Key Insights

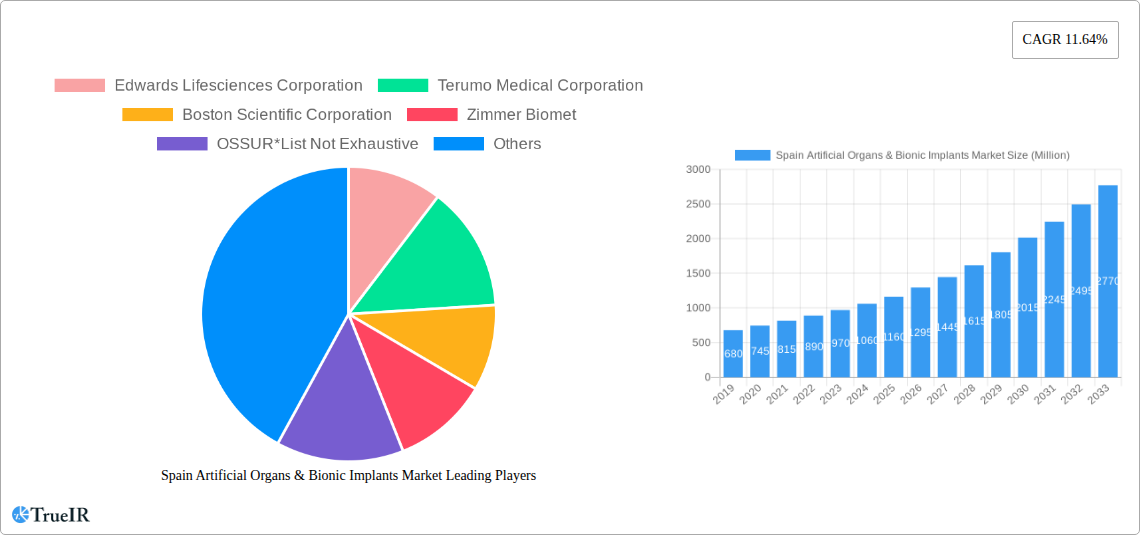

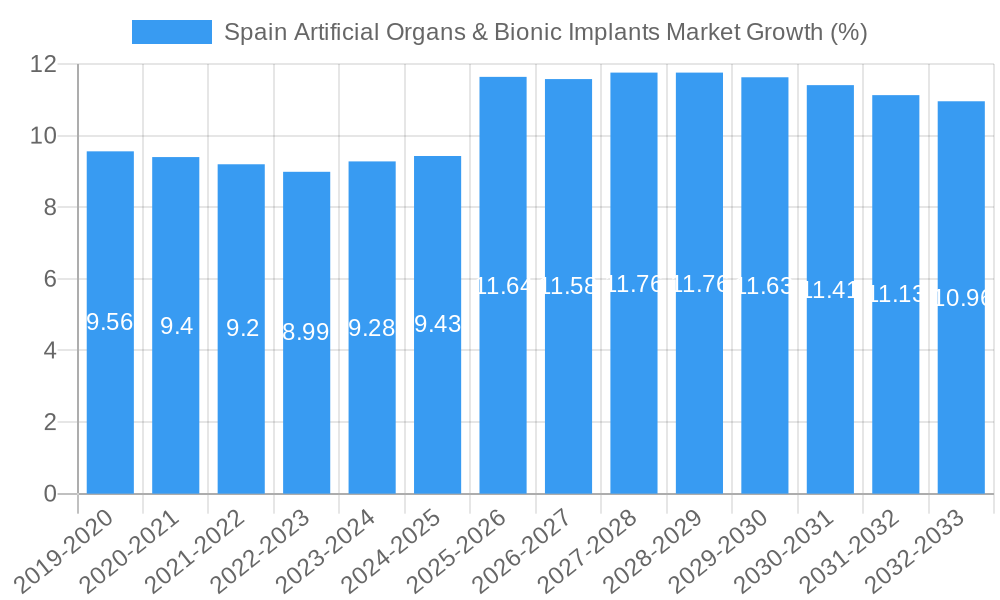

The Spanish Artificial Organs and Bionic Implants Market is poised for significant expansion, projected to reach a substantial market size of approximately $1,250 million by 2025, fueled by a robust Compound Annual Growth Rate (CAGR) of 11.64% throughout the forecast period of 2025-2033. This dynamic growth is primarily driven by an increasing prevalence of chronic diseases, a growing aging population, and a heightened demand for advanced medical technologies that improve patient quality of life. Key drivers include advancements in regenerative medicine, leading to more sophisticated artificial organs, and breakthroughs in bionic technologies, offering enhanced functionality for individuals with disabilities. The market is segmented into Artificial Organs, encompassing artificial hearts, kidneys, and other vital organ replacements, and Bionics, which includes vision, ear, orthopedic, and cardiac bionics. The rising incidence of cardiovascular diseases and kidney failure, coupled with an expanding geriatric population susceptible to orthopedic and vision impairments, will continue to propel demand across these segments. Furthermore, ongoing research and development efforts by leading global players are introducing innovative solutions, further stimulating market penetration and adoption within Spain.

The competitive landscape in Spain is characterized by the presence of major global players like Edwards Lifesciences Corporation, Medtronic plc, Boston Scientific Corporation, and Zimmer Biomet, alongside specialized companies focusing on bionic solutions such as Sonova Holding AG (Advanced Bionics) and Otto Bock Holding GmbH & Co KG. These companies are actively investing in product innovation, strategic partnerships, and clinical trials to secure a competitive edge. Emerging trends include the development of personalized bionic implants and the integration of artificial intelligence for improved device performance and patient outcomes. However, the market faces certain restraints, including the high cost of advanced medical devices and implants, which can limit accessibility for some patient segments, and the need for specialized training for healthcare professionals in implanting and managing these sophisticated technologies. Regulatory hurdles and reimbursement policies also play a crucial role in market adoption. Despite these challenges, the strong underlying demand, coupled with technological advancements and supportive government initiatives aimed at improving healthcare infrastructure, indicates a positive trajectory for the Spanish Artificial Organs and Bionic Implants Market.

Unlock critical insights into the burgeoning Spain Artificial Organs & Bionic Implants Market. This in-depth report offers a definitive analysis of market dynamics, key players, emerging trends, and future opportunities within Spain's advanced medical technology sector. Covering the historical period of 2019-2024 and projecting growth through 2033, this research is essential for stakeholders seeking to capitalize on the expanding demand for innovative bionic implants and artificial organ solutions.

Spain Artificial Organs & Bionic Implants Market Market Structure & Competitive Landscape

The Spain Artificial Organs & Bionic Implants Market is characterized by a moderate to high level of concentration, driven by the significant R&D investments and intellectual property held by established global players. Innovation is a primary driver, with companies heavily investing in advanced materials, miniaturization, and AI integration for enhanced functionality and patient outcomes. Regulatory frameworks, particularly those established by the European Medicines Agency (EMA) and Spanish health authorities, play a crucial role in market access and product approval, necessitating rigorous clinical trials and adherence to quality standards. Product substitutes, while limited in direct replacement for complex organs, exist in the form of less invasive treatments and alternative therapeutic approaches. The end-user segmentation is diverse, encompassing hospitals, specialized clinics, and research institutions, each with distinct purchasing patterns and needs. Merger and acquisition (M&A) activities have been observed, driven by the desire for market consolidation, portfolio expansion, and access to innovative technologies. For instance, the market has seen xx significant M&A transactions in the historical period, with an estimated xx billion value, contributing to a more consolidated yet dynamic competitive environment. Key players are actively seeking strategic partnerships to accelerate product development and market penetration.

Spain Artificial Organs & Bionic Implants Market Market Trends & Opportunities

The Spain Artificial Organs & Bionic Implants Market is poised for significant expansion, driven by a confluence of technological advancements, an aging population, and increasing awareness of advanced medical solutions. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately xx% from its base year of 2025, reaching an estimated value of xx million by 2033. Technological shifts are central to this growth, with advancements in 3D bioprinting, regenerative medicine, and sophisticated bionic interfaces enabling the development of more functional and biocompatible artificial organs and implants. Wearable bionic devices and smart implants are gaining traction, offering continuous monitoring and personalized treatment. Consumer preferences are evolving towards less invasive procedures, faster recovery times, and long-term implant performance, pushing manufacturers to innovate in these areas. Competitive dynamics are intensifying, with both global leaders and emerging domestic companies vying for market share. Opportunities abound in segments such as advanced prosthetics, neuroprosthetics, and bio-integrated organ replacements. The increasing prevalence of chronic diseases, including cardiovascular conditions, diabetes, and neurological disorders, is creating a sustained demand for artificial organs and bionic implants. Furthermore, government initiatives promoting healthcare innovation and investment in advanced medical technologies are expected to further accelerate market penetration rates, which are currently estimated at xx% for advanced bionic implants and xx% for artificial organ replacements. The development of artificial intelligence-powered diagnostic tools and personalized treatment plans integrated with bionic devices represents a significant frontier for market growth. The growing elderly population in Spain, coupled with a rising disposable income among certain demographics, contributes to a stronger ability to afford and adopt these advanced medical technologies, thereby driving market penetration and overall market value.

Dominant Markets & Segments in Spain Artificial Organs & Bionic Implants Market

Within the Spain Artificial Organs & Bionic Implants Market, Orthopedic Bionic holds a dominant position, driven by the high prevalence of age-related musculoskeletal conditions and sports injuries. The segment's dominance is further fueled by significant advancements in materials science, leading to more durable, lightweight, and bio-integrated prosthetic limbs and joint replacements. Government policies supporting rehabilitation services and the integration of advanced orthopedic devices into public healthcare systems have also played a pivotal role. The segment benefits from robust R&D pipelines focused on intuitive control systems and enhanced sensory feedback for prosthetic users, contributing to improved quality of life and functional recovery.

Artificial Organs, particularly Artificial Kidney and Artificial Heart segments, represent rapidly growing areas with immense potential. The increasing incidence of kidney failure and cardiovascular diseases, coupled with a shortage of organ donors, creates a substantial unmet need for artificial organ solutions. Technological innovations in implantable devices, such as improved dialysis technologies and advanced ventricular assist devices (VADs), are driving growth. While the initial cost of these artificial organs can be high, their long-term benefits in extending and improving patient lives are undeniable.

Ear Bionics, including cochlear implants, also exhibits strong growth due to increasing awareness and diagnosis of hearing loss, particularly among the elderly population. Advances in digital signal processing and miniaturization have made these devices more effective and less intrusive. The market penetration for ear bionics is steadily increasing as more individuals seek solutions for hearing impairment.

Vision Bionics, such as retinal implants and advanced artificial eyes, represent a nascent yet promising segment. Ongoing research and development in restoring sight through neuro-stimulation and bio-integrated prosthetics are paving the way for future market expansion. While currently niche, the potential to restore vision for individuals with degenerative eye diseases presents a significant long-term opportunity.

Key Growth Drivers for Dominant Segments:

- Orthopedic Bionic:

- Aging population and increasing incidence of osteoarthritis and osteoporosis.

- Technological advancements in materials (e.g., titanium alloys, advanced polymers) and robotics.

- Government initiatives promoting rehabilitation and accessibility.

- Growing demand for active lifestyles and participation in sports.

- Artificial Kidney:

- High prevalence of chronic kidney disease (CKD) and diabetes.

- Shortage of kidney donors for transplantation.

- Advancements in wearable and implantable dialysis technologies.

- Increasing healthcare expenditure and patient affordability.

- Artificial Heart:

- Rising rates of cardiovascular diseases, heart failure, and myocardial infarction.

- Limited availability of donor hearts for transplantation.

- Development of advanced ventricular assist devices (VADs) and total artificial hearts.

- Improved surgical techniques and post-operative care.

- Ear Bionics:

- Increasing prevalence of age-related hearing loss (presbycusis).

- Growing awareness and early diagnosis of hearing impairments.

- Technological advancements in digital signal processing and implantable devices.

- Government support for audiology services and hearing aid provision.

Spain Artificial Organs & Bionic Implants Market Product Analysis

The Spain Artificial Organs & Bionic Implants Market is witnessing rapid product innovation across all segments. In artificial organs, advancements are focused on improving biocompatibility, longevity, and reducing the risk of rejection, with a growing emphasis on bio-artificial organs that integrate living cells. For bionic implants, the trend is towards greater intelligence and seamless integration with the human nervous system, offering more natural control and sensory feedback. Innovations in materials science, such as the use of advanced polymers and nanoscale materials, are enhancing implant durability and minimizing patient discomfort. The market fit is strengthening as these products offer tangible improvements in patient quality of life, functional restoration, and the management of chronic conditions, positioning them as indispensable medical solutions.

Key Drivers, Barriers & Challenges in Spain Artificial Organs & Bionic Implants Market

Key Drivers:

- Technological Advancements: Continuous innovation in materials science, miniaturization, AI integration, and bio-engineering is creating more effective and patient-friendly solutions. For example, the development of AI-powered neural interfaces for bionic limbs significantly enhances control and dexterity.

- Aging Population: Spain's demographic shift towards an older population naturally increases the incidence of conditions requiring artificial organs and bionic implants, such as cardiovascular diseases, kidney failure, and musculoskeletal disorders.

- Rising Healthcare Expenditure: Increased investment in healthcare infrastructure and advanced medical technologies by both public and private sectors is making these sophisticated devices more accessible.

Barriers & Challenges:

- High Cost of Development and Production: The research, development, and manufacturing of artificial organs and bionic implants are resource-intensive, leading to high product prices that can limit accessibility for some patient segments. The estimated average cost of an artificial heart implantation ranges from xx million to xx million.

- Regulatory Hurdles: Stringent approval processes by regulatory bodies, requiring extensive clinical trials and post-market surveillance, can prolong market entry and increase development costs.

- Limited Availability of Skilled Professionals: A shortage of trained surgeons, prosthetists, and rehabilitation specialists proficient in implanting and managing these advanced devices poses a challenge to widespread adoption.

- Ethical and Social Acceptance: While growing, there can still be societal apprehension and ethical considerations surrounding the long-term use and integration of artificial body parts and implants.

Growth Drivers in the Spain Artificial Organs & Bionic Implants Market Market

The Spain Artificial Organs & Bionic Implants Market is propelled by a robust combination of technological advancements, demographic shifts, and supportive economic and policy environments. The relentless pace of innovation in areas like 3D bioprinting, regenerative medicine, and AI-driven prosthetics is creating novel solutions for unmet medical needs. The aging Spanish population, coupled with an increasing prevalence of chronic diseases, directly translates into a growing demand for artificial organs and bionic implants. Furthermore, favorable government policies that encourage R&D in the medtech sector, coupled with increasing healthcare expenditure, are creating an ecosystem conducive to market expansion and investment. The increasing awareness among patients about advanced treatment options and their potential to improve quality of life also plays a significant role in driving demand.

Challenges Impacting Spain Artificial Organs & Bionic Implants Market Growth

Despite the promising growth trajectory, the Spain Artificial Organs & Bionic Implants Market faces several significant challenges that can impede its expansion. The substantial capital investment required for research, development, and manufacturing of these highly sophisticated devices often results in high per-unit costs, posing a barrier to affordability and widespread accessibility. Regulatory compliance, while essential, involves lengthy and complex approval processes, which can delay product launches and increase operational expenses. Supply chain complexities, particularly for specialized components and materials, can also lead to production delays and increased costs. Moreover, the need for highly skilled medical professionals to implant, manage, and maintain these devices presents a human capital challenge that needs to be addressed to ensure optimal patient care and market growth.

Key Players Shaping the Spain Artificial Organs & Bionic Implants Market Market

- Edwards Lifesciences Corporation

- Terumo Medical Corporation

- Boston Scientific Corporation

- Zimmer Biomet

- OSSUR

- Medtronic plc

- Sonova Holding AG (Advanced Bionics)

- Otto Bock Holding GmbH & Co KG

Significant Spain Artificial Organs & Bionic Implants Market Industry Milestones

- 2019: Launch of a new generation of implantable cardiac devices with enhanced battery life and remote monitoring capabilities, significantly improving patient management.

- 2020: Approval of a novel bio-integrated prosthetic limb offering improved sensory feedback and intuitive control, marking a significant step in bionic limb technology.

- 2021: Introduction of advanced artificial kidney dialysis technology featuring a more compact and efficient design, enhancing patient comfort and home-use capabilities.

- 2022: Successful completion of clinical trials for a cutting-edge artificial pancreas system, showing promising results in glucose regulation for diabetic patients.

- 2023: Strategic acquisition of a specialized AI-driven rehabilitation software company by a leading bionic implant manufacturer to enhance post-implantation therapy and outcomes.

- 2024: Rollout of next-generation cochlear implants with improved sound processing algorithms, leading to clearer and more natural hearing experiences.

Future Outlook for Spain Artificial Organs & Bionic Implants Market Market

- 2019: Launch of a new generation of implantable cardiac devices with enhanced battery life and remote monitoring capabilities, significantly improving patient management.

- 2020: Approval of a novel bio-integrated prosthetic limb offering improved sensory feedback and intuitive control, marking a significant step in bionic limb technology.

- 2021: Introduction of advanced artificial kidney dialysis technology featuring a more compact and efficient design, enhancing patient comfort and home-use capabilities.

- 2022: Successful completion of clinical trials for a cutting-edge artificial pancreas system, showing promising results in glucose regulation for diabetic patients.

- 2023: Strategic acquisition of a specialized AI-driven rehabilitation software company by a leading bionic implant manufacturer to enhance post-implantation therapy and outcomes.

- 2024: Rollout of next-generation cochlear implants with improved sound processing algorithms, leading to clearer and more natural hearing experiences.

Future Outlook for Spain Artificial Organs & Bionic Implants Market Market

The future outlook for the Spain Artificial Organs & Bionic Implants Market is exceptionally bright, driven by relentless technological innovation and an ever-growing demand for advanced medical solutions. Strategic opportunities lie in the development of fully implantable and autonomous artificial organs, advanced neuroprosthetics that offer even greater integration with the central nervous system, and personalized bionic solutions tailored to individual patient needs. The increasing adoption of AI and machine learning in device design and patient monitoring will further enhance performance and outcomes. As regulatory pathways become more streamlined and healthcare infrastructure continues to evolve, market penetration is expected to accelerate, making these life-changing technologies accessible to a broader segment of the Spanish population and solidifying Spain's position as a key European market for artificial organs and bionic implants. The projected market size of xx million by 2033 signifies substantial growth and investment potential.

Spain Artificial Organs & Bionic Implants Market Segmentation

-

1. Product

-

1.1. Artificial Organs

- 1.1.1. Artificial Heart

- 1.1.2. Artificial Kidney

- 1.1.3. Others

-

1.2. Bionics

- 1.2.1. Vision Bionics

- 1.2.2. Ear Bionics

- 1.2.3. Orthopedic Bionic

- 1.2.4. Cardiac Bionics

-

1.1. Artificial Organs

Spain Artificial Organs & Bionic Implants Market Segmentation By Geography

- 1. Spain

Spain Artificial Organs & Bionic Implants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.64% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increased Incidence of Disabilities and Organ Failures and Increasing Medical Tourism; Technological Advancements Leading to Enhanced Applications

- 3.3. Market Restrains

- 3.3.1. ; Expensive Procedures and Fear of Device Malfunction and its Consequences

- 3.4. Market Trends

- 3.4.1. Cardiac Bionics Segment is Expected to Have a Highest Growth Rate in the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Artificial Organs & Bionic Implants Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Artificial Organs

- 5.1.1.1. Artificial Heart

- 5.1.1.2. Artificial Kidney

- 5.1.1.3. Others

- 5.1.2. Bionics

- 5.1.2.1. Vision Bionics

- 5.1.2.2. Ear Bionics

- 5.1.2.3. Orthopedic Bionic

- 5.1.2.4. Cardiac Bionics

- 5.1.1. Artificial Organs

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Edwards Lifesciences Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Terumo Medical Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Boston Scientific Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Zimmer Biomet

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 OSSUR*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Medtronic plc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sonova Holding AG (Advanced Bionics)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Otto Bock Holding GmbH & Co KG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Edwards Lifesciences Corporation

List of Figures

- Figure 1: Spain Artificial Organs & Bionic Implants Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Spain Artificial Organs & Bionic Implants Market Share (%) by Company 2024

List of Tables

- Table 1: Spain Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Spain Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Spain Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Spain Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Spain Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Product 2019 & 2032

- Table 6: Spain Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Artificial Organs & Bionic Implants Market?

The projected CAGR is approximately 11.64%.

2. Which companies are prominent players in the Spain Artificial Organs & Bionic Implants Market?

Key companies in the market include Edwards Lifesciences Corporation, Terumo Medical Corporation, Boston Scientific Corporation, Zimmer Biomet, OSSUR*List Not Exhaustive, Medtronic plc, Sonova Holding AG (Advanced Bionics), Otto Bock Holding GmbH & Co KG.

3. What are the main segments of the Spain Artificial Organs & Bionic Implants Market?

The market segments include Product.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increased Incidence of Disabilities and Organ Failures and Increasing Medical Tourism; Technological Advancements Leading to Enhanced Applications.

6. What are the notable trends driving market growth?

Cardiac Bionics Segment is Expected to Have a Highest Growth Rate in the Forecast Period.

7. Are there any restraints impacting market growth?

; Expensive Procedures and Fear of Device Malfunction and its Consequences.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Artificial Organs & Bionic Implants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Artificial Organs & Bionic Implants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Artificial Organs & Bionic Implants Market?

To stay informed about further developments, trends, and reports in the Spain Artificial Organs & Bionic Implants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence