Key Insights

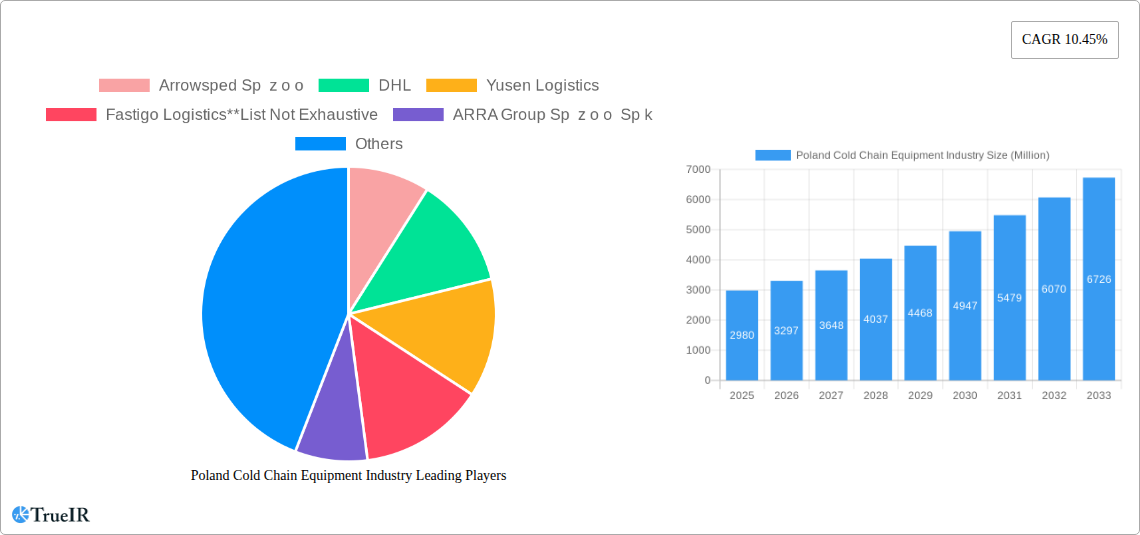

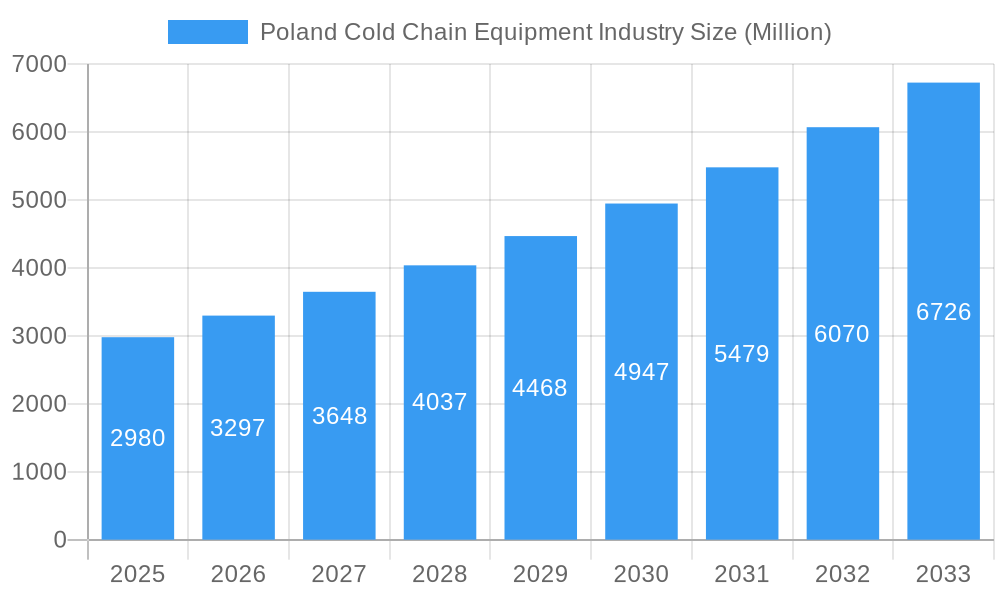

The Polish cold chain equipment market, valued at €2.98 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 10.45% from 2025 to 2033. This expansion is driven by several key factors. The burgeoning Polish food processing and pharmaceutical sectors are increasing demand for reliable cold chain solutions to maintain product quality and safety during transportation and storage. Growing consumer awareness of food safety and hygiene standards further fuels this demand. The rise of e-commerce, particularly in grocery deliveries, necessitates efficient cold chain logistics, contributing significantly to market growth. Furthermore, advancements in cold chain technologies, including energy-efficient refrigeration systems and real-time monitoring solutions, are improving operational efficiency and reducing costs, making them more attractive to businesses. Increased investments in infrastructure and a focus on reducing food waste are also playing a pivotal role. Key segments within the market include chilled and frozen storage, transportation services encompassing specialized fleets and value-added services like blast freezing and inventory management, catering to sectors like horticulture, dairy, meat, fish, poultry, processed foods, and pharmaceuticals. Competition is relatively intense, with both international players like DHL and UPS alongside prominent domestic logistics providers.

Poland Cold Chain Equipment Industry Market Size (In Billion)

However, the market also faces challenges. Fluctuations in energy prices can significantly impact operational costs. The availability of skilled labor and the need for compliance with stringent regulations related to food safety and environmental standards pose considerable hurdles. Despite these restraints, the long-term outlook for the Polish cold chain equipment market remains positive, fueled by continuous economic growth, expanding consumer demand for fresh and processed foods, and the increasing sophistication of the logistics sector. The market is well-positioned to benefit from increased foreign investment and government initiatives promoting sustainable supply chain practices. The growth trajectory is expected to remain robust, making it an attractive investment destination for both domestic and international companies.

Poland Cold Chain Equipment Industry Company Market Share

This comprehensive report provides a detailed analysis of the Poland cold chain equipment industry, covering market size, growth drivers, competitive landscape, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for businesses, investors, and policymakers seeking to understand this dynamic sector. The market is valued at XX Million in 2025 and is projected to reach XX Million by 2033, exhibiting a CAGR of XX%.

Poland Cold Chain Equipment Industry Market Structure & Competitive Landscape

The Polish cold chain equipment market is characterized by a dynamic and evolving structure, with a healthy blend of established global leaders and agile local specialists competing across various segments. While a few dominant players command significant market share, the landscape is increasingly shaped by innovation and specialized service offerings. Key participants, including logistics giants like Arrowsped Sp z o o, DHL, Yusen Logistics, Raben Group, and United Parcel Service of America, alongside specialized providers such as Fastigo Logistics, ARRA Group Sp z o o Sp k, ZBYNEK - Transport Spedycja, Artrans Transport, and Fructus Transport, contribute to a competitive environment. This comprehensive list is illustrative, as numerous other specialized entities contribute to the market's vibrancy. The market's competitive intensity is further amplified by a relentless pursuit of technological advancement and the ever-growing imperative for robust and efficient cold chain solutions.

Current market concentration analyses estimate the top 5 players to hold approximately XX% of the market share in 2025, indicating a moderately concentrated yet competitive landscape. Innovation remains a pivotal growth engine, with companies making substantial investments in cutting-edge refrigeration technologies, sophisticated automation systems, and advanced real-time monitoring solutions. The influence of evolving regulatory frameworks, particularly concerning food safety and stringent hygiene standards, is paramount, compelling market participants to implement rigorous quality control protocols and invest in compliant equipment. While product substitution for specialized cold chain equipment is generally limited due to its unique requirements, the continuous emergence of more energy-efficient and sustainable technologies is a notable factor influencing market dynamics. The end-user base is notably diverse, encompassing critical sectors such as horticulture, dairy, meat and fish processing, pharmaceuticals, and chemicals. Mergers and acquisitions (M&A) activity within the sector has seen moderate levels during the historical period (2019-2024), with an estimated transaction volume of XX Million. The forecast period (2025-2033) is anticipated to witness a surge in consolidation, as larger entities strategically pursue market expansion through targeted acquisitions, further shaping the competitive arena.

Poland Cold Chain Equipment Industry Market Trends & Opportunities

The Polish cold chain equipment market is experiencing a period of robust and sustained growth, propelled by a confluence of significant market drivers. The escalating demand for high-quality fresh and processed food products, coupled with a heightened consumer and regulatory emphasis on food safety and product integrity, is a primary catalyst for the expansion of sophisticated cold chain infrastructure. The rapid proliferation of e-commerce and the burgeoning popularity of online grocery shopping have further amplified the need for efficient, reliable, and scalable cold chain solutions capable of meeting evolving consumer expectations. Technological advancements are revolutionizing the sector, with the widespread adoption of Internet of Things (IoT)-enabled sensors, advanced telematics, and intelligent cold chain management systems transforming operational paradigms. These innovations are crucial for enhancing end-to-end visibility, optimizing temperature control across the supply chain, and significantly reducing product spoilage and associated financial losses. Consumer preferences are increasingly shifting towards sustainably sourced and premium-quality food products, thereby incentivizing companies to invest in state-of-the-art cold chain technologies to meticulously preserve product freshness and ensure safety from farm to fork. The market's competitive dynamics are predominantly influenced by strategic pricing, continuous technological innovation, and the strategic imperative to offer comprehensive, integrated solutions that encompass transportation, warehousing, and value-added services. The market is projected for substantial expansion throughout the forecast period, with an anticipated Compound Annual Growth Rate (CAGR) of XX%. A notable trend is the projected significant increase in the market penetration rates of advanced technologies, particularly IoT-enabled cold chain solutions, over the forecast period.

Dominant Markets & Segments in Poland Cold Chain Equipment Industry

The dominance of specific segments within the Polish cold chain equipment market is nuanced and varies based on the analytical parameters employed, reflecting the diverse needs of its end-users.

By Services: Currently, Transportation services hold the largest market share, driven by the extensive and intricate distribution networks essential for the timely and safe delivery of perishable goods, including food and pharmaceutical products. However, there is a pronounced and accelerating growth in the demand for value-added services. This includes specialized offerings such as advanced blast freezing capabilities, customized inventory management solutions, and temperature-controlled packaging services, all catering to the increasing need for tailored cold chain logistics.

By Temperature Type: The frozen segment remains the market leader, largely attributable to the substantial and consistent demand for a wide array of frozen food products, as well as critical pharmaceutical and medical supplies that require ultra-low temperature storage. The chilled segment, while currently smaller in market share, is exhibiting robust and steady growth. This expansion is directly fueled by the rising consumer appetite for fresh food products, including dairy, fruits, vegetables, and chilled ready-to-eat meals, all of which necessitate precise temperature control during transit and storage.

By Application: The food sector unequivocally dominates the market, with sub-segments like horticulture (fresh fruits and vegetables), dairy products, and processed meats representing the largest consumers of cold chain equipment. The pharmaceutical and life sciences sector is another significant and rapidly expanding segment. This growth is driven by the extremely stringent temperature control requirements for sensitive biologics, vaccines, and other pharmaceutical products, necessitating substantial investments in specialized, high-performance cold chain equipment and infrastructure.

Key Growth Drivers:

- Expanding Food Processing and Retail Sectors: The continuous growth and modernization of Poland's food processing industry and its dynamic retail sector are directly translating into increased demand for advanced cold chain equipment and logistics services.

- Stringent Food Safety Regulations and Consumer Awareness: A heightened global and national focus on food safety, coupled with an increasingly informed consumer base demanding higher quality and safer products, is a powerful driver for companies to invest in and adopt more advanced cold chain solutions.

- Supportive Government Initiatives: The Polish government's strategic focus on enhancing national infrastructure, particularly in logistics and the food industry, along with targeted support programs, is actively stimulating significant investments in cold chain infrastructure development.

- Surge in E-Commerce and Online Food Delivery: The exponential growth of online grocery shopping and food delivery services is creating a substantial and immediate demand for efficient, last-mile cold chain solutions to maintain product integrity during delivery.

Poland Cold Chain Equipment Industry Product Analysis

The Polish cold chain equipment market offers a comprehensive and evolving spectrum of products designed to meet the diverse and demanding requirements of temperature-sensitive supply chains. This portfolio includes a wide array of refrigerated transport vehicles (trucks and vans), sophisticated warehousing and storage systems such as walk-in coolers and freezers, and specialized equipment crucial for processes like blast freezing, precise temperature monitoring, and intelligent inventory management. A significant trend shaping the product landscape is the relentless pursuit of technological advancements, leading to the development of more energy-efficient refrigeration units, highly accurate temperature control systems, and enhanced data tracking and reporting capabilities. The market is witnessing a marked increase in the adoption of integrated solutions, featuring IoT-enabled sensors for real-time data collection, cloud-based monitoring platforms for remote oversight, and automated warehouse management systems (WMS) for optimized operations. These advanced solutions collectively provide unparalleled visibility throughout the cold chain, significantly mitigating the risks associated with temperature excursions, product spoilage, and associated financial losses. The ultimate success and market penetration of these products are critically dependent on their proven reliability, cost-effectiveness, and their unwavering ability to comply with the most stringent safety, hygiene, and regulatory standards prevalent in the industry.

Key Drivers, Barriers & Challenges in Poland Cold Chain Equipment Industry

Key Drivers: Growing food processing and retail sectors, increased government focus on infrastructure development, rising e-commerce adoption, and the need to meet increasingly stringent food safety regulations all drive market growth. The increasing implementation of environmentally friendly refrigeration technologies also contributes to market expansion.

Challenges: High initial investment costs for advanced cold chain equipment, competition from foreign suppliers, and potential disruptions to the supply chain due to geopolitical factors pose considerable challenges. Regulatory complexities and the need for skilled workforce also impede the industry's growth. For instance, ensuring compliance with EU food safety regulations can present substantial cost burdens. Supply chain disruptions, such as those experienced during the recent global events, highlight the vulnerability of the cold chain infrastructure and the need for diversification of suppliers and routes.

Growth Drivers in the Poland Cold Chain Equipment Industry Market

The Polish cold chain equipment market is experiencing substantial growth propelled by several interconnected factors. The expanding footprint and sophistication of the food processing and retail sectors are creating a sustained demand for robust cold chain infrastructure. Simultaneously, increasingly stringent food safety regulations, driven by both consumer expectations and legislative frameworks, are mandating higher standards and greater investment in specialized equipment. The rapid and ongoing adoption of e-commerce, particularly in the food and beverage segment, is creating an urgent need for efficient and reliable last-mile cold chain solutions. Furthermore, proactive government initiatives aimed at enhancing national logistics infrastructure and supporting key industries are providing a conducive environment for investment. Technological advancements play a crucial role, with the development and adoption of energy-efficient refrigeration technologies and sophisticated IoT-enabled monitoring systems significantly boosting market growth. The persistent and growing consumer demand for fresh, high-quality food products, coupled with the non-negotiable requirement for consistent and reliable temperature control throughout the entire supply chain, collectively contribute to the significant expansion of the cold chain equipment market in Poland.

Challenges Impacting Poland Cold Chain Equipment Industry Growth

Challenges include high initial investment costs for advanced equipment, the need for skilled labor to operate and maintain complex systems, regulatory complexities, and potential supply chain disruptions. Furthermore, competition from established international players can limit the growth of domestic businesses. These challenges highlight the necessity for innovative solutions and strategic partnerships to overcome these constraints and foster sustainable growth within the industry.

Key Players Shaping the Poland Cold Chain Equipment Industry Market

- Arrowsped Sp z o o

- DHL

- Yusen Logistics

- Fastigo Logistics

- ARRA Group Sp z o o Sp k

- Raben Group

- ZBYNEK - Transport Spedycja

- United Parcel Service of America

- Artrans Transport

- Fructus Transport

Significant Poland Cold Chain Equipment Industry Milestones

- 2020: Introduction of new EU regulations on food safety and hygiene standards prompting investments in advanced cold chain technology.

- 2021: Several major players invested in expanding their cold storage facilities and logistics networks.

- 2022: Increased adoption of IoT-enabled monitoring systems by key players in the food and pharmaceutical sectors.

- 2023: Launch of several new energy-efficient refrigeration technologies by major equipment manufacturers.

- 2024: Significant investments in cold chain infrastructure driven by government support and private sector initiatives.

Future Outlook for Poland Cold Chain Equipment Industry Market

The Polish cold chain equipment market is poised for continued growth driven by expanding food and pharmaceutical sectors, increased e-commerce adoption, and ongoing technological advancements. Strategic opportunities exist for companies that can offer integrated cold chain solutions, energy-efficient technologies, and enhanced data management capabilities. The market's long-term potential is significant, with strong growth expected across all key segments, including transportation, storage, and value-added services. This necessitates a focus on sustainable solutions, efficient operations, and technological innovation to capitalize on the burgeoning market opportunities.

Poland Cold Chain Equipment Industry Segmentation

-

1. Services

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature Type

- 2.1. Chilled

- 2.2. Frozen

-

3. Application

- 3.1. Horticulture (Fresh Fruits & Vegetables)

- 3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 3.3. Meats, Fish, Poultry

- 3.4. Processed Food Products

- 3.5. Pharma, Life Sciences, and Chemicals

Poland Cold Chain Equipment Industry Segmentation By Geography

- 1. Poland

Poland Cold Chain Equipment Industry Regional Market Share

Geographic Coverage of Poland Cold Chain Equipment Industry

Poland Cold Chain Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increased Globalization boosting the market4.; Technological advancements bolstering the market

- 3.3. Market Restrains

- 3.3.1. 4.; Infrastructure limitation affecting the market4.; Shortage of Labour force affecting the market

- 3.4. Market Trends

- 3.4.1. Changes in Consumer Habits Fueling the Demand for Cold Chain Facilities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland Cold Chain Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature Type

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Horticulture (Fresh Fruits & Vegetables)

- 5.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 5.3.3. Meats, Fish, Poultry

- 5.3.4. Processed Food Products

- 5.3.5. Pharma, Life Sciences, and Chemicals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Arrowsped Sp z o o

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Yusen Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fastigo Logistics**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ARRA Group Sp z o o Sp k

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Raben Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ZBYNEK - Transport Spedycja

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 United Parcel Service of America

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Artrans Transport

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fructus Transport

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Arrowsped Sp z o o

List of Figures

- Figure 1: Poland Cold Chain Equipment Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Poland Cold Chain Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: Poland Cold Chain Equipment Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Poland Cold Chain Equipment Industry Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 3: Poland Cold Chain Equipment Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Poland Cold Chain Equipment Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Poland Cold Chain Equipment Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 6: Poland Cold Chain Equipment Industry Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 7: Poland Cold Chain Equipment Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Poland Cold Chain Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland Cold Chain Equipment Industry?

The projected CAGR is approximately 10.45%.

2. Which companies are prominent players in the Poland Cold Chain Equipment Industry?

Key companies in the market include Arrowsped Sp z o o, DHL, Yusen Logistics, Fastigo Logistics**List Not Exhaustive, ARRA Group Sp z o o Sp k, Raben Group, ZBYNEK - Transport Spedycja, United Parcel Service of America, Artrans Transport, Fructus Transport.

3. What are the main segments of the Poland Cold Chain Equipment Industry?

The market segments include Services, Temperature Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.98 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increased Globalization boosting the market4.; Technological advancements bolstering the market.

6. What are the notable trends driving market growth?

Changes in Consumer Habits Fueling the Demand for Cold Chain Facilities.

7. Are there any restraints impacting market growth?

4.; Infrastructure limitation affecting the market4.; Shortage of Labour force affecting the market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland Cold Chain Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland Cold Chain Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland Cold Chain Equipment Industry?

To stay informed about further developments, trends, and reports in the Poland Cold Chain Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence