Key Insights

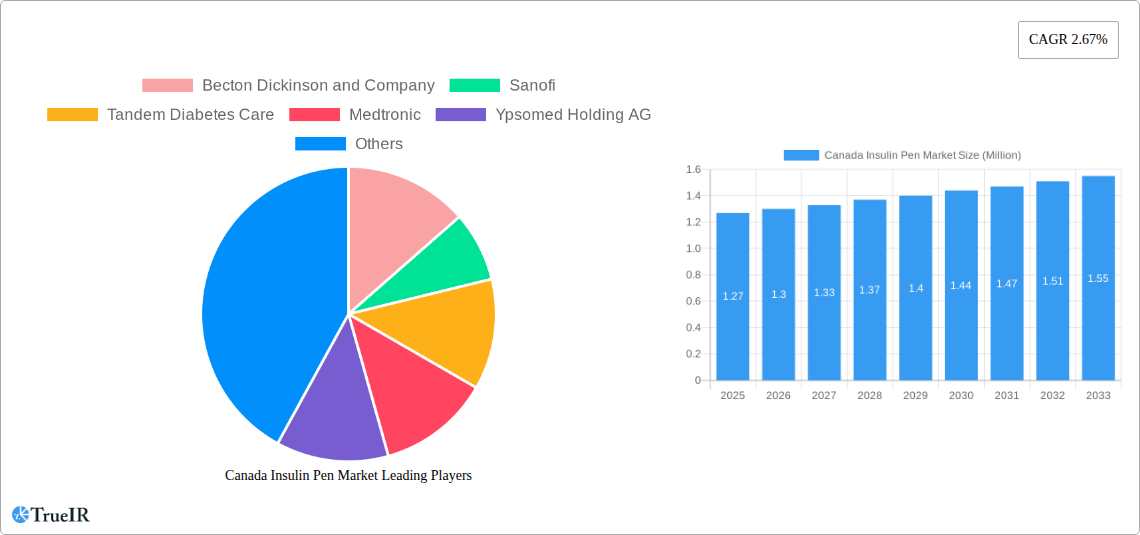

The Canadian insulin pen market is projected to reach approximately USD 1.27 million by 2025, exhibiting a steady Compound Annual Growth Rate (CAGR) of 2.67% through 2033. This consistent growth is primarily fueled by the increasing prevalence of diabetes in Canada, a significant public health concern. As the aging population continues to expand, so too does the incidence of type 1 and type 2 diabetes, necessitating a greater demand for efficient and user-friendly insulin delivery devices. Furthermore, advancements in insulin pen technology, including features like improved accuracy, dose memory, and connectivity to smart devices, are enhancing patient adherence and self-management of the condition. This technological innovation, coupled with increasing awareness campaigns about diabetes management, is a significant driver for the market's expansion. The market is characterized by a diverse range of product segments, with Insulin Pumps, Insulin Syringes, Disposable Insulin Pens, Insulin Cartridges in Reusable Pens, and Insulin Jet Injectors all catering to different patient needs and preferences.

Canada Insulin Pen Market Market Size (In Million)

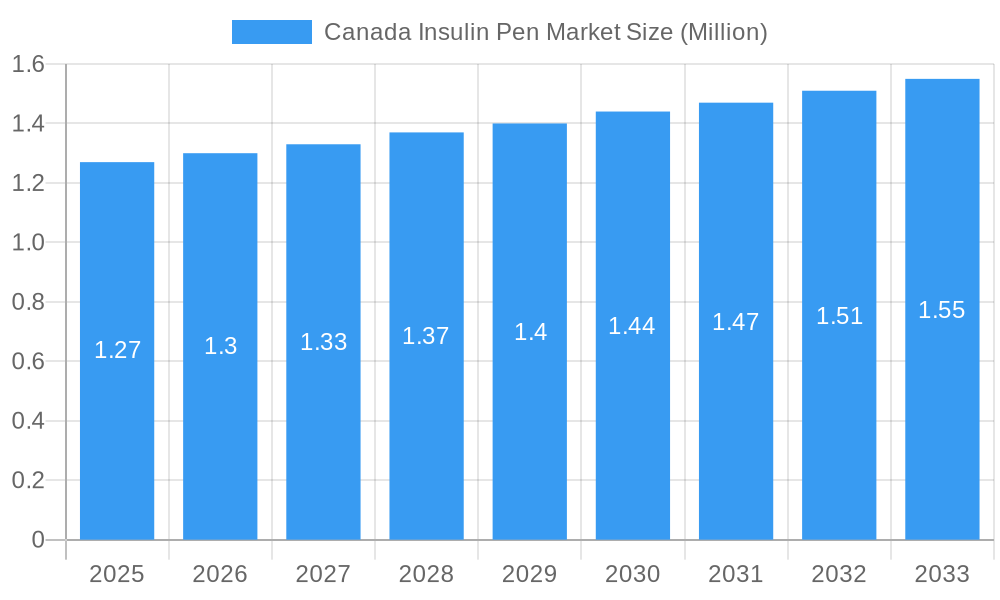

The competitive landscape of the Canadian insulin pen market is dominated by major pharmaceutical and medical device manufacturers, including Becton Dickinson and Company, Sanofi, Tandem Diabetes Care, Medtronic, Ypsomed Holding AG, Eli Lilly and Company, Insulet Corporation, Novo Nordisk, and F. Hoffmann-La Roche. These companies are actively engaged in research and development to introduce next-generation insulin pens that offer enhanced convenience and personalized therapy. Key trends shaping the market include a growing preference for disposable insulin pens due to their ease of use and portability, as well as the rising adoption of smart insulin pens that integrate with mobile applications to track insulin dosage and timings. However, the market also faces certain restraints, such as the high cost of some advanced insulin delivery systems and the availability of alternative insulin delivery methods like traditional syringes. Nevertheless, the overarching trend of increasing diabetes diagnoses and the continuous push for improved patient outcomes are expected to sustain the positive trajectory of the Canadian insulin pen market.

Canada Insulin Pen Market Company Market Share

This in-depth report provides an exhaustive examination of the Canada Insulin Pen Market, offering critical insights into its current landscape and future trajectory. Leveraging high-volume keywords such as "Canada insulin delivery devices," "diabetes management Canada," "insulin pens market share," and "diabetes technology Canada," this analysis is meticulously crafted for industry professionals, investors, and policymakers seeking to understand market dynamics, competitive strategies, and emerging opportunities within the Canadian healthcare sector. The study encompasses a detailed analysis from 2019 to 2033, with a base year of 2025 and a forecast period extending through 2033.

Canada Insulin Pen Market Market Structure & Competitive Landscape

The Canada Insulin Pen Market exhibits a moderately concentrated structure, characterized by a mix of global pharmaceutical giants and specialized diabetes device manufacturers. Innovation plays a pivotal role, driven by the continuous need for improved patient outcomes and user convenience in diabetes management. Regulatory frameworks, while generally supportive of medical device advancements, can also present hurdles in terms of product approval timelines and market access. Product substitutes, including traditional vials and syringes, continue to hold a presence, though the convenience and precision of insulin pens and pumps are increasingly favored. End-user segmentation reveals a growing demand from individuals with Type 1 and Type 2 diabetes, with an increasing preference for advanced delivery systems. Mergers and acquisitions (M&A) are a notable trend, as larger companies seek to expand their portfolios and technological capabilities. For instance, the recent acquisition activities signal a consolidation phase aimed at capturing a larger market share and enhancing integrated diabetes solutions. Market concentration is estimated to be in the moderate to high range, with the top 5 players holding approximately 60-70% of the market share. M&A volumes have seen a steady increase, with at least 2-3 significant transactions anticipated annually within the broader Canadian diabetes care market.

Canada Insulin Pen Market Market Trends & Opportunities

The Canada Insulin Pen Market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 6-8% from 2025 to 2033. This growth is fueled by a confluence of factors, including the rising prevalence of diabetes across all age groups in Canada, an increasing awareness of advanced diabetes management technologies, and a growing preference for user-friendly and discreet insulin delivery methods. The market is experiencing a significant technological shift, with a pronounced move towards smart insulin pens and integrated digital health solutions. These innovations offer enhanced data tracking, connectivity with continuous glucose monitors (CGMs), and personalized dosing recommendations, thereby improving patient adherence and glycemic control. Consumer preferences are increasingly leaning towards convenience, accuracy, and portability. Disposable insulin pens, for their ease of use and disposability, are gaining traction. Furthermore, reusable pens with advanced cartridges are offering a more sustainable and potentially cost-effective option for long-term users. Competitive dynamics are intense, with key players actively investing in research and development to introduce next-generation products and expand their market reach. Strategic partnerships between device manufacturers and pharmaceutical companies are becoming more prevalent, aiming to offer comprehensive diabetes care solutions. The market penetration rate for insulin pens, while already significant, is expected to climb as younger generations with diabetes embrace digital health tools and older demographics transition to more modern delivery systems. The increasing adoption of telehealth and remote patient monitoring further amplifies the demand for connected insulin delivery devices, presenting a significant opportunity for market expansion. The development of advanced algorithms for personalized insulin delivery, coupled with smart connectivity features, will be a key differentiator for market leaders.

Dominant Markets & Segments in Canada Insulin Pen Market

Within the Canada Insulin Pen Market, the Disposable Insulin Pens segment is currently demonstrating the most robust growth and is expected to maintain its dominance throughout the forecast period. This segment's ascendancy is attributed to several key growth drivers, including unparalleled convenience for on-the-go use, reduced risk of needle stick injuries compared to traditional syringes, and simplified dosing mechanisms, making them highly accessible for a broad patient demographic.

- Disposable Insulin Pens: Their ease of use, pre-filled cartridges, and self-contained nature make them an attractive option for both newly diagnosed and long-term diabetes patients. The growing preference for self-management and reduced healthcare facility visits further bolsters this segment.

- Insulin Cartridges in Reusable Pens: This segment is also experiencing steady growth, driven by a desire for more sustainable and potentially cost-effective solutions. As users become more familiar with pen delivery, investing in a reusable pen with multiple cartridge refills offers long-term benefits. The increasing availability of a wider variety of insulin types in cartridge form further supports this segment.

- Insulin Pumps: While representing a smaller but highly valuable segment, insulin pumps are experiencing significant technological advancements and are gaining traction among individuals with more complex diabetes management needs, particularly those with Type 1 diabetes. Their ability to deliver basal and bolus insulin continuously offers superior glycemic control.

- Insulin Syringes: Although a traditional and cost-effective option, the market share of insulin syringes is projected to gradually decline as newer, more convenient, and technologically advanced delivery methods become more prevalent. However, they will likely retain a niche market among budget-conscious consumers or specific clinical scenarios.

- Insulin Jet Injectors: This segment represents a nascent but promising area. While offering needle-free delivery, higher costs and specific application limitations have thus far restricted widespread adoption. Future advancements in technology and cost reduction could unlock greater potential for this segment.

The dominance of disposable insulin pens is further solidified by supportive healthcare policies in Canada that encourage patient self-management and the adoption of technologies that improve quality of life. Infrastructure development in healthcare, including the increasing integration of digital health platforms, also plays a crucial role in facilitating the adoption of these modern insulin delivery systems.

Canada Insulin Pen Market Product Analysis

Product innovation in the Canada Insulin Pen Market is primarily focused on enhancing user convenience, accuracy, and connectivity. Disposable insulin pens, offering pre-filled and ready-to-use functionality, continue to dominate due to their inherent simplicity. Reusable pens are seeing advancements with improved cartridge designs and ergonomic improvements. The integration of smart technology, such as Bluetooth connectivity for data logging and integration with CGMs, is a significant trend, enabling personalized insulin delivery and remote monitoring. These innovations offer distinct competitive advantages by improving patient adherence, reducing the burden of diabetes management, and contributing to better glycemic control.

Key Drivers, Barriers & Challenges in Canada Insulin Pen Market

Key Drivers: The Canada Insulin Pen Market is propelled by a combination of technological advancements, economic factors, and policy-driven initiatives.

- Technological Innovation: The development of smart pens, integrated CGM systems, and user-friendly interfaces are driving adoption. For example, the integration of Meal Detection Technology with insulin delivery devices is a key innovation.

- Rising Diabetes Prevalence: Canada’s increasing incidence of diabetes, both Type 1 and Type 2, creates a consistently growing demand for effective insulin delivery solutions.

- Government Support & Reimbursement: Favorable reimbursement policies and government initiatives promoting diabetes management technologies play a crucial role in market expansion.

Key Barriers & Challenges: Despite its growth potential, the market faces several restraints.

- High Cost of Advanced Devices: The initial purchase price of sophisticated insulin pumps and smart pens can be a significant barrier for some patients and healthcare systems, impacting market penetration.

- Regulatory Hurdles: The stringent approval processes for new medical devices in Canada can lead to extended time-to-market and increased development costs for manufacturers.

- Supply Chain Disruptions: Global supply chain vulnerabilities can impact the availability of critical components and finished products, potentially leading to shortages and price volatility.

- Competition: Intense competition from established players and emerging innovators necessitates continuous investment in R&D and marketing to maintain market share.

Growth Drivers in the Canada Insulin Pen Market Market

The growth of the Canada Insulin Pen Market is significantly influenced by several key factors. Technological advancements, particularly the development of smart insulin pens with connectivity features and integrated CGM capabilities, are driving user adoption and improving diabetes management outcomes. Economically, the increasing healthcare expenditure in Canada and favorable reimbursement policies for diabetes care technologies are creating a conducive environment for market expansion. Furthermore, government initiatives aimed at improving chronic disease management and promoting patient self-care are indirectly boosting the demand for advanced insulin delivery devices.

Challenges Impacting Canada Insulin Pen Market Growth

Several challenges are impacting the growth trajectory of the Canada Insulin Pen Market. The high cost associated with advanced insulin delivery systems, such as sophisticated insulin pumps and smart pens, remains a significant barrier to widespread adoption, especially for individuals with limited financial resources. Regulatory complexities and the lengthy approval processes for new medical devices can also hinder market entry and product innovation. Additionally, potential disruptions in global supply chains for raw materials and components can lead to manufacturing delays and increased costs. Intense competition among key players also pressures companies to continuously innovate and offer competitive pricing, which can strain profit margins.

Key Players Shaping the Canada Insulin Pen Market Market

- Becton Dickinson and Company

- Sanofi

- Tandem Diabetes Care

- Medtronic

- Ypsomed Holding AG

- Eli Lilly and Company

- Insulet Corporation

- Novo Nordisk

- F Hoffmann-La Roche

Significant Canada Insulin Pen Market Industry Milestones

- June 2023: Novo Nordisk entered exclusive negotiations for a controlling stake in BIOCORP, a French company specializing in innovative medical devices, including the Mallya Bluetooth-enabled smart add-on device for pen injectors. This strategic move signals a potential for enhanced smart insulin delivery solutions in the Canadian market.

- May 2023: Medtronic plc entered into definitive agreements to acquire EOFlow Co. Ltd., the manufacturer of the EOPatch device, a tubeless, wearable, and fully disposable insulin delivery device. This acquisition is expected to significantly expand Medtronic's diabetes management portfolio by integrating EOFlow's technology with its existing meal detection algorithms and CGMs, aiming to address a broader range of patient needs.

Future Outlook for Canada Insulin Pen Market Market

The future outlook for the Canada Insulin Pen Market is exceptionally positive, driven by sustained innovation and increasing demand for integrated diabetes care solutions. Strategic opportunities lie in further developing connected devices that seamlessly integrate with digital health platforms, enabling personalized treatment plans and remote patient monitoring. The growing awareness of the benefits of advanced insulin delivery systems, coupled with supportive government policies, will continue to fuel market expansion. Companies focusing on user-centric design, affordability, and robust data analytics capabilities are well-positioned to capture significant market share in the coming years. The trend towards connected health and the increasing acceptance of digital therapeutics will likely accelerate the adoption of smart insulin pens and pumps, transforming diabetes management in Canada.

Canada Insulin Pen Market Segmentation

-

1. Type

- 1.1. Insulin Pumps

- 1.2. Insulin Syringes

- 1.3. Disposable Insulin Pens

- 1.4. Insulin Cartridges in Reusable Pens

- 1.5. Insulin Jet Injectors

Canada Insulin Pen Market Segmentation By Geography

- 1. Canada

Canada Insulin Pen Market Regional Market Share

Geographic Coverage of Canada Insulin Pen Market

Canada Insulin Pen Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Cardiovascular Diseases; Technological Advancements in Pacemakers; Growing Geriatric Population

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Framework; High Cost of the Devices

- 3.4. Market Trends

- 3.4.1. Rising Diabetes Prevalence in Canada is anticipated to boost the market studied.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Insulin Pen Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Insulin Pumps

- 5.1.2. Insulin Syringes

- 5.1.3. Disposable Insulin Pens

- 5.1.4. Insulin Cartridges in Reusable Pens

- 5.1.5. Insulin Jet Injectors

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Becton Dickinson and Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sanofi

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tandem Diabetes Care

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Medtronic

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ypsomed Holding AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Eli Lilly and Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Insulet Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Novo Nordisk

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Other Company Share Analyse

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Novo Nordisk

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 F Hoffmann-La Roche

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Canada Insulin Pen Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Canada Insulin Pen Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Insulin Pen Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Canada Insulin Pen Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Canada Insulin Pen Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Canada Insulin Pen Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Canada Insulin Pen Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Canada Insulin Pen Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 7: Canada Insulin Pen Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Canada Insulin Pen Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Insulin Pen Market?

The projected CAGR is approximately 2.67%.

2. Which companies are prominent players in the Canada Insulin Pen Market?

Key companies in the market include Becton Dickinson and Company, Sanofi, Tandem Diabetes Care, Medtronic, Ypsomed Holding AG, Eli Lilly and Company, Insulet Corporation, Novo Nordisk, Other Company Share Analyse, Novo Nordisk, F Hoffmann-La Roche.

3. What are the main segments of the Canada Insulin Pen Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.27 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Cardiovascular Diseases; Technological Advancements in Pacemakers; Growing Geriatric Population.

6. What are the notable trends driving market growth?

Rising Diabetes Prevalence in Canada is anticipated to boost the market studied..

7. Are there any restraints impacting market growth?

Stringent Regulatory Framework; High Cost of the Devices.

8. Can you provide examples of recent developments in the market?

June 2023: Novo Nordisk entered exclusive negotiations for a controlling stake in BIOCORP, which would be followed by a mandatory simplified tender offer on all remaining outstanding shares in BIOCORP. BIOCORP is a French company specializing in the design, development, and manufacturing of delivery systems and innovative medical devices, including Mallya, a Bluetooth-enabled smart add-on device for pen injectors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Insulin Pen Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Insulin Pen Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Insulin Pen Market?

To stay informed about further developments, trends, and reports in the Canada Insulin Pen Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence