Key Insights

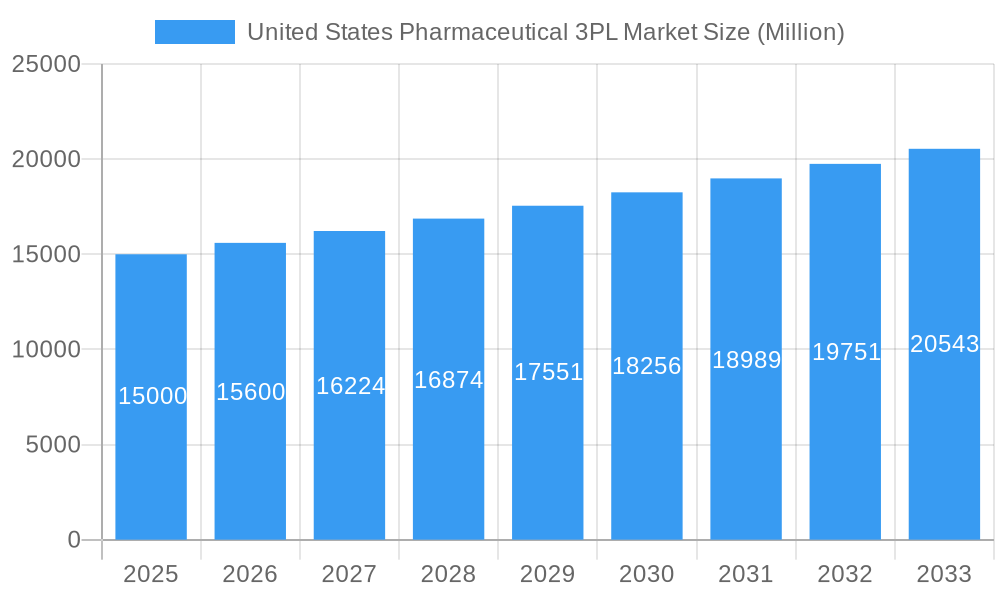

The United States pharmaceutical 3PL market is experiencing robust growth, driven by the increasing complexity of pharmaceutical supply chains and the rising demand for specialized logistics solutions. The market's expansion is fueled by several key factors. Firstly, the surge in pharmaceutical production and the global distribution of life-saving drugs necessitate efficient and reliable third-party logistics providers (3PLs). Secondly, stringent regulatory requirements and the need for temperature-controlled transportation (cold chain logistics) within the pharmaceutical industry are driving demand for specialized 3PL services. This necessitates significant investment in infrastructure and technology by 3PLs, leading to market consolidation and an increased focus on data-driven solutions to ensure product integrity and compliance. Furthermore, the growing adoption of advanced technologies such as blockchain for enhanced traceability and AI for predictive analytics is transforming the sector. The market is segmented by function (domestic/international transportation management, value-added warehousing and distribution) and supply chain (cold chain/non-cold chain). While precise market sizing for the US is unavailable from the provided data, considering the global CAGR of >4% and the significant pharmaceutical industry in the US, a reasonable estimate places the 2025 US market size in the billions (e.g., $15 billion USD), with projected robust growth throughout the forecast period (2025-2033). Major players like FedEx, UPS, DHL, and others are strategically investing in their pharmaceutical logistics capabilities to capture a larger market share. This is characterized by increased capacity for temperature-sensitive goods and the implementation of innovative solutions aimed at enhancing efficiency and reducing risks associated with pharmaceutical transportation and storage. The competitive landscape is intense, with established players facing challenges from new entrants and the constant need to innovate to meet evolving customer demands.

United States Pharmaceutical 3PL Market Market Size (In Billion)

The future of the US pharmaceutical 3PL market points towards further consolidation and specialization. We anticipate increased demand for integrated solutions encompassing transportation, warehousing, and value-added services such as labeling and packaging. The continued focus on enhancing supply chain visibility and utilizing advanced technologies to improve efficiency and reduce costs will be pivotal for success. The significant investment in cold chain infrastructure and the growing importance of compliance will shape the market trajectory in the coming years. The market will likely witness further growth spurred by the increasing demand for personalized medicine and the expansion of the biologics market, which requires even more stringent handling and transportation protocols. Overall, the US pharmaceutical 3PL market presents a promising investment opportunity due to its significant size and anticipated growth trajectory.

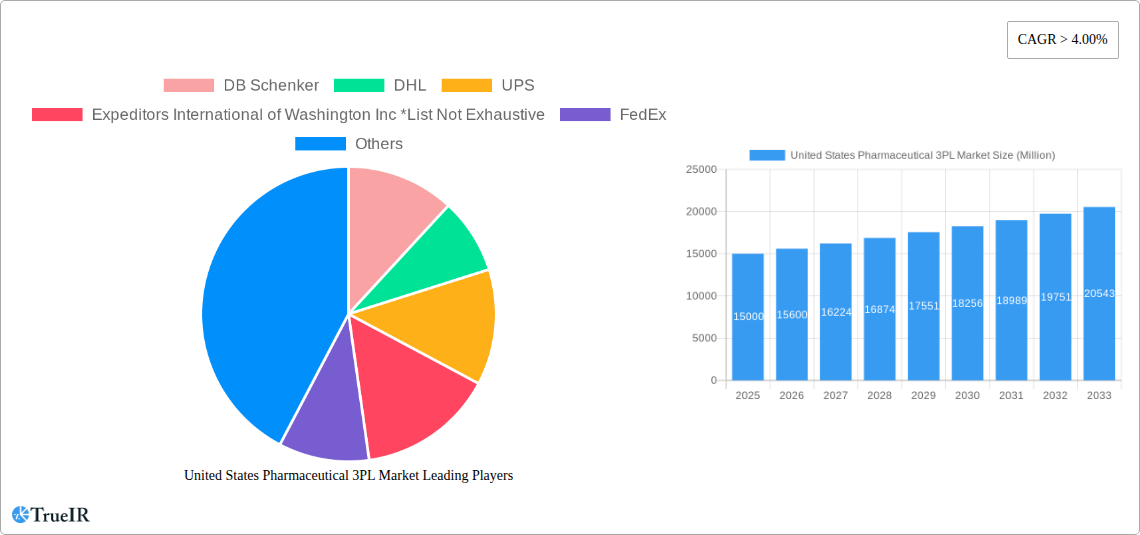

United States Pharmaceutical 3PL Market Company Market Share

United States Pharmaceutical 3PL Market: A Comprehensive Market Report (2019-2033)

This dynamic report offers an in-depth analysis of the United States Pharmaceutical 3PL market, providing crucial insights for stakeholders across the pharmaceutical supply chain. With a comprehensive study period spanning 2019-2033 (Base Year: 2025, Forecast Period: 2025-2033), this report leverages extensive data analysis and expert insights to illuminate current market dynamics and forecast future growth trajectories. The report covers key segments, including cold chain and non-cold chain logistics, alongside functional areas like domestic and international transportation management and value-added warehousing and distribution. The market size is projected to reach xx Million by 2033, presenting significant opportunities for investors and industry players.

United States Pharmaceutical 3PL Market Structure & Competitive Landscape

The US Pharmaceutical 3PL market exhibits a moderately concentrated structure, with a few major players commanding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a level of consolidation. However, the market remains dynamic, characterized by ongoing M&A activity and the emergence of niche players specializing in cold chain logistics and value-added services. Key factors shaping the competitive landscape include:

- Innovation: Technological advancements in temperature-controlled transportation, warehouse automation, and data analytics drive competitive differentiation.

- Regulatory Impacts: Stringent regulations governing drug storage, transportation, and handling significantly impact operational costs and compliance requirements. The FDA's guidelines for cold chain management, for instance, present both challenges and opportunities.

- Product Substitutes: While direct substitutes are limited, the pressure to optimize costs may lead to increased adoption of alternative transportation modes or warehousing strategies.

- End-User Segmentation: The market caters to diverse end-users, including pharmaceutical manufacturers, distributors, wholesalers, and hospitals. Understanding these segments' unique needs is crucial for effective targeting.

- M&A Trends: Consolidation through mergers and acquisitions is a prevalent trend, with larger 3PL providers actively seeking to expand their service offerings and geographical reach. The total value of M&A transactions in the period 2019-2024 is estimated at xx Million.

United States Pharmaceutical 3PL Market Market Trends & Opportunities

The US Pharmaceutical 3PL market is experiencing robust growth, driven by several key trends. The market size is projected to grow at a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, reaching xx Million by the end of the forecast period. This growth is fueled by factors such as:

- Expansion of the pharmaceutical industry: Continued growth in pharmaceutical R&D and the launch of new drugs are creating heightened demand for efficient and reliable 3PL services.

- Increasing outsourcing: Pharmaceutical companies increasingly outsource their logistics functions to 3PL providers to focus on core competencies and reduce operational costs.

- Technological advancements: Automation, data analytics, and real-time tracking technologies are transforming supply chain efficiency and visibility, driving the adoption of advanced 3PL services.

- Rising demand for cold chain logistics: The growing prevalence of temperature-sensitive pharmaceuticals, including biologics and vaccines, is significantly boosting demand for specialized cold chain solutions.

- Evolving consumer preferences: Consumers are increasingly demanding faster and more reliable delivery of pharmaceuticals, impacting the need for efficient last-mile delivery solutions.

Market penetration rates for cold chain logistics are expected to increase to xx% by 2033, reflecting the growing demand for temperature-sensitive drug handling. The market penetration for advanced warehousing technologies such as automated storage and retrieval systems (AS/RS) is anticipated to reach xx% by 2033. Competitive dynamics are marked by pricing pressures and a shift towards value-added services that offer greater flexibility and customization.

Dominant Markets & Segments in United States Pharmaceutical 3PL Market

The Northeast and West Coast regions of the United States stand as primary hubs for pharmaceutical 3PL services. This dominance is attributed to the significant presence of leading pharmaceutical manufacturers, cutting-edge research institutions, and a dense network of healthcare facilities. Among the service segments, cold chain logistics is experiencing the most rapid expansion. It is estimated to have captured approximately XX% of the market share in 2025 and is projected to grow to an impressive XX% by 2033, highlighting its increasing importance.

-

Key Growth Drivers for Cold Chain:

- Stringent Regulatory Compliance: The pharmaceutical industry's adherence to rigorous temperature control mandates for temperature-sensitive medications and biologics is a primary driver for significant investments in advanced cold chain infrastructure and technologies.

- Strategic Infrastructure Investments: Substantial investments in expanding state-of-the-art cold storage warehousing capabilities and the development of specialized, temperature-controlled transportation networks are crucial in supporting and accelerating the growth of this vital segment.

- Pioneering Technological Advancements: The integration of cutting-edge technologies such as real-time temperature monitoring systems, sophisticated data analytics for predictive insights, and innovative passive and active packaging solutions are continuously enhancing the reliability, security, and overall efficiency of cold chain logistics operations.

- Value-Added Warehousing and Distribution: This segment is demonstrating considerable growth potential. It is fueled by an escalating demand for highly customized inventory management solutions, precise order fulfillment processes, and an array of specialized value-added services, including kitting, labeling, and final-mile delivery optimization.

- Globalized Transportation Management: The accelerating globalization of the pharmaceutical sector is a significant catalyst for the expansion of international transportation services. This is particularly evident in the logistics requirements for high-value specialty drugs, complex clinical trial materials, and the global distribution of life-saving medicines.

United States Pharmaceutical 3PL Market Product Analysis

Product innovation within the United States pharmaceutical 3PL market is intensely focused on elevating visibility, optimizing operational efficiency, and ensuring unwavering regulatory compliance. Leading-edge technologies are revolutionizing the landscape. These include the implementation of blockchain for secure and transparent drug provenance tracking, AI-powered algorithms for dynamic route optimization, and sophisticated real-time temperature monitoring systems that provide immediate alerts and data. These advanced solutions offer profound competitive advantages by guaranteeing the integrity of pharmaceutical products throughout the supply chain, driving down operational costs, and significantly enhancing overall customer satisfaction and trust. The seamless integration of these transformative technologies into existing 3PL service offerings is not only propelling market expansion but also creating new avenues for specialized expertise and service differentiation.

Key Drivers, Barriers & Challenges in United States Pharmaceutical 3PL Market

Key Drivers: Technological advancements in automation, data analytics, and cold chain management are key drivers of market growth. Favorable economic conditions and a supportive regulatory environment (with specific exceptions related to compliance costs) also contribute. Government initiatives promoting the adoption of innovative technologies further stimulate the market.

Challenges & Restraints: Stringent regulatory compliance requirements create substantial hurdles, particularly concerning cold chain management and data security. Supply chain disruptions, such as those experienced during the COVID-19 pandemic, expose vulnerabilities and highlight the need for resilient logistics networks. Increasingly intense competition amongst 3PL providers necessitates differentiation through innovative service offerings and technology adoption. The cost of implementing advanced technologies, especially cold chain solutions, is a substantial barrier for smaller players.

Growth Drivers in the United States Pharmaceutical 3PL Market Market

The sustained and robust growth of the pharmaceutical industry, coupled with the increasing trend of outsourcing logistics functions, are the foremost catalysts propelling the United States pharmaceutical 3PL market forward. Furthermore, rapid advancements in technology, particularly in areas like automation and sophisticated data analytics, are instrumental in dramatically improving operational efficiency, supply chain visibility, and predictive capabilities. Supportive government initiatives, aimed at fostering supply chain resilience and encouraging the adoption of innovative technologies, are also making a significant positive contribution to the market's expansion and long-term sustainability.

Challenges Impacting United States Pharmaceutical 3PL Market Growth

Regulatory compliance, especially concerning drug safety and cold chain integrity, presents ongoing challenges. Supply chain vulnerabilities, amplified by geopolitical events and natural disasters, pose significant risks. Intense competition and pricing pressures also constrain profitability for some players.

Key Players Shaping the United States Pharmaceutical 3PL Market Market

- DB Schenker

- DHL

- UPS Healthcare

- Expeditors International of Washington Inc

- FedEx Logistics

- CEVA Logistics

- Kuehne + Nagel

- Agility Logistics

- Kerry Logistics

- C.H. Robinson Worldwide

- Amerisourcebergen

- Cardinal Health

- McKesson Corporation

Significant United States Pharmaceutical 3PL Market Industry Milestones

- May 2021: UPS launched UPS Cold Chain Solutions, expanding its capabilities in temperature-controlled logistics. This significantly enhanced its offerings in the pharmaceutical sector, increasing market competition and raising industry standards.

- December 2021: FedEx Corp. opened a substantially larger air cargo hub at Miami International Airport, doubling its capacity and including a significantly expanded cold storage section. This expansion boosted FedEx's handling capacity for temperature-sensitive pharmaceutical products, strengthening its position in the market.

Future Outlook for United States Pharmaceutical 3PL Market Market

The United States Pharmaceutical 3PL market is on a trajectory for continued and substantial growth. This expansion will be primarily fueled by the relentless pace of technological innovation, the ever-growing pharmaceutical and biotechnology sectors, and the persistent trend of pharmaceutical companies entrusting their complex logistics needs to specialized third-party providers. Significant strategic opportunities lie ahead for 3PL providers who can master and specialize in critical areas such as advanced cold chain logistics for biologics and vaccines, sophisticated value-added services tailored to specific drug products, and the deployment of intelligent, data-driven supply chain solutions. The future of this dynamic market will undoubtedly be characterized by a commitment to groundbreaking innovation, unparalleled operational efficiency, and an unwavering dedication to stringent regulatory compliance and patient safety.

United States Pharmaceutical 3PL Market Segmentation

-

1. Function

- 1.1. Domestic Transportation Management

- 1.2. International Transportation Management

- 1.3. Value-added Warehousing and Distribution

-

2. Supply Chain

- 2.1. Cold Chain

- 2.2. Non-cold Chain

United States Pharmaceutical 3PL Market Segmentation By Geography

- 1. United States

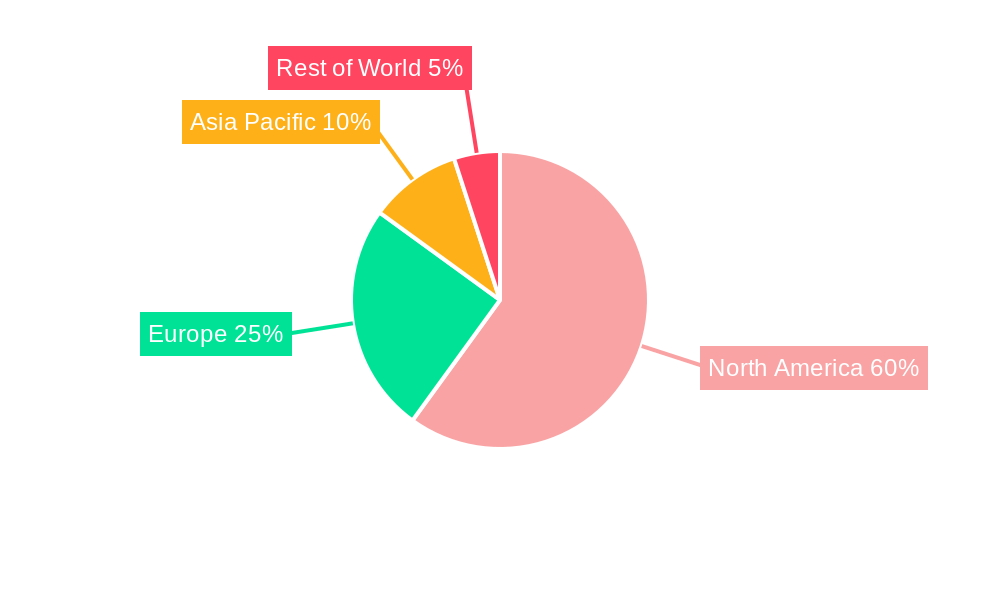

United States Pharmaceutical 3PL Market Regional Market Share

Geographic Coverage of United States Pharmaceutical 3PL Market

United States Pharmaceutical 3PL Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Over the Counter Drugs Across the European Region; Growing Manufacture Activity from Pharmaceutical Companies

- 3.3. Market Restrains

- 3.3.1. High Cost Associated with the Transportation Ordered

- 3.4. Market Trends

- 3.4.1. The United States is Leading in the Pharmaceutical Market Across the World

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Pharmaceutical 3PL Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Domestic Transportation Management

- 5.1.2. International Transportation Management

- 5.1.3. Value-added Warehousing and Distribution

- 5.2. Market Analysis, Insights and Forecast - by Supply Chain

- 5.2.1. Cold Chain

- 5.2.2. Non-cold Chain

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 UPS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Expeditors International of Washington Inc *List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 FedEx

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CEVA Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kuehne + Nagel

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Agility

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kerry Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 C H Robinson

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: United States Pharmaceutical 3PL Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Pharmaceutical 3PL Market Share (%) by Company 2025

List of Tables

- Table 1: United States Pharmaceutical 3PL Market Revenue Million Forecast, by Function 2020 & 2033

- Table 2: United States Pharmaceutical 3PL Market Revenue Million Forecast, by Supply Chain 2020 & 2033

- Table 3: United States Pharmaceutical 3PL Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: United States Pharmaceutical 3PL Market Revenue Million Forecast, by Function 2020 & 2033

- Table 5: United States Pharmaceutical 3PL Market Revenue Million Forecast, by Supply Chain 2020 & 2033

- Table 6: United States Pharmaceutical 3PL Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Pharmaceutical 3PL Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the United States Pharmaceutical 3PL Market?

Key companies in the market include DB Schenker, DHL, UPS, Expeditors International of Washington Inc *List Not Exhaustive, FedEx, CEVA Logistics, Kuehne + Nagel, Agility, Kerry Logistics, C H Robinson.

3. What are the main segments of the United States Pharmaceutical 3PL Market?

The market segments include Function, Supply Chain.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Over the Counter Drugs Across the European Region; Growing Manufacture Activity from Pharmaceutical Companies.

6. What are the notable trends driving market growth?

The United States is Leading in the Pharmaceutical Market Across the World.

7. Are there any restraints impacting market growth?

High Cost Associated with the Transportation Ordered.

8. Can you provide examples of recent developments in the market?

December 2021: FedEx Corp. began operations at its substantially bigger air cargo hub at Miami International Airport. The USD 72 million addition, two years under development and roughly the size of two football fields, doubles the hub's size to 282,000 square feet. The hub includes FedEx's largest cold storage section, covering 70,000 square feet - the equivalent of 33 tennis courts - of refrigerated and frozen storage.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Pharmaceutical 3PL Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Pharmaceutical 3PL Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Pharmaceutical 3PL Market?

To stay informed about further developments, trends, and reports in the United States Pharmaceutical 3PL Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence