Key Insights

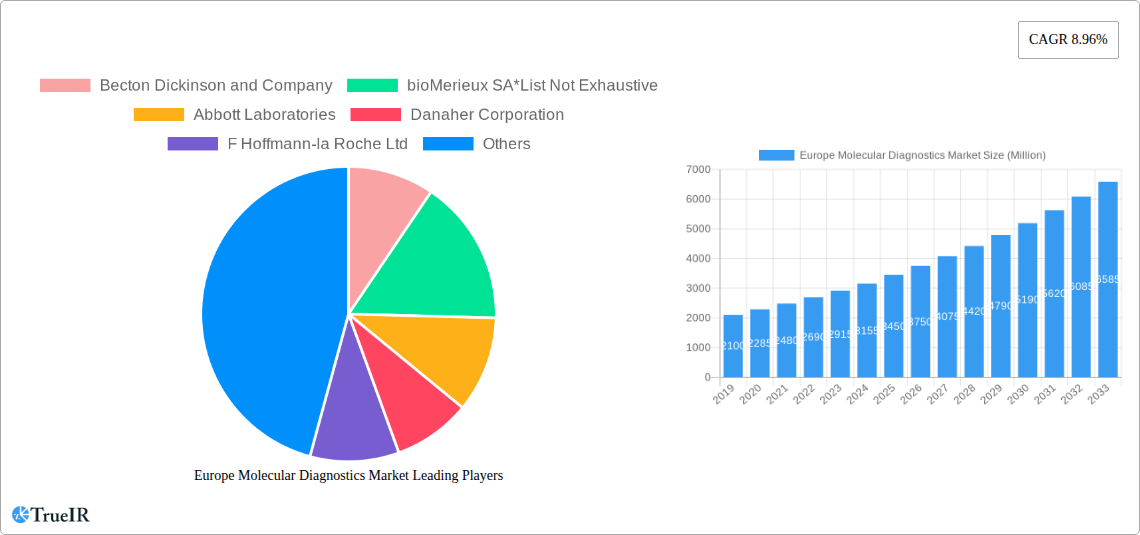

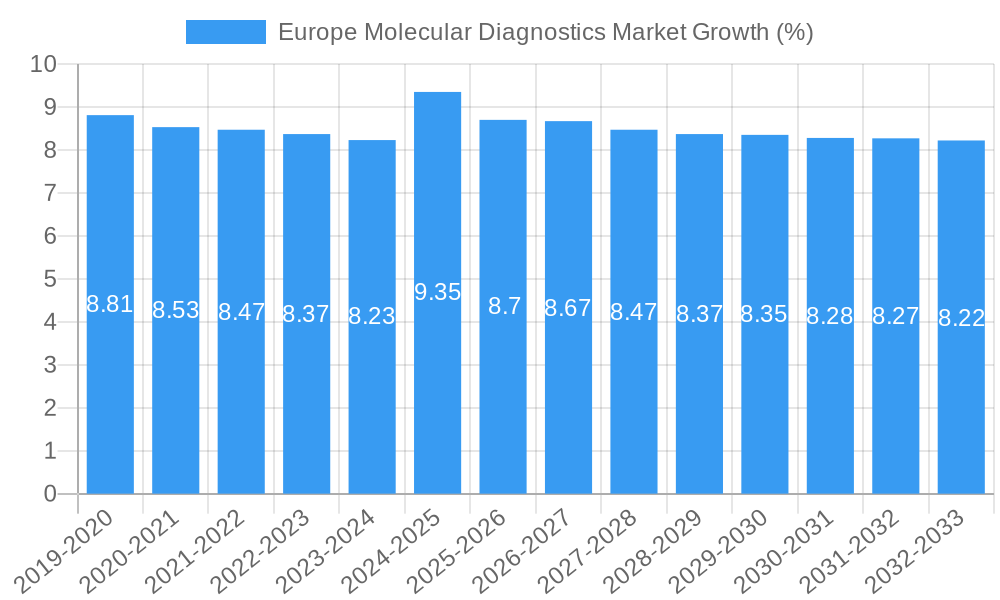

The European Molecular Diagnostics Market is poised for substantial growth, projected to reach approximately USD 3.45 million by 2025 and expand at a robust Compound Annual Growth Rate (CAGR) of 8.96% through 2033. This dynamic market is fueled by increasing prevalence of infectious diseases, a growing focus on personalized medicine in oncology, and advancements in pharmacogenomics. Key drivers include rising healthcare expenditure, increasing demand for early disease detection and accurate diagnostics, and supportive government initiatives promoting the adoption of advanced diagnostic technologies. The market's expansion is further propelled by innovative technologies such as In Situ Hybridization (ISH), Mass Spectrometry (MS), and advanced Sequencing techniques, which offer greater sensitivity and specificity in disease identification. Laboratories and hospitals are significantly investing in these technologies to enhance patient care and streamline diagnostic workflows.

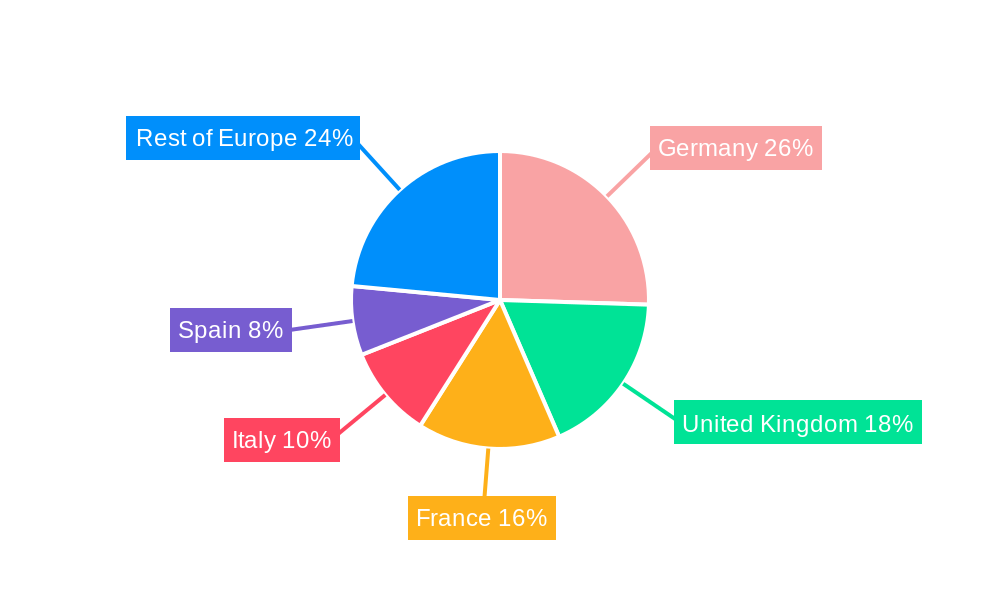

The molecular diagnostics landscape in Europe is characterized by a diverse range of applications, with infectious diseases and oncology emerging as dominant segments. Genetic disease testing and pharmacogenomics are also witnessing significant traction as healthcare providers increasingly adopt precision medicine approaches. The market is segmented by product into Instruments, Reagents, and Other Products, with instruments and reagents forming the core of the diagnostic process. Major players like Becton Dickinson and Company, bioMérieux SA, Abbott Laboratories, Danaher Corporation, F. Hoffmann-la Roche Ltd, and Thermo Fisher Scientific are actively engaged in research and development, product launches, and strategic collaborations to capture a larger market share. Restraints such as high initial investment costs for advanced instrumentation and the need for skilled personnel to operate complex diagnostic systems are present but are being overcome by technological advancements and increased accessibility. The growth in Europe is expected to be broad-based, with Germany, the United Kingdom, and France leading the adoption of molecular diagnostics due to their well-established healthcare infrastructure and significant R&D investments.

This in-depth report provides a panoramic view of the Europe Molecular Diagnostics Market, meticulously analyzing its present landscape and forecasting its trajectory through 2033. We delve into the intricate dynamics of market structure, competitive strategies, emerging trends, dominant segments, product innovations, and the pivotal drivers and challenges shaping this vital sector. This report is an indispensable resource for stakeholders seeking to understand and capitalize on the substantial growth and evolving opportunities within the European molecular diagnostics arena. Our study period spans from 2019 to 2033, with a base year of 2025, and a comprehensive forecast period from 2025 to 2033, building upon historical data from 2019 to 2024.

Europe Molecular Diagnostics Market Market Structure & Competitive Landscape

The Europe Molecular Diagnostics Market exhibits a moderately concentrated structure, characterized by a blend of large, established players and agile, emerging innovators. Key drivers of innovation include advancements in next-generation sequencing (NGS), polymerase chain reaction (PCR) technologies, and the increasing integration of artificial intelligence (AI) for data analysis. Regulatory frameworks, such as the In Vitro Diagnostic Regulation (IVDR) in Europe, exert significant influence, promoting standardization and ensuring product safety, thereby shaping market entry strategies and product development pipelines.

Product substitutes are continuously emerging, driven by the pursuit of faster, more accurate, and cost-effective diagnostic solutions. The end-user segmentation reveals a robust demand from hospitals and specialized diagnostic laboratories, driven by their critical role in patient care and research. Mergers and acquisitions (M&A) are a notable trend, with companies seeking to consolidate market share, acquire cutting-edge technologies, and expand their geographical reach. For instance, the past few years have seen several strategic acquisitions aimed at bolstering portfolios in oncology and infectious disease testing. The overall market concentration is influenced by the significant R&D investments required for molecular diagnostic technologies, creating high barriers to entry for new players.

Europe Molecular Diagnostics Market Market Trends & Opportunities

The Europe Molecular Diagnostics Market is poised for substantial expansion, projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 11.2% from 2025 to 2033, reaching an estimated market size of over xx Million Euros by 2033. This robust growth is underpinned by several converging trends. The increasing prevalence of chronic diseases, particularly oncology and infectious diseases, is a primary catalyst, driving demand for accurate and early diagnostic tools. Personalized medicine, a paradigm shift in healthcare, is fueling the growth of pharmacogenomics testing, enabling tailored treatment strategies based on an individual's genetic makeup.

Technological advancements are continuously reshaping the market. The widespread adoption of next-generation sequencing (NGS) has revolutionized genetic analysis, offering unprecedented resolution and throughput for disease detection and research. PCR-based diagnostics continue to be a cornerstone, particularly for infectious disease screening, due to their speed and sensitivity. Furthermore, the integration of bioinformatics and AI is enhancing the interpretation of complex molecular data, leading to more precise diagnoses and prognostic predictions.

Consumer preferences are evolving towards more proactive and preventive healthcare approaches. This has led to a rising demand for genetic predisposition testing and early disease detection services. The competitive landscape is characterized by intense R&D efforts, strategic partnerships, and a focus on developing multiplex assays that can simultaneously detect multiple analytes, thereby improving efficiency and reducing costs. The market penetration of molecular diagnostics is steadily increasing across various healthcare settings, driven by growing awareness among healthcare professionals and patients about the benefits of molecular-based testing. Opportunities abound in developing novel diagnostic platforms for emerging infectious agents, expanding the application of molecular diagnostics in rare disease identification, and enhancing point-of-care molecular testing solutions for greater accessibility and faster turnaround times. The growing emphasis on companion diagnostics, which link diagnostic tests to specific therapies, presents a significant growth avenue, particularly in the oncology sector.

Dominant Markets & Segments in Europe Molecular Diagnostics Market

The Europe Molecular Diagnostics Market is characterized by several dominant regions and segments, each contributing significantly to its overall growth. Geographically, Western European countries, including Germany, the United Kingdom, France, and Italy, represent the largest markets due to their advanced healthcare infrastructure, high per capita healthcare spending, and robust research and development ecosystems. The Nordic countries are also showing significant growth, driven by strong government initiatives in personalized medicine and digital health.

Within the technology segment, Polymerase Chain Reaction (PCR) remains a dominant force, particularly for infectious disease diagnostics, owing to its established reliability, speed, and cost-effectiveness. However, Sequencing technologies, especially Next-Generation Sequencing (NGS), are experiencing exponential growth, revolutionizing genetic disease testing, oncology diagnostics, and pharmacogenomics. Chips and Microarrays also hold a significant share, especially in gene expression profiling and SNP analysis. Mass Spectrometry (MS) is gaining traction for its ability to identify and quantify a wide range of biomolecules, with increasing applications in proteomics and metabolomics.

In terms of applications, Oncology is a leading segment, fueled by the demand for targeted therapies and companion diagnostics. Infectious Diseases testing continues to be a substantial market, especially in light of global health concerns and the need for rapid pathogen identification. Genetic Disease Testing is also a rapidly expanding area, driven by advancements in prenatal screening and rare disease diagnosis. Pharmacogenomics is a burgeoning segment, critical for optimizing drug efficacy and minimizing adverse drug reactions. Microbiology is another key application, with molecular methods offering significant advantages over traditional culture-based techniques for pathogen identification and antimicrobial resistance profiling.

The Product segment is dominated by Reagents and Consumables, owing to their repetitive purchase cycles and high usage rates across various molecular diagnostic assays. Instruments represent a significant initial investment but drive ongoing reagent sales. End-user-wise, Hospitals are major consumers, particularly for routine testing and acute care diagnostics. Laboratories, including independent diagnostic labs and research institutions, are also significant contributors, often specializing in advanced molecular testing.

Key growth drivers in these dominant segments include:

- Technological Advancements: Continuous innovation in PCR, NGS, and CRISPR-based technologies.

- Increasing Disease Burden: Rising incidence of cancer, infectious diseases, and genetic disorders.

- Government Initiatives: Supportive policies and funding for R&D and diagnostic infrastructure.

- Focus on Personalized Medicine: Growing adoption of pharmacogenomics and targeted therapies.

- Point-of-Care Testing (POCT) Expansion: Development of rapid, portable molecular diagnostic devices.

- Regulatory Approvals: Streamlined approval processes for novel molecular diagnostic tests.

Europe Molecular Diagnostics Market Product Analysis

The Europe Molecular Diagnostics Market is witnessing a surge in product innovation, driven by the pursuit of enhanced sensitivity, specificity, and speed. Key product advancements focus on multiplexing capabilities, allowing for the simultaneous detection of multiple targets, thereby improving efficiency and reducing turnaround times. The integration of liquid biopsy technologies in oncology is a significant trend, offering non-invasive methods for cancer detection, monitoring, and treatment selection. Furthermore, the development of advanced reagent formulations and assay kits, optimized for specific platforms like PCR and NGS, is crucial for delivering accurate and reliable results. The competitive advantage lies in developing user-friendly, automated solutions that can be implemented in diverse healthcare settings, from large reference laboratories to point-of-care facilities.

Key Drivers, Barriers & Challenges in Europe Molecular Diagnostics Market

Key Drivers, Barriers & Challenges in Europe Molecular Diagnostics Market

The Europe Molecular Diagnostics Market is propelled by a confluence of factors. Technologically, rapid advancements in sequencing, PCR, and multiplex assay development are driving innovation and expanding application areas. Economically, increasing healthcare expenditure, coupled with a growing demand for personalized medicine, fuels market growth. Policy-driven factors, such as government investments in R&D and the push for early disease detection, further bolster the market. Specific examples include the expanding use of companion diagnostics in oncology, enabled by regulatory support.

However, the market faces significant challenges. Regulatory hurdles, including the stringent requirements of the IVDR, can prolong product development and market entry timelines, leading to increased costs and complexity. Supply chain disruptions, as evidenced by recent global events, can impact the availability of critical reagents and components. Competitive pressures from established players and emerging innovators necessitate continuous R&D investment to maintain market share. The high cost of certain molecular diagnostic platforms and assays can also act as a barrier to widespread adoption in some regions or healthcare settings.

Growth Drivers in the Europe Molecular Diagnostics Market Market

Key growth drivers in the Europe Molecular Diagnostics Market are multifaceted. Technological advancements, particularly in Next-Generation Sequencing (NGS) and Polymerase Chain Reaction (PCR) technologies, are continuously expanding the scope and accuracy of molecular diagnostics. The increasing global burden of chronic diseases, including cancer and infectious diseases, coupled with a growing emphasis on early detection and personalized treatment, significantly boosts demand. Economic factors, such as rising healthcare expenditure and the growing affordability of advanced diagnostic solutions, contribute to market expansion. Furthermore, favorable government initiatives and policies promoting diagnostic innovation and public health infrastructure development play a crucial role. For instance, the European Union's focus on rare diseases and its support for research in this area are driving growth in genetic disease testing.

Challenges Impacting Europe Molecular Diagnostics Market Growth

Challenges impacting the Europe Molecular Diagnostics Market growth include stringent regulatory landscapes, particularly the European Union's In Vitro Diagnostic Regulation (IVDR), which imposes rigorous requirements for market approval, increasing development costs and timeframes. Supply chain vulnerabilities, as highlighted by recent global events, can lead to shortages of critical reagents and components, disrupting manufacturing and testing. Competitive pressures from a large number of market participants necessitate significant investment in research and development to maintain a competitive edge. The high cost associated with certain advanced molecular diagnostic technologies and assays can also pose a barrier to widespread adoption, especially in resource-constrained healthcare settings.

Key Players Shaping the Europe Molecular Diagnostics Market Market

- Becton Dickinson and Company

- bioMerieux SA

- Abbott Laboratories

- Danaher Corporation

- F Hoffmann-la Roche Ltd

- Qiagen NV

- Sysmex Corporation

- Myriad Genetics

- Illumina Inc

- Genomic Health Inc

- Hologic Corporation

- Thermo Fisher Scientific

- Agilent Technologies

Significant Europe Molecular Diagnostics Market Industry Milestones

- September 2022: SkylineDx launched Merlin Assay as a CE-IVD distributable test kit in Europe, identifying melanoma patients with a low risk for nodal metastasis, potentially enabling them to forgo sentinel lymph node biopsy surgery.

- March 2022: Illumina launched an in-vitro diagnostic test in Europe designed to profile cancer mutations and guide patients towards targeted therapies.

Future Outlook for Europe Molecular Diagnostics Market Market

The future outlook for the Europe Molecular Diagnostics Market is exceptionally promising, driven by sustained innovation and increasing healthcare integration. Strategic opportunities lie in the continued expansion of personalized medicine, the development of advanced infectious disease surveillance systems, and the growing demand for point-of-care molecular diagnostics. The market will witness further advancements in automation, AI-driven diagnostics, and the integration of multi-omics data for comprehensive disease profiling. Growth catalysts include the increasing adoption of companion diagnostics, the rising incidence of age-related diseases, and a global shift towards proactive, preventive healthcare. The market potential is significant, with continuous R&D investments and evolving clinical needs paving the way for groundbreaking diagnostic solutions.

Europe Molecular Diagnostics Market Segmentation

-

1. Technology

- 1.1. In Situ Hybridization

- 1.2. Chips and Microarrays

- 1.3. Mass Spectrometry (MS)

- 1.4. Sequencing

- 1.5. PCR

- 1.6. Other Technologies

-

2. Application

- 2.1. Infectious Diseases

- 2.2. Oncology

- 2.3. Pharmacogenomics

- 2.4. Microbiology

- 2.5. Genetic Disease Testing

- 2.6. Other Applciations

-

3. Product

- 3.1. Instruments

- 3.2. Reagents

- 3.3. Other Products

-

4. End-User

- 4.1. Hospitals

- 4.2. Laboratories

- 4.3. Other End-Users

Europe Molecular Diagnostics Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Rest of Europe

Europe Molecular Diagnostics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.96% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Point-of-care Diagnostics; Advancements in Pharmacogenomics and Other Technologies; Possibility of Outbreaks of Bacterial and Viral Epidemics

- 3.3. Market Restrains

- 3.3.1. Need for High-complexity Testing Centers

- 3.4. Market Trends

- 3.4.1. The Infectious Disease Segment is Expected to Witness High Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Molecular Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. In Situ Hybridization

- 5.1.2. Chips and Microarrays

- 5.1.3. Mass Spectrometry (MS)

- 5.1.4. Sequencing

- 5.1.5. PCR

- 5.1.6. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Infectious Diseases

- 5.2.2. Oncology

- 5.2.3. Pharmacogenomics

- 5.2.4. Microbiology

- 5.2.5. Genetic Disease Testing

- 5.2.6. Other Applciations

- 5.3. Market Analysis, Insights and Forecast - by Product

- 5.3.1. Instruments

- 5.3.2. Reagents

- 5.3.3. Other Products

- 5.4. Market Analysis, Insights and Forecast - by End-User

- 5.4.1. Hospitals

- 5.4.2. Laboratories

- 5.4.3. Other End-Users

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Germany

- 5.5.2. United Kingdom

- 5.5.3. France

- 5.5.4. Italy

- 5.5.5. Spain

- 5.5.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Germany Europe Molecular Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. In Situ Hybridization

- 6.1.2. Chips and Microarrays

- 6.1.3. Mass Spectrometry (MS)

- 6.1.4. Sequencing

- 6.1.5. PCR

- 6.1.6. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Infectious Diseases

- 6.2.2. Oncology

- 6.2.3. Pharmacogenomics

- 6.2.4. Microbiology

- 6.2.5. Genetic Disease Testing

- 6.2.6. Other Applciations

- 6.3. Market Analysis, Insights and Forecast - by Product

- 6.3.1. Instruments

- 6.3.2. Reagents

- 6.3.3. Other Products

- 6.4. Market Analysis, Insights and Forecast - by End-User

- 6.4.1. Hospitals

- 6.4.2. Laboratories

- 6.4.3. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. United Kingdom Europe Molecular Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. In Situ Hybridization

- 7.1.2. Chips and Microarrays

- 7.1.3. Mass Spectrometry (MS)

- 7.1.4. Sequencing

- 7.1.5. PCR

- 7.1.6. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Infectious Diseases

- 7.2.2. Oncology

- 7.2.3. Pharmacogenomics

- 7.2.4. Microbiology

- 7.2.5. Genetic Disease Testing

- 7.2.6. Other Applciations

- 7.3. Market Analysis, Insights and Forecast - by Product

- 7.3.1. Instruments

- 7.3.2. Reagents

- 7.3.3. Other Products

- 7.4. Market Analysis, Insights and Forecast - by End-User

- 7.4.1. Hospitals

- 7.4.2. Laboratories

- 7.4.3. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. France Europe Molecular Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. In Situ Hybridization

- 8.1.2. Chips and Microarrays

- 8.1.3. Mass Spectrometry (MS)

- 8.1.4. Sequencing

- 8.1.5. PCR

- 8.1.6. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Infectious Diseases

- 8.2.2. Oncology

- 8.2.3. Pharmacogenomics

- 8.2.4. Microbiology

- 8.2.5. Genetic Disease Testing

- 8.2.6. Other Applciations

- 8.3. Market Analysis, Insights and Forecast - by Product

- 8.3.1. Instruments

- 8.3.2. Reagents

- 8.3.3. Other Products

- 8.4. Market Analysis, Insights and Forecast - by End-User

- 8.4.1. Hospitals

- 8.4.2. Laboratories

- 8.4.3. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Italy Europe Molecular Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. In Situ Hybridization

- 9.1.2. Chips and Microarrays

- 9.1.3. Mass Spectrometry (MS)

- 9.1.4. Sequencing

- 9.1.5. PCR

- 9.1.6. Other Technologies

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Infectious Diseases

- 9.2.2. Oncology

- 9.2.3. Pharmacogenomics

- 9.2.4. Microbiology

- 9.2.5. Genetic Disease Testing

- 9.2.6. Other Applciations

- 9.3. Market Analysis, Insights and Forecast - by Product

- 9.3.1. Instruments

- 9.3.2. Reagents

- 9.3.3. Other Products

- 9.4. Market Analysis, Insights and Forecast - by End-User

- 9.4.1. Hospitals

- 9.4.2. Laboratories

- 9.4.3. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Spain Europe Molecular Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. In Situ Hybridization

- 10.1.2. Chips and Microarrays

- 10.1.3. Mass Spectrometry (MS)

- 10.1.4. Sequencing

- 10.1.5. PCR

- 10.1.6. Other Technologies

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Infectious Diseases

- 10.2.2. Oncology

- 10.2.3. Pharmacogenomics

- 10.2.4. Microbiology

- 10.2.5. Genetic Disease Testing

- 10.2.6. Other Applciations

- 10.3. Market Analysis, Insights and Forecast - by Product

- 10.3.1. Instruments

- 10.3.2. Reagents

- 10.3.3. Other Products

- 10.4. Market Analysis, Insights and Forecast - by End-User

- 10.4.1. Hospitals

- 10.4.2. Laboratories

- 10.4.3. Other End-Users

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Rest of Europe Europe Molecular Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 11.1.1. In Situ Hybridization

- 11.1.2. Chips and Microarrays

- 11.1.3. Mass Spectrometry (MS)

- 11.1.4. Sequencing

- 11.1.5. PCR

- 11.1.6. Other Technologies

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Infectious Diseases

- 11.2.2. Oncology

- 11.2.3. Pharmacogenomics

- 11.2.4. Microbiology

- 11.2.5. Genetic Disease Testing

- 11.2.6. Other Applciations

- 11.3. Market Analysis, Insights and Forecast - by Product

- 11.3.1. Instruments

- 11.3.2. Reagents

- 11.3.3. Other Products

- 11.4. Market Analysis, Insights and Forecast - by End-User

- 11.4.1. Hospitals

- 11.4.2. Laboratories

- 11.4.3. Other End-Users

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 12. Germany Europe Molecular Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 13. United Kingdom Europe Molecular Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 14. France Europe Molecular Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 15. Italy Europe Molecular Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 16. Spain Europe Molecular Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Europe Europe Molecular Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Becton Dickinson and Company

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 bioMerieux SA*List Not Exhaustive

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Abbott Laboratories

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Danaher Corporation

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 F Hoffmann-la Roche Ltd

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Qiagen NV

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Sysmex Corporation

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Myriad Genetics

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Illumina Inc

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Genomic Health Inc

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 Hologic Corporation

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 Thermo Fisher Scientific

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.13 Agilent Technologies

- 18.2.13.1. Overview

- 18.2.13.2. Products

- 18.2.13.3. SWOT Analysis

- 18.2.13.4. Recent Developments

- 18.2.13.5. Financials (Based on Availability)

- 18.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Europe Molecular Diagnostics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Molecular Diagnostics Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Molecular Diagnostics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Molecular Diagnostics Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 3: Europe Molecular Diagnostics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Europe Molecular Diagnostics Market Revenue Million Forecast, by Product 2019 & 2032

- Table 5: Europe Molecular Diagnostics Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 6: Europe Molecular Diagnostics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Europe Molecular Diagnostics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Germany Europe Molecular Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Molecular Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: France Europe Molecular Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Italy Europe Molecular Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Spain Europe Molecular Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe Molecular Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe Molecular Diagnostics Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 15: Europe Molecular Diagnostics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Europe Molecular Diagnostics Market Revenue Million Forecast, by Product 2019 & 2032

- Table 17: Europe Molecular Diagnostics Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 18: Europe Molecular Diagnostics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Europe Molecular Diagnostics Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 20: Europe Molecular Diagnostics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Europe Molecular Diagnostics Market Revenue Million Forecast, by Product 2019 & 2032

- Table 22: Europe Molecular Diagnostics Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 23: Europe Molecular Diagnostics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Europe Molecular Diagnostics Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 25: Europe Molecular Diagnostics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 26: Europe Molecular Diagnostics Market Revenue Million Forecast, by Product 2019 & 2032

- Table 27: Europe Molecular Diagnostics Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 28: Europe Molecular Diagnostics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Europe Molecular Diagnostics Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 30: Europe Molecular Diagnostics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 31: Europe Molecular Diagnostics Market Revenue Million Forecast, by Product 2019 & 2032

- Table 32: Europe Molecular Diagnostics Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 33: Europe Molecular Diagnostics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Europe Molecular Diagnostics Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 35: Europe Molecular Diagnostics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 36: Europe Molecular Diagnostics Market Revenue Million Forecast, by Product 2019 & 2032

- Table 37: Europe Molecular Diagnostics Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 38: Europe Molecular Diagnostics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 39: Europe Molecular Diagnostics Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 40: Europe Molecular Diagnostics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 41: Europe Molecular Diagnostics Market Revenue Million Forecast, by Product 2019 & 2032

- Table 42: Europe Molecular Diagnostics Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 43: Europe Molecular Diagnostics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Molecular Diagnostics Market?

The projected CAGR is approximately 8.96%.

2. Which companies are prominent players in the Europe Molecular Diagnostics Market?

Key companies in the market include Becton Dickinson and Company, bioMerieux SA*List Not Exhaustive, Abbott Laboratories, Danaher Corporation, F Hoffmann-la Roche Ltd, Qiagen NV, Sysmex Corporation, Myriad Genetics, Illumina Inc, Genomic Health Inc, Hologic Corporation, Thermo Fisher Scientific, Agilent Technologies.

3. What are the main segments of the Europe Molecular Diagnostics Market?

The market segments include Technology, Application, Product, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.45 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Point-of-care Diagnostics; Advancements in Pharmacogenomics and Other Technologies; Possibility of Outbreaks of Bacterial and Viral Epidemics.

6. What are the notable trends driving market growth?

The Infectious Disease Segment is Expected to Witness High Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Need for High-complexity Testing Centers.

8. Can you provide examples of recent developments in the market?

In September 2022, SkylineDxv launched Merlin Assay as CE-IVD distributable test kit in Europe. Merlin Assay identifies melanoma (skin cancer) patients with a low risk for nodal metastasis and can safely forgo a sentinel lymph node biopsy (SLNB) surgery.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Molecular Diagnostics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Molecular Diagnostics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Molecular Diagnostics Market?

To stay informed about further developments, trends, and reports in the Europe Molecular Diagnostics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence