Key Insights

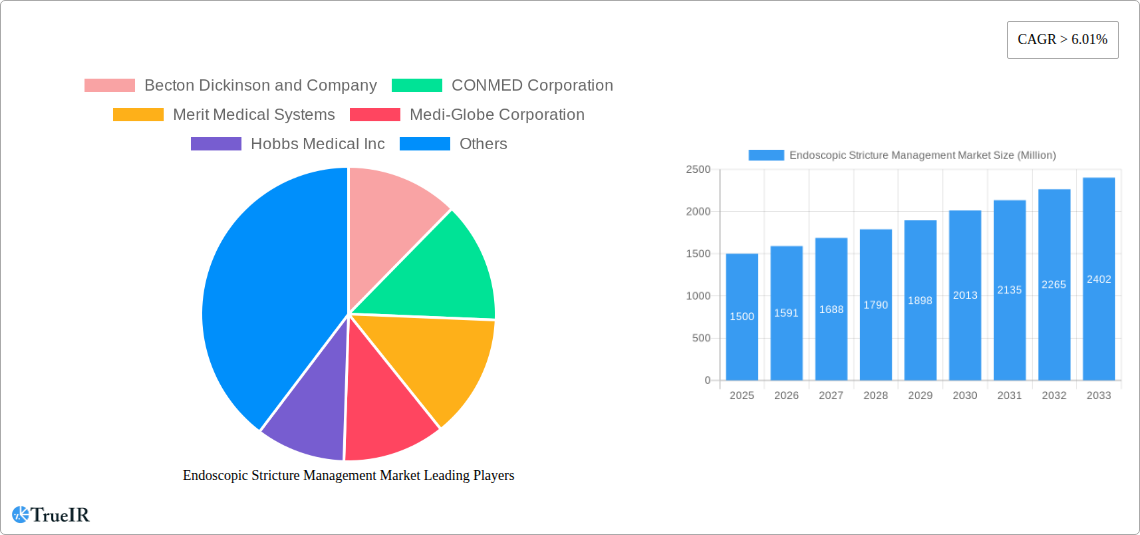

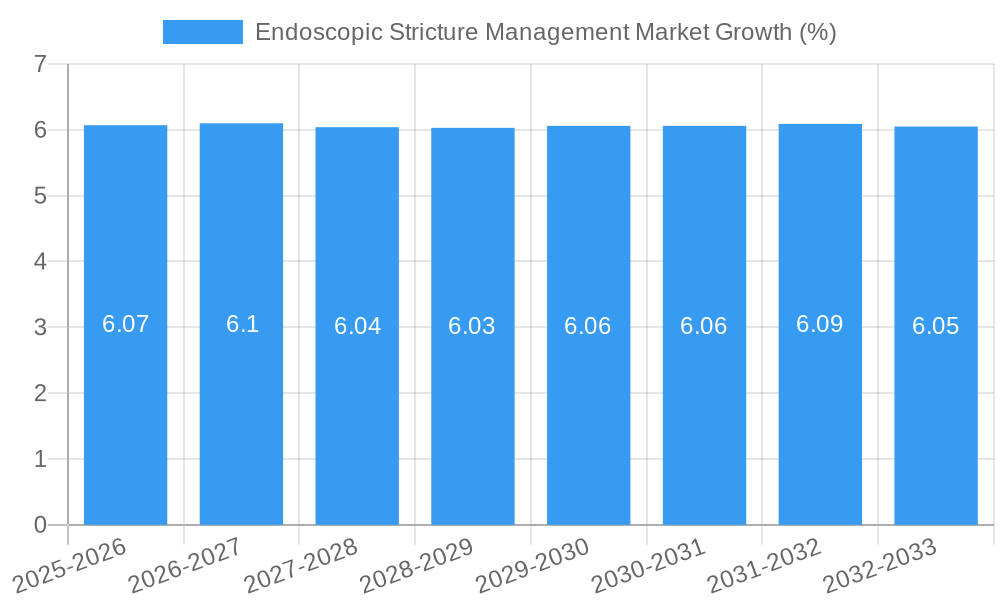

The Endoscopic Stricture Management Market is poised for robust expansion, driven by an increasing prevalence of conditions leading to strictures and advancements in minimally invasive endoscopic techniques. With a projected market size of approximately USD 1,500 million in 2025, the market is anticipated to witness a Compound Annual Growth Rate (CAGR) exceeding 6.01% through 2033. This growth is underpinned by key drivers such as the rising incidence of inflammatory bowel diseases, post-surgical complications, and gastrointestinal cancers, all contributing to the formation of strictures requiring endoscopic intervention. The increasing adoption of balloon dilators and stents, owing to their efficacy in widening narrowed lumens and restoring normal function, represents a significant segment within the market. Furthermore, the growing preference for less invasive procedures over traditional surgery fuels the demand for endoscopic solutions.

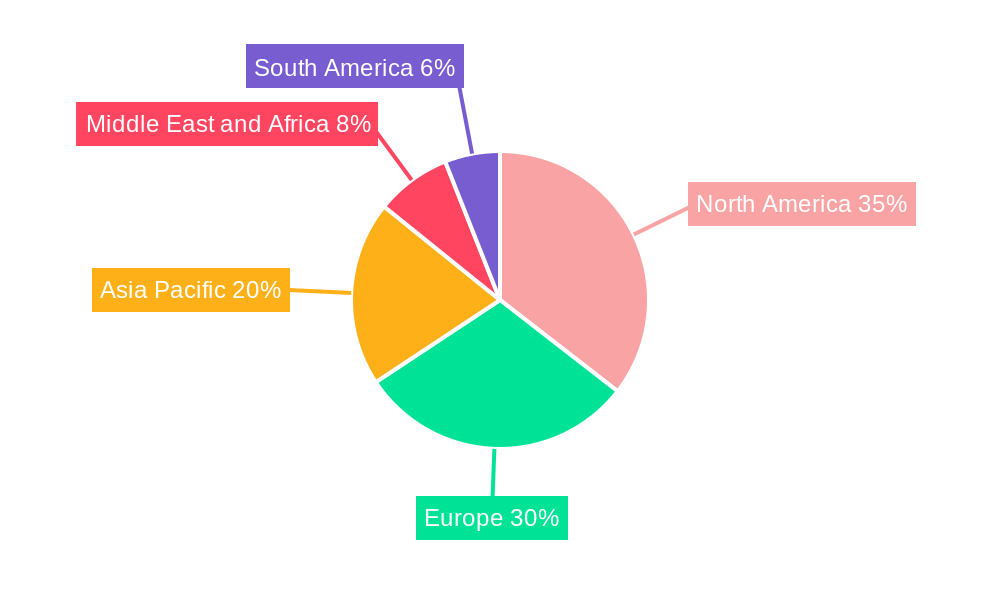

The market's trajectory is further shaped by ongoing technological innovations, including the development of more advanced stent materials and drug-eluting balloons, which promise improved patient outcomes and reduced recurrence rates. Hospitals and ambulatory surgical centers are increasingly investing in state-of-the-art endoscopic equipment, bolstering market growth. North America and Europe currently dominate the market, attributed to sophisticated healthcare infrastructures, high patient awareness, and greater access to advanced medical technologies. However, the Asia Pacific region is expected to exhibit the fastest growth, propelled by expanding healthcare expenditure, a burgeoning patient population, and a growing number of skilled endoscopists. Restraints such as the potential for complications, although diminishing with technological progress, and the cost of advanced procedures, may temper growth in certain demographics, but the overall outlook remains overwhelmingly positive.

Endoscopic Stricture Management Market: Comprehensive Market Analysis and Forecast (2019-2033)

This in-depth report delivers a dynamic, SEO-optimized analysis of the global Endoscopic Stricture Management Market, a crucial sector within medical devices. Leveraging high-volume keywords such as "endoscopic stricture dilation," "esophageal stricture treatment," "biliary stent placement," "bougie dilators," and "balloon dilators for GI," this research provides unparalleled insights for industry stakeholders. The study meticulously examines market structure, trends, segmentation, competitive landscape, and future outlook from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. The Endoscopic Stricture Management Market is projected to witness significant growth, driven by increasing prevalence of gastrointestinal and biliary disorders, advancements in endoscopic technologies, and a growing preference for minimally invasive procedures. The estimated market size for 2025 is USD xx Million, poised to expand at a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period.

Endoscopic Stricture Management Market Market Structure & Competitive Landscape

The Endoscopic Stricture Management Market exhibits a moderately concentrated structure, with a mix of established global players and emerging regional manufacturers. Innovation remains a key driver, fueled by continuous research and development into more effective and less invasive stricture management solutions, including advanced stent designs and drug-coated balloons. Regulatory impacts from bodies like the FDA and EMA play a significant role in shaping market access and product approval pathways. Substitutes, such as surgical interventions, exist but are increasingly being supplanted by endoscopic techniques due to their lower morbidity and faster recovery times.

End-user segmentation reveals the dominance of Hospitals as the primary consumers of endoscopic stricture management devices, followed by Ambulatory Surgical Centers. Mergers and acquisitions (M&A) are a notable trend, with companies strategically acquiring innovative technologies and expanding their product portfolios. For instance, the acquisition of M.I.Tech by Boston Scientific Corporation underscores the industry's drive for consolidation and market share expansion. The competitive landscape is characterized by a fierce battle for market share through product differentiation, strategic partnerships, and geographical expansion.

Endoscopic Stricture Management Market Market Trends & Opportunities

The global Endoscopic Stricture Management Market is experiencing a transformative period, characterized by rapid technological advancements and evolving patient care paradigms. The market size is projected to reach approximately USD xx Billion by 2033, propelled by an estimated CAGR of xx% during the forecast period (2025-2033). A significant trend is the escalating incidence of gastrointestinal and biliary strictures, often linked to chronic diseases like GERD, Crohn's disease, pancreatitis, and post-surgical complications, which directly fuels the demand for effective endoscopic interventions. The increasing global prevalence of these conditions, exacerbated by lifestyle factors and aging populations, presents a substantial growth opportunity for endoscopic stricture management solutions.

Technological shifts are profoundly reshaping the market. Innovations in stent materials, such as bioresorbable and self-expanding metallic stents (SEMS) with improved radial force and anti-migration properties, are enhancing treatment outcomes and patient comfort. Furthermore, the development and adoption of drug-coated balloons (DCBs) for conditions like urethral and biliary strictures are revolutionizing treatment by reducing restenosis rates. These advancements are driving a move towards more personalized and less invasive therapeutic approaches.

Consumer preferences are also tilting towards minimally invasive procedures, a direct consequence of increasing awareness about the benefits of endoscopy over traditional open surgeries, including shorter hospital stays, reduced pain, and quicker recovery times. This growing preference is a critical market penetration driver, encouraging both healthcare providers and patients to opt for endoscopic solutions. The competitive dynamics within the market are intensifying, with key players focusing on R&D to introduce next-generation devices and expanding their market reach through strategic collaborations and acquisitions. The ongoing efforts to address unmet clinical needs, such as managing complex or recurring strictures, present significant untapped opportunities for companies that can offer innovative and cost-effective solutions. The integration of artificial intelligence and advanced imaging in endoscopic procedures further promises to improve diagnostic accuracy and therapeutic precision, opening new avenues for market growth.

Dominant Markets & Segments in Endoscopic Stricture Management Market

The Esophageal segment stands as the dominant force within the Endoscopic Stricture Management Market, driven by the high prevalence of esophageal strictures resulting from conditions such as gastroesophageal reflux disease (GERD), Barrett's esophagus, and post-radiation or post-surgical complications. The increasing incidence of these ailments, particularly in aging populations and those with unhealthy lifestyles, significantly bolsters demand for endoscopic dilation and stenting procedures.

Hospitals represent the leading end-user segment, accounting for the largest share of the market. This dominance is attributed to the comprehensive infrastructure and specialized medical expertise available in hospital settings, enabling them to handle complex cases and perform a wide range of endoscopic interventions. The availability of advanced endoscopic suites and dedicated gastroenterology departments further solidifies hospitals' position as the primary consumers of endoscopic stricture management devices.

Geographically, North America currently holds the largest market share, driven by high healthcare expenditure, advanced healthcare infrastructure, widespread adoption of innovative medical technologies, and a robust presence of key market players. The region benefits from favorable reimbursement policies and a high awareness of minimally invasive treatment options among both healthcare professionals and patients.

Key growth drivers for these dominant segments include:

- High Disease Prevalence: A substantial and growing patient population suffering from esophageal and biliary conditions necessitates effective management solutions.

- Technological Advancements: Continuous innovation in balloon dilators, stents, and endoscopic accessories enhances procedural efficacy and patient outcomes.

- Minimally Invasive Preference: A strong global shift towards less invasive surgical alternatives favors endoscopic approaches.

- Healthcare Infrastructure: Well-equipped hospitals and specialized clinics provide the necessary environment for these procedures.

- Reimbursement Policies: Favorable reimbursement schemes in developed regions incentivize the adoption of these advanced treatments.

Within the Type segment, Balloon Dilators and Stents are particularly significant contributors. Balloon dilators offer a less invasive initial approach to stricture dilation, while self-expanding metal stents (SEMS) provide durable palliation and management of refractory or malignant strictures. The Biliary application segment is also a crucial growth area, fueled by the increasing rates of biliary strictures associated with gallstones, chronic pancreatitis, and surgical interventions. The Ambulatory Surgical Centers segment is expected to witness substantial growth as these facilities become increasingly equipped to handle a broader spectrum of endoscopic procedures, offering cost-effective alternatives to inpatient hospital stays.

Endoscopic Stricture Management Market Product Analysis

The Endoscopic Stricture Management Market is characterized by a portfolio of sophisticated medical devices designed for precise and effective treatment of luminal narrowing. Key product innovations include advanced balloon dilators offering improved radial force and controlled expansion, alongside a diverse range of self-expanding metal stents (SEMS) and fully covered stents with enhanced biocompatibility and anti-migration features. The development of drug-coated balloons (DCBs) represents a significant technological leap, promising to reduce restenosis rates in conditions like urethral strictures. These products offer distinct advantages in terms of ease of use, procedural efficiency, and improved patient outcomes, making them indispensable tools for managing esophageal, biliary, and other gastrointestinal strictures.

Key Drivers, Barriers & Challenges in Endoscopic Stricture Management Market

Key Drivers: The Endoscopic Stricture Management Market is propelled by a confluence of technological, economic, and policy-driven factors. The rising global prevalence of chronic gastrointestinal disorders such as GERD and inflammatory bowel disease directly translates to an increased demand for endoscopic interventions. Advancements in stent technology, including bioresorbable materials and improved deployment mechanisms, offer less invasive and more effective treatment options. Favorable reimbursement policies in developed economies further encourage the adoption of these procedures. The growing preference for minimally invasive techniques over traditional surgery, driven by patient demand for faster recovery and reduced complications, is a significant catalyst.

Barriers & Challenges: Despite robust growth, the market faces several constraints. High manufacturing costs associated with advanced endoscopic devices can lead to higher procedural costs, potentially limiting access in resource-constrained settings. Stringent regulatory approval processes in various regions can delay the market entry of new products. Competitive pressures among established players and the emergence of new entrants can impact pricing strategies and profit margins. Furthermore, the need for specialized training for endoscopists to effectively utilize these sophisticated devices can pose a challenge for widespread adoption, especially in emerging markets. Supply chain disruptions, as witnessed in recent global events, can also impact the availability and cost of critical components.

Growth Drivers in the Endoscopic Stricture Management Market Market

The Endoscopic Stricture Management Market is experiencing substantial growth fueled by several key drivers. Technologically, innovations in balloon dilator design, offering enhanced radial force and precise control, alongside the development of advanced self-expanding metal stents (SEMS) with improved biocompatibility and anti-migration properties, are enhancing treatment efficacy and patient outcomes. Economically, increasing healthcare expenditures globally, particularly in emerging economies, are expanding access to sophisticated medical treatments. Furthermore, favorable reimbursement policies for minimally invasive procedures in developed nations incentivize the adoption of endoscopic interventions. Regulatory advancements that streamline approval processes for novel devices also contribute to market expansion. The rising global incidence of esophageal and biliary strictures, driven by factors such as chronic diseases and lifestyle changes, creates a consistent demand for effective management solutions.

Challenges Impacting Endoscopic Stricture Management Market Growth

The growth of the Endoscopic Stricture Management Market is not without its hurdles. Regulatory complexities in obtaining approvals for novel devices, particularly those involving advanced materials or unique deployment mechanisms, can significantly prolong time-to-market. Supply chain vulnerabilities, exposed by recent global disruptions, can lead to shortages of critical components and increased manufacturing costs, impacting device availability and affordability. Intense competitive pressures among a growing number of manufacturers can lead to price erosion, affecting profitability and the ability to invest heavily in research and development. The need for specialized training and expertise among healthcare professionals to perform complex endoscopic procedures acts as a barrier to widespread adoption, especially in regions with limited access to advanced healthcare infrastructure. Furthermore, the high cost associated with some advanced endoscopic devices can limit their accessibility in certain healthcare systems, impacting market penetration.

Key Players Shaping the Endoscopic Stricture Management Market Market

- Becton Dickinson and Company

- CONMED Corporation

- Merit Medical Systems

- Medi-Globe Corporation

- Hobbs Medical Inc

- Cook Medical LLC

- PanMed US

- Boston Scientific Corporation

- Laborie

- Olympus Corporation

- Micro-Tech Endoscopy

- STERIS

Significant Endoscopic Stricture Management Market Industry Milestones

- June 2022: Boston Scientific Corporation entered into a definitive agreement to acquire a majority stake (approximately 64%) in M.I.Tech Co., Ltd, a Korean manufacturer of medical devices for endoscopic and urologic procedures. This move strengthens Boston Scientific's position in the stent market with M.I.Tech's HANAROSTENT technology.

- January 2022: Laborie Medical Technologies Inc. acquired a perpetual, exclusive license to the Optilume Urethral Drug-Coated Balloon (DCB), following FDA approval in late 2021. This acquisition expands Laborie's therapeutic offerings in urology and the management of urethral strictures.

Future Outlook for Endoscopic Stricture Management Market Market

The future outlook for the Endoscopic Stricture Management Market is exceptionally promising, driven by a synergistic interplay of continuous innovation and increasing healthcare demand. Strategic opportunities lie in the development of next-generation devices, including advanced biodegradable stents, intelligent dilation systems, and combination therapies that integrate drug delivery with mechanical dilation. The market is poised for significant expansion in emerging economies as healthcare infrastructure improves and awareness of minimally invasive treatments grows. Partnerships and collaborations between device manufacturers, research institutions, and healthcare providers will be crucial for accelerating the adoption of cutting-edge technologies and addressing unmet clinical needs. The increasing focus on patient-centric care and the pursuit of improved therapeutic outcomes will further solidify the market's growth trajectory, making endoscopic stricture management an increasingly vital component of gastrointestinal and urological care.

Endoscopic Stricture Management Market Segmentation

-

1. Type

- 1.1. Balloon Dilators

- 1.2. Stents

- 1.3. Bougie Dilators

-

2. Application

- 2.1. Esophageal

- 2.2. Biliary

- 2.3. Other Applications

-

3. End-user

- 3.1. Hospitals

- 3.2. Ambulatory Surgical Centers

- 3.3. Other End-users

Endoscopic Stricture Management Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Endoscopic Stricture Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.01% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Geriatric Population and Rise in Prevalence of GI Disorders; New Product Launches with Advanced Technologies and Preference for Minimally Invasive Procedures

- 3.3. Market Restrains

- 3.3.1. Highly Expensive GI Endoscopic Procedures and Troublesome Repayment Approaches; Lack of Trained and Skilled Healthcare Professionals in Endoscopic Stricture Technology

- 3.4. Market Trends

- 3.4.1. Stents Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Endoscopic Stricture Management Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Balloon Dilators

- 5.1.2. Stents

- 5.1.3. Bougie Dilators

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Esophageal

- 5.2.2. Biliary

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-user

- 5.3.1. Hospitals

- 5.3.2. Ambulatory Surgical Centers

- 5.3.3. Other End-users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Endoscopic Stricture Management Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Balloon Dilators

- 6.1.2. Stents

- 6.1.3. Bougie Dilators

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Esophageal

- 6.2.2. Biliary

- 6.2.3. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End-user

- 6.3.1. Hospitals

- 6.3.2. Ambulatory Surgical Centers

- 6.3.3. Other End-users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Endoscopic Stricture Management Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Balloon Dilators

- 7.1.2. Stents

- 7.1.3. Bougie Dilators

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Esophageal

- 7.2.2. Biliary

- 7.2.3. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End-user

- 7.3.1. Hospitals

- 7.3.2. Ambulatory Surgical Centers

- 7.3.3. Other End-users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Endoscopic Stricture Management Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Balloon Dilators

- 8.1.2. Stents

- 8.1.3. Bougie Dilators

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Esophageal

- 8.2.2. Biliary

- 8.2.3. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End-user

- 8.3.1. Hospitals

- 8.3.2. Ambulatory Surgical Centers

- 8.3.3. Other End-users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Endoscopic Stricture Management Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Balloon Dilators

- 9.1.2. Stents

- 9.1.3. Bougie Dilators

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Esophageal

- 9.2.2. Biliary

- 9.2.3. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End-user

- 9.3.1. Hospitals

- 9.3.2. Ambulatory Surgical Centers

- 9.3.3. Other End-users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Endoscopic Stricture Management Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Balloon Dilators

- 10.1.2. Stents

- 10.1.3. Bougie Dilators

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Esophageal

- 10.2.2. Biliary

- 10.2.3. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by End-user

- 10.3.1. Hospitals

- 10.3.2. Ambulatory Surgical Centers

- 10.3.3. Other End-users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Endoscopic Stricture Management Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Endoscopic Stricture Management Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Endoscopic Stricture Management Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Endoscopic Stricture Management Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Endoscopic Stricture Management Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Becton Dickinson and Company

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 CONMED Corporation

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Merit Medical Systems

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Medi-Globe Corporation

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Hobbs Medical Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Cook Medical LLC

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 PanMed US

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Boston Scientific Corporation

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Laborie*List Not Exhaustive

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Olympus Corporation

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Micro-Tech Endoscopy

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 STERIS

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Endoscopic Stricture Management Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Endoscopic Stricture Management Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Endoscopic Stricture Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Endoscopic Stricture Management Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Endoscopic Stricture Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Endoscopic Stricture Management Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Endoscopic Stricture Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Endoscopic Stricture Management Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Endoscopic Stricture Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Endoscopic Stricture Management Market Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Endoscopic Stricture Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Endoscopic Stricture Management Market Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Endoscopic Stricture Management Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Endoscopic Stricture Management Market Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Endoscopic Stricture Management Market Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Endoscopic Stricture Management Market Revenue (Million), by End-user 2024 & 2032

- Figure 17: North America Endoscopic Stricture Management Market Revenue Share (%), by End-user 2024 & 2032

- Figure 18: North America Endoscopic Stricture Management Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Endoscopic Stricture Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Endoscopic Stricture Management Market Revenue (Million), by Type 2024 & 2032

- Figure 21: Europe Endoscopic Stricture Management Market Revenue Share (%), by Type 2024 & 2032

- Figure 22: Europe Endoscopic Stricture Management Market Revenue (Million), by Application 2024 & 2032

- Figure 23: Europe Endoscopic Stricture Management Market Revenue Share (%), by Application 2024 & 2032

- Figure 24: Europe Endoscopic Stricture Management Market Revenue (Million), by End-user 2024 & 2032

- Figure 25: Europe Endoscopic Stricture Management Market Revenue Share (%), by End-user 2024 & 2032

- Figure 26: Europe Endoscopic Stricture Management Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Endoscopic Stricture Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Endoscopic Stricture Management Market Revenue (Million), by Type 2024 & 2032

- Figure 29: Asia Pacific Endoscopic Stricture Management Market Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Endoscopic Stricture Management Market Revenue (Million), by Application 2024 & 2032

- Figure 31: Asia Pacific Endoscopic Stricture Management Market Revenue Share (%), by Application 2024 & 2032

- Figure 32: Asia Pacific Endoscopic Stricture Management Market Revenue (Million), by End-user 2024 & 2032

- Figure 33: Asia Pacific Endoscopic Stricture Management Market Revenue Share (%), by End-user 2024 & 2032

- Figure 34: Asia Pacific Endoscopic Stricture Management Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Endoscopic Stricture Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Endoscopic Stricture Management Market Revenue (Million), by Type 2024 & 2032

- Figure 37: Middle East and Africa Endoscopic Stricture Management Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: Middle East and Africa Endoscopic Stricture Management Market Revenue (Million), by Application 2024 & 2032

- Figure 39: Middle East and Africa Endoscopic Stricture Management Market Revenue Share (%), by Application 2024 & 2032

- Figure 40: Middle East and Africa Endoscopic Stricture Management Market Revenue (Million), by End-user 2024 & 2032

- Figure 41: Middle East and Africa Endoscopic Stricture Management Market Revenue Share (%), by End-user 2024 & 2032

- Figure 42: Middle East and Africa Endoscopic Stricture Management Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East and Africa Endoscopic Stricture Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: South America Endoscopic Stricture Management Market Revenue (Million), by Type 2024 & 2032

- Figure 45: South America Endoscopic Stricture Management Market Revenue Share (%), by Type 2024 & 2032

- Figure 46: South America Endoscopic Stricture Management Market Revenue (Million), by Application 2024 & 2032

- Figure 47: South America Endoscopic Stricture Management Market Revenue Share (%), by Application 2024 & 2032

- Figure 48: South America Endoscopic Stricture Management Market Revenue (Million), by End-user 2024 & 2032

- Figure 49: South America Endoscopic Stricture Management Market Revenue Share (%), by End-user 2024 & 2032

- Figure 50: South America Endoscopic Stricture Management Market Revenue (Million), by Country 2024 & 2032

- Figure 51: South America Endoscopic Stricture Management Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Endoscopic Stricture Management Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 5: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Europe Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: India Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Australia Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: South Korea Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia Pacific Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: GCC Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: South Africa Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of Middle East and Africa Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Brazil Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Type 2019 & 2032

- Table 33: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Application 2019 & 2032

- Table 34: Global Endoscopic Stricture Management Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 35: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: United States Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Canada Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Mexico Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Type 2019 & 2032

- Table 40: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Application 2019 & 2032

- Table 41: Global Endoscopic Stricture Management Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 42: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Germany Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: United Kingdom Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: France Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Italy Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Spain Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Europe Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Type 2019 & 2032

- Table 50: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Application 2019 & 2032

- Table 51: Global Endoscopic Stricture Management Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 52: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: China Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Japan Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: India Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Australia Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: South Korea Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Asia Pacific Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Type 2019 & 2032

- Table 60: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Application 2019 & 2032

- Table 61: Global Endoscopic Stricture Management Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 62: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 63: GCC Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: South Africa Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Rest of Middle East and Africa Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Type 2019 & 2032

- Table 67: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Application 2019 & 2032

- Table 68: Global Endoscopic Stricture Management Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 69: Global Endoscopic Stricture Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 70: Brazil Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Argentina Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Rest of South America Endoscopic Stricture Management Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Endoscopic Stricture Management Market?

The projected CAGR is approximately > 6.01%.

2. Which companies are prominent players in the Endoscopic Stricture Management Market?

Key companies in the market include Becton Dickinson and Company, CONMED Corporation, Merit Medical Systems, Medi-Globe Corporation, Hobbs Medical Inc, Cook Medical LLC, PanMed US, Boston Scientific Corporation, Laborie*List Not Exhaustive, Olympus Corporation, Micro-Tech Endoscopy, STERIS.

3. What are the main segments of the Endoscopic Stricture Management Market?

The market segments include Type, Application, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Geriatric Population and Rise in Prevalence of GI Disorders; New Product Launches with Advanced Technologies and Preference for Minimally Invasive Procedures.

6. What are the notable trends driving market growth?

Stents Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

Highly Expensive GI Endoscopic Procedures and Troublesome Repayment Approaches; Lack of Trained and Skilled Healthcare Professionals in Endoscopic Stricture Technology.

8. Can you provide examples of recent developments in the market?

June 2022: Boston Scientific Corporation entered into a definitive agreement with Synergy Innovation Co., Ltd, to purchase its majority stake (approximately 64%) of M.I.Tech Co., Ltd, a publicly traded Korean manufacturer and distributor of medical devices for endoscopic and urologic procedures. M.I.Tech is the creator of the HANAROSTENT technology, a family of conformable, non-vascular, self-expanding metal stents, which Boston Scientific has distributed in Japan since 2015.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Endoscopic Stricture Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Endoscopic Stricture Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Endoscopic Stricture Management Market?

To stay informed about further developments, trends, and reports in the Endoscopic Stricture Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence