Key Insights

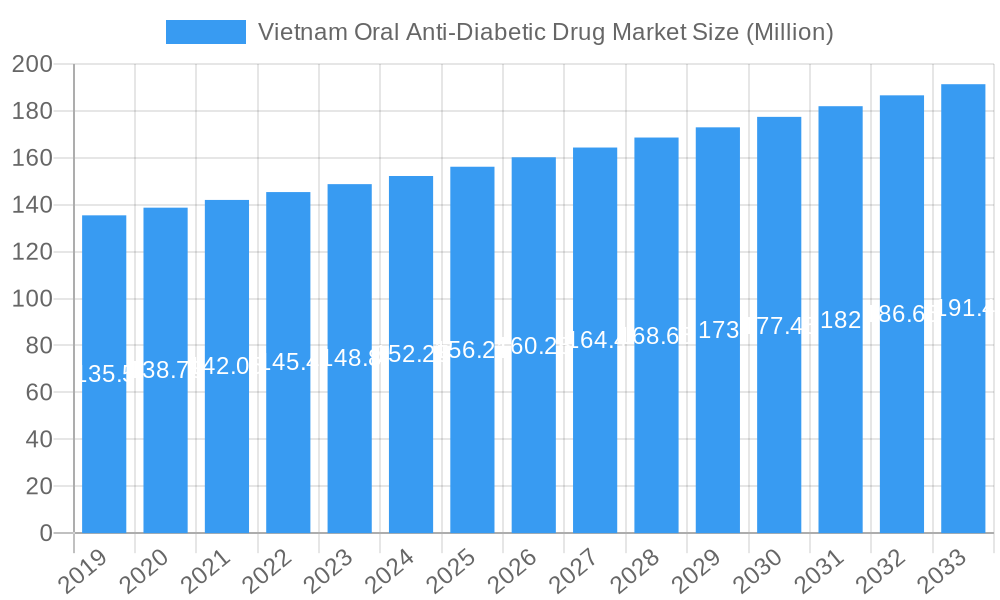

The Vietnam Oral Anti-Diabetic Drug Market is poised for robust expansion, projected to reach approximately $156.21 million by 2025, driven by a compelling CAGR exceeding 4.00%. This growth is fundamentally propelled by the escalating prevalence of diabetes, particularly Type 2 diabetes, within Vietnam, fueled by shifting lifestyle patterns, increasing urbanization, and an aging population. The rising awareness regarding diabetes management and the availability of a diverse range of oral anti-diabetic drug classes, including Biguanides, DPP-4 inhibitors, and SGLT-2 inhibitors, are further stimulating market demand. Pharmaceutical companies are actively investing in research and development to introduce innovative and more effective treatment options, contributing to market dynamics. Furthermore, government initiatives aimed at improving healthcare infrastructure and increasing access to affordable medications are expected to play a significant role in sustaining this upward trajectory. The expanding healthcare sector in Vietnam, coupled with a growing middle-class population with increased disposable income, further solidifies the positive outlook for the oral anti-diabetic drug market.

Vietnam Oral Anti-Diabetic Drug Market Market Size (In Million)

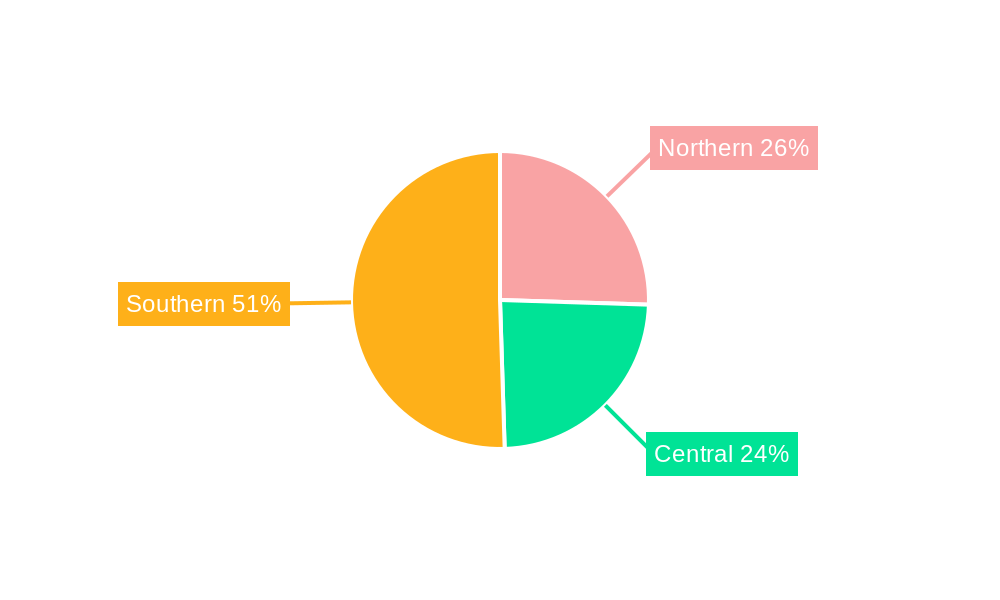

The market's segmentation reveals a strong emphasis on Type 2 diabetes, which accounts for the vast majority of cases, thus driving the demand for specific drug classes like Biguanides and DPP-4 inhibitors. Hospitals and retail pharmacies are identified as key end-user segments, reflecting the primary channels for drug distribution and patient access. Regionally, the Southern region of Vietnam is anticipated to lead market growth due to its higher population density and more developed healthcare infrastructure, though the Northern and Central regions are also expected to witness steady expansion. Leading global pharmaceutical players such as Novo Nordisk, Sanofi, and Merck & Co. are actively participating in this market, contributing to competition and innovation. The projected forecast period of 2025-2033 indicates sustained growth, underscoring the long-term importance of effective diabetes management solutions in Vietnam's evolving healthcare landscape.

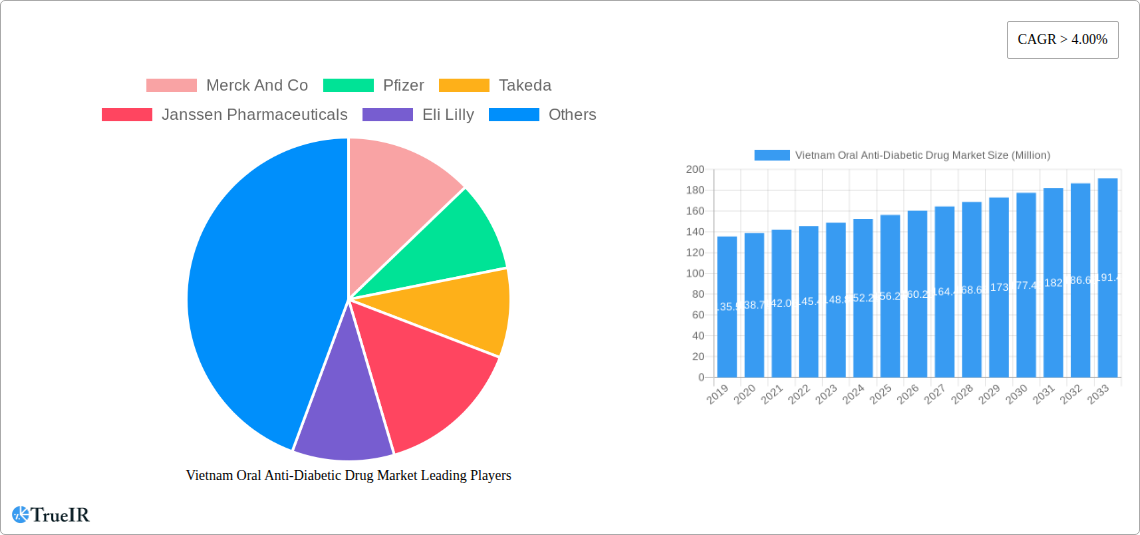

Vietnam Oral Anti-Diabetic Drug Market Company Market Share

This in-depth report provides a dynamic and SEO-optimized analysis of the Vietnam Oral Anti-Diabetic Drug Market. Leveraging high-volume keywords such as "Vietnam diabetes treatment," "oral anti-diabetic drugs Vietnam," and "Type 2 diabetes medication Vietnam," this report is designed to engage industry professionals, pharmaceutical stakeholders, and investors. Our comprehensive study covers the Study Period: 2019–2033, with a Base Year: 2025, an Estimated Year: 2025, and a robust Forecast Period: 2025–2033, building upon Historical Period: 2019–2024. We deliver actionable insights into market structure, trends, dominant segments, product analysis, key drivers, challenges, and the competitive landscape, featuring leading companies like Merck And Co, Pfizer, Takeda, Janssen Pharmaceuticals, Eli Lilly, Novartis, Sanofi, AstraZeneca, Bristol Myers Squibb, Novo Nordisk, Boehringer Ingelheim, and Astellas.

Vietnam Oral Anti-Diabetic Drug Market Market Structure & Competitive Landscape

The Vietnam Oral Anti-Diabetic Drug Market is characterized by a moderately consolidated structure, with a few major multinational pharmaceutical corporations holding significant market share alongside an increasing presence of domestic manufacturers. Innovation drivers are primarily focused on developing novel drug classes with improved efficacy, reduced side effects, and better patient adherence, driven by the escalating prevalence of diabetes. Regulatory impacts from the Ministry of Health and the Drug Administration of Vietnam play a crucial role in drug approvals, pricing, and market access, shaping the competitive environment. Product substitutes, including insulin therapies and lifestyle interventions, are present but oral anti-diabetic drugs remain the frontline treatment for a substantial portion of the diabetic population. End-user segmentation reveals a strong demand from hospitals and clinics for advanced therapies, while retail pharmacies cater to the broader patient population seeking accessible and affordable medication. Mergers and acquisition (M&A) trends are anticipated to intensify as larger players seek to expand their portfolios and market reach within Vietnam's growing pharmaceutical sector.

Vietnam Oral Anti-Diabetic Drug Market Market Trends & Opportunities

The Vietnam Oral Anti-Diabetic Drug Market is poised for substantial growth, driven by a confluence of epidemiological, economic, and healthcare policy shifts. The increasing incidence of Type 2 diabetes in Vietnam, a direct consequence of changing lifestyles, dietary habits, and a growing aging population, is the most significant market propellant. Projections indicate a compound annual growth rate (CAGR) of approximately xx% during the forecast period, pushing the market value from an estimated $xxx Million in 2025 to over $xxx Million by 2033. Technological shifts are characterized by a growing preference for newer drug classes such as SGLT-2 inhibitors and DPP-4 inhibitors, which offer distinct advantages in glycemic control, weight management, and cardiovascular protection compared to older classes like Sulfonylureas. Consumer preferences are evolving towards treatments that offer convenience, fewer side effects, and are supported by strong clinical evidence. Pharmaceutical companies are increasingly investing in research and development for combination therapies and personalized medicine approaches to address the complex needs of diabetic patients. Competitive dynamics are intensifying, with both global players and emerging local manufacturers vying for market share. Opportunities abound for companies that can navigate the regulatory landscape effectively, offer cost-effective yet high-quality medications, and establish robust distribution networks. The growing awareness among healthcare professionals and the general public about diabetes management further fuels the demand for effective oral anti-diabetic drugs. Furthermore, the government's focus on public health initiatives and improving healthcare infrastructure presents a conducive environment for market expansion. The penetration rate of advanced oral anti-diabetic drugs is expected to rise significantly as affordability improves and clinical guidelines evolve to incorporate these newer therapeutic options.

Dominant Markets & Segments in Vietnam Oral Anti-Diabetic Drug Market

The Vietnam Oral Anti-Diabetic Drug Market exhibits distinct patterns of dominance across its various segments. Type 2 diabetes is overwhelmingly the dominant indication, accounting for over xx% of the total market demand due to its high prevalence in the Vietnamese population. Within the drug class segmentation, Biguanides, particularly Metformin, continue to hold the largest market share due to their established efficacy, safety profile, and affordability. However, significant growth is observed in DPP-4 inhibitors and SGLT-2 inhibitors, driven by their superior glycemic control and associated cardiovascular and renal benefits, which align with evolving clinical guidelines and patient needs. Sulfonylureas maintain a steady presence, primarily in cost-sensitive segments.

The Southern region of Vietnam emerges as the dominant geographic market, driven by higher population density, greater urbanization, and more developed healthcare infrastructure, leading to increased diagnosis rates and access to advanced treatments. Cities like Ho Chi Minh City are major hubs for consumption.

In terms of end-users, Retail pharmacies represent the largest distribution channel, facilitating broad patient access to oral anti-diabetic medications. However, Hospitals and Clinics play a crucial role in prescribing advanced therapies and managing complex diabetic cases, contributing significantly to the revenue generated by newer and more expensive drug classes.

Key growth drivers in dominant segments include:

- Increasing prevalence of Type 2 Diabetes: Directly correlates with market size for diabetes medications.

- Rising disposable incomes: Enhances affordability of newer, more expensive drug classes.

- Growing awareness and diagnosis rates: Driven by public health campaigns and improved healthcare access.

- Advancement in clinical guidelines: Favoring newer drug classes with proven benefits.

- Strong distribution networks: Especially in urban areas of the Southern region.

- Government initiatives for chronic disease management: Boosting overall demand.

Vietnam Oral Anti-Diabetic Drug Market Product Analysis

Product innovation in the Vietnam Oral Anti-Diabetic Drug Market is primarily focused on enhancing efficacy, safety, and patient convenience. Manufacturers are introducing novel formulations and combination therapies to achieve better glycemic control with reduced side effects. For instance, advancements in DPP-4 inhibitors and SGLT-2 inhibitors offer significant advantages in terms of cardiovascular and renal protection, making them increasingly preferred by physicians for managing Type 2 diabetes. The competitive advantage for these products lies in their distinct therapeutic benefits, improved adherence profiles, and alignment with global clinical guidelines, catering to the evolving needs of Vietnamese patients and healthcare providers.

Key Drivers, Barriers & Challenges in Vietnam Oral Anti-Diabetic Drug Market

Key Drivers:

- Rising prevalence of diabetes: Driven by lifestyle changes and an aging population.

- Increasing healthcare expenditure: Allowing greater access to treatments.

- Government focus on public health: Promoting diabetes awareness and management.

- Technological advancements: Development of more effective and safer oral anti-diabetic drugs.

- Growing middle class: Enhancing affordability of medications.

Barriers & Challenges:

- Regulatory complexities: Stringent approval processes and pricing regulations.

- Supply chain inefficiencies: Particularly in rural areas, impacting drug availability.

- Counterfeit drugs: A persistent issue affecting market integrity and patient safety.

- Limited access to advanced diagnostics: Hindering early and accurate diagnosis.

- Price sensitivity: Dominance of affordable generics, especially in rural markets.

- Lack of comprehensive reimbursement policies: Limiting access to expensive novel therapies for a wider population.

Growth Drivers in the Vietnam Oral Anti-Diabetic Drug Market Market

The Vietnam Oral Anti-Diabetic Drug Market is propelled by a robust set of growth drivers. Epidemiologically, the alarmingly high and escalating prevalence of Type 2 diabetes, fueled by dietary shifts towards processed foods and sedentary lifestyles, forms the bedrock of market expansion. Economically, rising disposable incomes and a growing middle class are enhancing the affordability of oral anti-diabetic medications, including newer, more advanced drug classes. Policy-driven factors are also critical; government initiatives aimed at improving public health infrastructure, increasing diabetes awareness programs, and prioritizing chronic disease management directly stimulate demand. Furthermore, technological advancements in pharmaceutical research and development, leading to more efficacious and safer oral anti-diabetic drugs with added benefits like cardiovascular protection, are creating significant market opportunities.

Challenges Impacting Vietnam Oral Anti-Diabetic Drug Market Growth

The growth of the Vietnam Oral Anti-Diabetic Drug Market is not without its challenges. Regulatory complexities surrounding drug registration, pricing controls, and intellectual property rights can slow down market entry and product adoption. Supply chain issues, including logistical hurdles in reaching remote areas and ensuring consistent availability of medications, remain a significant restraint. Intense competition from established generic manufacturers and the persistent threat of counterfeit drugs can impact pricing strategies and erode market share. Furthermore, a considerable segment of the population remains price-sensitive, creating a barrier to the widespread adoption of more expensive, innovative therapies. Limited access to advanced diagnostic tools also hinders early and accurate identification of diabetes, thereby delaying treatment initiation.

Key Players Shaping the Vietnam Oral Anti-Diabetic Drug Market Market

- Merck And Co

- Pfizer

- Takeda

- Janssen Pharmaceuticals

- Eli Lilly

- Novartis

- Sanofi

- AstraZeneca

- Bristol Myers Squibb

- Novo Nordisk

- Boehringer Ingelheim

- Astellas

Significant Vietnam Oral Anti-Diabetic Drug Market Industry Milestones

- January 2024: Lupin gets USFDA approval to market generic medication to treat diabetes.

- November 2022: A pre-post study was Conducted which aimed to evaluate the impact of a peer-based club intervention to improve self-management among people living with T2D in two rural communities in Vietnam.

Future Outlook for Vietnam Oral Anti-Diabetic Drug Market Market

The future outlook for the Vietnam Oral Anti-Diabetic Drug Market is exceptionally promising, projecting continued robust growth driven by an increasing diabetic population and rising healthcare consciousness. Strategic opportunities lie in the development and market penetration of next-generation oral anti-diabetics, including those with demonstrated cardiovascular and renal benefits, which are gaining traction in global treatment guidelines. Expansion of localized manufacturing and strategic partnerships with local distributors will be crucial for enhancing market access and affordability. The growing demand for combination therapies and personalized treatment approaches will also shape future market dynamics. Investments in patient education and healthcare professional training will further solidify market potential, ensuring sustained growth in the coming years.

Vietnam Oral Anti-Diabetic Drug Market Segmentation

-

1. Drug Class

- 1.1. Biguanides

- 1.2. Alpha-glucosidase inhibitors

- 1.3. Dopamine D2 receptor agonists

- 1.4. SGLT-2 inhibitors

- 1.5. DPP-4 inhibitors

- 1.6. Sulfonylureas

- 1.7. Meglitinides

-

2. Indication

- 2.1. Type 1 diabetes

- 2.2. Type 2 diabetes

-

3. End User

- 3.1. Hospitals

- 3.2. Clinics

- 3.3. Retail pharmacies

-

4. Region

- 4.1. Northern

- 4.2. Central

- 4.3. Southern

Vietnam Oral Anti-Diabetic Drug Market Segmentation By Geography

- 1. Vietnam

Vietnam Oral Anti-Diabetic Drug Market Regional Market Share

Geographic Coverage of Vietnam Oral Anti-Diabetic Drug Market

Vietnam Oral Anti-Diabetic Drug Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Geriatric Population and Changing Dietary Habits; High Prevalence of Irritable bowel syndrome with constipation (IBS-C) and Opioid-induced constipation (OIC) and Chronic Constipation; Development of Latest Drugs and Treatment Procedures

- 3.3. Market Restrains

- 3.3.1. Increasing Dependence on Majority of Over-the-Counter (OTC) Drugs; Lack of Awareness and Reluctance Among Patients due to Adverse Effects of Opioid-Induced Constipation (OIC) Drugs

- 3.4. Market Trends

- 3.4.1. Sulfonylureas Segment Occupied the Highest Market Share in the Vietnam Oral Anti-Diabetic Drugs Market in the current year.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Oral Anti-Diabetic Drug Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Drug Class

- 5.1.1. Biguanides

- 5.1.2. Alpha-glucosidase inhibitors

- 5.1.3. Dopamine D2 receptor agonists

- 5.1.4. SGLT-2 inhibitors

- 5.1.5. DPP-4 inhibitors

- 5.1.6. Sulfonylureas

- 5.1.7. Meglitinides

- 5.2. Market Analysis, Insights and Forecast - by Indication

- 5.2.1. Type 1 diabetes

- 5.2.2. Type 2 diabetes

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals

- 5.3.2. Clinics

- 5.3.3. Retail pharmacies

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Northern

- 5.4.2. Central

- 5.4.3. Southern

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Drug Class

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Merck And Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Pfizer

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Takeda

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Janssen Pharmaceuticals

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eli Lilly

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Novartis

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sanofi

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AstraZeneca

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bristol Myers Squibb

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Novo Nordisk

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Boehringer Ingelheim

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Astellas

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Merck And Co

List of Figures

- Figure 1: Vietnam Oral Anti-Diabetic Drug Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Vietnam Oral Anti-Diabetic Drug Market Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Drug Class 2020 & 2033

- Table 2: Vietnam Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Drug Class 2020 & 2033

- Table 3: Vietnam Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Indication 2020 & 2033

- Table 4: Vietnam Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Indication 2020 & 2033

- Table 5: Vietnam Oral Anti-Diabetic Drug Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Vietnam Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: Vietnam Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Vietnam Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Vietnam Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Vietnam Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: Vietnam Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Drug Class 2020 & 2033

- Table 12: Vietnam Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Drug Class 2020 & 2033

- Table 13: Vietnam Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Indication 2020 & 2033

- Table 14: Vietnam Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Indication 2020 & 2033

- Table 15: Vietnam Oral Anti-Diabetic Drug Market Revenue Million Forecast, by End User 2020 & 2033

- Table 16: Vietnam Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 17: Vietnam Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Region 2020 & 2033

- Table 18: Vietnam Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 19: Vietnam Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Vietnam Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Oral Anti-Diabetic Drug Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Vietnam Oral Anti-Diabetic Drug Market?

Key companies in the market include Merck And Co, Pfizer, Takeda, Janssen Pharmaceuticals, Eli Lilly, Novartis, Sanofi, AstraZeneca, Bristol Myers Squibb, Novo Nordisk, Boehringer Ingelheim, Astellas.

3. What are the main segments of the Vietnam Oral Anti-Diabetic Drug Market?

The market segments include Drug Class, Indication, End User, Region.

4. Can you provide details about the market size?

The market size is estimated to be USD 156.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Geriatric Population and Changing Dietary Habits; High Prevalence of Irritable bowel syndrome with constipation (IBS-C) and Opioid-induced constipation (OIC) and Chronic Constipation; Development of Latest Drugs and Treatment Procedures.

6. What are the notable trends driving market growth?

Sulfonylureas Segment Occupied the Highest Market Share in the Vietnam Oral Anti-Diabetic Drugs Market in the current year..

7. Are there any restraints impacting market growth?

Increasing Dependence on Majority of Over-the-Counter (OTC) Drugs; Lack of Awareness and Reluctance Among Patients due to Adverse Effects of Opioid-Induced Constipation (OIC) Drugs.

8. Can you provide examples of recent developments in the market?

January 2024: Lupin gets USFDA approval to market generic medication to treat diabetes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Oral Anti-Diabetic Drug Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Oral Anti-Diabetic Drug Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Oral Anti-Diabetic Drug Market?

To stay informed about further developments, trends, and reports in the Vietnam Oral Anti-Diabetic Drug Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence