Key Insights

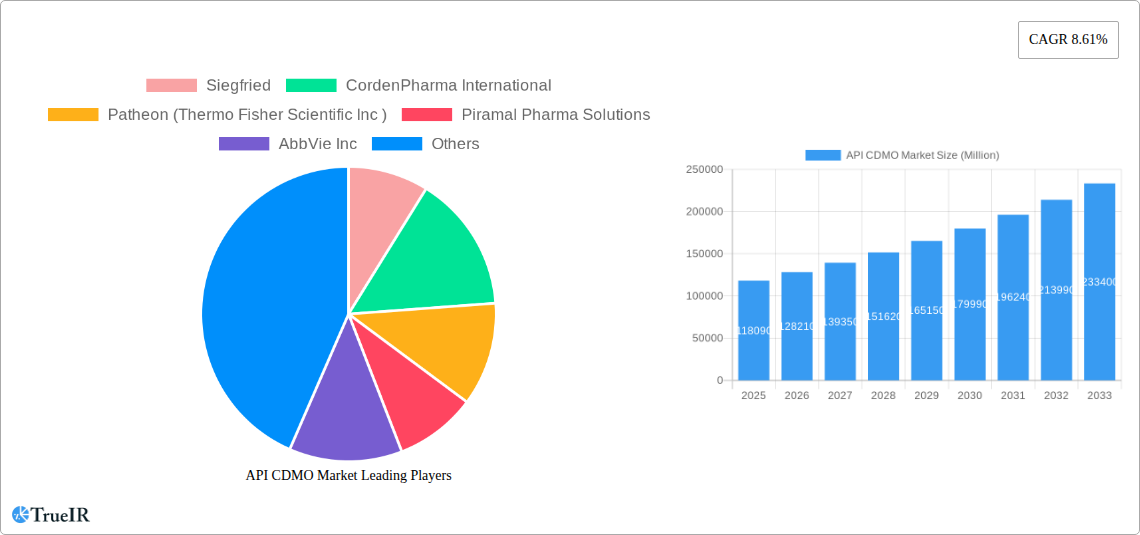

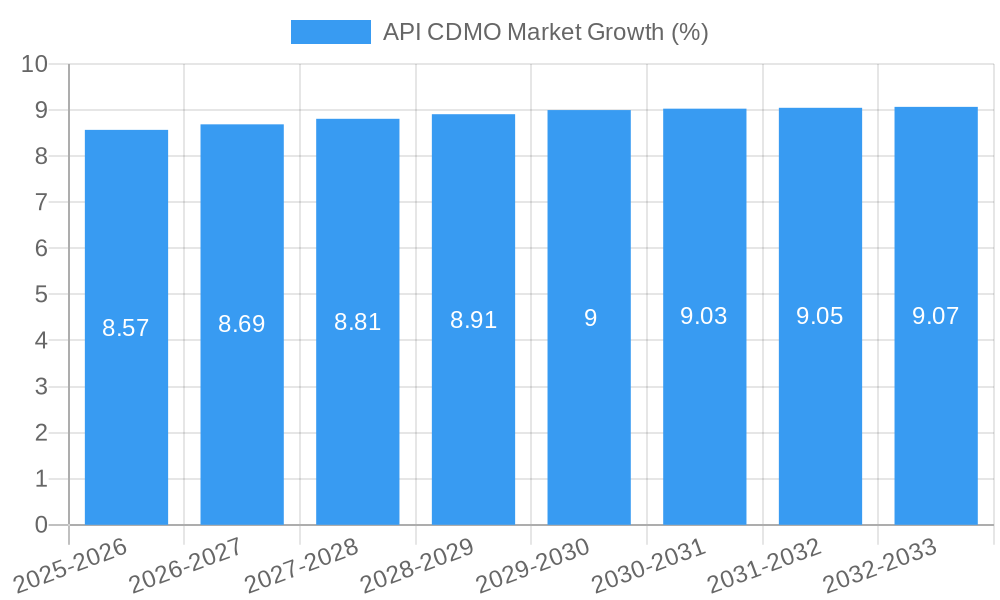

The global API CDMO (Active Pharmaceutical Ingredient Contract Development and Manufacturing Organization) market is poised for significant expansion, projected to reach USD 118.09 billion by 2025. This robust growth is fueled by an estimated Compound Annual Growth Rate (CAGR) of 8.61% from 2019 to 2033. Key drivers include the increasing complexity of drug molecules, necessitating specialized development and manufacturing capabilities that many pharmaceutical companies outsource. Furthermore, the rising trend of pharmaceutical companies focusing on core competencies like R&D and marketing, while offloading manufacturing, is a major impetus. The growing prevalence of chronic diseases, leading to a higher demand for pharmaceuticals, also contributes significantly to market growth. The market is segmented across various molecule types, including small and large molecules, with a notable shift towards large molecule development due to advancements in biopharmaceuticals. Synthesis methods, such as biotech and synthetic, are also diversifying. The drug type landscape is characterized by the simultaneous growth of innovative and generic drugs, both requiring expert CDMO support for efficient production and scale-up. The workflow segmentation reveals a strong demand for both clinical and commercial manufacturing services, highlighting the end-to-end support provided by CDMOs. Application areas such as cardiology and oncology, experiencing substantial drug development pipelines, are major contributors to the API CDMO market.

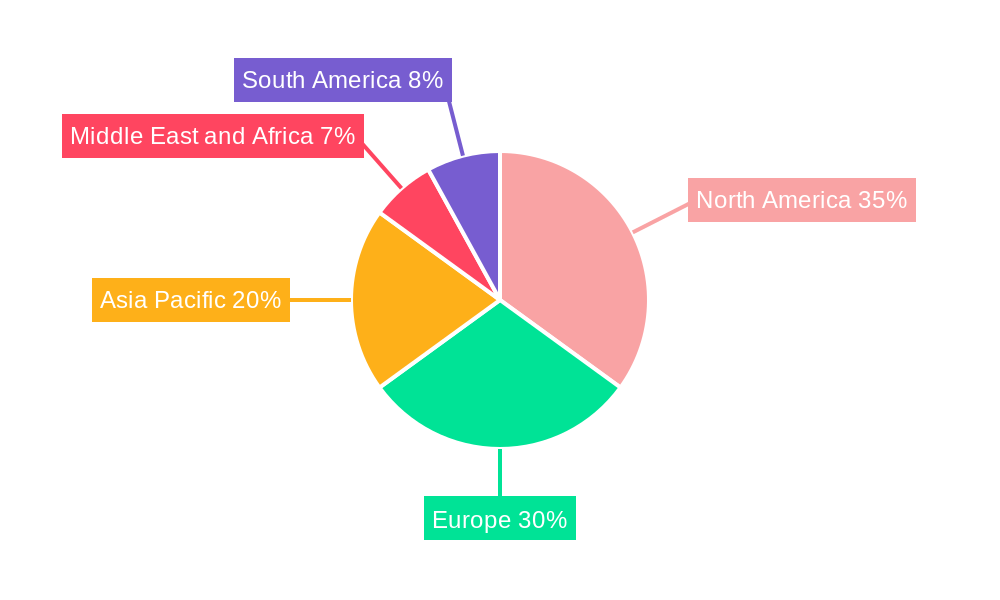

The API CDMO market is experiencing dynamic shifts and presents lucrative opportunities across its diverse segments and geographical regions. Restraints such as stringent regulatory compliance and intellectual property protection concerns are being effectively navigated by experienced CDMOs, showcasing their value proposition. The market is witnessing consolidation and strategic partnerships among key players like Lonza, Catalent Inc., and Patheon (Thermo Fisher Scientific Inc.), aiming to expand their service offerings and geographical reach. Emerging trends include the adoption of advanced manufacturing technologies, such as continuous manufacturing and single-use systems, to enhance efficiency and reduce costs. Geographic expansion into emerging markets, particularly in Asia Pacific, driven by cost advantages and growing pharmaceutical sectors in countries like China and India, is a significant trend. North America and Europe remain dominant regions due to established pharmaceutical ecosystems and high R&D investments. The growth across segments like synthetic and biotech synthesis, alongside innovative and generic drug types, underscores the comprehensive nature of CDMO services. The increasing reliance on specialized CDMOs for complex molecules and specialized applications like oncology and neurology indicates a maturing and indispensable role for these organizations within the pharmaceutical value chain.

Unlocking Global Pharmaceutical Growth: API CDMO Market Insights 2025-2033

This comprehensive report delves into the dynamic API CDMO Market, providing an in-depth analysis of its structure, trends, opportunities, and future trajectory. With a focus on high-volume keywords such as "API manufacturing," "CDMO services," "pharmaceutical outsourcing," and "drug development," this research is designed to empower industry stakeholders with actionable intelligence. The study encompasses a robust Study Period from 2019–2033, with a Base Year and Estimated Year of 2025, and a detailed Forecast Period of 2025–2033, built upon a thorough Historical Period analysis from 2019–2024. Gain a competitive edge by understanding market drivers, dominant segments, product innovations, and key players shaping the future of active pharmaceutical ingredient contract development and manufacturing organizations.

API CDMO Market Market Structure & Competitive Landscape

The API CDMO Market exhibits a moderately concentrated structure, with a significant presence of both established global players and emerging niche service providers. Innovation remains a key differentiator, driven by advancements in synthetic chemistry, biotechnology, and process optimization for both Small Molecule and Large Molecule APIs. Regulatory landscapes, including FDA, EMA, and other regional health authorities, exert a substantial influence, demanding stringent quality control and compliance adherence throughout the drug lifecycle. While direct product substitutes for APIs are limited, the increasing demand for outsourced manufacturing solutions highlights a shift in industry preferences. End-user segmentation is diverse, spanning from large pharmaceutical companies developing Innovative drugs to generic manufacturers seeking cost-effective API Synthesis. Mergers and acquisitions (M&A) are a notable trend, with approximately 15-20 significant M&A activities observed annually over the past five years, as larger CDMOs seek to expand their service portfolios, geographic reach, and technological capabilities. For example, the acquisition of smaller, specialized API manufacturers by major players aims to consolidate market share and offer integrated solutions. Key industry developments, such as Piramal Pharma Solutions' successful initial production runs at their new API plant in Aurora, Ontario in May 2022, underscore the market's expansion and commitment to advanced manufacturing. Furthermore, Lonza Group's CHF 20 million (USD 21 million) investment in June 2021 to expand its API development and manufacturing facility in China demonstrates a strategic focus on key growth regions. The competitive intensity is characterized by a balance between service breadth, technological expertise, cost-effectiveness, and a proven track record of regulatory compliance.

API CDMO Market Market Trends & Opportunities

The API CDMO Market is poised for substantial growth, with an estimated Compound Annual Growth Rate (CAGR) of approximately 8.5% projected for the forecast period. This expansion is fueled by a confluence of favorable market trends and emerging opportunities. The increasing complexity of drug molecules, particularly biologics and advanced therapies, necessitates specialized expertise and state-of-the-art manufacturing capabilities that many pharmaceutical companies opt to outsource to CDMOs. This trend is particularly evident in the Large Molecule segment, which is experiencing rapid growth. Advancements in Biotech Synthesis and continuous manufacturing technologies are revolutionizing API production, leading to improved efficiency, higher yields, and reduced environmental impact. Pharmaceutical companies are increasingly prioritizing their core competencies in drug discovery and marketing, leading to a greater reliance on CDMOs for Clinical and Commercial manufacturing workflows. The growing demand for both Innovative and Generics drugs globally, driven by aging populations, rising chronic disease prevalence, and expanding access to healthcare in emerging markets, directly translates to increased API demand.

The market penetration rate for outsourced API manufacturing has steadily increased, with a significant portion of overall API production now handled by CDMOs. This trend is expected to accelerate as pharmaceutical companies strive to optimize their supply chains and reduce capital expenditures. Opportunities abound for CDMOs that can offer integrated services, from early-stage process development and scale-up to commercial manufacturing and regulatory support. The rise of personalized medicine and targeted therapies further creates demand for flexible and agile manufacturing solutions capable of producing smaller batches of highly specialized APIs. Furthermore, the increasing regulatory scrutiny across global markets necessitates CDMOs with robust quality management systems and a strong understanding of international compliance standards. Strategic partnerships and collaborations between pharmaceutical companies and CDMOs are becoming more prevalent, fostering innovation and accelerating the path to market for new therapies. The global shift towards biologics and the expanding pipeline of such drugs indicate a sustained demand for specialized CDMO capabilities in this area.

Dominant Markets & Segments in API CDMO Market

The API CDMO Market is characterized by distinct dominant regions and segments, each contributing significantly to overall market dynamics. North America and Europe currently hold substantial market share due to the presence of major pharmaceutical companies, robust R&D investments, and stringent regulatory frameworks that drive the need for high-quality outsourced manufacturing. However, the Asia-Pacific region, particularly China and India, is emerging as a significant growth engine, driven by cost advantages, expanding manufacturing infrastructure, and a growing number of domestic pharmaceutical players.

Molecule Type: The Small Molecule segment continues to dominate the market in terms of volume and value, owing to their widespread use in established and generic drugs. However, the Large Molecule segment is experiencing a higher growth rate, fueled by the increasing development of biologics, monoclonal antibodies, and advanced therapies.

Synthesis: Both Biotech and Synthetic synthesis methods are crucial. While Synthetic chemistry remains foundational for a vast array of drugs, Biotech synthesis is rapidly gaining prominence with the rise of biopharmaceuticals, requiring specialized fermentation and purification techniques.

Drug Type: The demand for APIs for both Innovative and Generics drugs is substantial. The generics market provides a steady volume of business, while the innovative drug segment offers higher value opportunities, driven by novel drug discoveries and patent expirances.

Workflow: The Commercial workflow segment represents the largest share, driven by established drug manufacturing. However, the Clinical workflow segment is experiencing robust growth, reflecting the ongoing pipeline of new drug candidates undergoing clinical trials, necessitating early-stage manufacturing and process development.

Application: The Oncology and Cardiology application segments are leading the market due to the high prevalence of these diseases and significant R&D investments. Neurology and Ophthalmology are also key growth areas, with an increasing number of pipeline drugs targeting these therapeutic areas. The Orthopedic and Other Applications segments also contribute to the overall market demand.

Key growth drivers across these segments include significant investments in R&D by pharmaceutical companies, the expiry of patents leading to increased demand for generic APIs, and the growing outsourcing trend. Government initiatives promoting domestic pharmaceutical manufacturing and favorable trade policies in regions like Asia-Pacific further bolster market expansion.

API CDMO Market Product Analysis

The API CDMO Market is characterized by a continuous stream of product innovations aimed at enhancing manufacturing efficiency, purity, and sustainability. Companies are investing heavily in advanced technologies such as continuous manufacturing, flow chemistry, and advanced purification techniques to produce APIs with higher yields and reduced waste. This focus on technological advancement allows CDMOs to offer competitive advantages by meeting stringent quality requirements and faster turnaround times for complex molecules. Applications span across critical therapeutic areas like Cardiology, Oncology, Ophthalmology, and Neurology, with a growing emphasis on highly potent APIs (HPAPIs) and biologics. The market fit is driven by the ability of CDMOs to provide tailored solutions, from process development and optimization to large-scale commercial manufacturing, ensuring a reliable and high-quality supply of APIs for both innovative and generic drugs.

Key Drivers, Barriers & Challenges in API CDMO Market

The API CDMO Market is propelled by several key drivers, including the escalating R&D investments by pharmaceutical companies, leading to a robust pipeline of novel drug candidates. The increasing outsourcing trend by pharma majors, allowing them to focus on core competencies, is a significant catalyst. Furthermore, the growing demand for generics and biosimilars, coupled with patent expirations, fuels consistent API production needs. Technological advancements in API synthesis and manufacturing processes, such as continuous manufacturing and advanced analytical techniques, also drive market growth.

However, the market faces significant barriers and challenges. Stringent and evolving regulatory requirements across different geographies (e.g., FDA, EMA) demand continuous investment in compliance and quality management systems, increasing operational costs. Supply chain disruptions, exacerbated by geopolitical instability and global events, pose a substantial risk, impacting raw material availability and timely delivery. Intense competition among CDMOs can lead to price pressures, impacting profitability. The high cost of establishing and maintaining state-of-the-art manufacturing facilities, particularly for specialized APIs like highly potent compounds and biologics, also presents a capital expenditure barrier.

Growth Drivers in the API CDMO Market Market

Key growth drivers in the API CDMO Market are multifaceted, encompassing technological, economic, and regulatory factors. Technologically, advancements in Biotech Synthesis, including cell culture technologies and gene editing, are expanding the possibilities for Large Molecule API production. Economically, the sustained global demand for pharmaceuticals, driven by aging populations and increasing chronic disease prevalence, provides a foundational impetus. Regulatory tailwinds, such as expedited review pathways for innovative therapies and government initiatives supporting domestic manufacturing, further encourage market expansion. The strategic shift of pharmaceutical companies towards outsourcing their API manufacturing needs to specialized CDMOs to reduce costs and streamline operations is a critical economic driver.

Challenges Impacting API CDMO Market Growth

Several challenges significantly impact API CDMO Market growth. Regulatory complexities remain a paramount concern, with differing and stringent compliance standards across major markets like the US, Europe, and Asia requiring continuous adaptation and investment in quality control. Supply chain vulnerabilities, including the sourcing of raw materials and potential disruptions due to geopolitical events or trade disputes, pose a constant threat to production timelines and cost-effectiveness. Competitive pressures, particularly from low-cost manufacturers in emerging economies, can lead to margin erosion for established players. Furthermore, the substantial capital investment required for state-of-the-art manufacturing facilities, especially for specialized APIs such as high-potency compounds and biologics, acts as a significant barrier to entry and expansion.

Key Players Shaping the API CDMO Market Market

Key players shaping the API CDMO Market include Siegfried, CordenPharma International, Patheon (Thermo Fisher Scientific Inc), Piramal Pharma Solutions, AbbVie Inc, Lonza, Catalent Inc, Samsung Biologics, Recipharm AB, and Cambrex Corporation. This list is not exhaustive but highlights some of the leading organizations driving innovation and market development.

Significant API CDMO Market Industry Milestones

- May 2022: Piramal Pharma Solutions announced that its new active pharmaceutical ingredient (API) plant in Aurora, Ontario, successfully completed its initial production runs, marking a significant expansion of its manufacturing capabilities.

- June 2021: Lonza Group invested CHF 20 million (USD 21 million) to expand its API development and manufacturing facility in China, signaling a strategic commitment to growth in the Asian market.

Future Outlook for API CDMO Market Market

The future outlook for the API CDMO Market is exceptionally bright, characterized by sustained growth driven by innovation and increasing outsourcing trends. Strategic opportunities lie in the expanding pipeline of complex biologics and advanced therapies, which demand specialized CDMO expertise. The growing demand for personalized medicine will necessitate agile and flexible manufacturing solutions. CDMOs that invest in cutting-edge technologies, maintain robust quality systems, and build strong client relationships will be well-positioned to capitalize on the market's expansion. Furthermore, the continued push for supply chain resilience and regional manufacturing will create new avenues for growth. The market potential is further amplified by the increasing focus on sustainability and green chemistry in API production.

API CDMO Market Segmentation

-

1. Molecule Type

- 1.1. Small Molecule

- 1.2. Large Molecule

-

2. Synthesis

- 2.1. Biotech

- 2.2. Synthetic

-

3. Drug Type

- 3.1. Innovative

- 3.2. Generics

-

4. Workflow

- 4.1. Clinical

- 4.2. Commercial

-

5. Application

- 5.1. Cardiology

- 5.2. Oncology

- 5.3. Ophthalmology

- 5.4. Neurology

- 5.5. Orthopedic

- 5.6. Other Applications

API CDMO Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

API CDMO Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.61% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Pharmaceutical R&D Investment; Rising Demand for Generic Drugs; Complex Manufacturing; Patent Expiration

- 3.3. Market Restrains

- 3.3.1. Compliance Issues while Outsourcing; Concerns about Data Quality and Security

- 3.4. Market Trends

- 3.4.1. The Commercial Segment is Expected to Hold the Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global API CDMO Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Molecule Type

- 5.1.1. Small Molecule

- 5.1.2. Large Molecule

- 5.2. Market Analysis, Insights and Forecast - by Synthesis

- 5.2.1. Biotech

- 5.2.2. Synthetic

- 5.3. Market Analysis, Insights and Forecast - by Drug Type

- 5.3.1. Innovative

- 5.3.2. Generics

- 5.4. Market Analysis, Insights and Forecast - by Workflow

- 5.4.1. Clinical

- 5.4.2. Commercial

- 5.5. Market Analysis, Insights and Forecast - by Application

- 5.5.1. Cardiology

- 5.5.2. Oncology

- 5.5.3. Ophthalmology

- 5.5.4. Neurology

- 5.5.5. Orthopedic

- 5.5.6. Other Applications

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. Middle East and Africa

- 5.6.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Molecule Type

- 6. North America API CDMO Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Molecule Type

- 6.1.1. Small Molecule

- 6.1.2. Large Molecule

- 6.2. Market Analysis, Insights and Forecast - by Synthesis

- 6.2.1. Biotech

- 6.2.2. Synthetic

- 6.3. Market Analysis, Insights and Forecast - by Drug Type

- 6.3.1. Innovative

- 6.3.2. Generics

- 6.4. Market Analysis, Insights and Forecast - by Workflow

- 6.4.1. Clinical

- 6.4.2. Commercial

- 6.5. Market Analysis, Insights and Forecast - by Application

- 6.5.1. Cardiology

- 6.5.2. Oncology

- 6.5.3. Ophthalmology

- 6.5.4. Neurology

- 6.5.5. Orthopedic

- 6.5.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Molecule Type

- 7. Europe API CDMO Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Molecule Type

- 7.1.1. Small Molecule

- 7.1.2. Large Molecule

- 7.2. Market Analysis, Insights and Forecast - by Synthesis

- 7.2.1. Biotech

- 7.2.2. Synthetic

- 7.3. Market Analysis, Insights and Forecast - by Drug Type

- 7.3.1. Innovative

- 7.3.2. Generics

- 7.4. Market Analysis, Insights and Forecast - by Workflow

- 7.4.1. Clinical

- 7.4.2. Commercial

- 7.5. Market Analysis, Insights and Forecast - by Application

- 7.5.1. Cardiology

- 7.5.2. Oncology

- 7.5.3. Ophthalmology

- 7.5.4. Neurology

- 7.5.5. Orthopedic

- 7.5.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Molecule Type

- 8. Asia Pacific API CDMO Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Molecule Type

- 8.1.1. Small Molecule

- 8.1.2. Large Molecule

- 8.2. Market Analysis, Insights and Forecast - by Synthesis

- 8.2.1. Biotech

- 8.2.2. Synthetic

- 8.3. Market Analysis, Insights and Forecast - by Drug Type

- 8.3.1. Innovative

- 8.3.2. Generics

- 8.4. Market Analysis, Insights and Forecast - by Workflow

- 8.4.1. Clinical

- 8.4.2. Commercial

- 8.5. Market Analysis, Insights and Forecast - by Application

- 8.5.1. Cardiology

- 8.5.2. Oncology

- 8.5.3. Ophthalmology

- 8.5.4. Neurology

- 8.5.5. Orthopedic

- 8.5.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Molecule Type

- 9. Middle East and Africa API CDMO Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Molecule Type

- 9.1.1. Small Molecule

- 9.1.2. Large Molecule

- 9.2. Market Analysis, Insights and Forecast - by Synthesis

- 9.2.1. Biotech

- 9.2.2. Synthetic

- 9.3. Market Analysis, Insights and Forecast - by Drug Type

- 9.3.1. Innovative

- 9.3.2. Generics

- 9.4. Market Analysis, Insights and Forecast - by Workflow

- 9.4.1. Clinical

- 9.4.2. Commercial

- 9.5. Market Analysis, Insights and Forecast - by Application

- 9.5.1. Cardiology

- 9.5.2. Oncology

- 9.5.3. Ophthalmology

- 9.5.4. Neurology

- 9.5.5. Orthopedic

- 9.5.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Molecule Type

- 10. South America API CDMO Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Molecule Type

- 10.1.1. Small Molecule

- 10.1.2. Large Molecule

- 10.2. Market Analysis, Insights and Forecast - by Synthesis

- 10.2.1. Biotech

- 10.2.2. Synthetic

- 10.3. Market Analysis, Insights and Forecast - by Drug Type

- 10.3.1. Innovative

- 10.3.2. Generics

- 10.4. Market Analysis, Insights and Forecast - by Workflow

- 10.4.1. Clinical

- 10.4.2. Commercial

- 10.5. Market Analysis, Insights and Forecast - by Application

- 10.5.1. Cardiology

- 10.5.2. Oncology

- 10.5.3. Ophthalmology

- 10.5.4. Neurology

- 10.5.5. Orthopedic

- 10.5.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Molecule Type

- 11. North America API CDMO Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe API CDMO Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific API CDMO Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East API CDMO Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. GCC API CDMO Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 South Africa

- 15.1.2 Rest of Middle East

- 16. South America API CDMO Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 Brazil

- 16.1.2 Argentina

- 16.1.3 Rest of South America

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Siegfried

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 CordenPharma International

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Patheon (Thermo Fisher Scientific Inc )

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Piramal Pharma Solutions

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 AbbVie Inc

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Lonza

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Catalent Inc *List Not Exhaustive

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Samsung Biologics

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Recipharm AB

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Cambrex Corporation

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.1 Siegfried

List of Figures

- Figure 1: Global API CDMO Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America API CDMO Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America API CDMO Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe API CDMO Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe API CDMO Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific API CDMO Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific API CDMO Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East API CDMO Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East API CDMO Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: GCC API CDMO Market Revenue (Million), by Country 2024 & 2032

- Figure 11: GCC API CDMO Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America API CDMO Market Revenue (Million), by Country 2024 & 2032

- Figure 13: South America API CDMO Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America API CDMO Market Revenue (Million), by Molecule Type 2024 & 2032

- Figure 15: North America API CDMO Market Revenue Share (%), by Molecule Type 2024 & 2032

- Figure 16: North America API CDMO Market Revenue (Million), by Synthesis 2024 & 2032

- Figure 17: North America API CDMO Market Revenue Share (%), by Synthesis 2024 & 2032

- Figure 18: North America API CDMO Market Revenue (Million), by Drug Type 2024 & 2032

- Figure 19: North America API CDMO Market Revenue Share (%), by Drug Type 2024 & 2032

- Figure 20: North America API CDMO Market Revenue (Million), by Workflow 2024 & 2032

- Figure 21: North America API CDMO Market Revenue Share (%), by Workflow 2024 & 2032

- Figure 22: North America API CDMO Market Revenue (Million), by Application 2024 & 2032

- Figure 23: North America API CDMO Market Revenue Share (%), by Application 2024 & 2032

- Figure 24: North America API CDMO Market Revenue (Million), by Country 2024 & 2032

- Figure 25: North America API CDMO Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Europe API CDMO Market Revenue (Million), by Molecule Type 2024 & 2032

- Figure 27: Europe API CDMO Market Revenue Share (%), by Molecule Type 2024 & 2032

- Figure 28: Europe API CDMO Market Revenue (Million), by Synthesis 2024 & 2032

- Figure 29: Europe API CDMO Market Revenue Share (%), by Synthesis 2024 & 2032

- Figure 30: Europe API CDMO Market Revenue (Million), by Drug Type 2024 & 2032

- Figure 31: Europe API CDMO Market Revenue Share (%), by Drug Type 2024 & 2032

- Figure 32: Europe API CDMO Market Revenue (Million), by Workflow 2024 & 2032

- Figure 33: Europe API CDMO Market Revenue Share (%), by Workflow 2024 & 2032

- Figure 34: Europe API CDMO Market Revenue (Million), by Application 2024 & 2032

- Figure 35: Europe API CDMO Market Revenue Share (%), by Application 2024 & 2032

- Figure 36: Europe API CDMO Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Europe API CDMO Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Asia Pacific API CDMO Market Revenue (Million), by Molecule Type 2024 & 2032

- Figure 39: Asia Pacific API CDMO Market Revenue Share (%), by Molecule Type 2024 & 2032

- Figure 40: Asia Pacific API CDMO Market Revenue (Million), by Synthesis 2024 & 2032

- Figure 41: Asia Pacific API CDMO Market Revenue Share (%), by Synthesis 2024 & 2032

- Figure 42: Asia Pacific API CDMO Market Revenue (Million), by Drug Type 2024 & 2032

- Figure 43: Asia Pacific API CDMO Market Revenue Share (%), by Drug Type 2024 & 2032

- Figure 44: Asia Pacific API CDMO Market Revenue (Million), by Workflow 2024 & 2032

- Figure 45: Asia Pacific API CDMO Market Revenue Share (%), by Workflow 2024 & 2032

- Figure 46: Asia Pacific API CDMO Market Revenue (Million), by Application 2024 & 2032

- Figure 47: Asia Pacific API CDMO Market Revenue Share (%), by Application 2024 & 2032

- Figure 48: Asia Pacific API CDMO Market Revenue (Million), by Country 2024 & 2032

- Figure 49: Asia Pacific API CDMO Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East and Africa API CDMO Market Revenue (Million), by Molecule Type 2024 & 2032

- Figure 51: Middle East and Africa API CDMO Market Revenue Share (%), by Molecule Type 2024 & 2032

- Figure 52: Middle East and Africa API CDMO Market Revenue (Million), by Synthesis 2024 & 2032

- Figure 53: Middle East and Africa API CDMO Market Revenue Share (%), by Synthesis 2024 & 2032

- Figure 54: Middle East and Africa API CDMO Market Revenue (Million), by Drug Type 2024 & 2032

- Figure 55: Middle East and Africa API CDMO Market Revenue Share (%), by Drug Type 2024 & 2032

- Figure 56: Middle East and Africa API CDMO Market Revenue (Million), by Workflow 2024 & 2032

- Figure 57: Middle East and Africa API CDMO Market Revenue Share (%), by Workflow 2024 & 2032

- Figure 58: Middle East and Africa API CDMO Market Revenue (Million), by Application 2024 & 2032

- Figure 59: Middle East and Africa API CDMO Market Revenue Share (%), by Application 2024 & 2032

- Figure 60: Middle East and Africa API CDMO Market Revenue (Million), by Country 2024 & 2032

- Figure 61: Middle East and Africa API CDMO Market Revenue Share (%), by Country 2024 & 2032

- Figure 62: South America API CDMO Market Revenue (Million), by Molecule Type 2024 & 2032

- Figure 63: South America API CDMO Market Revenue Share (%), by Molecule Type 2024 & 2032

- Figure 64: South America API CDMO Market Revenue (Million), by Synthesis 2024 & 2032

- Figure 65: South America API CDMO Market Revenue Share (%), by Synthesis 2024 & 2032

- Figure 66: South America API CDMO Market Revenue (Million), by Drug Type 2024 & 2032

- Figure 67: South America API CDMO Market Revenue Share (%), by Drug Type 2024 & 2032

- Figure 68: South America API CDMO Market Revenue (Million), by Workflow 2024 & 2032

- Figure 69: South America API CDMO Market Revenue Share (%), by Workflow 2024 & 2032

- Figure 70: South America API CDMO Market Revenue (Million), by Application 2024 & 2032

- Figure 71: South America API CDMO Market Revenue Share (%), by Application 2024 & 2032

- Figure 72: South America API CDMO Market Revenue (Million), by Country 2024 & 2032

- Figure 73: South America API CDMO Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global API CDMO Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global API CDMO Market Revenue Million Forecast, by Molecule Type 2019 & 2032

- Table 3: Global API CDMO Market Revenue Million Forecast, by Synthesis 2019 & 2032

- Table 4: Global API CDMO Market Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 5: Global API CDMO Market Revenue Million Forecast, by Workflow 2019 & 2032

- Table 6: Global API CDMO Market Revenue Million Forecast, by Application 2019 & 2032

- Table 7: Global API CDMO Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global API CDMO Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global API CDMO Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Germany API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United Kingdom API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: France API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italy API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Spain API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Europe API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global API CDMO Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: China API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Japan API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: India API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Australia API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Asia Pacific API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global API CDMO Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global API CDMO Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: South Africa API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Middle East API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global API CDMO Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Brazil API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Argentina API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of South America API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global API CDMO Market Revenue Million Forecast, by Molecule Type 2019 & 2032

- Table 36: Global API CDMO Market Revenue Million Forecast, by Synthesis 2019 & 2032

- Table 37: Global API CDMO Market Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 38: Global API CDMO Market Revenue Million Forecast, by Workflow 2019 & 2032

- Table 39: Global API CDMO Market Revenue Million Forecast, by Application 2019 & 2032

- Table 40: Global API CDMO Market Revenue Million Forecast, by Country 2019 & 2032

- Table 41: United States API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Canada API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Mexico API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global API CDMO Market Revenue Million Forecast, by Molecule Type 2019 & 2032

- Table 45: Global API CDMO Market Revenue Million Forecast, by Synthesis 2019 & 2032

- Table 46: Global API CDMO Market Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 47: Global API CDMO Market Revenue Million Forecast, by Workflow 2019 & 2032

- Table 48: Global API CDMO Market Revenue Million Forecast, by Application 2019 & 2032

- Table 49: Global API CDMO Market Revenue Million Forecast, by Country 2019 & 2032

- Table 50: Germany API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: United Kingdom API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: France API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Italy API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Spain API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Global API CDMO Market Revenue Million Forecast, by Molecule Type 2019 & 2032

- Table 57: Global API CDMO Market Revenue Million Forecast, by Synthesis 2019 & 2032

- Table 58: Global API CDMO Market Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 59: Global API CDMO Market Revenue Million Forecast, by Workflow 2019 & 2032

- Table 60: Global API CDMO Market Revenue Million Forecast, by Application 2019 & 2032

- Table 61: Global API CDMO Market Revenue Million Forecast, by Country 2019 & 2032

- Table 62: China API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Japan API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: India API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Australia API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: South Korea API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: Rest of Asia Pacific API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Global API CDMO Market Revenue Million Forecast, by Molecule Type 2019 & 2032

- Table 69: Global API CDMO Market Revenue Million Forecast, by Synthesis 2019 & 2032

- Table 70: Global API CDMO Market Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 71: Global API CDMO Market Revenue Million Forecast, by Workflow 2019 & 2032

- Table 72: Global API CDMO Market Revenue Million Forecast, by Application 2019 & 2032

- Table 73: Global API CDMO Market Revenue Million Forecast, by Country 2019 & 2032

- Table 74: GCC API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 75: South Africa API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Rest of Middle East and Africa API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 77: Global API CDMO Market Revenue Million Forecast, by Molecule Type 2019 & 2032

- Table 78: Global API CDMO Market Revenue Million Forecast, by Synthesis 2019 & 2032

- Table 79: Global API CDMO Market Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 80: Global API CDMO Market Revenue Million Forecast, by Workflow 2019 & 2032

- Table 81: Global API CDMO Market Revenue Million Forecast, by Application 2019 & 2032

- Table 82: Global API CDMO Market Revenue Million Forecast, by Country 2019 & 2032

- Table 83: Brazil API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 84: Argentina API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 85: Rest of South America API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the API CDMO Market?

The projected CAGR is approximately 8.61%.

2. Which companies are prominent players in the API CDMO Market?

Key companies in the market include Siegfried, CordenPharma International, Patheon (Thermo Fisher Scientific Inc ), Piramal Pharma Solutions, AbbVie Inc, Lonza, Catalent Inc *List Not Exhaustive, Samsung Biologics, Recipharm AB, Cambrex Corporation.

3. What are the main segments of the API CDMO Market?

The market segments include Molecule Type, Synthesis, Drug Type, Workflow, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 118.09 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Pharmaceutical R&D Investment; Rising Demand for Generic Drugs; Complex Manufacturing; Patent Expiration.

6. What are the notable trends driving market growth?

The Commercial Segment is Expected to Hold the Major Market Share.

7. Are there any restraints impacting market growth?

Compliance Issues while Outsourcing; Concerns about Data Quality and Security.

8. Can you provide examples of recent developments in the market?

In May 2022, Piramal Pharma Solutions stated that the company's new active pharmaceutical ingredient (API) plant in Aurora, Ontario, went online and successfully completed its initial production runs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "API CDMO Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the API CDMO Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the API CDMO Market?

To stay informed about further developments, trends, and reports in the API CDMO Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence