Key Insights

The United States pharmaceutical transportation market, integral to the healthcare supply chain, is projected for robust expansion. Key growth drivers include escalating pharmaceutical production, an increasing elderly demographic requiring more medication, and the burgeoning e-commerce sector for prescription drug fulfillment. With a projected CAGR of 6% and an estimated market size of $107.6 billion by 2025, the sector is experiencing significant momentum. The necessity for specialized cold-chain logistics, mandated by stringent regulatory requirements for temperature-sensitive pharmaceuticals, is a primary influencer. Furthermore, the escalating demand for efficient and dependable delivery services across varied geographies, coupled with technological advancements like real-time tracking and monitoring systems, enhances supply chain visibility and security, propelling market growth.

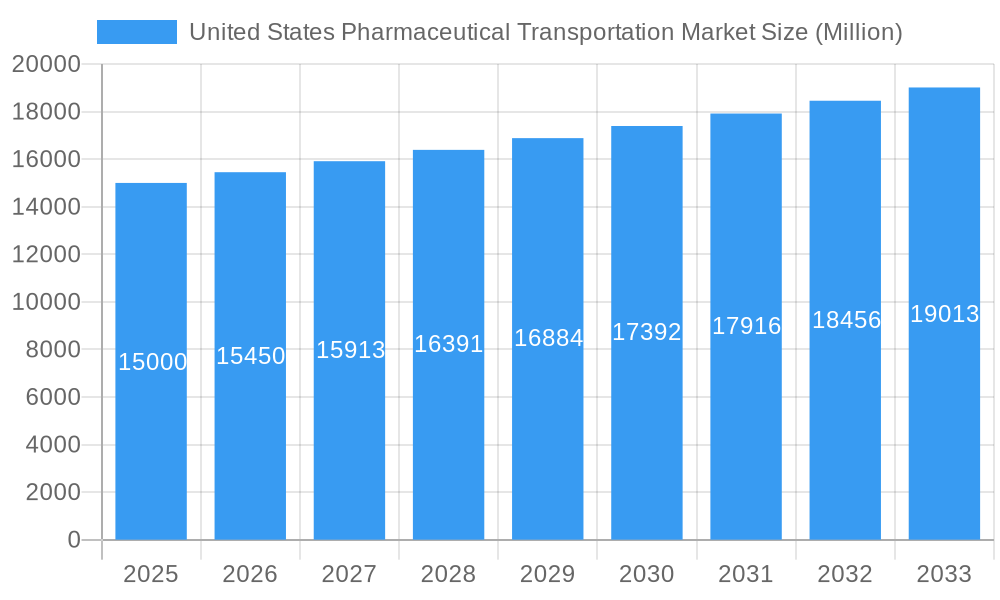

United States Pharmaceutical Transportation Market Market Size (In Billion)

The market is segmented by product (generics and branded drugs), operational mode (cold chain and non-cold chain transport), and offered services (transportation, warehousing, and value-added services). Competitive dynamics are intense, with leading providers such as FedEx, UPS, and DHL, alongside specialized logistics firms, competing through technological innovation, optimized networks, and comprehensive service offerings.

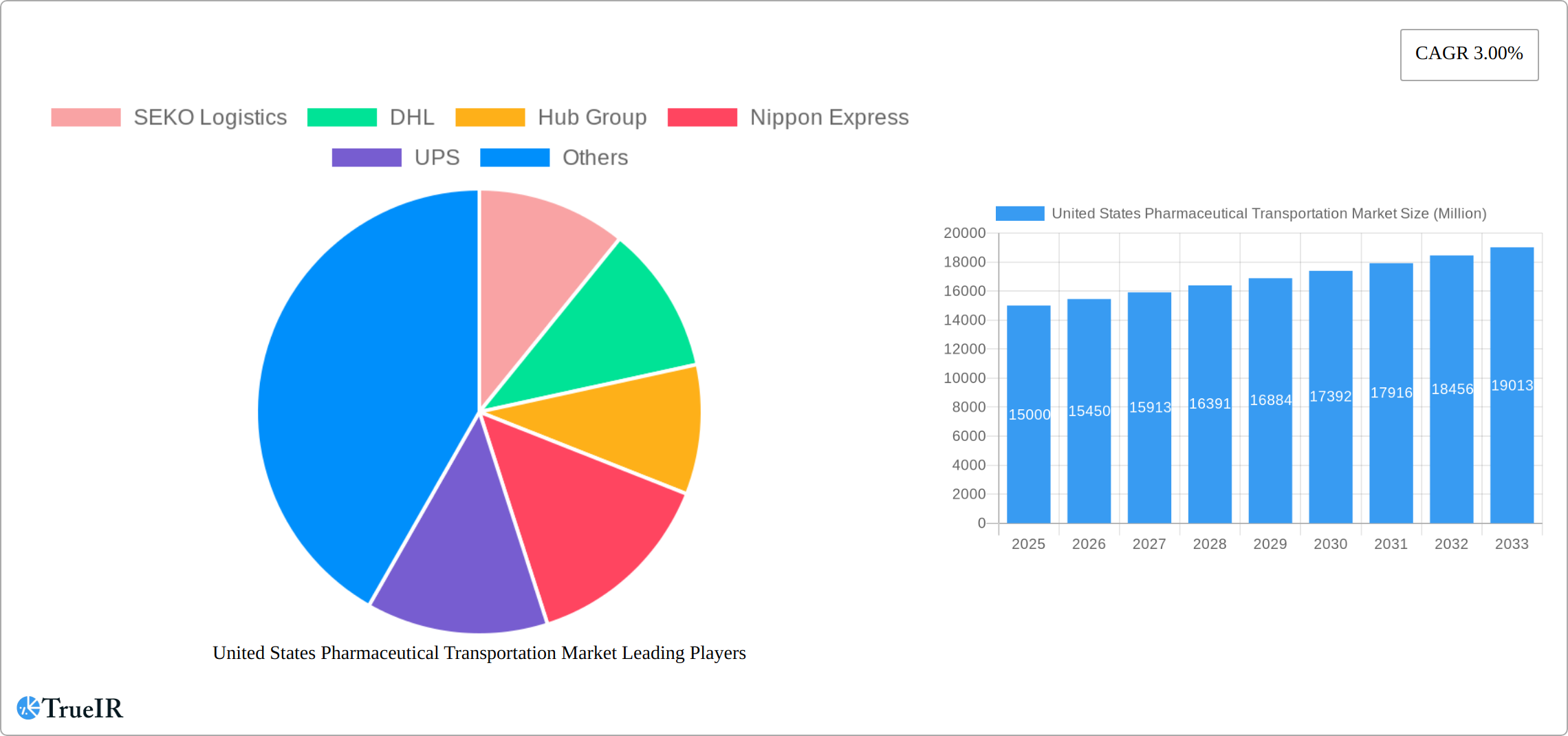

United States Pharmaceutical Transportation Market Company Market Share

Despite growth, the market faces certain constraints. Volatile fuel prices directly impact transportation expenditures, affecting profitability. Maintaining cold chain integrity throughout transit remains a persistent logistical and technological challenge. Navigating complex security protocols and ensuring regulatory adherence further complicate operations. The market's evolution will be shaped by the growing demand for personalized medicine and specialized pharmaceutical products, presenting both opportunities and challenges for logistics providers to innovate and adapt their solutions. Companies are investing in advanced technologies and expanding their networks to effectively manage the increasing complexities of pharmaceutical cold chain and last-mile delivery, which are critical for operational efficiency and patient well-being.

United States Pharmaceutical Transportation Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the United States pharmaceutical transportation market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a comprehensive study period spanning 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report delivers an in-depth understanding of market dynamics, growth drivers, and future trends. The market is projected to reach xx Million by 2033, exhibiting a notable CAGR of xx% during the forecast period. This report leverages high-impact keywords like "pharmaceutical transportation," "cold chain logistics," "drug delivery," and "US pharmaceutical market" to ensure optimal search engine visibility.

United States Pharmaceutical Transportation Market Market Structure & Competitive Landscape

The US pharmaceutical transportation market exhibits a moderately concentrated structure, with a handful of major players commanding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately competitive landscape. Key players, such as SEKO Logistics, DHL, Hub Group, Nippon Express, UPS, Penske Logistics, XPO Logistics, FedEx, Expeditors International, and DB Schenker, dominate the market, although many smaller, regional players also exist. The market is characterized by ongoing consolidation through mergers and acquisitions (M&A), with xx M&A deals recorded between 2019 and 2024. These activities are primarily driven by the pursuit of scale economies, expansion into new geographical markets, and diversification of service offerings. Regulatory pressures related to drug safety and security, alongside stringent compliance requirements, are significant factors impacting market structure. Product substitution is limited, primarily due to the specialized nature of pharmaceutical transportation, particularly for temperature-sensitive drugs. End-user segmentation is largely determined by the size of the pharmaceutical companies, ranging from large multinational corporations to smaller niche players.

- Market Concentration: HHI estimated at xx.

- Innovation Drivers: Technological advancements in temperature-controlled transportation, tracking and monitoring systems.

- Regulatory Impacts: Stringent FDA regulations impacting transportation and storage.

- Product Substitutes: Limited due to specialized nature of pharmaceutical transport.

- End-User Segmentation: Large pharmaceutical corporations, smaller niche players, hospitals, pharmacies.

- M&A Trends: xx M&A deals between 2019-2024 driven by scale and diversification.

United States Pharmaceutical Transportation Market Market Trends & Opportunities

The US pharmaceutical transportation market is experiencing robust growth, fueled by a convergence of factors. The escalating prevalence of chronic diseases, the surging demand for specialty pharmaceuticals (including biologics and cell therapies), and the burgeoning e-commerce sector within healthcare are all significantly increasing the need for efficient and reliable pharmaceutical logistics. This demand is further amplified by the rising complexities of pharmaceutical supply chains, driven by the globalization of manufacturing and the increasing need for stringent quality control and regulatory compliance. Technological advancements are revolutionizing the industry, with real-time tracking systems, IoT devices, AI-powered predictive analytics, and advanced temperature-monitoring technologies enhancing transparency, efficiency, and overall supply chain resilience. Consumer preferences are also driving change, with a clear emphasis on faster delivery times and greater end-to-end supply chain visibility. This presents significant opportunities for companies offering value-added services such as customized, temperature-controlled solutions, expedited shipping, and robust risk mitigation strategies. Cold chain transportation continues to witness substantial growth due to the increasing demand for temperature-sensitive drugs, emphasizing the critical need for advanced and reliable cold chain infrastructure and technology. The competitive landscape is dynamic, characterized by both strategic alliances and intense competition. Companies are forging partnerships to expand service offerings and capabilities while simultaneously striving for market share through operational excellence, innovation, and cost optimization.

Dominant Markets & Segments in United States Pharmaceutical Transportation Market

The Northeast and West Coast regions of the US remain dominant in the pharmaceutical transportation market, due to the high concentration of pharmaceutical manufacturers, research and development facilities, and major healthcare systems. Within product segments, branded drugs generally command a larger market share than generic drugs due to their higher value and the more stringent requirements for their handling and transportation. Cold chain transportation is experiencing particularly strong growth, reflecting the expanding market for temperature-sensitive biologics and specialty pharmaceuticals. While transport services currently hold the largest share of the overall service segment, warehousing, specialized handling, and value-added services such as last-mile delivery and returns management are displaying significant growth potential, driven by increasing demand for end-to-end supply chain solutions.

Leading Region: Northeast and West Coast.

Key Growth Drivers (Cold Chain): Rising demand for temperature-sensitive drugs, technological advancements in temperature control and monitoring, and increasing regulatory scrutiny.

Key Growth Drivers (Branded Drugs): Higher value, stringent transportation requirements, specialized handling needs, and greater emphasis on product security and traceability.

Key Growth Drivers (Transport Services): Essential for pharmaceutical distribution and delivery networks; increasing demand for speed, reliability and real-time visibility.

Market Dominance Analysis (Paragraph): The dominance of the Northeast and West Coast regions is primarily attributed to the high concentration of pharmaceutical companies, research institutions, and major distribution hubs in these areas. The robust demand for branded pharmaceuticals, which require specialized handling and transportation solutions due to their high value and sensitivity, further contributes to this regional market concentration. The rapid expansion of the cold chain transportation segment is a direct result of the increasing demand for temperature-sensitive products and concurrent advancements in temperature-controlled transportation technologies. This growth is also fueled by increased investments in state-of-the-art cold chain infrastructure and stringent regulatory oversight in these key regions.

United States Pharmaceutical Transportation Market Product Analysis

Product innovations are centered on enhancing temperature control, real-time tracking capabilities, and data analytics to provide greater transparency and efficiency. Companies are developing specialized containers and vehicles that utilize advanced insulation and temperature monitoring technologies. These innovations are improving the safety and reliability of drug transportation, reducing spoilage and ensuring the delivery of high-quality products. The market fit for these innovations is exceptionally high, as they address crucial industry needs related to temperature sensitivity, security, and regulatory compliance.

Key Drivers, Barriers & Challenges in United States Pharmaceutical Transportation Market

Key Drivers: Technological advancements in temperature control and tracking systems, the expanding market for specialty and biologics, and government initiatives to improve healthcare infrastructure all fuel market growth.

Challenges: Stringent regulatory compliance, rising fuel costs, and supply chain disruptions resulting from unforeseen events like natural disasters or pandemics present significant challenges. These factors have resulted in an estimated xx% increase in transportation costs over the last five years, impacting profitability and pricing strategies.

Growth Drivers in the United States Pharmaceutical Transportation Market Market

Continued technological advancements, increasing demand for pharmaceuticals, and government regulations for safe transportation are driving market growth. The growing biologics market is a significant contributor.

Challenges Impacting United States Pharmaceutical Transportation Market Growth

The US pharmaceutical transportation market faces significant challenges, including increasing frequency and severity of supply chain disruptions, stringent regulatory compliance requirements (e.g., GDP, temperature excursion reporting), intense competition from both established and new market entrants, and the volatility of fuel prices, impacting operational costs and profitability. Furthermore, ensuring data security and protecting sensitive patient information throughout the transportation process adds further complexity and cost.

Key Players Shaping the United States Pharmaceutical Transportation Market Market

- SEKO Logistics

- DHL

- Hub Group

- Nippon Express

- UPS

- Penske Logistics

- XPO Logistics

- FedEx

- Expeditors International

- DB Schenker

- 63 Other Companies

Significant United States Pharmaceutical Transportation Market Industry Milestones

- August 2022: Wabash expands its North American dealer network with the addition of Bergey's Truck Centers and Allegiance Trucks, enhancing the availability of parts and services for refrigerated transport.

- May 2022: Vertical Cold Storage acquires three public refrigerated warehouses, expanding its capacity and footprint in the cold chain logistics sector. This demonstrates increasing investment in cold storage infrastructure to meet rising demand.

Future Outlook for United States Pharmaceutical Transportation Market Market

The US pharmaceutical transportation market is projected to experience continued robust growth, driven by several key factors. Technological innovation, particularly in areas such as automation, AI-powered analytics, and blockchain technology for enhanced traceability and security, will continue to play a vital role. The increasing demand for specialized pharmaceuticals, including advanced therapies and personalized medicines, will further drive growth. Significant investments in cold chain infrastructure, coupled with stricter regulatory compliance requirements, will shape the market landscape. Strategic partnerships and mergers and acquisitions are expected to reshape the competitive landscape, with companies that successfully navigate regulatory hurdles, optimize supply chain efficiency, and invest in innovative solutions poised for significant growth. The market offers substantial opportunities for companies focusing on sustainability initiatives, digitalization, and delivering comprehensive, end-to-end pharmaceutical logistics solutions.

United States Pharmaceutical Transportation Market Segmentation

-

1. Product

- 1.1. Generic Drugs

- 1.2. Branded Drugs

-

2. Mode of Operation

- 2.1. Cold Chain Transport

- 2.2. Non-cold Chain Transport

-

3. Services

-

3.1. Transport

- 3.1.1. Road

- 3.1.2. Air

- 3.1.3. Rail

- 3.1.4. Sea

- 3.2. Warehousing Services

- 3.3. Value-added Services and Other Services

-

3.1. Transport

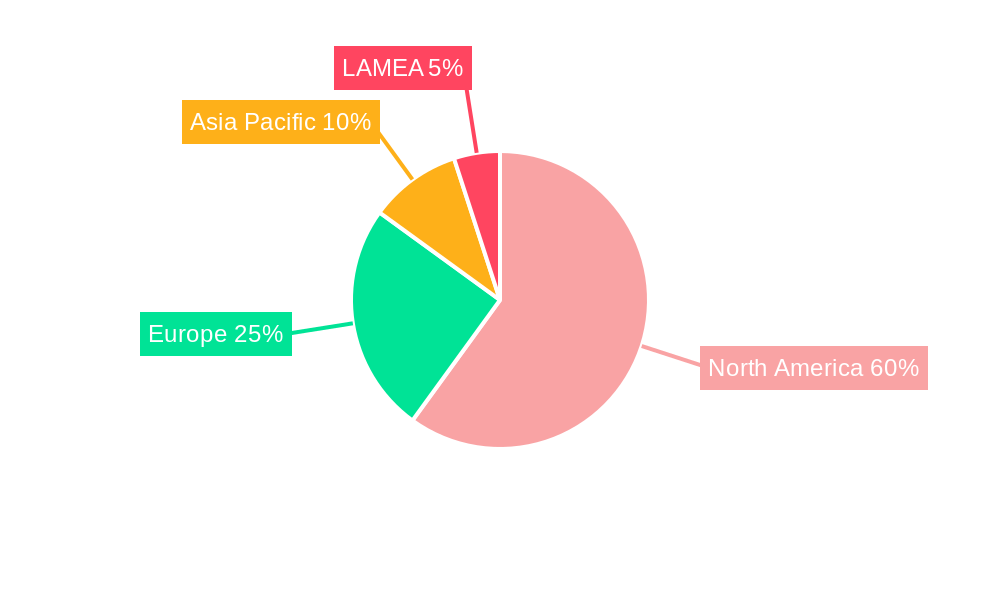

United States Pharmaceutical Transportation Market Segmentation By Geography

- 1. United States

United States Pharmaceutical Transportation Market Regional Market Share

Geographic Coverage of United States Pharmaceutical Transportation Market

United States Pharmaceutical Transportation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. E-commerce Boom; Same-day and Next-day Delivery

- 3.3. Market Restrains

- 3.3.1. Regulatory Challenges; Infrastructure Limitations

- 3.4. Market Trends

- 3.4.1. Growing Pharmaceutical Industry in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Pharmaceutical Transportation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Generic Drugs

- 5.1.2. Branded Drugs

- 5.2. Market Analysis, Insights and Forecast - by Mode of Operation

- 5.2.1. Cold Chain Transport

- 5.2.2. Non-cold Chain Transport

- 5.3. Market Analysis, Insights and Forecast - by Services

- 5.3.1. Transport

- 5.3.1.1. Road

- 5.3.1.2. Air

- 5.3.1.3. Rail

- 5.3.1.4. Sea

- 5.3.2. Warehousing Services

- 5.3.3. Value-added Services and Other Services

- 5.3.1. Transport

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SEKO Logistics

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hub Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nippon Express

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 UPS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Penske Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 XPO Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FedEx

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Expeditors International

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DB Schenker*List Not Exhaustive 6 3 Other Companie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 SEKO Logistics

List of Figures

- Figure 1: United States Pharmaceutical Transportation Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Pharmaceutical Transportation Market Share (%) by Company 2025

List of Tables

- Table 1: United States Pharmaceutical Transportation Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: United States Pharmaceutical Transportation Market Revenue billion Forecast, by Mode of Operation 2020 & 2033

- Table 3: United States Pharmaceutical Transportation Market Revenue billion Forecast, by Services 2020 & 2033

- Table 4: United States Pharmaceutical Transportation Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: United States Pharmaceutical Transportation Market Revenue billion Forecast, by Product 2020 & 2033

- Table 6: United States Pharmaceutical Transportation Market Revenue billion Forecast, by Mode of Operation 2020 & 2033

- Table 7: United States Pharmaceutical Transportation Market Revenue billion Forecast, by Services 2020 & 2033

- Table 8: United States Pharmaceutical Transportation Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Pharmaceutical Transportation Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the United States Pharmaceutical Transportation Market?

Key companies in the market include SEKO Logistics, DHL, Hub Group, Nippon Express, UPS, Penske Logistics, XPO Logistics, FedEx, Expeditors International, DB Schenker*List Not Exhaustive 6 3 Other Companie.

3. What are the main segments of the United States Pharmaceutical Transportation Market?

The market segments include Product, Mode of Operation, Services.

4. Can you provide details about the market size?

The market size is estimated to be USD 107.6 billion as of 2022.

5. What are some drivers contributing to market growth?

E-commerce Boom; Same-day and Next-day Delivery.

6. What are the notable trends driving market growth?

Growing Pharmaceutical Industry in the Country.

7. Are there any restraints impacting market growth?

Regulatory Challenges; Infrastructure Limitations.

8. Can you provide examples of recent developments in the market?

August 2022: Wabash, a provider of transportation, logistics, and distribution solutions, announced the addition of two dealers to its industry-leading North American dealer network. Bergey's Truck Centers and Allegiance Trucks, two of the largest dealers in the Northeast, will be full-line dealers of Wabash parts, services, and equipment, including dry and refrigerated van trailers, dry and refrigerated truck bodies, and platform trailers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Pharmaceutical Transportation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Pharmaceutical Transportation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Pharmaceutical Transportation Market?

To stay informed about further developments, trends, and reports in the United States Pharmaceutical Transportation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence