Key Insights

The North American arts promoters market is poised for significant expansion, driven by a confluence of economic and cultural factors. Anticipated to achieve a Compound Annual Growth Rate (CAGR) of 11.6%, the market is projected to reach $518.5 billion by 2025, with 2025 serving as the base year. Key growth drivers include the increasing disposable income of high-net-worth individuals, fostering demand for premium art, and the widespread adoption of online art platforms and digital marketing strategies, enhancing global audience engagement. Furthermore, the proliferation of immersive art experiences and augmented corporate sponsorship of artistic ventures are fueling market momentum.

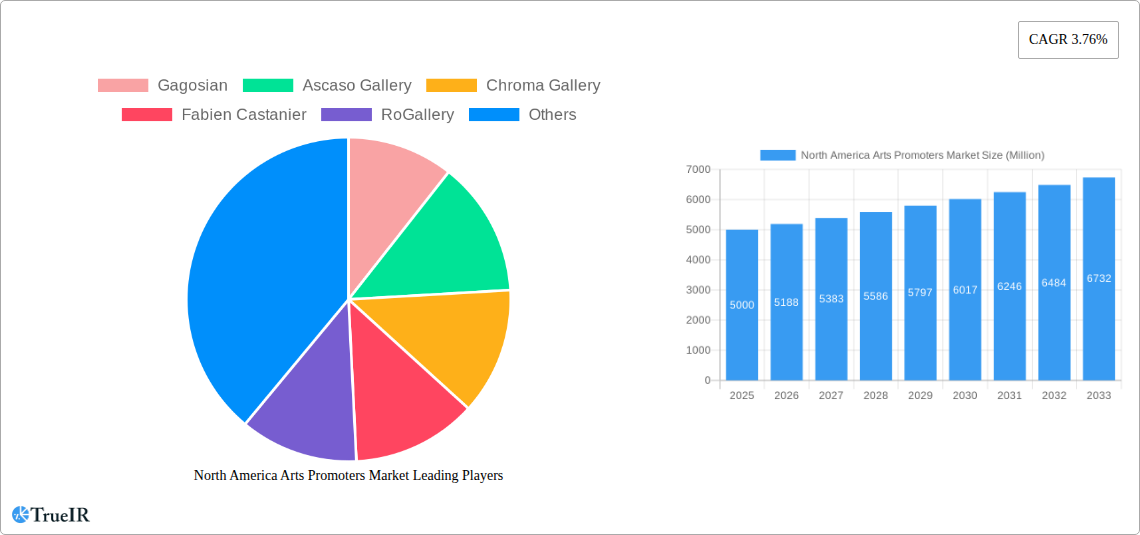

North America Arts Promoters Market Market Size (In Billion)

Despite these positive trends, the market navigates inherent challenges such as economic downturns impacting discretionary art spending and the speculative nature of art investments. Intense competition among established and emerging galleries for coveted artworks and prominent artists remains a significant barrier. Market segmentation reveals diverse gallery structures, from boutique independent entities to global powerhouses like Gagosian and Hauser & Wirth, each presenting unique growth opportunities. Geographical disparities are also notable, with metropolitan hubs exhibiting concentrated gallery activity and higher transaction volumes.

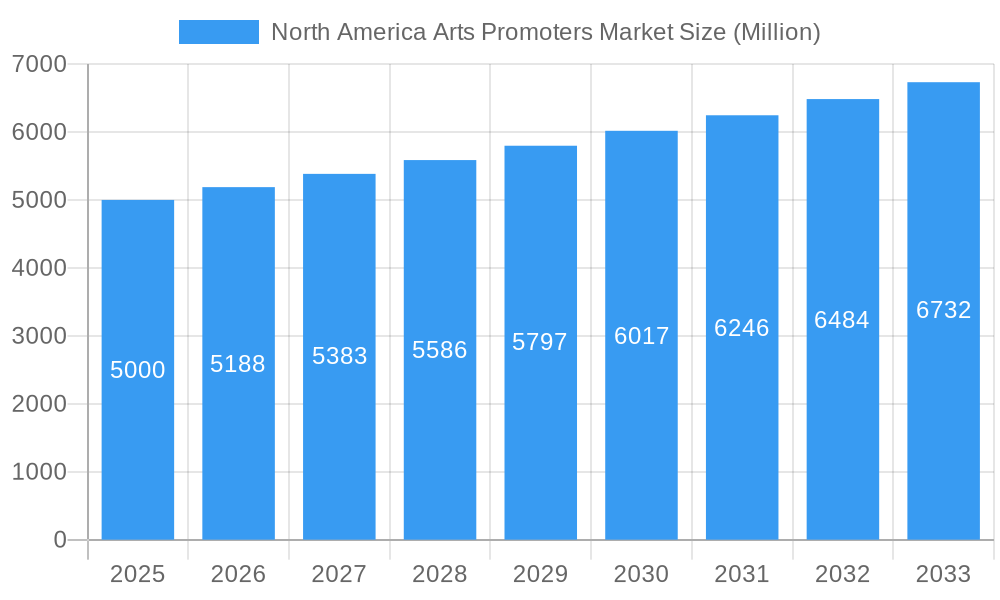

North America Arts Promoters Market Company Market Share

The influence of leading players, including Gagosian, Pace Gallery, and David Zwirner, underscores a market ripe for consolidation and strategic alliances. The ongoing evolution of digital platforms for art promotion is set to fundamentally reshape pricing, accessibility, and the very definition of art promotion. Sustained growth necessitates strategic agility and innovation to mitigate economic fluctuations and cater to the evolving preferences of collectors and art enthusiasts. Success in this competitive arena demands continuous investment in targeted marketing, cultivation of robust artist relationships, and the establishment of a distinct brand identity within a dynamic and evolving market.

North America Arts Promoters Market: A Comprehensive Report (2019-2033)

This dynamic report provides an in-depth analysis of the North America Arts Promoters Market, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this study unveils the market's structure, competitive landscape, growth drivers, and future potential. The market is projected to reach xx Million by 2033, demonstrating significant growth opportunities.

North America Arts Promoters Market Structure & Competitive Landscape

The North America Arts Promoters Market exhibits a moderately concentrated structure, with a few key players holding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx in 2025, indicating a moderately competitive environment. Innovation is a key driver, with galleries constantly seeking new ways to engage audiences and artists. Regulatory impacts, such as tax policies and copyright laws, play a significant role, while product substitutes, including online art marketplaces, exert competitive pressure. The market is segmented by art type (painting, sculpture, photography, etc.), price range, and target audience (private collectors, institutions, etc.). M&A activity is moderate, with an estimated xx Million in deal value in 2024. Key trends include:

- Increasing focus on digital platforms: Galleries are increasingly leveraging online platforms for sales, exhibitions, and outreach.

- Rise of experiential art: Interactive and immersive art installations are gaining popularity.

- Growing importance of artist representation: Strong artist representation is crucial for market success.

- Emphasis on sustainability and ethical sourcing: A growing awareness of environmental and social responsibility is influencing gallery practices.

- Consolidation among galleries: Mergers and acquisitions are reshaping the competitive landscape.

North America Arts Promoters Market Trends & Opportunities

The North America Arts Promoters Market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including rising disposable incomes, increased interest in art as an investment, and the growing influence of social media in shaping art trends. Market penetration rates vary significantly depending on the art segment and geographic location. Technological advancements, including virtual reality (VR) and augmented reality (AR) technologies, are transforming the art experience, creating new avenues for engagement and accessibility. Changing consumer preferences toward experience-driven purchases are also significantly impacting market demand. Competitive dynamics remain intense, with galleries competing for both artists and collectors.

Dominant Markets & Segments in North America Arts Promoters Market

The New York City art market maintains its dominant position within North America, accounting for approximately xx% of the total market value in 2025. Other key markets include Los Angeles, Miami, and Chicago. The high concentration in New York City is attributed to several factors:

- Established infrastructure: The city possesses a well-established art infrastructure, including museums, galleries, auction houses, and art schools.

- Concentrated wealth: New York City has a high concentration of high-net-worth individuals, who are significant buyers of art.

- Favorable regulatory environment: The regulatory environment is generally supportive of the art market.

- Network effects: The presence of numerous galleries and artists creates a strong network effect, attracting further investment and activity.

Other significant segments include contemporary art, which holds a considerable market share driven by investor interest in emerging artists, and digital art, experiencing exponential growth fuelled by technological advancements and the rise of NFTs.

North America Arts Promoters Market Product Analysis

The North America Arts Promoters Market showcases a diverse range of products and services, from traditional gallery representation to online art platforms and curated experiences. Technological advancements, such as high-resolution digital imaging and virtual exhibitions, are improving accessibility and expanding the market reach. Furthermore, personalized client services and tailored art advisory are becoming increasingly important in a competitive landscape. The successful products and services cater to individual collector preferences, offer unique market positioning, and prioritize the efficient management and logistics of art transactions.

Key Drivers, Barriers & Challenges in North America Arts Promoters Market

Key Drivers: Rising disposable incomes, growing interest in art as an investment, and increasing use of digital platforms are key drivers. Government support for the arts and favorable regulatory environments also contribute. Technological advancements in art creation and display are opening new opportunities.

Challenges: Economic downturns can significantly impact demand. Supply chain disruptions related to shipping and insurance of artworks can affect profitability. Competition from online marketplaces puts pressure on traditional galleries. For example, xx% of the market is estimated to be influenced by online art sales in 2025, presenting a notable challenge.

Growth Drivers in the North America Arts Promoters Market Market

The primary growth drivers include rising affluence, particularly amongst millennials and Gen Z, who are increasingly engaging with art. Technological advancements, enabling virtual galleries and immersive experiences, are expanding market reach. Favourable government policies, such as tax incentives for art purchases, contribute significantly to growth.

Challenges Impacting North America Arts Promoters Market Growth

Challenges include economic volatility, which directly impacts consumer spending on art. Increased competition from online platforms necessitates strategic adaptations. Regulatory hurdles concerning international art trade can present logistical complexities and increased costs.

Key Players Shaping the North America Arts Promoters Market Market

- Gagosian

- Ascaso Gallery

- Chroma Gallery

- Fabien Castanier

- RoGallery

- Pace Gallery

- Dawid Zwirner Gallery

- Matthew Marks Gallery

- Hauser & Wirth

- Andrea Rosen Gallery

Significant North America Arts Promoters Market Industry Milestones

- July 2023: K-Pop Boy Band TREASURE partners with Columbia Records for a U.S. record deal, signaling increased cross-cultural collaboration and potential market expansion.

- March 2023: Coca-Cola's "Create Real Magic" initiative using an AI platform showcases the growing integration of technology in the arts, opening new avenues for digital artists and expanding the definition of art promotion.

Future Outlook for North America Arts Promoters Market Market

The North America Arts Promoters Market is poised for continued growth, driven by evolving consumer preferences, technological innovation, and strategic partnerships. Opportunities exist in expanding digital platforms, creating immersive experiences, and catering to a younger, more diverse audience. The market's future success hinges on adapting to technological change and fostering creative collaborations.

North America Arts Promoters Market Segmentation

-

1. Type

- 1.1. Fine Arts

- 1.2. Antiques

- 1.3. Collectables

- 1.4. Abstract Art

- 1.5. Digital Art

- 1.6. Other Types

-

2. Revenue Source

- 2.1. Media Rights

- 2.2. Merchandizing

- 2.3. Tickets

- 2.4. Sponsoring

-

3. End-Users

- 3.1. Individuals

- 3.2. Companies

-

4. Channel

- 4.1. Online

- 4.2. Offline

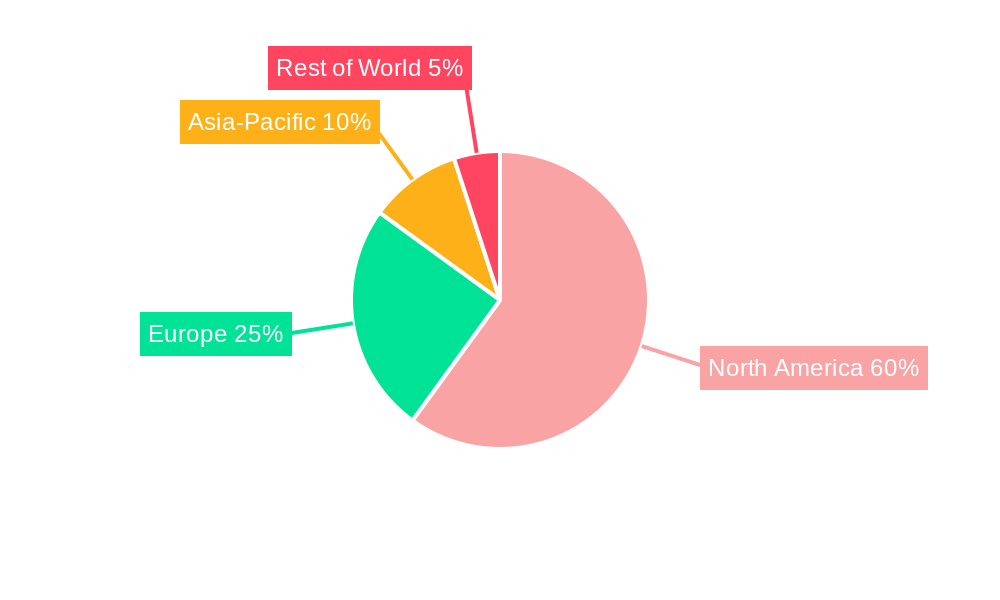

North America Arts Promoters Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Arts Promoters Market Regional Market Share

Geographic Coverage of North America Arts Promoters Market

North America Arts Promoters Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Digital Art Products driving the Market

- 3.3. Market Restrains

- 3.3.1. Rise in Digital Art Products driving the Market

- 3.4. Market Trends

- 3.4.1. Increase in Collaborations and Partnerships

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Arts Promoters Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fine Arts

- 5.1.2. Antiques

- 5.1.3. Collectables

- 5.1.4. Abstract Art

- 5.1.5. Digital Art

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Revenue Source

- 5.2.1. Media Rights

- 5.2.2. Merchandizing

- 5.2.3. Tickets

- 5.2.4. Sponsoring

- 5.3. Market Analysis, Insights and Forecast - by End-Users

- 5.3.1. Individuals

- 5.3.2. Companies

- 5.4. Market Analysis, Insights and Forecast - by Channel

- 5.4.1. Online

- 5.4.2. Offline

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Gagosian

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ascaso Gallery

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Chroma Gallery

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fabien Castanier

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 RoGallery

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pace Gallery

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Dawid Zwirner Gallery

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Matthew Marks Gallery

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hauser & Wirth

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Andrea Rosen Gallery**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Gagosian

List of Figures

- Figure 1: North America Arts Promoters Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Arts Promoters Market Share (%) by Company 2025

List of Tables

- Table 1: North America Arts Promoters Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Arts Promoters Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 3: North America Arts Promoters Market Revenue billion Forecast, by End-Users 2020 & 2033

- Table 4: North America Arts Promoters Market Revenue billion Forecast, by Channel 2020 & 2033

- Table 5: North America Arts Promoters Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Arts Promoters Market Revenue billion Forecast, by Type 2020 & 2033

- Table 7: North America Arts Promoters Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 8: North America Arts Promoters Market Revenue billion Forecast, by End-Users 2020 & 2033

- Table 9: North America Arts Promoters Market Revenue billion Forecast, by Channel 2020 & 2033

- Table 10: North America Arts Promoters Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States North America Arts Promoters Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada North America Arts Promoters Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico North America Arts Promoters Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Arts Promoters Market?

The projected CAGR is approximately 11.6%.

2. Which companies are prominent players in the North America Arts Promoters Market?

Key companies in the market include Gagosian, Ascaso Gallery, Chroma Gallery, Fabien Castanier, RoGallery, Pace Gallery, Dawid Zwirner Gallery, Matthew Marks Gallery, Hauser & Wirth, Andrea Rosen Gallery**List Not Exhaustive.

3. What are the main segments of the North America Arts Promoters Market?

The market segments include Type, Revenue Source, End-Users, Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 518.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in Digital Art Products driving the Market.

6. What are the notable trends driving market growth?

Increase in Collaborations and Partnerships.

7. Are there any restraints impacting market growth?

Rise in Digital Art Products driving the Market.

8. Can you provide examples of recent developments in the market?

July 2023: K-Pop Boy Band TREASURE Partners With Columbia Records For U.S. Record Deal. TREASURE is the latest K-pop artist signaling a signing between Korean and U.S. labels, marking a slew of exciting beginnings for the boy band and its Korean label and management, YG Entertainment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Arts Promoters Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Arts Promoters Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Arts Promoters Market?

To stay informed about further developments, trends, and reports in the North America Arts Promoters Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence