Key Insights

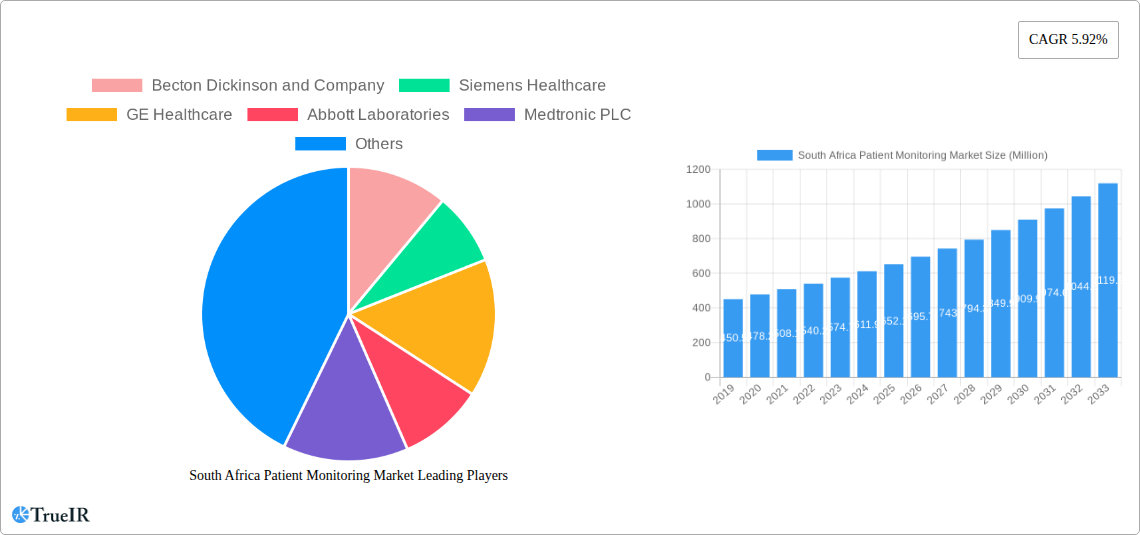

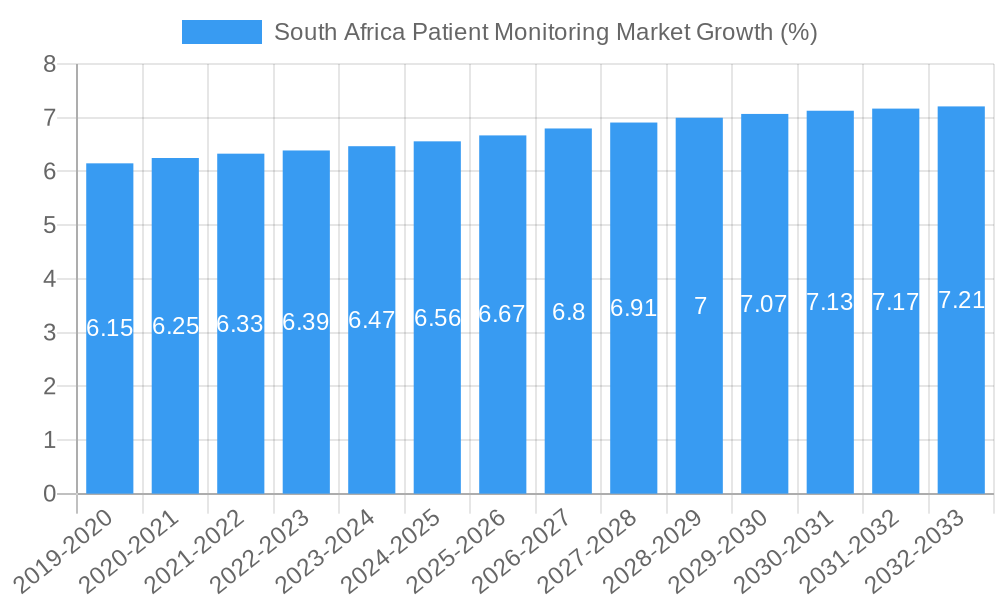

The South African patient monitoring market is poised for significant expansion, projected to reach a substantial market size of approximately USD 712 million by 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 5.92%, indicating a healthy and sustained upward trajectory over the forecast period of 2025-2033. Several key drivers are fueling this expansion, including the increasing prevalence of chronic diseases such as cardiovascular and respiratory conditions, which necessitate continuous and advanced patient monitoring. Furthermore, a growing emphasis on preventative healthcare and early disease detection is propelling the adoption of sophisticated monitoring devices. The aging population demographic in South Africa also contributes to the demand for reliable patient monitoring solutions, as older individuals often require more frequent and comprehensive care. Technological advancements, such as the integration of artificial intelligence (AI) and the Internet of Medical Things (IoMT) in patient monitoring devices, are enhancing their capabilities and driving market adoption. The growing acceptance and implementation of remote patient monitoring (RPM) solutions, especially in the wake of global health events, further bolster the market's potential, offering convenience and improved patient outcomes.

The market is segmented across various device types, applications, and end-users, reflecting a diverse and dynamic landscape. Hemodynamic monitoring devices, cardiac monitoring devices, and respiratory monitoring devices are expected to witness strong demand due to the high incidence of related diseases. Remote monitoring devices are also gaining traction, offering greater flexibility for patients and healthcare providers. Applications in cardiology and respiratory care are projected to dominate the market, driven by the specific health challenges faced in South Africa. The expanding home healthcare sector and ambulatory care centers are emerging as significant end-user segments, signaling a shift towards decentralized healthcare delivery. While the market benefits from these growth drivers, it also faces certain restraints. The high cost of advanced patient monitoring devices can be a barrier to widespread adoption, particularly in resource-constrained settings. Limited access to advanced healthcare infrastructure in certain regions and the need for skilled healthcare professionals to operate and interpret data from these devices also present challenges. Nevertheless, ongoing investments in healthcare infrastructure and increasing health awareness are expected to mitigate these restraints, paving the way for sustained growth in the South African patient monitoring market.

This in-depth report provides a dynamic and SEO-optimized analysis of the South Africa Patient Monitoring Market. Leveraging high-volume keywords such as "South Africa patient monitoring devices," "healthcare technology South Africa," and "remote patient monitoring market share," this report is designed to engage industry professionals, investors, and stakeholders. We meticulously analyze market structure, competitive landscape, trends, opportunities, and key segments, offering actionable insights for strategic decision-making. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, encompassing historical data from 2019-2024.

South Africa Patient Monitoring Market Market Structure & Competitive Landscape

The South Africa patient monitoring market exhibits a moderately concentrated structure, characterized by the presence of a few dominant global players alongside a growing number of local and regional innovators. Innovation drivers are primarily propelled by the increasing burden of chronic diseases, advancements in digital health technologies, and a growing emphasis on preventative and personalized healthcare. Regulatory impacts, while evolving, are geared towards improving patient safety and data security, influencing product development and market entry strategies. Product substitutes are emerging, particularly in the form of integrated wellness devices and mobile health applications, compelling traditional patient monitoring manufacturers to enhance their product offerings with advanced features and connectivity. End-user segmentation reveals a shift towards home healthcare and ambulatory care centers, driven by cost-effectiveness and patient convenience. Mergers and acquisitions (M&A) trends indicate strategic consolidation among larger entities seeking to expand their product portfolios and market reach, alongside smaller companies focusing on niche technological advancements. The M&A volume for the historical period is estimated to be around 50 Million USD, with a projected increase of 15% in the forecast period, reflecting active market consolidation.

South Africa Patient Monitoring Market Market Trends & Opportunities

The South Africa patient monitoring market is poised for significant expansion, projected to grow at a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. This robust growth is fueled by several interconnected trends. The increasing prevalence of lifestyle-related diseases such as cardiovascular conditions, diabetes, and respiratory ailments necessitates continuous and proactive patient monitoring. Technological advancements, particularly in the realm of Artificial Intelligence (AI) and the Internet of Medical Things (IoMT), are revolutionizing patient monitoring capabilities, enabling real-time data collection, remote diagnostics, and predictive analytics. Consumer preferences are increasingly shifting towards convenient and accessible healthcare solutions, driving the demand for remote patient monitoring (RPM) devices and home-based care technologies. This trend is further amplified by the growing awareness among the South African population regarding health and wellness, leading to a higher adoption rate of wearable and portable monitoring devices.

The competitive dynamics within the market are intensifying, with both established multinational corporations and agile local startups vying for market share. Companies are focusing on developing user-friendly interfaces, miniaturized devices, and cloud-based platforms to enhance data management and interoperability. The South African government's initiatives to improve healthcare infrastructure and access, particularly in underserved rural areas, present substantial opportunities for market penetration. Furthermore, the growing demand for specialized monitoring solutions for critical care, neurology, and neonatal care segments contributes to the market's diversification. The integration of AI-powered diagnostics and personalized treatment recommendations is a key opportunity that will shape the future of patient monitoring, enabling healthcare providers to offer more efficient and effective care. The market penetration rate for remote patient monitoring devices is estimated to reach xx% by 2030, indicating a substantial untapped potential.

Dominant Markets & Segments in South Africa Patient Monitoring Market

The Hospitals end-user segment is projected to maintain its dominant position in the South Africa patient monitoring market. This dominance is attributed to the continuous need for sophisticated and reliable monitoring equipment in critical care units, intensive care units (ICUs), and operating theaters. Hospitals represent the largest consumers of a wide range of patient monitoring devices, including hemodynamic, cardiac, and respiratory monitors.

- Hospitals: Key growth drivers include government investment in public healthcare infrastructure, the increasing number of private healthcare facilities, and the demand for advanced medical technologies to manage complex patient cases. Policies aimed at improving hospital efficiency and patient outcomes further bolster the adoption of integrated patient monitoring systems. The market share for the hospital segment is estimated at xx% in the base year of 2025.

- Cardiac Monitoring Devices: This device type holds a significant share due to the high incidence of cardiovascular diseases in South Africa. Advances in non-invasive and wearable cardiac monitors are driving adoption for both in-hospital and remote monitoring.

- Growth Drivers: Rising cardiovascular disease rates, technological advancements in ECG monitoring, and the increasing demand for Holter monitors and implantable cardiac devices.

- Cardiology: This application segment mirrors the dominance of cardiac monitoring devices, with a substantial portion of patient monitoring efforts dedicated to the diagnosis and management of heart-related conditions.

- Growth Drivers: High prevalence of hypertension and ischemic heart disease, growing awareness of cardiac health, and the development of new treatment protocols.

- Remote Monitoring Devices: This segment is experiencing rapid growth, driven by the increasing adoption of telehealth and the need for continuous patient management outside traditional healthcare settings.

- Growth Drivers: Government support for digital health, increasing affordability of devices, and the growing preference for home-based care.

Other notable segments contributing to market growth include Neuromonitoring Devices driven by neurological disorder prevalence, and Respiratory Monitoring Devices due to the burden of respiratory diseases. The Home Healthcare end-user segment is also a significant growth area, fueled by an aging population and the demand for chronic disease management at home.

South Africa Patient Monitoring Market Product Analysis

The South Africa patient monitoring market is characterized by innovative product developments focused on enhancing accuracy, portability, and connectivity. Hemodynamic monitoring devices are becoming less invasive, offering real-time physiological data crucial for critical care. Neuromonitoring devices are seeing advancements in non-invasive techniques for early detection of neurological conditions. Cardiac monitoring devices are increasingly integrated with AI for anomaly detection, while respiratory monitors are becoming more user-friendly for home use. Remote monitoring devices, leveraging IoMT and cloud-based platforms, are central to the market's evolution, enabling continuous data streams and virtual consultations. These advancements offer a competitive advantage by addressing the growing demand for personalized, proactive, and accessible healthcare solutions.

Key Drivers, Barriers & Challenges in South Africa Patient Monitoring Market

Key Drivers:

- Rising Chronic Disease Burden: The increasing prevalence of non-communicable diseases like cardiovascular diseases, diabetes, and respiratory disorders is a primary driver, necessitating continuous patient oversight.

- Technological Advancements: Innovations in IoMT, AI, and wearable technology are enabling more sophisticated, portable, and user-friendly patient monitoring solutions.

- Government Initiatives: Growing investment in healthcare infrastructure and the push for digital health adoption by the South African government are creating a conducive environment for market growth.

- Cost-Effectiveness of Remote Monitoring: The ability of remote patient monitoring to reduce hospital readmissions and improve efficiency is a significant economic driver.

Barriers & Challenges:

- Limited Healthcare Infrastructure: Inadequate healthcare facilities and trained personnel in rural and remote areas can hinder widespread adoption.

- Data Security and Privacy Concerns: Ensuring the secure transmission and storage of sensitive patient data is a critical challenge, requiring robust cybersecurity measures and regulatory compliance.

- Affordability and Reimbursement Policies: The high cost of advanced monitoring devices and the complexity of reimbursement policies can limit accessibility for a significant portion of the population.

- Regulatory Hurdles: Navigating the evolving regulatory landscape for medical devices and digital health solutions can pose challenges for market entry and product approval.

Growth Drivers in the South Africa Patient Monitoring Market Market

The South Africa patient monitoring market is propelled by a confluence of robust growth drivers. Technologically, the integration of Artificial Intelligence (AI) and the Internet of Medical Things (IoMT) is enabling the development of smart, connected devices that offer real-time data analytics and predictive capabilities. Economically, the increasing disposable income in certain segments of the population, coupled with a growing awareness of proactive health management, fuels the demand for advanced monitoring solutions. Regulatory frameworks aimed at promoting digital health and telemedicine are also providing a significant boost, encouraging innovation and market penetration. Furthermore, the growing burden of chronic diseases, such as cardiovascular conditions and diabetes, creates an ongoing need for continuous and effective patient monitoring.

Challenges Impacting South Africa Patient Monitoring Market Growth

Several barriers and restraints are impacting the growth trajectory of the South Africa patient monitoring market. Regulatory complexities, particularly concerning data privacy and device certification, can lead to extended approval timelines and increased compliance costs for manufacturers. Supply chain disruptions, exacerbated by global events, can affect the availability and cost of essential components, impacting production and distribution. Intense competitive pressures from both global giants and emerging local players can lead to price wars and necessitate continuous investment in R&D to maintain market differentiation. Furthermore, the limited digital literacy and access to reliable internet connectivity in certain regions pose challenges to the widespread adoption of remote and connected patient monitoring solutions. The cost of advanced patient monitoring equipment can also be a significant barrier for public healthcare institutions and individuals with limited financial resources.

Key Players Shaping the South Africa Patient Monitoring Market Market

- Becton Dickinson and Company

- Siemens Healthcare

- GE Healthcare

- Abbott Laboratories

- Medtronic PLC

- Koninklijke Philips NV

- Johnson & Johnson

- Boston Scientific Corporation

- Baxter International Inc

- Draegerwerk AG

Significant South Africa Patient Monitoring Market Industry Milestones

- October 2022: Biospectal SA and Amref Health Africa launched a Mobile Remote Patient Monitoring (MRPM) hypertension management pilot program in Kibera, Nairobi, Kenya, addressing healthcare access in informal settlements and demonstrating the potential of RPM in diverse African settings.

- October 2022: Quro Medical, a South African digital health company, partnered with Operation Healing Hands, showcasing a commitment to community welfare and the advancement of home-based medical treatment using AI and technology within South Africa and the broader African medical industry.

Future Outlook for South Africa Patient Monitoring Market Market

- October 2022: Biospectal SA and Amref Health Africa launched a Mobile Remote Patient Monitoring (MRPM) hypertension management pilot program in Kibera, Nairobi, Kenya, addressing healthcare access in informal settlements and demonstrating the potential of RPM in diverse African settings.

- October 2022: Quro Medical, a South African digital health company, partnered with Operation Healing Hands, showcasing a commitment to community welfare and the advancement of home-based medical treatment using AI and technology within South Africa and the broader African medical industry.

Future Outlook for South Africa Patient Monitoring Market Market

The future outlook for the South Africa patient monitoring market is exceptionally promising, driven by sustained technological innovation and increasing healthcare demands. Strategic opportunities lie in the expansion of remote patient monitoring solutions, particularly for chronic disease management and post-operative care, capitalizing on the growing acceptance of telehealth. The integration of AI and big data analytics will unlock further potential for predictive diagnostics and personalized treatment plans, enhancing patient outcomes and healthcare efficiency. Investments in robust cybersecurity infrastructure and user-friendly interfaces will be crucial to foster trust and accelerate adoption across diverse socioeconomic segments. The market is expected to witness significant growth as healthcare providers and payers increasingly recognize the value proposition of continuous, data-driven patient monitoring in improving quality of care and reducing healthcare costs.

South Africa Patient Monitoring Market Segmentation

-

1. Type of Device

- 1.1. Hemodynamic Monitoring Devices

- 1.2. Neuromonitoring Devices

- 1.3. Cardiac Monitoring Devices

- 1.4. Respiratory Monitoring Devices

- 1.5. Remote Monitoring Devices

- 1.6. Other Type of Devices

-

2. Application

- 2.1. Cardiology

- 2.2. Neurology

- 2.3. Respiratory

- 2.4. Fetal and Neonatal

- 2.5. Weight Management and Fitness Monitoring

- 2.6. Other Applications

-

3. End User

- 3.1. Home Healthcare

- 3.2. Ambulatory Care Centers

- 3.3. Hospitals

- 3.4. Other End Users

South Africa Patient Monitoring Market Segmentation By Geography

- 1. South Africa

South Africa Patient Monitoring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.92% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Incidences of Chronic Diseases; Growth in Geriatric Population; Ease of Use and Portability Devices to Promote the Growth

- 3.3. Market Restrains

- 3.3.1. High Cost of Technology; Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Application in Cardiology Expected to Dominate the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Patient Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 5.1.1. Hemodynamic Monitoring Devices

- 5.1.2. Neuromonitoring Devices

- 5.1.3. Cardiac Monitoring Devices

- 5.1.4. Respiratory Monitoring Devices

- 5.1.5. Remote Monitoring Devices

- 5.1.6. Other Type of Devices

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cardiology

- 5.2.2. Neurology

- 5.2.3. Respiratory

- 5.2.4. Fetal and Neonatal

- 5.2.5. Weight Management and Fitness Monitoring

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Home Healthcare

- 5.3.2. Ambulatory Care Centers

- 5.3.3. Hospitals

- 5.3.4. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 6. South Africa South Africa Patient Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan South Africa Patient Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda South Africa Patient Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania South Africa Patient Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya South Africa Patient Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa South Africa Patient Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Becton Dickinson and Company

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Siemens Healthcare

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 GE Healthcare

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Abbott Laboratories

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Medtronic PLC

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Koninklijke Philips NV

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Johnson & Johnson

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Boston Scientific Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Baxter International Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Draegerwerk AG

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: South Africa Patient Monitoring Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa Patient Monitoring Market Share (%) by Company 2024

List of Tables

- Table 1: South Africa Patient Monitoring Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa Patient Monitoring Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: South Africa Patient Monitoring Market Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 4: South Africa Patient Monitoring Market Volume K Unit Forecast, by Type of Device 2019 & 2032

- Table 5: South Africa Patient Monitoring Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: South Africa Patient Monitoring Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: South Africa Patient Monitoring Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: South Africa Patient Monitoring Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 9: South Africa Patient Monitoring Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: South Africa Patient Monitoring Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: South Africa Patient Monitoring Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: South Africa Patient Monitoring Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: South Africa South Africa Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South Africa South Africa Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Sudan South Africa Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Sudan South Africa Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Uganda South Africa Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Uganda South Africa Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Tanzania South Africa Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Tanzania South Africa Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Kenya South Africa Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Kenya South Africa Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Rest of Africa South Africa Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Africa South Africa Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: South Africa Patient Monitoring Market Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 26: South Africa Patient Monitoring Market Volume K Unit Forecast, by Type of Device 2019 & 2032

- Table 27: South Africa Patient Monitoring Market Revenue Million Forecast, by Application 2019 & 2032

- Table 28: South Africa Patient Monitoring Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 29: South Africa Patient Monitoring Market Revenue Million Forecast, by End User 2019 & 2032

- Table 30: South Africa Patient Monitoring Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 31: South Africa Patient Monitoring Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: South Africa Patient Monitoring Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Patient Monitoring Market?

The projected CAGR is approximately 5.92%.

2. Which companies are prominent players in the South Africa Patient Monitoring Market?

Key companies in the market include Becton Dickinson and Company, Siemens Healthcare, GE Healthcare, Abbott Laboratories, Medtronic PLC, Koninklijke Philips NV, Johnson & Johnson, Boston Scientific Corporation, Baxter International Inc, Draegerwerk AG.

3. What are the main segments of the South Africa Patient Monitoring Market?

The market segments include Type of Device, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 712.00 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Incidences of Chronic Diseases; Growth in Geriatric Population; Ease of Use and Portability Devices to Promote the Growth.

6. What are the notable trends driving market growth?

Application in Cardiology Expected to Dominate the Growth of the Market.

7. Are there any restraints impacting market growth?

High Cost of Technology; Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

October 2022: Biospectal SA, the remote patient monitoring and biosensing software company, and Amref Health Africa, the largest health NGO in Africa, reported the launch of a Mobile Remote Patient Monitoring (MRPM) hypertension management pilot program in Kibera (Nairobi), Kenya, the largest informal settlement in Africa.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Patient Monitoring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Patient Monitoring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Patient Monitoring Market?

To stay informed about further developments, trends, and reports in the South Africa Patient Monitoring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence