Key Insights

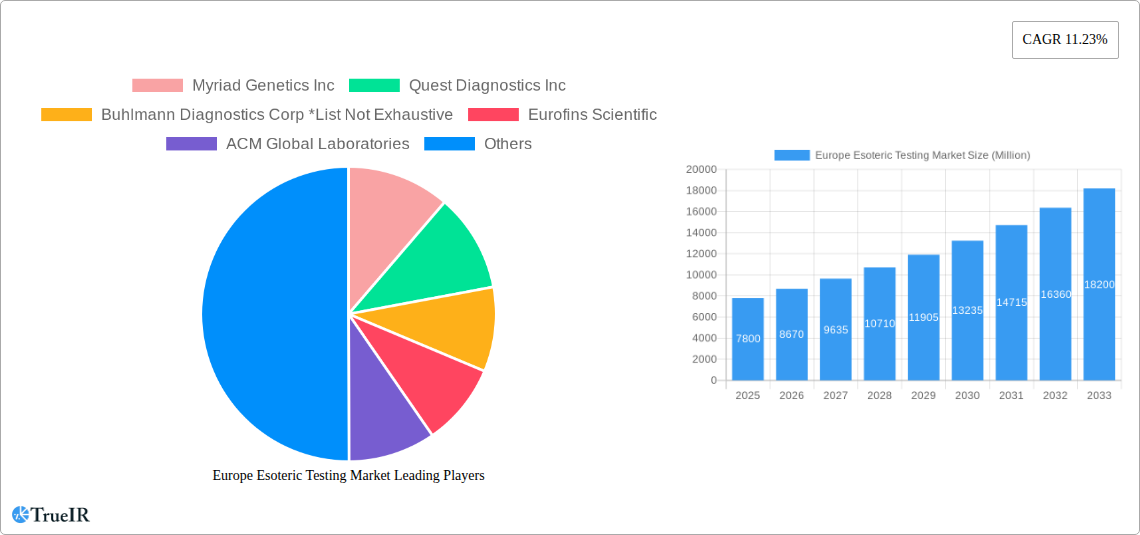

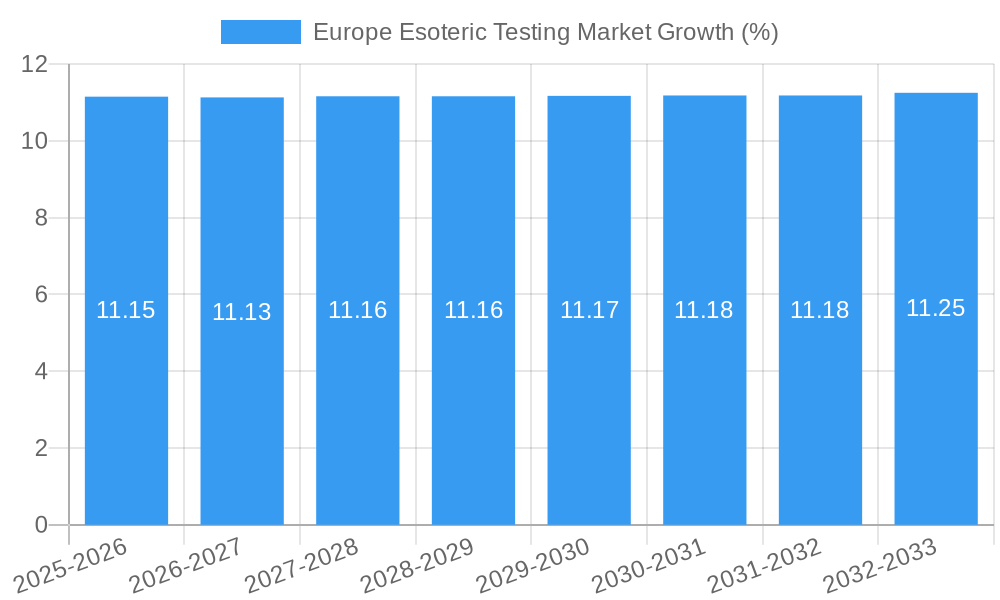

The European Esoteric Testing Market is poised for substantial expansion, with an estimated market size of $7.80 billion in 2025. This growth is fueled by a robust Compound Annual Growth Rate (CAGR) of 11.23% projected over the forecast period of 2025-2033. This significant upward trajectory is largely driven by the increasing prevalence of complex and rare diseases, coupled with advancements in diagnostic technologies. The growing demand for personalized medicine and the subsequent need for highly specialized diagnostic tests are pivotal factors propelling the market forward. Furthermore, increased government initiatives and healthcare spending aimed at early disease detection and management contribute to this dynamic market. The expanding portfolio of esoteric tests across various domains like endocrinology, oncology, infectious diseases, and neurology, alongside the adoption of cutting-edge technologies such as mass spectrometry and chemiluminescence immunoassay, are key enablers of this growth. Leading companies like Myriad Genetics Inc., Quest Diagnostics Inc., and Eurofins Scientific are actively investing in research and development to cater to the evolving needs of healthcare providers and patients, further solidifying the market's expansion potential.

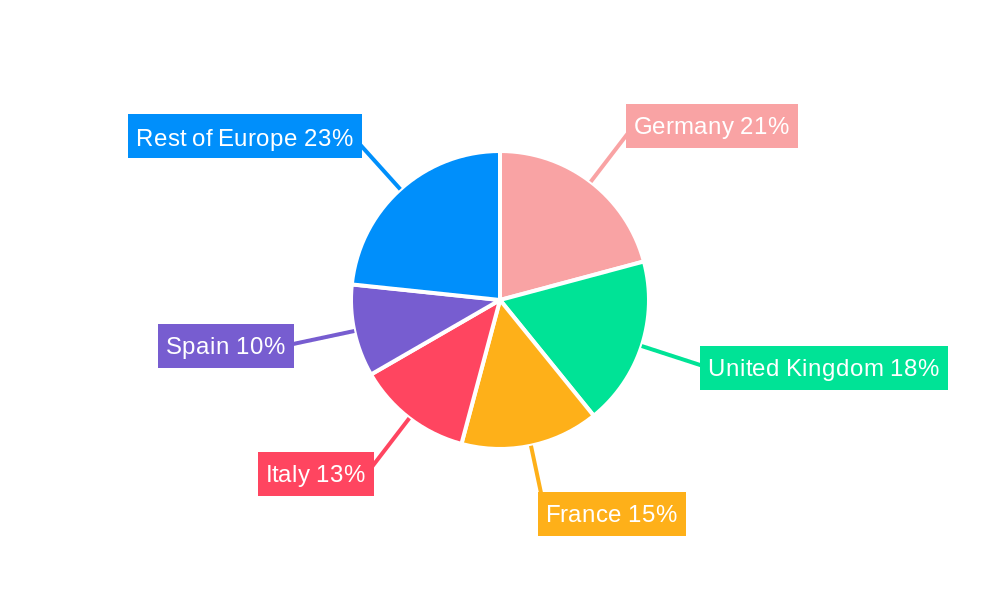

The European Esoteric Testing Market is characterized by a diverse range of test types and sophisticated technologies, catering to the intricate diagnostic needs across the region. Within test types, oncology tests are expected to dominate, reflecting the high burden of cancer and the continuous development of novel targeted therapies. Endocrinology and infectious disease testing also represent significant segments, driven by the increasing incidence of hormonal imbalances and emerging infectious threats. Neurological disorders and toxicology tests are also integral to the market's scope, addressing complex neurological conditions and the need for substance abuse and poisoning detection. On the technology front, chemiluminescence immunoassay and mass spectrometry are emerging as frontrunners, offering high sensitivity, specificity, and efficiency for esoteric test analysis. Flow cytometry and radioimmunoassay also hold their ground, contributing to the comprehensive diagnostic capabilities. Geographically, while specific regional data is not provided for Germany, the United Kingdom, France, Italy, and Spain, the "Rest of Europe" segment likely encompasses a considerable portion of the market, indicating widespread adoption across the continent. This comprehensive landscape of specialized tests and advanced technologies underscores the market's critical role in advancing healthcare outcomes in Europe.

Europe Esoteric Testing Market: Comprehensive Market Analysis & Future Outlook (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Esoteric Testing Market, exploring market dynamics, key trends, emerging opportunities, and the competitive landscape. Leveraging high-volume keywords such as "esoteric testing Europe," "specialty diagnostics," "advanced laboratory testing," and "in vitro diagnostics EU," this report is meticulously crafted for industry professionals, researchers, and investors seeking critical insights into this rapidly evolving sector. The study period spans from 2019 to 2033, with a base year of 2025 and a detailed forecast period from 2025 to 2033.

Europe Esoteric Testing Market Market Structure & Competitive Landscape

The Europe Esoteric Testing Market is characterized by a moderately fragmented structure, with a mix of large, established players and innovative niche providers. Market concentration is influenced by the high capital investment required for advanced technologies and specialized expertise. Innovation drivers include the increasing prevalence of rare diseases, the demand for personalized medicine, and advancements in molecular diagnostics. Regulatory impacts are significant, with bodies like the European Medicines Agency (EMA) and the impending full implementation of the In Vitro Diagnostic Regulation (IVDR) shaping product development and market access. Product substitutes are limited for truly esoteric tests due to their unique nature, but advancements in broad-spectrum screening technologies can indirectly impact demand. End-user segmentation is diverse, encompassing hospitals, reference laboratories, academic research institutions, and pharmaceutical companies. Mergers and acquisitions (M&A) are a key trend, driven by the pursuit of technological consolidation and market expansion. Notable M&A activities are anticipated to continue as companies seek to broaden their esoteric test portfolios and geographic reach.

- Market Concentration: Moderately fragmented with key players investing heavily in R&D and technology.

- Innovation Drivers: Rising incidence of rare diseases, personalized medicine, and advancements in omics technologies.

- Regulatory Impacts: Stringent IVDR compliance, evolving reimbursement policies.

- Product Substitutes: Limited for highly specialized tests, but broad screening technologies pose indirect competition.

- End-User Segmentation: Hospitals, reference labs, academic institutions, pharmaceutical firms.

- M&A Trends: Strategic acquisitions to gain market share, expand test menus, and acquire novel technologies.

Europe Esoteric Testing Market Market Trends & Opportunities

The Europe Esoteric Testing Market is poised for substantial growth, driven by an increasing demand for highly specialized diagnostic tests that address complex and rare medical conditions. The market size is projected to expand significantly, with a robust Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period (2025-2033). This growth is fueled by several converging trends: the relentless pace of technological advancements, particularly in genomics, proteomics, and metabolomics, which enable the development of novel esoteric assays; a growing patient and physician awareness of the benefits of early and accurate diagnosis for improved patient outcomes; and a paradigm shift towards personalized medicine, where genetic and molecular profiling dictates treatment strategies.

Consumer preferences are increasingly leaning towards targeted therapies and precision diagnostics, thereby boosting the demand for esoteric testing. Competitive dynamics are intensifying, with both established diagnostic giants and agile biotech firms vying for market leadership. Opportunities abound for companies that can navigate the complex regulatory landscape, develop cost-effective and highly sensitive assays, and establish strong partnerships with healthcare providers and research institutions. The increasing prevalence of chronic diseases, emerging infectious diseases, and the growing burden of neurological and oncological disorders are significant demand generators. Furthermore, the expanding healthcare infrastructure across various European nations, coupled with supportive government initiatives aimed at enhancing diagnostic capabilities, presents a fertile ground for market expansion. The penetration rate of advanced esoteric testing is expected to rise as awareness grows and reimbursement policies become more favorable, making these critical diagnostics accessible to a wider patient population.

- Market Size Growth: Projected CAGR of 8.5% from 2025-2033.

- Technological Shifts: Rapid advancements in genomics, proteomics, mass spectrometry, and AI-driven diagnostics.

- Consumer Preferences: Growing demand for personalized medicine, targeted therapies, and precision diagnostics.

- Competitive Dynamics: Intense competition among established players and innovative biotech firms.

- Market Penetration Rates: Increasing as awareness, accessibility, and favorable reimbursement policies grow.

Dominant Markets & Segments in Europe Esoteric Testing Market

The Oncology segment stands out as a dominant force within the Europe Esoteric Testing Market, driven by the escalating incidence of cancer and the critical need for precise diagnostic and prognostic tools. This dominance is further bolstered by the segment's alignment with advancements in precision oncology, where genetic mutations and molecular markers guide treatment decisions. Within oncology, tests for solid tumors and hematological malignancies, utilizing technologies like next-generation sequencing (NGS) and advanced flow cytometry, are experiencing substantial growth.

The Neurology segment is also a significant contributor, propelled by the rising prevalence of neurodegenerative diseases such as Alzheimer's and Parkinson's, as well as an increased focus on early diagnosis and management of complex neurological disorders. The development of sophisticated biomarker testing and advanced neuroimaging analysis fuels this segment's expansion.

In terms of Technology, Mass Spectrometry is a key enabler of esoteric testing, offering high sensitivity and specificity for a wide range of analytes, from complex proteins to trace elements. Its application spans across endocrinology, toxicology, and infectious diseases, making it a versatile and indispensable technology. Chemiluminescence Immunoassay (CLIA) also holds a substantial share due to its reliability and efficiency in detecting various biomarkers.

Geographically, Germany, the United Kingdom, and France are leading markets within Europe, owing to their robust healthcare infrastructures, significant investments in medical research, and a higher propensity for adopting advanced diagnostic technologies. Supportive government policies, a concentration of specialized medical centers, and a large patient pool susceptible to chronic and rare diseases contribute to their market leadership. The expanding healthcare expenditure and an increasing emphasis on early disease detection in these countries are key growth drivers.

- Dominant Test Type: Oncology

- Key Growth Drivers: Rising cancer incidence, personalized medicine, advancements in NGS and biomarker discovery.

- Detailed Analysis: Demand for liquid biopsies, companion diagnostics, and predictive markers for targeted therapies is soaring.

- Dominant Test Type: Neurology

- Key Growth Drivers: Increasing prevalence of neurodegenerative diseases, focus on early diagnosis of complex neurological conditions.

- Detailed Analysis: Development of sophisticated cerebrospinal fluid (CSF) analysis and advanced imaging biomarkers is crucial.

- Dominant Technology: Mass Spectrometry

- Key Growth Drivers: High sensitivity and specificity, versatility across multiple disease areas.

- Detailed Analysis: Essential for metabolomics, proteomics, and complex toxicology screening.

- Dominant Technology: Chemiluminescence Immunoassay (CLIA)

- Key Growth Drivers: Efficiency, reliability, and broad applicability in biomarker detection.

- Detailed Analysis: Widely used for hormone, infectious disease, and cardiac marker testing.

- Leading Markets: Germany, United Kingdom, France

- Key Growth Drivers: Advanced healthcare infrastructure, substantial R&D investment, favorable reimbursement policies, high disease burden.

- Detailed Analysis: Strong adoption of cutting-edge diagnostic solutions and a well-established network of specialized laboratories.

Europe Esoteric Testing Market Product Analysis

Product innovation in the Europe Esoteric Testing Market is primarily driven by the quest for higher sensitivity, specificity, and faster turnaround times. Companies are focusing on developing novel assays for rare genetic disorders, complex autoimmune conditions, and challenging infectious diseases. The application of advanced technologies like liquid biopsies for cancer detection and early neurological disorder biomarkers is a key product development trend. Competitive advantages are gained through patented assay designs, proprietary algorithms for data analysis, and the ability to integrate multiple analytes into single testing panels. Technological advancements in sample preparation and detection methods are crucial for enhancing the clinical utility and market fit of these specialized diagnostic tools.

Key Drivers, Barriers & Challenges in Europe Esoteric Testing Market

Key Drivers, Barriers & Challenges in Europe Esoteric Testing Market

Key Drivers: The Europe Esoteric Testing Market is propelled by several significant factors. Technologically, the continuous evolution of platforms like next-generation sequencing (NGS), mass spectrometry, and advanced immunoassay techniques enables the development of more accurate and comprehensive tests for rare and complex conditions. Economically, increasing healthcare expenditure across Europe and a growing understanding of the cost-effectiveness of early and precise diagnosis contribute to market expansion. Policy-driven factors, such as government initiatives to improve public health and the ongoing implementation of stringent regulatory frameworks like IVDR, indirectly encourage the development of high-quality, specialized diagnostics. The rising prevalence of chronic diseases and the growing demand for personalized medicine are also substantial growth catalysts.

Key Barriers & Challenges: Despite the positive outlook, the market faces considerable restraints. Regulatory hurdles, particularly the complexities and costs associated with IVDR certification for novel esoteric tests, present a significant challenge. Supply chain issues for specialized reagents and equipment can lead to delays and increased operational costs. Competitive pressures from established diagnostic providers and the slow adoption of new technologies by some healthcare systems can also hinder growth. Furthermore, the high cost of many esoteric tests can be a barrier to wider adoption, especially in regions with limited reimbursement coverage. The need for specialized training for laboratory personnel to perform and interpret these complex tests adds another layer of complexity.

Growth Drivers in the Europe Esoteric Testing Market Market

Growth drivers in the Europe Esoteric Testing Market are multifaceted, with technological advancements at the forefront. Innovations in genomics, proteomics, and metabolomics are continuously expanding the scope of detectable biomarkers and enabling the development of novel, highly specific assays. Economically, rising healthcare expenditure across European nations and a growing appreciation for the value of early and accurate diagnosis of complex conditions contribute significantly to market expansion. Regulatory support, such as streamlined approval pathways for innovative diagnostics and favorable reimbursement policies for esoteric tests, plays a crucial role. The increasing incidence of chronic diseases, the rise of personalized medicine, and a greater emphasis on proactive health management further fuel the demand for specialized diagnostic solutions.

Challenges Impacting Europe Esoteric Testing Market Growth

Several challenges significantly impact the growth of the Europe Esoteric Testing Market. Regulatory complexities, particularly the stringent and evolving requirements of the In Vitro Diagnostic Regulation (IVDR), can lead to prolonged approval times and substantial compliance costs for manufacturers of esoteric tests. Supply chain disruptions for specialized reagents, sophisticated instruments, and highly trained personnel can create bottlenecks in service delivery and increase operational expenses. Competitive pressures, especially from large, well-established diagnostic companies with extensive market reach, can make it difficult for smaller, specialized players to gain traction. Furthermore, the high cost associated with developing and performing many esoteric tests often presents a reimbursement challenge, limiting their accessibility for a wider patient population.

Key Players Shaping the Europe Esoteric Testing Market Market

- Myriad Genetics Inc

- Quest Diagnostics Inc

- Buhlmann Diagnostics Corp

- Eurofins Scientific

- ACM Global Laboratories

- Arup Laboratories

- Nordic Laboratories

- OPKO Health Inc

- Miraca Holdings Inc

- Foundation Medicine

- Exact Sciences

Significant Europe Esoteric Testing Market Industry Milestones

- May 2024: Bruker Corporation completed its acquisition of ELITechGroup (ELITech) for a cash consideration of EUR 870 million (USD 938.50 million), excluding the sale of ELITech's clinical chemistry business. ELITech is a specialized, rapidly expanding, and highly profitable provider of systems and assays for molecular diagnostics (MDx), biomedical systems, specialty in vitro diagnostics (IVD), and microbiology. This acquisition significantly strengthens Bruker's presence in the molecular diagnostics and specialty IVD sectors.

- March 2023: OGT, a Sysmex Group company, received IVDR certification from the European Union (EU) for eight CytoCell fluorescence in situ hybridization (FISH) probes. These probes are intended for the diagnosis of patient management in hematological cancers and prenatal conditions. This milestone demonstrates OGT's commitment to regulatory compliance and enhances its product offerings in the European market.

Future Outlook for Europe Esoteric Testing Market Market

The future outlook for the Europe Esoteric Testing Market is exceptionally promising, driven by sustained technological innovation and an increasing recognition of the value of specialized diagnostics. Key growth catalysts include the continued expansion of genomic sequencing capabilities, the emergence of novel biomarkers for a wider range of diseases, and the integration of artificial intelligence (AI) for enhanced data interpretation and predictive diagnostics. Strategic opportunities lie in expanding testing menus for rare diseases, developing more accessible and cost-effective assays, and forging stronger collaborations between diagnostic providers, pharmaceutical companies, and academic research institutions. The market potential is further amplified by the growing demand for personalized treatment strategies and the imperative to address unmet diagnostic needs across various medical specialties. The proactive adoption of advanced testing by healthcare systems across Europe will be crucial in realizing this growth.

Europe Esoteric Testing Market Segmentation

-

1. Test Type

- 1.1. Endocrinology

- 1.2. Infectious Disease

- 1.3. Oncology

- 1.4. Neurology

- 1.5. Toxicology

- 1.6. Other Test Types

-

2. Technology

- 2.1. Flow Cytometry

- 2.2. Chemiluminescence Immunoassay

- 2.3. Mass Spectrometry

- 2.4. Radio Immunoassay

- 2.5. Other Technologies

Europe Esoteric Testing Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Rest of Europe

Europe Esoteric Testing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.23% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Burden of Chronic Diseases and Rare Diseases; Increasing Research Expenditure

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Oncology Segment is Expected to Exhibit Significant Market Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Esoteric Testing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Test Type

- 5.1.1. Endocrinology

- 5.1.2. Infectious Disease

- 5.1.3. Oncology

- 5.1.4. Neurology

- 5.1.5. Toxicology

- 5.1.6. Other Test Types

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Flow Cytometry

- 5.2.2. Chemiluminescence Immunoassay

- 5.2.3. Mass Spectrometry

- 5.2.4. Radio Immunoassay

- 5.2.5. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Italy

- 5.3.5. Spain

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Test Type

- 6. Germany Europe Esoteric Testing Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Test Type

- 6.1.1. Endocrinology

- 6.1.2. Infectious Disease

- 6.1.3. Oncology

- 6.1.4. Neurology

- 6.1.5. Toxicology

- 6.1.6. Other Test Types

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Flow Cytometry

- 6.2.2. Chemiluminescence Immunoassay

- 6.2.3. Mass Spectrometry

- 6.2.4. Radio Immunoassay

- 6.2.5. Other Technologies

- 6.1. Market Analysis, Insights and Forecast - by Test Type

- 7. United Kingdom Europe Esoteric Testing Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Test Type

- 7.1.1. Endocrinology

- 7.1.2. Infectious Disease

- 7.1.3. Oncology

- 7.1.4. Neurology

- 7.1.5. Toxicology

- 7.1.6. Other Test Types

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Flow Cytometry

- 7.2.2. Chemiluminescence Immunoassay

- 7.2.3. Mass Spectrometry

- 7.2.4. Radio Immunoassay

- 7.2.5. Other Technologies

- 7.1. Market Analysis, Insights and Forecast - by Test Type

- 8. France Europe Esoteric Testing Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Test Type

- 8.1.1. Endocrinology

- 8.1.2. Infectious Disease

- 8.1.3. Oncology

- 8.1.4. Neurology

- 8.1.5. Toxicology

- 8.1.6. Other Test Types

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Flow Cytometry

- 8.2.2. Chemiluminescence Immunoassay

- 8.2.3. Mass Spectrometry

- 8.2.4. Radio Immunoassay

- 8.2.5. Other Technologies

- 8.1. Market Analysis, Insights and Forecast - by Test Type

- 9. Italy Europe Esoteric Testing Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Test Type

- 9.1.1. Endocrinology

- 9.1.2. Infectious Disease

- 9.1.3. Oncology

- 9.1.4. Neurology

- 9.1.5. Toxicology

- 9.1.6. Other Test Types

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Flow Cytometry

- 9.2.2. Chemiluminescence Immunoassay

- 9.2.3. Mass Spectrometry

- 9.2.4. Radio Immunoassay

- 9.2.5. Other Technologies

- 9.1. Market Analysis, Insights and Forecast - by Test Type

- 10. Spain Europe Esoteric Testing Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Test Type

- 10.1.1. Endocrinology

- 10.1.2. Infectious Disease

- 10.1.3. Oncology

- 10.1.4. Neurology

- 10.1.5. Toxicology

- 10.1.6. Other Test Types

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Flow Cytometry

- 10.2.2. Chemiluminescence Immunoassay

- 10.2.3. Mass Spectrometry

- 10.2.4. Radio Immunoassay

- 10.2.5. Other Technologies

- 10.1. Market Analysis, Insights and Forecast - by Test Type

- 11. Rest of Europe Europe Esoteric Testing Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Test Type

- 11.1.1. Endocrinology

- 11.1.2. Infectious Disease

- 11.1.3. Oncology

- 11.1.4. Neurology

- 11.1.5. Toxicology

- 11.1.6. Other Test Types

- 11.2. Market Analysis, Insights and Forecast - by Technology

- 11.2.1. Flow Cytometry

- 11.2.2. Chemiluminescence Immunoassay

- 11.2.3. Mass Spectrometry

- 11.2.4. Radio Immunoassay

- 11.2.5. Other Technologies

- 11.1. Market Analysis, Insights and Forecast - by Test Type

- 12. Germany Europe Esoteric Testing Market Analysis, Insights and Forecast, 2019-2031

- 13. United Kingdom Europe Esoteric Testing Market Analysis, Insights and Forecast, 2019-2031

- 14. France Europe Esoteric Testing Market Analysis, Insights and Forecast, 2019-2031

- 15. Italy Europe Esoteric Testing Market Analysis, Insights and Forecast, 2019-2031

- 16. Spain Europe Esoteric Testing Market Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Europe Europe Esoteric Testing Market Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Myriad Genetics Inc

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Quest Diagnostics Inc

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Buhlmann Diagnostics Corp *List Not Exhaustive

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Eurofins Scientific

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 ACM Global Laboratories

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Arup Laboratories

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Nordic Laboratories

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 OPKO Health Inc

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Miraca Holdings Inc

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Foundation Medicine

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 Exact Sciences

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.1 Myriad Genetics Inc

List of Figures

- Figure 1: Europe Esoteric Testing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Esoteric Testing Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Esoteric Testing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Esoteric Testing Market Revenue Million Forecast, by Test Type 2019 & 2032

- Table 3: Europe Esoteric Testing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: Europe Esoteric Testing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Esoteric Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Esoteric Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: United Kingdom Europe Esoteric Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Esoteric Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Esoteric Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Spain Europe Esoteric Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe Esoteric Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Europe Esoteric Testing Market Revenue Million Forecast, by Test Type 2019 & 2032

- Table 13: Europe Esoteric Testing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 14: Europe Esoteric Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Europe Esoteric Testing Market Revenue Million Forecast, by Test Type 2019 & 2032

- Table 16: Europe Esoteric Testing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 17: Europe Esoteric Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Europe Esoteric Testing Market Revenue Million Forecast, by Test Type 2019 & 2032

- Table 19: Europe Esoteric Testing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 20: Europe Esoteric Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Europe Esoteric Testing Market Revenue Million Forecast, by Test Type 2019 & 2032

- Table 22: Europe Esoteric Testing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 23: Europe Esoteric Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Europe Esoteric Testing Market Revenue Million Forecast, by Test Type 2019 & 2032

- Table 25: Europe Esoteric Testing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 26: Europe Esoteric Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Europe Esoteric Testing Market Revenue Million Forecast, by Test Type 2019 & 2032

- Table 28: Europe Esoteric Testing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 29: Europe Esoteric Testing Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Esoteric Testing Market?

The projected CAGR is approximately 11.23%.

2. Which companies are prominent players in the Europe Esoteric Testing Market?

Key companies in the market include Myriad Genetics Inc, Quest Diagnostics Inc, Buhlmann Diagnostics Corp *List Not Exhaustive, Eurofins Scientific, ACM Global Laboratories, Arup Laboratories, Nordic Laboratories, OPKO Health Inc, Miraca Holdings Inc, Foundation Medicine, Exact Sciences.

3. What are the main segments of the Europe Esoteric Testing Market?

The market segments include Test Type, Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Burden of Chronic Diseases and Rare Diseases; Increasing Research Expenditure.

6. What are the notable trends driving market growth?

Oncology Segment is Expected to Exhibit Significant Market Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

May 2024: Bruker Corporation completed its acquisition of ELITechGroup (ELITech) for a cash consideration of EUR 870 million (USD 938.50 million), excluding the sale of ELITech's clinical chemistry business. ELITech is a specialized, rapidly expanding, and highly profitable provider of systems and assays for molecular diagnostics (MDx), biomedical systems, specialty in vitro diagnostics (IVD), and microbiology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Esoteric Testing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Esoteric Testing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Esoteric Testing Market?

To stay informed about further developments, trends, and reports in the Europe Esoteric Testing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence