Key Insights

The North American shipping agency market is poised for significant expansion, projected to achieve a Compound Annual Growth Rate (CAGR) of 15.32% from 2025 to 2033. This robust growth is propelled by escalating global trade volumes, particularly between North America and Asia, which necessitates efficient port and cargo handling. The integration of advanced technologies, including digitalization and automation, is further optimizing operations, enhancing efficiency, and reducing costs, thereby stimulating market development. The market is segmented by agency type (port, cargo, charter) and application (shipowner, lessee), with port and cargo agencies leading in market share due to their pivotal roles in port operations and cargo management. Leading industry participants such as Evergreen Shipping Agency, Seahorse Ship Agencies, and GAC North America are actively pursuing strategic investments in technological enhancements and expanding their service offerings to solidify their competitive positions. The United States represents the largest market segment, followed by Canada and Mexico, with the broader Rest of North America region also presenting substantial growth prospects.

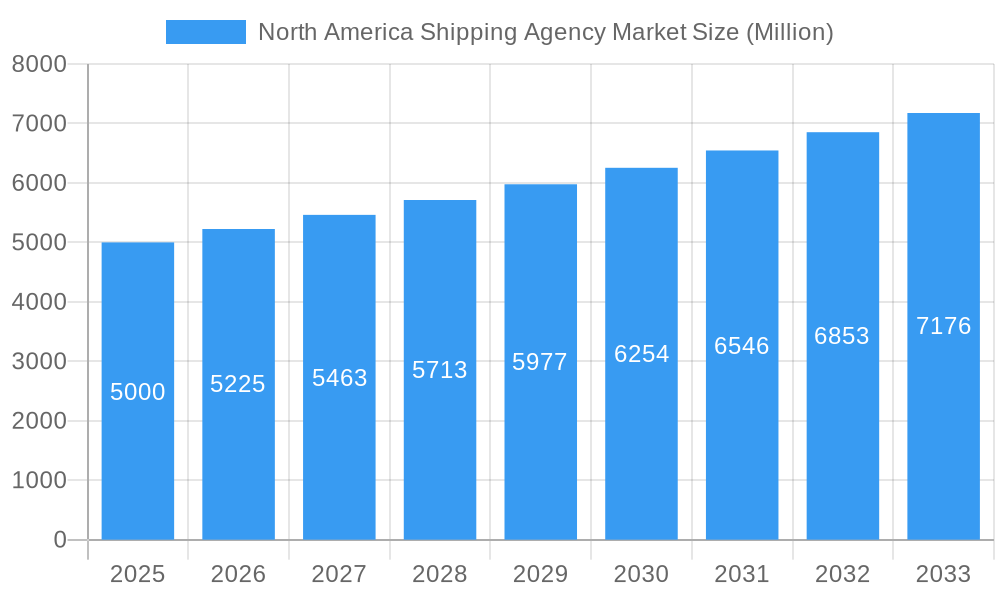

North America Shipping Agency Market Market Size (In Billion)

While the market outlook is predominantly positive, certain challenges may impact growth. These include volatility in global fuel prices, geopolitical disruptions affecting trade routes, and potential shifts in regulatory landscapes. However, sustained e-commerce growth and increasing dependence on global supply chains are expected to underpin a strong long-term trajectory. The competitive environment is characterized by a blend of large multinational corporations and agile regional players, fostering dynamic competition and innovation. A notable trend is the ongoing market consolidation, where larger agencies are acquiring smaller entities to expand their market reach and service capabilities. This consolidation, combined with technological advancements and a growing emphasis on sustainability, will significantly shape the future evolution of the North American shipping agency market. With an estimated market size of $7.29 billion in the base year 2025, the future growth potential for the North American shipping agency market is substantial.

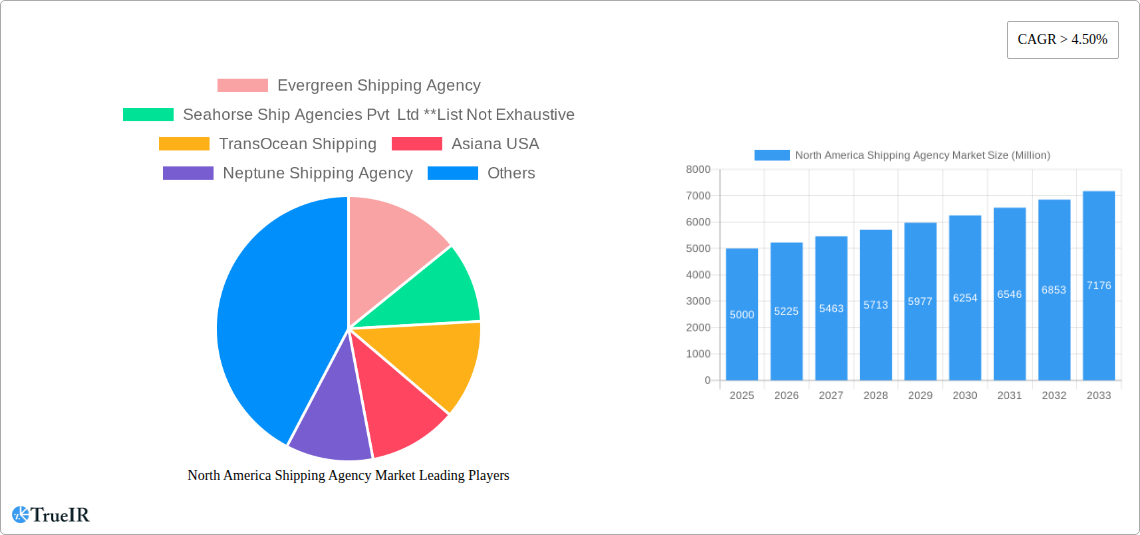

North America Shipping Agency Market Company Market Share

North America Shipping Agency Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America Shipping Agency market, offering invaluable insights for industry stakeholders, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this study delves into market structure, competitive dynamics, growth drivers, challenges, and future projections. The report leverages extensive data analysis to forecast a market valued at xx Million by 2033, showcasing significant growth opportunities across various segments.

North America Shipping Agency Market Market Structure & Competitive Landscape

The North American shipping agency market exhibits a moderately concentrated structure, with a Herfindahl-Hirschman Index (HHI) estimated at xx in 2025. Key players, including Evergreen Shipping Agency, Seahorse Ship Agencies Pvt Ltd, TransOcean Shipping, Asiana USA, Neptune Shipping Agency, North American Shipping Agencies (NASA), Lighthouse Shipping Agency Inc, GAC North America, United Shipping, and Moran Shipping Agency, contribute significantly to the overall market share. However, the market is characterized by a mix of large multinational corporations and smaller, regional players.

Innovation in areas such as digitalization of shipping processes, and advanced data analytics for supply chain optimization are driving market growth. Regulatory changes, particularly concerning environmental regulations and security protocols, pose both challenges and opportunities. Product substitutes, such as streamlined freight forwarding services and digital platforms, exert competitive pressure, leading to ongoing market evolution.

The end-user segmentation comprises primarily shipowners and lessees, with shipowners holding a larger market share due to their reliance on comprehensive shipping agency services. Mergers and acquisitions (M&A) activity within the sector is moderate. In the period 2019-2024, approximately xx M&A transactions were recorded, primarily focused on consolidating regional players and enhancing operational efficiency. This trend is expected to continue, driven by the need for scale and diversification.

- Market Concentration: HHI estimated at xx in 2025.

- Innovation Drivers: Digitalization, data analytics.

- Regulatory Impacts: Environmental regulations, security protocols.

- Product Substitutes: Streamlined freight forwarding, digital platforms.

- End-User Segmentation: Shipowners (xx%), Lessees (xx%).

- M&A Trends: Approximately xx transactions (2019-2024).

North America Shipping Agency Market Market Trends & Opportunities

The North America shipping agency market is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by the increasing volume of global trade, particularly in North America, along with the rising demand for efficient and reliable shipping services. Technological advancements, including the adoption of blockchain technology for enhanced transparency and security in shipping documentation, are transforming industry operations.

Consumer preferences are shifting towards integrated logistics solutions, requiring shipping agencies to offer comprehensive services beyond basic port agency functions. This trend is reflected in the increasing adoption of value-added services, such as cargo insurance, customs brokerage, and supply chain management solutions. Competitive dynamics are intense, with established players focusing on consolidation and diversification strategies while newer entrants leverage technological advancements to capture market share.

Market penetration rates vary across different segments, with port agency services exhibiting the highest penetration due to their indispensable nature in port operations. The integration of digital technologies into port operations is leading to enhanced efficiency, cost reduction, and improved turnaround times. However, challenges like cybersecurity threats and the need for substantial investment in technological upgrades require careful consideration.

Dominant Markets & Segments in North America Shipping Agency Market

The East Coast of the United States currently represents the dominant market within the North American shipping agency landscape, driven by its high volume of port activities and significant international trade flows. Within the segment breakdown:

By Type: Port agency services maintain the largest market share, fueled by high demand from shipowners and other stakeholders, representing xx Million in 2025. Cargo agency services are experiencing strong growth, while charter agency services hold a smaller, yet stable, market position. The “others” category encompasses specialized services, growing at a CAGR of xx%.

By Application: Shipowners constitute the largest user base for shipping agency services, driven by their necessity for comprehensive support in port operations and cargo handling. Lessees represent a significant segment, particularly in the charter agency market.

Key Growth Drivers (By Region & Segment):

- East Coast US: High volume of port activities, significant international trade.

- Port Agency: Essential nature of services, growing port activity.

- Cargo Agency: Increasing trade volumes, demand for efficient handling.

- Shipowners: Reliance on comprehensive shipping agency services.

North America Shipping Agency Market Product Analysis

Innovation within the shipping agency sector focuses primarily on technology-driven solutions that streamline operations, enhance efficiency, and improve data visibility across the supply chain. This includes the use of digital platforms for documentation management, real-time tracking of cargo, and predictive analytics for optimizing shipping routes and minimizing delays. The competitive advantage lies in offering integrated logistics solutions that cater to the evolving needs of shippers, incorporating technology to enhance transparency, reliability, and cost-effectiveness.

Key Drivers, Barriers & Challenges in North America Shipping Agency Market

Key Drivers: The burgeoning global trade and e-commerce activities propel significant growth. Furthermore, technological advancements such as blockchain and AI offer enhanced efficiency and security. Favorable government policies promoting trade also stimulate market growth.

Key Challenges: Stringent environmental regulations and rising fuel costs add operational complexities and increase expenses. Supply chain disruptions, such as port congestion and labor shortages, hamper smooth operations. Increased competition necessitates continuous innovation and strategic adjustments to maintain market share. These challenges could result in a xx% reduction in market growth if not addressed effectively.

Growth Drivers in the North America Shipping Agency Market Market

Growth is fueled by the expansion of global trade, technological advancements offering better efficiency and transparency, and supportive government policies and infrastructure investments.

Challenges Impacting North America Shipping Agency Market Growth

Regulatory complexities, supply chain disruptions (leading to a xx% increase in operational costs in 2024), and intensifying competition are major impediments to market growth.

Key Players Shaping the North America Shipping Agency Market Market

- Evergreen Shipping Agency

- Seahorse Ship Agencies Pvt Ltd

- TransOcean Shipping

- Asiana USA

- Neptune Shipping Agency

- North American Shipping Agencies (NASA)

- Lighthouse Shipping Agency Inc

- GAC North America

- United Shipping

- Moran Shipping Agency

Significant North America Shipping Agency Market Industry Milestones

- 2020: Implementation of new security protocols following heightened cybersecurity concerns.

- 2021: Launch of a major digital platform by a leading shipping agency, improving operational efficiency.

- 2022: Merger of two regional shipping agencies, leading to increased market consolidation.

- 2023: Introduction of new environmental regulations impacting shipping operations.

Future Outlook for North America Shipping Agency Market Market

The North America shipping agency market is poised for continued growth, driven by the ongoing expansion of global trade, increasing adoption of digital technologies, and the growing need for comprehensive logistics solutions. Strategic opportunities lie in leveraging technological advancements to enhance efficiency, optimize supply chains, and offer value-added services to meet the evolving needs of shippers. The market is expected to witness further consolidation through M&A activity, with a focus on creating larger, more diversified players capable of competing effectively in a dynamic global landscape.

North America Shipping Agency Market Segmentation

-

1. Type

- 1.1. Port Agency

- 1.2. Cargo Agency

- 1.3. Charter Agency

- 1.4. Others

-

2. Application

- 2.1. Shipowner

- 2.2. Lessee

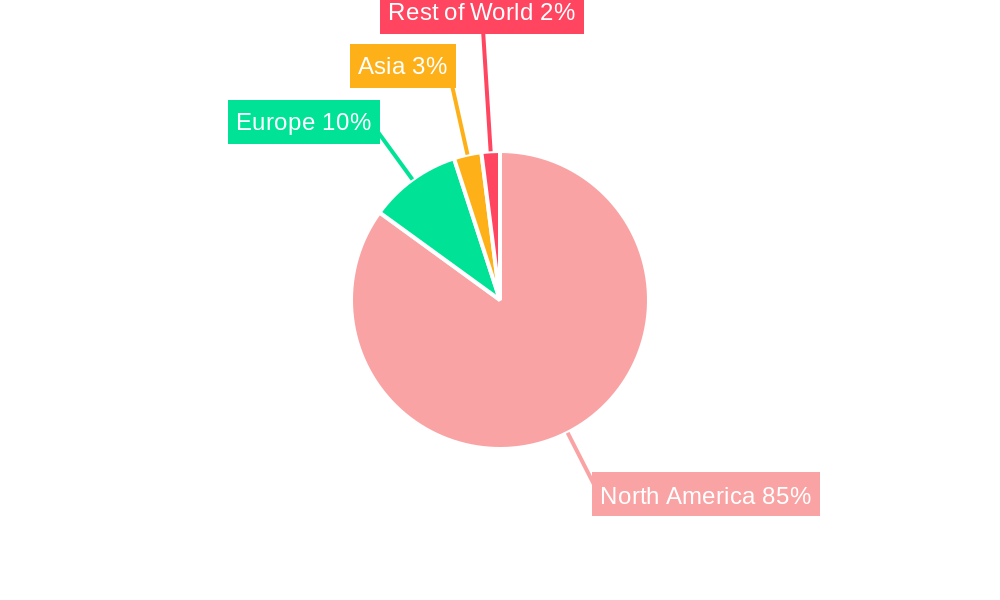

North America Shipping Agency Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Shipping Agency Market Regional Market Share

Geographic Coverage of North America Shipping Agency Market

North America Shipping Agency Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid E-commerce Growth4.; Development Of Logistics Infrastructure And Connectivity

- 3.3. Market Restrains

- 3.3.1. 4.; Logistics Integration In Last-mile Delivery

- 3.4. Market Trends

- 3.4.1. Increase Marintime Trade Boosting the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Shipping Agency Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Port Agency

- 5.1.2. Cargo Agency

- 5.1.3. Charter Agency

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Shipowner

- 5.2.2. Lessee

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Evergreen Shipping Agency

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Seahorse Ship Agencies Pvt Ltd **List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 TransOcean Shipping

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Asiana USA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Neptune Shipping Agency

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 North American Shipping Agencies (NASA)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Lighthouse Shipping Agency Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 GAC North America

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 United Shipping

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Moran Shipping Agency

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Evergreen Shipping Agency

List of Figures

- Figure 1: North America Shipping Agency Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Shipping Agency Market Share (%) by Company 2025

List of Tables

- Table 1: North America Shipping Agency Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Shipping Agency Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: North America Shipping Agency Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America Shipping Agency Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: North America Shipping Agency Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: North America Shipping Agency Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States North America Shipping Agency Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Shipping Agency Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Shipping Agency Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Shipping Agency Market?

The projected CAGR is approximately 15.32%.

2. Which companies are prominent players in the North America Shipping Agency Market?

Key companies in the market include Evergreen Shipping Agency, Seahorse Ship Agencies Pvt Ltd **List Not Exhaustive, TransOcean Shipping, Asiana USA, Neptune Shipping Agency, North American Shipping Agencies (NASA), Lighthouse Shipping Agency Inc, GAC North America, United Shipping, Moran Shipping Agency.

3. What are the main segments of the North America Shipping Agency Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.29 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid E-commerce Growth4.; Development Of Logistics Infrastructure And Connectivity.

6. What are the notable trends driving market growth?

Increase Marintime Trade Boosting the market.

7. Are there any restraints impacting market growth?

4.; Logistics Integration In Last-mile Delivery.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Shipping Agency Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Shipping Agency Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Shipping Agency Market?

To stay informed about further developments, trends, and reports in the North America Shipping Agency Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence