Key Insights

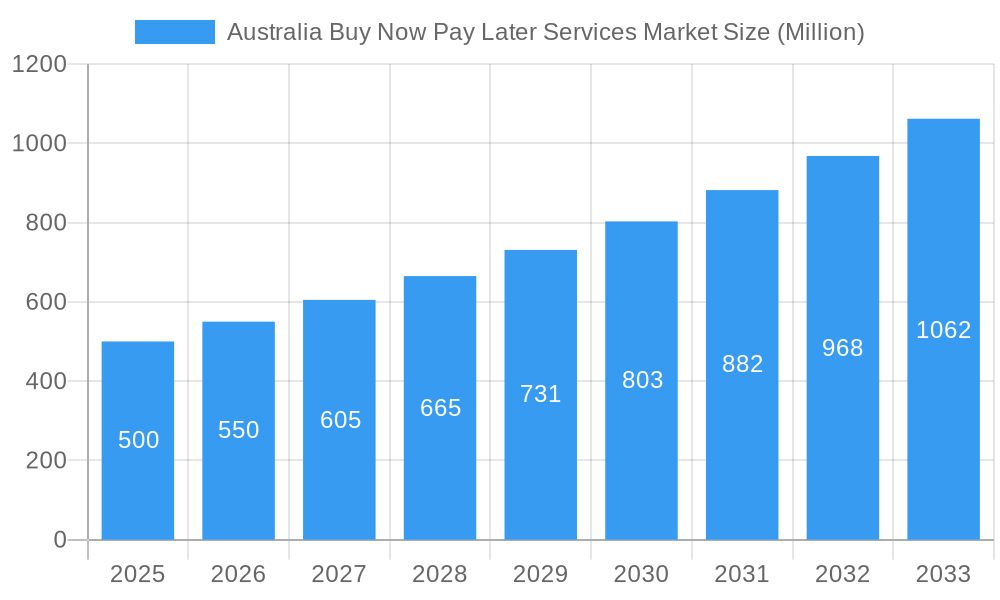

The Australian Buy Now Pay Later (BNPL) services market is demonstrating substantial expansion, propelled by heightened consumer engagement with digital payment solutions and a growing preference for adaptable payment structures. This dynamic sector is projected to achieve a Compound Annual Growth Rate (CAGR) of 12.1%. The market size is estimated at $14.52 billion in the base year of 2025, with continued strong growth anticipated. Key growth drivers include the surging penetration of e-commerce, the increasing adoption of BNPL by younger consumer segments for online transactions, and aggressive marketing initiatives by leading providers. The competitive environment is intense, featuring established entities such as Afterpay (now part of Square) and Zip, alongside emerging players and traditional financial institutions expanding their BNPL portfolios. Emerging regulatory oversight concerning responsible lending and consumer protection poses a significant challenge that could influence future market development.

Australia Buy Now Pay Later Services Market Market Size (In Billion)

Economic indicators play a crucial role in the performance of the Australian BNPL market. Consumer confidence and disposable income directly affect spending patterns and BNPL service utilization. While resilient, potential economic slowdowns could impact consumer expenditure and, consequently, the demand for BNPL offerings. Technological innovations, including seamless e-commerce integration and advanced fraud detection, are critical for the industry's sustained viability. Evolving regulatory landscapes and a commitment to responsible lending practices will shape the competitive dynamics and the market's future growth trajectory. Detailed segment and regional data are essential for a comprehensive understanding, but current insights indicate a rapidly evolving market with considerable expansion opportunities.

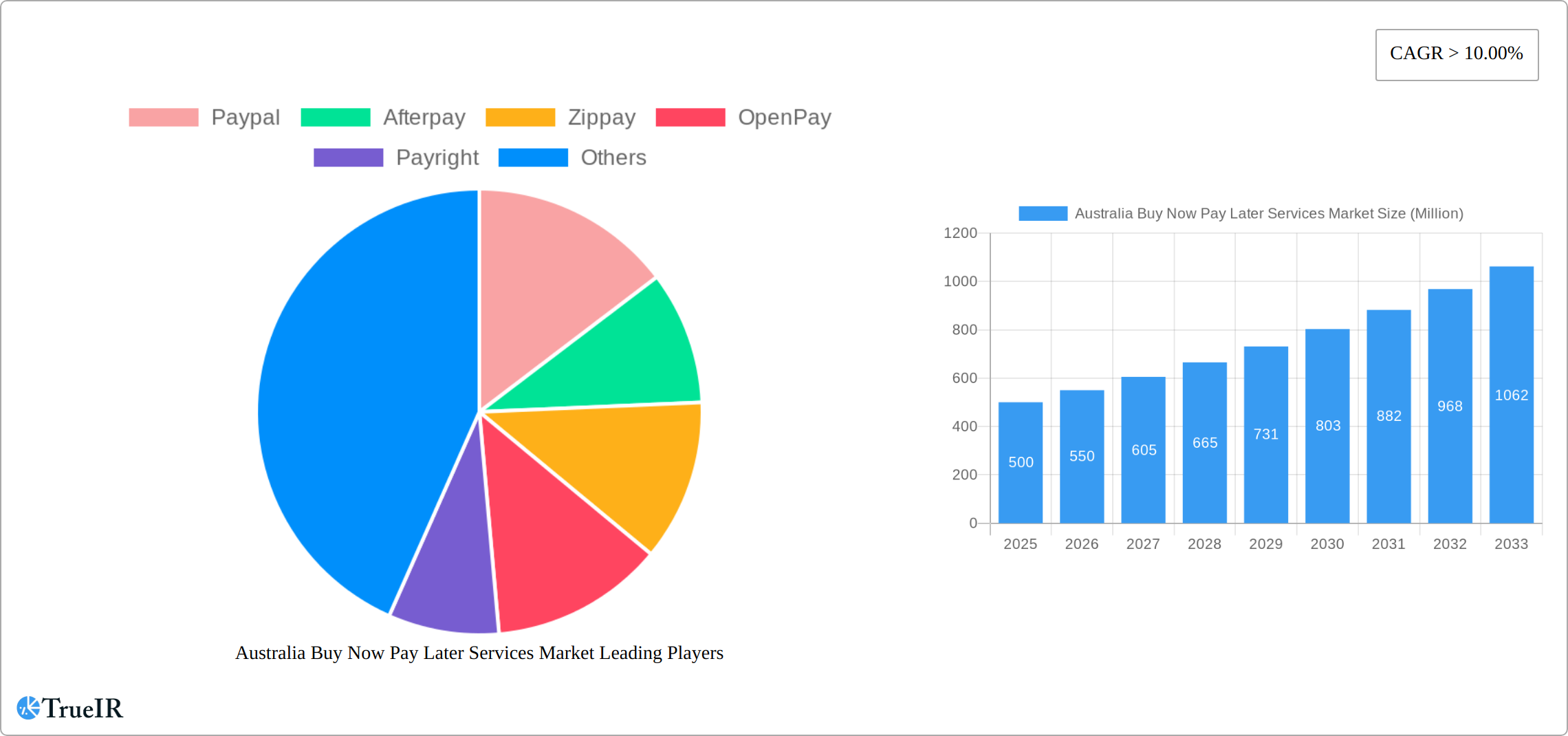

Australia Buy Now Pay Later Services Market Company Market Share

Australia Buy Now Pay Later Services Market: A Comprehensive Report (2019-2033)

This dynamic report provides an in-depth analysis of the burgeoning Australia Buy Now Pay Later (BNPL) services market, offering invaluable insights for investors, businesses, and industry stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report leverages rigorous data analysis and expert commentary to illuminate market trends, competitive dynamics, and future growth potential. The Australian BNPL market, valued at xx Million in 2025, is projected to experience significant growth, reaching xx Million by 2033, exhibiting a CAGR of xx%.

Australia Buy Now Pay Later Services Market Structure & Competitive Landscape

The Australian BNPL market is characterized by a dynamic competitive landscape, with a mix of established players and emerging fintechs. Market concentration is [insert concentration ratio, e.g., moderately high], with key players holding significant market share. However, the market remains relatively fragmented, with continuous entry of new players and innovative offerings. Innovation is a key driver, with companies constantly developing new features, integrations, and customer-centric solutions. Regulatory scrutiny is increasing, impacting operational strategies and compliance requirements. Product substitutes include traditional credit cards and installment payment plans, although BNPL's convenience and accessibility are key differentiators. The market is segmented by demographic (e.g., age, income), transaction value, and industry vertical. M&A activity is substantial, reflecting the market's rapid growth and consolidation trends. Recent years have witnessed several significant mergers and acquisitions, including the 2022 acquisition of Sezzle by Zip for approximately AUD 491 Million. The volume of M&A transactions in the past five years has been [Insert Number] resulting in a xx% increase in market consolidation.

Australia Buy Now Pay Later Services Market Market Trends & Opportunities

The Australian Buy Now Pay Later (BNPL) market is experiencing explosive growth, fueled by a confluence of factors. A primary driver is the surging consumer adoption rate, driven by the unparalleled convenience and accessibility these services offer. This convenience is further amplified by significant technological advancements. Seamless integration with popular e-commerce platforms and sophisticated, data-driven risk assessment models enhance the user experience, minimize operational costs for businesses, and instill greater confidence in consumers. A clear shift in consumer preferences towards flexible payment options complements this technological progress, bolstering market demand considerably. The ongoing digitalization of retail and the meteoric rise of mobile commerce have created a fertile environment for BNPL's expansion. Intense competition among established players and new entrants is fostering rapid product innovation and a relentless improvement in service offerings, further enhancing the market's appeal. Market penetration is expanding across diverse demographics, fueled by creative marketing campaigns and strategic partnerships with key retailers. This robust growth trajectory presents significant opportunities for both established BNPL providers and ambitious newcomers, with substantial potential for expansion into new market segments and geographic territories. Industry analysts project the market to reach [Insert Updated Projected Value] Million AUD by 2033, signifying a substantial expansion in the coming years. This growth is further fueled by increasing financial inclusion, enabling access to credit for individuals previously underserved by traditional financial institutions.

Dominant Markets & Segments in Australia Buy Now Pay Later Services Market

The Australian BNPL market demonstrates remarkable penetration across various regions and consumer segments. While pinpointing a single dominant region or segment definitively requires more granular data, several key factors are driving widespread growth:

- E-commerce Boom: The explosive growth of online shopping is a major catalyst for BNPL adoption, providing a highly attractive payment option for online purchases across a wide range of product categories.

- Millennial and Gen Z Adoption: Younger generations, known for their comfort with digital transactions and their preference for flexible payment solutions, are driving a significant portion of the market's growth.

- Strategic Retailer Partnerships: Collaborations with major retailers are crucial, expanding market reach and enhancing brand awareness among target demographics. These partnerships often involve integrated checkout processes for a seamless user experience.

- Technological Innovation: Continuous advancements in risk assessment models, fraud detection technologies, and robust security measures are building consumer trust and facilitating wider acceptance of BNPL services.

- Expanding Product Offerings: The market is seeing the development of diverse BNPL options, catering to various spending habits and financial profiles, including options for larger purchases and longer repayment terms.

A comprehensive analysis of market dominance necessitates more detailed data, but the factors outlined above strongly suggest a broad market spread across segments and geographic locations.

Australia Buy Now Pay Later Services Market Product Analysis

The Australian BNPL market showcases a range of products, each tailored to specific consumer needs and merchant requirements. Innovation is evident in features like customizable repayment schedules, flexible interest rates, and integrated loyalty programs. These features enhance customer convenience, differentiate offerings from traditional payment methods, and boost merchant adoption. Competition drives innovation, leading to continuous product enhancements and improved user experiences. Technological advancements, such as AI-powered fraud detection and improved risk management systems, enhance security and efficiency within the BNPL ecosystem. The integration of BNPL services with various e-commerce platforms provides added convenience to both merchants and consumers.

Key Drivers, Barriers & Challenges in Australia Buy Now Pay Later Services Market

Key Drivers:

- Rising e-commerce penetration: The increasing shift towards online shopping creates a large addressable market for BNPL services.

- Consumer preference for flexible payment options: Consumers are increasingly seeking convenient and flexible payment choices.

- Technological advancements: Continuous improvements in security and integration capabilities are enhancing the BNPL experience.

Key Challenges:

- Regulatory uncertainty: The evolving regulatory landscape poses challenges for compliance and operational efficiency. New regulations may limit market growth or impose increased operational costs, potentially slowing down expansion.

- Increased competition: Intense competition puts pressure on profit margins and necessitates continuous innovation.

- Risk of defaults: The inherent risk of customer defaults presents a significant challenge for BNPL providers and requires effective risk management strategies.

Growth Drivers in the Australia Buy Now Pay Later Services Market Market

The Australian BNPL market’s growth is primarily driven by the increasing popularity of e-commerce, younger generations' preference for flexible payment solutions, and technological advancements that improve security and convenience. Government support for fintech innovation also plays a significant role.

Challenges Impacting Australia Buy Now Pay Later Services Market Growth

Significant challenges include regulatory hurdles, potential for increased consumer debt, and the need for robust risk management strategies to mitigate default rates. Maintaining a balance between attracting new customers and managing credit risk is critical for continued sustainable growth.

Significant Australia Buy Now Pay Later Services Market Industry Milestones

- October 2021: Visa's expansion of its BNPL offering, Visa Installments, into the Australian market, partnering with ANZ and Quest Payment Systems, significantly intensified competition and broadened consumer choice.

- March 2022: Zip's acquisition of Sezzle for approximately AUD 491 Million exemplifies the substantial mergers and acquisitions (M&A) activity within the dynamic BNPL sector, consolidating market share and expanding international reach.

- [Insert a more recent and relevant milestone here, e.g., a new regulatory development, a major partnership, a significant funding round, etc.]

Future Outlook for Australia Buy Now Pay Later Services Market Market

The Australian BNPL market is projected to maintain its strong growth trajectory, propelled by ongoing technological innovation, sustained consumer adoption, and the expansion of strategic retailer partnerships. Future success will hinge on proactive initiatives focused on enhancing security protocols, refining risk management strategies, and strategically expanding into underserved market segments. The market's potential remains considerable, with significant opportunities for disruptive innovation, strategic expansion, and the emergence of new business models. Regulatory changes and their impact on the industry will also play a significant role in shaping the future landscape.

Australia Buy Now Pay Later Services Market Segmentation

-

1. Channel

- 1.1. Online

- 1.2. Point of Sale (POS)

-

2. Enterprise

- 2.1. Large Enterprise

- 2.2. Small & Medium Enterprise

-

3. End User Type

- 3.1. Consumer Electronics

- 3.2. Fashion and Personal Care

- 3.3. Healthcare

- 3.4. Leisure & Entertainment

- 3.5. Retail

- 3.6. Others

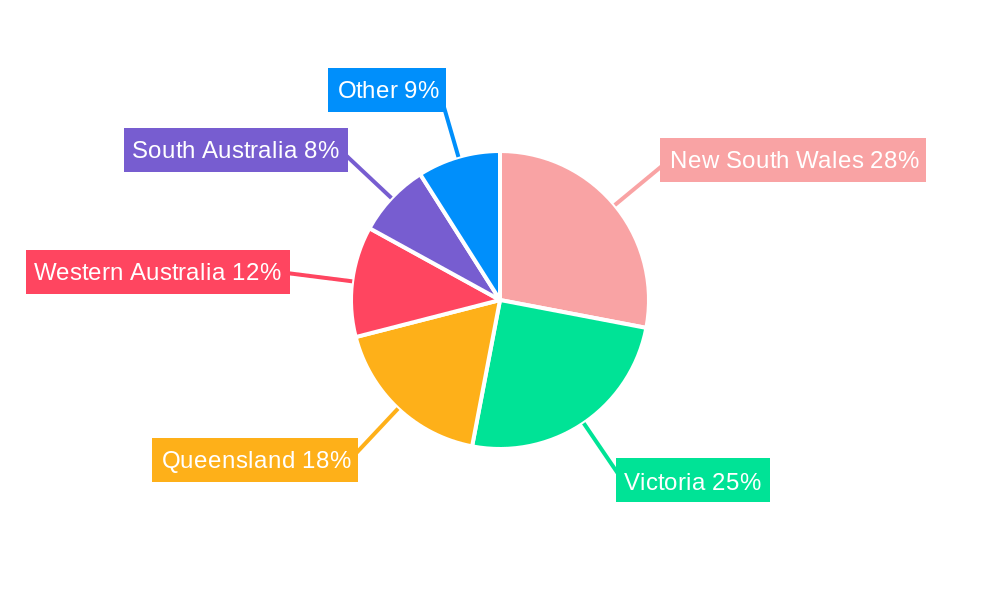

Australia Buy Now Pay Later Services Market Segmentation By Geography

- 1. Australia

Australia Buy Now Pay Later Services Market Regional Market Share

Geographic Coverage of Australia Buy Now Pay Later Services Market

Australia Buy Now Pay Later Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increase of Non-Cash Payments helps in Market growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Buy Now Pay Later Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 5.1.1. Online

- 5.1.2. Point of Sale (POS)

- 5.2. Market Analysis, Insights and Forecast - by Enterprise

- 5.2.1. Large Enterprise

- 5.2.2. Small & Medium Enterprise

- 5.3. Market Analysis, Insights and Forecast - by End User Type

- 5.3.1. Consumer Electronics

- 5.3.2. Fashion and Personal Care

- 5.3.3. Healthcare

- 5.3.4. Leisure & Entertainment

- 5.3.5. Retail

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Paypal

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Afterpay

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Zippay

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 OpenPay

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Payright

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BPay

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Payment Express

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bpoint

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 POLi

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Stripe**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Paypal

List of Figures

- Figure 1: Australia Buy Now Pay Later Services Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Australia Buy Now Pay Later Services Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Buy Now Pay Later Services Market Revenue billion Forecast, by Channel 2020 & 2033

- Table 2: Australia Buy Now Pay Later Services Market Revenue billion Forecast, by Enterprise 2020 & 2033

- Table 3: Australia Buy Now Pay Later Services Market Revenue billion Forecast, by End User Type 2020 & 2033

- Table 4: Australia Buy Now Pay Later Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Australia Buy Now Pay Later Services Market Revenue billion Forecast, by Channel 2020 & 2033

- Table 6: Australia Buy Now Pay Later Services Market Revenue billion Forecast, by Enterprise 2020 & 2033

- Table 7: Australia Buy Now Pay Later Services Market Revenue billion Forecast, by End User Type 2020 & 2033

- Table 8: Australia Buy Now Pay Later Services Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Buy Now Pay Later Services Market?

The projected CAGR is approximately 12.1%.

2. Which companies are prominent players in the Australia Buy Now Pay Later Services Market?

Key companies in the market include Paypal, Afterpay, Zippay, OpenPay, Payright, BPay, Payment Express, Bpoint, POLi, Stripe**List Not Exhaustive.

3. What are the main segments of the Australia Buy Now Pay Later Services Market?

The market segments include Channel, Enterprise, End User Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.52 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increase of Non-Cash Payments helps in Market growth.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In March 2022, Australian buy now, pay later (BNPL) firm Zip has announced a definitive agreement to acquire rival US BNPL fintech Sezzle. The deal values Sezzle at approximately USD 360 million (AUD 491 million).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Buy Now Pay Later Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Buy Now Pay Later Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Buy Now Pay Later Services Market?

To stay informed about further developments, trends, and reports in the Australia Buy Now Pay Later Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence