched a new digital shipping platform, Delhivery One, to offer logistics support to small and medium enterprises, along with D2C brands, across the country. Delhivery said Delhivery One integrates shipping services such as post-purchase communication, analytics, international shipping, one-click integration with sales channels, NDR management, and more. The new platform allows smaller businesses to ship without a minimum order value and with a minimum wallet recharge of INR 500. It also offers discounted shipping rates on heavier parcels above 5 kg.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India E-Commerce Logistics Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India E-Commerce Logistics Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India E-Commerce Logistics Services Market?

To stay informed about further developments, trends, and reports in the India E-Commerce Logistics Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence