Key Insights

The French Pay Later (BNPL) market is experiencing significant expansion, driven by increasing e-commerce penetration and a growing consumer preference for flexible payment options. With a projected Compound Annual Growth Rate (CAGR) of 11.3%, the market is anticipated to reach a size of 12.68 billion by 2025. Key growth drivers include the rising popularity of online shopping, particularly among younger demographics, and the widespread adoption of smartphones and digital financial services. BNPL solutions are demonstrating versatility across various sectors, including consumer electronics, fashion, personal care, and healthcare, offering enhanced convenience and accessibility. While regulatory considerations and consumer debt levels represent potential challenges, the market outlook remains optimistic, supported by ongoing innovation and heightened competition among key providers.

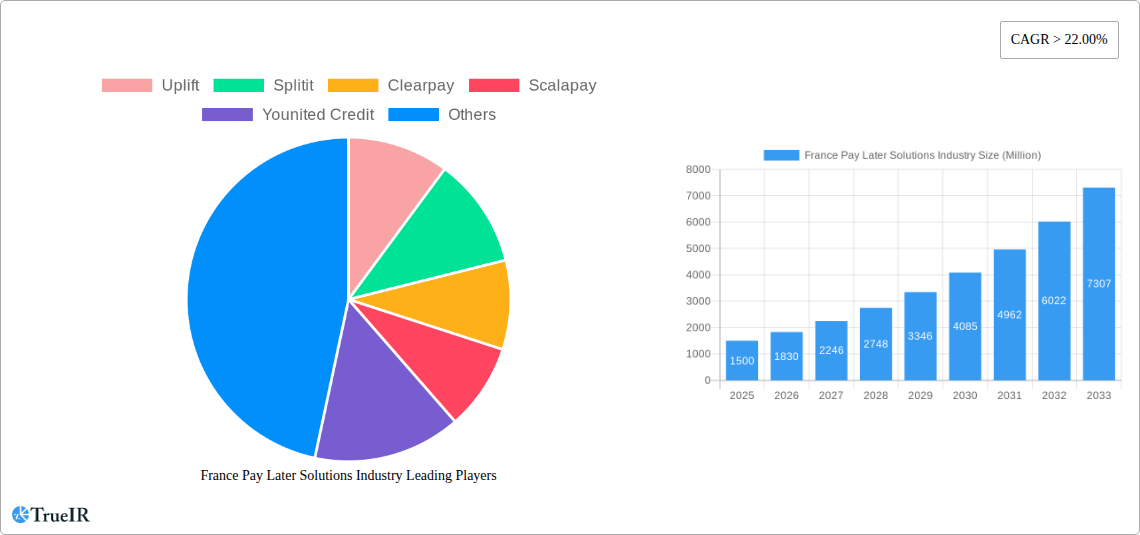

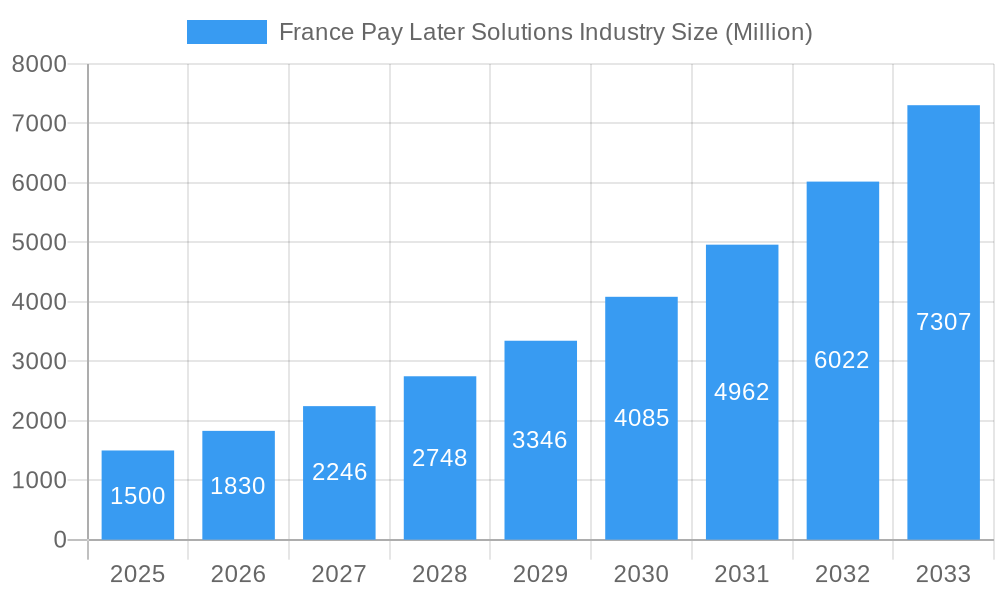

France Pay Later Solutions Industry Market Size (In Billion)

France's strategic position within the European Union, coupled with a digitally adept population and substantial disposable income, establishes it as a crucial European market for BNPL solutions. Competitive dynamics are fostering innovation, with providers continuously enhancing user experience through personalized payment plans, advanced fraud prevention, and strategic retail partnerships. The market's segmentation across online and Point-of-Sale (POS) channels highlights the adaptability of BNPL solutions. Future developments are expected to emphasize responsible lending practices, tailored offers, and the integration of BNPL within broader financial management tools, ensuring sustainable market growth.

France Pay Later Solutions Industry Company Market Share

France Pay Later Solutions Industry Market Overview: 2019-2033

This report offers a comprehensive analysis of the French Pay Later (BNPL) industry, detailing market size, competitive landscape, growth catalysts, challenges, and future projections from 2019 to 2033. Utilizing extensive data and expert insights, the study provides actionable intelligence for stakeholders navigating this evolving market. The analysis encompasses a historical period (2019-2024), a base year (2025), and a forecast period (2025-2033). Key players examined include Uplift, Splitit, Clearpay, Scalapay, Younited Credit, Klarna, Alma, Thunes, PayPal, and Sezzle, among others.

France Pay Later Solutions Industry Market Structure & Competitive Landscape

The French BNPL market exhibits a moderately concentrated structure, with a few dominant players and a growing number of smaller competitors. The market concentration ratio (CR4) is estimated at xx% in 2025. Innovation is a key driver, with companies constantly introducing new features, such as improved risk assessment models and integrations with e-commerce platforms. Regulatory oversight is increasingly stringent, impacting the operational costs and profitability of players. Existing credit cards and traditional financing options serve as substitutes, though the convenience and accessibility of BNPL pose a significant challenge. The end-user segment is diverse, spanning various age groups, income levels, and purchasing behaviors.

- Market Concentration: CR4 estimated at xx% in 2025.

- Innovation Drivers: AI-powered risk assessment, seamless e-commerce integrations.

- Regulatory Impacts: Compliance with PSD2 and other regulations.

- Product Substitutes: Traditional credit cards, personal loans.

- End-User Segmentation: Demographic analysis by age, income, and purchasing behavior.

- M&A Trends: xx number of M&A deals observed between 2019 and 2024, with a total value of approximately €xx Million.

France Pay Later Solutions Industry Market Trends & Opportunities

The French BNPL market is experiencing robust growth, fueled by increasing e-commerce adoption, rising consumer demand for flexible payment options, and advancements in financial technology. The market size is projected to reach €xx Million in 2025, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is driven by several factors, including the increasing popularity of online shopping, the shift in consumer preference towards convenient payment methods, and the expansion of BNPL services into new product categories and retail channels. Technological advancements, such as improved fraud detection systems and enhanced user experiences, are further bolstering market expansion. The rising adoption of mobile payments and the increasing penetration of smartphones also contribute to the market’s growth. Competitive dynamics remain intense, with established players and new entrants vying for market share through strategic partnerships, product innovation, and aggressive marketing campaigns. Market penetration rates are expected to increase significantly, reaching xx% by 2033.

Dominant Markets & Segments in France Pay Later Solutions Industry

The online channel currently dominates the French BNPL market, accounting for xx% of total transactions in 2025. However, the POS segment is rapidly gaining traction, reflecting the increasing adoption of BNPL solutions by brick-and-mortar retailers. Within product categories, Consumer Electronics and Fashion & Personal Care represent the largest segments, driven by higher purchase frequency and higher average transaction values.

- Key Growth Drivers:

- Online Channel: High e-commerce penetration, ease of integration with online platforms.

- POS Channel: Increasing adoption by retailers, improved point-of-sale technology.

- Consumer Electronics: High average transaction value, frequent purchases.

- Fashion & Personal Care: Impulse purchases, diverse product offerings.

France Pay Later Solutions Industry Product Analysis

BNPL solutions in France are characterized by diverse offerings, including fixed-term installment plans, revolving credit lines, and point-of-sale financing. Technological advancements like AI-driven risk assessment and seamless integration with e-commerce platforms are improving the efficiency and security of these services, enhancing their market fit and competitive advantages. The focus on user experience and flexible repayment options has driven significant adoption among consumers.

Key Drivers, Barriers & Challenges in France Pay Later Solutions Industry

Key Drivers:

- Rising e-commerce adoption.

- Increasing consumer demand for flexible payment options.

- Technological advancements (AI, mobile payments).

- Supportive regulatory environment (though evolving).

Key Challenges & Restraints:

- Regulatory uncertainty and evolving compliance requirements.

- Potential for increased consumer debt.

- Intense competition and pricing pressures.

- Risk of fraud and chargebacks. Estimated annual losses due to fraud at €xx Million in 2025.

Growth Drivers in the France Pay Later Solutions Industry Market

The key growth drivers include the rising popularity of e-commerce, increasing consumer preference for flexible payment options, and technological advancements in the BNPL space. Government initiatives promoting financial inclusion and digital payments also contribute to the market's expansion.

Challenges Impacting France Pay Later Solutions Industry Growth

Challenges include regulatory hurdles, stringent KYC/AML compliance requirements, and potential risks associated with rising consumer debt and fraud. Competition from established financial institutions and other BNPL providers also poses a significant challenge.

Significant France Pay Later Solutions Industry Industry Milestones

- July 2021: Air Tahiti partners with Uplift to offer BNPL to travelers.

- November 2021: Younited Credit partners with Bankable and LiftForward to launch a BNPL product in Italy.

Future Outlook for France Pay Later Solutions Industry Market

The French BNPL market is poised for continued expansion, driven by ongoing technological advancements, increasing consumer adoption, and further penetration into new market segments. Strategic partnerships, product innovation, and aggressive marketing efforts will be crucial for success in this competitive landscape. The market presents significant opportunities for both established players and new entrants, with substantial growth potential predicted throughout the forecast period.

France Pay Later Solutions Industry Segmentation

-

1. Channel

- 1.1. Online

- 1.2. POS

-

2. Product Category

- 2.1. Consumer Electronics

- 2.2. Fashion and Personal Care

- 2.3. Health Care

- 2.4. Other Products

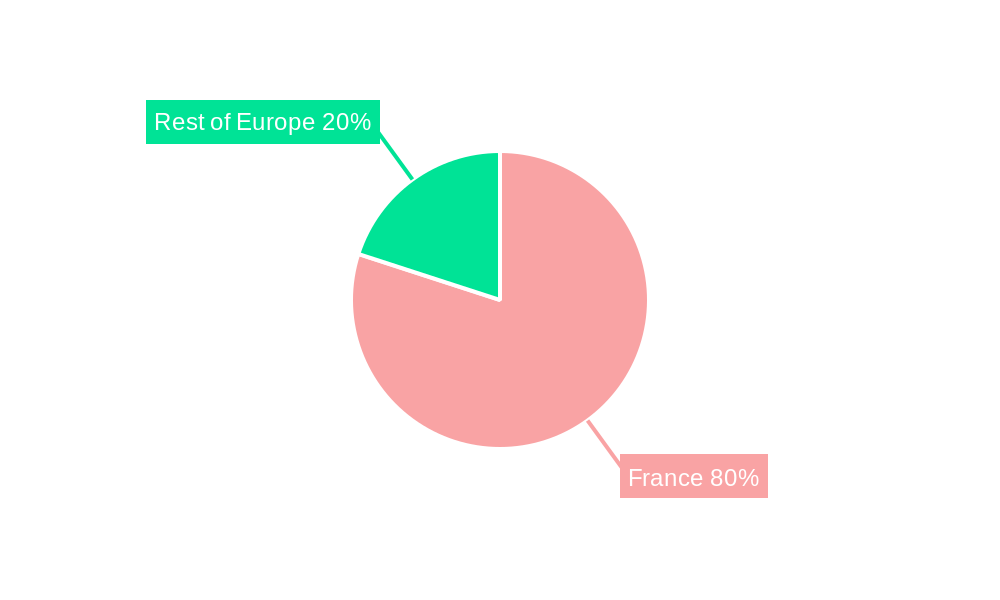

France Pay Later Solutions Industry Segmentation By Geography

- 1. France

France Pay Later Solutions Industry Regional Market Share

Geographic Coverage of France Pay Later Solutions Industry

France Pay Later Solutions Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Motorcycle Ownership; Customized Loan Options

- 3.3. Market Restrains

- 3.3.1. Market Saturation and Competition; Changing Mobility Preferences

- 3.4. Market Trends

- 3.4.1. Affordable and Convenient Payment Service of Buy Now Pay Later Platforms

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Pay Later Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 5.1.1. Online

- 5.1.2. POS

- 5.2. Market Analysis, Insights and Forecast - by Product Category

- 5.2.1. Consumer Electronics

- 5.2.2. Fashion and Personal Care

- 5.2.3. Health Care

- 5.2.4. Other Products

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Uplift

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Splitit

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Clearpay

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Scalapay

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Younited Credit

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Klarna

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Alma

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Thunes**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Paypal

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sezzle

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Uplift

List of Figures

- Figure 1: France Pay Later Solutions Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: France Pay Later Solutions Industry Share (%) by Company 2025

List of Tables

- Table 1: France Pay Later Solutions Industry Revenue billion Forecast, by Channel 2020 & 2033

- Table 2: France Pay Later Solutions Industry Revenue billion Forecast, by Product Category 2020 & 2033

- Table 3: France Pay Later Solutions Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: France Pay Later Solutions Industry Revenue billion Forecast, by Channel 2020 & 2033

- Table 5: France Pay Later Solutions Industry Revenue billion Forecast, by Product Category 2020 & 2033

- Table 6: France Pay Later Solutions Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Pay Later Solutions Industry?

The projected CAGR is approximately 11.3%.

2. Which companies are prominent players in the France Pay Later Solutions Industry?

Key companies in the market include Uplift, Splitit, Clearpay, Scalapay, Younited Credit, Klarna, Alma, Thunes**List Not Exhaustive, Paypal, Sezzle.

3. What are the main segments of the France Pay Later Solutions Industry?

The market segments include Channel, Product Category.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.68 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Motorcycle Ownership; Customized Loan Options.

6. What are the notable trends driving market growth?

Affordable and Convenient Payment Service of Buy Now Pay Later Platforms.

7. Are there any restraints impacting market growth?

Market Saturation and Competition; Changing Mobility Preferences.

8. Can you provide examples of recent developments in the market?

July 2021: Air Tahiti entered into a strategic partnership with Fly Now Pay Later provider, Uplift. Under the collaboration, travelers booking Air Tahiti can pay in installments using the BNPL payment method offered by Uplift. Notably, Uplift has partnered with over 200 airlines to offer its BNPL payment method to travelers worldwide.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Pay Later Solutions Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Pay Later Solutions Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Pay Later Solutions Industry?

To stay informed about further developments, trends, and reports in the France Pay Later Solutions Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence