Key Insights

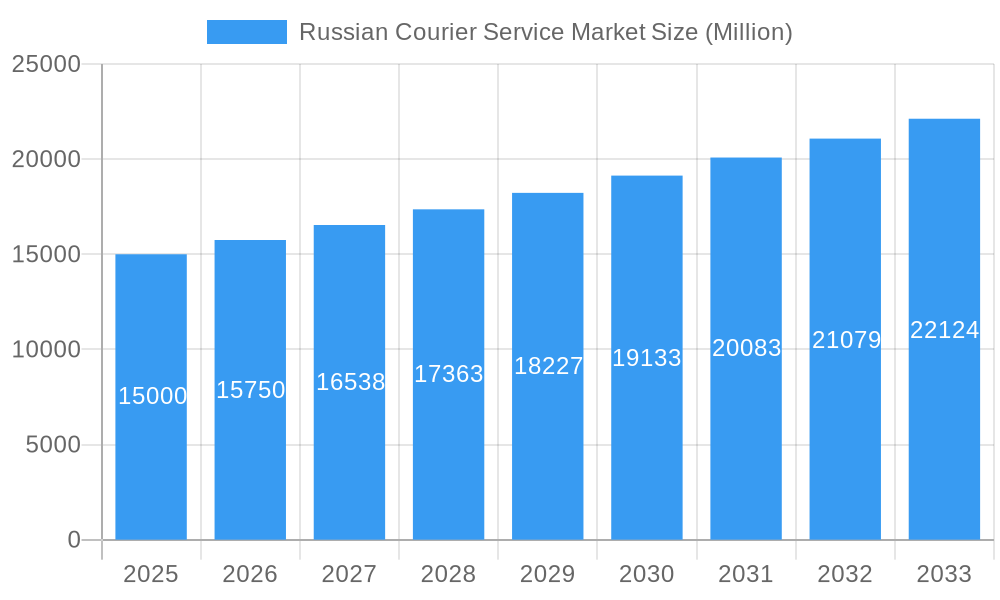

The Russian courier service market, valued at approximately $XX million in 2025 (estimated based on provided CAGR and unspecified market size), is experiencing robust growth, exceeding a 5% CAGR through 2033. This expansion is fueled by the burgeoning e-commerce sector, particularly B2C deliveries, a rise in online shopping across various demographics, and the increasing reliance on expedited delivery services, especially express options. The market's segmentation highlights a strong preference for road transport due to its cost-effectiveness and extensive reach across Russia's vast geography. While B2B services constitute a significant portion, the dominance of B2C reflects the accelerated growth of e-commerce and consumer demand for faster delivery times. Growth is further propelled by the expansion of logistics infrastructure and technological advancements in tracking and delivery management. However, challenges remain, including infrastructure limitations in remote regions, seasonal fluctuations impacting delivery times, and potential regulatory hurdles. The competitive landscape is diverse, with established players like Russian Post and DHL alongside rapidly growing domestic companies like SDEK-Global LLC and Delovye Linii Group. These players are actively investing in technological upgrades and expanding their networks to maintain a competitive edge.

Russian Courier Service Market Market Size (In Billion)

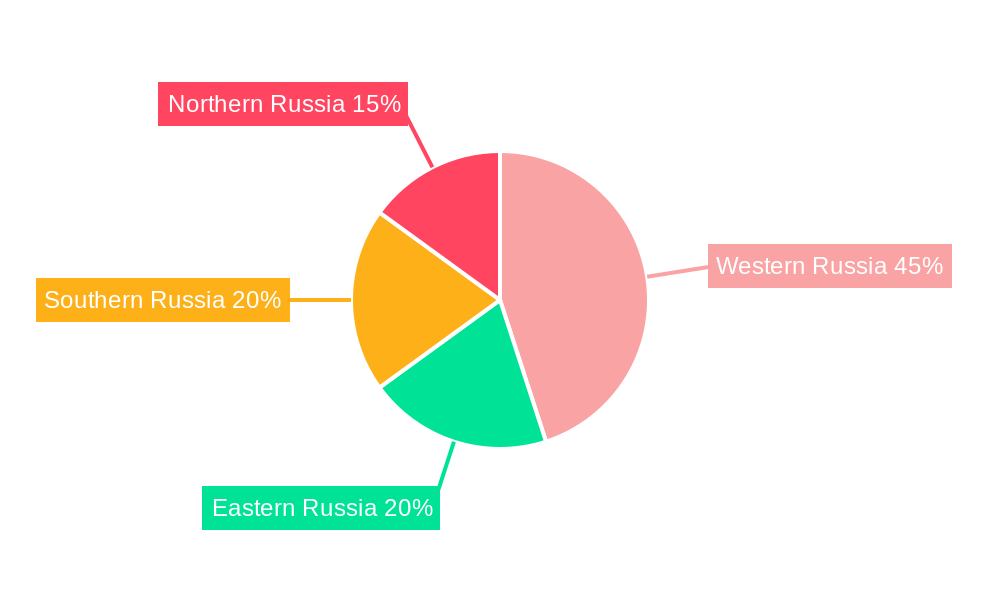

The regional distribution of the market shows significant variations. Western Russia, due to its higher population density and economic activity, commands the largest market share. However, growth is particularly strong in Eastern and Southern Russia as e-commerce penetration expands into these regions. The diverse shipment weight categories reflect the varying needs of different industries, with e-commerce driving demand for light to medium weight shipments, while manufacturing and other sectors utilize heavy-weight shipment options more often. The continued growth of e-commerce in Russia, coupled with increasing consumer expectations for speed and reliability, indicates the continued expansion of the Russian courier services market throughout the forecast period, with significant opportunities for both established and emerging players. Successful companies will be those that can effectively adapt to the unique logistical challenges of the Russian market, invest in technological improvements and maintain competitive pricing strategies.

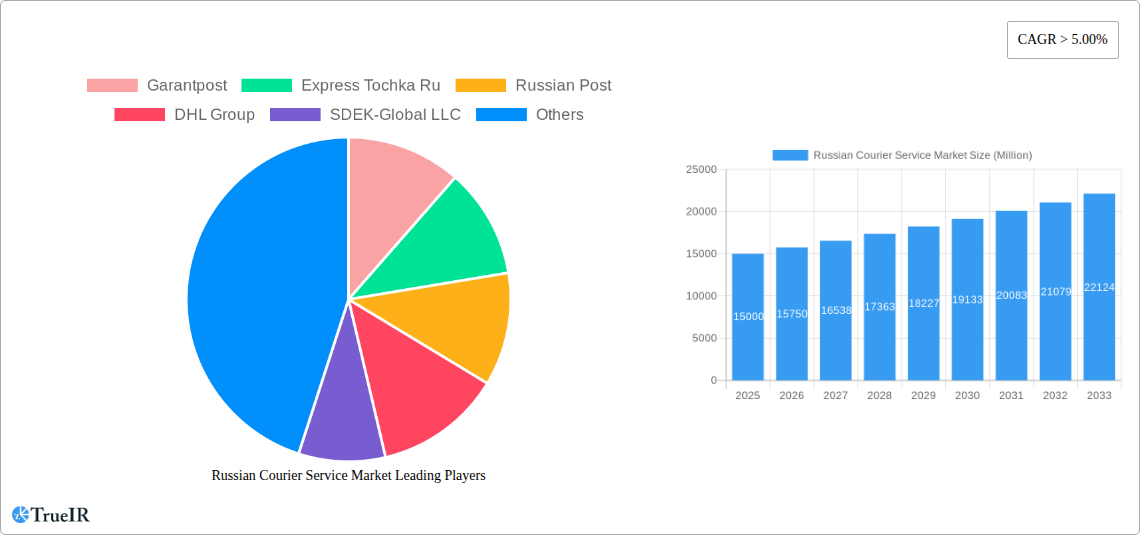

Russian Courier Service Market Company Market Share

Russian Courier Service Market: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the Russian courier service market, encompassing market size, segmentation, competitive landscape, and future outlook. Leveraging extensive research and data, this report is an invaluable resource for industry stakeholders, investors, and strategic decision-makers seeking a comprehensive understanding of this rapidly evolving market. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, while the historical period encompasses 2019-2024. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

Russian Courier Service Market Market Structure & Competitive Landscape

The Russian courier service market exhibits a moderately concentrated structure, with several key players vying for market share. The market's Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately competitive environment. However, the dominance of a few large players, such as Russian Post and SDEK-Global LLC, significantly influences market dynamics. Innovation drivers include technological advancements in tracking and delivery management systems, the increasing adoption of automation, and the expansion of e-commerce. Regulatory impacts, including government policies on logistics and transportation, significantly affect operational costs and market access. Product substitutes include postal services and individual transportation options, though their market share remains limited due to courier services' efficiency and speed.

End-user segmentation is crucial, with significant contributions from e-commerce, BFSI, and wholesale and retail trade sectors. Mergers and acquisitions (M&A) activity has been moderate in recent years, with smaller players consolidating to enhance their operational efficiency and market reach. The total M&A volume in the sector during the historical period is estimated at xx Million. This consolidation trend is anticipated to continue, further shaping the market landscape.

- High market concentration: Dominated by a few key players.

- Significant e-commerce contribution: Driving growth in B2C segment.

- Technological advancements: Optimizing delivery and tracking systems.

- Regulatory influence: Government policies impact operational costs.

- Moderate M&A activity: Consolidation trends expected to continue.

Russian Courier Service Market Market Trends & Opportunities

The Russian courier service market is witnessing robust growth fueled by the expansion of e-commerce, increasing consumer demand for faster and more reliable delivery options, and the growing penetration of mobile commerce. The market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. Technological advancements, such as advanced tracking systems, drone deliveries, and optimized route planning, enhance efficiency and customer satisfaction. Consumer preferences shift towards faster delivery options, leading to a greater demand for express services. Competitive dynamics are shaped by pricing strategies, service offerings, and network coverage. Market penetration rates are particularly high in urban areas, with ongoing efforts to expand reach into rural regions.

Dominant Markets & Segments in Russian Courier Service Market

The domestic segment dominates the Russian courier service market due to the expansive internal trade and e-commerce activity. Within end-user industries, e-commerce is the leading segment, followed by wholesale and retail trade (offline) and BFSI. Express delivery services hold the largest market share based on speed of delivery, driven by customer preference for rapid delivery of goods. The B2C model exhibits the highest growth within delivery models, aligning with the booming e-commerce sector. Medium-weight shipments comprise the largest volume of shipments, reflecting the typical size of online purchases. Road transport remains the primary mode of transportation due to its cost-effectiveness and wide network coverage.

- Key Growth Drivers (Domestic Market): Strong e-commerce growth, expanding infrastructure, government support for logistics development.

- Key Growth Drivers (E-commerce Segment): Increased online shopping, rise of mobile commerce, demand for faster deliveries.

- Key Growth Drivers (Express Delivery): Customer preference for speed, efficient logistics solutions.

- Key Growth Drivers (B2C Model): Increased online shopping, convenience to consumers.

- Key Growth Drivers (Road Transport): Cost-effectiveness, wide network coverage.

Russian Courier Service Market Product Analysis

The Russian courier service market offers a range of products tailored to diverse customer needs. These include express and non-express delivery options, handling various shipment weights (light, medium, heavy), and utilizing various modes of transport (air, road, rail). Key innovations focus on enhancing tracking capabilities, improving last-mile delivery efficiency, and developing specialized solutions for sensitive goods (healthcare, etc.). The market is witnessing a shift towards integrated logistics solutions, offering customers a comprehensive range of services beyond basic delivery. Competitive advantages are derived from network reach, speed and reliability of delivery, pricing strategies, and specialized service offerings.

Key Drivers, Barriers & Challenges in Russian Courier Service Market

Key Drivers: The expanding e-commerce sector, growing consumer demand for faster deliveries, and ongoing investments in logistics infrastructure are driving market growth. Government initiatives supporting the development of the logistics sector further stimulate market expansion.

Challenges: Geopolitical factors can disrupt supply chains, creating uncertainties and affecting delivery times. Regulatory complexities, including customs procedures and transportation regulations, pose operational challenges. Intense competition amongst existing players exerts pressure on pricing and profitability. The vast geographical expanse of Russia presents logistical hurdles in ensuring timely and efficient delivery to remote areas.

Growth Drivers in the Russian Courier Service Market Market

The Russian courier service market is propelled by the rapid growth of e-commerce, particularly in urban areas. Government initiatives focused on infrastructure development and simplifying logistics regulations also support growth. Technological advancements, such as sophisticated tracking systems and optimized delivery routes, contribute to efficiency gains and customer satisfaction.

Challenges Impacting Russian Courier Service Market Growth

Significant challenges include maintaining efficient supply chains amidst geopolitical uncertainties and regulatory complexities. Competition among numerous players leads to price pressure and reduced profit margins. Logistical difficulties associated with serving remote regions remain a significant hurdle. The fluctuation of the Ruble creates a volatile economic landscape, increasing operational costs and impacting profitability.

Key Players Shaping the Russian Courier Service Market Market

- Garantpost

- Express Tochka Ru

- Russian Post

- DHL Group

- SDEK-Global LLC

- Delovye Linii Group

- Ural-Press (Boxberry)

- Major Express

- Pony Express

- Courier Service Express (CSE)

- Yande

- SberLogistics LLC

Significant Russian Courier Service Market Industry Milestones

- December 2023: SberLogistics LLC expanded delivery directions across multiple Russian regions and introduced new tariffs for SberCourier and SberPosylka services.

- May 2023: Garantpost improved service operations at its St. Petersburg branch.

- March 2023: Launch of Sea + Railway delivery service from China and Southeast Asia to Moscow and St. Petersburg, via Riga.

Future Outlook for Russian Courier Service Market Market

The Russian courier service market is poised for continued growth, driven by the sustained expansion of e-commerce, infrastructure investments, and technological advancements. Strategic opportunities lie in expanding into underserved regions, offering specialized services (e.g., cold chain logistics), and developing innovative delivery solutions. The market's potential remains significant, with substantial room for growth in both volume and value terms, provided geopolitical stability and economic conditions are favorable.

Russian Courier Service Market Segmentation

-

1. Destination

- 1.1. Domestic

- 1.2. International

-

2. Speed Of Delivery

- 2.1. Express

- 2.2. Non-Express

-

3. Model

- 3.1. Business-to-Business (B2B)

- 3.2. Business-to-Consumer (B2C)

- 3.3. Consumer-to-Consumer (C2C)

-

4. Shipment Weight

- 4.1. Heavy Weight Shipments

- 4.2. Light Weight Shipments

- 4.3. Medium Weight Shipments

-

5. Mode Of Transport

- 5.1. Air

- 5.2. Road

- 5.3. Others

-

6. End User Industry

- 6.1. E-Commerce

- 6.2. Financial Services (BFSI)

- 6.3. Healthcare

- 6.4. Manufacturing

- 6.5. Primary Industry

- 6.6. Wholesale and Retail Trade (Offline)

- 6.7. Others

Russian Courier Service Market Segmentation By Geography

- 1. Russia

Russian Courier Service Market Regional Market Share

Geographic Coverage of Russian Courier Service Market

Russian Courier Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising E-commerce Sector to Boost the International CEP Market in China; Increasing Volume of Parcel Shipments in China

- 3.3. Market Restrains

- 3.3.1. Poor infrastructure and higher logistics costs; Lack of control of manufacturers on logistics services

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russian Courier Service Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 5.1.1. Domestic

- 5.1.2. International

- 5.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 5.2.1. Express

- 5.2.2. Non-Express

- 5.3. Market Analysis, Insights and Forecast - by Model

- 5.3.1. Business-to-Business (B2B)

- 5.3.2. Business-to-Consumer (B2C)

- 5.3.3. Consumer-to-Consumer (C2C)

- 5.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 5.4.1. Heavy Weight Shipments

- 5.4.2. Light Weight Shipments

- 5.4.3. Medium Weight Shipments

- 5.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 5.5.1. Air

- 5.5.2. Road

- 5.5.3. Others

- 5.6. Market Analysis, Insights and Forecast - by End User Industry

- 5.6.1. E-Commerce

- 5.6.2. Financial Services (BFSI)

- 5.6.3. Healthcare

- 5.6.4. Manufacturing

- 5.6.5. Primary Industry

- 5.6.6. Wholesale and Retail Trade (Offline)

- 5.6.7. Others

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Garantpost

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Express Tochka Ru

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Russian Post

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DHL Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SDEK-Global LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Delovye Linii Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ural-Press (Boxberry)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Major Express

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pony Express

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Courier Service Express (CSE)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Yande

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 SberLogistics LLC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Garantpost

List of Figures

- Figure 1: Russian Courier Service Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Russian Courier Service Market Share (%) by Company 2025

List of Tables

- Table 1: Russian Courier Service Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 2: Russian Courier Service Market Revenue Million Forecast, by Speed Of Delivery 2020 & 2033

- Table 3: Russian Courier Service Market Revenue Million Forecast, by Model 2020 & 2033

- Table 4: Russian Courier Service Market Revenue Million Forecast, by Shipment Weight 2020 & 2033

- Table 5: Russian Courier Service Market Revenue Million Forecast, by Mode Of Transport 2020 & 2033

- Table 6: Russian Courier Service Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 7: Russian Courier Service Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Russian Courier Service Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 9: Russian Courier Service Market Revenue Million Forecast, by Speed Of Delivery 2020 & 2033

- Table 10: Russian Courier Service Market Revenue Million Forecast, by Model 2020 & 2033

- Table 11: Russian Courier Service Market Revenue Million Forecast, by Shipment Weight 2020 & 2033

- Table 12: Russian Courier Service Market Revenue Million Forecast, by Mode Of Transport 2020 & 2033

- Table 13: Russian Courier Service Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 14: Russian Courier Service Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russian Courier Service Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Russian Courier Service Market?

Key companies in the market include Garantpost, Express Tochka Ru, Russian Post, DHL Group, SDEK-Global LLC, Delovye Linii Group, Ural-Press (Boxberry), Major Express, Pony Express, Courier Service Express (CSE), Yande, SberLogistics LLC.

3. What are the main segments of the Russian Courier Service Market?

The market segments include Destination, Speed Of Delivery, Model, Shipment Weight, Mode Of Transport, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising E-commerce Sector to Boost the International CEP Market in China; Increasing Volume of Parcel Shipments in China.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Poor infrastructure and higher logistics costs; Lack of control of manufacturers on logistics services.

8. Can you provide examples of recent developments in the market?

December 2023: has expanded the number of delivery directions in the regions of Krasnodar region, Tver region, Arkhangelsk region, Amur region, Karachay-Cherkessia, The Republic of Khakassia, Tyva Republic, and Kemerovo region. Also, the new tariffs for sending parcels using SberCourier and SberPosylka services had come into effect for SberLogistics LLC from January 16, 2023.May 2023: Garantpost announced that it improved service operations at its St. Petersburg branch for courier and parcel deliveries.March 2023: The Sea + Railway delivery service is available from the main ports of China and Southeast Asia to the Russian Federation (Moscow and St. Petersburg). The option includes sea freight to the port of Riga, transshipment to a railway car, and shipment by rail to the Russian Federation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russian Courier Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russian Courier Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russian Courier Service Market?

To stay informed about further developments, trends, and reports in the Russian Courier Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence