Key Insights

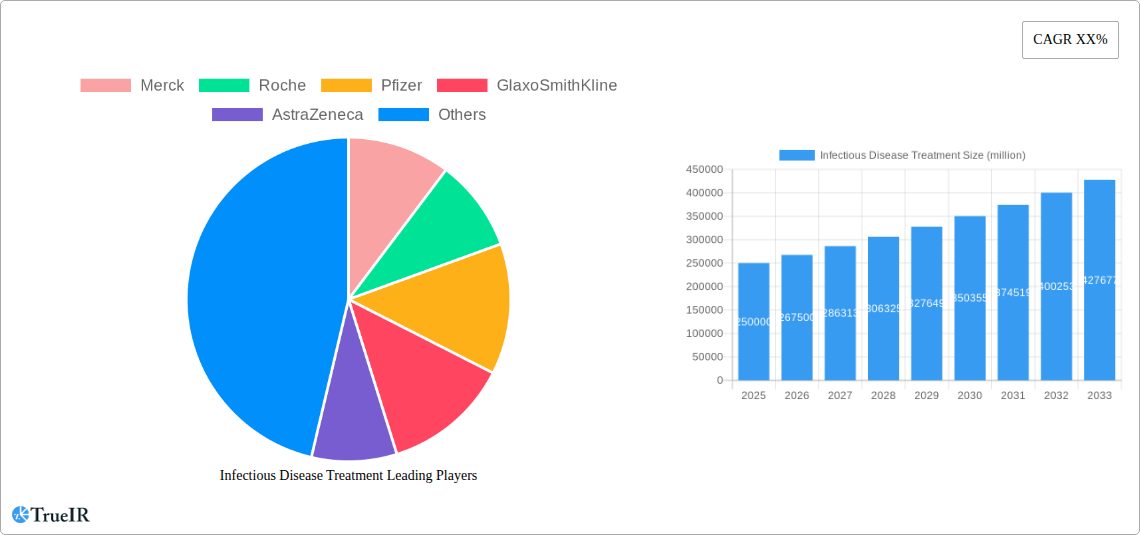

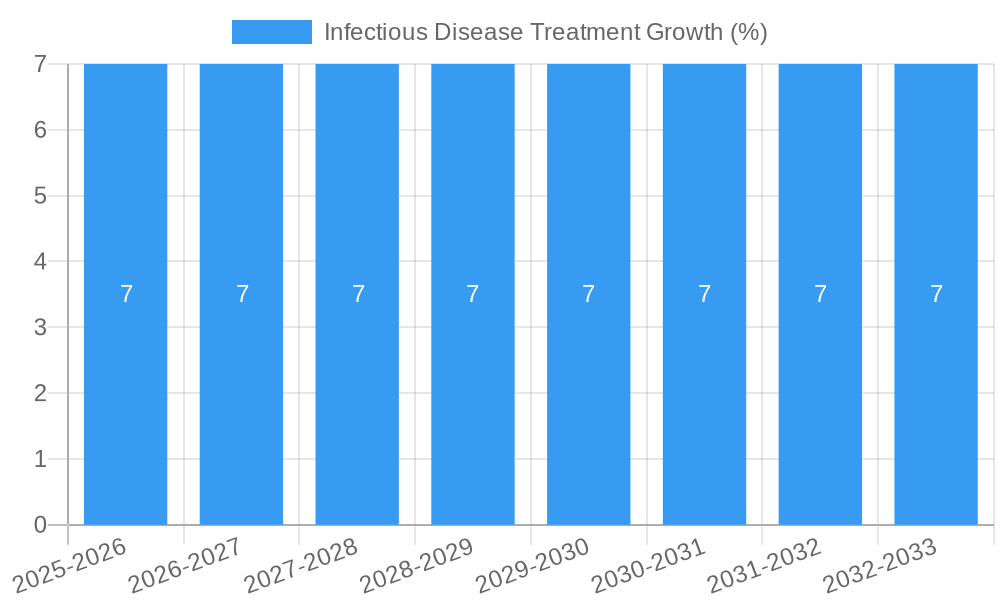

The global Infectious Disease Treatment market is poised for significant expansion, estimated at a substantial market size of USD 250 billion in 2025, with a projected Compound Annual Growth Rate (CAGR) of 7.5% through 2033. This robust growth trajectory is primarily fueled by an escalating incidence of both novel and re-emerging infectious diseases, coupled with the increasing prevalence of antimicrobial resistance (AMR), which necessitates continuous development and adoption of advanced treatment solutions. Public health initiatives and government investments aimed at combating infectious disease outbreaks further bolster market dynamics. The growing awareness and accessibility of healthcare services globally, particularly in emerging economies, are also contributing factors.

The market segmentation highlights key areas of opportunity and focus. Hospitals & Clinics represent the dominant application segment, reflecting the primary settings for diagnosis and treatment of infectious diseases. Within the types segment, antibacterial drugs hold a significant share due to the widespread nature of bacterial infections. However, the Antiviral Drugs segment is experiencing accelerated growth, driven by advancements in therapies for viral infections like influenza, HIV, and hepatitis, as well as the ongoing global efforts to control and treat emerging viral pandemics. Retail pharmacies also play a crucial role in the accessibility of infectious disease treatments. Leading global pharmaceutical giants like Merck, Roche, Pfizer, GlaxoSmithKline, and AstraZeneca are at the forefront of innovation, investing heavily in research and development to introduce novel therapeutics and address unmet medical needs in this critical sector.

Here's a dynamic, SEO-optimized report description for Infectious Disease Treatment, designed for immediate use without modification:

Infectious Disease Treatment Market Structure & Competitive Landscape

The infectious disease treatment market, a critical segment of global healthcare, is characterized by a moderately concentrated competitive landscape. Innovation remains a paramount driver, fueled by the persistent emergence of novel pathogens and the increasing prevalence of antimicrobial resistance. Regulatory bodies play a significant role, shaping market access and product approvals through stringent efficacy and safety standards. While product substitutes exist, primarily in the form of alternative therapies and preventative measures, the development of novel drug classes continues to define competitive advantage. End-user segmentation is predominantly divided between Hospitals & Clinics and Retail Pharmacies, each with distinct purchasing patterns and treatment protocols. Merger and acquisition (M&A) activity within the infectious disease treatment sector has been robust, with approximately XX volume of transactions observed historically, indicating a strategic consolidation aimed at expanding product portfolios and market reach. Key players like Merck, Roche, Pfizer, GlaxoSmithKline, AstraZeneca, Novartis, Sanofi, and Mylan are actively engaged in R&D and strategic partnerships to maintain and enhance their market positions.

Infectious Disease Treatment Market Trends & Opportunities

The global infectious disease treatment market is projected for substantial expansion, driven by a confluence of factors that underscore its strategic importance. The market size is estimated to have reached over $XXX million in the base year of 2025, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This impressive growth trajectory is underpinned by an escalating incidence of infectious diseases, including antibiotic-resistant bacteria, viral pandemics, and emerging fungal infections, necessitating continuous innovation in treatment modalities. Technological shifts are revolutionizing the landscape, with advancements in diagnostics leading to earlier and more accurate identification of pathogens, enabling prompt and targeted therapeutic interventions. Precision medicine, including the development of personalized treatments based on genetic profiling and pathogen characteristics, is gaining traction, offering enhanced efficacy and reduced side effects. Consumer preferences are evolving, with a growing demand for safer, more effective, and patient-centric treatment options. The increasing awareness among the general population regarding infectious disease prevention and treatment further propels market growth. Competitive dynamics are intense, with pharmaceutical giants and emerging biotechs vying for market share through extensive research and development, strategic collaborations, and the introduction of novel drug candidates. The market penetration rate for advanced infectious disease treatments is steadily increasing, reflecting the growing adoption of innovative therapies across developed and developing economies. The increasing burden of diseases such as HIV, Hepatitis, Influenza, and tuberculosis, coupled with the rise of hospital-acquired infections, continues to fuel the demand for effective treatment solutions. Furthermore, the global healthcare expenditure, particularly in emerging economies, is on an upward trend, providing a fertile ground for market expansion.

Dominant Markets & Segments in Infectious Disease Treatment

The Hospitals & Clinics segment currently dominates the infectious disease treatment market, driven by the critical need for immediate and intensive care for severe infections. This segment benefits from centralized procurement systems, specialized medical expertise, and the availability of advanced diagnostic and therapeutic infrastructure. The application of infectious disease treatments within hospital settings is crucial for managing life-threatening conditions, post-operative infections, and outbreaks.

- Key Growth Drivers in Hospitals & Clinics:

- Infrastructure Development: Continuous investment in hospital infrastructure and advanced medical equipment facilitates the administration of complex infectious disease treatments.

- Skilled Healthcare Professionals: The presence of infectious disease specialists, intensivists, and pharmacists ensures optimal patient care and treatment outcomes.

- Government Policies & Funding: Supportive government policies promoting public health initiatives and increased healthcare funding for infectious disease management bolster hospital-based treatments.

- Prevalence of Hospital-Acquired Infections (HAIs): The persistent challenge of HAIs necessitates robust antimicrobial stewardship programs and advanced treatment protocols within hospital environments.

Among the types of infectious disease treatments, Antiviral Drugs have witnessed significant growth, largely propelled by the impact of global pandemics and the persistent threat of viral infections like influenza, HIV, and hepatitis. The ongoing research and development in this area, aiming to combat emerging viral strains and drug-resistant viruses, are key contributors to its market dominance.

- Key Growth Drivers for Antiviral Drugs:

- Pandemic Preparedness: Global health organizations and governments are prioritizing the development and stockpiling of antiviral medications to counter future pandemic threats.

- Advancements in Genetic Research: Deeper understanding of viral replication mechanisms is enabling the development of more targeted and effective antiviral therapies.

- Increasing Incidence of Chronic Viral Infections: The long-term management of conditions like HIV and chronic hepatitis B and C drives consistent demand for antiviral treatments.

Infectious Disease Treatment Product Analysis

Product innovations in infectious disease treatment are primarily focused on developing novel therapeutics with enhanced efficacy, improved safety profiles, and the ability to combat drug-resistant pathogens. Key advancements include the development of targeted therapies like monoclonal antibodies for viral infections and new classes of antibiotics with novel mechanisms of action. The competitive advantage lies in the ability to address unmet medical needs and offer differentiated solutions, particularly for multi-drug resistant organisms.

Key Drivers, Barriers & Challenges in Infectious Disease Treatment

The infectious disease treatment market is propelled by the growing burden of infectious diseases globally, including the rise of antimicrobial resistance (AMR) and emerging viral threats. Technological advancements in diagnostics and drug discovery, coupled with increased healthcare expenditure and favorable government initiatives promoting public health, are significant growth catalysts. The demand for novel treatments is consistently high.

However, the market faces substantial challenges and restraints. The development of new antibiotics, in particular, is hampered by economic disincentives due to limited treatment duration and the rapid emergence of resistance. Stringent regulatory hurdles for drug approval, coupled with high R&D costs and the threat of antibiotic stewardship programs limiting usage, present significant barriers. Supply chain disruptions and manufacturing complexities also pose challenges.

Growth Drivers in the Infectious Disease Treatment Market

Key drivers for the infectious disease treatment market include the escalating global prevalence of various infectious diseases, from bacterial and fungal infections to widespread viral outbreaks. The alarming rise of antimicrobial resistance (AMR) is a critical impetus, demanding constant innovation in antibiotic development and alternative therapies. Technological advancements in genomic sequencing and rapid diagnostics enable faster pathogen identification and more personalized treatment approaches. Furthermore, increased global healthcare expenditure and supportive government policies aimed at enhancing public health infrastructure and disease surveillance are fostering market growth.

Challenges Impacting Infectious Disease Treatment Growth

Significant challenges impacting infectious disease treatment growth include the economic disincentives associated with antibiotic development, where high R&D costs are often not recouped due to short treatment durations and the need for judicious use. Stringent and lengthy regulatory approval processes for new drugs, particularly antibiotics, add to development timelines and costs. Supply chain vulnerabilities and manufacturing complexities for complex biologics and pharmaceuticals can lead to drug shortages. Moreover, the ever-present threat of pathogen evolution and resistance development necessitates continuous innovation, creating an ongoing arms race between drug developers and infectious agents.

Key Players Shaping the Infectious Disease Treatment Market

- Merck

- Roche

- Pfizer

- GlaxoSmithKline

- AstraZeneca

- Novartis

- Sanofi

- Mylan

Significant Infectious Disease Treatment Industry Milestones

- 2019: Launch of new-generation antiviral drug for Hepatitis C, significantly improving cure rates.

- 2020: Rapid development and deployment of mRNA vaccines for COVID-19, revolutionizing infectious disease response.

- 2021: Approval of novel antibiotic targeting multi-drug resistant Gram-negative bacteria.

- 2022: Strategic partnership announced between major pharmaceutical firms to accelerate AMR research.

- 2023: Significant investment in development of pan-coronavirus vaccines.

- 2024: Introduction of new antifungal treatment with improved efficacy and reduced side effects.

Future Outlook for Infectious Disease Treatment Market

The future outlook for the infectious disease treatment market is exceptionally robust, driven by ongoing global health concerns and relentless scientific innovation. Strategic opportunities lie in addressing the unmet needs posed by antimicrobial resistance and emerging viral threats. The market is poised for sustained growth fueled by investments in cutting-edge research, the adoption of advanced diagnostic technologies, and the increasing global demand for effective and accessible infectious disease therapies.

Infectious Disease Treatment Segmentation

-

1. Application

- 1.1. Hospitals & Clinics

- 1.2. Retail Pharmacies

-

2. Types

- 2.1. Antibacterial

- 2.2. Antifungal Drugs

- 2.3. Antiviral Drugs

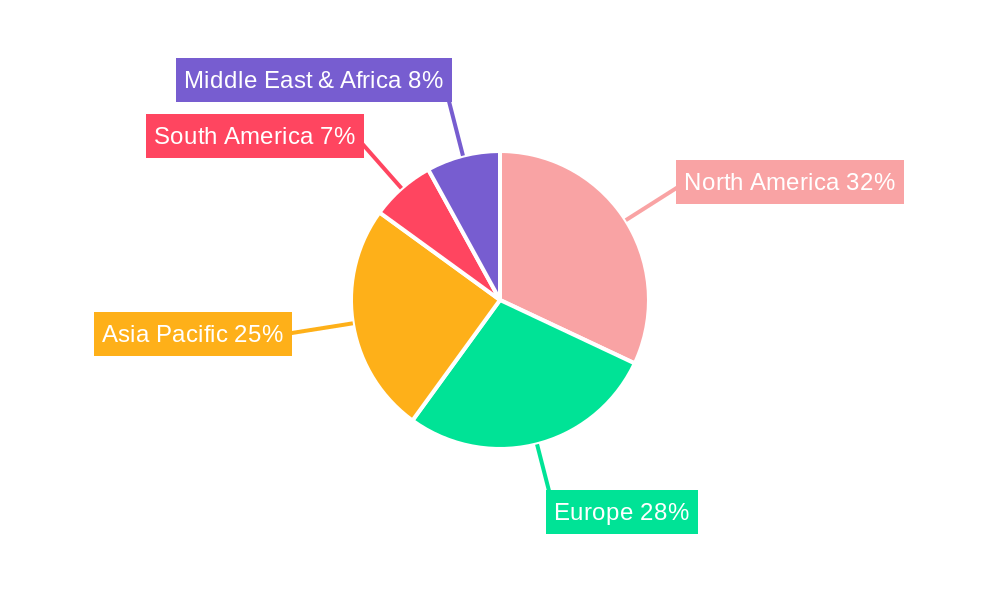

Infectious Disease Treatment Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Infectious Disease Treatment REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Infectious Disease Treatment Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospitals & Clinics

- 5.1.2. Retail Pharmacies

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Antibacterial

- 5.2.2. Antifungal Drugs

- 5.2.3. Antiviral Drugs

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Infectious Disease Treatment Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospitals & Clinics

- 6.1.2. Retail Pharmacies

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Antibacterial

- 6.2.2. Antifungal Drugs

- 6.2.3. Antiviral Drugs

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Infectious Disease Treatment Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospitals & Clinics

- 7.1.2. Retail Pharmacies

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Antibacterial

- 7.2.2. Antifungal Drugs

- 7.2.3. Antiviral Drugs

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Infectious Disease Treatment Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospitals & Clinics

- 8.1.2. Retail Pharmacies

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Antibacterial

- 8.2.2. Antifungal Drugs

- 8.2.3. Antiviral Drugs

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Infectious Disease Treatment Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospitals & Clinics

- 9.1.2. Retail Pharmacies

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Antibacterial

- 9.2.2. Antifungal Drugs

- 9.2.3. Antiviral Drugs

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Infectious Disease Treatment Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospitals & Clinics

- 10.1.2. Retail Pharmacies

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Antibacterial

- 10.2.2. Antifungal Drugs

- 10.2.3. Antiviral Drugs

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Merck

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Roche

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Pfizer

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GlaxoSmithKline

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AstraZeneca

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Novartis

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sanofi

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Mylan

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Merck

List of Figures

- Figure 1: Global Infectious Disease Treatment Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Infectious Disease Treatment Revenue (million), by Application 2024 & 2032

- Figure 3: North America Infectious Disease Treatment Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Infectious Disease Treatment Revenue (million), by Types 2024 & 2032

- Figure 5: North America Infectious Disease Treatment Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Infectious Disease Treatment Revenue (million), by Country 2024 & 2032

- Figure 7: North America Infectious Disease Treatment Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Infectious Disease Treatment Revenue (million), by Application 2024 & 2032

- Figure 9: South America Infectious Disease Treatment Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Infectious Disease Treatment Revenue (million), by Types 2024 & 2032

- Figure 11: South America Infectious Disease Treatment Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Infectious Disease Treatment Revenue (million), by Country 2024 & 2032

- Figure 13: South America Infectious Disease Treatment Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Infectious Disease Treatment Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Infectious Disease Treatment Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Infectious Disease Treatment Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Infectious Disease Treatment Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Infectious Disease Treatment Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Infectious Disease Treatment Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Infectious Disease Treatment Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Infectious Disease Treatment Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Infectious Disease Treatment Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Infectious Disease Treatment Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Infectious Disease Treatment Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Infectious Disease Treatment Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Infectious Disease Treatment Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Infectious Disease Treatment Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Infectious Disease Treatment Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Infectious Disease Treatment Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Infectious Disease Treatment Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Infectious Disease Treatment Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Infectious Disease Treatment Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Infectious Disease Treatment Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Infectious Disease Treatment Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Infectious Disease Treatment Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Infectious Disease Treatment Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Infectious Disease Treatment Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Infectious Disease Treatment Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Infectious Disease Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Infectious Disease Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Infectious Disease Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Infectious Disease Treatment Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Infectious Disease Treatment Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Infectious Disease Treatment Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Infectious Disease Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Infectious Disease Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Infectious Disease Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Infectious Disease Treatment Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Infectious Disease Treatment Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Infectious Disease Treatment Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Infectious Disease Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Infectious Disease Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Infectious Disease Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Infectious Disease Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Infectious Disease Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Infectious Disease Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Infectious Disease Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Infectious Disease Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Infectious Disease Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Infectious Disease Treatment Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Infectious Disease Treatment Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Infectious Disease Treatment Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Infectious Disease Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Infectious Disease Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Infectious Disease Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Infectious Disease Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Infectious Disease Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Infectious Disease Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Infectious Disease Treatment Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Infectious Disease Treatment Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Infectious Disease Treatment Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Infectious Disease Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Infectious Disease Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Infectious Disease Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Infectious Disease Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Infectious Disease Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Infectious Disease Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Infectious Disease Treatment Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Infectious Disease Treatment?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Infectious Disease Treatment?

Key companies in the market include Merck, Roche, Pfizer, GlaxoSmithKline, AstraZeneca, Novartis, Sanofi, Mylan.

3. What are the main segments of the Infectious Disease Treatment?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 5600.00, USD 8400.00, and USD 11200.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Infectious Disease Treatment," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Infectious Disease Treatment report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Infectious Disease Treatment?

To stay informed about further developments, trends, and reports in the Infectious Disease Treatment, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence