Key Insights

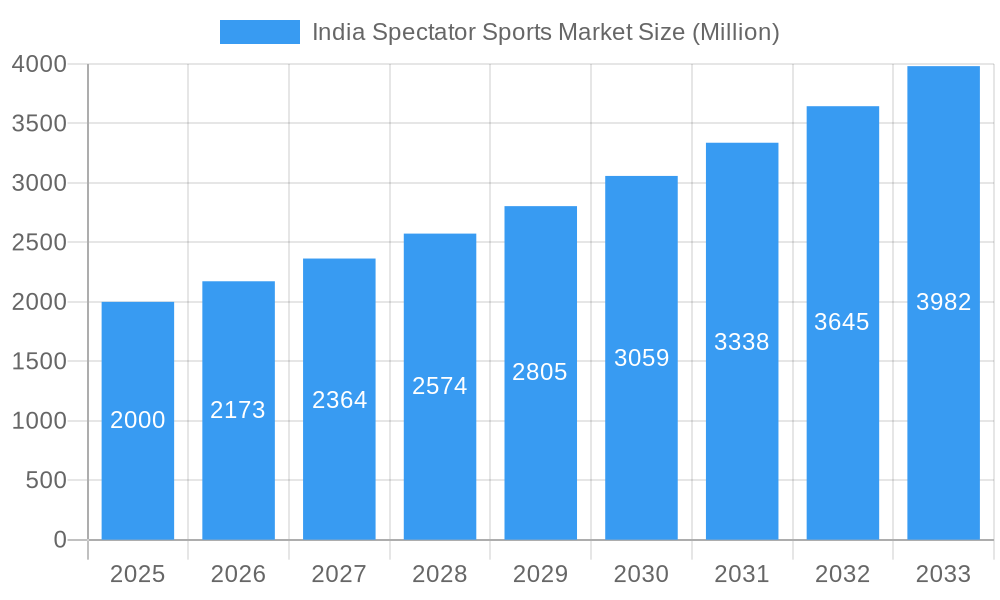

The India Spectator Sports Market is poised for significant expansion, driven by a youthful demographic's passion for sports and growing disposable incomes. The market, valued at approximately $235.23 billion in 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 6% from 2025 to 2033. Key growth drivers include the increasing popularity of cricket and football, amplified media coverage, and a surge in sponsorship and merchandising activities. Government initiatives and investments in sports infrastructure further bolster this growth. Cricket dominates the "Type of Sport" segment, while media rights are the leading revenue generator. Challenges such as infrastructure limitations and attendance variability are acknowledged, but the overall outlook is positive. Opportunities lie in leveraging digital engagement, exploring esports and virtual events, and expanding into underserved regions.

India Spectator Sports Market Market Size (In Billion)

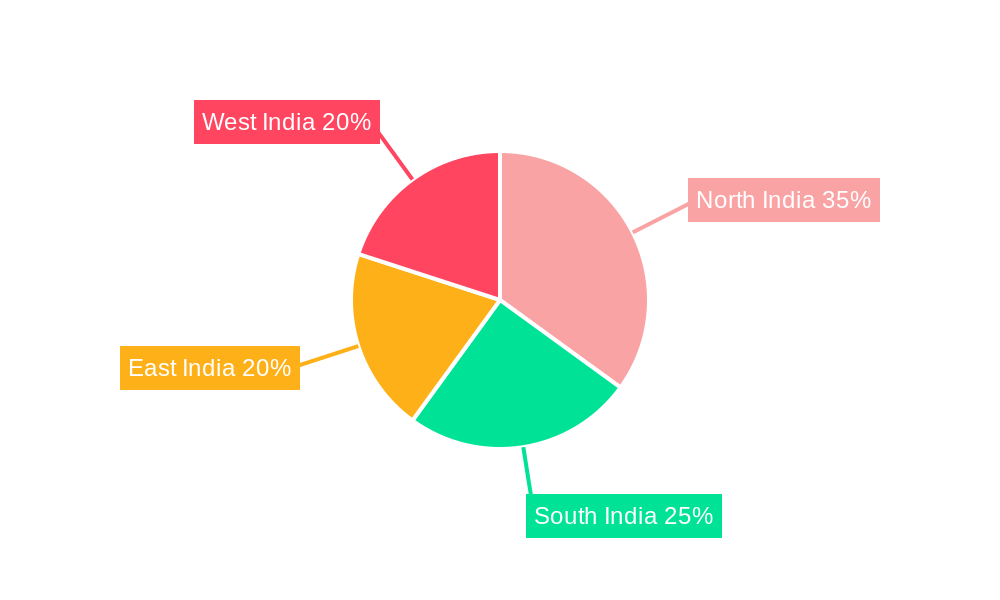

Regional market penetration varies across India. While specific data is limited, North and West India are expected to maintain market leadership due to higher population density and established sporting cultures. South and East India, however, are anticipated to experience above-average growth, driven by the rising popularity of sports. Key market participants include the Board of Control for Cricket in India (BCCI), emerging sports management firms, and academies. Diversifying revenue streams through digital platforms, strategic talent development, and investment will be critical for sustained success in this competitive market.

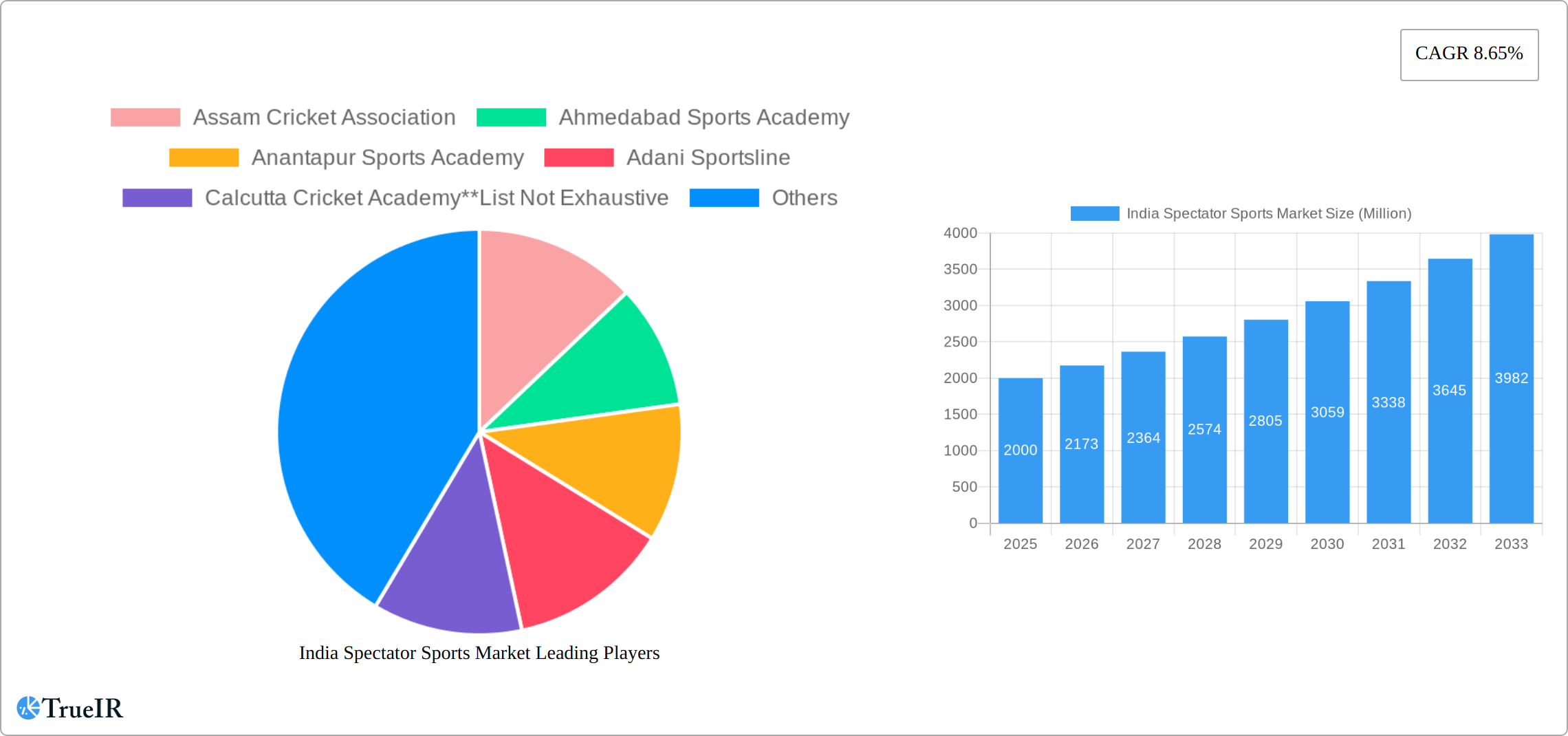

India Spectator Sports Market Company Market Share

This comprehensive report offers deep insights into the Indian spectator sports market, catering to investors, industry professionals, and strategic decision-makers. Covering the period from 2019 to 2033, with a 2025 base year and a forecast period of 2025-2033, the analysis provides a holistic view of the market's current standing and future prospects. It includes detailed segment analysis, key player profiles, and significant industry developments, presenting a 360-degree perspective on this high-growth sector.

India Spectator Sports Market Market Structure & Competitive Landscape

The Indian spectator sports market presents a dynamic landscape characterized by moderate concentration, with key players like the Board of Control for Cricket in India (BCCI) holding substantial market share, primarily within cricket. However, a wave of growth is transforming the sector, driven by increased participation across various sports, amplified media coverage, and substantial investments in infrastructure development. While the 2025 concentration ratio (CR4) is estimated at xx%, indicating a moderately consolidated market, the sector's inherent dynamism suggests a constantly shifting competitive balance. Innovation is a key driver, with technologies like virtual reality (VR) and augmented reality (AR) enhancing fan engagement and the rise of fantasy sports platforms creating new avenues for participation and revenue generation.

Regulatory frameworks, largely influenced by governing bodies such as the BCCI and the All India Football Federation (AIFF), significantly shape the market's trajectory. While direct product substitutes are limited, the availability of diverse entertainment options creates a form of indirect competition. End-user segmentation is primarily driven by demographic factors, including age, geographic location, and individual sports preferences, resulting in notable variations in consumption patterns across different groups. Mergers and acquisitions (M&A) activity in the Indian spectator sports sector remains relatively low compared to other industries, with an estimated xx deals concluded between 2019 and 2024. Nevertheless, a noticeable increase in strategic partnerships and investments highlights the growing interest of corporate entities in capitalizing on the sector's potential.

- Market Concentration: Moderately concentrated, with a CR4 of xx% in 2025, indicating room for both established players and emerging competitors.

- Innovation Drivers: VR/AR experiences, fantasy sports platforms, and data-driven fan engagement strategies are reshaping the industry.

- Regulatory Impacts: Significant influence from BCCI, AIFF, and other governing bodies, creating both opportunities and challenges for market players.

- Product Substitutes: Limited direct substitutes, but indirect competition from other entertainment options necessitates continuous innovation and engagement strategies.

- End-User Segmentation: Primarily driven by demographics (age, location, sports preference), requiring targeted marketing and content strategies.

- M&A Trends: Relatively low volume (xx deals between 2019-2024), with a growing trend of strategic partnerships and investments signaling increased sector interest.

India Spectator Sports Market Market Trends & Opportunities

The India spectator sports market is experiencing robust growth, driven by a burgeoning middle class with increasing disposable incomes, a rising passion for sports amongst the youth, and significant investments in sports infrastructure. The market size grew from xx Million in 2019 to xx Million in 2024, reflecting a CAGR of xx%. This upward trajectory is projected to continue, with the market expected to reach xx Million by 2033. Technological advancements, including improved broadcasting capabilities (HD, 4K, streaming), mobile access, and interactive platforms, are enhancing fan engagement and creating new revenue streams.

Consumer preferences are increasingly sophisticated, demanding immersive experiences and personalized interactions. Competitive dynamics are intense, with key players focusing on strategic partnerships, talent acquisition, and innovative marketing strategies to gain a competitive edge. Market penetration rates for specific sports vary significantly, with cricket enjoying the highest penetration, followed by other sports like hockey, football, and badminton at a growing rate.

The market presents lucrative opportunities for companies involved in media rights, merchandising, sponsorships, and infrastructure development. The growing popularity of fantasy sports and esports also presents significant potential for expansion.

Dominant Markets & Segments in India Spectator Sports Market

Cricket remains the undisputed dominant sport in India, commanding the lion's share of viewership, media rights revenue, and sponsorships. However, football, badminton, and hockey are witnessing significant growth, fueled by increased participation, improved infrastructure, and rising media attention.

By Type of Sport:

- Cricket: Dominant market share, driven by high viewership and strong media rights revenue.

- Football: Rapidly growing segment, supported by investments in infrastructure and league development.

- Badminton: Significant growth driven by increased participation and success at international level.

- Hockey: Growing popularity, with efforts to improve infrastructure and attract young talent.

- Racing: Niche segment with potential for growth.

- Other Types of Sports: Includes kabaddi, wrestling, etc. showing increasing participation.

By Revenue Source:

- Media Rights: Largest revenue stream, particularly for cricket.

- Sponsoring: Significant revenue source across all sports.

- Ticket Sales: Important source of revenue, especially for major events.

- Merchandising: Growing segment, with increasing demand for sports-related merchandise.

Key Growth Drivers:

- Growing Middle Class: Increased disposable income fuels spending on sports entertainment.

- Improved Infrastructure: Investments in stadiums and training facilities enhance participation and viewership.

- Government Policies: Supportive policies promoting sports development and infrastructure.

- Rising Media Coverage: Increased TV coverage and digital platforms expand reach and engagement.

India Spectator Sports Market Product Analysis

Product innovations focus on enhancing fan engagement through interactive technologies, improved broadcasting quality (HD, 4K, VR/AR), and personalized content. Applications range from live streaming and fantasy sports platforms to interactive mobile apps. The competitive advantage lies in delivering innovative, immersive, and personalized experiences that cater to the evolving demands of the discerning Indian sports fan.

Key Drivers, Barriers & Challenges in India Spectator Sports Market

Key Drivers:

- Rising disposable incomes and a growing middle class are driving increased spending on spectator sports.

- Government initiatives and policies promoting sports development are creating a favorable environment for growth.

- Investments in infrastructure, such as new stadiums and training facilities, are boosting participation and viewership.

- Increased media coverage and the rise of digital platforms are enhancing fan engagement and creating new revenue streams.

Challenges and Restraints:

- Competition from other entertainment options can impact participation and viewership.

- Infrastructure gaps in certain regions can limit access and participation.

- Regulatory hurdles and bureaucratic complexities can hinder market development.

- Lack of consistent high-level success in international competition for some sports could impact interest.

Growth Drivers in the India Spectator Sports Market Market

The key drivers for growth are the expanding middle class, government initiatives, improving infrastructure, and the rising popularity of digital platforms. These factors combine to fuel both participation and spectator engagement across various sports.

Challenges Impacting India Spectator Sports Market Growth

Challenges include competition from alternative entertainment, infrastructure gaps in certain regions, and regulatory hurdles. Addressing these challenges is crucial for sustained market growth.

Key Players Shaping the India Spectator Sports Market Market

- Assam Cricket Association

- Ahmedabad Sports Academy

- Anantapur Sports Academy

- Adani Sportsline

- Calcutta Cricket Academy

- Aarka Sports Management

- AllSportsFit

- AIFF Masters

- Board of Control for Cricket in India

- Aavhan IIT Bombay

Significant India Spectator Sports Market Industry Milestones

- September 2023: Football Sports Development Limited (FSDL) announced Viacom18 Media Private Limited as the 'new home of Indian Football' for the 2023-24 and 2024-25 seasons. This deal signifies a significant investment in Indian football and promises enhanced media coverage and fan engagement.

- October 2022: MCC's New Code of Laws for 2022 officially came into force. This update to the laws of cricket has been well-received and impacted the global game, demonstrating a commitment to the modernization and improvement of the sport.

Future Outlook for India Spectator Sports Market Market

The India spectator sports market is poised for continued robust growth, driven by a combination of factors including rising disposable incomes, increasing government support, and technological advancements. Strategic opportunities exist for companies focused on innovative fan engagement, infrastructure development, and the expansion of new sports leagues and competitions. The market's future potential is significant, with opportunities for expansion across all segments and revenue streams.

India Spectator Sports Market Segmentation

-

1. Type of Sports

- 1.1. Cricket

- 1.2. Hockey

- 1.3. Football

- 1.4. Badminton

- 1.5. Racing

- 1.6. Other Types of Sports

-

2. Revenue Source

- 2.1. Media Rights

- 2.2. Merchandising

- 2.3. Ticket

- 2.4. Sponsoring

India Spectator Sports Market Segmentation By Geography

- 1. India

India Spectator Sports Market Regional Market Share

Geographic Coverage of India Spectator Sports Market

India Spectator Sports Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Sponsorships; Viewership of Multiple Sports Channels

- 3.3. Market Restrains

- 3.3.1. Threat From Home Entertainment

- 3.4. Market Trends

- 3.4.1. The Rise of Cricket in India

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Spectator Sports Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Sports

- 5.1.1. Cricket

- 5.1.2. Hockey

- 5.1.3. Football

- 5.1.4. Badminton

- 5.1.5. Racing

- 5.1.6. Other Types of Sports

- 5.2. Market Analysis, Insights and Forecast - by Revenue Source

- 5.2.1. Media Rights

- 5.2.2. Merchandising

- 5.2.3. Ticket

- 5.2.4. Sponsoring

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type of Sports

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Assam Cricket Association

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ahmedabad Sports Academy

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Anantapur Sports Academy

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Adani Sportsline

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Calcutta Cricket Academy**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Aarka Sports Management

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AllSportsFit

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AIFF Masters

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Board of Control for Cricket in India

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Aavhan IIT Bombay

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Assam Cricket Association

List of Figures

- Figure 1: India Spectator Sports Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Spectator Sports Market Share (%) by Company 2025

List of Tables

- Table 1: India Spectator Sports Market Revenue billion Forecast, by Type of Sports 2020 & 2033

- Table 2: India Spectator Sports Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 3: India Spectator Sports Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Spectator Sports Market Revenue billion Forecast, by Type of Sports 2020 & 2033

- Table 5: India Spectator Sports Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 6: India Spectator Sports Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Spectator Sports Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the India Spectator Sports Market?

Key companies in the market include Assam Cricket Association, Ahmedabad Sports Academy, Anantapur Sports Academy, Adani Sportsline, Calcutta Cricket Academy**List Not Exhaustive, Aarka Sports Management, AllSportsFit, AIFF Masters, Board of Control for Cricket in India, Aavhan IIT Bombay.

3. What are the main segments of the India Spectator Sports Market?

The market segments include Type of Sports, Revenue Source.

4. Can you provide details about the market size?

The market size is estimated to be USD 235.23 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Sponsorships; Viewership of Multiple Sports Channels.

6. What are the notable trends driving market growth?

The Rise of Cricket in India.

7. Are there any restraints impacting market growth?

Threat From Home Entertainment.

8. Can you provide examples of recent developments in the market?

September 2023: Football Sports Development Limited (FSDL) announced Viacom18 Media Private Limited as the 'new home of Indian Football' for the 2023-24 and 2024-25 seasons. Viacom18 will likely be the exclusive media rights holder for ISL, India's top-tier football league, across Digital and Linear TV platforms.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Spectator Sports Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Spectator Sports Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Spectator Sports Market?

To stay informed about further developments, trends, and reports in the India Spectator Sports Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence