Key Insights

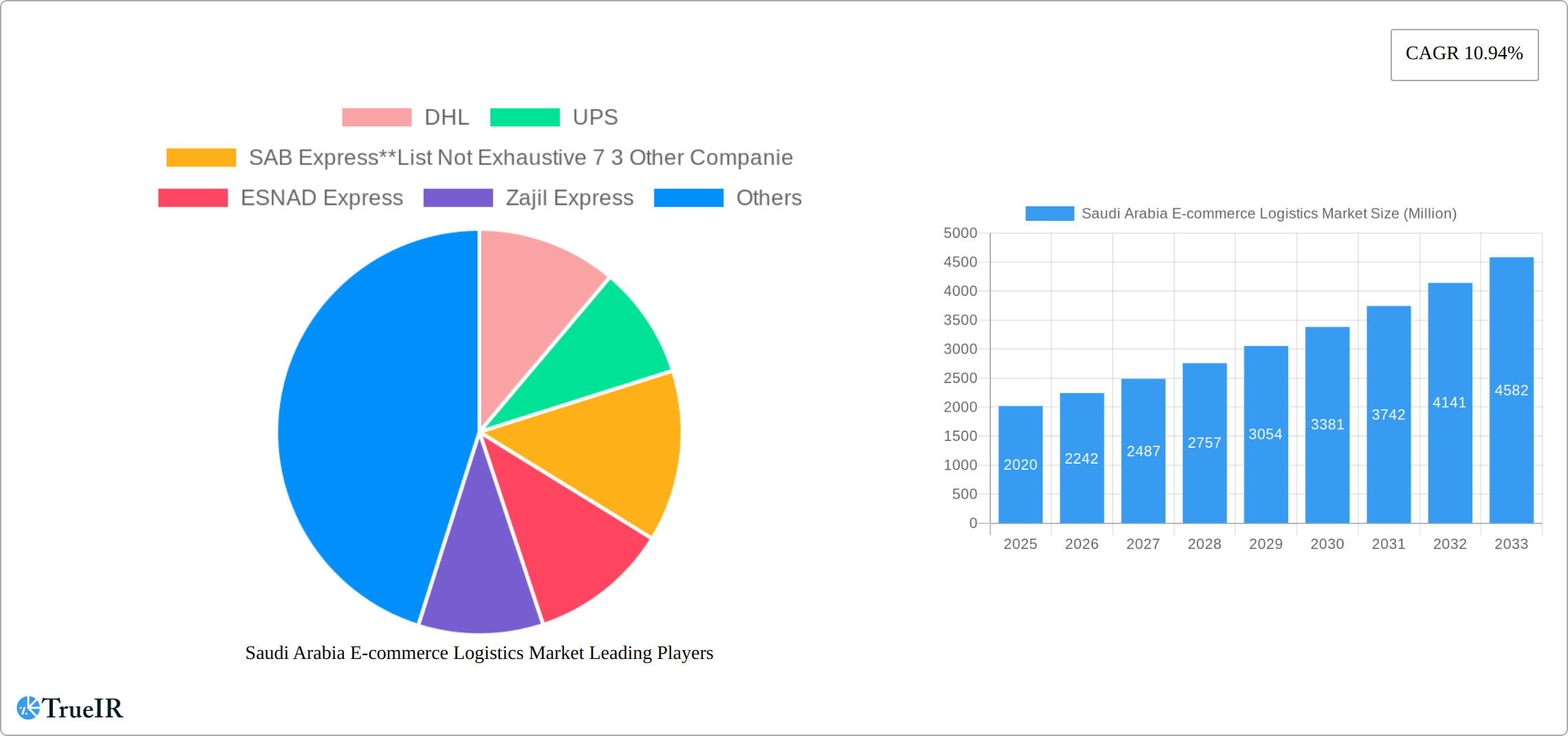

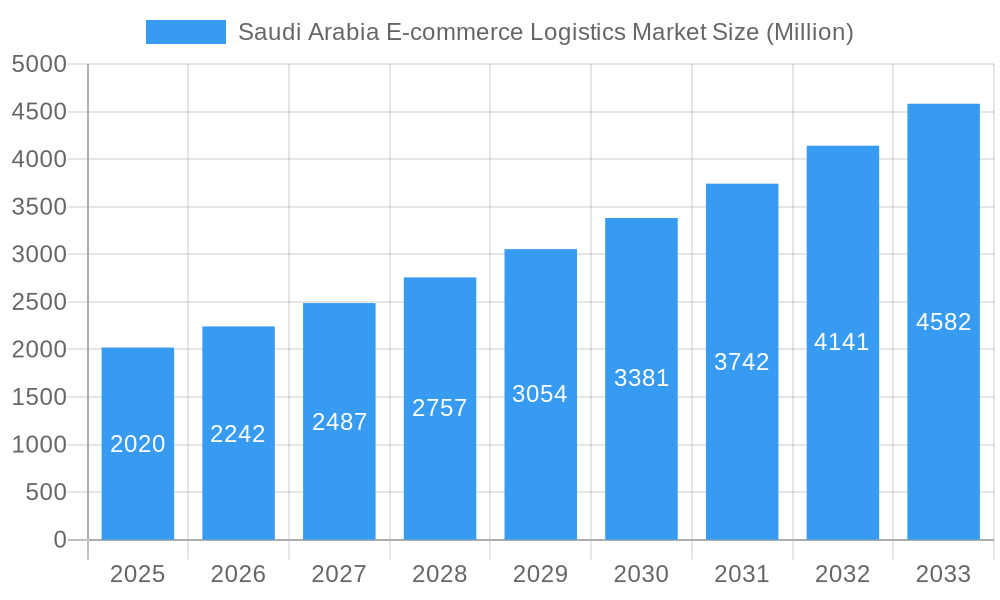

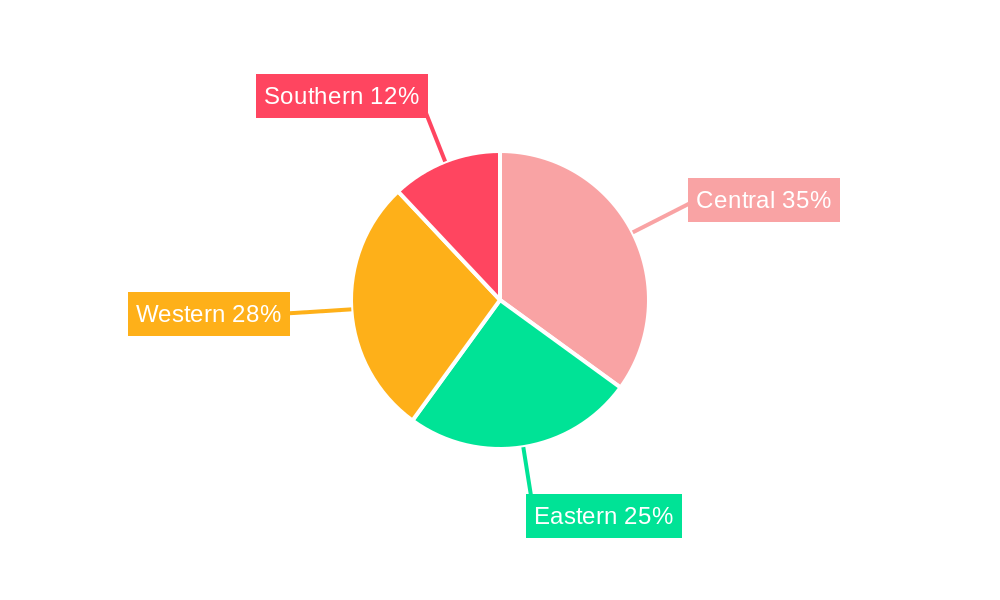

The Saudi Arabian e-commerce logistics market is experiencing robust growth, projected to reach \$2.02 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 10.94% from 2025 to 2033. This expansion is fueled by several key factors. The surge in online shopping, driven by increasing internet and smartphone penetration, a young and digitally-savvy population, and government initiatives promoting digital transformation, are significant drivers. Furthermore, the diversification of the Saudi economy and the growth of the middle class contribute to higher consumer spending on e-commerce, thereby increasing demand for efficient and reliable logistics services. The market is segmented by service type (transportation, warehousing, inventory management, value-added services), business type (B2B, B2C), destination (domestic, international), and product category (fashion, electronics, home appliances, furniture, beauty products, and others). The competitive landscape is diverse, encompassing both international giants like DHL and UPS, and regional players such as Aramex, Saudi Post, and others, indicating a healthy market with opportunities for both established and emerging companies. The regional distribution across Saudi Arabia (Central, Eastern, Western, Southern) will likely see varying growth rates depending on infrastructure development and population density.

Saudi Arabia E-commerce Logistics Market Market Size (In Billion)

Growth within the market will likely be driven by continuous investments in technology, particularly in areas such as last-mile delivery solutions, automated warehousing, and advanced tracking systems. The increasing adoption of omnichannel strategies by retailers will further fuel demand for flexible and integrated logistics services. However, challenges remain, including the need for infrastructure improvements, particularly in remote areas, and the ongoing development of a robust regulatory framework for the e-commerce sector. Overcoming these challenges will be crucial for unlocking the full potential of the Saudi Arabian e-commerce logistics market and ensuring sustainable long-term growth. The increasing focus on sustainability and customer experience will also shape the future of this dynamic market, with companies investing in eco-friendly delivery options and enhanced customer service capabilities.

Saudi Arabia E-commerce Logistics Market Company Market Share

Saudi Arabia E-commerce Logistics Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the burgeoning Saudi Arabia e-commerce logistics market, offering invaluable insights for investors, businesses, and industry stakeholders. With a comprehensive study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive data and expert analysis to illuminate the market's current state, future trajectory, and key players. The market is segmented by service (transportation, warehousing, inventory management, value-added services), business (B2B, B2C), destination (domestic, international), and product (fashion, electronics, home appliances, furniture, beauty, and other products). The report projects significant growth, driven by technological advancements, supportive government policies, and rising e-commerce adoption. Key players like DHL, UPS, Aramex, and Saudi Post are analyzed, along with emerging players shaping the competitive landscape. The report also identifies key challenges and opportunities, offering a clear roadmap for success in this rapidly evolving market. Expect detailed analysis on market size (in Millions), CAGR, market penetration rates, and concentration ratios.

Saudi Arabia E-commerce Logistics Market Structure & Competitive Landscape

The Saudi Arabia e-commerce logistics market exhibits a moderately concentrated structure, with a handful of major players alongside a larger number of smaller, specialized firms. The market concentration ratio (CR4) for 2024 is estimated at xx%, indicating some dominance by larger players. However, the presence of numerous smaller companies, particularly in niche segments, demonstrates a competitive landscape. Innovation is a key driver, with companies investing heavily in technologies such as AI-powered route optimization, automated warehousing, and last-mile delivery solutions. Government regulations, particularly those related to data privacy and cross-border trade, significantly impact the market. Substitutes for traditional logistics services include crowdsourced delivery platforms and peer-to-peer delivery networks, though these currently hold a relatively small market share. The market is segmented by various end-users based on their specific logistic needs, including large e-commerce companies, small and medium-sized enterprises (SMEs), and individual consumers.

The M&A activity in the sector has been moderate in recent years, with xx major deals reported between 2019 and 2024. These transactions reflect consolidation efforts by larger players seeking to expand their service portfolios and geographic reach.

- Market Concentration: CR4 (2024) estimated at xx%.

- Innovation Drivers: AI-powered solutions, automated warehousing, last-mile delivery technologies.

- Regulatory Impacts: Data privacy regulations, cross-border trade policies.

- Product Substitutes: Crowdsourced delivery, peer-to-peer delivery (low market share).

- End-User Segmentation: Large e-commerce companies, SMEs, individual consumers.

- M&A Trends: xx major deals (2019-2024), reflecting consolidation.

Saudi Arabia E-commerce Logistics Market Market Trends & Opportunities

The Saudi Arabia e-commerce logistics market is experiencing robust growth, driven by several key factors. The market size is projected to reach xx Million by 2025, expanding at a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by the rapid expansion of e-commerce in the Kingdom, spurred by increased internet and smartphone penetration, a burgeoning middle class, and government initiatives promoting digital transformation. Technological advancements, such as the adoption of drones for last-mile delivery and the implementation of advanced warehousing management systems, are further accelerating market growth. Shifting consumer preferences towards convenience and speed are driving demand for faster delivery options, including same-day and next-day delivery services. Competitive dynamics are characterized by intense rivalry among existing players, alongside the emergence of new entrants offering innovative solutions. The market penetration rate of e-commerce logistics is expected to reach xx% by 2033, indicating significant untapped potential for growth.

Dominant Markets & Segments in Saudi Arabia E-commerce Logistics Market

The Saudi Arabian e-commerce logistics market is a dynamic landscape comprised of diverse segments, each exhibiting unique growth trajectories and challenges. This multifaceted market is experiencing rapid expansion, driven by several key factors detailed below.

Segmentation Analysis:

The market can be segmented in several ways, offering a comprehensive view of its structure and growth potential:

By Service Type:

- Transportation: This remains the largest segment, fueled by the increasing demand for efficient and reliable goods movement across the Kingdom. Significant investments in infrastructure, coupled with advancements in fleet management technologies (like GPS tracking and route optimization software), are accelerating growth within this sector.

- Warehousing & Inventory Management: Experiencing substantial growth due to the escalating need for sophisticated storage and inventory tracking solutions among e-commerce businesses. The adoption of Warehouse Management Systems (WMS) and automated storage and retrieval systems (AS/RS) is transforming this segment.

- Value-Added Services: This rapidly expanding segment encompasses services such as customized packaging, labeling, returns processing, and last-mile delivery solutions. E-commerce businesses are increasingly prioritizing value-added services to enhance customer experience and build brand loyalty.

- Last-Mile Delivery: This crucial segment is witnessing innovation with the introduction of technologies like drone delivery and alternative transportation methods to ensure timely and efficient delivery to customers, particularly in remote areas.

By Business Model:

- Business-to-Consumer (B2C): This remains the dominant segment, reflecting the phenomenal growth of online retail in Saudi Arabia. The increasing penetration of smartphones and internet access fuels this expansion.

- Business-to-Business (B2B): This segment is witnessing steady growth, driven by the rising adoption of e-procurement systems and the increasing preference for online transactions among businesses.

By Geographic Scope:

- Domestic: Continues to be the largest segment, indicative of the concentration of e-commerce activities within the Kingdom's borders. However, the international segment is catching up quickly.

- International: Experiencing explosive growth, propelled by the surge in cross-border e-commerce. This necessitates robust customs clearance procedures and efficient international shipping capabilities.

By Product Category:

- Fashion and Apparel: A leading segment due to the high demand for online clothing and accessories, benefiting from visual merchandising and easy returns policies.

- Consumer Electronics: Continues to experience robust growth driven by the widespread adoption of smartphones, laptops, and other electronic gadgets.

- Groceries and Food: A rapidly expanding segment, with increased demand for online grocery delivery services. This requires specialized logistics solutions to maintain cold-chain integrity.

- Other Product Categories: This includes a diverse range of products, exhibiting consistent demand across various segments.

Key Growth Catalysts:

- Robust Infrastructure Development: Ongoing substantial investments in transportation networks, modern warehousing facilities, and cutting-edge technological infrastructure are significantly boosting market growth.

- Government Initiatives: Supportive government policies and initiatives, including Vision 2030's focus on digital transformation and e-commerce expansion, are creating a conducive environment for market expansion.

- Rising Smartphone Penetration and Internet Access: The increasing adoption of smartphones and widespread internet access is driving the adoption of e-commerce and creating a larger consumer base.

- Technological Advancements: The integration of Artificial Intelligence (AI), Machine Learning (ML), and automation technologies is streamlining operations, enhancing efficiency, and reducing costs.

Saudi Arabia E-commerce Logistics Market Product Analysis

The Saudi Arabia e-commerce logistics market is characterized by ongoing product innovation, focusing on enhancing efficiency, speed, and customer experience. Technological advancements like AI-powered route optimization, automated sorting systems, and drone delivery are transforming the industry. Companies are investing in advanced warehouse management systems (WMS) and transportation management systems (TMS) to streamline operations and reduce costs. The market is seeing a growing focus on sustainable logistics solutions, such as electric vehicles and eco-friendly packaging materials, in response to growing environmental concerns. The successful implementation of these technologies depends on the ability to integrate them effectively within existing operations and adapt them to local infrastructure limitations.

Key Drivers, Barriers & Challenges in Saudi Arabia E-commerce Logistics Market

Key Drivers:

- Government support: Vision 2030's emphasis on digital transformation is a major driver.

- Rising e-commerce adoption: Increased internet penetration fuels demand for logistics services.

- Technological advancements: Automation and AI improve efficiency and reduce costs.

Key Challenges and Restraints:

- Infrastructure limitations: Limited warehousing capacity and underdeveloped transportation networks in certain areas pose challenges. This leads to increased transportation times and costs, impacting last-mile delivery efficiency.

- Regulatory hurdles: Complex regulations and bureaucratic processes can slow down market entry and expansion. This adds to operational complexity and potentially increases costs.

- Competitive pressures: The intense competition among established players and new entrants creates pricing pressures, impacting profitability. This necessitates innovation and operational excellence to maintain a competitive edge.

Growth Drivers in the Saudi Arabia E-commerce Logistics Market Market

The Saudi Arabia e-commerce logistics market's growth is fueled by significant investments in infrastructure, driven by Vision 2030's digital transformation goals. The expansion of e-commerce, coupled with technological advancements such as AI and automation, further boosts efficiency and customer satisfaction. Government regulations supporting e-commerce activities and facilitating foreign investment contribute to positive market growth.

Challenges Impacting Saudi Arabia E-commerce Logistics Market Growth

Challenges include infrastructure limitations, especially in less-developed regions, leading to higher transportation costs. Regulatory complexities and bureaucratic processes pose significant hurdles. Intense competition from established and new players creates pricing pressures. Addressing these challenges through infrastructure development, regulatory simplification, and strategic partnerships is crucial for sustained market growth.

Significant Saudi Arabia E-commerce Logistics Market Industry Milestones

- February 2024: Naqel Express partners with Red Sea Global, utilizing biofueled and electric vehicles for sustainable logistics services. This signifies a shift towards environmentally conscious practices within the sector.

- February 2024: Aramco and DHL establish ASMO, a joint venture for procurement and logistics services, highlighting collaboration and investment in modernizing supply chains. This underscores the increasing importance of efficient supply chain management in the Kingdom.

Future Outlook for Saudi Arabia E-commerce Logistics Market Market

The Saudi Arabia e-commerce logistics market is poised for continued strong growth, driven by sustained e-commerce expansion, ongoing infrastructure development, and technological innovations. Strategic partnerships between logistics providers and e-commerce businesses will further enhance market efficiency and customer experience. The focus on sustainable logistics solutions will also shape the market's future trajectory, creating opportunities for environmentally conscious companies. The market presents significant potential for both established players and new entrants seeking to capitalize on the Kingdom's dynamic e-commerce landscape.

Saudi Arabia E-commerce Logistics Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehousing Inventory Management

- 1.3. Value-added Services (Labelling, Packaging)

-

2. Business

- 2.1. B2B

- 2.2. B2C

-

3. Destination

- 3.1. Domestic

- 3.2. International

-

4. Product

- 4.1. Fashion and Apparel

- 4.2. Consumer Electronics

- 4.3. Home Appliances

- 4.4. Furnniture

- 4.5. Beauty and Personal Care Products

- 4.6. Other Products (Toys. Food Products)

Saudi Arabia E-commerce Logistics Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia E-commerce Logistics Market Regional Market Share

Geographic Coverage of Saudi Arabia E-commerce Logistics Market

Saudi Arabia E-commerce Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Internet and Smart Phone Penetration; Urbanization and Lifestyle Changes; Government Initiatives

- 3.3. Market Restrains

- 3.3.1. Poor Infrastructure and Last-mile Delivery

- 3.4. Market Trends

- 3.4.1. Growth in e-Commerce Sales is Driving the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia E-commerce Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehousing Inventory Management

- 5.1.3. Value-added Services (Labelling, Packaging)

- 5.2. Market Analysis, Insights and Forecast - by Business

- 5.2.1. B2B

- 5.2.2. B2C

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International

- 5.4. Market Analysis, Insights and Forecast - by Product

- 5.4.1. Fashion and Apparel

- 5.4.2. Consumer Electronics

- 5.4.3. Home Appliances

- 5.4.4. Furnniture

- 5.4.5. Beauty and Personal Care Products

- 5.4.6. Other Products (Toys. Food Products)

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DHL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 UPS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SAB Express**List Not Exhaustive 7 3 Other Companie

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ESNAD Express

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Zajil Express

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SMSA Express

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Aramex

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ali Express

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Alma Express

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Saudi Post

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DHL

List of Figures

- Figure 1: Saudi Arabia E-commerce Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia E-commerce Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia E-commerce Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Saudi Arabia E-commerce Logistics Market Revenue Million Forecast, by Business 2020 & 2033

- Table 3: Saudi Arabia E-commerce Logistics Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 4: Saudi Arabia E-commerce Logistics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 5: Saudi Arabia E-commerce Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Saudi Arabia E-commerce Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 7: Saudi Arabia E-commerce Logistics Market Revenue Million Forecast, by Business 2020 & 2033

- Table 8: Saudi Arabia E-commerce Logistics Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 9: Saudi Arabia E-commerce Logistics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 10: Saudi Arabia E-commerce Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia E-commerce Logistics Market?

The projected CAGR is approximately 10.94%.

2. Which companies are prominent players in the Saudi Arabia E-commerce Logistics Market?

Key companies in the market include DHL, UPS, SAB Express**List Not Exhaustive 7 3 Other Companie, ESNAD Express, Zajil Express, SMSA Express, Aramex, Ali Express, Alma Express, Saudi Post.

3. What are the main segments of the Saudi Arabia E-commerce Logistics Market?

The market segments include Service, Business, Destination, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Internet and Smart Phone Penetration; Urbanization and Lifestyle Changes; Government Initiatives.

6. What are the notable trends driving market growth?

Growth in e-Commerce Sales is Driving the Growth of the Market.

7. Are there any restraints impacting market growth?

Poor Infrastructure and Last-mile Delivery.

8. Can you provide examples of recent developments in the market?

February 2024: Naqel Express by SPL for Logistics Services announced a partnership with Red Sea Global. NAQEL Express, a fully owned subsidiary of Saudi Post Logistics, will operate all long-haul and local transportation services for The Red Sea and provide logistics equipment, labor, and supply chain technologies. As part of the partnership, Naqel Express will be using biofueled and electric vehicles. This aligns with RSG’s smart and sustainable mobility strategy, which prioritizes the use of hydrogen, electric, and biofueled vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia E-commerce Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia E-commerce Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia E-commerce Logistics Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia E-commerce Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence