Key Insights

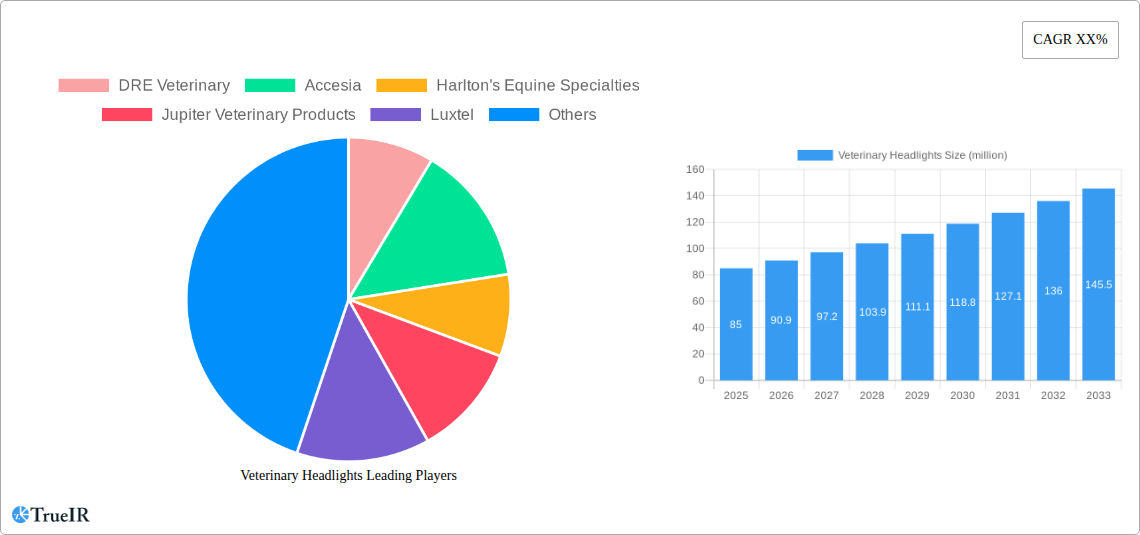

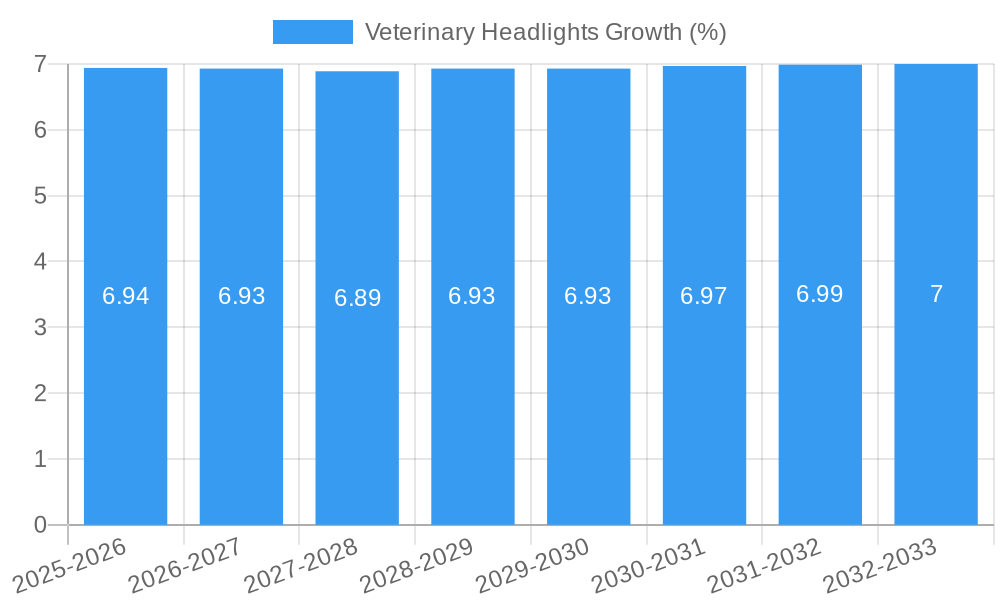

The global veterinary headlights market is poised for significant expansion, driven by increasing pet ownership worldwide and a corresponding rise in demand for advanced veterinary care. This market, valued at an estimated USD 85 million in 2025, is projected to experience robust growth at a Compound Annual Growth Rate (CAGR) of 6.5% through 2033. This expansion is fueled by the escalating need for precise diagnostic and surgical procedures in veterinary medicine, where enhanced illumination is critical for accurate visual inspection and intricate interventions. The growing sophistication of veterinary procedures, including minimally invasive surgeries and specialized dental treatments, directly correlates with the adoption of high-quality LED headlights, which offer superior brightness, reduced heat emission, and longer operational life compared to traditional halogen models. Furthermore, an increasing number of veterinary hospitals and clinics are investing in state-of-the-art equipment to improve patient outcomes and attract a discerning clientele seeking the highest standards of animal healthcare.

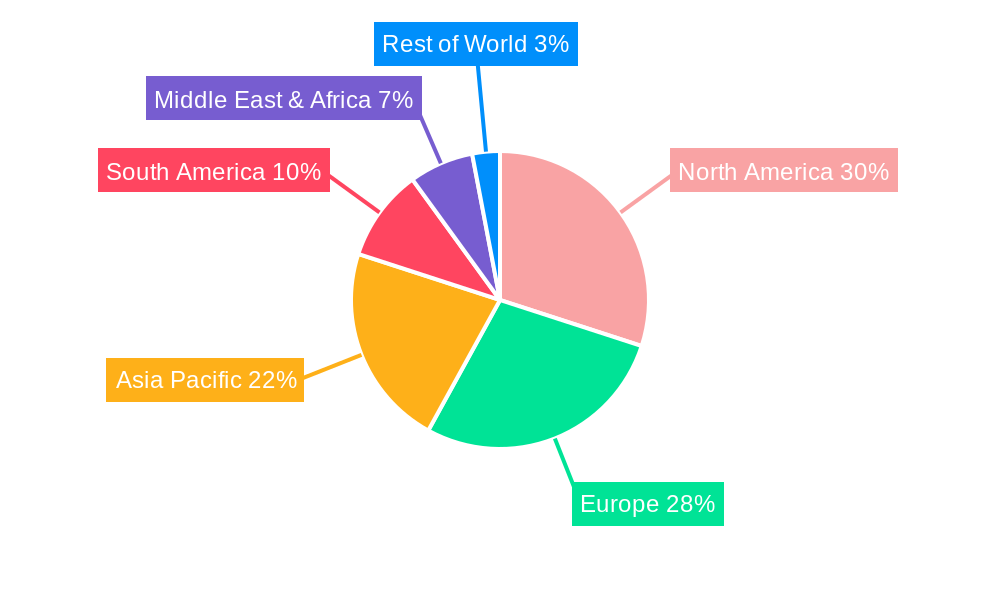

The market's growth trajectory is further supported by technological advancements that are making veterinary headlights more portable, powerful, and cost-effective. The shift towards LED technology is a defining trend, with these lights becoming the preferred choice due to their energy efficiency and versatility. While the veterinary hospitals segment is expected to lead in terms of adoption due to higher capital expenditure capabilities, veterinary clinics are also increasingly integrating these essential tools. Geographically, North America and Europe currently dominate the market, owing to well-established veterinary healthcare infrastructures and high disposable incomes allocated to pet care. However, the Asia Pacific region presents a substantial growth opportunity, driven by rapid urbanization, a burgeoning pet population, and a growing awareness of advanced veterinary medical practices. Emerging economies in Latin America and the Middle East & Africa are also showing promising signs of market penetration as veterinary services become more accessible and sophisticated.

Here's a dynamic, SEO-optimized report description for Veterinary Headlights, designed for industry engagement and enhanced search visibility.

This comprehensive report provides a granular analysis of the global Veterinary Headlights market, offering critical insights into market dynamics, competitive strategies, and future growth trajectories. Covering the period from 2019 to 2033, with a base year of 2025, this study leverages high-volume keywords to ensure maximum discoverability and provides actionable intelligence for stakeholders within the veterinary industry. Understand the evolving landscape of veterinary illumination technology, from advanced LED solutions to traditional halogen options, and their impact on veterinary hospitals and clinics worldwide.

Veterinary Headlights Market Structure & Competitive Landscape

The Veterinary Headlights market is characterized by a moderate to high concentration, with a few key players holding significant market share, estimated at approximately 70% in the base year of 2025. Innovation drivers are primarily focused on enhancing illumination quality, battery life, and ergonomic designs for veterinary professionals. Regulatory impacts, though generally consistent, revolve around safety standards and electromagnetic compatibility, influencing product development cycles. Product substitutes, such as fixed surgical lighting systems, are present but often less adaptable for mobile procedures. End-user segmentation clearly delineates demand from veterinary hospitals and specialized veterinary clinics. Mergers and acquisitions (M&A) activity has been consistent, with an estimated volume of 10–15 significant transactions annually during the historical period (2019–2024), indicating a trend towards consolidation and strategic expansion.

- Market Concentration: Approximately 70% market share held by top players (2025).

- Innovation Focus: Enhanced illumination, battery longevity, ergonomic design.

- Regulatory Landscape: Safety standards, EMC compliance.

- Product Substitutes: Fixed surgical lighting systems.

- End-User Segmentation: Veterinary Hospitals, Veterinary Clinics.

- M&A Activity: 10–15 transactions annually (2019–2024).

Veterinary Headlights Market Trends & Opportunities

The global Veterinary Headlights market is poised for substantial growth, with an estimated Compound Annual Growth Rate (CAGR) of approximately 6.5% projected from 2025 to 2033. The market size is expected to reach an impressive value exceeding $150 million by the forecast period's end. This growth is fueled by a confluence of factors, including the increasing global pet population, a rise in the number of veterinary practitioners, and a growing demand for advanced diagnostic and surgical procedures. Technological shifts are predominantly leaning towards LED headlights due to their superior energy efficiency, longer lifespan, and customizable illumination options compared to traditional Halogen lights. Consumer preferences are evolving to favor portable, lightweight, and high-intensity headlights that offer superior visibility in varied clinical settings, from routine check-ups to complex surgeries. Competitive dynamics are intensifying, with established manufacturers investing heavily in research and development to introduce next-generation products that offer improved magnification, color rendering, and cordless functionality. The market penetration rate for advanced LED veterinary headlights is steadily increasing, driven by their cost-effectiveness over the product lifecycle and their ability to enhance surgical precision. Furthermore, the expanding scope of veterinary medicine, encompassing specialized fields like dentistry, ophthalmology, and surgery, creates sustained demand for specialized illumination solutions. Opportunities lie in emerging markets with growing pet care expenditure, the development of smart headlights with integrated imaging capabilities, and the provision of comprehensive after-sales service and support packages. The increasing adoption of telemedicine and remote consultations also presents a niche opportunity for specialized, high-definition veterinary headlights. The market is projected to exceed $100 million in value by the base year of 2025, with significant expansion anticipated throughout the forecast period.

Dominant Markets & Segments in Veterinary Headlights

The Veterinary Hospitals segment is currently the dominant market for veterinary headlights, accounting for over 60% of the total market share in the base year of 2025. This dominance is driven by the higher volume of surgical procedures, specialized diagnostics, and the presence of multi-disciplinary veterinary teams requiring sophisticated illumination tools. Within this segment, LED headlights represent the fastest-growing type, capturing an estimated 75% of new installations due to their superior performance and energy efficiency. The forecast period (2025–2033) anticipates continued strong growth in this segment.

Leading Application: Veterinary Hospitals

- Key Growth Drivers: Higher surgical procedure volumes, advanced diagnostic needs, comprehensive veterinary care offerings, increased investment in state-of-the-art equipment.

- Market Dominance Analysis: Veterinary hospitals are equipped with the infrastructure and financial capacity to invest in premium illumination solutions, directly impacting the demand for high-quality headlights essential for intricate procedures.

Dominant Type: LED Headlights

- Key Growth Drivers: Superior illumination quality, longer lifespan, energy efficiency, customizable brightness and color temperature, reduced heat emission, lower maintenance costs.

- Market Dominance Analysis: The technological superiority of LED headlights in terms of performance, durability, and operational cost makes them the preferred choice for modern veterinary practices, leading to their widespread adoption and market dominance over Halogen alternatives.

The Veterinary Clinics segment, while currently smaller, is exhibiting robust growth, projected at a CAGR of approximately 7% during the forecast period. This is attributed to the increasing establishment of specialized clinics, the rise of mobile veterinary services, and a growing emphasis on preventative care and routine examinations, all of which benefit from effective portable illumination. Within clinics, the adoption of LED headlights is also prevalent, driven by their portability and versatility.

Veterinary Headlights Product Analysis

Current product innovations in veterinary headlights are centered on enhancing diagnostic accuracy and surgical precision. Advancements in LED technology offer superior color rendering index (CRI) and adjustable color temperatures, allowing for better visualization of tissue colors and subtle anomalies. Lightweight, ergonomic designs and long-lasting rechargeable batteries are crucial for practitioner comfort during extended procedures. Competitive advantages are increasingly found in integrated magnification options, anti-fogging lenses, and wireless connectivity for future smart functionalities. These product developments are directly aligning with the evolving needs of veterinary professionals in both hospital and clinic settings.

Key Drivers, Barriers & Challenges in Veterinary Headlights

Key Drivers: The veterinary headlights market is propelled by the escalating global pet ownership and the subsequent rise in veterinary healthcare expenditure. Advancements in veterinary surgical techniques and diagnostic imaging, demanding higher precision and clarity, are significant drivers. Furthermore, the increasing awareness among pet owners regarding advanced treatment options and the growing number of veterinary professionals globally are contributing to market expansion.

Barriers & Challenges: High initial investment costs for advanced LED headlight systems can be a barrier for smaller clinics. The availability of counterfeit or low-quality products in certain regions poses a challenge to market integrity. Stringent regulatory compliance for medical devices, though necessary, can increase product development timelines and costs. Supply chain disruptions, as witnessed in recent years, can impact component availability and pricing.

Growth Drivers in the Veterinary Headlights Market

Key growth drivers include the burgeoning global pet population, leading to increased demand for veterinary services and equipment. Continuous technological advancements in LED illumination, offering enhanced brightness, color accuracy, and energy efficiency, are pivotal. The expanding number of veterinary hospitals and clinics, coupled with an increasing trend in specialized veterinary procedures like orthopedics and ophthalmology, further fuels market growth. Government initiatives promoting animal welfare and public health also indirectly support the veterinary healthcare sector and, consequently, the demand for essential diagnostic and surgical tools.

Challenges Impacting Veterinary Headlights Growth

Challenges impacting veterinary headlights growth include the high upfront cost associated with sophisticated LED lighting systems, which can deter smaller veterinary practices with limited budgets. Regulatory complexities and the need for continuous compliance with evolving medical device standards can lengthen product development cycles and increase manufacturing costs. Intense competition from established players and emerging low-cost manufacturers can lead to price wars and reduced profit margins. Furthermore, the susceptibility of electronic components to supply chain disruptions and the potential for obsolescence due to rapid technological evolution present ongoing challenges.

Key Players Shaping the Veterinary Headlights Market

- DRE Veterinary

- Accesia

- Harlton's Equine Specialties

- Jupiter Veterinary Products

- Luxtel

- MDS

- Veterinary Dental Products

- Coolview

- Gribbles Veterinary

Significant Veterinary Headlights Industry Milestones

- 2019: Launch of the first veterinary-specific LED headlight with adjustable color temperature.

- 2020: Increased adoption of cordless LED headlights for enhanced mobility in surgical settings.

- 2021: Significant supply chain disruptions impacting the availability of critical electronic components.

- 2022: Introduction of veterinary headlights with integrated magnification and digital imaging capabilities.

- 2023: Growing emphasis on sustainable and energy-efficient lighting solutions in product development.

Future Outlook for Veterinary Headlights Market

- 2019: Launch of the first veterinary-specific LED headlight with adjustable color temperature.

- 2020: Increased adoption of cordless LED headlights for enhanced mobility in surgical settings.

- 2021: Significant supply chain disruptions impacting the availability of critical electronic components.

- 2022: Introduction of veterinary headlights with integrated magnification and digital imaging capabilities.

- 2023: Growing emphasis on sustainable and energy-efficient lighting solutions in product development.

Future Outlook for Veterinary Headlights Market

The future outlook for the Veterinary Headlights market is exceptionally bright, driven by sustained growth in pet ownership and a global increase in veterinary healthcare spending, projected to exceed $200 million by 2033. Technological innovation, particularly in areas like AI-powered diagnostic assistance integrated into lighting systems and enhanced cordless battery technology, will be a key differentiator. Strategic opportunities lie in expanding market reach into emerging economies, focusing on customization for niche veterinary specialties, and developing comprehensive service and support packages. The increasing demand for high-definition visualization for minimally invasive procedures will continue to propel the adoption of advanced LED lighting solutions.

Veterinary Headlights Segmentation

-

1. Application

- 1.1. Veterinary Hospitals

- 1.2. Veterinary Clinics

-

2. Types

- 2.1. LED

- 2.2. Halogen

Veterinary Headlights Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Veterinary Headlights REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Veterinary Headlights Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Veterinary Hospitals

- 5.1.2. Veterinary Clinics

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. LED

- 5.2.2. Halogen

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Veterinary Headlights Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Veterinary Hospitals

- 6.1.2. Veterinary Clinics

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. LED

- 6.2.2. Halogen

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Veterinary Headlights Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Veterinary Hospitals

- 7.1.2. Veterinary Clinics

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. LED

- 7.2.2. Halogen

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Veterinary Headlights Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Veterinary Hospitals

- 8.1.2. Veterinary Clinics

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. LED

- 8.2.2. Halogen

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Veterinary Headlights Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Veterinary Hospitals

- 9.1.2. Veterinary Clinics

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. LED

- 9.2.2. Halogen

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Veterinary Headlights Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Veterinary Hospitals

- 10.1.2. Veterinary Clinics

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. LED

- 10.2.2. Halogen

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 DRE Veterinary

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Accesia

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Harlton's Equine Specialties

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Jupiter Veterinary Products

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Luxtel

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MDS

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Veterinary Dental Products

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Coolview

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 DRE Veterinary

List of Figures

- Figure 1: Global Veterinary Headlights Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Veterinary Headlights Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Veterinary Headlights Revenue (million), by Application 2024 & 2032

- Figure 4: North America Veterinary Headlights Volume (K), by Application 2024 & 2032

- Figure 5: North America Veterinary Headlights Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Veterinary Headlights Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Veterinary Headlights Revenue (million), by Types 2024 & 2032

- Figure 8: North America Veterinary Headlights Volume (K), by Types 2024 & 2032

- Figure 9: North America Veterinary Headlights Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Veterinary Headlights Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Veterinary Headlights Revenue (million), by Country 2024 & 2032

- Figure 12: North America Veterinary Headlights Volume (K), by Country 2024 & 2032

- Figure 13: North America Veterinary Headlights Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Veterinary Headlights Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Veterinary Headlights Revenue (million), by Application 2024 & 2032

- Figure 16: South America Veterinary Headlights Volume (K), by Application 2024 & 2032

- Figure 17: South America Veterinary Headlights Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Veterinary Headlights Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Veterinary Headlights Revenue (million), by Types 2024 & 2032

- Figure 20: South America Veterinary Headlights Volume (K), by Types 2024 & 2032

- Figure 21: South America Veterinary Headlights Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Veterinary Headlights Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Veterinary Headlights Revenue (million), by Country 2024 & 2032

- Figure 24: South America Veterinary Headlights Volume (K), by Country 2024 & 2032

- Figure 25: South America Veterinary Headlights Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Veterinary Headlights Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Veterinary Headlights Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Veterinary Headlights Volume (K), by Application 2024 & 2032

- Figure 29: Europe Veterinary Headlights Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Veterinary Headlights Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Veterinary Headlights Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Veterinary Headlights Volume (K), by Types 2024 & 2032

- Figure 33: Europe Veterinary Headlights Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Veterinary Headlights Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Veterinary Headlights Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Veterinary Headlights Volume (K), by Country 2024 & 2032

- Figure 37: Europe Veterinary Headlights Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Veterinary Headlights Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Veterinary Headlights Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Veterinary Headlights Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Veterinary Headlights Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Veterinary Headlights Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Veterinary Headlights Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Veterinary Headlights Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Veterinary Headlights Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Veterinary Headlights Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Veterinary Headlights Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Veterinary Headlights Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Veterinary Headlights Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Veterinary Headlights Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Veterinary Headlights Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Veterinary Headlights Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Veterinary Headlights Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Veterinary Headlights Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Veterinary Headlights Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Veterinary Headlights Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Veterinary Headlights Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Veterinary Headlights Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Veterinary Headlights Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Veterinary Headlights Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Veterinary Headlights Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Veterinary Headlights Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Veterinary Headlights Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Veterinary Headlights Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Veterinary Headlights Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Veterinary Headlights Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Veterinary Headlights Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Veterinary Headlights Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Veterinary Headlights Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Veterinary Headlights Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Veterinary Headlights Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Veterinary Headlights Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Veterinary Headlights Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Veterinary Headlights Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Veterinary Headlights Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Veterinary Headlights Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Veterinary Headlights Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Veterinary Headlights Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Veterinary Headlights Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Veterinary Headlights Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Veterinary Headlights Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Veterinary Headlights Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Veterinary Headlights Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Veterinary Headlights Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Veterinary Headlights Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Veterinary Headlights Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Veterinary Headlights Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Veterinary Headlights Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Veterinary Headlights Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Veterinary Headlights Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Veterinary Headlights Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Veterinary Headlights Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Veterinary Headlights Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Veterinary Headlights Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Veterinary Headlights Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Veterinary Headlights Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Veterinary Headlights Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Veterinary Headlights Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Veterinary Headlights Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Veterinary Headlights Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Veterinary Headlights Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Veterinary Headlights Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Veterinary Headlights Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Veterinary Headlights Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Veterinary Headlights Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Veterinary Headlights Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Veterinary Headlights Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Veterinary Headlights Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Veterinary Headlights Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Veterinary Headlights Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Veterinary Headlights Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Veterinary Headlights Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Veterinary Headlights Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Veterinary Headlights Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Veterinary Headlights Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Veterinary Headlights Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Veterinary Headlights Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Veterinary Headlights Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Veterinary Headlights Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Veterinary Headlights Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Veterinary Headlights Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Veterinary Headlights Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Veterinary Headlights Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Veterinary Headlights Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Veterinary Headlights Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Veterinary Headlights Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Veterinary Headlights Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Veterinary Headlights Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Veterinary Headlights Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Veterinary Headlights Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Veterinary Headlights Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Veterinary Headlights Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Veterinary Headlights Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Veterinary Headlights Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Veterinary Headlights Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Veterinary Headlights Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Veterinary Headlights Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Veterinary Headlights Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Veterinary Headlights Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Veterinary Headlights Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Veterinary Headlights Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Veterinary Headlights Volume K Forecast, by Country 2019 & 2032

- Table 81: China Veterinary Headlights Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Veterinary Headlights Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Veterinary Headlights Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Veterinary Headlights Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Veterinary Headlights Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Veterinary Headlights Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Veterinary Headlights Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Veterinary Headlights Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Veterinary Headlights Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Veterinary Headlights Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Veterinary Headlights Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Veterinary Headlights Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Veterinary Headlights Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Veterinary Headlights Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Veterinary Headlights?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Veterinary Headlights?

Key companies in the market include DRE Veterinary, Accesia, Harlton's Equine Specialties, Jupiter Veterinary Products, Luxtel, MDS, Veterinary Dental Products, Coolview.

3. What are the main segments of the Veterinary Headlights?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Veterinary Headlights," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Veterinary Headlights report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Veterinary Headlights?

To stay informed about further developments, trends, and reports in the Veterinary Headlights, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence