Key Insights

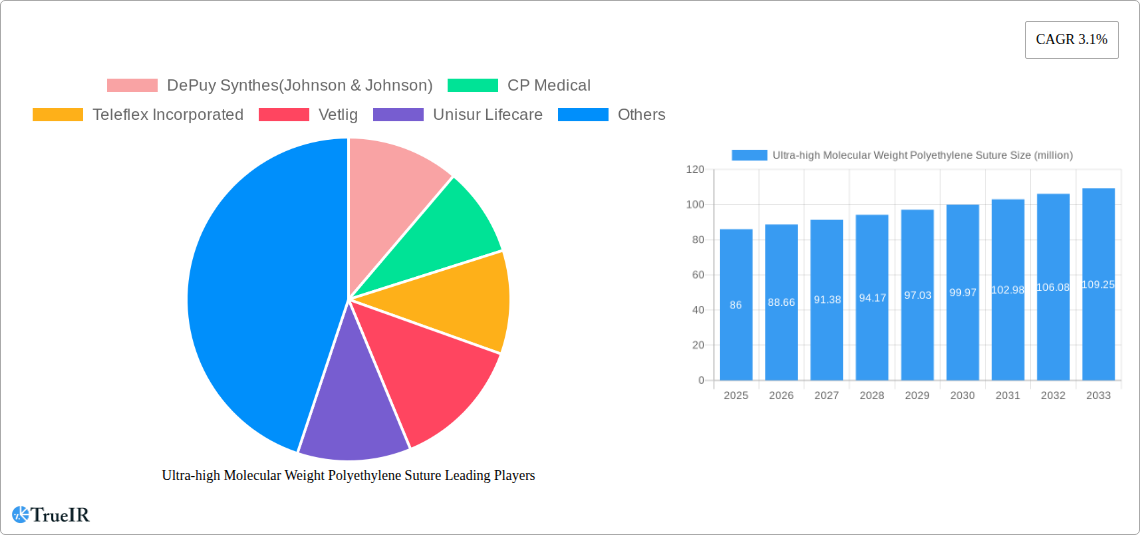

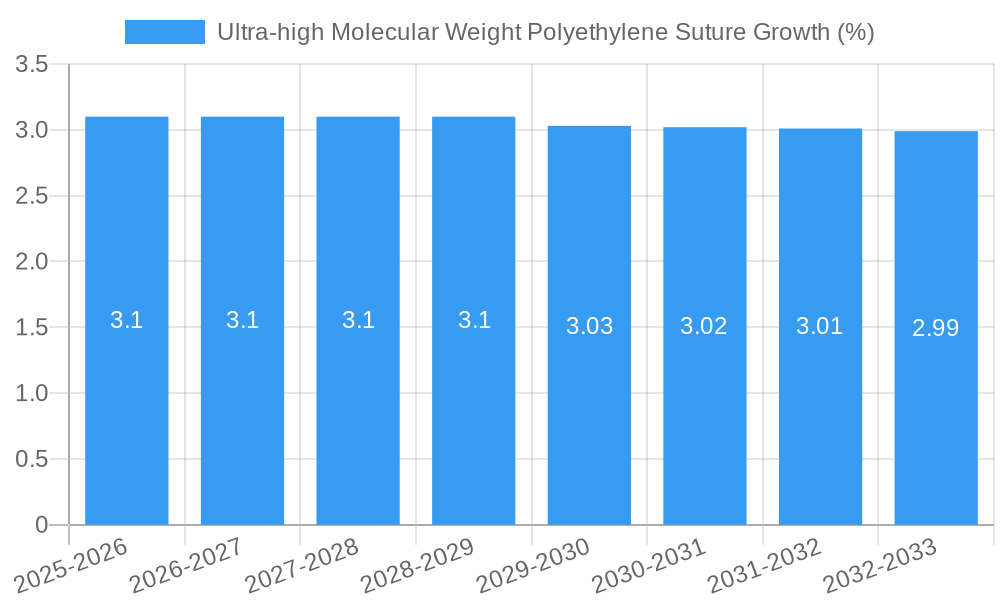

The global Ultra-high Molecular Weight Polyethylene (UHMWPE) Suture market is poised for steady growth, projecting a market size of \$86 million in 2025 and anticipated to expand at a Compound Annual Growth Rate (CAGR) of 3.1% through 2033. This sustained expansion is largely driven by the increasing prevalence of orthopedic procedures and cardiovascular surgeries, where UHMWPE sutures offer superior strength, durability, and biocompatibility compared to traditional materials. The material's inherent properties, such as high abrasion resistance and low friction, make it an ideal choice for demanding surgical applications requiring reliable tissue approximation and long-term stability. The growing adoption of minimally invasive surgical techniques further bolsters demand, as UHMWPE sutures facilitate precise manipulation and secure knot tying in confined surgical fields.

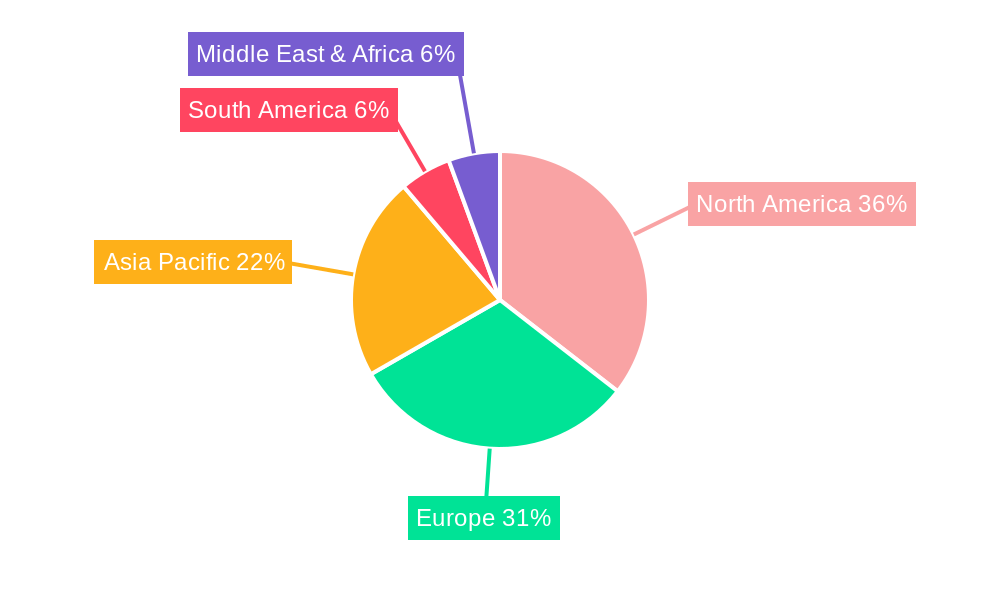

The market is segmented by application into Cardiovascular Surgery, Orthopedic Procedures, Arthroscopy, and Other categories, with Orthopedic Procedures and Cardiovascular Surgery expected to represent the largest shares due to the high volume of interventions in these fields. The "Pure Ultra-high Molecular Weight Polyethylene" and "Ultra High Molecular Polyethylene and Polyester" segments represent the primary types, with ongoing innovation in material science and blending techniques likely to enhance their performance characteristics and expand their utility. Geographically, North America and Europe currently dominate the market, driven by advanced healthcare infrastructure and a high rate of surgical procedure adoption. However, the Asia Pacific region is anticipated to exhibit the fastest growth, fueled by an expanding patient base, increasing healthcare expenditure, and a growing demand for advanced surgical materials. Restraints in the market may include the higher cost of UHMWPE sutures compared to some conventional alternatives and the need for specialized surgical training for optimal utilization.

Ultra-high Molecular Weight Polyethylene Suture Market: Comprehensive Analysis and Future Projections (2019-2033)

This in-depth report provides a dynamic, SEO-optimized analysis of the global Ultra-high Molecular Weight Polyethylene (UHMWPE) Suture market. Leveraging high-volume keywords essential for industry professionals and stakeholders, this report offers critical insights into market structure, trends, dominant segments, product innovations, growth drivers, challenges, and the competitive landscape. The study encompasses a comprehensive historical period from 2019 to 2024, with a base year of 2025 and a robust forecast period extending to 2033, offering a unique 14-year outlook.

Ultra-high Molecular Weight Polyethylene Suture Market Structure & Competitive Landscape

The global Ultra-high Molecular Weight Polyethylene (UHMWPE) suture market is characterized by a moderately consolidated structure, with a few key players holding significant market share. Innovation serves as a primary driver, with companies continuously investing in research and development to enhance suture strength, biocompatibility, and specialized applications. Regulatory landscapes, particularly stringent approval processes for medical devices in major economies, significantly impact market entry and product launches. Product substitutes, while present in the broader surgical suture market, are less direct for UHMWPE's niche applications due to its superior tensile strength and low friction properties. End-user segmentation is crucial, with hospitals and surgical centers representing the primary consumer base, further divided by surgical specialty. Merger and acquisition (M&A) activities have been observed, with larger medical device manufacturers acquiring smaller, innovative UHMWPE suture companies to expand their product portfolios and market reach. For instance, recent M&A volumes have seen an estimated xx billion USD in transactions, reflecting strategic consolidation. Concentration ratios suggest the top 5 players account for approximately 65% of the market share.

Ultra-high Molecular Weight Polyethylene Suture Market Trends & Opportunities

The global Ultra-high Molecular Weight Polyethylene (UHMWPE) suture market is poised for substantial growth, driven by an increasing demand for advanced surgical materials and a rising prevalence of complex medical procedures. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 8.5% over the forecast period. Technological advancements are central to this growth, with ongoing research focusing on improving the bio-inertness and handling characteristics of UHMWPE sutures. Innovations such as braided structures for enhanced knot security and specialized coatings for improved tissue integration are gaining traction. Consumer preferences are shifting towards sutures that offer superior tensile strength, minimal tissue reaction, and faster patient recovery times, all of which are inherent advantages of UHMWPE. The competitive dynamics within the market are intensifying, with established players focusing on product differentiation and market expansion, while emerging companies are striving to carve out niches through specialized product offerings and strategic partnerships. Market penetration rates for UHMWPE sutures are steadily increasing, particularly in developed regions, as healthcare providers recognize their efficacy in critical surgical interventions. The global market size for UHMWPE sutures is estimated to reach over $2.5 million in 2025 and is projected to grow to over $4.8 million by 2033. Opportunities lie in the development of novel delivery systems, biodegradable UHMWPE variants, and sutures tailored for emerging minimally invasive surgical techniques. The growing geriatric population worldwide also presents a significant opportunity, as this demographic is more prone to conditions requiring surgical intervention, thus boosting the demand for high-performance sutures. Furthermore, the increasing adoption of advanced surgical robotics and the continuous drive for precision in surgical procedures will further fuel the demand for UHMWPE sutures, which offer the necessary strength and precision required for these sophisticated interventions. The market is also seeing a rise in personalized medicine approaches, which may lead to the development of custom-designed UHMWPE sutures for specific patient needs and surgical scenarios.

Dominant Markets & Segments in Ultra-high Molecular Weight Polyethylene Suture

The Ultra-high Molecular Weight Polyethylene (UHMWPE) Suture market exhibits strong dominance in specific regions and application segments, driven by a confluence of factors.

- Dominant Region: North America currently leads the UHMWPE suture market, primarily due to its advanced healthcare infrastructure, high disposable incomes, and a robust adoption rate of cutting-edge medical technologies. The region boasts a well-established network of hospitals and research institutions that drive innovation and demand for high-performance surgical materials. Government initiatives promoting advancements in medical device technology and favorable reimbursement policies also contribute to North America's leading position.

- Dominant Country: The United States stands out as the most significant contributor to the global UHMWPE suture market within North America. This is attributed to the high volume of complex surgical procedures performed annually, coupled with a strong emphasis on patient outcomes and the use of premium surgical consumables.

- Dominant Application Segment: Orthopedic Procedures represent the largest and fastest-growing application segment for UHMWPE sutures. The inherent strength and durability of UHMWPE make it ideal for reconstructive surgeries, ligament repairs, and joint replacements, where high tensile strength and resistance to wear are paramount. The increasing incidence of sports-related injuries and age-related degenerative joint diseases globally further propels the demand for UHMWPE sutures in orthopedic applications.

- Key Growth Drivers in Orthopedics:

- Rising prevalence of osteoarthritis and sports injuries.

- Technological advancements in arthroscopic and minimally invasive orthopedic surgeries.

- Growing adoption of advanced implant materials requiring strong and reliable fixation.

- Increasing demand for faster patient recovery and reduced complication rates.

- Key Growth Drivers in Orthopedics:

- Dominant Type Segment: Pure Ultra-high Molecular Weight Polyethylene sutures hold the largest market share within the UHMWPE suture types. This dominance stems from their superior tensile strength-to-weight ratio, excellent biocompatibility, and resistance to degradation, making them the preferred choice for demanding surgical applications where minimal elongation and maximum load-bearing capacity are critical.

- Key Growth Drivers for Pure UHMWPE:

- Unmatched tensile strength and knot security.

- Low friction and excellent lubricity for ease of passage through tissues.

- High resistance to abrasion and fatigue.

- Biocompatibility and minimal inflammatory response.

- Key Growth Drivers for Pure UHMWPE:

While Cardiovascular Surgery and Arthroscopy are significant segments, their growth is currently outpaced by the burgeoning demand in Orthopedics. The "Other" segment, encompassing various specialized surgical fields, also contributes to the market, reflecting the versatility of UHMWPE sutures. The "Ultra High Molecular Polyethylene and Polyester" blend segment is gaining traction due to its unique combination of properties, offering enhanced flexibility and handling in certain procedures.

Ultra-high Molecular Weight Polyethylene Suture Product Analysis

UHMWPE sutures are distinguished by their exceptional tensile strength, low friction, and high abrasion resistance, surpassing traditional suture materials. Innovations focus on braided constructs for improved knot security and tactile feedback, alongside specialized coatings to enhance biocompatibility and tissue interaction. These advancements allow for more precise and secure tissue approximation in complex procedures, leading to improved patient outcomes and reduced complication rates. Their application extends across critical surgical specialties, offering a competitive advantage in high-demand medical interventions.

Key Drivers, Barriers & Challenges in Ultra-high Molecular Weight Polyethylene Suture

Key Drivers: The UHMWPE suture market is propelled by the increasing demand for minimally invasive surgeries, technological advancements in surgical techniques, and a rising global burden of chronic diseases requiring surgical intervention. The superior mechanical properties of UHMWPE, such as its high tensile strength and low friction, are critical enablers. Furthermore, a growing emphasis on faster patient recovery and reduced post-operative complications fuels the adoption of advanced suture materials like UHMWPE. Favorable reimbursement policies in developed economies also act as a significant growth catalyst.

Barriers & Challenges: Despite robust growth prospects, the market faces several challenges. The high cost of UHMWPE suture manufacturing and raw materials can lead to higher product prices, potentially limiting adoption in cost-sensitive markets. Stringent regulatory approvals for medical devices, particularly in regions like Europe and Asia, can prolong time-to-market for new products. Supply chain disruptions and the dependence on specialized raw material suppliers can also pose risks. Intense competition from established and emerging players, as well as the continuous need for product innovation to stay ahead, present ongoing challenges.

Growth Drivers in the Ultra-high Molecular Weight Polyethylene Suture Market

Key growth drivers for the UHMWPE suture market are multifaceted. Technologically, advancements in braiding techniques and surface coatings are enhancing suture performance. Economically, increasing healthcare expenditure globally and the rising disposable income in emerging economies are expanding market access. Regulatory factors, such as streamlined approval pathways for innovative medical devices in certain regions, also contribute to growth. Specific examples include the development of absorbable UHMWPE-based sutures and the integration of UHMWPE into smart surgical tools. The growing prevalence of chronic diseases like cardiovascular disorders and orthopedic conditions necessitates advanced surgical interventions, thereby driving demand for high-performance sutures.

Challenges Impacting Ultra-high Molecular Weight Polyethylene Suture Growth

Several challenges can impede the growth of the UHMWPE suture market. Regulatory complexities and the lengthy approval processes in various countries represent significant hurdles for market entry and expansion. Supply chain vulnerabilities, including the availability and cost of raw materials, can impact production volumes and pricing. Competitive pressures from both established manufacturers offering a broad range of sutures and new entrants with specialized products necessitate continuous innovation and aggressive market strategies. The high initial investment required for research and development and manufacturing infrastructure can also be a restraint for smaller companies.

Key Players Shaping the Ultra-high Molecular Weight Polyethylene Suture Market

- DePuy Synthes (Johnson & Johnson)

- CP Medical

- Teleflex Incorporated

- Vetlig

- Unisur Lifecare

- MZF4

- Riverpoint Medical

- Zhejiang Qianxilong Special Fibre Co.,Ltd.

- SMI AG

Significant Ultra-high Molecular Weight Polyethylene Suture Industry Milestones

- 2019: Introduction of enhanced braided UHMWPE sutures with improved knot security for orthopedic applications.

- 2020: Launch of novel UHMWPE sutures with antimicrobial coatings to reduce surgical site infections.

- 2021: Significant investments in R&D for biodegradable UHMWPE variants.

- 2022: Expansion of manufacturing capacity by key players to meet growing global demand.

- 2023: Emergence of specialized UHMWPE sutures for complex cardiovascular procedures.

- 2024: Increased focus on sustainable manufacturing practices for UHMWPE suture production.

Future Outlook for Ultra-high Molecular Weight Polyethylene Suture Market

The future outlook for the Ultra-high Molecular Weight Polyethylene (UHMWPE) suture market is exceptionally promising, driven by continuous innovation and a growing global demand for superior surgical materials. Strategic opportunities lie in the development of advanced bio-integrated UHMWPE sutures, tailored for specific regenerative medicine applications. The increasing adoption of robotic-assisted surgery will further propel the need for high-precision, high-strength sutures like UHMWPE. Market expansion into emerging economies, coupled with a focus on cost-effective manufacturing processes, will unlock significant growth potential. The sustained increase in the prevalence of chronic diseases and the aging global population will ensure a consistent and growing demand for advanced surgical solutions, making UHMWPE sutures a critical component of modern surgical practice.

Ultra-high Molecular Weight Polyethylene Suture Segmentation

-

1. Application

- 1.1. Cardiovascular Surgery

- 1.2. Orthopedic Procedures

- 1.3. Arthroscopy

- 1.4. Other

-

2. Types

- 2.1. Pure Ultra-high Molecular Weight Polyethylene

- 2.2. Ultra High Molecular Polyethylene and Polyester

Ultra-high Molecular Weight Polyethylene Suture Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Ultra-high Molecular Weight Polyethylene Suture REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.1% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ultra-high Molecular Weight Polyethylene Suture Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Cardiovascular Surgery

- 5.1.2. Orthopedic Procedures

- 5.1.3. Arthroscopy

- 5.1.4. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Pure Ultra-high Molecular Weight Polyethylene

- 5.2.2. Ultra High Molecular Polyethylene and Polyester

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Ultra-high Molecular Weight Polyethylene Suture Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Cardiovascular Surgery

- 6.1.2. Orthopedic Procedures

- 6.1.3. Arthroscopy

- 6.1.4. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Pure Ultra-high Molecular Weight Polyethylene

- 6.2.2. Ultra High Molecular Polyethylene and Polyester

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Ultra-high Molecular Weight Polyethylene Suture Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Cardiovascular Surgery

- 7.1.2. Orthopedic Procedures

- 7.1.3. Arthroscopy

- 7.1.4. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Pure Ultra-high Molecular Weight Polyethylene

- 7.2.2. Ultra High Molecular Polyethylene and Polyester

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Ultra-high Molecular Weight Polyethylene Suture Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Cardiovascular Surgery

- 8.1.2. Orthopedic Procedures

- 8.1.3. Arthroscopy

- 8.1.4. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Pure Ultra-high Molecular Weight Polyethylene

- 8.2.2. Ultra High Molecular Polyethylene and Polyester

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Ultra-high Molecular Weight Polyethylene Suture Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Cardiovascular Surgery

- 9.1.2. Orthopedic Procedures

- 9.1.3. Arthroscopy

- 9.1.4. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Pure Ultra-high Molecular Weight Polyethylene

- 9.2.2. Ultra High Molecular Polyethylene and Polyester

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Ultra-high Molecular Weight Polyethylene Suture Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Cardiovascular Surgery

- 10.1.2. Orthopedic Procedures

- 10.1.3. Arthroscopy

- 10.1.4. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Pure Ultra-high Molecular Weight Polyethylene

- 10.2.2. Ultra High Molecular Polyethylene and Polyester

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 DePuy Synthes(Johnson & Johnson)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CP Medical

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Teleflex Incorporated

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Vetlig

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Unisur Lifecare

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MZF4

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Riverpoint Medical

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Zhejiang Qianxilong Special Fibre Co.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ltd.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SMI AG

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 DePuy Synthes(Johnson & Johnson)

List of Figures

- Figure 1: Global Ultra-high Molecular Weight Polyethylene Suture Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Ultra-high Molecular Weight Polyethylene Suture Revenue (million), by Application 2024 & 2032

- Figure 3: North America Ultra-high Molecular Weight Polyethylene Suture Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Ultra-high Molecular Weight Polyethylene Suture Revenue (million), by Types 2024 & 2032

- Figure 5: North America Ultra-high Molecular Weight Polyethylene Suture Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Ultra-high Molecular Weight Polyethylene Suture Revenue (million), by Country 2024 & 2032

- Figure 7: North America Ultra-high Molecular Weight Polyethylene Suture Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Ultra-high Molecular Weight Polyethylene Suture Revenue (million), by Application 2024 & 2032

- Figure 9: South America Ultra-high Molecular Weight Polyethylene Suture Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Ultra-high Molecular Weight Polyethylene Suture Revenue (million), by Types 2024 & 2032

- Figure 11: South America Ultra-high Molecular Weight Polyethylene Suture Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Ultra-high Molecular Weight Polyethylene Suture Revenue (million), by Country 2024 & 2032

- Figure 13: South America Ultra-high Molecular Weight Polyethylene Suture Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Ultra-high Molecular Weight Polyethylene Suture Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Ultra-high Molecular Weight Polyethylene Suture Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Ultra-high Molecular Weight Polyethylene Suture Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Ultra-high Molecular Weight Polyethylene Suture Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Ultra-high Molecular Weight Polyethylene Suture Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Ultra-high Molecular Weight Polyethylene Suture Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Ultra-high Molecular Weight Polyethylene Suture Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Ultra-high Molecular Weight Polyethylene Suture Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Ultra-high Molecular Weight Polyethylene Suture Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Ultra-high Molecular Weight Polyethylene Suture Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Ultra-high Molecular Weight Polyethylene Suture Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Ultra-high Molecular Weight Polyethylene Suture Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Ultra-high Molecular Weight Polyethylene Suture Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Ultra-high Molecular Weight Polyethylene Suture Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Ultra-high Molecular Weight Polyethylene Suture Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Ultra-high Molecular Weight Polyethylene Suture Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Ultra-high Molecular Weight Polyethylene Suture Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Ultra-high Molecular Weight Polyethylene Suture Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Ultra-high Molecular Weight Polyethylene Suture Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Ultra-high Molecular Weight Polyethylene Suture Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Ultra-high Molecular Weight Polyethylene Suture Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Ultra-high Molecular Weight Polyethylene Suture Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Ultra-high Molecular Weight Polyethylene Suture Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Ultra-high Molecular Weight Polyethylene Suture Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Ultra-high Molecular Weight Polyethylene Suture Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Ultra-high Molecular Weight Polyethylene Suture Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Ultra-high Molecular Weight Polyethylene Suture Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Ultra-high Molecular Weight Polyethylene Suture Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Ultra-high Molecular Weight Polyethylene Suture Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Ultra-high Molecular Weight Polyethylene Suture Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Ultra-high Molecular Weight Polyethylene Suture Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Ultra-high Molecular Weight Polyethylene Suture Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Ultra-high Molecular Weight Polyethylene Suture Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Ultra-high Molecular Weight Polyethylene Suture Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Ultra-high Molecular Weight Polyethylene Suture Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Ultra-high Molecular Weight Polyethylene Suture Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Ultra-high Molecular Weight Polyethylene Suture Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Ultra-high Molecular Weight Polyethylene Suture Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Ultra-high Molecular Weight Polyethylene Suture Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Ultra-high Molecular Weight Polyethylene Suture Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Ultra-high Molecular Weight Polyethylene Suture Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Ultra-high Molecular Weight Polyethylene Suture Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Ultra-high Molecular Weight Polyethylene Suture Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Ultra-high Molecular Weight Polyethylene Suture Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Ultra-high Molecular Weight Polyethylene Suture Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Ultra-high Molecular Weight Polyethylene Suture Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Ultra-high Molecular Weight Polyethylene Suture Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Ultra-high Molecular Weight Polyethylene Suture Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Ultra-high Molecular Weight Polyethylene Suture Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Ultra-high Molecular Weight Polyethylene Suture Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Ultra-high Molecular Weight Polyethylene Suture Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Ultra-high Molecular Weight Polyethylene Suture Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Ultra-high Molecular Weight Polyethylene Suture Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Ultra-high Molecular Weight Polyethylene Suture Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Ultra-high Molecular Weight Polyethylene Suture Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Ultra-high Molecular Weight Polyethylene Suture Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Ultra-high Molecular Weight Polyethylene Suture Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Ultra-high Molecular Weight Polyethylene Suture Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Ultra-high Molecular Weight Polyethylene Suture Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Ultra-high Molecular Weight Polyethylene Suture Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Ultra-high Molecular Weight Polyethylene Suture Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Ultra-high Molecular Weight Polyethylene Suture Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Ultra-high Molecular Weight Polyethylene Suture Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Ultra-high Molecular Weight Polyethylene Suture Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Ultra-high Molecular Weight Polyethylene Suture Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ultra-high Molecular Weight Polyethylene Suture?

The projected CAGR is approximately 3.1%.

2. Which companies are prominent players in the Ultra-high Molecular Weight Polyethylene Suture?

Key companies in the market include DePuy Synthes(Johnson & Johnson), CP Medical, Teleflex Incorporated, Vetlig, Unisur Lifecare, MZF4, Riverpoint Medical, Zhejiang Qianxilong Special Fibre Co., Ltd., SMI AG.

3. What are the main segments of the Ultra-high Molecular Weight Polyethylene Suture?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 86 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ultra-high Molecular Weight Polyethylene Suture," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ultra-high Molecular Weight Polyethylene Suture report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ultra-high Molecular Weight Polyethylene Suture?

To stay informed about further developments, trends, and reports in the Ultra-high Molecular Weight Polyethylene Suture, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence