Key Insights

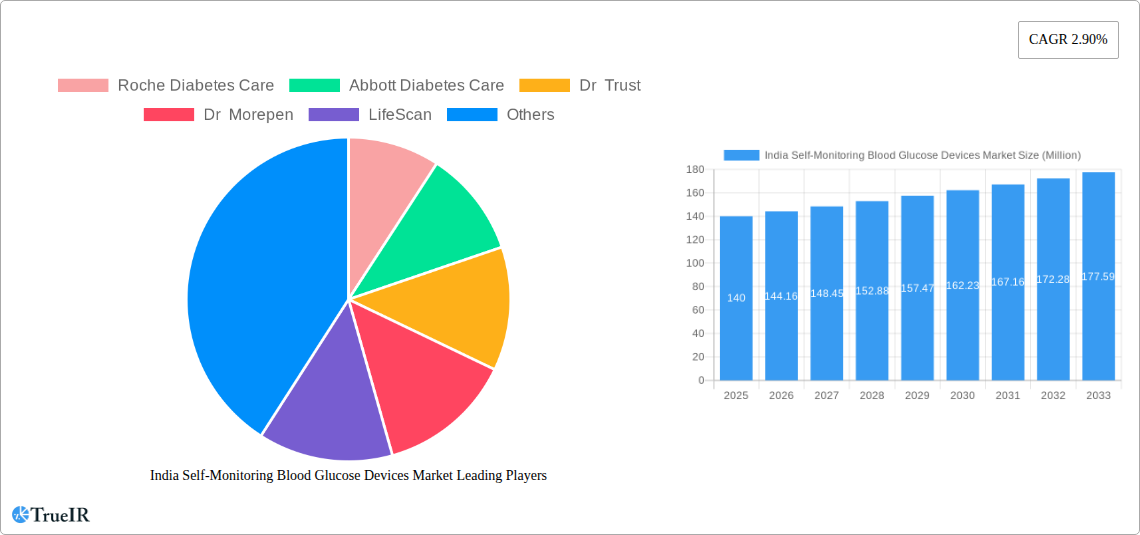

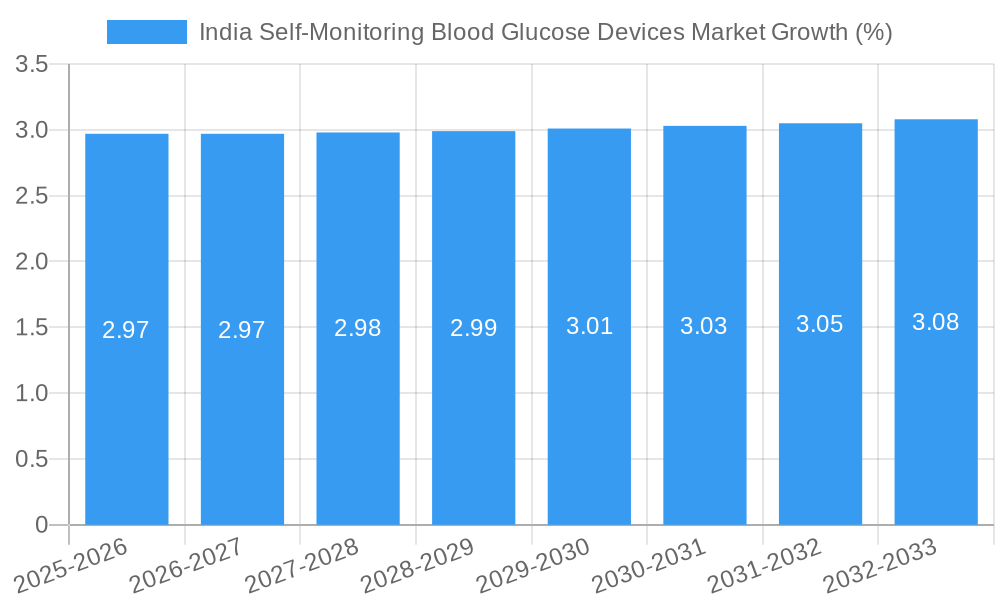

The Indian Self-Monitoring Blood Glucose Devices Market is poised for significant expansion, with a projected market size of USD 140 million in 2025, growing at a Compound Annual Growth Rate (CAGR) of 2.90% from 2019 to 2033. This robust growth is underpinned by a confluence of factors, including the escalating prevalence of diabetes, increasing health consciousness among the population, and the growing adoption of advanced glucose monitoring technologies. The market is witnessing a shift towards digital and connected devices, offering greater convenience and accuracy for individuals managing their diabetes. Key market drivers include rising disposable incomes, a growing emphasis on preventive healthcare, and supportive government initiatives aimed at improving diabetes care infrastructure. The increasing demand for user-friendly and portable glucometers, coupled with the expanding awareness of the benefits of regular blood glucose monitoring for preventing long-term complications, are further fueling market growth.

The market is segmented into several key components, with glucometer devices and test strips forming the largest share. Lancets also play a crucial role in the overall ecosystem. Prominent players such as Roche Diabetes Care, Abbott Diabetes Care, Dr. Trust, and Dr. Morepen are actively engaged in product innovation and market expansion, catering to the diverse needs of the Indian consumer base. Emerging trends indicate a strong inclination towards smart glucometers with app connectivity for data logging and analysis, which is transforming the self-monitoring landscape. However, challenges such as the initial cost of advanced devices and the need for greater awareness regarding the importance of regular testing in semi-urban and rural areas need to be addressed to unlock the full market potential. The continuous innovation in diagnostic technologies and the increasing focus on chronic disease management by healthcare providers are expected to sustain the positive growth trajectory of the Indian self-monitoring blood glucose devices market in the coming years.

This in-depth report provides a granular analysis of the India Self-Monitoring Blood Glucose (SMBG) Devices Market, encompassing market structure, competitive landscape, trends, opportunities, product analysis, and future outlook. Leveraging high-volume keywords such as "diabetes care India," "blood glucose monitoring devices," "SMBG market India," "glucometer India," and "diabetes management India," this report is designed for industry stakeholders seeking actionable insights and strategic planning. The study covers the historical period from 2019 to 2024, with the base and estimated year set at 2025, and a comprehensive forecast period extending from 2025 to 2033. The total market valuation is projected to reach USD 1,500 Million by 2025, with a significant Compound Annual Growth Rate (CAGR) of 8.5% during the forecast period.

India Self-Monitoring Blood Glucose Devices Market Market Structure & Competitive Landscape

The India Self-Monitoring Blood Glucose Devices Market is characterized by a moderately concentrated landscape, with key global players holding substantial market share alongside a growing number of domestic manufacturers and emerging digital health platforms. Innovation is a primary driver, fueled by the increasing demand for accurate, user-friendly, and connected SMBG devices. Regulatory impacts, though evolving, are becoming more significant, with a focus on quality standards and data security. Product substitutes exist in the form of continuous glucose monitoring (CGM) devices, which are gaining traction, particularly among tech-savvy and insulin-dependent diabetic populations. End-user segmentation is crucial, with distinct needs for individuals with Type 1 diabetes, Type 2 diabetes, gestational diabetes, and pre-diabetes. Mergers & Acquisitions (M&A) trends are relatively nascent but are expected to gain momentum as larger players seek to expand their product portfolios and market reach within the burgeoning Indian diabetes care ecosystem. Industry consolidation is anticipated as companies strive to achieve economies of scale and broaden their competitive edge in this dynamic market.

India Self-Monitoring Blood Glucose Devices Market Market Trends & Opportunities

The India Self-Monitoring Blood Glucose Devices Market is poised for robust growth, driven by a confluence of factors including rising diabetes prevalence, increasing health awareness, and a growing middle class with enhanced disposable income. The market size for SMBG devices in India is estimated to have reached USD 1,200 Million in 2024 and is projected to expand to USD 1,500 Million by 2025, exhibiting a substantial CAGR of 8.5% during the forecast period (2025-2033). Technological shifts are profoundly impacting the market, with a discernible move towards smart glucometers that offer Bluetooth connectivity, data logging capabilities, and integration with mobile applications. This facilitates seamless data sharing with healthcare providers, enabling more personalized diabetes management. Consumer preferences are increasingly leaning towards convenience, accuracy, and affordability. The demand for minimally invasive lancing devices and easy-to-use test strips is also on the rise. Competitive dynamics are intensifying, with both established global brands and agile domestic players vying for market share. The increasing penetration of e-commerce platforms like Amazon and Flipkart has further democratized access to SMBG devices, creating new avenues for market expansion. Furthermore, government initiatives aimed at improving diabetes care infrastructure and promoting preventive healthcare are creating significant opportunities for market participants. The adoption of digital health solutions, including telehealth and remote patient monitoring, is expected to accelerate the growth of the SMBG market, as these technologies integrate seamlessly with SMBG devices.

Dominant Markets & Segments in India Self-Monitoring Blood Glucose Devices Market

The Glucometer Devices segment currently holds the dominant position within the India Self-Monitoring Blood Glucose Devices Market, accounting for approximately 60% of the total market revenue. This dominance is attributed to the fundamental need for a device to measure blood glucose levels. Within this segment, the demand for handheld, portable glucometers with enhanced accuracy and user-friendly interfaces is particularly strong. The Test Strips segment follows, representing approximately 35% of the market share. The growth of this segment is intrinsically linked to the sales of glucometer devices, as test strips are consumables required for each measurement. The ongoing development of highly accurate and reliable test strips with extended shelf lives is a key growth driver. The Lancets segment, while smaller, constitutes the remaining 5% of the market. Innovations in painless lancing technology and disposable lancet packs are crucial for sustained growth in this sub-segment. Geographically, the urban and semi-urban regions of India represent the dominant markets due to higher disposable incomes, greater awareness of diabetes management, and better access to healthcare facilities and advanced technology. The southern states, including Tamil Nadu, Karnataka, and Kerala, along with Maharashtra and Gujarat in the west, are leading the charge in SMBG device adoption. Government policies promoting diabetes screening programs and increasing healthcare expenditure in these regions further bolster market dominance.

India Self-Monitoring Blood Glucose Devices Market Product Analysis

Product innovations in the India Self-Monitoring Blood Glucose Devices Market are primarily focused on enhancing user experience, accuracy, and connectivity. Smart glucometers with Bluetooth capabilities that sync with smartphone apps are gaining significant traction, allowing for automated data logging, trend analysis, and easy sharing with healthcare providers. Fewer-drop blood sample requirements and faster testing times are also key competitive advantages being pursued by manufacturers. The integration of SMBG devices with digital diabetes management platforms is a crucial trend, offering a holistic approach to care. Applications range from simple blood glucose tracking to advanced predictive analytics for managing diabetes complications.

Key Drivers, Barriers & Challenges in India Self-Monitoring Blood Glucose Devices Market

Key Drivers:

- Rising Prevalence of Diabetes: India is projected to have a substantial diabetic population, creating a massive and growing demand for SMBG devices.

- Increasing Health Awareness & Disposable Income: Growing awareness about diabetes management and improved economic conditions are enabling more individuals to invest in self-monitoring tools.

- Technological Advancements: Development of smart, connected, and user-friendly SMBG devices is driving adoption.

- Government Initiatives: Programs promoting diabetes screening and management contribute to market growth.

Barriers & Challenges:

- Affordability: While prices are declining, the initial cost of some advanced devices and the ongoing expense of test strips can be a barrier for lower-income segments.

- Limited Awareness in Rural Areas: Penetration of SMBG devices is lower in rural India due to limited awareness and access to information.

- Regulatory Hurdles: Navigating evolving medical device regulations can be complex for manufacturers.

- Counterfeit Products: The presence of counterfeit or sub-standard devices can erode consumer trust and pose health risks.

Growth Drivers in the India Self-Monitoring Blood Glucose Devices Market Market

The India Self-Monitoring Blood Glucose Devices Market is significantly propelled by the escalating prevalence of diabetes and pre-diabetes across the nation, creating a vast and ever-expanding user base. Increasing health consciousness among the Indian population, coupled with a rising disposable income, is empowering individuals to proactively manage their health, leading to a higher adoption rate of SMBG devices. Technological innovations, such as the introduction of smart glucometers with seamless smartphone integration and advanced data analytics capabilities, are making blood glucose monitoring more convenient and effective. Furthermore, supportive government policies and increasing investments in healthcare infrastructure, particularly in urban and semi-urban areas, are creating a conducive environment for market expansion.

Challenges Impacting India Self-Monitoring Blood Glucose Devices Market Growth

Despite the positive growth trajectory, the India Self-Monitoring Blood Glucose Devices Market faces several challenges. The significant cost of test strips, while declining, remains a considerable barrier for a large segment of the population, impacting consistent monitoring. Limited awareness and accessibility of advanced diabetes management tools in remote and rural areas of India hinder market penetration. Navigating the complex and evolving regulatory landscape for medical devices in India can present challenges for both domestic and international manufacturers. Moreover, the competitive pressure from both established global players and emerging local brands, coupled with the threat of counterfeit products, can impact market dynamics and consumer trust.

Key Players Shaping the India Self-Monitoring Blood Glucose Devices Market Market

- Roche Diabetes Care

- Abbott Diabetes Care

- Dr Trust

- Dr Morepen

- LifeScan

- Menarini

- BeatO

- Arkray Inc

- Ascensia Diabetes Care

Significant India Self-Monitoring Blood Glucose Devices Market Industry Milestones

- May 2023: Roche Diabetes Care collaborated with Sanmina-SCI India and Parekh Integrated Services for manufacturing and distribution of blood glucose devices. The production of Accu-Chek Active metres will take place in Sanmina’s multi-client manufacturing site in Chennai, bearing the ‘Made in India’ tag.

- March 2022: Zyla Health launched an integrated offering with Accu-Chek, combining a smart glucometer with continuous diabetes care by doctors and experts. This offering was launched on Amazon & Flipkart.

Future Outlook for India Self-Monitoring Blood Glucose Devices Market Market

- May 2023: Roche Diabetes Care collaborated with Sanmina-SCI India and Parekh Integrated Services for manufacturing and distribution of blood glucose devices. The production of Accu-Chek Active metres will take place in Sanmina’s multi-client manufacturing site in Chennai, bearing the ‘Made in India’ tag.

- March 2022: Zyla Health launched an integrated offering with Accu-Chek, combining a smart glucometer with continuous diabetes care by doctors and experts. This offering was launched on Amazon & Flipkart.

Future Outlook for India Self-Monitoring Blood Glucose Devices Market Market

The future outlook for the India Self-Monitoring Blood Glucose Devices Market is exceptionally bright, driven by persistent high diabetes prevalence and an increasing emphasis on preventive healthcare. The ongoing integration of SMBG devices with digital health ecosystems, including telehealth and AI-powered diabetes management platforms, will be a key growth catalyst. Expect to see a surge in demand for connected glucometers that offer real-time data insights and personalized feedback. The market will also witness continued innovation in user-friendly designs, painless blood sampling technologies, and improved accuracy of test strips. The expanding reach of e-commerce and growing health awareness in Tier 2 and Tier 3 cities will further fuel market penetration, positioning India as a significant global hub for diabetes self-monitoring solutions.

India Self-Monitoring Blood Glucose Devices Market Segmentation

-

1. Component

- 1.1. Glucometer Devices

- 1.2. Test Strips

- 1.3. Lancets

India Self-Monitoring Blood Glucose Devices Market Segmentation By Geography

- 1. India

India Self-Monitoring Blood Glucose Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment

- 3.3. Market Restrains

- 3.3.1. High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Rising Diabetes Prevalence in India

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Self-Monitoring Blood Glucose Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Glucometer Devices

- 5.1.2. Test Strips

- 5.1.3. Lancets

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North India India Self-Monitoring Blood Glucose Devices Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Self-Monitoring Blood Glucose Devices Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Self-Monitoring Blood Glucose Devices Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Self-Monitoring Blood Glucose Devices Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Roche Diabetes Care

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Abbott Diabetes Care

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Dr Trust

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Dr Morepen

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 LifeScan

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Menarini

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 BeatO

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Arkray Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Ascensia Diabetes Care

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Roche Diabetes Care

List of Figures

- Figure 1: India Self-Monitoring Blood Glucose Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Self-Monitoring Blood Glucose Devices Market Share (%) by Company 2024

List of Tables

- Table 1: India Self-Monitoring Blood Glucose Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Self-Monitoring Blood Glucose Devices Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: India Self-Monitoring Blood Glucose Devices Market Revenue Million Forecast, by Component 2019 & 2032

- Table 4: India Self-Monitoring Blood Glucose Devices Market Volume K Unit Forecast, by Component 2019 & 2032

- Table 5: India Self-Monitoring Blood Glucose Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: India Self-Monitoring Blood Glucose Devices Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: India Self-Monitoring Blood Glucose Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: India Self-Monitoring Blood Glucose Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: North India India Self-Monitoring Blood Glucose Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North India India Self-Monitoring Blood Glucose Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 11: South India India Self-Monitoring Blood Glucose Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South India India Self-Monitoring Blood Glucose Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: East India India Self-Monitoring Blood Glucose Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: East India India Self-Monitoring Blood Glucose Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: West India India Self-Monitoring Blood Glucose Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: West India India Self-Monitoring Blood Glucose Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: India Self-Monitoring Blood Glucose Devices Market Revenue Million Forecast, by Component 2019 & 2032

- Table 18: India Self-Monitoring Blood Glucose Devices Market Volume K Unit Forecast, by Component 2019 & 2032

- Table 19: India Self-Monitoring Blood Glucose Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: India Self-Monitoring Blood Glucose Devices Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Self-Monitoring Blood Glucose Devices Market?

The projected CAGR is approximately 2.90%.

2. Which companies are prominent players in the India Self-Monitoring Blood Glucose Devices Market?

Key companies in the market include Roche Diabetes Care, Abbott Diabetes Care, Dr Trust, Dr Morepen, LifeScan, Menarini, BeatO, Arkray Inc, Ascensia Diabetes Care.

3. What are the main segments of the India Self-Monitoring Blood Glucose Devices Market?

The market segments include Component.

4. Can you provide details about the market size?

The market size is estimated to be USD 140 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment.

6. What are the notable trends driving market growth?

Rising Diabetes Prevalence in India.

7. Are there any restraints impacting market growth?

High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

May 2023: Roche Diabetes Care has collaborated with Sanmina-SCI India and Parekh Integrated Services for manufacturing and distribution of the blood glucose devices. The production of Accu-Chek Active metres will take place in Sanmina’s multi-client manufacturing site in Chennai, in line with globally approved quality standards, the company has said. The new Accu-Chek Active product packs will now display the ‘Made in India’ tag.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Self-Monitoring Blood Glucose Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Self-Monitoring Blood Glucose Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Self-Monitoring Blood Glucose Devices Market?

To stay informed about further developments, trends, and reports in the India Self-Monitoring Blood Glucose Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence