Key Insights

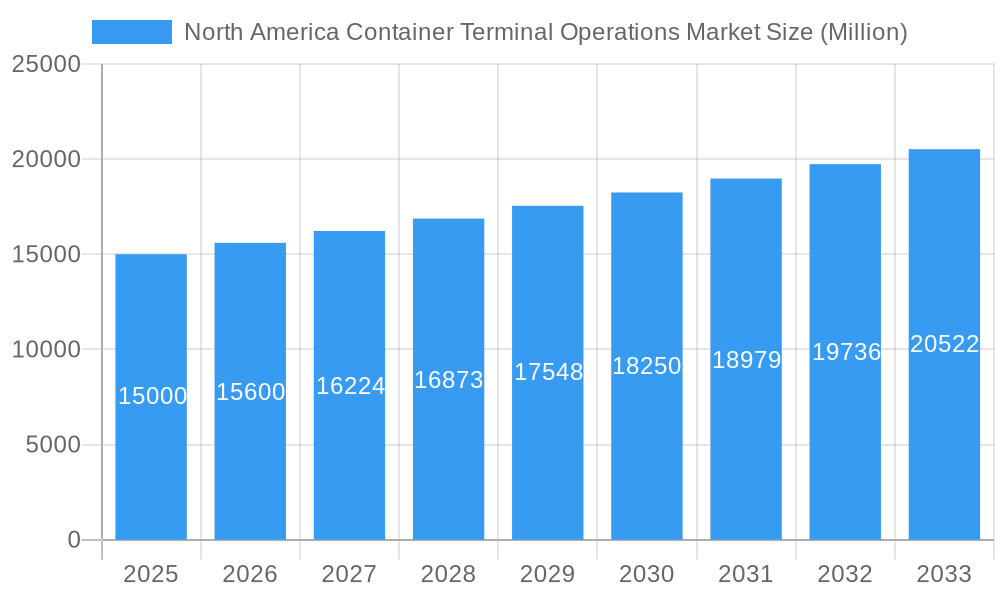

The North America container terminal operations market, encompassing stevedoring, cargo handling, and transportation services, is poised for substantial growth. This expansion is fueled by escalating global trade volumes, the surge in e-commerce driving import/export activity, and significant investments in port infrastructure modernization across key North American hubs. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5%. The market size is estimated to reach $213.38 billion by 2025, with continued expansion anticipated through 2033. Leading companies are strategically enhancing capacity, implementing technological advancements like automation and improved data analytics, and forging partnerships to boost efficiency and reduce operational costs. Challenges such as fluctuating fuel prices, labor shortages, and potential supply chain disruptions may temporarily temper growth. Dry cargo dominates market share, followed by liquid and crude oil, underscoring the importance of containerized goods in North American trade. Stevedoring and cargo handling transportation are key service drivers, highlighting the critical role of efficient port operations within the supply chain. The United States leads market growth due to its robust economy and extensive trade activities, with Canada and Mexico also contributing significantly.

North America Container Terminal Operations Market Market Size (In Billion)

The forecast period (2025-2033) anticipates sustained expansion driven by ongoing infrastructure projects, the adoption of innovative technologies for increased throughput and reduced environmental impact, and government-led port modernization initiatives. Continued growth necessitates addressing existing restraints, ensuring regulatory compliance, mitigating geopolitical risks and environmental concerns, and fostering cross-stakeholder collaboration throughout the supply chain. The market offers considerable opportunities for both established and emerging players who can adapt to evolving dynamics and leverage technological advancements to optimize operations and elevate customer satisfaction.

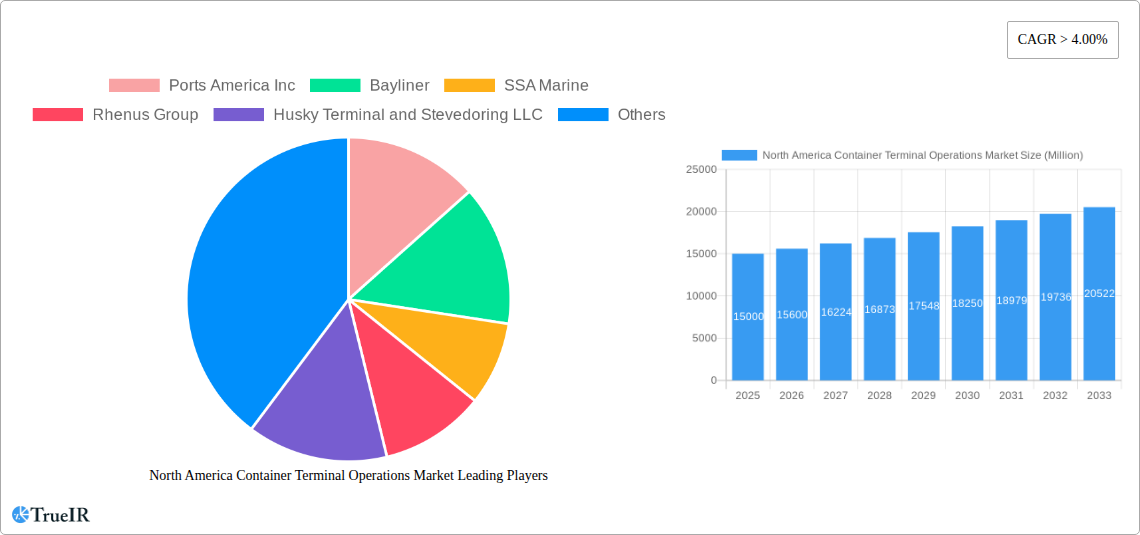

North America Container Terminal Operations Market Company Market Share

North America Container Terminal Operations Market: A Comprehensive Report (2019-2033)

This dynamic report provides a deep dive into the North American container terminal operations market, offering invaluable insights for stakeholders seeking to navigate this rapidly evolving landscape. With a comprehensive study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages rigorous data analysis and expert insights to present a clear picture of current market dynamics and future growth potential. The market is segmented by cargo type (crude oil, dry cargo, other liquid cargo) and service (stevedoring, cargo and handling transportation, others). Key players analyzed include Ports America Inc, Bayliner, SSA Marine, Rhenus Group, Husky Terminal and Stevedoring LLC, Viking Line, Indiana Port Commission, MEYER WERFT GmbH & Co KG, Mississippi State Port Authority at Gulfport, Mediterranean Shipping Company S.A., and others. The report's value surpasses Million in comprehensive analysis.

North America Container Terminal Operations Market Market Structure & Competitive Landscape

The North American container terminal operations market exhibits a moderately concentrated structure, with a few large players commanding significant market share. The Herfindahl-Hirschman Index (HHI) for 2025 is estimated at xx, indicating a moderately concentrated market. However, the market also features numerous smaller, regional operators, creating a dynamic competitive landscape. Innovation is driven by the need for increased efficiency, automation, and improved sustainability. Stringent environmental regulations and safety standards significantly impact operational costs and strategies. Product substitutes, such as improved inland transportation networks, exert some competitive pressure. The market is segmented based on various end-user industries, including manufacturing, retail, and agriculture. Mergers and acquisitions (M&A) activity has been moderate in recent years, with approximately xx M&A deals recorded between 2019 and 2024. These deals largely focused on consolidation and expansion into new markets.

- Market Concentration: HHI (2025): xx

- Innovation Drivers: Automation, sustainability initiatives, data analytics

- Regulatory Impacts: Environmental regulations, safety standards, port security

- End-User Segmentation: Manufacturing, retail, agriculture, etc.

- M&A Trends: Consolidation and expansion into new markets. xx deals between 2019 and 2024.

North America Container Terminal Operations Market Market Trends & Opportunities

The North American container terminal operations market is projected to experience robust growth during the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is primarily fueled by rising e-commerce activity, increasing global trade volumes, and ongoing investments in port infrastructure upgrades. Technological advancements such as automated guided vehicles (AGVs), robotic cranes, and AI-powered systems are significantly improving operational efficiency and reducing labor costs. Consumer preferences are shifting toward faster delivery times and enhanced supply chain transparency, which is putting pressure on terminal operators to adopt advanced technologies. The competitive landscape is becoming increasingly intense, with companies focusing on differentiation strategies such as improved service quality, enhanced sustainability initiatives, and strategic partnerships. Market penetration of automated systems is projected to increase from xx% in 2025 to xx% by 2033.

Dominant Markets & Segments in North America Container Terminal Operations Market

The West Coast of the United States represents the dominant market within North America, driven by high import-export volumes and established port infrastructure. Within the cargo type segment, dry cargo dominates the market, accounting for approximately xx% of the total volume in 2025. The stevedoring service segment is the largest, capturing xx% market share.

- Key Growth Drivers (West Coast): High import/export volume, robust port infrastructure, strategic location.

- Key Growth Drivers (Dry Cargo): Global trade in manufactured goods, agricultural products.

- Key Growth Drivers (Stevedoring): Essential service for container handling, significant labor component.

North America Container Terminal Operations Market Product Analysis

Technological advancements are reshaping the container terminal operations landscape. Automated systems, including AGVs, automated stacking cranes, and AI-powered optimization software, are improving efficiency, reducing costs, and enhancing safety. These innovations are enhancing terminal capacity and optimizing logistics, improving overall market fit and providing competitive advantages to early adopters.

Key Drivers, Barriers & Challenges in North America Container Terminal Operations Market

Key Drivers:

- Growing e-commerce and global trade.

- Technological advancements in automation and digitization.

- Government investments in port infrastructure.

Challenges:

- Supply chain disruptions (e.g., xx% increase in transit times due to congestion in 2024).

- Labor shortages and increasing labor costs (xx% increase in labor costs projected for 2026).

- Stringent environmental regulations.

Growth Drivers in the North America Container Terminal Operations Market Market

Continued growth in global trade, particularly e-commerce, coupled with technological innovations leading to improved efficiency and capacity are major growth drivers. Government investments in infrastructure modernization further strengthen this positive outlook.

Challenges Impacting North America Container Terminal Operations Market Growth

Significant challenges include supply chain bottlenecks, rising labor costs, and stringent environmental regulations, all potentially impacting operational efficiency and profitability.

Key Players Shaping the North America Container Terminal Operations Market Market

- Ports America Inc

- Bayliner

- SSA Marine

- Rhenus Group

- Husky Terminal and Stevedoring LLC

- Viking Line

- Indiana Port Commission

- MEYER WERFT GmbH & Co KG

- Mississippi State Port Authority at Gulfport

- Mediterranean Shipping Company S.A

Significant North America Container Terminal Operations Market Industry Milestones

- 2021: Implementation of new automated systems at the Port of Los Angeles.

- 2022: Completion of major port infrastructure upgrades in Seattle.

- 2023: Several M&A activities consolidating smaller terminal operators.

Future Outlook for North America Container Terminal Operations Market Market

The North American container terminal operations market is poised for continued growth, driven by technological advancements, increased global trade, and strategic investments in infrastructure. Opportunities exist for companies to leverage automation, data analytics, and sustainable practices to gain a competitive edge. The market’s future will be shaped by the successful navigation of challenges like supply chain resilience and regulatory compliance.

North America Container Terminal Operations Market Segmentation

-

1. Service

- 1.1. Stevedoring

- 1.2. Cargo and handling transportation

- 1.3. Others

-

2. Cargo Type

- 2.1. Crude Oil

- 2.2. Dry Cargo

- 2.3. Other Liquid Cargo

- 3. US

- 4. Canada

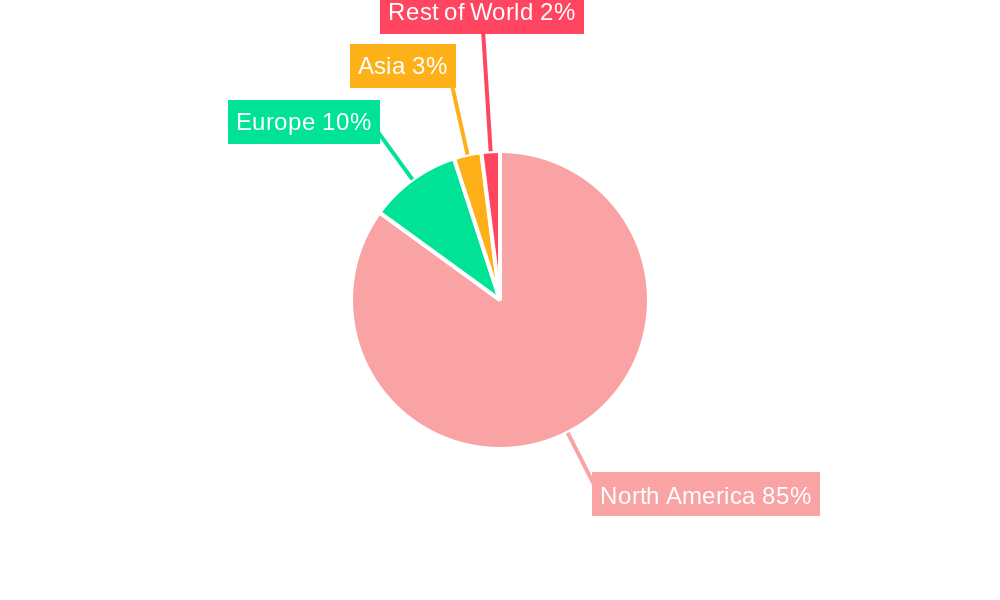

North America Container Terminal Operations Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Container Terminal Operations Market Regional Market Share

Geographic Coverage of North America Container Terminal Operations Market

North America Container Terminal Operations Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing global trade activities; Infrastructure Development is on rise

- 3.3. Market Restrains

- 3.3.1. Manufacturers' lack of control over logistics services and also increasing logistical costs

- 3.4. Market Trends

- 3.4.1. Initiatives towards Greener Industrial Port Activities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Container Terminal Operations Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Stevedoring

- 5.1.2. Cargo and handling transportation

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Cargo Type

- 5.2.1. Crude Oil

- 5.2.2. Dry Cargo

- 5.2.3. Other Liquid Cargo

- 5.3. Market Analysis, Insights and Forecast - by US

- 5.4. Market Analysis, Insights and Forecast - by Canada

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ports America Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bayliner

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SSA Marine

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Rhenus Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Husky Terminal and Stevedoring LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Viking Line

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Indiana Port Commission

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 MEYER WERFT GmbH & Co KG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mississippi State Port Authority at Gulfport**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mediterranean Shipping Company S A

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ports America Inc

List of Figures

- Figure 1: North America Container Terminal Operations Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Container Terminal Operations Market Share (%) by Company 2025

List of Tables

- Table 1: North America Container Terminal Operations Market Revenue billion Forecast, by Service 2020 & 2033

- Table 2: North America Container Terminal Operations Market Revenue billion Forecast, by Cargo Type 2020 & 2033

- Table 3: North America Container Terminal Operations Market Revenue billion Forecast, by US 2020 & 2033

- Table 4: North America Container Terminal Operations Market Revenue billion Forecast, by Canada 2020 & 2033

- Table 5: North America Container Terminal Operations Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Container Terminal Operations Market Revenue billion Forecast, by Service 2020 & 2033

- Table 7: North America Container Terminal Operations Market Revenue billion Forecast, by Cargo Type 2020 & 2033

- Table 8: North America Container Terminal Operations Market Revenue billion Forecast, by US 2020 & 2033

- Table 9: North America Container Terminal Operations Market Revenue billion Forecast, by Canada 2020 & 2033

- Table 10: North America Container Terminal Operations Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States North America Container Terminal Operations Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada North America Container Terminal Operations Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico North America Container Terminal Operations Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Container Terminal Operations Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the North America Container Terminal Operations Market?

Key companies in the market include Ports America Inc, Bayliner, SSA Marine, Rhenus Group, Husky Terminal and Stevedoring LLC, Viking Line, Indiana Port Commission, MEYER WERFT GmbH & Co KG, Mississippi State Port Authority at Gulfport**List Not Exhaustive, Mediterranean Shipping Company S A.

3. What are the main segments of the North America Container Terminal Operations Market?

The market segments include Service, Cargo Type, US, Canada.

4. Can you provide details about the market size?

The market size is estimated to be USD 213.38 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing global trade activities; Infrastructure Development is on rise.

6. What are the notable trends driving market growth?

Initiatives towards Greener Industrial Port Activities.

7. Are there any restraints impacting market growth?

Manufacturers' lack of control over logistics services and also increasing logistical costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Container Terminal Operations Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Container Terminal Operations Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Container Terminal Operations Market?

To stay informed about further developments, trends, and reports in the North America Container Terminal Operations Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence