Key Insights

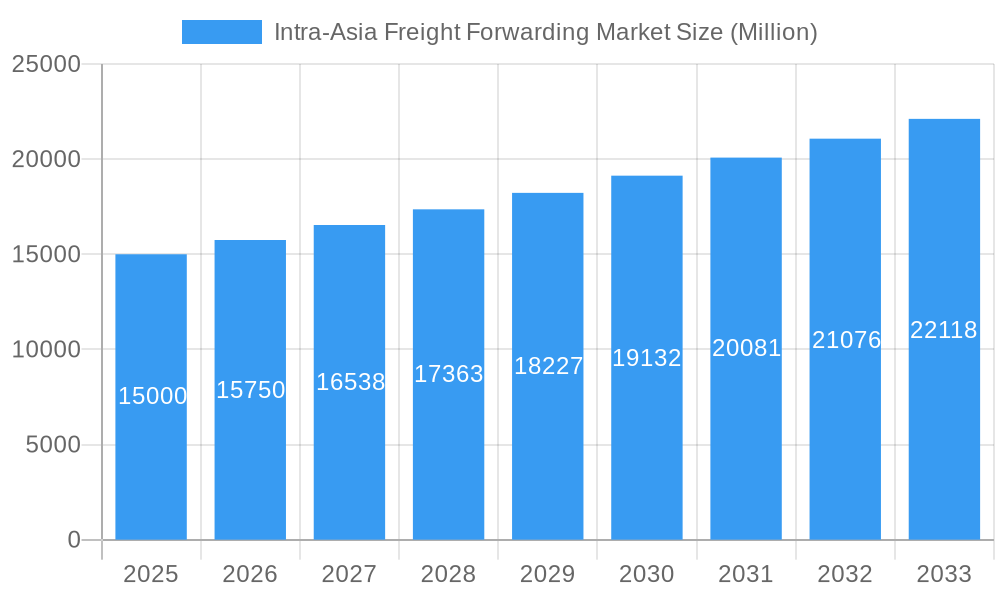

The Intra-Asia Freight Forwarding market is poised for significant expansion, fueled by the region's dynamic manufacturing and e-commerce sectors. Projected to reach $42.5 billion by 2033, the market is set to experience a Compound Annual Growth Rate (CAGR) of 6.2% from the base year 2024. This robust growth is driven by increasing intra-regional trade, particularly among key economies like China, Japan, South Korea, and India. The demand for efficient and reliable logistics is escalating, supported by technological advancements in digital freight forwarding and sophisticated supply chain management. Opportunities are particularly strong within the B2B segment for industrial and manufacturing goods transportation. While ocean freight forwarding remains dominant, air freight adoption is rising for time-sensitive cargo. Potential headwinds include geopolitical instability, fluctuating fuel prices, and port congestion. Market participants are prioritizing strategic alliances, infrastructure development, and technology integration to leverage expanding trade volumes.

Intra-Asia Freight Forwarding Market Market Size (In Billion)

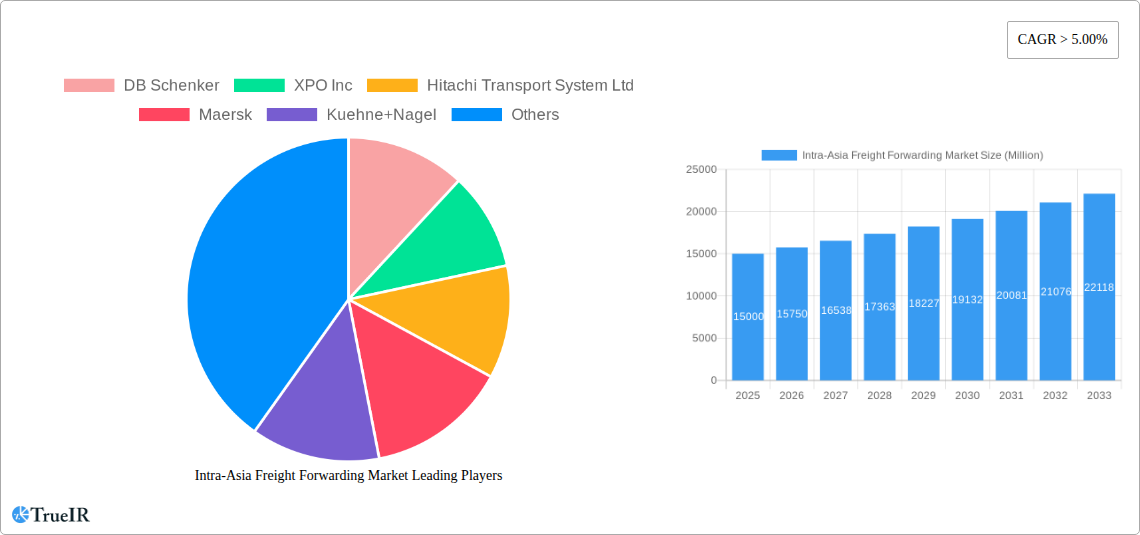

The competitive arena features global logistics leaders such as DB Schenker, DHL, and Maersk, alongside specialized regional providers. The market's dynamism stems from the interplay between established players with extensive networks and innovative startups offering niche solutions. Sustained growth hinges on Asia's continued economic development, effective logistics infrastructure enhancements, and market players' adaptability to evolving regulations and technology. Companies are increasingly offering integrated logistics services, including warehousing, customs brokerage, and value-added solutions, to differentiate themselves. The emergence of sustainable and eco-friendly transportation options is also a growing trend, influenced by environmental consciousness and regulatory mandates.

Intra-Asia Freight Forwarding Market Company Market Share

Intra-Asia Freight Forwarding Market: A Comprehensive Report (2019-2033)

This dynamic report provides a comprehensive analysis of the Intra-Asia Freight Forwarding Market, offering invaluable insights for businesses, investors, and industry stakeholders. Covering the period 2019-2033, with a focus on 2025, this study unveils market trends, competitive landscapes, and future growth opportunities within this vital sector. Expect detailed segmentation across customer types (B2B, B2C), applications (industrial, retail, healthcare, etc.), and modes of transportation (ocean, air, road, rail), all underpinned by robust quantitative data and qualitative analysis.

Intra-Asia Freight Forwarding Market Structure & Competitive Landscape

The Intra-Asia freight forwarding market exhibits a moderately concentrated structure, with several major players commanding significant market share. Key players include DB Schenker, XPO Inc, Hitachi Transport System Ltd, Maersk, Kuehne+Nagel, Yamato Transport Co Ltd, DHL, Asia Forwarding Private Limited, UPS, FedEx, CEVA Logistics, CHINA COSCO SHIPPING, and NYK Line. However, the market also accommodates numerous smaller, regional players, creating a diverse competitive landscape.

The market's competitive intensity is driven by several factors, including price competition, service differentiation, technological innovation, and strategic alliances. Consolidation through mergers and acquisitions (M&A) is a noticeable trend. The estimated volume of M&A activities in the period 2019-2024 reached xx Million, with xx% attributed to cross-border transactions. This signifies a shift towards larger, more integrated logistics providers capable of offering comprehensive end-to-end solutions.

Regulatory changes, particularly those related to trade policies, environmental regulations, and safety standards, significantly impact market dynamics. Furthermore, the emergence of innovative technologies such as blockchain, AI, and IoT is reshaping operational efficiencies and supply chain management, creating both opportunities and challenges for market participants. Substitute products and services, such as direct shipping arrangements by shippers, exert a degree of competitive pressure.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately concentrated market.

- Innovation Drivers: Technological advancements (e.g., digital freight platforms, AI-powered route optimization) are key drivers.

- Regulatory Impacts: Trade agreements, environmental regulations (e.g., IMO 2020), and data privacy laws shape market dynamics.

- Product Substitutes: Direct shipping by shippers and alternative transport modes create competitive pressures.

- End-User Segmentation: The market is segmented by customer type (B2B, B2C) and application (industrial, retail, etc.) reflecting diverse demand patterns.

- M&A Trends: Consolidation continues, with xx Million in estimated M&A activity (2019-2024), pushing for enhanced economies of scale.

Intra-Asia Freight Forwarding Market Trends & Opportunities

The Intra-Asia freight forwarding market is experiencing robust growth, driven by a surge in intra-regional trade, expanding e-commerce activities, and the increasing demand for efficient supply chain solutions. The market size reached xx Million in 2024 and is projected to reach xx Million by 2033, registering a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including:

- E-commerce boom: The rapid growth of e-commerce within Asia is generating a huge demand for reliable and efficient last-mile delivery solutions, pushing up the demand for freight forwarding services.

- Technological advancements: The adoption of digital technologies, such as blockchain and AI, is enhancing supply chain visibility, streamlining operations, and reducing costs for freight forwarders.

- Infrastructure improvements: Ongoing investments in port infrastructure, transportation networks, and logistics hubs across Asia are significantly improving the efficiency and capacity of the freight forwarding industry.

- Shifting consumer preferences: Consumers are increasingly demanding faster delivery times and greater transparency in the supply chain. This requires freight forwarders to adapt to these expectations through improved technology and service offerings.

- Competitive dynamics: The competitive landscape is characterized by both intense competition and collaborative partnerships, driving innovation and efficiency improvements.

Dominant Markets & Segments in Intra-Asia Freight Forwarding Market

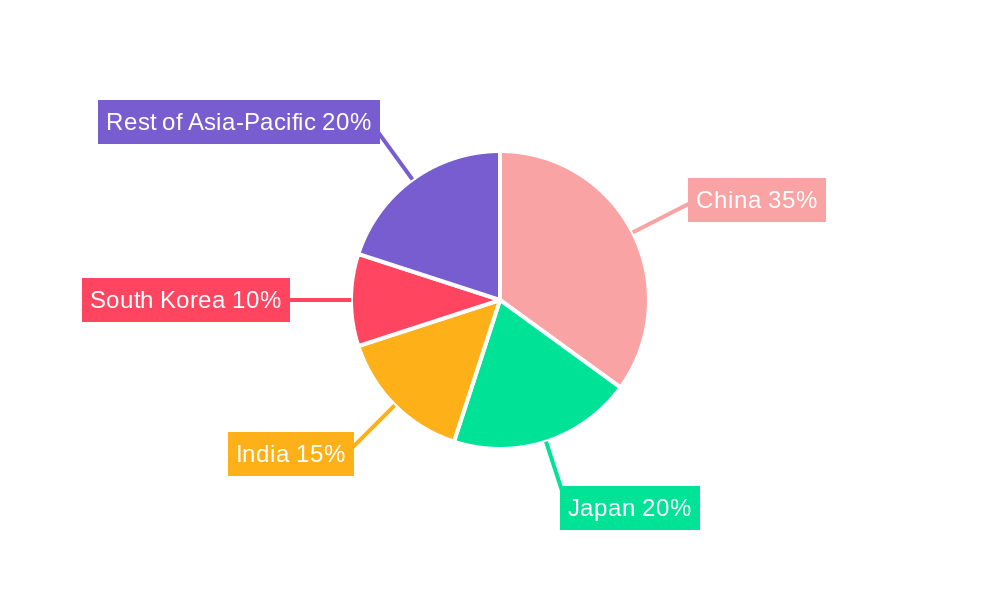

Within the Intra-Asia Freight Forwarding market, several key regions, countries, and segments stand out in terms of market dominance and growth potential.

By Customer Type: The B2B segment currently holds a larger market share compared to B2C due to the extensive needs of large corporations. However, the B2C segment demonstrates significant growth potential driven by the e-commerce boom.

By Application: The industrial and manufacturing segment dominates in terms of volume, owing to the high demand for shipping raw materials, intermediate goods, and finished products. However, the retail, healthcare, and food and beverage segments show considerable growth potential, driven by consumer demands for fast and reliable delivery.

By Mode of Transportation: Ocean freight forwarding is the dominant mode, reflecting the geographical expanse of the Intra-Asia trade network. However, air freight forwarding continues to gain traction for time-sensitive goods, while road and rail freight forwarding are witnessing growth in specific regions, driven by infrastructure developments.

- Key Growth Drivers (by region): China and Southeast Asia are leading growth areas, driven by strong economic growth, industrialization, and significant investments in infrastructure.

- Market Dominance: China plays a dominant role as both a source and destination for a large proportion of intra-Asia freight.

Intra-Asia Freight Forwarding Market Product Analysis

The Intra-Asia freight forwarding market is characterized by a range of services, including ocean, air, road, and rail freight forwarding, often bundled together to provide comprehensive solutions. Recent technological advancements such as real-time tracking systems, digital documentation platforms, and automated customs clearance processes enhance efficiency and transparency. These innovations enable increased visibility, improved cost management, and optimized delivery times, leading to a significant competitive advantage in the market.

Key Drivers, Barriers & Challenges in Intra-Asia Freight Forwarding Market

Key Drivers: The growing intra-Asian trade, rising e-commerce, expanding manufacturing activity, and improvements in logistics infrastructure are key drivers. Government policies promoting trade facilitation and infrastructure development further accelerate market growth.

Challenges: Supply chain disruptions, geopolitical uncertainties, fluctuating fuel prices, and the increasing complexity of regulations pose significant challenges. Competition from both established players and emerging tech companies is also intensifying. The estimated impact of supply chain disruptions in 2022 led to a xx Million loss in market revenue.

Growth Drivers in the Intra-Asia Freight Forwarding Market Market

The burgeoning e-commerce sector, rapid industrialization in several Asian countries, and ongoing infrastructure investments are propelling market growth. Furthermore, government initiatives supporting trade liberalization and improved logistics networks are creating a favorable environment for expansion.

Challenges Impacting Intra-Asia Freight Forwarding Market Growth

Supply chain vulnerabilities, including port congestion and geopolitical instability, pose substantial risks. Rising fuel costs and environmental regulations impose additional operational burdens. Intense competition from established players and new entrants also presents considerable challenges.

Key Players Shaping the Intra-Asia Freight Forwarding Market Market

- DB Schenker

- XPO Inc

- Hitachi Transport System Ltd

- Maersk

- Kuehne+Nagel

- Yamato Transport Co Ltd

- DHL

- Asia Forwarding Private Limited

- UPS

- FedEx

- CEVA Logistics

- CHINA COSCO SHIPPING

- NYK Line

Significant Intra-Asia Freight Forwarding Market Industry Milestones

- November 2022: NYK Line announced plans to order two LNG-fueled large coal carriers, demonstrating a commitment to sustainable shipping practices and impacting the long-term market dynamics related to environmental regulations.

- August 2022: DHL Express and Singapore Airlines launched a new Boeing 777 freighter, expanding air freight capacity and enhancing delivery speed and efficiency within the Intra-Asia market.

Future Outlook for Intra-Asia Freight Forwarding Market Market

The Intra-Asia freight forwarding market is poised for sustained growth, driven by the ongoing expansion of e-commerce, industrialization, and infrastructure improvements across the region. Strategic partnerships, technological advancements, and the increasing focus on sustainable logistics solutions will further shape market dynamics. The market presents significant opportunities for companies that can effectively navigate the challenges and leverage the emerging trends to gain a competitive edge.

Intra-Asia Freight Forwarding Market Segmentation

-

1. Mode of Transportation

- 1.1. Ocean Freight Forwarding

- 1.2. Air Freight Forwarding

- 1.3. Road Freight Forwarding

- 1.4. Rail Freight Forwarding

-

2. Customer Type

- 2.1. Business to Business (B2B)

- 2.2. Business to Customer (B2C)

-

3. Application

- 3.1. Industrial and Manufacturing

- 3.2. Retail

- 3.3. Healthcare

- 3.4. Oil And Gas

- 3.5. Food And Beverages

- 3.6. Other Applications

-

4. Geography

- 4.1. China

- 4.2. Japan

- 4.3. South Korea

- 4.4. India

- 4.5. Rest of Asia

Intra-Asia Freight Forwarding Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. South Korea

- 4. India

- 5. Rest of Asia

Intra-Asia Freight Forwarding Market Regional Market Share

Geographic Coverage of Intra-Asia Freight Forwarding Market

Intra-Asia Freight Forwarding Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. E-commerce is Booming the Market; Increasing Intra-Regional Trade

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Labor; Competition From the Global Players

- 3.4. Market Trends

- 3.4.1. Booming E-commerce Sector is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Intra-Asia Freight Forwarding Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transportation

- 5.1.1. Ocean Freight Forwarding

- 5.1.2. Air Freight Forwarding

- 5.1.3. Road Freight Forwarding

- 5.1.4. Rail Freight Forwarding

- 5.2. Market Analysis, Insights and Forecast - by Customer Type

- 5.2.1. Business to Business (B2B)

- 5.2.2. Business to Customer (B2C)

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Industrial and Manufacturing

- 5.3.2. Retail

- 5.3.3. Healthcare

- 5.3.4. Oil And Gas

- 5.3.5. Food And Beverages

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. South Korea

- 5.4.4. India

- 5.4.5. Rest of Asia

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. Japan

- 5.5.3. South Korea

- 5.5.4. India

- 5.5.5. Rest of Asia

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transportation

- 6. China Intra-Asia Freight Forwarding Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Mode of Transportation

- 6.1.1. Ocean Freight Forwarding

- 6.1.2. Air Freight Forwarding

- 6.1.3. Road Freight Forwarding

- 6.1.4. Rail Freight Forwarding

- 6.2. Market Analysis, Insights and Forecast - by Customer Type

- 6.2.1. Business to Business (B2B)

- 6.2.2. Business to Customer (B2C)

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Industrial and Manufacturing

- 6.3.2. Retail

- 6.3.3. Healthcare

- 6.3.4. Oil And Gas

- 6.3.5. Food And Beverages

- 6.3.6. Other Applications

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. Japan

- 6.4.3. South Korea

- 6.4.4. India

- 6.4.5. Rest of Asia

- 6.1. Market Analysis, Insights and Forecast - by Mode of Transportation

- 7. Japan Intra-Asia Freight Forwarding Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Mode of Transportation

- 7.1.1. Ocean Freight Forwarding

- 7.1.2. Air Freight Forwarding

- 7.1.3. Road Freight Forwarding

- 7.1.4. Rail Freight Forwarding

- 7.2. Market Analysis, Insights and Forecast - by Customer Type

- 7.2.1. Business to Business (B2B)

- 7.2.2. Business to Customer (B2C)

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Industrial and Manufacturing

- 7.3.2. Retail

- 7.3.3. Healthcare

- 7.3.4. Oil And Gas

- 7.3.5. Food And Beverages

- 7.3.6. Other Applications

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. Japan

- 7.4.3. South Korea

- 7.4.4. India

- 7.4.5. Rest of Asia

- 7.1. Market Analysis, Insights and Forecast - by Mode of Transportation

- 8. South Korea Intra-Asia Freight Forwarding Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Mode of Transportation

- 8.1.1. Ocean Freight Forwarding

- 8.1.2. Air Freight Forwarding

- 8.1.3. Road Freight Forwarding

- 8.1.4. Rail Freight Forwarding

- 8.2. Market Analysis, Insights and Forecast - by Customer Type

- 8.2.1. Business to Business (B2B)

- 8.2.2. Business to Customer (B2C)

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Industrial and Manufacturing

- 8.3.2. Retail

- 8.3.3. Healthcare

- 8.3.4. Oil And Gas

- 8.3.5. Food And Beverages

- 8.3.6. Other Applications

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. Japan

- 8.4.3. South Korea

- 8.4.4. India

- 8.4.5. Rest of Asia

- 8.1. Market Analysis, Insights and Forecast - by Mode of Transportation

- 9. India Intra-Asia Freight Forwarding Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Mode of Transportation

- 9.1.1. Ocean Freight Forwarding

- 9.1.2. Air Freight Forwarding

- 9.1.3. Road Freight Forwarding

- 9.1.4. Rail Freight Forwarding

- 9.2. Market Analysis, Insights and Forecast - by Customer Type

- 9.2.1. Business to Business (B2B)

- 9.2.2. Business to Customer (B2C)

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Industrial and Manufacturing

- 9.3.2. Retail

- 9.3.3. Healthcare

- 9.3.4. Oil And Gas

- 9.3.5. Food And Beverages

- 9.3.6. Other Applications

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. Japan

- 9.4.3. South Korea

- 9.4.4. India

- 9.4.5. Rest of Asia

- 9.1. Market Analysis, Insights and Forecast - by Mode of Transportation

- 10. Rest of Asia Intra-Asia Freight Forwarding Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Mode of Transportation

- 10.1.1. Ocean Freight Forwarding

- 10.1.2. Air Freight Forwarding

- 10.1.3. Road Freight Forwarding

- 10.1.4. Rail Freight Forwarding

- 10.2. Market Analysis, Insights and Forecast - by Customer Type

- 10.2.1. Business to Business (B2B)

- 10.2.2. Business to Customer (B2C)

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Industrial and Manufacturing

- 10.3.2. Retail

- 10.3.3. Healthcare

- 10.3.4. Oil And Gas

- 10.3.5. Food And Beverages

- 10.3.6. Other Applications

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. China

- 10.4.2. Japan

- 10.4.3. South Korea

- 10.4.4. India

- 10.4.5. Rest of Asia

- 10.1. Market Analysis, Insights and Forecast - by Mode of Transportation

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DB Schenker

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 XPO Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hitachi Transport System Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Maersk

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kuehne+Nagel

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Yamato Transport Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 DHL

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Asia Forwarding Private Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 UPS**List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 FedEx

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 CEVA Logistics

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 CHINA COSCO SHIPPING

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 NYK Line

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 DB Schenker

List of Figures

- Figure 1: Intra-Asia Freight Forwarding Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Intra-Asia Freight Forwarding Market Share (%) by Company 2025

List of Tables

- Table 1: Intra-Asia Freight Forwarding Market Revenue billion Forecast, by Mode of Transportation 2020 & 2033

- Table 2: Intra-Asia Freight Forwarding Market Revenue billion Forecast, by Customer Type 2020 & 2033

- Table 3: Intra-Asia Freight Forwarding Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Intra-Asia Freight Forwarding Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Intra-Asia Freight Forwarding Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Intra-Asia Freight Forwarding Market Revenue billion Forecast, by Mode of Transportation 2020 & 2033

- Table 7: Intra-Asia Freight Forwarding Market Revenue billion Forecast, by Customer Type 2020 & 2033

- Table 8: Intra-Asia Freight Forwarding Market Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Intra-Asia Freight Forwarding Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Intra-Asia Freight Forwarding Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Intra-Asia Freight Forwarding Market Revenue billion Forecast, by Mode of Transportation 2020 & 2033

- Table 12: Intra-Asia Freight Forwarding Market Revenue billion Forecast, by Customer Type 2020 & 2033

- Table 13: Intra-Asia Freight Forwarding Market Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Intra-Asia Freight Forwarding Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Intra-Asia Freight Forwarding Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Intra-Asia Freight Forwarding Market Revenue billion Forecast, by Mode of Transportation 2020 & 2033

- Table 17: Intra-Asia Freight Forwarding Market Revenue billion Forecast, by Customer Type 2020 & 2033

- Table 18: Intra-Asia Freight Forwarding Market Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Intra-Asia Freight Forwarding Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Intra-Asia Freight Forwarding Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Intra-Asia Freight Forwarding Market Revenue billion Forecast, by Mode of Transportation 2020 & 2033

- Table 22: Intra-Asia Freight Forwarding Market Revenue billion Forecast, by Customer Type 2020 & 2033

- Table 23: Intra-Asia Freight Forwarding Market Revenue billion Forecast, by Application 2020 & 2033

- Table 24: Intra-Asia Freight Forwarding Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: Intra-Asia Freight Forwarding Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Intra-Asia Freight Forwarding Market Revenue billion Forecast, by Mode of Transportation 2020 & 2033

- Table 27: Intra-Asia Freight Forwarding Market Revenue billion Forecast, by Customer Type 2020 & 2033

- Table 28: Intra-Asia Freight Forwarding Market Revenue billion Forecast, by Application 2020 & 2033

- Table 29: Intra-Asia Freight Forwarding Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: Intra-Asia Freight Forwarding Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Intra-Asia Freight Forwarding Market?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the Intra-Asia Freight Forwarding Market?

Key companies in the market include DB Schenker, XPO Inc, Hitachi Transport System Ltd, Maersk, Kuehne+Nagel, Yamato Transport Co Ltd, DHL, Asia Forwarding Private Limited, UPS**List Not Exhaustive, FedEx, CEVA Logistics, CHINA COSCO SHIPPING, NYK Line.

3. What are the main segments of the Intra-Asia Freight Forwarding Market?

The market segments include Mode of Transportation, Customer Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 42.5 billion as of 2022.

5. What are some drivers contributing to market growth?

E-commerce is Booming the Market; Increasing Intra-Regional Trade.

6. What are the notable trends driving market growth?

Booming E-commerce Sector is Driving the Market.

7. Are there any restraints impacting market growth?

Lack of Skilled Labor; Competition From the Global Players.

8. Can you provide examples of recent developments in the market?

November 2022: NYK Line (a Japanese shipping company) planned to order two LNG-fueled large coal carriers from Oshima Shipbuilding Co., Ltd., and the vessels are expected to be delivered in 2025. In addition, this ship order is part of a bulk carrier fleet development that is aimed at achieving net-zero greenhouse gas emissions in the NYK Group's oceangoing businesses by 2050.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Intra-Asia Freight Forwarding Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Intra-Asia Freight Forwarding Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Intra-Asia Freight Forwarding Market?

To stay informed about further developments, trends, and reports in the Intra-Asia Freight Forwarding Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence