Key Insights

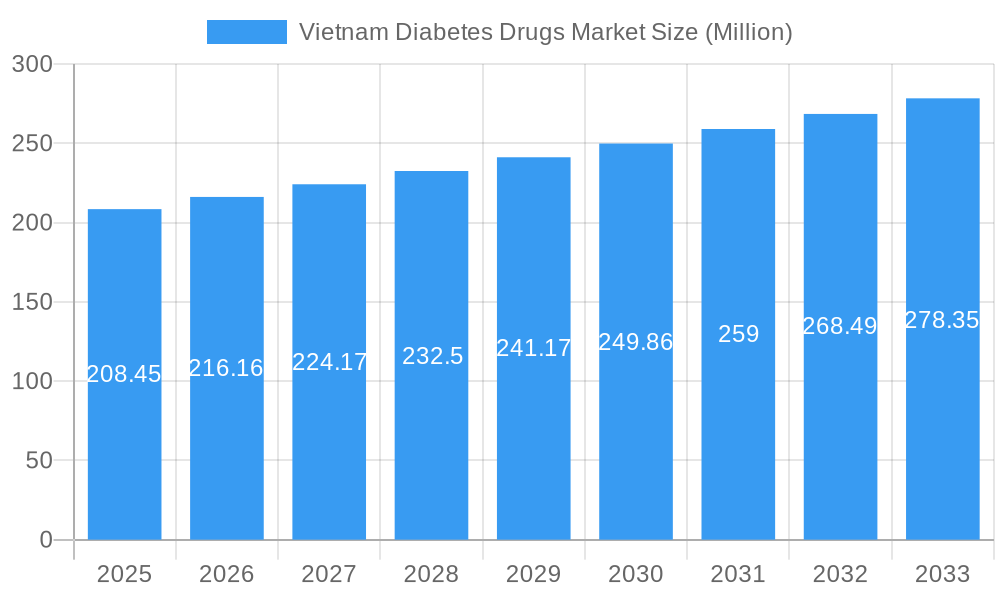

The Vietnam Diabetes Drugs Market is projected for significant expansion, reaching an estimated USD 208.45 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 3.70% anticipated through to 2033. This upward trajectory is primarily fueled by the increasing prevalence of diabetes across Vietnam, a growing awareness of diabetes management, and advancements in therapeutic options. The market is experiencing strong demand for Oral Anti-diabetic Drugs, which continue to dominate due to their convenience and affordability. However, Non-Insulin Injectable Drugs are emerging as a rapidly growing segment, driven by their efficacy in managing complex cases and improving patient outcomes. Insulin Drugs, while a foundational treatment, are also seeing steady growth, particularly newer formulations offering enhanced patient compliance.

Vietnam Diabetes Drugs Market Market Size (In Million)

Key drivers propelling this market forward include lifestyle changes leading to higher rates of obesity and sedentary behavior, which are significant risk factors for diabetes. An aging population also contributes to the rising incidence of the disease. Furthermore, government initiatives aimed at improving healthcare infrastructure and increasing access to diabetes care are playing a crucial role. Despite these positive indicators, certain restraints, such as the out-of-pocket expenditure for some advanced treatments and potential gaps in patient education regarding adherence to medication regimens, need to be addressed to ensure sustained and equitable growth. The competitive landscape features major global pharmaceutical players like Merck & Co., Pfizer, Takeda, and Novo Nordisk, alongside domestic companies, all vying to capture market share through innovation and strategic partnerships.

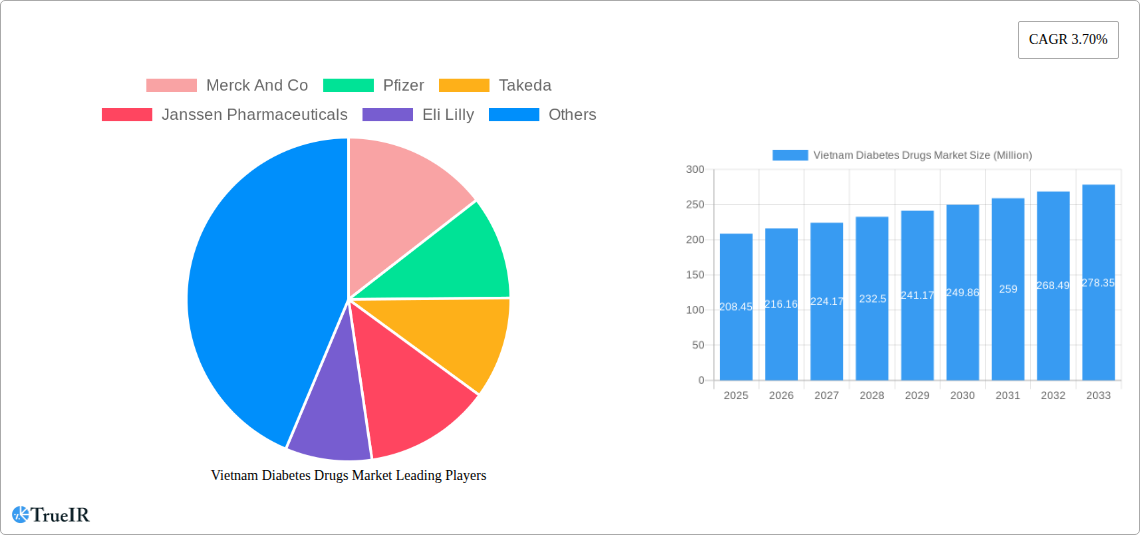

Vietnam Diabetes Drugs Market Company Market Share

Unlock critical insights into the burgeoning Vietnam Diabetes Drugs Market with this in-depth report. Covering a comprehensive study period from 2019 to 2033, with a base year of 2025 and a detailed forecast period of 2025–2033, this analysis provides unparalleled strategic intelligence for stakeholders. We meticulously examine market size, key trends, competitive dynamics, and future growth opportunities within Vietnam's vital pharmaceutical sector. This report leverages high-volume SEO keywords, including "Vietnam diabetes treatment," "diabetes medication Vietnam," "insulin market Vietnam," "oral anti-diabetics Vietnam," and "pharmaceutical industry Vietnam," to ensure maximum visibility and engagement with industry professionals.

Vietnam Diabetes Drugs Market Market Structure & Competitive Landscape

The Vietnam diabetes drugs market is characterized by a moderately concentrated competitive landscape, with key global pharmaceutical giants vying for market share alongside emerging local players. Innovation is a primary driver, fueled by the increasing prevalence of diabetes and the demand for advanced treatment modalities. Regulatory frameworks, while evolving, play a crucial role in shaping market access and pricing strategies. Product substitutes, particularly from the traditional medicine sector, present a continuous challenge, although their efficacy is often debated and scientifically unproven. End-user segmentation is largely driven by disease severity, patient demographics, and physician prescribing patterns. Mergers and acquisitions (M&A) have been relatively subdued, with a focus on strategic partnerships and technology transfer to enhance local manufacturing capabilities and broaden product portfolios. The market anticipates a rise in strategic alliances aimed at leveraging the growing demand for diabetes management solutions.

- Market Concentration: Moderate, with a mix of multinational corporations and a growing number of local manufacturers.

- Innovation Drivers: Rising diabetes prevalence, development of novel drug classes, and government initiatives promoting healthcare access.

- Regulatory Impacts: Evolving price controls and approval processes influence market entry and product pricing.

- Product Substitutes: Traditional remedies and alternative therapies pose a competitive challenge.

- End-User Segmentation: Driven by disease progression, patient age, and socioeconomic factors.

- M&A Trends: Primarily focused on strategic partnerships and technology licensing for localized production.

Vietnam Diabetes Drugs Market Market Trends & Opportunities

The Vietnam diabetes drugs market is poised for significant expansion, driven by a confluence of factors including a rapidly growing patient population, increasing awareness of diabetes management, and supportive government initiatives aimed at improving healthcare infrastructure. The market size is projected to witness substantial growth, with an estimated Compound Annual Growth Rate (CAGR) of approximately 7.5% between 2025 and 2033. Technological advancements are playing a pivotal role, with a growing adoption of innovative drug delivery systems and novel therapeutic agents. Consumer preferences are shifting towards more convenient and effective treatment options, fueling demand for non-insulin injectables and advanced oral anti-diabetic drugs. Competitive dynamics are intensifying, compelling companies to invest in research and development, expand their product portfolios, and strengthen their distribution networks across the country.

A key opportunity lies in the increasing penetration of advanced therapies in both urban and rural areas. As disposable incomes rise and public health campaigns gain momentum, the demand for high-quality diabetes medications is expected to surge. The government's commitment to enhancing healthcare accessibility further augments these opportunities. Furthermore, the aging demographic in Vietnam, coupled with a sedentary lifestyle and dietary changes, is contributing to the escalating burden of type 2 diabetes, creating a sustained demand for effective pharmacotherapy. Pharmaceutical companies that can offer a diverse range of products, from established oral medications to cutting-edge biologics, will be well-positioned to capture this expanding market. Investment in localized manufacturing and research capabilities presents another significant avenue for growth, reducing reliance on imports and potentially lowering treatment costs. The market is also witnessing a growing interest in personalized medicine approaches, which could lead to the development of more targeted and effective diabetes treatments in the future.

The rising awareness about the long-term complications of poorly managed diabetes is also a significant catalyst, encouraging patients and healthcare providers to seek more proactive and comprehensive treatment strategies. This trend supports the market for a wider spectrum of diabetes medications, including those that address comorbidities. The increasing prevalence of obesity, a major risk factor for type 2 diabetes, further amplifies the demand for pharmacotherapies that aid in weight management. Pharmaceutical firms that can leverage these trends by introducing innovative products and robust patient support programs will find fertile ground for growth in the Vietnamese market.

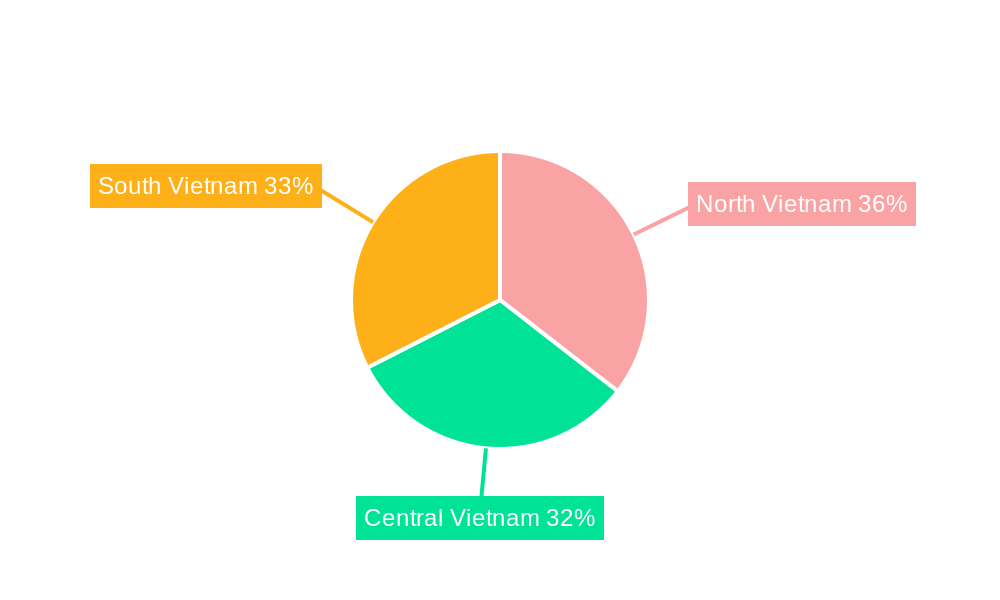

Dominant Markets & Segments in Vietnam Diabetes Drugs Market

The Vietnam diabetes drugs market exhibits a clear dominance within specific segments, reflecting the disease's epidemiological trends and treatment adoption patterns. The Oral Anti-diabetic Drugs segment is a cornerstone of diabetes management in Vietnam, accounting for a substantial portion of the market share due to their accessibility, affordability, and ease of use. These drugs, including metformin and sulfonylureas, are typically the first line of treatment for type 2 diabetes, which is the most prevalent form of the disease in the country. The South Vietnam region, particularly major economic hubs like Ho Chi Minh City, represents the most dominant geographical market. This dominance is attributed to a higher concentration of healthcare facilities, greater physician density, advanced medical infrastructure, and a more affluent population with better access to healthcare services and pharmaceuticals.

The Insulin Drugs segment is also experiencing robust growth, driven by the increasing diagnosis of type 1 diabetes, advanced stages of type 2 diabetes requiring exogenous insulin, and a growing acceptance of insulin therapy. While traditionally perceived as more complex, patient education and improved insulin delivery devices are facilitating wider adoption. Within the drug classes, Non-Insulin Injectable Drugs, including GLP-1 receptor agonists and SGLT-2 inhibitors, are emerging as a significant growth area. These newer classes offer distinct advantages in terms of glycemic control, weight management, and cardiovascular benefits, aligning with the evolving treatment paradigms and the rising awareness of comprehensive diabetes care.

North Vietnam and Central Vietnam are also crucial markets, with significant growth potential. Government initiatives focused on expanding healthcare access and improving infrastructure in these regions are gradually bridging the gap with the South. Policies aimed at disease prevention and early diagnosis are likely to further fuel the demand for all categories of diabetes drugs across these regions. The increasing prevalence of metabolic syndrome and associated risk factors in these areas underscores the need for effective and accessible diabetes medications.

- Dominant Drug Class: Oral Anti-diabetic Drugs, driven by prevalence of Type 2 Diabetes and affordability.

- Dominant Region: South Vietnam, due to advanced healthcare infrastructure, higher population density, and economic prosperity.

- Growing Segment: Non-Insulin Injectable Drugs, due to superior efficacy, weight management benefits, and cardiovascular protection.

- Key Growth Drivers in North and Central Vietnam: Government healthcare expansion initiatives, improving infrastructure, and increasing public health awareness.

- Market Penetration of Insulin Drugs: Steadily increasing, supported by better patient education and device innovation.

Vietnam Diabetes Drugs Market Product Analysis

The Vietnam diabetes drugs market is characterized by a diverse array of product innovations focused on enhancing efficacy, improving patient compliance, and offering better safety profiles. Oral anti-diabetic drugs, including biguanides, sulfonylureas, DPP-4 inhibitors, and SGLT-2 inhibitors, form the backbone of treatment, with continuous advancements in combination therapies to optimize glycemic control. Insulin drugs range from traditional insulins to biosimilar and novel formulations designed for improved pharmacokinetic profiles and reduced injection frequency. Non-insulin injectable drugs, such as GLP-1 receptor agonists, are gaining traction for their dual benefits of glycemic control and weight management, addressing a critical unmet need in diabetes care. The competitive advantage lies in products offering superior efficacy, minimal side effects, convenience of administration, and cost-effectiveness, alongside those demonstrating proven cardiovascular and renal protective benefits.

Key Drivers, Barriers & Challenges in Vietnam Diabetes Drugs Market

Key Drivers: The Vietnam diabetes drugs market is propelled by several key drivers. A surging diabetic population, fueled by lifestyle changes and an aging demographic, creates a consistent and growing demand for treatment. Government initiatives focused on expanding healthcare access and promoting public health awareness are significantly boosting market penetration. Technological advancements in drug development, including novel drug classes and improved delivery systems, are enhancing treatment efficacy and patient convenience. Increasing disposable incomes and a growing middle class are enabling greater expenditure on healthcare, including advanced diabetes medications.

Barriers & Challenges: Despite robust growth prospects, the market faces notable barriers. The prevalence of counterfeit or substandard drugs poses a significant threat to patient safety and erodes trust in legitimate pharmaceuticals. Regulatory hurdles, including complex approval processes and evolving pricing policies, can impact market entry and profitability for pharmaceutical companies. Supply chain disruptions, particularly in sourcing raw materials and ensuring consistent distribution, remain a concern. Intense price competition, especially from generic manufacturers, can squeeze profit margins for branded products. Furthermore, limited access to specialized diabetes care in remote areas and a shortage of trained healthcare professionals can hinder the optimal use of advanced therapies.

Growth Drivers in the Vietnam Diabetes Drugs Market Market

The growth of the Vietnam diabetes drugs market is primarily driven by a rapidly expanding patient pool due to rising incidence of type 2 diabetes, linked to evolving lifestyles and dietary habits. Government efforts to enhance healthcare infrastructure and accessibility, especially in rural regions, are crucial in expanding the market reach for diabetes medications. The introduction of innovative drug classes, such as GLP-1 receptor agonists and SGLT-2 inhibitors, which offer improved glycemic control and additional cardiovascular benefits, is a significant growth catalyst. Furthermore, increasing patient awareness regarding the management of diabetes and its long-term complications encourages the adoption of more effective and comprehensive treatment regimens, thereby driving the demand for a wider range of diabetes drugs.

Challenges Impacting Vietnam Diabetes Drugs Market Growth

Challenges impacting Vietnam diabetes drugs market growth include the persistent issue of counterfeit and substandard medicines, which poses significant risks to public health and the reputation of legitimate pharmaceutical manufacturers. Navigating complex and sometimes inconsistent regulatory pathways for drug approval and pricing can create delays and uncertainties for market entry. Supply chain vulnerabilities, ranging from raw material sourcing to effective distribution networks across diverse geographical regions, can disrupt product availability. Intense competition from generic drug manufacturers, often offering lower-priced alternatives, exerts downward pressure on the profitability of branded diabetes medications, requiring companies to focus on value-added services and product differentiation.

Key Players Shaping the Vietnam Diabetes Drugs Market Market

- Merck And Co

- Pfizer

- Takeda

- Janssen Pharmaceuticals

- Eli Lilly

- Novartis

- AstraZeneca

- Bristol Myers Squibb

- Novo Nordisk

- Boehringer Ingelheim

- Sanofi

- Astellas

Significant Vietnam Diabetes Drugs Market Industry Milestones

- December 2022: Viatris announced the expansion of an existing partnership with Cypriot pharmaceutical company Medochemie, aimed at boosting drug production in Vietnam and improving patients' access to locally made medicines. Viatris was expected to transfer technology to Medochemie for licensed production of certain noncommunicable disease portfolio drugs.

- August 2022: Vietnam declared that 'Hạ An Đường' does not cure diabetes. This declaration addressed concerns surrounding a product marketed as Vietnamese Hạ An Đường, which was believed by some to cure diabetes but was not listed by the Philippine Food and Drug Administration (FDA) as an approved drug.

Future Outlook for Vietnam Diabetes Drugs Market Market

The future outlook for the Vietnam diabetes drugs market is highly promising, characterized by sustained growth and evolving therapeutic landscapes. The market is expected to benefit from the ongoing increase in diabetes prevalence, coupled with proactive government policies aimed at improving public health outcomes. Innovations in drug development, particularly in areas like incretin-based therapies and advanced insulin formulations, will continue to shape treatment paradigms. Opportunities will arise from the growing demand for integrated diabetes management solutions that combine pharmacotherapy with digital health tools and patient support programs. Companies focusing on affordable yet effective treatment options, alongside advanced therapies addressing comorbidities, will be well-positioned to capitalize on the market's expansion and the increasing sophistication of healthcare delivery in Vietnam.

Vietnam Diabetes Drugs Market Segmentation

-

1. Drug Class

- 1.1. Oral Anti-diabetic Drugs

- 1.2. Insulin Drugs

- 1.3. Non-Insulin Injectable Drugs

-

2. Region

- 2.1. North Vietnam

- 2.2. Central Vietnam

- 2.3. South Vietnam

Vietnam Diabetes Drugs Market Segmentation By Geography

- 1. Vietnam

Vietnam Diabetes Drugs Market Regional Market Share

Geographic Coverage of Vietnam Diabetes Drugs Market

Vietnam Diabetes Drugs Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Geriatric Population and Changing Dietary Habits; High Prevalence of Irritable bowel syndrome with constipation (IBS-C) and Opioid-induced constipation (OIC) and Chronic Constipation; Development of Latest Drugs and Treatment Procedures

- 3.3. Market Restrains

- 3.3.1. Increasing Dependence on Majority of Over-the-Counter (OTC) Drugs; Lack of Awareness and Reluctance Among Patients due to Adverse Effects of Opioid-Induced Constipation (OIC) Drugs

- 3.4. Market Trends

- 3.4.1. Oral-Anti Diabetes Drugs is Having the Highest Market Share in the Current Year.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Diabetes Drugs Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Drug Class

- 5.1.1. Oral Anti-diabetic Drugs

- 5.1.2. Insulin Drugs

- 5.1.3. Non-Insulin Injectable Drugs

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North Vietnam

- 5.2.2. Central Vietnam

- 5.2.3. South Vietnam

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Drug Class

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Merck And Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Pfizer

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Takeda

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Janssen Pharmaceuticals

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eli Lilly

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Novartis

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AstraZeneca

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bristol Myers Squibb

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Novo Nordisk

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Boehringer Ingelheim

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Sanofi

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Astellas

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Merck And Co

List of Figures

- Figure 1: Vietnam Diabetes Drugs Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Vietnam Diabetes Drugs Market Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Diabetes Drugs Market Revenue Million Forecast, by Drug Class 2020 & 2033

- Table 2: Vietnam Diabetes Drugs Market Volume K Unit Forecast, by Drug Class 2020 & 2033

- Table 3: Vietnam Diabetes Drugs Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Vietnam Diabetes Drugs Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Vietnam Diabetes Drugs Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Vietnam Diabetes Drugs Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Vietnam Diabetes Drugs Market Revenue Million Forecast, by Drug Class 2020 & 2033

- Table 8: Vietnam Diabetes Drugs Market Volume K Unit Forecast, by Drug Class 2020 & 2033

- Table 9: Vietnam Diabetes Drugs Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Vietnam Diabetes Drugs Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: Vietnam Diabetes Drugs Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Vietnam Diabetes Drugs Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Diabetes Drugs Market?

The projected CAGR is approximately 3.70%.

2. Which companies are prominent players in the Vietnam Diabetes Drugs Market?

Key companies in the market include Merck And Co, Pfizer, Takeda, Janssen Pharmaceuticals, Eli Lilly, Novartis, AstraZeneca, Bristol Myers Squibb, Novo Nordisk, Boehringer Ingelheim, Sanofi, Astellas.

3. What are the main segments of the Vietnam Diabetes Drugs Market?

The market segments include Drug Class, Region.

4. Can you provide details about the market size?

The market size is estimated to be USD 208.45 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Geriatric Population and Changing Dietary Habits; High Prevalence of Irritable bowel syndrome with constipation (IBS-C) and Opioid-induced constipation (OIC) and Chronic Constipation; Development of Latest Drugs and Treatment Procedures.

6. What are the notable trends driving market growth?

Oral-Anti Diabetes Drugs is Having the Highest Market Share in the Current Year..

7. Are there any restraints impacting market growth?

Increasing Dependence on Majority of Over-the-Counter (OTC) Drugs; Lack of Awareness and Reluctance Among Patients due to Adverse Effects of Opioid-Induced Constipation (OIC) Drugs.

8. Can you provide examples of recent developments in the market?

December 2022: Viatris announced the expansion of an existing partnership with Cypriot pharmaceutical company Medochemie, which aimed to boost drug production in Vietnam and improve patients' access to locally made medicines there. Specifically, Viatris was expected to transfer the technology that Medochemie was to use under license to make certain drugs from Viatris' noncommunicable disease portfolio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Diabetes Drugs Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Diabetes Drugs Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Diabetes Drugs Market?

To stay informed about further developments, trends, and reports in the Vietnam Diabetes Drugs Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence