Key Insights

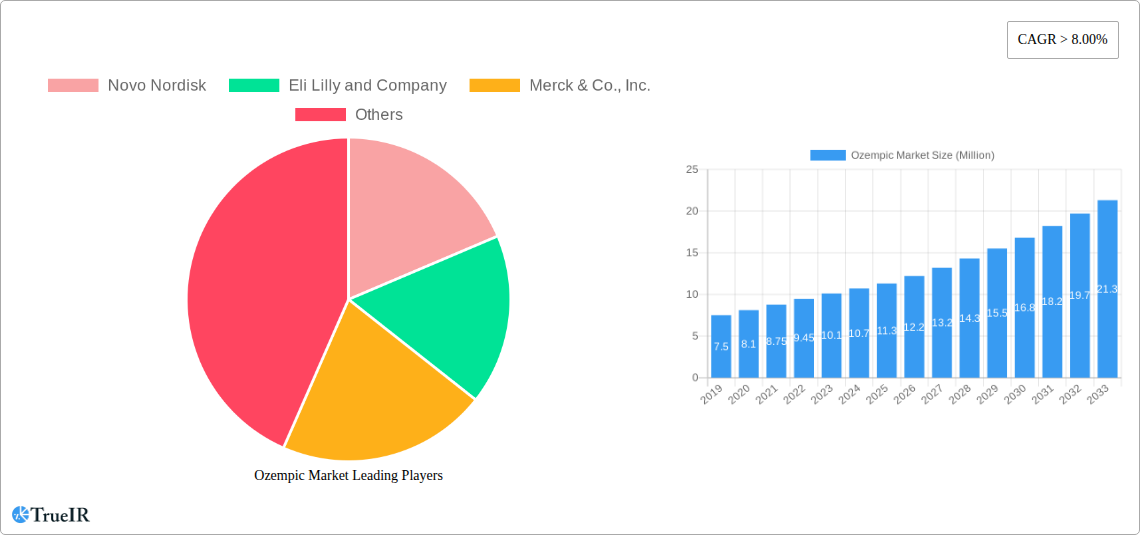

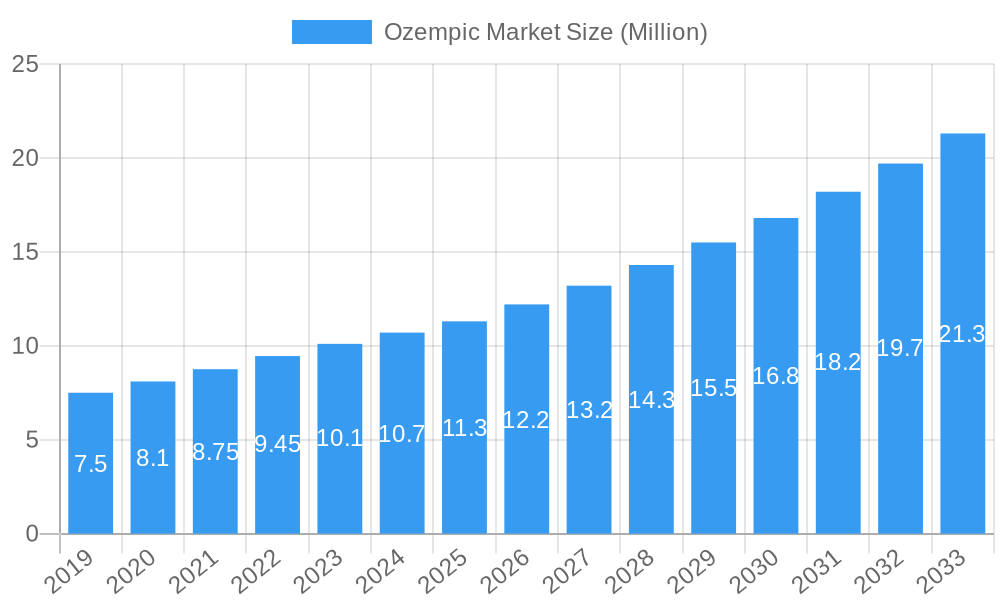

The Ozempic market is poised for substantial growth, projected to reach an estimated $10.99 million by 2025 and expanding at a robust Compound Annual Growth Rate (CAGR) exceeding 8.00%. This upward trajectory is primarily fueled by the increasing prevalence of type 2 diabetes globally and the growing demand for effective glycemic control solutions. Ozempic, a leading GLP-1 receptor agonist, has demonstrated significant efficacy in not only managing blood sugar levels but also in promoting weight loss, making it a highly sought-after treatment. The drug's expanding therapeutic applications, including its potential benefits in cardiovascular risk reduction, further contribute to its market dominance. Key players like Novo Nordisk, Eli Lilly and Company, and Merck & Co., Inc. are actively investing in research and development, aiming to enhance existing formulations and explore new indications, thereby driving innovation and market expansion. The market's growth is also supported by increasing healthcare expenditure and a greater awareness among patients and healthcare providers regarding the benefits of advanced diabetes management therapies.

Ozempic Market Market Size (In Million)

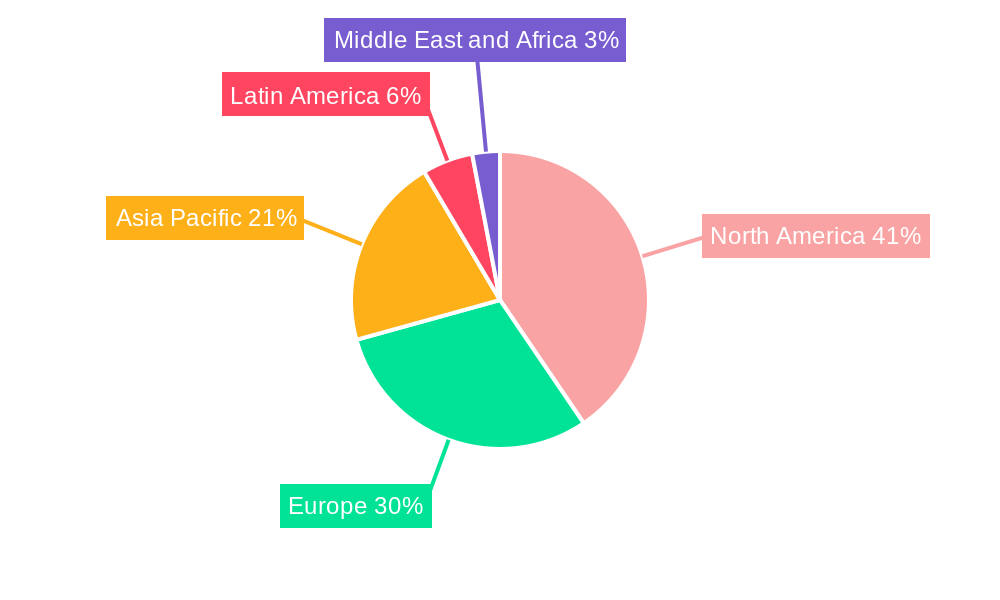

The market segmentation reveals Ozempic as the primary focus, highlighting its central role. Geographically, North America, particularly the United States, is expected to maintain its leading position due to a high diabetes burden and advanced healthcare infrastructure. Europe follows as a significant market, with key economies like Germany, France, and the UK showing strong adoption rates. The Asia Pacific region presents a substantial growth opportunity, driven by a rapidly expanding patient population, increasing disposable incomes, and improving access to advanced medical treatments in countries like China and India. However, certain factors could restrain market growth. These include the high cost of Ozempic, potential side effects requiring careful patient management, and the emergence of alternative treatment options, including biosimil versions of existing drugs, which could intensify competition. Despite these challenges, the overwhelming clinical benefits and increasing diagnosis rates of type 2 diabetes indicate a sustained positive outlook for the Ozempic market in the coming years, with continuous innovation and strategic market penetrations expected to shape its future landscape.

Ozempic Market Company Market Share

Ozempic Market Analysis: Global Demand, Supply Chain Dynamics, and Future Projections (2019–2033)

This comprehensive Ozempic market report delves into the intricate dynamics shaping the global demand, supply, and future trajectory of this revolutionary pharmaceutical. Analyzing the market from 2019–2033, with a base year of 2025 and a forecast period of 2025–2033, this report provides in-depth insights into market structure, trends, dominant regions, product analysis, key drivers, challenges, and the competitive landscape. Leveraging high-volume keywords such as "Ozempic market size," "Ozempic demand," "Ozempic supply chain," "diabetes drug shortage," "weight loss drug," and "GLP-1 agonists," this report is optimized for search engines and tailored to engage industry professionals, investors, and stakeholders.

Ozempic Market Market Structure & Competitive Landscape

The Ozempic market is characterized by a concentrated structure, dominated by a few key players, most notably Novo Nordisk. Innovation drivers revolve around the drug's efficacy in glycemic control and its significant off-label application for weight management, leading to unprecedented demand. Regulatory impacts are substantial, with health authorities worldwide grappling with shortages and considering export restrictions, as evidenced by Germany's BfArM's considerations in November 2023. Product substitutes are emerging, but Ozempic's established position and proven efficacy create a high barrier to entry. End-user segmentation reveals a strong demand from both the diabetes patient population and individuals seeking weight loss solutions. Mergers and acquisition trends, while currently limited due to the dominance of existing players, could see consolidation as companies seek to enhance their GLP-1 portfolio. The market concentration ratio is estimated to be over 85% for the top two players, with an estimated M&A volume of less than $500 Million in the historical period.

Ozempic Market Market Trends & Opportunities

The Ozempic market is experiencing explosive growth, driven by a confluence of factors including an aging global population, rising prevalence of type 2 diabetes, and an increasing awareness and demand for effective weight management solutions. The Ozempic market size is projected to reach an estimated $XX Billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately XX% during the 2025–2033 forecast period. Technological shifts in drug development, particularly the advancement of GLP-1 receptor agonists, have been instrumental in creating highly effective therapeutic options. Consumer preferences are increasingly leaning towards treatments that offer both clinical benefits and aesthetic outcomes, propelling the off-label use of Ozempic for weight loss. This surge in demand, especially for lower-dose formulations as highlighted in September 2023 by Novo Nordisk's advisory to the TGA, has outpaced manufacturing capacities, leading to global shortages. This scarcity presents a significant opportunity for manufacturers to expand production, explore new distribution channels, and for research institutions to accelerate the development of next-generation GLP-1 agonists or alternative therapies. The market penetration rate for Ozempic in its approved indications is estimated at XX%, while the off-label use is rapidly expanding beyond XX% of the target demographic for weight management. The competitive dynamics are intensifying, with Eli Lilly and Company and Merck & Co., Inc. emerging as significant contenders in the GLP-1 space, aiming to capture market share through product innovation and strategic partnerships.

Dominant Markets & Segments in Ozempic Market

The Ozempic market is witnessing significant dominance from North America, particularly the United States, which accounts for an estimated XX% of the global market share. This dominance is fueled by a high prevalence of type 2 diabetes, a strong emphasis on preventative healthcare, and a well-established pharmaceutical market with high patient affordability and access to advanced treatments. Key growth drivers in this region include robust insurance coverage for chronic disease management, a substantial patient pool seeking effective weight loss solutions, and a proactive regulatory environment that, while facing supply challenges, generally supports the adoption of innovative therapies.

The segment of "Ozempic:" itself is the undisputed leader within the broader GLP-1 agonist market. Its multi-faceted benefits, addressing both glycemic control and weight management, have solidified its position.

- North America (USA & Canada): High prevalence of diabetes and obesity, advanced healthcare infrastructure, and strong consumer demand for weight loss solutions.

- Europe: Growing awareness of diabetes and obesity management, increasing healthcare spending, and a strong presence of key pharmaceutical players. However, supply chain issues are currently impacting market growth in countries like Germany, with the BfArM considering export bans due to widespread shortages.

- Asia Pacific: A rapidly growing market driven by increasing disposable incomes, rising incidence of lifestyle diseases, and expanding access to advanced healthcare. Countries like China and India represent significant untapped potential.

The dominant segment, Ozempic:, continues to be the primary revenue generator due to its dual-action therapeutic profile, making it a critical drug for both diabetes management and obesity treatment. The off-label use for weight loss is a critical factor contributing to its market dominance, creating substantial demand that manufacturers are struggling to meet.

Ozempic Market Product Analysis

Ozempic (semaglutide) stands out for its dual efficacy in managing type 2 diabetes and promoting significant weight loss. Its primary competitive advantage lies in its mechanism of action as a GLP-1 receptor agonist, which mimics the effects of the natural hormone, enhancing insulin secretion, reducing glucagon release, slowing gastric emptying, and promoting satiety. This results in improved glycemic control, HbA1c reduction, and substantial body weight reduction, offering a compelling value proposition for patients and healthcare providers. The convenience of once-weekly injection further enhances patient adherence and market appeal, differentiating it from more frequent dosing regimens.

Key Drivers, Barriers & Challenges in Ozempic Market

Key Drivers:

- Rising global prevalence of type 2 diabetes and obesity: A growing patient pool seeking effective management solutions.

- Demonstrated efficacy for both glycemic control and weight loss: The dual benefit drives significant patient and physician demand.

- Technological advancements in GLP-1 agonists: Development of more potent and convenient formulations.

- Increasing patient and physician awareness: Growing understanding of the benefits of GLP-1 receptor agonists.

Barriers & Challenges:

- Global supply chain constraints and manufacturing limitations: Demand significantly outstrips current production capacity, leading to widespread shortages.

- Regulatory scrutiny and potential export restrictions: Health authorities are closely monitoring supply and considering measures to ensure domestic availability.

- High cost of treatment: Affordability remains a significant barrier for some patient populations, particularly in regions with limited insurance coverage.

- Emergence of competing GLP-1 agonists and alternative therapies: Intensifying competition necessitates continuous innovation.

Growth Drivers in the Ozempic Market Market

The Ozempic market growth is primarily propelled by the escalating global epidemic of type 2 diabetes and obesity, creating a vast and expanding patient base requiring effective therapeutic interventions. The unique dual-action efficacy of Ozempic, simultaneously addressing blood sugar control and significant weight reduction, positions it as a highly desirable treatment option. Technological innovation in the development of GLP-1 receptor agonists, offering improved efficacy and administration convenience, further fuels market expansion. Additionally, increasing physician and patient awareness regarding the benefits of these advanced therapies, coupled with a growing societal focus on metabolic health and weight management, are crucial economic and policy-driven factors contributing to sustained growth.

Challenges Impacting Ozempic Market Growth

Significant challenges impacting Ozempic market growth are predominantly rooted in global supply chain disruptions and limited manufacturing capacities. Demand has surged unexpectedly, far exceeding existing production capabilities, resulting in critical drug shortages worldwide. This scarcity has prompted regulatory bodies, such as the German regulator BfArM, to consider export bans to safeguard domestic supply. Furthermore, the high price point of Ozempic presents an affordability barrier for many patients, especially in healthcare systems with restricted reimbursement policies. The competitive landscape is also intensifying with the emergence of new GLP-1 agonists and alternative weight-loss therapies, creating pressure for continuous product development and market differentiation.

Key Players Shaping the Ozempic Market Market

- Novo Nordisk

- Eli Lilly and Company

- Merck & Co., Inc.

Significant Ozempic Market Industry Milestones

- November 2023: German regulator BfArM is considering banning Ozempic exports as Europe's health systems struggle with a shortage of the diabetes drug, which is in high demand for its weight-loss benefits.

- September 2023: Novo Nordisk advised the Therapeutic Goods Administration and the Ozempic Medicine Shortage Action Group that supply throughout the rest of 2023 and 2024 will be limited. Novo Nordisk advised that demand had accelerated in recent months, particularly for the low-dose (0.25/0.5 mg) version. This additional demand is caused mainly by a rapid increase in prescribing for ‘off-label’ use (prescriptions to treat conditions other than those approved by the TGA).

Future Outlook for Ozempic Market Market

The future outlook for the Ozempic market remains exceptionally strong, driven by persistent and growing demand for effective diabetes and weight management solutions. Strategic opportunities lie in scaling up manufacturing capabilities to alleviate current shortages and meet projected demand, estimated to grow significantly. Further research and development into next-generation GLP-1 agonists with even greater efficacy, improved side-effect profiles, and broader applications will be crucial for sustained market leadership. Expansion into emerging markets with increasing prevalence of lifestyle diseases also presents substantial growth potential. The market will likely witness continued intense competition and evolving regulatory landscapes, necessitating agile strategies from key players.

Ozempic Market Segmentation

- 1. Ozempic

Ozempic Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. Spain

- 2.3. Italy

- 2.4. France

- 2.5. United Kingdom

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. Japan

- 3.2. China

- 3.3. Australia

- 3.4. India

- 3.5. South Korea

- 3.6. Malaysia

- 3.7. Indonesia

- 3.8. Thailand

- 3.9. Philippines

- 3.10. Vietnam

- 3.11. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Oman

- 5.4. Egypt

- 5.5. Iran

- 5.6. Rest of Middle East and Africa

Ozempic Market Regional Market Share

Geographic Coverage of Ozempic Market

Ozempic Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 8.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Effective and Accurate Drugs; Exponential Rise in the Incidence of Diseases like Cancer; Rising Global Agricultural Activities and Pharmaceutical Establishments

- 3.3. Market Restrains

- 3.3.1. Patent Expirations of Enzyme Inhibitor Drugs; Low-cost Generic Drugs

- 3.4. Market Trends

- 3.4.1. Rising obesity and diabetes prevalence globally is likely to drive the market over forecast period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ozempic Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ozempic

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Ozempic

- 6. North America Ozempic Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Ozempic

- 6.1. Market Analysis, Insights and Forecast - by Ozempic

- 7. Europe Ozempic Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Ozempic

- 7.1. Market Analysis, Insights and Forecast - by Ozempic

- 8. Asia Pacific Ozempic Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Ozempic

- 8.1. Market Analysis, Insights and Forecast - by Ozempic

- 9. Latin America Ozempic Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Ozempic

- 9.1. Market Analysis, Insights and Forecast - by Ozempic

- 10. Middle East and Africa Ozempic Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Ozempic

- 10.1. Market Analysis, Insights and Forecast - by Ozempic

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Novo Nordisk

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Eli Lilly and Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Merck & Co. Inc.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.1 Novo Nordisk

List of Figures

- Figure 1: Global Ozempic Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Ozempic Market Revenue (Million), by Ozempic 2025 & 2033

- Figure 3: North America Ozempic Market Revenue Share (%), by Ozempic 2025 & 2033

- Figure 4: North America Ozempic Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Ozempic Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Ozempic Market Revenue (Million), by Ozempic 2025 & 2033

- Figure 7: Europe Ozempic Market Revenue Share (%), by Ozempic 2025 & 2033

- Figure 8: Europe Ozempic Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Ozempic Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Ozempic Market Revenue (Million), by Ozempic 2025 & 2033

- Figure 11: Asia Pacific Ozempic Market Revenue Share (%), by Ozempic 2025 & 2033

- Figure 12: Asia Pacific Ozempic Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Ozempic Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Ozempic Market Revenue (Million), by Ozempic 2025 & 2033

- Figure 15: Latin America Ozempic Market Revenue Share (%), by Ozempic 2025 & 2033

- Figure 16: Latin America Ozempic Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Ozempic Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Ozempic Market Revenue (Million), by Ozempic 2025 & 2033

- Figure 19: Middle East and Africa Ozempic Market Revenue Share (%), by Ozempic 2025 & 2033

- Figure 20: Middle East and Africa Ozempic Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Ozempic Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Ozempic Market Revenue Million Forecast, by Ozempic 2020 & 2033

- Table 2: Global Ozempic Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Ozempic Market Revenue Million Forecast, by Ozempic 2020 & 2033

- Table 4: Global Ozempic Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Rest of North America Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Ozempic Market Revenue Million Forecast, by Ozempic 2020 & 2033

- Table 9: Global Ozempic Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Germany Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Spain Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Russia Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Ozempic Market Revenue Million Forecast, by Ozempic 2020 & 2033

- Table 18: Global Ozempic Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Japan Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: China Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Australia Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: India Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: South Korea Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Malaysia Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Indonesia Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Thailand Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Philippines Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Vietnam Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Ozempic Market Revenue Million Forecast, by Ozempic 2020 & 2033

- Table 31: Global Ozempic Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Mexico Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of Latin America Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Ozempic Market Revenue Million Forecast, by Ozempic 2020 & 2033

- Table 36: Global Ozempic Market Revenue Million Forecast, by Country 2020 & 2033

- Table 37: South Africa Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Saudi Arabia Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oman Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Egypt Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Iran Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Rest of Middle East and Africa Ozempic Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ozempic Market?

The projected CAGR is approximately > 8.00%.

2. Which companies are prominent players in the Ozempic Market?

Key companies in the market include Novo Nordisk , Eli Lilly and Company , Merck & Co., Inc..

3. What are the main segments of the Ozempic Market?

The market segments include Ozempic.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.99 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Effective and Accurate Drugs; Exponential Rise in the Incidence of Diseases like Cancer; Rising Global Agricultural Activities and Pharmaceutical Establishments.

6. What are the notable trends driving market growth?

Rising obesity and diabetes prevalence globally is likely to drive the market over forecast period.

7. Are there any restraints impacting market growth?

Patent Expirations of Enzyme Inhibitor Drugs; Low-cost Generic Drugs.

8. Can you provide examples of recent developments in the market?

November 2023: German regulator BfArM is considering banning Ozempic exports as Europe's health systems struggle with a shortage of the diabetes drug, which is in high demand for its weight-loss benefits.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ozempic Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ozempic Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ozempic Market?

To stay informed about further developments, trends, and reports in the Ozempic Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence