Key Insights

The European sports medicine market is projected to reach 6.69 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.6% from 2025 to 2033. This growth is driven by increased global health consciousness and rising sports participation across all age groups. The escalating incidence of sports-related injuries, alongside advancements in diagnostic and treatment technologies, further fuels market expansion. Adoption of innovative products like advanced implants, minimally invasive arthroscopy devices, and sophisticated prosthetics is on the rise. Key application segments, particularly knee and shoulder injuries prevalent in both professional and recreational sports, are significant demand drivers. Heightened awareness of effective sports injury management also contributes to this positive trend.

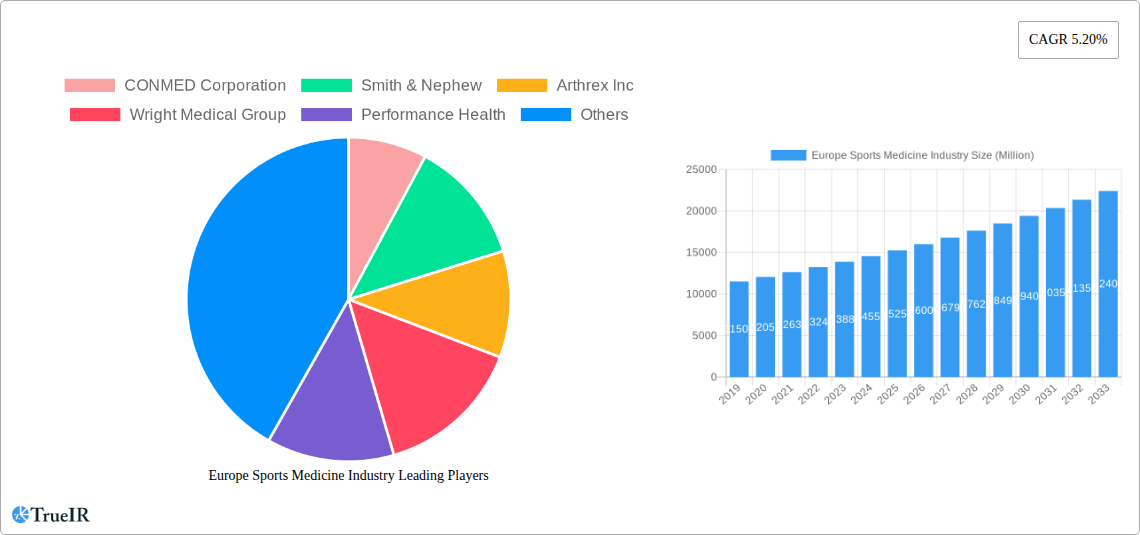

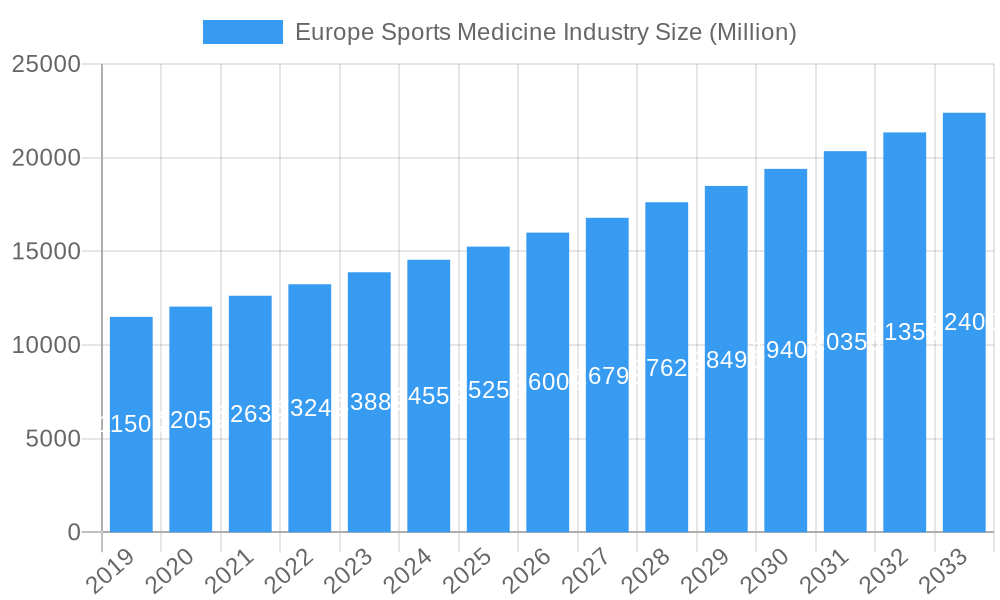

Europe Sports Medicine Industry Market Size (In Billion)

The European sports medicine sector features a competitive landscape with key players actively investing in research and development to introduce novel products and expand their market reach. Strategic collaborations, mergers, and acquisitions are shaping the market to consolidate share and enhance product portfolios. While growth potential is strong, challenges include the high cost of advanced medical devices and procedures, potentially limiting accessibility. Reimbursement policies and regulatory complexities across European nations can also impact market penetration. Nevertheless, the trend towards personalized medicine, bio-regenerative therapies (orthobiologics), and the increasing demand for effective bracing and support solutions are expected to sustain market momentum. The evolution of sports medicine focuses on improving patient outcomes, reducing recovery times, and enabling confident return to activity with minimized re-injury risk.

Europe Sports Medicine Industry Company Market Share

This report offers a comprehensive analysis of the Europe Sports Medicine Industry, driven by increasing sports participation, an aging population, and medical technology advancements. It covers the historical period (2019–2024), base year (2025), and forecast period (2025–2033), providing actionable insights for stakeholders. The study examines market structure, competitive landscape, key trends and opportunities, dominant regions and segments, product analysis, critical drivers, barriers, challenges, and future outlook. With a projected market size reaching approximately 6.69 billion by 2025, this report is essential for businesses aiming to capitalize on the robust growth in European sports medicine.

Europe Sports Medicine Industry Market Structure & Competitive Landscape

The Europe Sports Medicine Industry exhibits a moderately concentrated market structure, with a blend of large multinational corporations and niche players. Key innovation drivers include the relentless pursuit of minimally invasive surgical techniques, enhanced diagnostic tools, and the development of advanced biomaterials and orthobiologics. Regulatory impacts, such as stringent approval processes for new medical devices and varying reimbursement policies across European nations, significantly shape market entry and expansion strategies. Product substitutes, while present in some areas (e.g., conservative treatments versus surgical interventions), are increasingly challenged by the efficacy and faster recovery times offered by modern sports medicine solutions. End-user segmentation reveals a strong reliance on orthopedic surgeons, sports physicians, physiotherapists, and athletes themselves. Mergers and Acquisitions (M&A) trends indicate strategic consolidation aimed at expanding product portfolios, gaining market share, and acquiring innovative technologies. For instance, the market has witnessed approximately XX M&A deals in the past five years, with a total deal value of XX Million Euros, highlighting the active consolidation within the industry. Concentration ratios, particularly in segments like arthroscopy devices, suggest the top 3-5 players hold a significant market share, estimated to be around XX%.

Europe Sports Medicine Industry Market Trends & Opportunities

The Europe Sports Medicine Industry is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of XX% between 2025 and 2033. This robust expansion is fueled by a confluence of factors including rising participation in amateur and professional sports, an increasing prevalence of sports-related injuries, and a growing awareness among individuals regarding the importance of musculoskeletal health. The aging European population is also a significant contributor, as age-related conditions and a desire for active lifestyles necessitate effective sports medicine interventions. Technological advancements are at the forefront of market evolution, with innovations in robotics, artificial intelligence for diagnostics and treatment planning, and the development of advanced biomaterials for implants and regenerative therapies. The shift towards less invasive surgical procedures, such as arthroscopy and endoscopic techniques, continues to gain momentum, driven by demands for shorter recovery times and reduced patient discomfort. Furthermore, the burgeoning field of orthobiologics, including stem cell therapies and platelet-rich plasma (PRP), presents a significant opportunity for accelerating tissue healing and regeneration. Consumer preferences are increasingly leaning towards personalized treatment plans and preventative care strategies, pushing for the development of tailored solutions for athletes and active individuals. The competitive landscape is dynamic, characterized by strategic partnerships, product launches, and investments in research and development to maintain a competitive edge. The penetration rate of advanced sports medicine products is steadily increasing, indicating a growing acceptance and adoption of these innovative solutions across various healthcare settings. The market penetration rate for arthroscopy devices, for example, is estimated to be XX% in key European markets, with significant room for further growth. Opportunities also lie in emerging markets within Europe and in the development of cost-effective solutions to improve accessibility.

Dominant Markets & Segments in Europe Sports Medicine Industry

The Knee Injuries segment consistently emerges as the dominant application area within the Europe Sports Medicine Industry, driven by the high incidence of ligament tears, meniscal damage, and cartilage injuries prevalent in a wide array of sports. Consequently, Implants and Arthroscopy Devices are leading product segments, reflecting the surgical interventions required for these conditions. Geographically, Germany, with its robust healthcare infrastructure, high disposable income, and a strong sporting culture, stands as a leading market. The UK also demonstrates significant market dominance due to its extensive sports participation and advanced healthcare system.

Product Segment Dominance:

- Implants: Driven by the demand for reconstructive surgery, particularly for ligament and cartilage repair.

- Arthroscopy Devices: Essential for minimally invasive procedures, offering faster recovery and reduced complications.

- Orthobiologics: Experiencing rapid growth due to their potential in tissue regeneration and accelerated healing.

Application Segment Dominance:

- Knee Injuries: The primary driver, encompassing a wide spectrum of acute and chronic conditions.

- Shoulder Injuries: Another significant segment, with rotator cuff tears and dislocations being common.

- Ankle and Foot Injuries: Growing in importance with the popularity of sports like running and football.

Regional Dominance:

- Germany: Characterized by substantial investment in sports medicine research and development, coupled with a high volume of procedures. Government policies promoting active lifestyles and sports participation further bolster its position.

- United Kingdom: Benefits from a well-established National Health Service (NHS) and a significant private healthcare sector, supporting the widespread adoption of sports medicine technologies.

- France: Shows strong growth potential, particularly in areas like spine surgery and arthroplasty.

The growth in these dominant segments is underpinned by strong infrastructure, favorable reimbursement policies in leading countries, and proactive government initiatives promoting health and wellness. The increasing adoption of advanced surgical techniques further solidifies the dominance of these interconnected product and application areas.

Europe Sports Medicine Industry Product Analysis

Innovations in the Europe Sports Medicine Industry are primarily focused on enhancing surgical precision, improving patient outcomes, and accelerating recovery. Implants are seeing advancements in biocompatible materials and bioresorbable designs, offering superior integration with the body. Arthroscopy Devices are becoming more sophisticated with enhanced visualization technologies and robotic-assisted instrumentation, enabling less invasive and more precise interventions. Orthobiologics, such as stem cell therapies and PRP, are revolutionizing treatment by harnessing the body's natural healing capabilities. Prosthetics are evolving with advanced microprocessors and lighter materials for improved functionality and comfort. The competitive advantage lies in developing products that offer reduced patient trauma, shorter rehabilitation periods, and greater long-term efficacy.

Key Drivers, Barriers & Challenges in Europe Sports Medicine Industry

Key Drivers: The Europe Sports Medicine Industry is propelled by a growing emphasis on an active lifestyle and increased participation in sports, leading to a higher incidence of sports-related injuries. Technological advancements, particularly in minimally invasive surgery and regenerative medicine, are creating new treatment avenues. An aging population seeking to maintain mobility and quality of life further fuels demand. Favorable reimbursement policies in key European markets and government initiatives promoting public health and sports also act as significant growth catalysts.

Barriers & Challenges: Navigating complex and varying regulatory landscapes across European nations poses a significant challenge. High research and development costs associated with innovative medical devices can be a restraint. Supply chain disruptions, as witnessed in recent global events, can impact product availability and cost. Intense competition among established players and emerging startups necessitates continuous innovation and cost-effectiveness. The economic downturns and budget constraints within healthcare systems can also affect adoption rates of expensive treatments.

Growth Drivers in the Europe Sports Medicine Industry Market

The Europe Sports Medicine Industry is experiencing robust growth driven by several key factors. The escalating participation in sports and fitness activities across all age groups directly correlates with an increased incidence of sports injuries, necessitating advanced treatment solutions. Technological innovation is a paramount driver, with breakthroughs in robotic-assisted surgery, advanced imaging, and biomaterials continually improving the efficacy and safety of procedures. The growing awareness among individuals about the importance of musculoskeletal health and a desire for faster recovery and improved quality of life are also significant contributors. Furthermore, supportive government policies and reimbursement frameworks in many European countries that encourage investment in healthcare infrastructure and the adoption of advanced medical technologies are critical growth enablers.

Challenges Impacting Europe Sports Medicine Industry Growth

Several challenges are impacting the growth trajectory of the Europe Sports Medicine Industry. The stringent and diverse regulatory approval processes across different European countries can lead to delays in market access for new products and technologies. Supply chain vulnerabilities, particularly concerning specialized components and raw materials, can disrupt manufacturing and distribution, leading to price volatility and availability issues. Intense competitive pressures from both established global players and agile regional companies necessitate substantial investment in research and development, while also potentially driving down profit margins. Moreover, the economic climate and healthcare budget constraints in some European nations can limit the adoption of more expensive, albeit advanced, sports medicine treatments.

Key Players Shaping the Europe Sports Medicine Industry Market

- CONMED Corporation

- Smith & Nephew

- Arthrex Inc

- Wright Medical Group

- Performance Health

- Medtronic PLC

- Ossur

- Johnson & Johnson

- Mueller Sports Medicine Inc

- Stryker Corporation

- Zimmer Biomet Holdings Inc

Significant Europe Sports Medicine Industry Industry Milestones

- February 2022: Ossur launched its new POWER KNEETM, an actively powered microprocessor prosthetic knee for individuals with above-the-knee amputations or limb differences, enhancing mobility and functionality.

- July 2022: Spineway, specializing in implants for severe spine problems, acquired all shares of Spine Innovations, a French company manufacturing artificial cervical and lumbar discs, consolidating expertise in spinal care.

Future Outlook for Europe Sports Medicine Industry Market

The future outlook for the Europe Sports Medicine Industry is exceptionally promising, characterized by sustained growth and transformative innovation. Key growth catalysts include the continued development of personalized treatment protocols driven by advancements in diagnostics and AI, and the expansion of regenerative medicine techniques offering non-surgical or minimally invasive alternatives. Strategic opportunities lie in addressing the unmet needs of an aging population seeking to remain active and in catering to the rising demands for advanced rehabilitation technologies. The market is expected to witness further consolidation and strategic partnerships as companies strive to expand their product portfolios and geographical reach, solidifying their positions in this dynamic and essential sector.

Europe Sports Medicine Industry Segmentation

-

1. Product

- 1.1. Implants

- 1.2. Arthroscopy Devices

- 1.3. Prosthetic

- 1.4. Orthobiologics

- 1.5. Braces

- 1.6. Other Products

-

2. Applications

- 2.1. Knee Injuries

- 2.2. Shoulder Injuries

- 2.3. Ankle and Foot Injuries

- 2.4. Back and Spine Injuries

- 2.5. Other Applications

Europe Sports Medicine Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Rest of Europe

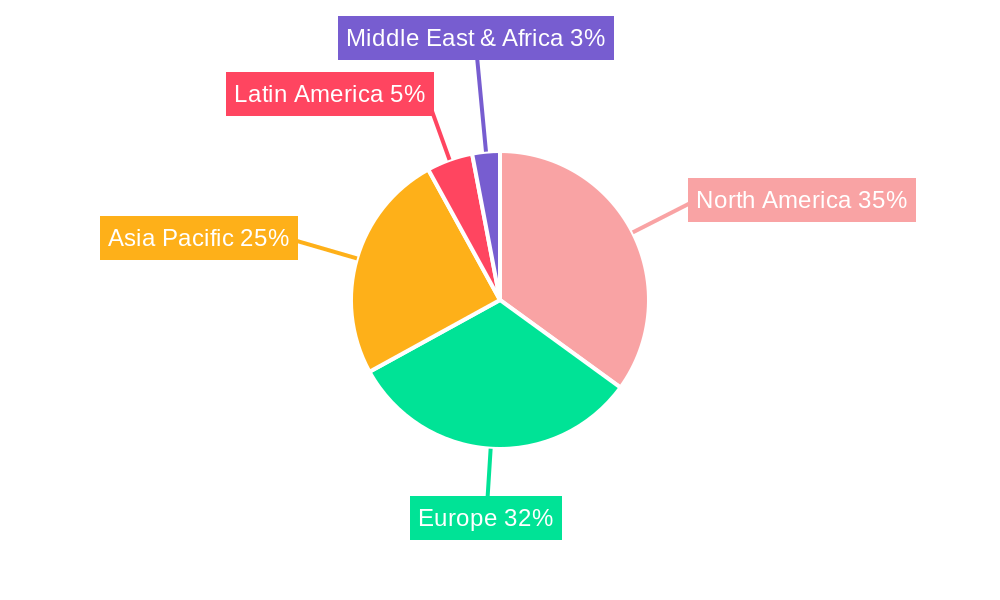

Europe Sports Medicine Industry Regional Market Share

Geographic Coverage of Europe Sports Medicine Industry

Europe Sports Medicine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Incidence of Sports Injuries; Rising Demand for Minimally Invasive Surgeries

- 3.3. Market Restrains

- 3.3.1. High Cost of Implants and Devices

- 3.4. Market Trends

- 3.4.1. Implants Segment is Expected to Witness a Significant Growth Over the Forecast Period.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Sports Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Implants

- 5.1.2. Arthroscopy Devices

- 5.1.3. Prosthetic

- 5.1.4. Orthobiologics

- 5.1.5. Braces

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Applications

- 5.2.1. Knee Injuries

- 5.2.2. Shoulder Injuries

- 5.2.3. Ankle and Foot Injuries

- 5.2.4. Back and Spine Injuries

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Italy

- 5.3.5. Spain

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Germany Europe Sports Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Implants

- 6.1.2. Arthroscopy Devices

- 6.1.3. Prosthetic

- 6.1.4. Orthobiologics

- 6.1.5. Braces

- 6.1.6. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Applications

- 6.2.1. Knee Injuries

- 6.2.2. Shoulder Injuries

- 6.2.3. Ankle and Foot Injuries

- 6.2.4. Back and Spine Injuries

- 6.2.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. United Kingdom Europe Sports Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Implants

- 7.1.2. Arthroscopy Devices

- 7.1.3. Prosthetic

- 7.1.4. Orthobiologics

- 7.1.5. Braces

- 7.1.6. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Applications

- 7.2.1. Knee Injuries

- 7.2.2. Shoulder Injuries

- 7.2.3. Ankle and Foot Injuries

- 7.2.4. Back and Spine Injuries

- 7.2.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. France Europe Sports Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Implants

- 8.1.2. Arthroscopy Devices

- 8.1.3. Prosthetic

- 8.1.4. Orthobiologics

- 8.1.5. Braces

- 8.1.6. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Applications

- 8.2.1. Knee Injuries

- 8.2.2. Shoulder Injuries

- 8.2.3. Ankle and Foot Injuries

- 8.2.4. Back and Spine Injuries

- 8.2.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Italy Europe Sports Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Implants

- 9.1.2. Arthroscopy Devices

- 9.1.3. Prosthetic

- 9.1.4. Orthobiologics

- 9.1.5. Braces

- 9.1.6. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Applications

- 9.2.1. Knee Injuries

- 9.2.2. Shoulder Injuries

- 9.2.3. Ankle and Foot Injuries

- 9.2.4. Back and Spine Injuries

- 9.2.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Spain Europe Sports Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Implants

- 10.1.2. Arthroscopy Devices

- 10.1.3. Prosthetic

- 10.1.4. Orthobiologics

- 10.1.5. Braces

- 10.1.6. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Applications

- 10.2.1. Knee Injuries

- 10.2.2. Shoulder Injuries

- 10.2.3. Ankle and Foot Injuries

- 10.2.4. Back and Spine Injuries

- 10.2.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Rest of Europe Europe Sports Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product

- 11.1.1. Implants

- 11.1.2. Arthroscopy Devices

- 11.1.3. Prosthetic

- 11.1.4. Orthobiologics

- 11.1.5. Braces

- 11.1.6. Other Products

- 11.2. Market Analysis, Insights and Forecast - by Applications

- 11.2.1. Knee Injuries

- 11.2.2. Shoulder Injuries

- 11.2.3. Ankle and Foot Injuries

- 11.2.4. Back and Spine Injuries

- 11.2.5. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Product

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 CONMED Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Smith & Nephew

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Arthrex Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Wright Medical Group

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Performance Health

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Medtronic PLC

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Ossur

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Johnson & Johnson

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Mueller Sports Medicine Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Stryker Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Zimmer Biomet Holdings Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 CONMED Corporation

List of Figures

- Figure 1: Europe Sports Medicine Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Sports Medicine Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Sports Medicine Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Europe Sports Medicine Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: Europe Sports Medicine Industry Revenue billion Forecast, by Applications 2020 & 2033

- Table 4: Europe Sports Medicine Industry Volume K Unit Forecast, by Applications 2020 & 2033

- Table 5: Europe Sports Medicine Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe Sports Medicine Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Europe Sports Medicine Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 8: Europe Sports Medicine Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 9: Europe Sports Medicine Industry Revenue billion Forecast, by Applications 2020 & 2033

- Table 10: Europe Sports Medicine Industry Volume K Unit Forecast, by Applications 2020 & 2033

- Table 11: Europe Sports Medicine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Europe Sports Medicine Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Europe Sports Medicine Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 14: Europe Sports Medicine Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 15: Europe Sports Medicine Industry Revenue billion Forecast, by Applications 2020 & 2033

- Table 16: Europe Sports Medicine Industry Volume K Unit Forecast, by Applications 2020 & 2033

- Table 17: Europe Sports Medicine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Europe Sports Medicine Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Europe Sports Medicine Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 20: Europe Sports Medicine Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 21: Europe Sports Medicine Industry Revenue billion Forecast, by Applications 2020 & 2033

- Table 22: Europe Sports Medicine Industry Volume K Unit Forecast, by Applications 2020 & 2033

- Table 23: Europe Sports Medicine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Europe Sports Medicine Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Europe Sports Medicine Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 26: Europe Sports Medicine Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 27: Europe Sports Medicine Industry Revenue billion Forecast, by Applications 2020 & 2033

- Table 28: Europe Sports Medicine Industry Volume K Unit Forecast, by Applications 2020 & 2033

- Table 29: Europe Sports Medicine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Europe Sports Medicine Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Europe Sports Medicine Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 32: Europe Sports Medicine Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 33: Europe Sports Medicine Industry Revenue billion Forecast, by Applications 2020 & 2033

- Table 34: Europe Sports Medicine Industry Volume K Unit Forecast, by Applications 2020 & 2033

- Table 35: Europe Sports Medicine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Europe Sports Medicine Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: Europe Sports Medicine Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 38: Europe Sports Medicine Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 39: Europe Sports Medicine Industry Revenue billion Forecast, by Applications 2020 & 2033

- Table 40: Europe Sports Medicine Industry Volume K Unit Forecast, by Applications 2020 & 2033

- Table 41: Europe Sports Medicine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Europe Sports Medicine Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Sports Medicine Industry?

The projected CAGR is approximately 6.6%.

2. Which companies are prominent players in the Europe Sports Medicine Industry?

Key companies in the market include CONMED Corporation, Smith & Nephew, Arthrex Inc, Wright Medical Group, Performance Health, Medtronic PLC, Ossur, Johnson & Johnson, Mueller Sports Medicine Inc, Stryker Corporation, Zimmer Biomet Holdings Inc.

3. What are the main segments of the Europe Sports Medicine Industry?

The market segments include Product, Applications.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.69 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Incidence of Sports Injuries; Rising Demand for Minimally Invasive Surgeries.

6. What are the notable trends driving market growth?

Implants Segment is Expected to Witness a Significant Growth Over the Forecast Period..

7. Are there any restraints impacting market growth?

High Cost of Implants and Devices.

8. Can you provide examples of recent developments in the market?

February 2022: Ossur launched its new POWER KNEETM, which is an actively powered microprocessor prosthetic knee for people with above-the-knee amputations or limb differences.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Sports Medicine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Sports Medicine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Sports Medicine Industry?

To stay informed about further developments, trends, and reports in the Europe Sports Medicine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence