Key Insights

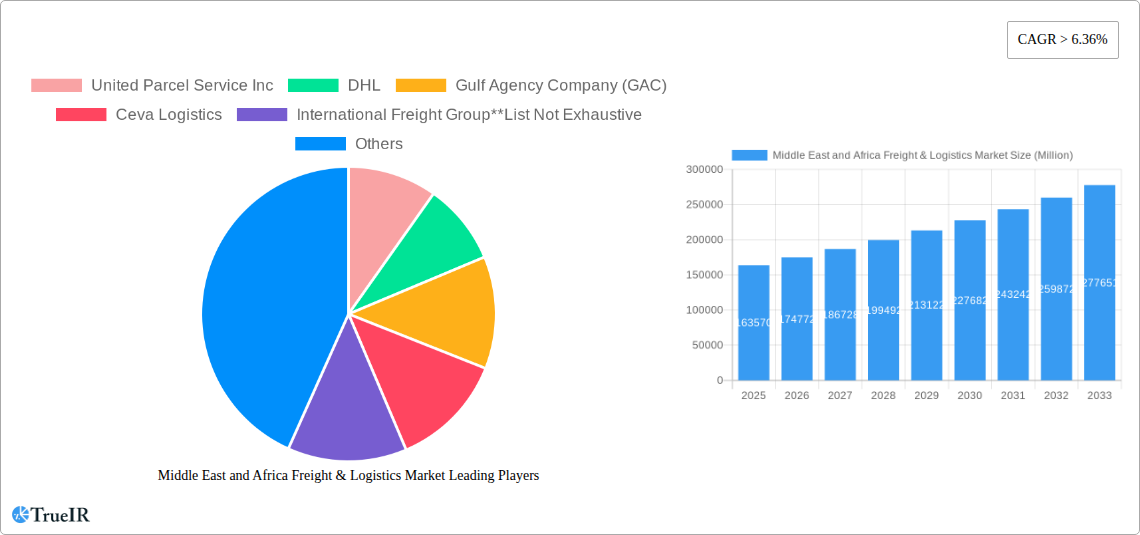

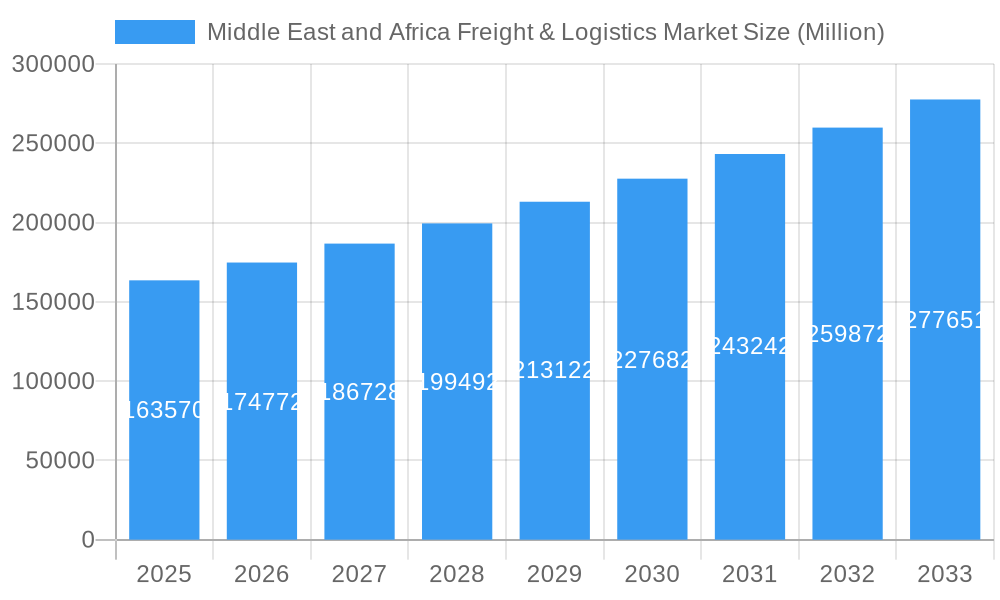

The Middle East and Africa (MEA) freight and logistics market, valued at $163.57 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 6.36% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning e-commerce sector across the region significantly boosts demand for efficient delivery networks. Simultaneously, infrastructural developments, including port expansions and improved road networks, are enhancing logistics capabilities and reducing transit times. Growth in key sectors like manufacturing, automotive, oil & gas, and construction further contributes to market expansion. The increasing adoption of advanced technologies such as blockchain for enhanced supply chain transparency and AI-powered route optimization is driving efficiency and cost savings. However, challenges remain, including geopolitical instability in certain regions, fluctuating fuel prices, and a shortage of skilled labor. Despite these constraints, the long-term outlook for the MEA freight and logistics market remains positive, driven by sustained economic growth and rising consumer demand.

Middle East and Africa Freight & Logistics Market Market Size (In Billion)

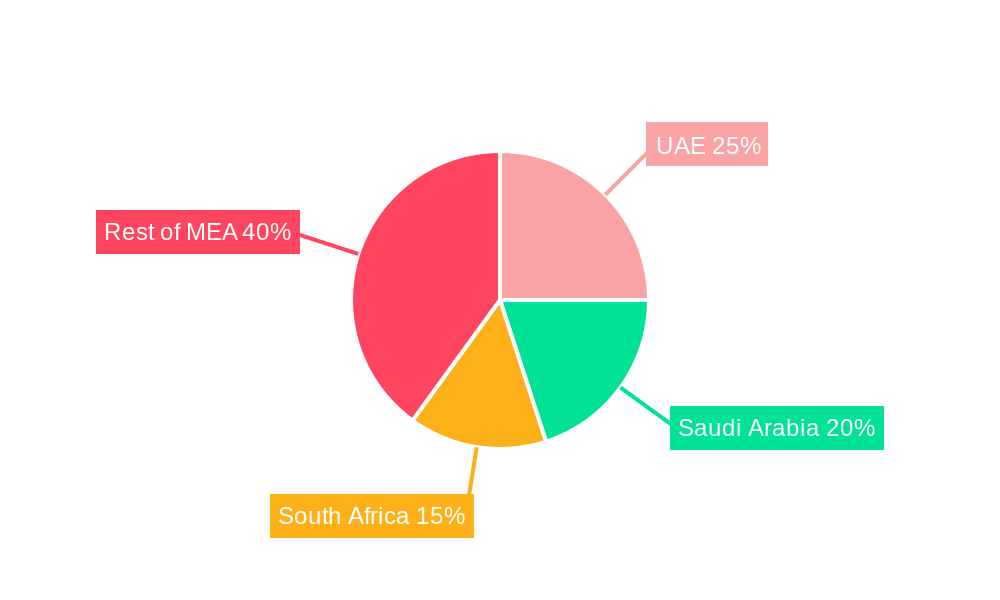

Market segmentation reveals a diverse landscape. Freight transport and warehousing dominate the functional segments, while the manufacturing and automotive sectors are leading end-users. Within the geographical breakdown, the UAE, Saudi Arabia, and South Africa represent significant market shares, benefiting from robust economic activity and strategic location. The competitive landscape is characterized by a mix of global giants like UPS, DHL, and FedEx, along with regional players such as Gulf Agency Company (GAC) and Agility Logistics. These companies are strategically investing in technology and expansion to capitalize on the market's growth potential. The competitive dynamics are further shaped by factors like pricing strategies, service offerings, and technological advancements. The market's future success depends on addressing regulatory hurdles, fostering technological innovation, and ensuring sustainable practices to maintain growth trajectories in the coming decade.

Middle East and Africa Freight & Logistics Market Company Market Share

Middle East and Africa Freight & Logistics Market: A Comprehensive Report (2019-2033)

This dynamic report provides an in-depth analysis of the Middle East and Africa freight and logistics market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Leveraging extensive data from 2019-2024 (historical period), 2025 (base and estimated year), and forecasting to 2033, this report unveils the market's current state, future trends, and key players. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period (2025-2033). The report covers crucial segments, including freight forwarding, warehousing, and value-added services, across diverse end-user industries, and analyzes leading countries within the region.

Middle East and Africa Freight & Logistics Market Structure & Competitive Landscape

The Middle East and Africa freight and logistics market exhibits a moderately concentrated structure, with several multinational corporations and regional players vying for market share. The Herfindahl-Hirschman Index (HHI) for the market in 2024 is estimated to be xx, indicating a moderately concentrated landscape. Key innovation drivers include the adoption of advanced technologies such as blockchain, AI-powered route optimization, and automation in warehousing. Regulatory landscapes vary significantly across countries, impacting operational efficiency and costs. Product substitutes, like decentralized logistics networks and alternative transportation modes, are emerging but have limited impact on the overall market currently.

- Market Concentration: The top 5 players (UPS, DHL, FedEx, Agility, and Kuehne + Nagel) hold an estimated xx% market share in 2024.

- M&A Activity: The period 2019-2024 witnessed xx major mergers and acquisitions, primarily driven by expansion strategies and technological integration.

- End-User Segmentation: The manufacturing and automotive, oil and gas, and distributive trade sectors are currently the largest consumers of freight and logistics services.

- Regulatory Impact: Varying regulations across countries create complexities for logistics operators, particularly regarding customs procedures and cross-border transport.

The market displays a dynamic competitive landscape, with ongoing investments in technology and infrastructure shaping future growth. Continued consolidation through mergers and acquisitions is anticipated.

Middle East and Africa Freight & Logistics Market Market Trends & Opportunities

The Middle East and Africa freight and logistics market is experiencing significant growth driven by the expansion of e-commerce, rising infrastructure investments, and the growth of various industries. The market size is projected to reach xx Million by 2025 and xx Million by 2033, representing a CAGR of xx% during this period. Technological advancements, such as the Internet of Things (IoT) and big data analytics, are improving supply chain visibility and efficiency. Consumer preferences are shifting toward faster delivery times and enhanced tracking capabilities, driving demand for advanced logistics solutions. The competitive landscape is marked by intense competition among global and regional players, leading to innovative service offerings and price optimization strategies. Market penetration rates for advanced logistics technologies remain relatively low, presenting substantial growth opportunities. Significant untapped potential exists in leveraging technology to improve last-mile delivery in less developed regions.

Dominant Markets & Segments in Middle East and Africa Freight & Logistics Market

The United Arab Emirates (UAE) and Saudi Arabia currently dominate the Middle East and Africa freight and logistics market, driven by robust economic activity, significant infrastructure development, and strategic geographic locations. South Africa holds the largest market share in Africa.

Leading Segments (By Function):

- Freight Forwarding: This segment holds the largest market share, driven by increasing international trade and the complexity of global supply chains.

- Warehousing: Growing e-commerce and the need for efficient inventory management are driving demand for warehousing services.

Leading Segments (By End-User):

- Manufacturing and Automotive: This sector dominates due to significant industrial activity and reliance on efficient supply chains.

- Oil and Gas: The region's substantial hydrocarbon reserves fuel strong demand for specialized logistics solutions.

- Distributive Trade (FMCG Included): The growth of FMCG necessitates efficient and reliable logistics networks.

Key Growth Drivers (Regional):

- UAE: Strategic location, advanced infrastructure, and free trade zones.

- Saudi Arabia: Government investments in Vision 2030, focusing on logistics and infrastructure improvements.

- South Africa: Well-developed infrastructure and its role as a regional hub.

Middle East and Africa Freight & Logistics Market Product Analysis

The market showcases a diverse range of products and services, including freight forwarding, warehousing, customs brokerage, and value-added services like packaging and labeling. Technological innovations are transforming the landscape, with the adoption of blockchain for enhanced supply chain transparency, AI for route optimization, and automation for improved warehouse efficiency. These advancements offer competitive advantages by streamlining operations, reducing costs, and enhancing customer satisfaction. The market's future hinges on successful integration of these technologies, offering customized and responsive services to meet evolving customer demands.

Key Drivers, Barriers & Challenges in Middle East and Africa Freight & Logistics Market

Key Drivers:

- Growing e-commerce: Increased online shopping necessitates efficient delivery networks.

- Infrastructure development: Investments in ports, roads, and railways are improving connectivity.

- Government initiatives: Policies promoting logistics and trade facilitation are boosting growth.

Key Challenges:

- Supply chain disruptions: Global events like the pandemic underscore the fragility of supply chains.

- Regulatory complexities: Differing regulations across countries create operational hurdles.

- Infrastructure gaps: Limited infrastructure in certain regions hampers efficient logistics operations. The estimated cost of infrastructure deficits is xx Million annually.

Growth Drivers in the Middle East and Africa Freight & Logistics Market Market

Increased cross-border trade, government investments in logistics infrastructure, and rising e-commerce activity are primary drivers for market expansion. The development of special economic zones and free trade agreements also contributes significantly. Technological advancements like AI and blockchain create further opportunities for streamlined operations and cost reduction.

Challenges Impacting Middle East and Africa Freight & Logistics Market Growth

Political instability in certain regions, infrastructure limitations, particularly in landlocked countries, and a shortage of skilled labor pose significant challenges. The fluctuating oil prices and macroeconomic instability also influence market growth.

Key Players Shaping the Middle East and Africa Freight & Logistics Market Market

- United Parcel Service Inc

- DHL

- Gulf Agency Company (GAC)

- Ceva Logistics

- International Freight Group

- FedEx

- Agility Logistics

- Al-Futtaim Logistics

- Kuehne + Nagel

- Saudi Transport & Investment Co (Mubarrad)

- RAK Logistics

- Almajdouie Group

Significant Middle East and Africa Freight & Logistics Market Industry Milestones

- May 2023: Saudi Logistics Services (SAL) and Lufthansa Technik Logistik Services (LTLS) signed a MoU to collaborate on logistics activities in Saudi Arabia, expanding SAL's service reach and strengthening LTLS's presence.

- April 2023: Almajdouie Logistics expanded its fleet with 30 new Hyundai Xcient trucks, boosting its capacity and efficiency.

Future Outlook for Middle East and Africa Freight & Logistics Market Market

The Middle East and Africa freight and logistics market is poised for continued growth, fueled by technological advancements, infrastructure improvements, and supportive government policies. The increasing adoption of e-commerce and the expansion of various industries present significant opportunities for logistics providers. Strategic partnerships, investments in technology, and a focus on sustainable practices will be key factors in shaping the market's future.

Middle East and Africa Freight & Logistics Market Segmentation

-

1. Function

-

1.1. Freight Transport

- 1.1.1. Road

- 1.1.2. Water

- 1.1.3. Air

- 1.1.4. Rail

- 1.2. Freight Forwarding

- 1.3. Warehousing

- 1.4. Value-added Services and Other Functions

-

1.1. Freight Transport

-

2. End User

- 2.1. Manufacturing and Automotive

- 2.2. Oil and Gas, Mining, and Quarrying

- 2.3. Agriculture, Fishing, and Forestry

- 2.4. Construction

- 2.5. Distribu

- 2.6. Other En

Middle East and Africa Freight & Logistics Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Freight & Logistics Market Regional Market Share

Geographic Coverage of Middle East and Africa Freight & Logistics Market

Middle East and Africa Freight & Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.36% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise In E-commerce Growth in The Region; Development of Logistic Infrastructure

- 3.3. Market Restrains

- 3.3.1. Poor Infrastruture

- 3.4. Market Trends

- 3.4.1. Development of freight transport segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Freight & Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Freight Transport

- 5.1.1.1. Road

- 5.1.1.2. Water

- 5.1.1.3. Air

- 5.1.1.4. Rail

- 5.1.2. Freight Forwarding

- 5.1.3. Warehousing

- 5.1.4. Value-added Services and Other Functions

- 5.1.1. Freight Transport

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Oil and Gas, Mining, and Quarrying

- 5.2.3. Agriculture, Fishing, and Forestry

- 5.2.4. Construction

- 5.2.5. Distribu

- 5.2.6. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. South Africa Middle East and Africa Freight & Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7. Sudan Middle East and Africa Freight & Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8. Uganda Middle East and Africa Freight & Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9. Tanzania Middle East and Africa Freight & Logistics Market Analysis, Insights and Forecast, 2020-2032

- 10. Kenya Middle East and Africa Freight & Logistics Market Analysis, Insights and Forecast, 2020-2032

- 11. Rest of Africa Middle East and Africa Freight & Logistics Market Analysis, Insights and Forecast, 2020-2032

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 United Parcel Service Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 DHL

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Gulf Agency Company (GAC)

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Ceva Logistics

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 International Freight Group**List Not Exhaustive

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 FedEx

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Agility Logistics

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Al-Futtaim Logistics

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Kuehne + Nagel

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Saudi Transport & Investment Co (Mubarrad)

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 RAK Logistics

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Almajdouie Group

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 United Parcel Service Inc

List of Figures

- Figure 1: Middle East and Africa Freight & Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Freight & Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Freight & Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Middle East and Africa Freight & Logistics Market Revenue Million Forecast, by Function 2020 & 2033

- Table 3: Middle East and Africa Freight & Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Middle East and Africa Freight & Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Middle East and Africa Freight & Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 6: South Africa Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Sudan Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Uganda Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Tanzania Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Kenya Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Africa Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Middle East and Africa Freight & Logistics Market Revenue Million Forecast, by Function 2020 & 2033

- Table 13: Middle East and Africa Freight & Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Middle East and Africa Freight & Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: Saudi Arabia Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: United Arab Emirates Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Israel Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Qatar Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Kuwait Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Oman Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Bahrain Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Jordan Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Lebanon Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Freight & Logistics Market?

The projected CAGR is approximately > 6.36%.

2. Which companies are prominent players in the Middle East and Africa Freight & Logistics Market?

Key companies in the market include United Parcel Service Inc, DHL, Gulf Agency Company (GAC), Ceva Logistics, International Freight Group**List Not Exhaustive, FedEx, Agility Logistics, Al-Futtaim Logistics, Kuehne + Nagel, Saudi Transport & Investment Co (Mubarrad), RAK Logistics, Almajdouie Group.

3. What are the main segments of the Middle East and Africa Freight & Logistics Market?

The market segments include Function, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 163.57 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise In E-commerce Growth in The Region; Development of Logistic Infrastructure.

6. What are the notable trends driving market growth?

Development of freight transport segment.

7. Are there any restraints impacting market growth?

Poor Infrastruture.

8. Can you provide examples of recent developments in the market?

May 2023: Saudi Logistics Services (SAL) and Lufthansa Technik Logistik Services (LTLS) have signed an initial Memorandum of Understanding (MoU) to collaborate on the logistics activities of LTLS within Saudi Arabia. Under this MoU, SAL will provide freight forwarding, transportation, and customs brokerage services to support LTLS' maintenance logistics operations for their key customers around Saudi Arabia. As a result, LTLS would subsequently strengthen its logistics services coverage within Saudi Arabia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Freight & Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Freight & Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Freight & Logistics Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Freight & Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence