Key Insights

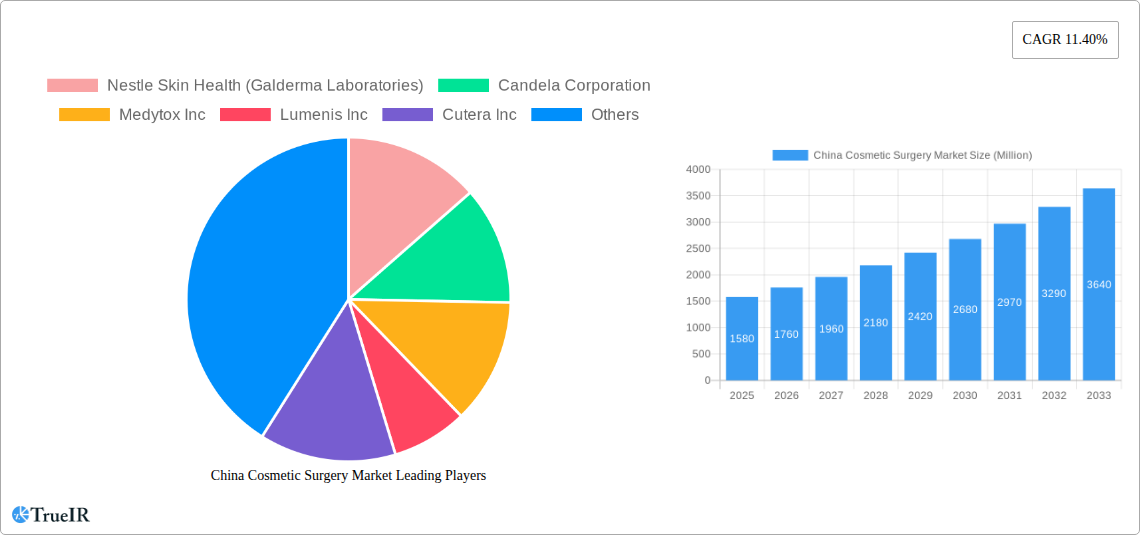

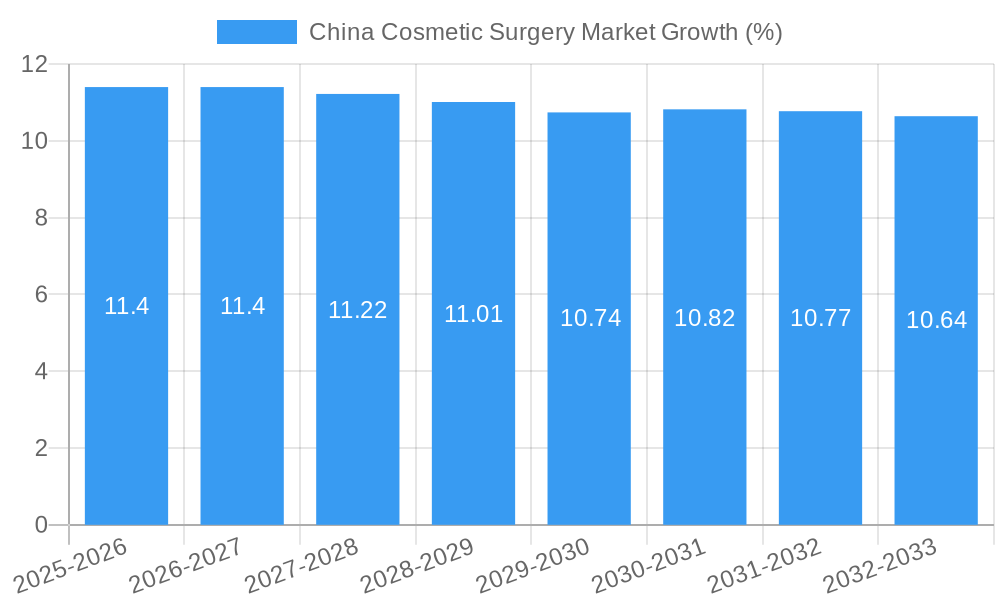

The China cosmetic surgery market is poised for substantial growth, projected to reach a valuation of $1.58 billion by 2025. This impressive expansion is driven by a robust Compound Annual Growth Rate (CAGR) of 11.40% between 2019 and 2033. Several key factors fuel this upward trajectory. A rising disposable income among the Chinese population, coupled with increasing societal acceptance of aesthetic procedures, creates a fertile ground for market expansion. Furthermore, the growing influence of social media and celebrity culture has significantly heightened consumer interest in enhancing their appearance. The market is segmented across a diverse range of products, from energy-based devices like laser and RF treatments to non-energy based solutions such as botulinum toxin and dermal fillers. Applications are equally varied, encompassing skin resurfacing and tightening, body contouring, hair removal, and facial aesthetic procedures, reflecting a comprehensive demand for aesthetic improvements. End-users span hospitals, clinics, beauty centers, and even the burgeoning home settings, indicating a widespread adoption of cosmetic treatments.

The market's dynamism is further characterized by evolving trends. A notable trend is the increasing preference for minimally invasive procedures, driven by shorter recovery times and reduced risks. Technological advancements in energy-based devices are continuously improving efficacy and patient comfort, making treatments more accessible and appealing. However, the market also faces certain restraints. Stringent regulatory frameworks governing medical devices and aesthetic procedures can pose challenges to new market entrants and product launches. Concerns regarding unqualified practitioners and the potential for adverse outcomes can also impact consumer confidence. Despite these challenges, the outlook for the China cosmetic surgery market remains exceptionally positive, supported by innovative product development, growing consumer awareness, and a strong underlying demand for aesthetic enhancement.

This in-depth report provides an indispensable analysis of the China Cosmetic Surgery Market, offering granular insights into market dynamics, growth trajectories, and competitive strategies from 2019 to 2033. With the base year at 2025, our comprehensive research leverages high-volume keywords and extensive data to guide industry stakeholders through this rapidly evolving landscape. The market is projected to reach an estimated value of $XX Billion by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025–2033).

China Cosmetic Surgery Market Market Structure & Competitive Landscape

The China Cosmetic Surgery Market is characterized by a moderately consolidated structure, with key players vying for market share through continuous innovation and strategic partnerships. The market concentration is driven by significant R&D investments in novel technologies and minimally invasive procedures, alongside the influence of stringent regulatory frameworks governing product safety and efficacy. Product substitutes, particularly the rising popularity of non-surgical aesthetic treatments, present a dynamic competitive front. End-user segmentation reveals a growing demand from clinics and beauty centers, indicating a shift towards specialized aesthetic services. Mergers and acquisitions (M&A) activity is a notable trend, with companies actively seeking to expand their product portfolios and geographical reach. For instance, the volume of M&A deals in the historical period (2019-2024) was approximately XX valued at $XX Million. The Herfindahl-Hirschman Index (HHI) for the market in 2025 is estimated at XX, suggesting a moderate level of competition.

- Innovation Drivers: Advancement in energy-based devices, development of bio-compatible dermal fillers, and advancements in non-invasive treatment modalities.

- Regulatory Impacts: Strict approval processes for new devices and injectables, emphasizing patient safety and ethical marketing practices.

- Product Substitutes: The increasing availability and affordability of non-surgical alternatives like advanced skincare and at-home devices.

- End-User Segmentation: Dominance of hospitals and clinics, with a burgeoning segment of specialized beauty centers.

- M&A Trends: Strategic acquisitions to gain access to new technologies, expand product lines, and enhance market penetration.

China Cosmetic Surgery Market Market Trends & Opportunities

The China Cosmetic Surgery Market is experiencing remarkable growth, driven by a confluence of socio-economic factors and technological advancements. The market size is estimated to grow from $XX Billion in 2019 to $XX Billion by 2025, and is projected to reach $XX Billion by 2033, exhibiting a CAGR of XX% during the forecast period. This expansion is fueled by increasing disposable incomes, a burgeoning middle class, and a growing societal acceptance of aesthetic procedures. Consumers are increasingly seeking both surgical and non-surgical solutions for appearance enhancement and anti-aging, leading to a higher market penetration rate for these services, estimated at XX% in 2025. Technological shifts are evident with the rise of minimally invasive techniques and energy-based devices offering faster recovery times and more natural-looking results. The demand for personalized treatments, tailored to individual needs and desired outcomes, is a significant trend. Competitive dynamics are intensifying as both domestic and international players introduce innovative products and services. Opportunities lie in addressing the growing demand for reconstructive surgery, catering to the aging population, and expanding into Tier 2 and Tier 3 cities where awareness and access are still developing. The market also presents opportunities for providers of advanced training and educational programs for medical professionals, ensuring the safe and effective delivery of these procedures. Furthermore, the integration of artificial intelligence (AI) in personalized treatment planning and the development of advanced biomaterials for implants and fillers are poised to revolutionize the market. The growing influence of social media and celebrity endorsements also plays a crucial role in shaping consumer preferences, driving demand for specific procedures and treatments.

Dominant Markets & Segments in China Cosmetic Surgery Market

Within the China Cosmetic Surgery Market, energy-based aesthetic devices currently hold a dominant position, driven by their versatility and effectiveness across a wide range of applications. Specifically, Laser-based Aesthetic Devices are leading this segment, accounting for an estimated XX% of the energy-based device market share in 2025. The Facial Aesthetic Procedures application segment also commands significant market dominance, representing approximately XX% of the total market revenue in the base year. This is closely followed by Skin Resurfacing and Tightening procedures, reflecting the growing demand for anti-aging solutions. The Hospitals, Clinics and Beauty Centers end-user segment is the most significant, contributing an estimated XX% to the market's revenue in 2025.

- Dominant Product Segment: Energy-based Aesthetic Devices, with Laser-based Aesthetic Devices leading due to their efficacy in skin rejuvenation and hair removal.

- Key Growth Drivers: Technological advancements in laser technology offering improved precision and reduced downtime.

- Market Dominance Analysis: High adoption rates in dermatology and plastic surgery clinics, supported by extensive clinical research and proven results.

- Dominant Application Segment: Facial Aesthetic Procedures, driven by the desire for youthful appearance and the popularity of injectables and minimally invasive facial treatments.

- Key Growth Drivers: Increasing prevalence of aesthetic concerns related to aging, sun damage, and environmental factors.

- Market Dominance Analysis: A broad range of procedures like facelifts, rhinoplasty, and injectables contribute to this segment's leadership.

- Dominant End-User Segment: Hospitals, Clinics and Beauty Centers, due to the specialized equipment, trained professionals, and controlled environments required for these procedures.

- Key Growth Drivers: Growing number of aesthetic clinics and the increasing preference for professional treatment over DIY solutions.

- Market Dominance Analysis: Well-established infrastructure and healthcare systems facilitate the widespread availability and delivery of cosmetic surgery services.

China Cosmetic Surgery Market Product Analysis

The China Cosmetic Surgery Market is witnessing rapid product innovation, particularly in the realm of energy-based aesthetic devices and advanced non-energy based solutions. Laser-based devices, RF-based devices, and light-based devices are continuously being refined for greater precision and patient comfort. In the non-energy based segment, dermal fillers and aesthetic threads are gaining immense popularity due to their minimally invasive nature and immediate results. Companies are focusing on developing biocompatible materials with enhanced longevity and reduced risk of adverse reactions. The competitive advantage lies in offering devices and products that provide superior clinical outcomes, faster recovery times, and a higher degree of patient satisfaction, catering to the evolving demands for natural-looking enhancements.

Key Drivers, Barriers & Challenges in China Cosmetic Surgery Market

Key Drivers: The primary forces propelling the China Cosmetic Surgery Market include a rapidly growing affluent population with increasing disposable incomes, a societal shift towards valuing appearance and self-care, and continuous technological advancements in minimally invasive procedures and devices. Government initiatives promoting medical tourism and the rise of social media influence also act as significant growth catalysts. For instance, the expansion of healthcare infrastructure in Tier 2 and Tier 3 cities is opening new avenues for market growth.

Barriers & Challenges: Key challenges impacting the market include stringent and evolving regulatory frameworks, potential supply chain disruptions for specialized equipment and materials, and intense competition from both established international players and emerging domestic manufacturers. Ethical concerns and the risk of unregulated or substandard procedures also pose a threat to market integrity. The high cost of advanced treatments can be a barrier for a segment of the population.

Growth Drivers in the China Cosmetic Surgery Market Market

The China Cosmetic Surgery Market is propelled by several key growth drivers. A significant factor is the burgeoning middle class with heightened disposable incomes, enabling greater investment in aesthetic enhancement. Societal trends favoring youthful appearances and self-care are also contributing to increased demand. Technological advancements, particularly in energy-based devices and minimally invasive injectables, offer safer and more effective solutions. Furthermore, supportive government policies aimed at developing the healthcare sector and promoting medical tourism provide a favorable environment for market expansion. The increasing influence of social media and celebrity endorsements is also playing a crucial role in driving consumer interest and demand.

Challenges Impacting China Cosmetic Surgery Market Growth

Despite robust growth, the China Cosmetic Surgery Market faces several challenges. Regulatory complexities and evolving approval processes for new technologies and products can lead to delays in market entry. Supply chain vulnerabilities, especially for specialized components and raw materials, can disrupt production and distribution. Intense competitive pressures, with a growing number of domestic and international players, can lead to price wars and squeezed profit margins. The risk of unethical practices and the need for stringent quality control to ensure patient safety remain paramount concerns. Public perception and the potential for negative publicity following adverse events can also impact market growth.

Key Players Shaping the China Cosmetic Surgery Market Market

- Nestle Skin Health (Galderma Laboratories)

- Candela Corporation

- Medytox Inc

- Lumenis Inc

- Cutera Inc

- Merz Pharma GmbH & Co KGaA

- Sisram Medical Ltd (Alma Lasers)

- Abbvie Inc (Allergan Inc)

- Bausch Health Companies Inc

- Sinclair Pharma PLC

Significant China Cosmetic Surgery Market Industry Milestones

- 2019: Launch of advanced hyaluronic acid-based dermal fillers with extended longevity.

- 2020: Introduction of novel laser technology for fractional skin resurfacing with reduced downtime.

- 2021: Increased investment in R&D for bio-stimulatory injectables and advanced thread lifting techniques.

- 2022: Growing trend of integrated aesthetic clinics offering a comprehensive suite of surgical and non-surgical treatments.

- 2023: Enhanced focus on patient safety and regulatory compliance across the industry.

- 2024: Rise of AI-powered diagnostic tools for personalized treatment planning in cosmetic procedures.

Future Outlook for China Cosmetic Surgery Market Market

The China Cosmetic Surgery Market is poised for continued robust growth, driven by ongoing demographic shifts, evolving consumer preferences, and relentless technological innovation. Strategic opportunities lie in expanding into underserved regions, developing more affordable and accessible treatment options, and leveraging digital platforms for patient engagement and education. The market is expected to witness further consolidation through mergers and acquisitions as companies seek to gain a competitive edge. The increasing demand for male aesthetic procedures and the growing acceptance of preventative aesthetic treatments will also shape future market dynamics. The focus on personalized medicine and the integration of cutting-edge technologies will undoubtedly define the future landscape of cosmetic surgery in China.

China Cosmetic Surgery Market Segmentation

-

1. Product

-

1.1. Energy-based Aesthetic Device

- 1.1.1. Laser-based Aesthetic Device

- 1.1.2. Radiofrequency (RF) Based Aesthetic Device

- 1.1.3. Light-based Aesthetic Device

- 1.1.4. Ultrasound Aesthetic Device

-

1.2. Non-energy Based Aesthetic Device

- 1.2.1. Botulinum Toxin

- 1.2.2. Dermal Fillers and Aesthetic Threads

- 1.2.3. Microdermabrasion

-

1.2.4. Implants

- 1.2.4.1. Facial Implants

- 1.2.4.2. Breast Implants

- 1.2.4.3. Other Implants

- 1.2.5. Other Products

-

1.1. Energy-based Aesthetic Device

-

2. Application

- 2.1. Skin Resurfacing and Tightening

- 2.2. Body Contouring and Cellulite Reduction

- 2.3. Hair Removal

- 2.4. Facial Aesthetic Procedures

- 2.5. Breast Augmentation

- 2.6. Other Applications

-

3. End User

- 3.1. Hospitals

- 3.2. Clinics and Beauty Centers

- 3.3. Home Settings

China Cosmetic Surgery Market Segmentation By Geography

- 1. China

China Cosmetic Surgery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Obese Population; Increasing Awareness Regarding Aesthetic Procedures and Rising Adoption of Minimally Invasive Devices; Technological Advancements in Devices

- 3.3. Market Restrains

- 3.3.1. Side Effects Associated With Cosmetic Procedures; Poor Reimbursement Scenario

- 3.4. Market Trends

- 3.4.1. Dermal Fillers and Aesthetic Threads Expected to Account for Major Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Cosmetic Surgery Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Energy-based Aesthetic Device

- 5.1.1.1. Laser-based Aesthetic Device

- 5.1.1.2. Radiofrequency (RF) Based Aesthetic Device

- 5.1.1.3. Light-based Aesthetic Device

- 5.1.1.4. Ultrasound Aesthetic Device

- 5.1.2. Non-energy Based Aesthetic Device

- 5.1.2.1. Botulinum Toxin

- 5.1.2.2. Dermal Fillers and Aesthetic Threads

- 5.1.2.3. Microdermabrasion

- 5.1.2.4. Implants

- 5.1.2.4.1. Facial Implants

- 5.1.2.4.2. Breast Implants

- 5.1.2.4.3. Other Implants

- 5.1.2.5. Other Products

- 5.1.1. Energy-based Aesthetic Device

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Skin Resurfacing and Tightening

- 5.2.2. Body Contouring and Cellulite Reduction

- 5.2.3. Hair Removal

- 5.2.4. Facial Aesthetic Procedures

- 5.2.5. Breast Augmentation

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals

- 5.3.2. Clinics and Beauty Centers

- 5.3.3. Home Settings

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Nestle Skin Health (Galderma Laboratories)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Candela Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Medytox Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lumenis Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cutera Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Merz Pharma GmbH & Co KGaA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sisram Medical Ltd (Alma Lasers)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Abbvie Inc (Allergan Inc)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bausch Health Companies Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sinclair Pharma PLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Nestle Skin Health (Galderma Laboratories)

List of Figures

- Figure 1: China Cosmetic Surgery Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Cosmetic Surgery Market Share (%) by Company 2024

List of Tables

- Table 1: China Cosmetic Surgery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Cosmetic Surgery Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: China Cosmetic Surgery Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: China Cosmetic Surgery Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: China Cosmetic Surgery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: China Cosmetic Surgery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Cosmetic Surgery Market Revenue Million Forecast, by Product 2019 & 2032

- Table 8: China Cosmetic Surgery Market Revenue Million Forecast, by Application 2019 & 2032

- Table 9: China Cosmetic Surgery Market Revenue Million Forecast, by End User 2019 & 2032

- Table 10: China Cosmetic Surgery Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Cosmetic Surgery Market?

The projected CAGR is approximately 11.40%.

2. Which companies are prominent players in the China Cosmetic Surgery Market?

Key companies in the market include Nestle Skin Health (Galderma Laboratories), Candela Corporation, Medytox Inc, Lumenis Inc, Cutera Inc, Merz Pharma GmbH & Co KGaA, Sisram Medical Ltd (Alma Lasers), Abbvie Inc (Allergan Inc), Bausch Health Companies Inc, Sinclair Pharma PLC.

3. What are the main segments of the China Cosmetic Surgery Market?

The market segments include Product, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.58 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Obese Population; Increasing Awareness Regarding Aesthetic Procedures and Rising Adoption of Minimally Invasive Devices; Technological Advancements in Devices.

6. What are the notable trends driving market growth?

Dermal Fillers and Aesthetic Threads Expected to Account for Major Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Side Effects Associated With Cosmetic Procedures; Poor Reimbursement Scenario.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Cosmetic Surgery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Cosmetic Surgery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Cosmetic Surgery Market?

To stay informed about further developments, trends, and reports in the China Cosmetic Surgery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence