Key Insights

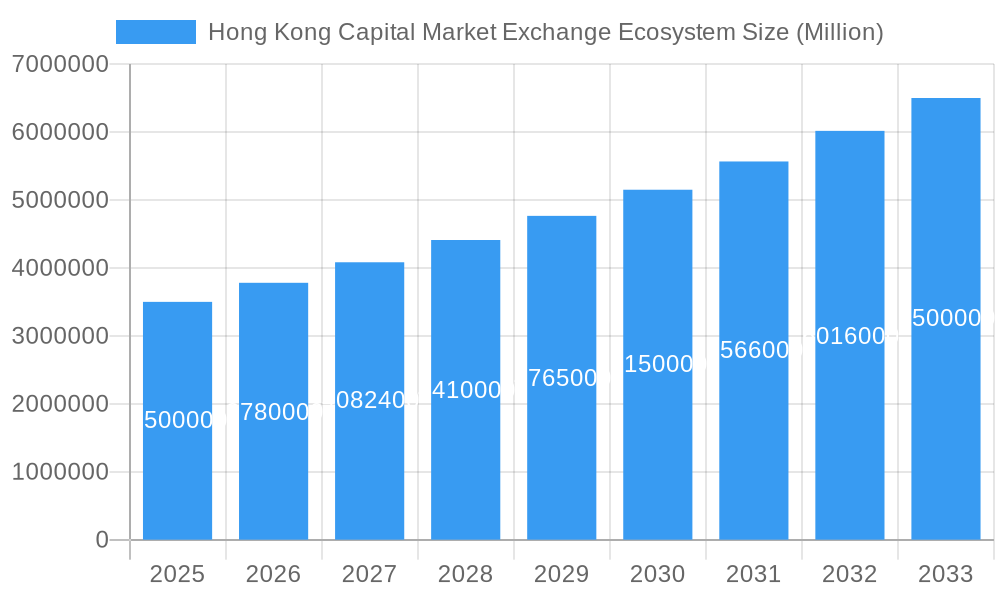

The Hong Kong Capital Market Exchange Ecosystem, exhibiting a robust Compound Annual Growth Rate (CAGR) of 8.00% from 2019 to 2024, is poised for continued expansion. This growth is fueled by several key drivers, including Hong Kong's strategic position as a leading financial hub in Asia, its robust regulatory framework attracting both domestic and international investment, and the increasing participation of Chinese companies in global capital markets. Furthermore, technological advancements, such as the rise of fintech and digital trading platforms, are streamlining operations and broadening access, contributing significantly to market expansion. While competitive pressures from other regional financial centers and global economic uncertainties represent potential restraints, the sustained growth trajectory suggests a positive outlook for the foreseeable future. The substantial involvement of major players like Tencent, Alibaba, and others reflects the market's dynamism and future potential. The diverse segment composition, encompassing equities, bonds, and derivatives, ensures resilience against market fluctuations. Based on the provided CAGR, and assuming a continued positive trend in investment and market participation, a conservative projection of market size in 2025 would be in the range of US$ 3.5 trillion, with substantial growth projected through 2033.

Hong Kong Capital Market Exchange Ecosystem Market Size (In Million)

The forecast period (2025-2033) promises continued expansion driven by several converging factors. The ongoing integration of mainland China's financial markets with Hong Kong's, particularly under the “Greater Bay Area” initiative, is expected to further amplify growth. Moreover, increasing foreign direct investment (FDI) into Hong Kong, coupled with efforts to enhance market liquidity and efficiency, suggests a sustained upward trajectory. However, risks such as geopolitical uncertainty and potential regulatory changes will warrant continuous monitoring. The ecosystem's future success depends on maintaining its competitive edge through technological innovation, regulatory adaptability, and attracting both local and international talent. A diversified investor base, including retail investors, institutional investors, and high-net-worth individuals, underpin the ecosystem's stability and resilience. The continuing dominance of established players while accommodating new entrants and innovative technologies points to a healthy and dynamic market environment.

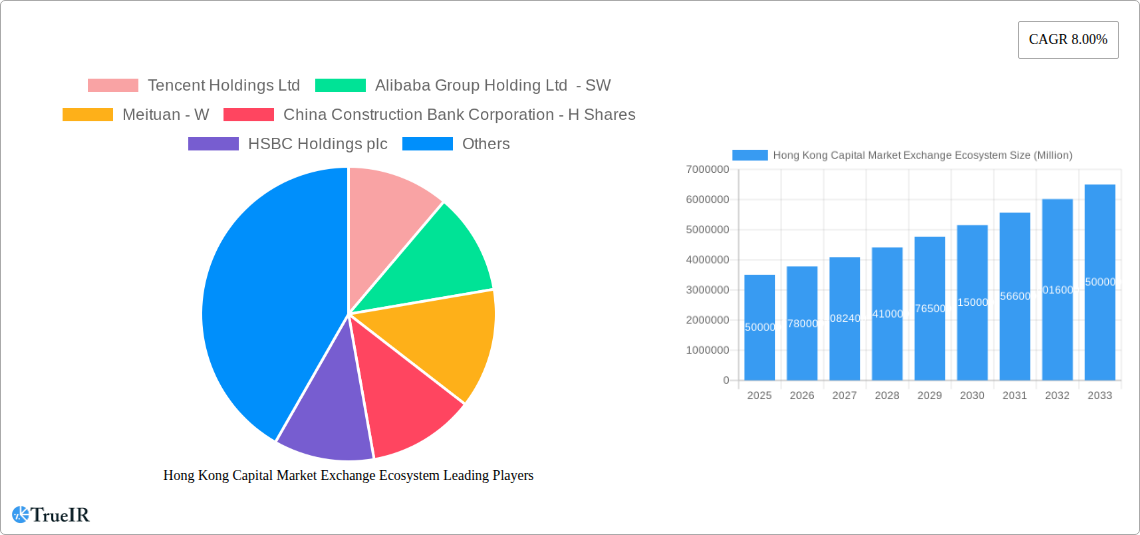

Hong Kong Capital Market Exchange Ecosystem Company Market Share

This dynamic report provides a deep dive into the Hong Kong Capital Market Exchange Ecosystem, offering a comprehensive analysis of its structure, trends, and future outlook from 2019 to 2033. Leveraging extensive data and insightful analysis, this report is essential for investors, businesses, and policymakers seeking to understand this vibrant and rapidly evolving market. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024.

Hong Kong Capital Market Exchange Ecosystem Market Structure & Competitive Landscape

This section analyzes the competitive intensity and market dynamics within the Hong Kong Capital Market Exchange Ecosystem. We examine market concentration using various ratios, identifying key players and assessing their market share. The report explores innovation drivers, including technological advancements and regulatory changes, and evaluates the impact of substitute products and services. Further, we examine the evolving end-user segments and analyze M&A trends, including the volume and value of deals within the period. Qualitative insights are provided to contextualize the quantitative data.

- Market Concentration: The Hong Kong market exhibits a moderately concentrated structure with a Herfindahl-Hirschman Index (HHI) estimated at xx in 2025. Key players such as Tencent Holdings Ltd, Alibaba Group Holding Ltd - SW, and HSBC Holdings plc hold significant market share.

- Innovation Drivers: Technological advancements, particularly in fintech and digitalization, are driving significant innovation. Regulatory reforms aimed at attracting international investment and promoting competition also play a crucial role.

- Regulatory Impacts: The Hong Kong Monetary Authority (HKMA) actively shapes the regulatory environment, influencing market structure and competitive dynamics. The report details the impact of key regulations on market players.

- M&A Trends: The report analyzes the M&A activity within the Hong Kong Capital Market Exchange Ecosystem, identifying key trends and patterns, with estimated M&A volume totaling xx Million USD during the period 2019-2024.

Hong Kong Capital Market Exchange Ecosystem Market Trends & Opportunities

This section examines the growth trajectory of the Hong Kong Capital Market Exchange Ecosystem. It details the market size (in Millions of USD) and projects its future growth, including Compound Annual Growth Rate (CAGR) and market penetration rates. The analysis accounts for technological shifts, evolving consumer preferences, and competitive dynamics influencing market growth.

The Hong Kong Capital Market Exchange Ecosystem is projected to reach xx Million USD in 2025 and xx Million USD by 2033, representing a CAGR of xx%. Factors like the increasing adoption of technology in financial services and the growing investor base are major growth drivers. The market penetration rate for digital trading platforms is anticipated to increase from xx% in 2025 to xx% in 2033. Competitive dynamics, including the entry of new players and strategic alliances, are further dissected.

Dominant Markets & Segments in Hong Kong Capital Market Exchange Ecosystem

This section identifies the leading segments and sub-segments within the Hong Kong Capital Market Exchange Ecosystem. We analyze the factors contributing to their dominance, including supportive infrastructure, favorable government policies, and strong investor interest.

- Key Growth Drivers:

- Robust regulatory framework fostering investor confidence.

- Well-developed financial infrastructure.

- Strategic geographic location facilitating access to Asian markets.

- Government initiatives to promote innovation and attract foreign investment.

The dominance of specific segments is further explained considering their unique characteristics and advantages within the overall market structure. Analysis includes quantitative data, such as revenue shares and market projections for leading sectors.

Hong Kong Capital Market Exchange Ecosystem Product Analysis

This section summarizes the major product innovations and applications, highlighting their competitive advantages. The analysis focuses on technological advancements and market fit, assessing factors such as user-friendliness, cost-effectiveness, and regulatory compliance. The continuous evolution of trading platforms and related financial technologies contributes significantly to the market's dynamic nature.

Key Drivers, Barriers & Challenges in Hong Kong Capital Market Exchange Ecosystem

This section analyzes the major factors driving growth within the ecosystem, emphasizing technological advancements, economic expansion, and supportive government policies, including specific examples such as the introduction of new trading platforms and government incentives for fintech firms. It also addresses key challenges and constraints impacting the market, such as regulatory hurdles, supply chain disruptions, and intensifying competitive pressures. Quantifiable impacts where available are included.

Growth Drivers in the Hong Kong Capital Market Exchange Ecosystem Market

Key growth drivers for the Hong Kong Capital Market Exchange Ecosystem include: Government initiatives to promote fintech innovation; increasing adoption of digital trading platforms; growing participation of individual investors; and strong economic growth in Hong Kong and the wider Asian region. These factors are expected to fuel significant growth throughout the forecast period.

Challenges Impacting Hong Kong Capital Market Exchange Ecosystem Growth

Challenges include: Geopolitical uncertainties and potential regulatory changes impacting investor sentiment; competition from other regional financial hubs; and potential talent shortages within the financial technology sector. These factors pose significant challenges to sustainable market growth.

Key Players Shaping the Hong Kong Capital Market Exchange Ecosystem Market

Significant Hong Kong Capital Market Exchange Ecosystem Industry Milestones

- March 2023: Credit Suisse reopened its Hong Kong branch following UBS's takeover, highlighting resilience within the market.

- March 2022: AIA Group announced a USD 10 Billion share repurchase program, reflecting confidence in the market's long-term prospects.

Future Outlook for Hong Kong Capital Market Exchange Ecosystem Market

The Hong Kong Capital Market Exchange Ecosystem is poised for continued growth, driven by technological innovation, supportive government policies, and the region's strong economic fundamentals. Strategic partnerships and investments in fintech are expected to unlock further opportunities, strengthening Hong Kong's position as a leading Asian financial center. The market's future outlook remains positive, with continued expansion anticipated across key segments.

Hong Kong Capital Market Exchange Ecosystem Segmentation

-

1. Type of Market

- 1.1. Primary Market

- 1.2. Secondary Market

-

2. Financial Product

- 2.1. Debt

- 2.2. Equity

-

3. Investors

- 3.1. Retail Investors

- 3.2. Institutional Investors

Hong Kong Capital Market Exchange Ecosystem Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

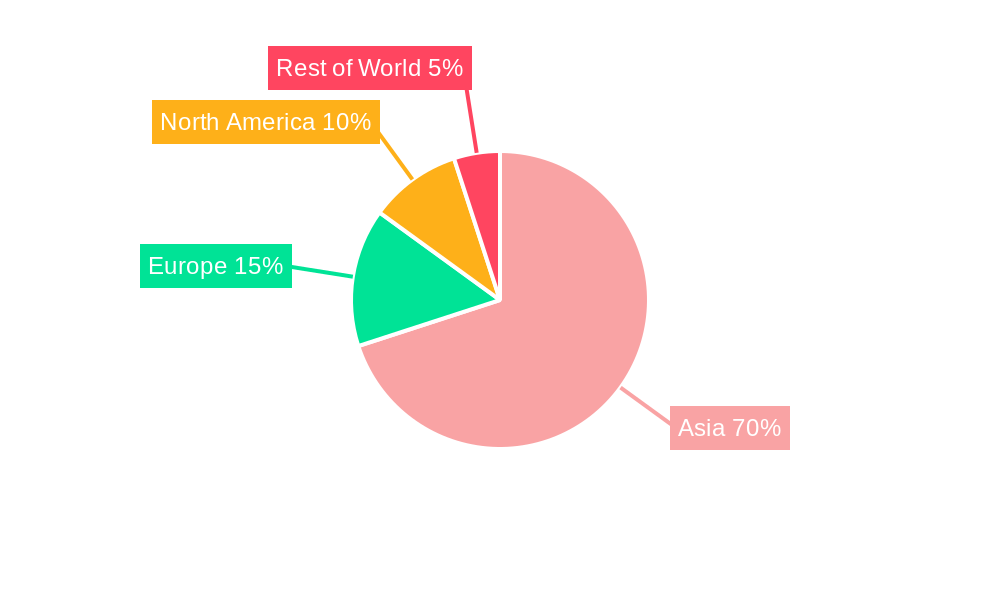

Hong Kong Capital Market Exchange Ecosystem Regional Market Share

Geographic Coverage of Hong Kong Capital Market Exchange Ecosystem

Hong Kong Capital Market Exchange Ecosystem REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1 Investment and Holding

- 3.4.2 Real Estate

- 3.4.3 Professional and Business Services are Major FDIs in Hong Kong

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hong Kong Capital Market Exchange Ecosystem Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Market

- 5.1.1. Primary Market

- 5.1.2. Secondary Market

- 5.2. Market Analysis, Insights and Forecast - by Financial Product

- 5.2.1. Debt

- 5.2.2. Equity

- 5.3. Market Analysis, Insights and Forecast - by Investors

- 5.3.1. Retail Investors

- 5.3.2. Institutional Investors

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type of Market

- 6. North America Hong Kong Capital Market Exchange Ecosystem Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Market

- 6.1.1. Primary Market

- 6.1.2. Secondary Market

- 6.2. Market Analysis, Insights and Forecast - by Financial Product

- 6.2.1. Debt

- 6.2.2. Equity

- 6.3. Market Analysis, Insights and Forecast - by Investors

- 6.3.1. Retail Investors

- 6.3.2. Institutional Investors

- 6.1. Market Analysis, Insights and Forecast - by Type of Market

- 7. South America Hong Kong Capital Market Exchange Ecosystem Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Market

- 7.1.1. Primary Market

- 7.1.2. Secondary Market

- 7.2. Market Analysis, Insights and Forecast - by Financial Product

- 7.2.1. Debt

- 7.2.2. Equity

- 7.3. Market Analysis, Insights and Forecast - by Investors

- 7.3.1. Retail Investors

- 7.3.2. Institutional Investors

- 7.1. Market Analysis, Insights and Forecast - by Type of Market

- 8. Europe Hong Kong Capital Market Exchange Ecosystem Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Market

- 8.1.1. Primary Market

- 8.1.2. Secondary Market

- 8.2. Market Analysis, Insights and Forecast - by Financial Product

- 8.2.1. Debt

- 8.2.2. Equity

- 8.3. Market Analysis, Insights and Forecast - by Investors

- 8.3.1. Retail Investors

- 8.3.2. Institutional Investors

- 8.1. Market Analysis, Insights and Forecast - by Type of Market

- 9. Middle East & Africa Hong Kong Capital Market Exchange Ecosystem Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Market

- 9.1.1. Primary Market

- 9.1.2. Secondary Market

- 9.2. Market Analysis, Insights and Forecast - by Financial Product

- 9.2.1. Debt

- 9.2.2. Equity

- 9.3. Market Analysis, Insights and Forecast - by Investors

- 9.3.1. Retail Investors

- 9.3.2. Institutional Investors

- 9.1. Market Analysis, Insights and Forecast - by Type of Market

- 10. Asia Pacific Hong Kong Capital Market Exchange Ecosystem Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Market

- 10.1.1. Primary Market

- 10.1.2. Secondary Market

- 10.2. Market Analysis, Insights and Forecast - by Financial Product

- 10.2.1. Debt

- 10.2.2. Equity

- 10.3. Market Analysis, Insights and Forecast - by Investors

- 10.3.1. Retail Investors

- 10.3.2. Institutional Investors

- 10.1. Market Analysis, Insights and Forecast - by Type of Market

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Tencent Holdings Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Alibaba Group Holding Ltd - SW

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Meituan - W

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 China Construction Bank Corporation - H Shares

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 HSBC Holdings plc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 China Mobile Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AIA Group Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 JD com Inc - SW

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hong Kong Exchanges and Clearing Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 NetEase Inc **List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Tencent Holdings Ltd

List of Figures

- Figure 1: Global Hong Kong Capital Market Exchange Ecosystem Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Type of Market 2025 & 2033

- Figure 3: North America Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Type of Market 2025 & 2033

- Figure 4: North America Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Financial Product 2025 & 2033

- Figure 5: North America Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Financial Product 2025 & 2033

- Figure 6: North America Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Investors 2025 & 2033

- Figure 7: North America Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Investors 2025 & 2033

- Figure 8: North America Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Type of Market 2025 & 2033

- Figure 11: South America Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Type of Market 2025 & 2033

- Figure 12: South America Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Financial Product 2025 & 2033

- Figure 13: South America Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Financial Product 2025 & 2033

- Figure 14: South America Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Investors 2025 & 2033

- Figure 15: South America Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Investors 2025 & 2033

- Figure 16: South America Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Type of Market 2025 & 2033

- Figure 19: Europe Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Type of Market 2025 & 2033

- Figure 20: Europe Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Financial Product 2025 & 2033

- Figure 21: Europe Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Financial Product 2025 & 2033

- Figure 22: Europe Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Investors 2025 & 2033

- Figure 23: Europe Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Investors 2025 & 2033

- Figure 24: Europe Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Type of Market 2025 & 2033

- Figure 27: Middle East & Africa Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Type of Market 2025 & 2033

- Figure 28: Middle East & Africa Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Financial Product 2025 & 2033

- Figure 29: Middle East & Africa Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Financial Product 2025 & 2033

- Figure 30: Middle East & Africa Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Investors 2025 & 2033

- Figure 31: Middle East & Africa Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Investors 2025 & 2033

- Figure 32: Middle East & Africa Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Type of Market 2025 & 2033

- Figure 35: Asia Pacific Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Type of Market 2025 & 2033

- Figure 36: Asia Pacific Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Financial Product 2025 & 2033

- Figure 37: Asia Pacific Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Financial Product 2025 & 2033

- Figure 38: Asia Pacific Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Investors 2025 & 2033

- Figure 39: Asia Pacific Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Investors 2025 & 2033

- Figure 40: Asia Pacific Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Type of Market 2020 & 2033

- Table 2: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Financial Product 2020 & 2033

- Table 3: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Investors 2020 & 2033

- Table 4: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Type of Market 2020 & 2033

- Table 6: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Financial Product 2020 & 2033

- Table 7: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Investors 2020 & 2033

- Table 8: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Type of Market 2020 & 2033

- Table 13: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Financial Product 2020 & 2033

- Table 14: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Investors 2020 & 2033

- Table 15: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Type of Market 2020 & 2033

- Table 20: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Financial Product 2020 & 2033

- Table 21: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Investors 2020 & 2033

- Table 22: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Type of Market 2020 & 2033

- Table 33: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Financial Product 2020 & 2033

- Table 34: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Investors 2020 & 2033

- Table 35: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Type of Market 2020 & 2033

- Table 43: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Financial Product 2020 & 2033

- Table 44: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Investors 2020 & 2033

- Table 45: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hong Kong Capital Market Exchange Ecosystem?

The projected CAGR is approximately 8.00%.

2. Which companies are prominent players in the Hong Kong Capital Market Exchange Ecosystem?

Key companies in the market include Tencent Holdings Ltd, Alibaba Group Holding Ltd - SW, Meituan - W, China Construction Bank Corporation - H Shares, HSBC Holdings plc, China Mobile Ltd, AIA Group Ltd, JD com Inc - SW, Hong Kong Exchanges and Clearing Ltd, NetEase Inc **List Not Exhaustive.

3. What are the main segments of the Hong Kong Capital Market Exchange Ecosystem?

The market segments include Type of Market, Financial Product, Investors.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Investment and Holding. Real Estate. Professional and Business Services are Major FDIs in Hong Kong.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In March 2023, In Hong Kong, Credit Suisse reopened as usual following UBS's US$3.25 billion takeover. Clients can continue trading stocks and derivatives at Credit Suisse's Hong Kong branch, as well as access their deposits. With assets of HK$100 billion (US$12.74 billion), or roughly 0.5 percent of the city's total banking assets, Credit Suisse operates just one branch in Hong Kong.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hong Kong Capital Market Exchange Ecosystem," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hong Kong Capital Market Exchange Ecosystem report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hong Kong Capital Market Exchange Ecosystem?

To stay informed about further developments, trends, and reports in the Hong Kong Capital Market Exchange Ecosystem, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence