Key Insights

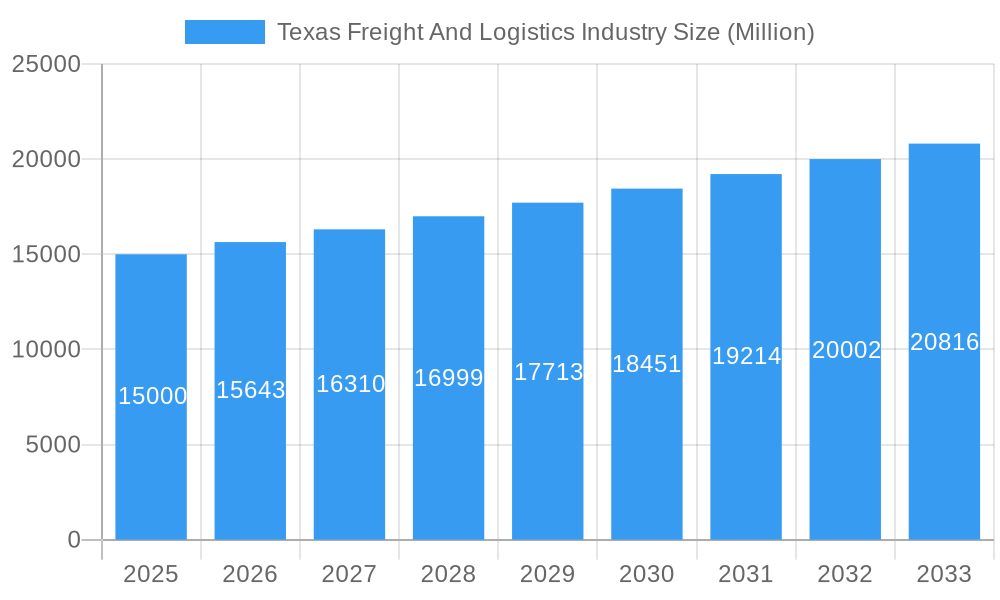

The Texas freight and logistics industry, a significant component of the broader global market, is experiencing robust growth fueled by several key factors. The state's strategic location, acting as a major transportation hub connecting Mexico and the rest of the US, significantly contributes to its prominence. The burgeoning e-commerce sector, demanding efficient and timely delivery networks, is a major driver. Furthermore, the energy and manufacturing sectors within Texas, known for their significant output and reliance on logistics for raw materials and finished goods, are substantial contributors to industry expansion. A projected Compound Annual Growth Rate (CAGR) of 4.34% (as observed in the global market) suggests a sustained upward trajectory for the Texas market, although the specific Texas CAGR might vary slightly due to local economic factors. Growth is anticipated to be fueled by increasing infrastructure investments aimed at improving road networks, port facilities, and rail connectivity.

Texas Freight And Logistics Industry Market Size (In Billion)

However, challenges exist. Competition within the sector is fierce, with national and international players vying for market share. Fluctuations in fuel prices, driver shortages, and evolving regulations related to emissions and safety standards present operational hurdles. Despite these challenges, the long-term outlook remains positive. The continued expansion of the Texas economy, especially within key sectors like energy, manufacturing, and e-commerce, is expected to maintain high demand for freight and logistics services. Diversification of services, including the adoption of advanced technologies like automation and data analytics, will be key for companies to maintain competitiveness and capitalize on growth opportunities. The development of sustainable and efficient logistics solutions will also be crucial for addressing environmental concerns and attracting environmentally conscious customers.

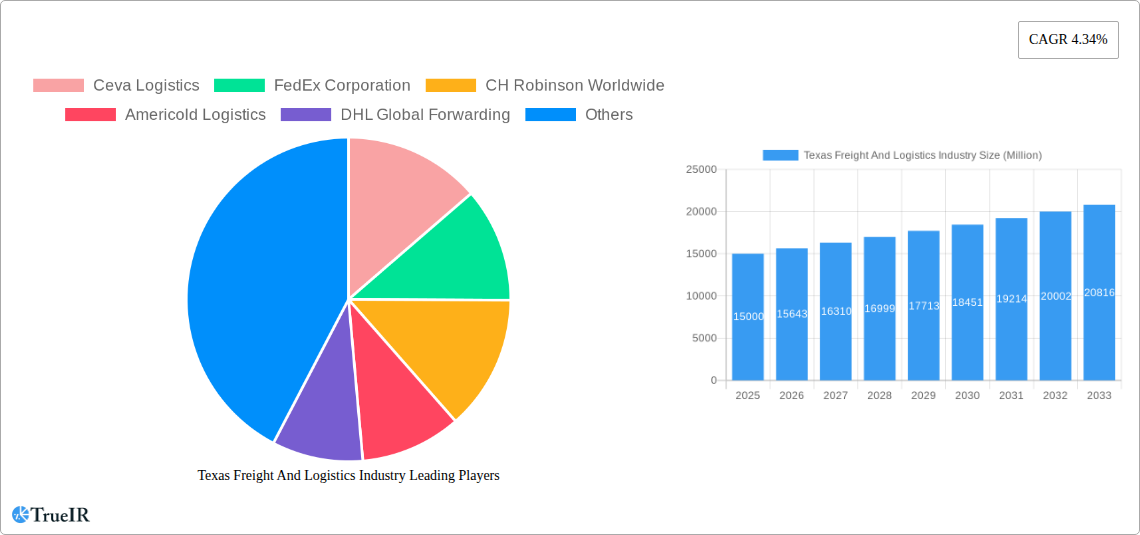

Texas Freight And Logistics Industry Company Market Share

Texas Freight & Logistics Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the Texas freight and logistics industry, offering invaluable insights for investors, industry professionals, and strategic decision-makers. We delve into market structure, competitive dynamics, emerging trends, and future growth projections, covering the period from 2019 to 2033, with a focus on 2025. The report leverages extensive data analysis and industry expertise to deliver actionable intelligence on this vital sector of the Texas economy. The market is expected to reach xx Million by 2033.

Texas Freight And Logistics Industry Market Structure & Competitive Landscape

The Texas freight and logistics industry exhibits a moderately concentrated market structure, with several large players and a significant number of smaller, specialized firms. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately competitive landscape. However, the increasing prevalence of mergers and acquisitions (M&A) activities signals a trend toward consolidation.

Key Market Structure Factors:

- High Barriers to Entry: Significant capital investment in infrastructure, technology, and skilled labor creates high barriers to entry for new players.

- Innovation Drivers: Technological advancements, such as automation, AI, and IoT, are driving efficiency and innovation within the industry.

- Regulatory Impacts: Federal and state regulations, including safety and environmental standards, significantly impact operational costs and strategies.

- Product Substitutes: The rise of e-commerce and last-mile delivery solutions presents both opportunities and challenges for traditional freight and logistics providers.

- End-User Segmentation: The industry caters to diverse end-users, including construction, oil and gas, manufacturing, and distributive trade, each with unique logistics needs.

- M&A Trends: The recent acquisition spree by Quantix (detailed later) highlights the ongoing M&A activity aimed at achieving economies of scale and expanding service offerings. The total value of M&A deals in the Texas freight and logistics sector between 2019 and 2024 was approximately xx Million.

Texas Freight And Logistics Industry Market Trends & Opportunities

The Texas freight and logistics market is experiencing robust growth, fueled by a combination of factors. The market size in 2024 is estimated at xx Million and is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching xx Million by 2033. This expansion is driven by several factors:

- E-commerce Boom: The exponential growth of e-commerce is increasing demand for efficient and reliable last-mile delivery solutions.

- Technological Advancements: Adoption of advanced technologies such as AI, machine learning, and blockchain is enhancing efficiency and transparency in supply chain operations.

- Infrastructure Development: Investments in transportation infrastructure, including highways, ports, and railways, are further supporting industry growth.

- Shifting Consumer Preferences: Consumers demand faster and more convenient delivery options, placing pressure on logistics providers to innovate and optimize their services.

- Competitive Dynamics: The market is characterized by intense competition, forcing companies to continuously improve their offerings and pricing strategies to maintain market share. Market penetration rates in key segments are showing steady increases, particularly in warehousing and value-added services.

Dominant Markets & Segments in Texas Freight And Logistics Industry

While the entire Texas market demonstrates significant growth, certain segments and end-users are particularly dominant:

By Function:

- Freight Transport: This segment holds the largest market share, driven by the state's vast geographical area and robust manufacturing and energy sectors.

- Warehousing: The demand for warehousing space is increasing, particularly near major transportation hubs, due to e-commerce growth and inventory management needs.

- Freight Forwarding: The air freight forwarding segment experiences substantial growth, driven by the state's international trade activity.

- Value-Added Services: The demand for specialized services, such as packaging, labeling, and inventory management, is increasing as businesses prioritize supply chain efficiency.

By End-User:

- Manufacturing and Automotive: The manufacturing and automotive sectors are major drivers of freight and logistics activity, due to their significant production and distribution volumes.

- Oil and Gas and Quarrying: This sector requires specialized logistics solutions for the transportation of bulky and hazardous materials.

- Distributive Trade: The retail and wholesale sectors heavily rely on efficient logistics for timely product delivery to consumers and businesses.

Key Growth Drivers:

- Strong Economic Growth: Texas's strong economic performance drives demand for freight and logistics services.

- Strategic Location: The state's strategic location, with access to major transportation networks, is a significant advantage.

- Favorable Regulatory Environment: A relatively business-friendly regulatory environment fosters investment and growth in the sector.

Texas Freight And Logistics Industry Product Analysis

The industry is characterized by a diverse range of products and services, with a focus on technological integration to enhance efficiency and visibility across the supply chain. Innovations include advanced Transportation Management Systems (TMS), real-time tracking capabilities, and the implementation of autonomous vehicles. These advancements cater to growing demands for speed, accuracy, and transparency in logistics operations. The competitive advantage lies in leveraging technological advancements to optimize operations and provide customers with superior value-added services.

Key Drivers, Barriers & Challenges in Texas Freight And Logistics Industry

Key Drivers:

- Technological advancements in automation, AI, and data analytics are increasing efficiency and reducing costs.

- The growing e-commerce market demands faster and more reliable last-mile delivery solutions.

- Favorable regulatory environment supports business growth and investment.

Challenges:

- Driver shortages and rising labor costs pose significant operational challenges. This is estimated to impact profitability by xx Million annually.

- Fuel price volatility and infrastructure limitations affect transportation costs and delivery times.

- Increased competition and pressure to reduce prices impact profit margins.

Growth Drivers in the Texas Freight And Logistics Industry Market

Several key drivers are propelling growth in the Texas freight and logistics industry. These include the robust economic activity in the state, advancements in technology leading to efficiency gains, and supportive regulatory policies that encourage investment. The expansion of e-commerce further fuels the demand for advanced logistics solutions. Government initiatives aimed at improving infrastructure, such as highway expansions and port modernization projects, also contribute to the sector's growth.

Challenges Impacting Texas Freight And Logistics Industry Growth

The industry faces several challenges, including a persistent driver shortage, leading to increased labor costs and capacity constraints. Fluctuating fuel prices impact transportation costs, while regulatory complexities and environmental concerns add to operational burdens. The intense competition, often leading to price wars, also erodes profit margins for many companies.

Key Players Shaping the Texas Freight And Logistics Industry Market

- Ceva Logistics

- FedEx Corporation

- CH Robinson Worldwide

- Americold Logistics

- DHL Global Forwarding

- Expeditors International of Washington

- XPO Logistics Inc

- DSV Air & Sea Inc

- Bollore Logistics

- Kintetsu World Express

Significant Texas Freight And Logistics Industry Industry Milestones

- November 2022: Quantix's acquisition of five companies and addition of L.D. McCloud Transportation significantly expanded its liquid and plastics transportation capabilities along the Gulf Coast, adding over 140 trucks. This move strengthened market competition and improved service offerings in the region.

- October 2022: E2open's partnership expansion with Uber Freight enhanced real-time rate comparisons within its TMS application, improving efficiency and transparency for shippers. This innovation increased competition among carriers and facilitated better rate negotiations.

Future Outlook for Texas Freight And Logistics Industry Market

The Texas freight and logistics market is poised for continued growth, driven by strong economic fundamentals, technological advancements, and strategic investments in infrastructure. Opportunities exist in leveraging automation, data analytics, and sustainable practices to enhance operational efficiency and meet the evolving demands of the e-commerce sector. The market's future hinges on addressing challenges such as driver shortages and supply chain vulnerabilities while capitalizing on emerging technologies to improve service delivery and customer satisfaction.

Texas Freight And Logistics Industry Segmentation

-

1. Function

-

1.1. Freight Transport

- 1.1.1. Road

- 1.1.2. Rail

- 1.1.3. Sea and Inland

- 1.1.4. Air

- 1.2. Freight Forwarding

- 1.3. Warehousing

- 1.4. Value-added Services

-

1.1. Freight Transport

-

2. End-User

- 2.1. Construction

- 2.2. Oil and Gas and Quarrying

- 2.3. Agriculture, Fishing, and Forestry

- 2.4. Manufacturing and Automotive

- 2.5. Distributive Trade

- 2.6. Other End Users

Texas Freight And Logistics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

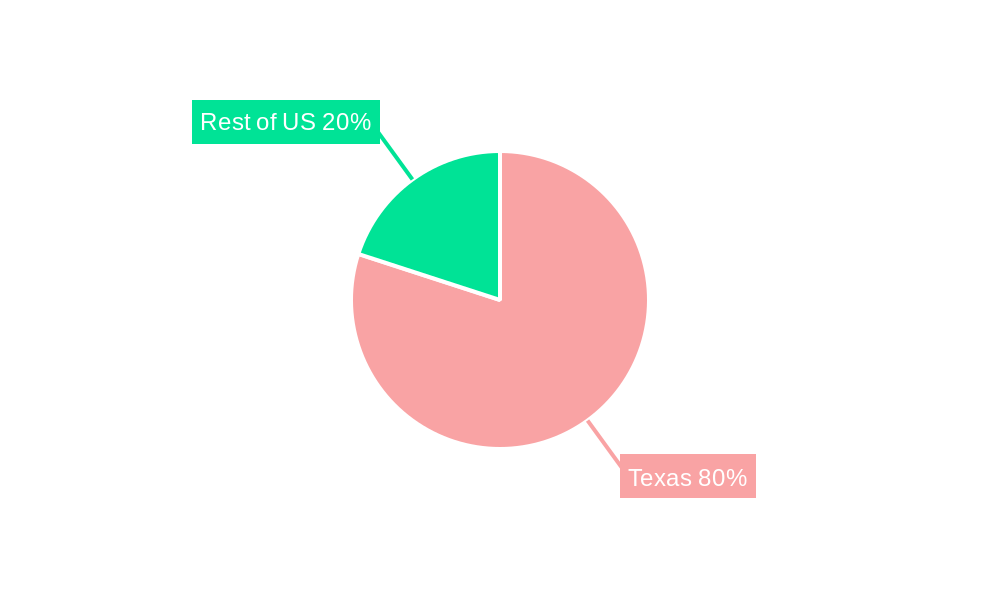

Texas Freight And Logistics Industry Regional Market Share

Geographic Coverage of Texas Freight And Logistics Industry

Texas Freight And Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expansion of online apparel sales; The demand for faster delivery and quicker time to market

- 3.3. Market Restrains

- 3.3.1. Highly perishable fashion trends; High cost of technology and infrastructure

- 3.4. Market Trends

- 3.4.1. Increase in value-added services in the country driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Texas Freight And Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Freight Transport

- 5.1.1.1. Road

- 5.1.1.2. Rail

- 5.1.1.3. Sea and Inland

- 5.1.1.4. Air

- 5.1.2. Freight Forwarding

- 5.1.3. Warehousing

- 5.1.4. Value-added Services

- 5.1.1. Freight Transport

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Construction

- 5.2.2. Oil and Gas and Quarrying

- 5.2.3. Agriculture, Fishing, and Forestry

- 5.2.4. Manufacturing and Automotive

- 5.2.5. Distributive Trade

- 5.2.6. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. North America Texas Freight And Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Function

- 6.1.1. Freight Transport

- 6.1.1.1. Road

- 6.1.1.2. Rail

- 6.1.1.3. Sea and Inland

- 6.1.1.4. Air

- 6.1.2. Freight Forwarding

- 6.1.3. Warehousing

- 6.1.4. Value-added Services

- 6.1.1. Freight Transport

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Construction

- 6.2.2. Oil and Gas and Quarrying

- 6.2.3. Agriculture, Fishing, and Forestry

- 6.2.4. Manufacturing and Automotive

- 6.2.5. Distributive Trade

- 6.2.6. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Function

- 7. South America Texas Freight And Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Function

- 7.1.1. Freight Transport

- 7.1.1.1. Road

- 7.1.1.2. Rail

- 7.1.1.3. Sea and Inland

- 7.1.1.4. Air

- 7.1.2. Freight Forwarding

- 7.1.3. Warehousing

- 7.1.4. Value-added Services

- 7.1.1. Freight Transport

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Construction

- 7.2.2. Oil and Gas and Quarrying

- 7.2.3. Agriculture, Fishing, and Forestry

- 7.2.4. Manufacturing and Automotive

- 7.2.5. Distributive Trade

- 7.2.6. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Function

- 8. Europe Texas Freight And Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Function

- 8.1.1. Freight Transport

- 8.1.1.1. Road

- 8.1.1.2. Rail

- 8.1.1.3. Sea and Inland

- 8.1.1.4. Air

- 8.1.2. Freight Forwarding

- 8.1.3. Warehousing

- 8.1.4. Value-added Services

- 8.1.1. Freight Transport

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Construction

- 8.2.2. Oil and Gas and Quarrying

- 8.2.3. Agriculture, Fishing, and Forestry

- 8.2.4. Manufacturing and Automotive

- 8.2.5. Distributive Trade

- 8.2.6. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Function

- 9. Middle East & Africa Texas Freight And Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Function

- 9.1.1. Freight Transport

- 9.1.1.1. Road

- 9.1.1.2. Rail

- 9.1.1.3. Sea and Inland

- 9.1.1.4. Air

- 9.1.2. Freight Forwarding

- 9.1.3. Warehousing

- 9.1.4. Value-added Services

- 9.1.1. Freight Transport

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Construction

- 9.2.2. Oil and Gas and Quarrying

- 9.2.3. Agriculture, Fishing, and Forestry

- 9.2.4. Manufacturing and Automotive

- 9.2.5. Distributive Trade

- 9.2.6. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Function

- 10. Asia Pacific Texas Freight And Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Function

- 10.1.1. Freight Transport

- 10.1.1.1. Road

- 10.1.1.2. Rail

- 10.1.1.3. Sea and Inland

- 10.1.1.4. Air

- 10.1.2. Freight Forwarding

- 10.1.3. Warehousing

- 10.1.4. Value-added Services

- 10.1.1. Freight Transport

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Construction

- 10.2.2. Oil and Gas and Quarrying

- 10.2.3. Agriculture, Fishing, and Forestry

- 10.2.4. Manufacturing and Automotive

- 10.2.5. Distributive Trade

- 10.2.6. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Function

- 11. Asia Pacific Texas Freight And Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 China

- 11.1.2 Japan

- 11.1.3 India

- 11.1.4 South Korea

- 11.1.5 ASEAN

- 11.1.6 Rest of Asia Pacific

- 12. North America Texas Freight And Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 12.1.3 Brazil

- 12.1.4 Mexico

- 12.1.5 Rest of Americas

- 13. Europe Texas Freight And Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 United Kingdom

- 13.1.2 Germany

- 13.1.3 Italy

- 13.1.4 Spain

- 13.1.5 France

- 13.1.6 Rest of Europe

- 14. Middle East and Africa Texas Freight And Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Saudi Arabia

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2025

- 15.2. Company Profiles

- 15.2.1 Ceva Logistics

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 FedEx Corporation

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 CH Robinson Worldwide

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Americold Logistics

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 DHL Global Forwarding

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Expeditors International of Washington**List Not Exhaustive

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 XPO Logistics Inc

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 DSV Air & Sea Inc

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Bollore Logistics

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Kintetsu World Express

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.1 Ceva Logistics

List of Figures

- Figure 1: Global Texas Freight And Logistics Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Texas Freight And Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 3: Asia Pacific Texas Freight And Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 4: North America Texas Freight And Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Texas Freight And Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Texas Freight And Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: Europe Texas Freight And Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Middle East and Africa Texas Freight And Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Middle East and Africa Texas Freight And Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Texas Freight And Logistics Industry Revenue (Million), by Function 2025 & 2033

- Figure 11: North America Texas Freight And Logistics Industry Revenue Share (%), by Function 2025 & 2033

- Figure 12: North America Texas Freight And Logistics Industry Revenue (Million), by End-User 2025 & 2033

- Figure 13: North America Texas Freight And Logistics Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 14: North America Texas Freight And Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 15: North America Texas Freight And Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 16: South America Texas Freight And Logistics Industry Revenue (Million), by Function 2025 & 2033

- Figure 17: South America Texas Freight And Logistics Industry Revenue Share (%), by Function 2025 & 2033

- Figure 18: South America Texas Freight And Logistics Industry Revenue (Million), by End-User 2025 & 2033

- Figure 19: South America Texas Freight And Logistics Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 20: South America Texas Freight And Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: South America Texas Freight And Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe Texas Freight And Logistics Industry Revenue (Million), by Function 2025 & 2033

- Figure 23: Europe Texas Freight And Logistics Industry Revenue Share (%), by Function 2025 & 2033

- Figure 24: Europe Texas Freight And Logistics Industry Revenue (Million), by End-User 2025 & 2033

- Figure 25: Europe Texas Freight And Logistics Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 26: Europe Texas Freight And Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 27: Europe Texas Freight And Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 28: Middle East & Africa Texas Freight And Logistics Industry Revenue (Million), by Function 2025 & 2033

- Figure 29: Middle East & Africa Texas Freight And Logistics Industry Revenue Share (%), by Function 2025 & 2033

- Figure 30: Middle East & Africa Texas Freight And Logistics Industry Revenue (Million), by End-User 2025 & 2033

- Figure 31: Middle East & Africa Texas Freight And Logistics Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 32: Middle East & Africa Texas Freight And Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Texas Freight And Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Texas Freight And Logistics Industry Revenue (Million), by Function 2025 & 2033

- Figure 35: Asia Pacific Texas Freight And Logistics Industry Revenue Share (%), by Function 2025 & 2033

- Figure 36: Asia Pacific Texas Freight And Logistics Industry Revenue (Million), by End-User 2025 & 2033

- Figure 37: Asia Pacific Texas Freight And Logistics Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 38: Asia Pacific Texas Freight And Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 39: Asia Pacific Texas Freight And Logistics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Function 2020 & 2033

- Table 3: Global Texas Freight And Logistics Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 6: China Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Japan Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: South Korea Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: ASEAN Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Brazil Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Mexico Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of Americas Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Italy Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Spain Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: France Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Europe Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Saudi Arabia Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: South Africa Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Middle East and Africa Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Function 2020 & 2033

- Table 30: Global Texas Freight And Logistics Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 31: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: United States Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Canada Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Mexico Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Function 2020 & 2033

- Table 36: Global Texas Freight And Logistics Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 37: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 38: Brazil Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Argentina Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of South America Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Function 2020 & 2033

- Table 42: Global Texas Freight And Logistics Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 43: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 44: United Kingdom Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Germany Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: France Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Italy Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Spain Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: Russia Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Benelux Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Nordics Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Europe Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 53: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Function 2020 & 2033

- Table 54: Global Texas Freight And Logistics Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 55: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Turkey Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 57: Israel Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: GCC Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: North Africa Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: South Africa Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: Rest of Middle East & Africa Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Function 2020 & 2033

- Table 63: Global Texas Freight And Logistics Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 64: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 65: China Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: India Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 67: Japan Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: South Korea Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 69: ASEAN Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: Oceania Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 71: Rest of Asia Pacific Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Texas Freight And Logistics Industry?

The projected CAGR is approximately 4.34%.

2. Which companies are prominent players in the Texas Freight And Logistics Industry?

Key companies in the market include Ceva Logistics, FedEx Corporation, CH Robinson Worldwide, Americold Logistics, DHL Global Forwarding, Expeditors International of Washington**List Not Exhaustive, XPO Logistics Inc, DSV Air & Sea Inc, Bollore Logistics, Kintetsu World Express.

3. What are the main segments of the Texas Freight And Logistics Industry?

The market segments include Function, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 93.07 Million as of 2022.

5. What are some drivers contributing to market growth?

Expansion of online apparel sales; The demand for faster delivery and quicker time to market.

6. What are the notable trends driving market growth?

Increase in value-added services in the country driving the market.

7. Are there any restraints impacting market growth?

Highly perishable fashion trends; High cost of technology and infrastructure.

8. Can you provide examples of recent developments in the market?

November 2022- Quantix, a portfolio company of Wind Point Partners in Chicago, has acquired five companies: Dobbins Enterprises, C&S Express, Chancelor Transportation, T&K Chancelor Enterprises, and Templet Transit. Quantix also announced the addition of a new agent, L.D. McCloud Transportation, to its liquid and plastics transportation division, added more than 140 trucks and ancillary equipment. Customers will be served by the new trucks all along the Gulf Coast, including Houston, Baton Rouge and Port Allen, Louisiana, and Meridian, Mississippi.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Texas Freight And Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Texas Freight And Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Texas Freight And Logistics Industry?

To stay informed about further developments, trends, and reports in the Texas Freight And Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence