Key Insights

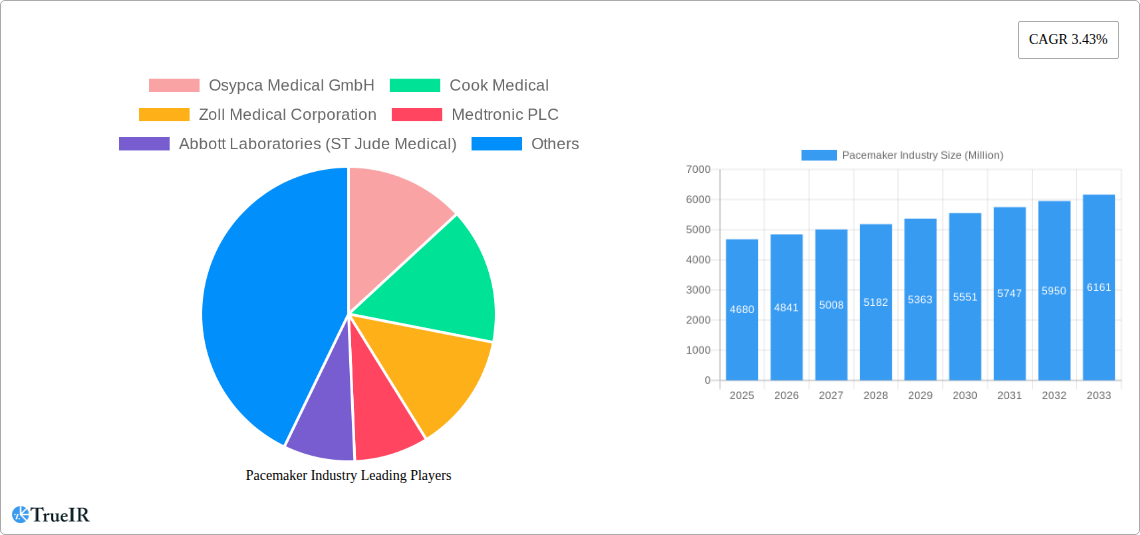

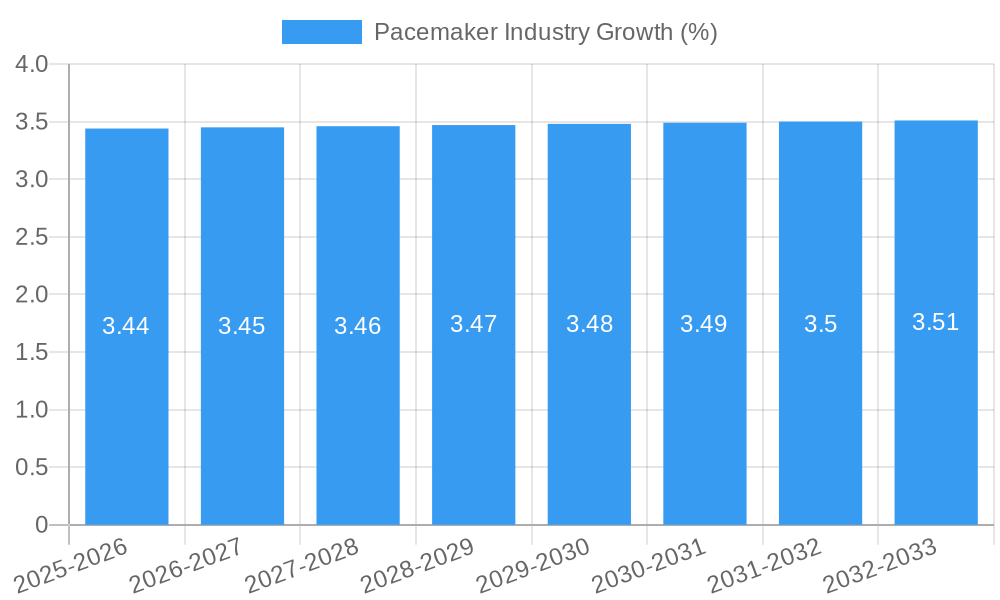

The global pacemaker market is projected to reach a substantial USD 4.68 billion in 2025, demonstrating a robust Compound Annual Growth Rate (CAGR) of 3.43% from 2019 to 2033. This sustained growth is primarily propelled by the increasing prevalence of cardiovascular diseases, particularly bradycardia and heart failure, globally. An aging population further fuels demand, as elderly individuals are more susceptible to cardiac rhythm disorders requiring pacemaker implantation. Advancements in pacemaker technology, including the development of smaller, more sophisticated, and leadless devices offering enhanced patient comfort and reduced complication rates, are significant growth drivers. The rising adoption of implantable pacemakers, categorized into single-chamber, dual-chamber, and biventricular devices, alongside the persistent need for external pacemakers in critical care settings, underpins market expansion. Furthermore, a growing awareness of cardiac health and improved diagnostic capabilities are contributing to earlier detection and intervention, thereby boosting the market.

Despite a positive outlook, the pacemaker market faces certain restraints that could temper its growth trajectory. High healthcare costs associated with pacemaker implantation, including the device itself and subsequent medical care, can limit accessibility, particularly in emerging economies. Stringent regulatory approvals for new medical devices and reimbursement challenges in various healthcare systems also pose hurdles. Moreover, the increasing adoption of minimally invasive procedures and alternative treatment modalities for certain cardiac conditions could present competitive pressure. However, the continuous innovation in device functionality, such as remote monitoring capabilities and longer battery life, alongside expanding healthcare infrastructure and increasing disposable incomes in developing regions, are expected to mitigate these restraints and ensure continued market progress throughout the forecast period.

Pacemaker Industry Market Report: Growth, Trends, and Future Outlook (2019-2033)

This comprehensive report provides an in-depth analysis of the global Pacemaker Industry, a critical segment of the cardiovascular medical device market. Covering the historical period from 2019-2024 and forecasting through 2033, with a base and estimated year of 2025, this report leverages high-volume SEO keywords to offer unparalleled insights for industry stakeholders. We explore market dynamics, competitive landscapes, technological advancements, and future growth trajectories for implantable and external pacemakers.

Pacemaker Industry Market Structure & Competitive Landscape

The global Pacemaker Industry exhibits a moderately consolidated market structure, characterized by the presence of several large, established players alongside a growing number of specialized innovators. Key innovation drivers include the relentless pursuit of miniaturization, enhanced diagnostic capabilities, improved patient comfort, and the integration of artificial intelligence for predictive diagnostics and therapy optimization. Regulatory frameworks, primarily governed by bodies like the FDA and EMA, play a significant role in market entry and product development, ensuring patient safety and efficacy. Product substitutes, while limited for truly life-saving pacing needs, include advancements in less invasive cardiac rhythm management techniques and potential future bio-electronic therapies.

End-user segmentation is primarily driven by patient demographics, cardiac conditions requiring pacing, and healthcare infrastructure in various regions. Mergers and acquisitions (M&A) are a notable trend, as larger companies seek to expand their product portfolios, acquire cutting-edge technologies, and gain market share. For instance, the acquisition of remote cardiac monitoring specialists signals a move towards integrated cardiac care solutions. Concentration ratios are estimated to be in the xx% range for the top five players, indicating a significant market influence. M&A volumes in the past three years have been valued at approximately $xx Million, demonstrating active consolidation.

Pacemaker Industry Market Trends & Opportunities

The Pacemaker Industry is poised for substantial growth, driven by an increasing prevalence of cardiovascular diseases, an aging global population, and advancements in medical technology. The global market size is projected to reach over $xx Million by 2033, expanding at a compound annual growth rate (CAGR) of approximately xx% from the base year 2025. Technological shifts are at the forefront of this expansion, with a strong emphasis on leadless pacemakers, which offer a less invasive implantation procedure and reduced risk of complications. The development of smaller, longer-lasting, and more intelligent devices capable of remote monitoring and therapeutic adjustments is a key trend.

Consumer preferences are evolving towards minimally invasive procedures and devices that offer greater autonomy and improved quality of life. Patients are increasingly seeking solutions that allow for a more active lifestyle with reduced reliance on frequent hospital visits. Competitive dynamics are intensifying, with companies investing heavily in research and development to introduce next-generation pacemakers. The growing demand for remote cardiac monitoring solutions, integrated with pacemakers, presents a significant opportunity for companies to offer comprehensive patient management platforms. Market penetration rates for advanced pacing technologies are expected to rise as awareness and accessibility improve across diverse healthcare settings. The integration of AI and machine learning algorithms within pacemakers for personalized therapy and early detection of arrhythmias will further shape the market, creating new avenues for innovation and revenue generation.

Dominant Markets & Segments in Pacemaker Industry

The Implantable Pacemaker segment is expected to dominate the global Pacemaker Industry due to its critical role in managing chronic cardiac conditions. Within this segment, Dual Chamber pacemakers historically hold the largest market share, followed closely by Single Chamber devices, catering to a wide spectrum of bradycardia and atrial fibrillation management needs. The Biventricular pacing segment is experiencing robust growth, driven by the increasing diagnosis and management of heart failure.

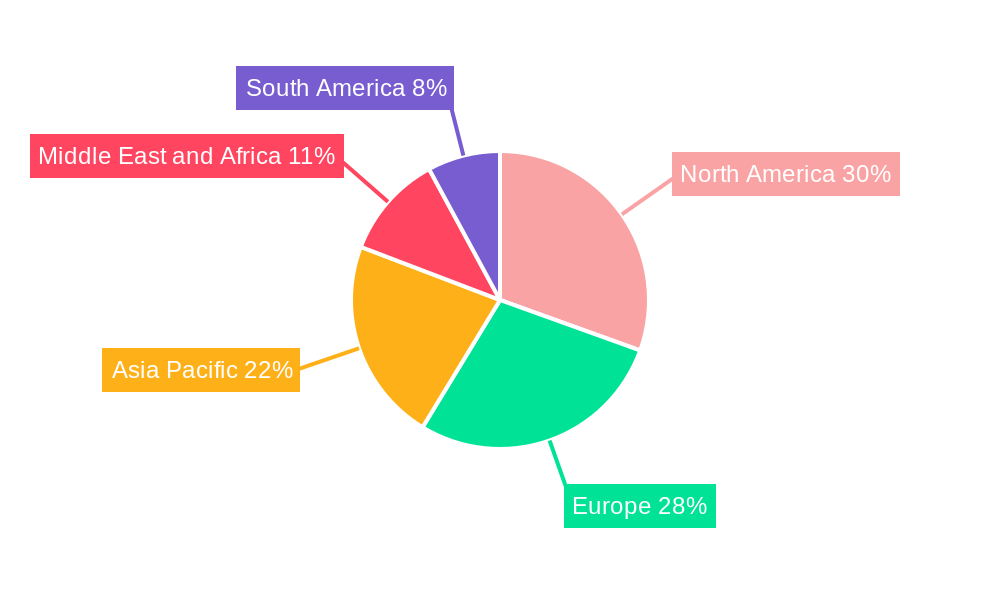

Leading Regions: North America and Europe currently represent the dominant markets for pacemakers, owing to their well-established healthcare infrastructure, high per capita income, advanced medical technologies, and favorable reimbursement policies.

- North America: High prevalence of cardiovascular diseases and a strong emphasis on technological innovation contribute to its leadership.

- Europe: Aging demographics and robust healthcare systems support consistent demand.

Emerging Markets: Asia-Pacific is emerging as a significant growth engine, fueled by rapid economic development, increasing healthcare expenditure, a growing middle class, and a rising incidence of cardiac ailments.

- Key Growth Drivers in Asia-Pacific:

- Expanding healthcare access and infrastructure.

- Government initiatives to improve cardiovascular care.

- Increasing adoption of advanced medical devices.

- Growing awareness of cardiac conditions and treatment options.

Segment Dominance Analysis:

- Implantable Pacemakers: This segment is driven by the unmet need for long-term management of arrhythmias and heart failure. The increasing adoption of sophisticated implantable devices, such as leadless pacemakers, further solidifies its dominance.

- External Pacemakers: While not as significant in market value as implantable devices, external pacemakers serve crucial roles in temporary pacing during acute cardiac events, post-operative care, and diagnostic procedures. Their market is driven by emergency medical services and hospital critical care units.

Pacemaker Industry Product Analysis

Product innovation in the Pacemaker Industry is characterized by a relentless drive towards miniaturization, enhanced efficacy, and improved patient outcomes. Leadless pacemakers, such as the Micra AV from India Medtronic Private Limited, represent a significant leap forward, offering a minimally invasive approach with a miniaturized, fully self-contained design that eliminates the need for transvenous leads. This innovation directly addresses patient concerns regarding lead-related complications and improves aesthetic appeal. Other advancements include pacemakers with expanded diagnostic capabilities, such as continuous monitoring for atrial fibrillation detection, and those incorporating AI algorithms for predictive analytics and personalized pacing strategies. Competitive advantages are increasingly being derived from these technological breakthroughs, superior battery longevity, and seamless integration with remote patient monitoring platforms, offering a comprehensive solution for cardiovascular care.

Key Drivers, Barriers & Challenges in Pacemaker Industry

Key Drivers:

- Increasing Cardiovascular Disease Burden: The global rise in heart failure, arrhythmias, and bradycardia is a primary driver for pacemaker demand.

- Aging Global Population: Elderly individuals are more susceptible to cardiac conditions requiring pacing.

- Technological Advancements: Miniaturization, leadless technology, improved battery life, and AI integration are spurring market growth.

- Growing Awareness and Diagnosis: Enhanced diagnostic tools and patient education are leading to earlier and more accurate diagnoses.

- Favorable Reimbursement Policies: Government and private insurance coverage for pacemaker implantation and related procedures in developed markets support market expansion.

Barriers & Challenges:

- High Cost of Devices: Advanced pacemakers can be expensive, posing a barrier to access in low-income regions.

- Regulatory Hurdles: Stringent approval processes for new devices can delay market entry.

- Supply Chain Disruptions: Global events can impact the availability of critical components and finished products.

- Competition and Pricing Pressure: Intense competition among key players can lead to price erosion.

- Limited Infrastructure in Developing Regions: Inadequate healthcare facilities and trained personnel in some regions hinder adoption.

Growth Drivers in the Pacemaker Industry Market

The Pacemaker Industry's growth is propelled by several key factors. Technologically, the advent of leadless pacemakers is revolutionizing implantation procedures, reducing patient morbidity and hospital stays. The increasing sophistication of implantable cardiac rhythm management devices, incorporating advanced sensing and therapeutic algorithms, caters to complex cardiac conditions. Economically, rising healthcare expenditure globally, particularly in emerging economies, is expanding access to these life-saving technologies. Favorable reimbursement policies in major markets continue to support demand. Regulatory bodies are also facilitating innovation while ensuring safety, with streamlined approval pathways for novel devices. The growing prevalence of atrial fibrillation and heart failure worldwide presents a substantial and expanding patient pool actively seeking effective treatment solutions.

Challenges Impacting Pacemaker Industry Growth

The Pacemaker Industry faces significant challenges that can impede its growth trajectory. Regulatory complexities and the lengthy approval processes for novel devices can delay market entry and innovation diffusion. Supply chain disruptions, exacerbated by global events, pose a risk to the consistent availability of critical components and finished medical devices, impacting production timelines and potentially leading to shortages. Intense competitive pressures among major players can lead to pricing challenges, affecting profitability margins. Furthermore, the high cost of advanced pacemakers remains a considerable barrier to access, particularly in developing economies with limited healthcare budgets and lower per capita income. The need for specialized training for implantation and maintenance can also limit adoption in regions with less developed medical infrastructure.

Key Players Shaping the Pacemaker Industry Market

- Osypca Medical GmbH

- Cook Medical

- Zoll Medical Corporation

- Medtronic PLC

- Abbott Laboratories (ST Jude Medical)

- Medico SpA

- Oscor Inc

- Pacetronix

- Lepu Medical Co Ltd

- MicroPort Scientific Corporation

- Biotronik SE & Co KG

- Boston Scientific Corporation

- Sorin Group

Significant Pacemaker Industry Industry Milestones

- June 2021: India Medtronic Private Limited launched Micra AV, a miniaturized, fully self-contained pacemaker. This device delivers advanced pacing technology to atrioventricular (AV) block patients via a minimally invasive approach. It is the first pacemaker capable of sensing atrial activity without a lead or device in the upper chamber of the heart, marking a significant advancement in leadless pacing.

- January 2021: Boston Scientific Corporation announced its plan to acquire Preventice Solutions, a remote cardiac monitoring developer. This strategic move underscores the industry's trend towards integrated patient care and the growing importance of data analytics in cardiovascular management.

Future Outlook for Pacemaker Industry Market

The future outlook for the Pacemaker Industry is exceptionally promising, driven by a confluence of technological innovation, demographic shifts, and increasing global health awareness. Growth catalysts include the continued development and widespread adoption of leadless pacemaker technology, which offers a superior patient experience. The integration of artificial intelligence and machine learning into pacemakers will enable more personalized and predictive therapies, improving patient outcomes and reducing healthcare burdens. Furthermore, the expansion of remote patient monitoring systems will facilitate proactive management of chronic cardiac conditions, allowing for early intervention and preventing costly hospitalizations. Strategic opportunities lie in expanding market reach into underserved regions and developing cost-effective solutions to enhance accessibility. The market potential remains robust, fueled by the ongoing need to manage the growing burden of cardiovascular diseases worldwide.

Pacemaker Industry Segmentation

-

1. Type

-

1.1. Implantable

- 1.1.1. Single Chamber

- 1.1.2. Dual Chamber

- 1.1.3. Biventricular

- 1.2. External

-

1.1. Implantable

Pacemaker Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Pacemaker Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.43% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Lifestyle-related Disorders; Rapidly Growing Geriatric Population; Advancements in Pacemaker Technology and Minimally Invasive Procedures

- 3.3. Market Restrains

- 3.3.1. High Costs Associated with Application and Maintenance; Cyber Security Risk Associated with Connected Pacemakers

- 3.4. Market Trends

- 3.4.1. Implantable Cardiac Pacemakers Segment Captures the Largest Market Share and is Expected to Grow with a Lucrative Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pacemaker Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Implantable

- 5.1.1.1. Single Chamber

- 5.1.1.2. Dual Chamber

- 5.1.1.3. Biventricular

- 5.1.2. External

- 5.1.1. Implantable

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East and Africa

- 5.2.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Pacemaker Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Implantable

- 6.1.1.1. Single Chamber

- 6.1.1.2. Dual Chamber

- 6.1.1.3. Biventricular

- 6.1.2. External

- 6.1.1. Implantable

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Pacemaker Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Implantable

- 7.1.1.1. Single Chamber

- 7.1.1.2. Dual Chamber

- 7.1.1.3. Biventricular

- 7.1.2. External

- 7.1.1. Implantable

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Pacemaker Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Implantable

- 8.1.1.1. Single Chamber

- 8.1.1.2. Dual Chamber

- 8.1.1.3. Biventricular

- 8.1.2. External

- 8.1.1. Implantable

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Pacemaker Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Implantable

- 9.1.1.1. Single Chamber

- 9.1.1.2. Dual Chamber

- 9.1.1.3. Biventricular

- 9.1.2. External

- 9.1.1. Implantable

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Pacemaker Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Implantable

- 10.1.1.1. Single Chamber

- 10.1.1.2. Dual Chamber

- 10.1.1.3. Biventricular

- 10.1.2. External

- 10.1.1. Implantable

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Pacemaker Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Pacemaker Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Pacemaker Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Pacemaker Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Pacemaker Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Osypca Medical GmbH

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Cook Medical

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Zoll Medical Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Medtronic PLC

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Abbott Laboratories (ST Jude Medical)

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Medico SpA

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Oscor Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Pacetronix

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Lepu Medical Co Ltd

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 MicroPort Scientific Corporation

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Biotronik SE & Co KG

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Boston Scientific Corporation

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Sorin Group*List Not Exhaustive

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.1 Osypca Medical GmbH

List of Figures

- Figure 1: Global Pacemaker Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Pacemaker Industry Volume Breakdown (K Units, %) by Region 2024 & 2032

- Figure 3: North America Pacemaker Industry Revenue (Million), by Country 2024 & 2032

- Figure 4: North America Pacemaker Industry Volume (K Units), by Country 2024 & 2032

- Figure 5: North America Pacemaker Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: North America Pacemaker Industry Volume Share (%), by Country 2024 & 2032

- Figure 7: Europe Pacemaker Industry Revenue (Million), by Country 2024 & 2032

- Figure 8: Europe Pacemaker Industry Volume (K Units), by Country 2024 & 2032

- Figure 9: Europe Pacemaker Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe Pacemaker Industry Volume Share (%), by Country 2024 & 2032

- Figure 11: Asia Pacific Pacemaker Industry Revenue (Million), by Country 2024 & 2032

- Figure 12: Asia Pacific Pacemaker Industry Volume (K Units), by Country 2024 & 2032

- Figure 13: Asia Pacific Pacemaker Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Asia Pacific Pacemaker Industry Volume Share (%), by Country 2024 & 2032

- Figure 15: Middle East and Africa Pacemaker Industry Revenue (Million), by Country 2024 & 2032

- Figure 16: Middle East and Africa Pacemaker Industry Volume (K Units), by Country 2024 & 2032

- Figure 17: Middle East and Africa Pacemaker Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Middle East and Africa Pacemaker Industry Volume Share (%), by Country 2024 & 2032

- Figure 19: South America Pacemaker Industry Revenue (Million), by Country 2024 & 2032

- Figure 20: South America Pacemaker Industry Volume (K Units), by Country 2024 & 2032

- Figure 21: South America Pacemaker Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: South America Pacemaker Industry Volume Share (%), by Country 2024 & 2032

- Figure 23: North America Pacemaker Industry Revenue (Million), by Type 2024 & 2032

- Figure 24: North America Pacemaker Industry Volume (K Units), by Type 2024 & 2032

- Figure 25: North America Pacemaker Industry Revenue Share (%), by Type 2024 & 2032

- Figure 26: North America Pacemaker Industry Volume Share (%), by Type 2024 & 2032

- Figure 27: North America Pacemaker Industry Revenue (Million), by Country 2024 & 2032

- Figure 28: North America Pacemaker Industry Volume (K Units), by Country 2024 & 2032

- Figure 29: North America Pacemaker Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: North America Pacemaker Industry Volume Share (%), by Country 2024 & 2032

- Figure 31: Europe Pacemaker Industry Revenue (Million), by Type 2024 & 2032

- Figure 32: Europe Pacemaker Industry Volume (K Units), by Type 2024 & 2032

- Figure 33: Europe Pacemaker Industry Revenue Share (%), by Type 2024 & 2032

- Figure 34: Europe Pacemaker Industry Volume Share (%), by Type 2024 & 2032

- Figure 35: Europe Pacemaker Industry Revenue (Million), by Country 2024 & 2032

- Figure 36: Europe Pacemaker Industry Volume (K Units), by Country 2024 & 2032

- Figure 37: Europe Pacemaker Industry Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Pacemaker Industry Volume Share (%), by Country 2024 & 2032

- Figure 39: Asia Pacific Pacemaker Industry Revenue (Million), by Type 2024 & 2032

- Figure 40: Asia Pacific Pacemaker Industry Volume (K Units), by Type 2024 & 2032

- Figure 41: Asia Pacific Pacemaker Industry Revenue Share (%), by Type 2024 & 2032

- Figure 42: Asia Pacific Pacemaker Industry Volume Share (%), by Type 2024 & 2032

- Figure 43: Asia Pacific Pacemaker Industry Revenue (Million), by Country 2024 & 2032

- Figure 44: Asia Pacific Pacemaker Industry Volume (K Units), by Country 2024 & 2032

- Figure 45: Asia Pacific Pacemaker Industry Revenue Share (%), by Country 2024 & 2032

- Figure 46: Asia Pacific Pacemaker Industry Volume Share (%), by Country 2024 & 2032

- Figure 47: Middle East and Africa Pacemaker Industry Revenue (Million), by Type 2024 & 2032

- Figure 48: Middle East and Africa Pacemaker Industry Volume (K Units), by Type 2024 & 2032

- Figure 49: Middle East and Africa Pacemaker Industry Revenue Share (%), by Type 2024 & 2032

- Figure 50: Middle East and Africa Pacemaker Industry Volume Share (%), by Type 2024 & 2032

- Figure 51: Middle East and Africa Pacemaker Industry Revenue (Million), by Country 2024 & 2032

- Figure 52: Middle East and Africa Pacemaker Industry Volume (K Units), by Country 2024 & 2032

- Figure 53: Middle East and Africa Pacemaker Industry Revenue Share (%), by Country 2024 & 2032

- Figure 54: Middle East and Africa Pacemaker Industry Volume Share (%), by Country 2024 & 2032

- Figure 55: South America Pacemaker Industry Revenue (Million), by Type 2024 & 2032

- Figure 56: South America Pacemaker Industry Volume (K Units), by Type 2024 & 2032

- Figure 57: South America Pacemaker Industry Revenue Share (%), by Type 2024 & 2032

- Figure 58: South America Pacemaker Industry Volume Share (%), by Type 2024 & 2032

- Figure 59: South America Pacemaker Industry Revenue (Million), by Country 2024 & 2032

- Figure 60: South America Pacemaker Industry Volume (K Units), by Country 2024 & 2032

- Figure 61: South America Pacemaker Industry Revenue Share (%), by Country 2024 & 2032

- Figure 62: South America Pacemaker Industry Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Pacemaker Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Pacemaker Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 3: Global Pacemaker Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Pacemaker Industry Volume K Units Forecast, by Type 2019 & 2032

- Table 5: Global Pacemaker Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Pacemaker Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 7: Global Pacemaker Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Global Pacemaker Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 9: United States Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United States Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 11: Canada Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Canada Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 13: Mexico Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Mexico Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 15: Global Pacemaker Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Pacemaker Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 17: Germany Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Germany Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 19: United Kingdom Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: United Kingdom Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 21: France Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: France Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 23: Italy Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Italy Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 25: Spain Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Spain Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 27: Rest of Europe Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 29: Global Pacemaker Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Global Pacemaker Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 31: China Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: China Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 33: Japan Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Japan Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 35: India Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: India Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 37: Australia Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Australia Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 39: South Korea Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: South Korea Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 41: Rest of Asia Pacific Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Asia Pacific Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 43: Global Pacemaker Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 44: Global Pacemaker Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 45: GCC Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: GCC Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 47: South Africa Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Africa Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 49: Rest of Middle East and Africa Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Rest of Middle East and Africa Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 51: Global Pacemaker Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 52: Global Pacemaker Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 53: Brazil Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Brazil Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 55: Argentina Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Argentina Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 57: Rest of South America Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of South America Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 59: Global Pacemaker Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 60: Global Pacemaker Industry Volume K Units Forecast, by Type 2019 & 2032

- Table 61: Global Pacemaker Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 62: Global Pacemaker Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 63: United States Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: United States Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 65: Canada Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Canada Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 67: Mexico Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Mexico Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 69: Global Pacemaker Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 70: Global Pacemaker Industry Volume K Units Forecast, by Type 2019 & 2032

- Table 71: Global Pacemaker Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 72: Global Pacemaker Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 73: Germany Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: Germany Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 75: United Kingdom Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: United Kingdom Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 77: France Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: France Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 79: Italy Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 80: Italy Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 81: Spain Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 82: Spain Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 83: Rest of Europe Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 84: Rest of Europe Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 85: Global Pacemaker Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 86: Global Pacemaker Industry Volume K Units Forecast, by Type 2019 & 2032

- Table 87: Global Pacemaker Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 88: Global Pacemaker Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 89: China Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 90: China Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 91: Japan Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 92: Japan Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 93: India Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 94: India Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 95: Australia Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 96: Australia Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 97: South Korea Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 98: South Korea Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 99: Rest of Asia Pacific Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 100: Rest of Asia Pacific Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 101: Global Pacemaker Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 102: Global Pacemaker Industry Volume K Units Forecast, by Type 2019 & 2032

- Table 103: Global Pacemaker Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 104: Global Pacemaker Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 105: GCC Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 106: GCC Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 107: South Africa Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 108: South Africa Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 109: Rest of Middle East and Africa Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 110: Rest of Middle East and Africa Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 111: Global Pacemaker Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 112: Global Pacemaker Industry Volume K Units Forecast, by Type 2019 & 2032

- Table 113: Global Pacemaker Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 114: Global Pacemaker Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 115: Brazil Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 116: Brazil Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 117: Argentina Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 118: Argentina Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 119: Rest of South America Pacemaker Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 120: Rest of South America Pacemaker Industry Volume (K Units) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pacemaker Industry?

The projected CAGR is approximately 3.43%.

2. Which companies are prominent players in the Pacemaker Industry?

Key companies in the market include Osypca Medical GmbH, Cook Medical, Zoll Medical Corporation, Medtronic PLC, Abbott Laboratories (ST Jude Medical), Medico SpA, Oscor Inc, Pacetronix, Lepu Medical Co Ltd, MicroPort Scientific Corporation, Biotronik SE & Co KG, Boston Scientific Corporation, Sorin Group*List Not Exhaustive.

3. What are the main segments of the Pacemaker Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.68 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Lifestyle-related Disorders; Rapidly Growing Geriatric Population; Advancements in Pacemaker Technology and Minimally Invasive Procedures.

6. What are the notable trends driving market growth?

Implantable Cardiac Pacemakers Segment Captures the Largest Market Share and is Expected to Grow with a Lucrative Rate.

7. Are there any restraints impacting market growth?

High Costs Associated with Application and Maintenance; Cyber Security Risk Associated with Connected Pacemakers.

8. Can you provide examples of recent developments in the market?

In June 2021, India Medtronic Private Limited launched Micra AV, a miniaturized, fully self-contained pacemaker that delivers advanced pacing technology to atrioventricular (AV) block patients via a minimally invasive approach. The device is the first pacemaker that can sense atrial activity without a lead or device in the upper chamber of the heart

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pacemaker Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pacemaker Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pacemaker Industry?

To stay informed about further developments, trends, and reports in the Pacemaker Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence