Key Insights

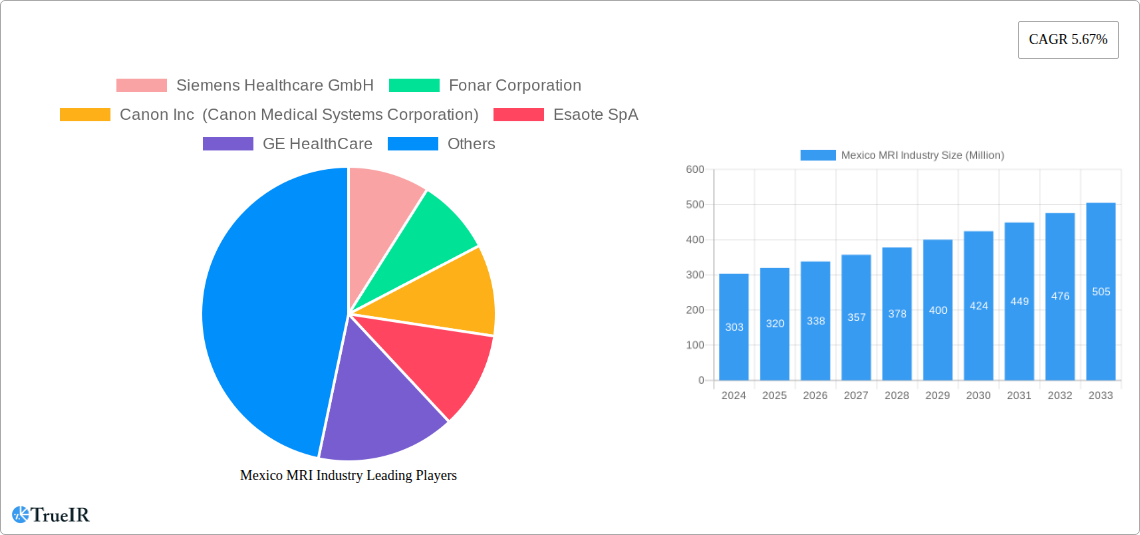

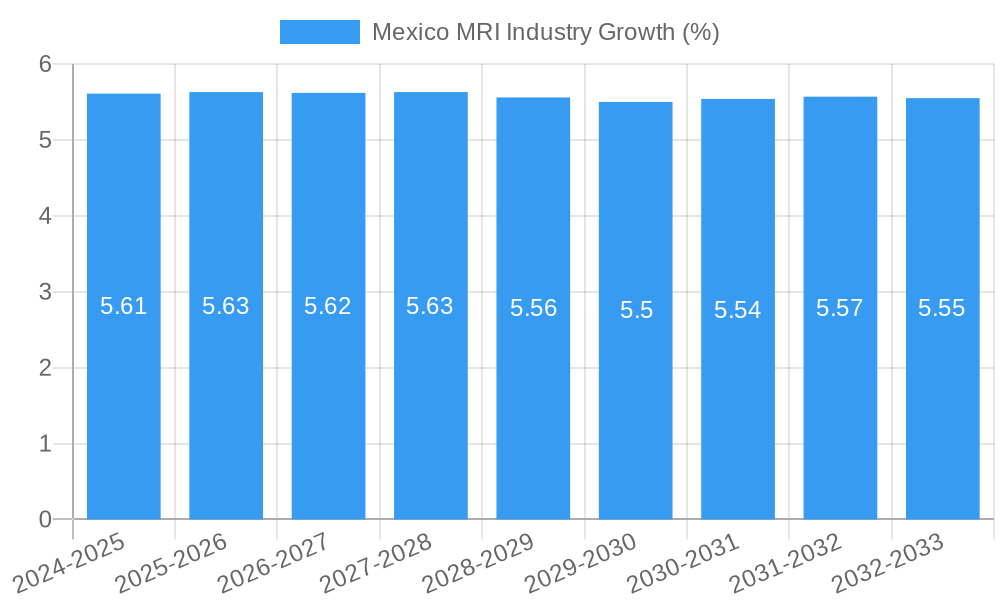

The Mexico MRI industry is poised for significant expansion, projected to reach an estimated market size of approximately USD 320 million in 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 5.67%. This growth is underpinned by increasing healthcare expenditure, a rising prevalence of chronic diseases such as oncology and neurology, and an expanding demand for advanced diagnostic imaging solutions. The government's focus on improving healthcare infrastructure and increased private sector investment in medical technology are further fueling this positive trajectory. Furthermore, the growing adoption of open MRI systems, catering to patient comfort and accessibility, and the increasing demand for high-field MRI systems for superior image resolution in complex diagnoses, are key architectural and field strength segment drivers. The application segments of oncology and neurology are expected to lead the market due to the escalating burden of these diseases in Mexico, necessitating early and accurate diagnosis.

The Mexican MRI market is characterized by a dynamic competitive landscape, with major global players like Siemens Healthcare GmbH, GE HealthCare, Koninklijke Philips NV, and Canon Inc. (Canon Medical Systems Corporation) actively participating through strategic partnerships, product launches, and investments in technological advancements. Emerging players and established local entities are also contributing to market diversification. However, certain restraints such as the high initial cost of MRI systems, the need for skilled radiologists and technicians, and the regulatory complexities for medical device approvals could temper growth in specific sub-segments. Nonetheless, the overall outlook remains highly optimistic, with ongoing technological innovations and a sustained focus on enhancing diagnostic capabilities expected to propel the market forward throughout the forecast period.

Mexico MRI Industry Market Analysis & Forecast 2024-2033: Unveiling Growth Trends and Opportunities

This comprehensive report provides an in-depth analysis of the Mexico MRI industry, offering critical insights into market dynamics, competitive strategies, and future projections. Leveraging high-volume keywords such as "Mexico MRI market," "magnetic resonance imaging Mexico," "MRI systems Mexico," "medical imaging Mexico," and "healthcare technology Mexico," this report is designed for industry stakeholders seeking to understand and capitalize on the evolving landscape. The study covers the historical period (2019-2024), base year (2025), estimated year (2025), and a robust forecast period (2025-2033), offering a complete 360-degree view.

Mexico MRI Industry Market Structure & Competitive Landscape

The Mexico MRI industry is characterized by a moderately concentrated market structure, with a few dominant players like Siemens Healthcare GmbH, GE HealthCare, and Koninklijke Philips NV holding significant market share. Innovation drivers are primarily fueled by advancements in imaging technology, increasing demand for advanced diagnostics, and government initiatives promoting healthcare infrastructure development. Regulatory impacts, while present, are generally supportive of technological adoption, with stringent quality and safety standards. Product substitutes, such as CT scanners and ultrasound, exist but are often complementary rather than direct replacements for MRI's unique diagnostic capabilities. End-user segmentation is diverse, spanning large hospital networks, specialized diagnostic centers, and research institutions. Merger and acquisition (M&A) trends have been modest, with focus on strategic partnerships to enhance distribution networks and technological integration. The estimated market concentration ratio for the top three players is around 65%, reflecting a competitive yet consolidated environment. M&A volumes are projected to remain stable, with an estimated 2-3 significant transactions annually, primarily focused on expanding service offerings and geographical reach.

Mexico MRI Industry Market Trends & Opportunities

The Mexico MRI industry is poised for substantial growth, projected to expand significantly from its current valuation to an estimated USD 750 Million by 2033. This expansion will be driven by a compound annual growth rate (CAGR) of approximately 5.8% during the forecast period (2025-2033). Technological shifts are a major catalyst, with a growing emphasis on higher field strength MRI systems (e.g., 3 Tesla MRI systems) for enhanced image resolution and faster scan times. The demand for advanced applications in neurology, oncology, and cardiology is escalating, fueled by an aging population and a rising incidence of chronic diseases. Consumer preferences are increasingly leaning towards minimally invasive diagnostic procedures and patient comfort, driving innovation in open MRI systems. Competitive dynamics are intensifying, with global players vying for market dominance through product innovation, strategic collaborations, and aggressive market penetration strategies. Opportunities lie in addressing the unmet needs in rural healthcare access, developing cost-effective MRI solutions for emerging market segments, and leveraging artificial intelligence for image analysis and workflow optimization. Market penetration for advanced MRI technologies is expected to increase by approximately 15% over the next decade, presenting a substantial opportunity for early adopters and innovators. The growing investment in healthcare infrastructure, coupled with a rising disposable income, further bolsters the positive market outlook.

Dominant Markets & Segments in Mexico MRI Industry

Within the Mexico MRI industry, Closed MRI Systems dominate the market architecture, accounting for an estimated 70% of the total market revenue. This dominance is driven by their superior image quality, wider range of applications, and higher field strengths, which are essential for complex diagnostic procedures. The High Field MRI Systems segment, particularly 1.5 Tesla and 3 Tesla MRI scanners, is the leading field strength, representing a substantial 60% of the market share. This is due to their advanced diagnostic capabilities, especially in neurology and oncology, where precise imaging is paramount. In terms of applications, Neurology and Oncology are the most dominant segments, collectively contributing to over 50% of the MRI market revenue. The increasing prevalence of neurological disorders like Alzheimer's and Parkinson's, alongside the rising cancer rates in Mexico, fuels the demand for advanced MRI diagnostics in these areas. Infrastructure development, such as the establishment of new diagnostic centers and the upgrade of existing hospital facilities, plays a crucial role in market dominance. Supportive government policies aimed at improving healthcare access and investing in medical technology further propel the growth of these dominant segments. The Musculoskeletal segment also shows robust growth, driven by an active lifestyle and sports-related injuries.

Mexico MRI Industry Product Analysis

The Mexico MRI industry is witnessing a wave of product innovations focused on enhancing diagnostic accuracy, improving patient comfort, and increasing workflow efficiency. Key advancements include the development of ultra-high field MRI systems for specialized research and clinical applications, as well as more compact and cost-effective low field MRI systems for wider accessibility. Integration of AI and machine learning algorithms is revolutionizing image reconstruction, analysis, and diagnosis, leading to faster and more precise results. The development of open MRI systems continues to address patient anxiety and claustrophobia, expanding the applicability of MRI in pediatric and geriatric populations. Competitive advantages are being carved out through superior image quality, reduced scan times, enhanced patient-centric features, and integrated software solutions for data management and reporting.

Key Drivers, Barriers & Challenges in Mexico MRI Industry

The Mexico MRI industry is propelled by several key drivers, including the increasing demand for advanced diagnostic imaging, growing awareness of MRI's diagnostic capabilities for various diseases, and significant investments in healthcare infrastructure. Technological advancements, such as AI integration and development of more sophisticated MRI sequences, are also critical growth catalysts. For instance, the deployment of AI-powered image reconstruction algorithms can significantly reduce scan times, enhancing patient throughput and improving the overall patient experience.

However, the industry faces notable barriers and challenges. High initial capital expenditure for MRI equipment remains a significant restraint for many healthcare providers, particularly in smaller or public facilities. Regulatory hurdles related to equipment approval and data privacy can also slow down market entry and adoption. Furthermore, supply chain disruptions for specialized components and skilled labor shortages for maintenance and operation of advanced MRI systems present ongoing challenges. Competitive pressures from established global players and the potential rise of lower-cost imaging alternatives can also impact market growth. The estimated cost of a high-end MRI system can range from USD 1 Million to USD 3 Million, posing a substantial financial barrier.

Growth Drivers in the Mexico MRI Industry Market

The growth of the Mexico MRI industry is significantly driven by an escalating demand for sophisticated diagnostic imaging solutions, fueled by the rising incidence of chronic diseases like cancer and neurological disorders. Government initiatives promoting healthcare infrastructure development and increased public and private sector investments in advanced medical technologies are paramount. Technological advancements, such as the integration of Artificial Intelligence (AI) for image analysis and workflow optimization, and the development of more patient-friendly open MRI systems, are further accelerating market expansion. A growing healthcare-aware population and the increasing affordability of medical imaging procedures also contribute to sustained market growth.

Challenges Impacting Mexico MRI Industry Growth

The Mexico MRI industry grapples with several challenges that can impede its growth trajectory. The substantial capital investment required for acquiring and maintaining MRI systems, particularly high-field strength models, presents a significant financial barrier for many healthcare providers, especially in underserved regions. Stringent regulatory complexities and the time-consuming approval processes for new medical devices can delay market penetration. Furthermore, persistent supply chain issues impacting the availability of essential components and spare parts can lead to prolonged equipment downtime and operational inefficiencies. Intense competitive pressures from both established global manufacturers and emerging local players can also lead to price wars and reduced profit margins.

Key Players Shaping the Mexico MRI Industry Market

- Siemens Healthcare GmbH

- Fonar Corporation

- Canon Inc (Canon Medical Systems Corporation)

- Esaote SpA

- GE HealthCare

- Koninklijke Philips NV

- Fujifilm Holdings Corporation

Significant Mexico MRI Industry Industry Milestones

- December 2022: Universidad Nacional Autonoma de Mexico sponsored a clinical trial to understand the possible changes in motor function and the brain's functional connectivity through resting-state functional Magnetic Resonance Imaging (rs-fMRI) for subacute ischemic stroke outpatients associated with occupational therapy using interactive applications as a therapeutic complement, comparing with patients on conventional therapy. This initiative highlights the growing research focus on advanced MRI applications in rehabilitation.

- August 2022: Simon Hegele Healthcare Solutions launched a new service from its warehouse in Mexico City: cooling and storing magnetic resonance imaging instruments in a specially equipped cryo farm. This development addresses critical logistical needs for maintaining the integrity of sensitive MRI components, ensuring operational readiness and reliability.

Future Outlook for Mexico MRI Industry Market

The future outlook for the Mexico MRI industry is highly promising, driven by a confluence of factors including sustained technological innovation, increasing healthcare expenditure, and a growing demand for advanced diagnostic capabilities. The continued development of AI-integrated MRI systems, enhanced low field MRI systems for broader accessibility, and specialized applications in areas like oncology and neurology will be key growth catalysts. Strategic partnerships, potential M&A activities aimed at expanding service portfolios, and a focus on digital health solutions will further shape the market. Opportunities exist in addressing healthcare disparities and expanding the reach of MRI diagnostics into remote and underserved regions. The market is expected to witness steady growth, with an increasing adoption of advanced imaging techniques and a greater emphasis on patient-centric care.

Mexico MRI Industry Segmentation

-

1. Architecture

- 1.1. Closed MRI Systems

- 1.2. Open MRI Systems

-

2. Field Strength

- 2.1. Low Field MRI Systems

- 2.2. High Field MRI Systems

- 2.3. Very Hig

-

3. Application

- 3.1. Oncology

- 3.2. Neurology

- 3.3. Cardiology

- 3.4. Gastroenterology

- 3.5. Musculoskeletal

- 3.6. Other Applications

Mexico MRI Industry Segmentation By Geography

- 1. Mexico

Mexico MRI Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.67% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Advancements in MRI Systems; Growing Number of Chronic Diseases

- 3.3. Market Restrains

- 3.3.1. High Cost of MRI Systems

- 3.4. Market Trends

- 3.4.1. Neurology Segment is Expected to Witness a Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico MRI Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Architecture

- 5.1.1. Closed MRI Systems

- 5.1.2. Open MRI Systems

- 5.2. Market Analysis, Insights and Forecast - by Field Strength

- 5.2.1. Low Field MRI Systems

- 5.2.2. High Field MRI Systems

- 5.2.3. Very Hig

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Oncology

- 5.3.2. Neurology

- 5.3.3. Cardiology

- 5.3.4. Gastroenterology

- 5.3.5. Musculoskeletal

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Architecture

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Siemens Healthcare GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Fonar Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Canon Inc (Canon Medical Systems Corporation)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Esaote SpA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 GE HealthCare

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Koninklijke Philips NV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fujifilm Holdings Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Siemens Healthcare GmbH

List of Figures

- Figure 1: Mexico MRI Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mexico MRI Industry Share (%) by Company 2024

List of Tables

- Table 1: Mexico MRI Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mexico MRI Industry Revenue Million Forecast, by Architecture 2019 & 2032

- Table 3: Mexico MRI Industry Revenue Million Forecast, by Field Strength 2019 & 2032

- Table 4: Mexico MRI Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Mexico MRI Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Mexico MRI Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Mexico MRI Industry Revenue Million Forecast, by Architecture 2019 & 2032

- Table 8: Mexico MRI Industry Revenue Million Forecast, by Field Strength 2019 & 2032

- Table 9: Mexico MRI Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 10: Mexico MRI Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico MRI Industry?

The projected CAGR is approximately 5.67%.

2. Which companies are prominent players in the Mexico MRI Industry?

Key companies in the market include Siemens Healthcare GmbH, Fonar Corporation, Canon Inc (Canon Medical Systems Corporation), Esaote SpA, GE HealthCare, Koninklijke Philips NV, Fujifilm Holdings Corporation.

3. What are the main segments of the Mexico MRI Industry?

The market segments include Architecture, Field Strength, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Advancements in MRI Systems; Growing Number of Chronic Diseases.

6. What are the notable trends driving market growth?

Neurology Segment is Expected to Witness a Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of MRI Systems.

8. Can you provide examples of recent developments in the market?

December 2022: Universidad Nacional Autonoma de Mexico sponsored a clinical trial to understand the possible changes in motor function and the brain's functional connectivity through resting-state functional Magnetic Resonance Imaging (rs-fMRI) for subacute ischemic stroke outpatients associated with occupational therapy using interactive applications as a therapeutic complement, comparing with patients on conventional therapy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico MRI Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico MRI Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico MRI Industry?

To stay informed about further developments, trends, and reports in the Mexico MRI Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence