Key Insights

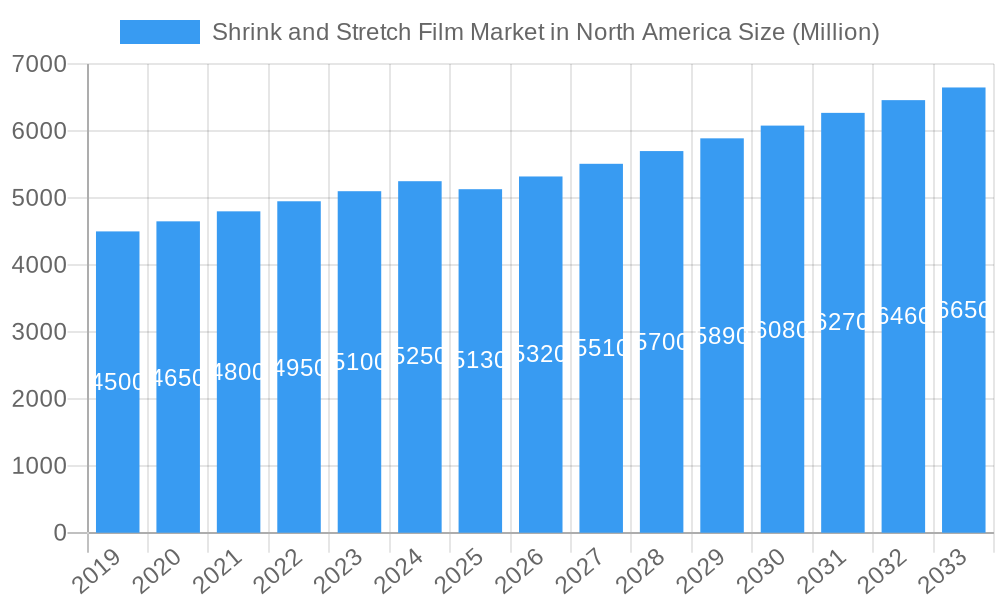

The North American Shrink and Stretch Film Market is poised for steady growth, projected to reach approximately USD 5.13 billion in 2025. With a Compound Annual Growth Rate (CAGR) of 3.73% expected throughout the forecast period of 2019-2033, the market is anticipated to witness sustained expansion. This growth is primarily driven by the increasing demand from the food and beverage sector, where shrink and stretch films play a crucial role in product protection, preservation, and consumer appeal through innovative packaging solutions. The consumer goods industry also represents a significant driver, leveraging these films for secondary packaging and tamper-evident sealing. Furthermore, the pharmaceutical sector's growing need for sterile and secure packaging solutions contributes to market dynamism.

Shrink and Stretch Film Market in North America Market Size (In Billion)

The market's expansion is further fueled by advancements in film materials and product types. The prevalence of Polyethylene terephthalate (PET) and Polyvinyl chloride (PVC) in applications requiring high clarity and strength, alongside the increasing adoption of Low-density polyethylene (LDPE) for its flexibility and cost-effectiveness, underpins market demand. While the market exhibits robust growth, potential restraints such as fluctuating raw material prices and increasing environmental regulations regarding plastic waste could influence market dynamics. However, the ongoing development of biodegradable and recyclable shrink and stretch film alternatives is expected to mitigate these challenges, positioning the market for continued positive performance across North America.

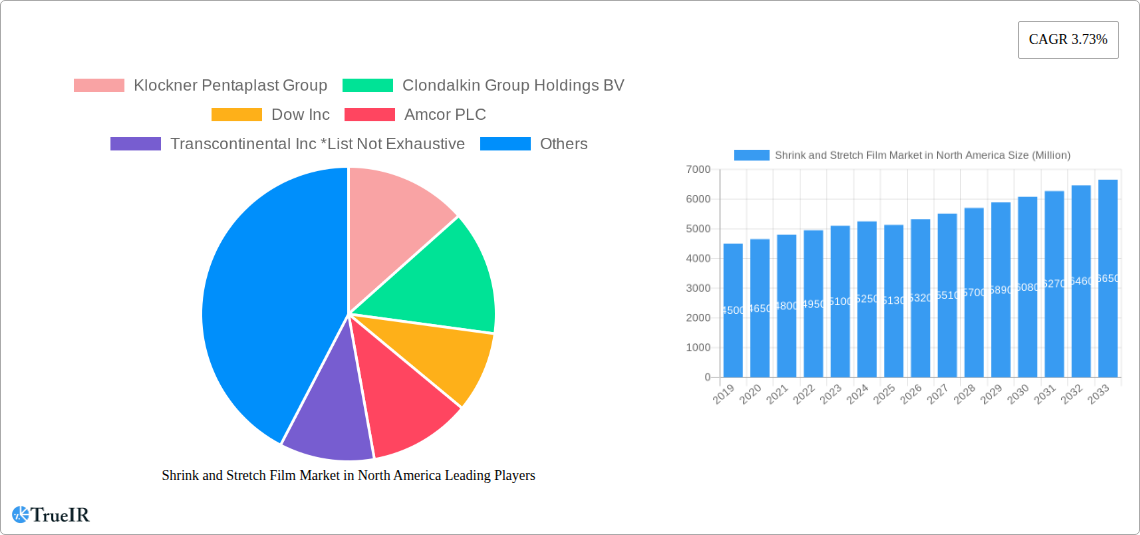

Shrink and Stretch Film Market in North America Company Market Share

Here's a dynamic, SEO-optimized report description for the North America Shrink and Stretch Film Market:

North America Shrink and Stretch Film Market: Size, Trends, Opportunities, and Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the North America shrink and stretch film market, offering critical insights into market dynamics, competitive landscapes, and future trajectories. Spanning from 2019 to 2033, with a base year of 2025, this study is designed for industry professionals, investors, and stakeholders seeking to understand the growth catalysts, challenges, and strategic opportunities within this vital packaging sector.

Shrink and Stretch Film Market in North America Market Structure & Competitive Landscape

The North America shrink and stretch film market is characterized by a moderately concentrated structure, with key players like Amcor PLC, Berry Global Inc., and Sealed Air Corporation holding significant market shares. Innovation remains a primary driver, focusing on the development of high-performance films, sustainable material alternatives, and enhanced barrier properties. Regulatory impacts, particularly concerning sustainability and recycled content mandates, are increasingly shaping market strategies. Product substitutes, such as paper-based packaging and reusable containers, present a competitive challenge, though the unique protective and containment qualities of shrink and stretch films maintain their dominance in many applications. End-user segmentation reveals robust demand from the Food and Beverage and Consumer Goods sectors, driven by evolving consumer preferences for convenience and product protection. Mergers and acquisitions (M&A) are expected to continue as companies seek to expand their product portfolios, geographic reach, and sustainable offerings. The market is poised for significant growth, influenced by technological advancements and increasing demand for efficient packaging solutions.

Shrink and Stretch Film Market in North America Market Trends & Opportunities

The North America shrink and stretch film market is on a trajectory of substantial growth, projected to witness a Compound Annual Growth Rate (CAGR) of xx% over the forecast period of 2025-2033. This expansion is fueled by escalating demand across diverse end-use industries, including Food and Beverage, Consumer Goods, Pharmaceutical, and Industrial applications. Technological shifts are paramount, with a growing emphasis on the development of high-performance, lightweight, and stretchable films that offer superior product protection and reduced material usage. The adoption of advanced manufacturing techniques, such as co-extrusion and multilayer film production, is enabling enhanced barrier properties and improved puncture resistance, thereby catering to specific product needs. Consumer preferences are increasingly leaning towards sustainable and eco-friendly packaging solutions, creating significant opportunities for manufacturers to innovate with recycled content, bio-based materials, and easily recyclable film formulations. The ongoing e-commerce boom continues to be a major market penetration driver, as stretch films are indispensable for securing shipments and protecting goods during transit. Furthermore, the pharmaceutical industry's demand for tamper-evident and sterile packaging solutions contributes to the market's robust performance. Competitive dynamics are intensifying, with companies investing heavily in research and development to differentiate their offerings and capture market share. Strategic collaborations and acquisitions are also playing a crucial role in consolidating the market and expanding capabilities. The market is ripe with opportunities for players who can align their product development with sustainability goals, leverage digital transformation for operational efficiency, and cater to the evolving needs of a dynamic consumer base. The push towards a circular economy is creating a favorable environment for innovations in film recycling and reuse, presenting a significant avenue for market expansion and value creation. The market size is anticipated to reach an estimated $XX Billion by 2033.

Dominant Markets & Segments in Shrink and Stretch Film Market in North America

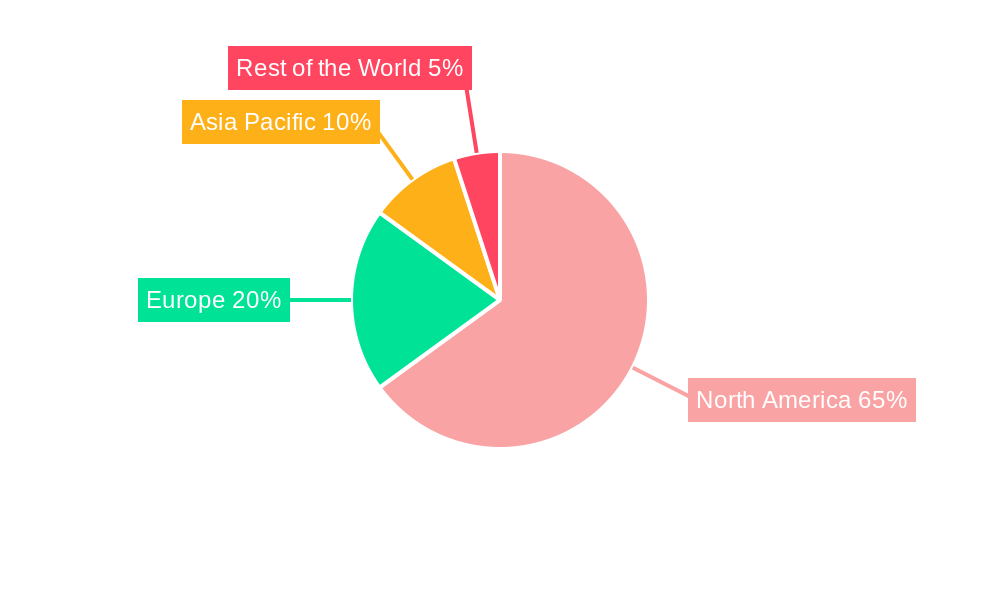

The United States stands as the dominant market within North America's shrink and stretch film landscape, accounting for an estimated xx% of the total market value in 2025. This dominance is attributed to its large consumer base, advanced manufacturing infrastructure, and significant presence of key end-use industries, particularly Food and Beverage and Consumer Goods.

Product Type Dominance:

- Wraps are the leading product type, driven by their versatility in palletizing, bundling, and protecting a wide array of products across industrial and consumer sectors. Their market share is estimated at xx% in 2025.

- Hoods exhibit strong growth, particularly in the industrial and appliance sectors, offering comprehensive protection for large items.

- Sleeve Labels are gaining traction due to their aesthetic appeal and branding capabilities, especially in the beverage and personal care industries.

Material Dominance:

- Polyethylene (PE), especially Low-Density Polyethylene (LDPE), commands the largest market share, estimated at xx% in 2025, owing to its excellent flexibility, clarity, and cost-effectiveness.

- Polyvinyl Chloride (PVC) remains a significant material, offering high shrink force and clarity, particularly for consumer goods and industrial applications.

- Polyethylene Terephthalate (PET) is experiencing growth, driven by its strength, clarity, and recyclability, making it a preferred choice for certain food and beverage packaging.

End-use Industry Dominance:

- The Food and Beverage industry is the largest consumer of shrink and stretch films, representing an estimated xx% of the market in 2025. This is due to the need for product preservation, tamper-evidence, and enhanced shelf appeal.

- Consumer Goods follow closely, with applications ranging from packaging personal care items and electronics to household products.

- The Industrial sector utilizes these films extensively for pallet stabilization, wrapping machinery, and protecting goods during transit and storage.

Key Growth Drivers in Dominant Segments:

- Infrastructure Development: Investments in warehousing and logistics infrastructure in the United States support the increased demand for pallet wrapping and protection.

- E-commerce Growth: The burgeoning e-commerce sector necessitates robust packaging solutions for shipping and handling, boosting the demand for stretch wraps and shrink films.

- Food Safety Regulations: Stringent food safety regulations drive the adoption of high-barrier shrink films to maintain product freshness and prevent contamination.

- Sustainability Initiatives: Growing consumer and regulatory pressure for sustainable packaging is fostering innovation in recyclable and bio-based shrink and stretch film materials.

Shrink and Stretch Film Market in North America Product Analysis

Innovations in the North America shrink and stretch film market are primarily focused on enhancing performance, sustainability, and application versatility. Manufacturers are developing advanced multi-layer films with superior barrier properties, offering extended shelf life for perishable goods and improved protection against oxygen and moisture. The trend towards thinner yet stronger films, utilizing technologies like high-performance polyethylene (HPPE), reduces material consumption and environmental impact. Furthermore, the integration of features such as anti-static additives, UV protection, and enhanced clarity are key competitive advantages. Product applications are expanding beyond traditional packaging, with growing use in medical device sterilization, automotive component protection, and even in agricultural applications for crop protection.

Key Drivers, Barriers & Challenges in Shrink and Stretch Film Market in North America

Key Drivers:

The North America shrink and stretch film market is propelled by several key drivers. Technological advancements in film extrusion and material science enable the creation of thinner, stronger, and more sustainable films, reducing material waste. The growing e-commerce sector fuels demand for robust and efficient packaging solutions to secure goods during transit. Furthermore, the Food and Beverage industry's continuous need for product preservation and shelf appeal remains a significant growth catalyst. Government initiatives promoting sustainability and recycled content, such as those in Canada, are also driving innovation and market adoption of eco-friendly film options.

Barriers & Challenges:

Despite robust growth, the market faces several challenges. Volatility in raw material prices, particularly for petroleum-based resins, can impact profitability and pricing strategies. Regulatory complexities and evolving environmental standards require continuous adaptation and investment in compliant materials. Supply chain disruptions, as witnessed in recent years, can affect the availability and cost of essential raw materials and finished products. Intensifying competitive pressure from both established players and emerging manufacturers necessitates a focus on product differentiation and cost optimization. The development and adoption of truly circular economy solutions for plastic films also present a significant ongoing challenge, requiring collaborative efforts across the value chain.

Growth Drivers in the Shrink and Stretch Film Market in North America Market

Key growth drivers in the North America shrink and stretch film market are multifaceted. Technologically, advancements in co-extrusion and blown film processes allow for the production of films with tailored properties, such as enhanced puncture resistance and high clarity. Economically, the expanding e-commerce sector continues to necessitate efficient and protective packaging, driving demand for stretch wraps. Regulatory factors, such as increasing mandates for recycled content in packaging materials, are stimulating innovation in sustainable film formulations and encouraging market penetration of these eco-friendly options. The consistent demand from the Food and Beverage industry for product protection and extended shelf life further underpins market growth.

Challenges Impacting Shrink and Stretch Film Market in North America Growth

Challenges impacting the growth of the North America shrink and stretch film market include the inherent volatility of raw material prices, primarily driven by crude oil fluctuations, which can lead to significant cost pressures. Regulatory complexities surrounding plastic waste management and sustainability standards require continuous adaptation and investment from manufacturers. Supply chain vulnerabilities, including potential disruptions in resin availability and logistics, pose a persistent threat to consistent production and timely delivery. Moreover, intense competitive pressures from a fragmented market and the ongoing need to balance cost-effectiveness with the demand for premium, sustainable packaging solutions present a considerable hurdle.

Key Players Shaping the Shrink and Stretch Film Market in North America Market

- Klockner Pentaplast Group

- Clondalkin Group Holdings BV

- Dow Inc

- Amcor PLC

- Transcontinental Inc

- Emsur Macdonell SA

- Intertape Polymer Group Inc

- Berry Global Inc

- Sealed Air Corporation

- Taghleef Industries LLC

Significant Shrink and Stretch Film Market in North America Industry Milestones

- February 2022: The federal government of Canada mandated the use of recycled plastics in shrink and stretch films and other products. The Federal Environment Agency, Environment and Climate Change Canada (ECCC), issued a notice that it plans to draft a minimum recycling content regulation, perhaps by the end of 2022. Overall, the government of Canada plans to require 50% recycled content in plastic packaging by 2030. This landmark regulation is expected to significantly drive demand for recycled content in the North American market.

- February 2021: CCL created a closed-loop recycling solution for stretch sleeves by using technology that enables de-inking the printed sleeves. The new investment is part of CCL Label's long-term plan to support the design for recycling with their labels and to contribute to a more circular economy. It is the first in the industry to offer a circular solution for stretch sleeves, signaling a major step towards achieving a circular economy for flexible packaging.

Future Outlook for Shrink and Stretch Film Market in North America Market

The future outlook for the North America shrink and stretch film market is overwhelmingly positive, driven by a confluence of sustained demand and burgeoning innovation. The increasing adoption of sustainable film solutions, including those incorporating recycled content and bio-based materials, will be a significant growth catalyst. Continued expansion of the e-commerce sector will further bolster demand for robust and efficient packaging. Technological advancements in film properties, such as enhanced barrier capabilities and thinner gauges, will drive market penetration and offer competitive advantages. Strategic partnerships and investments focused on circular economy principles will shape the market's trajectory, presenting substantial opportunities for companies that can adapt to evolving regulatory landscapes and consumer preferences for environmentally responsible packaging.

Shrink and Stretch Film Market in North America Segmentation

-

1. Product Type

- 1.1. Hoods

- 1.2. Wraps

- 1.3. Sleeve Labels

-

2. Material

- 2.1. Low-dens

- 2.2. Polyvinyl chloride (PVC)

- 2.3. Polyethylene terephthalate (PET)

- 2.4. Other Materials

-

3. End-use Industry

- 3.1. Food and Beverage

- 3.2. Consumer Goods

- 3.3. Pharmaceutical

- 3.4. Industrial

- 3.5. Other End-use Industries

-

4. Geography

- 4.1. United States

- 4.2. Canada

Shrink and Stretch Film Market in North America Segmentation By Geography

- 1. United States

- 2. Canada

Shrink and Stretch Film Market in North America Regional Market Share

Geographic Coverage of Shrink and Stretch Film Market in North America

Shrink and Stretch Film Market in North America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.73% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ability to Conform to Any Size and Shape and Provide the Necessary Protection; The Need for Tamper-evident Protection to Drive Market Growth

- 3.3. Market Restrains

- 3.3.1. ; Strict Regulations regarding Single Use Plastics

- 3.4. Market Trends

- 3.4.1. The Food and Beverage Industry is one of the Significant Factors for Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Shrink and Stretch Film Market in North America Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Hoods

- 5.1.2. Wraps

- 5.1.3. Sleeve Labels

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Low-dens

- 5.2.2. Polyvinyl chloride (PVC)

- 5.2.3. Polyethylene terephthalate (PET)

- 5.2.4. Other Materials

- 5.3. Market Analysis, Insights and Forecast - by End-use Industry

- 5.3.1. Food and Beverage

- 5.3.2. Consumer Goods

- 5.3.3. Pharmaceutical

- 5.3.4. Industrial

- 5.3.5. Other End-use Industries

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States Shrink and Stretch Film Market in North America Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Hoods

- 6.1.2. Wraps

- 6.1.3. Sleeve Labels

- 6.2. Market Analysis, Insights and Forecast - by Material

- 6.2.1. Low-dens

- 6.2.2. Polyvinyl chloride (PVC)

- 6.2.3. Polyethylene terephthalate (PET)

- 6.2.4. Other Materials

- 6.3. Market Analysis, Insights and Forecast - by End-use Industry

- 6.3.1. Food and Beverage

- 6.3.2. Consumer Goods

- 6.3.3. Pharmaceutical

- 6.3.4. Industrial

- 6.3.5. Other End-use Industries

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada Shrink and Stretch Film Market in North America Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Hoods

- 7.1.2. Wraps

- 7.1.3. Sleeve Labels

- 7.2. Market Analysis, Insights and Forecast - by Material

- 7.2.1. Low-dens

- 7.2.2. Polyvinyl chloride (PVC)

- 7.2.3. Polyethylene terephthalate (PET)

- 7.2.4. Other Materials

- 7.3. Market Analysis, Insights and Forecast - by End-use Industry

- 7.3.1. Food and Beverage

- 7.3.2. Consumer Goods

- 7.3.3. Pharmaceutical

- 7.3.4. Industrial

- 7.3.5. Other End-use Industries

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 Klockner Pentaplast Group

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Clondalkin Group Holdings BV

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Dow Inc

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Amcor PLC

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Transcontinental Inc *List Not Exhaustive

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Emsur Macdonell SA

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Intertape Polymer Group Inc

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Berry Global Inc

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Sealed Air Corporation

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 Taghleef Industries LLC

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.1 Klockner Pentaplast Group

List of Figures

- Figure 1: Shrink and Stretch Film Market in North America Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Shrink and Stretch Film Market in North America Share (%) by Company 2025

List of Tables

- Table 1: Shrink and Stretch Film Market in North America Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Shrink and Stretch Film Market in North America Revenue Million Forecast, by Material 2020 & 2033

- Table 3: Shrink and Stretch Film Market in North America Revenue Million Forecast, by End-use Industry 2020 & 2033

- Table 4: Shrink and Stretch Film Market in North America Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: Shrink and Stretch Film Market in North America Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Shrink and Stretch Film Market in North America Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: Shrink and Stretch Film Market in North America Revenue Million Forecast, by Material 2020 & 2033

- Table 8: Shrink and Stretch Film Market in North America Revenue Million Forecast, by End-use Industry 2020 & 2033

- Table 9: Shrink and Stretch Film Market in North America Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Shrink and Stretch Film Market in North America Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Shrink and Stretch Film Market in North America Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Shrink and Stretch Film Market in North America Revenue Million Forecast, by Material 2020 & 2033

- Table 13: Shrink and Stretch Film Market in North America Revenue Million Forecast, by End-use Industry 2020 & 2033

- Table 14: Shrink and Stretch Film Market in North America Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Shrink and Stretch Film Market in North America Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Shrink and Stretch Film Market in North America?

The projected CAGR is approximately 3.73%.

2. Which companies are prominent players in the Shrink and Stretch Film Market in North America?

Key companies in the market include Klockner Pentaplast Group, Clondalkin Group Holdings BV, Dow Inc, Amcor PLC, Transcontinental Inc *List Not Exhaustive, Emsur Macdonell SA, Intertape Polymer Group Inc, Berry Global Inc, Sealed Air Corporation, Taghleef Industries LLC.

3. What are the main segments of the Shrink and Stretch Film Market in North America?

The market segments include Product Type, Material, End-use Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.13 Million as of 2022.

5. What are some drivers contributing to market growth?

Ability to Conform to Any Size and Shape and Provide the Necessary Protection; The Need for Tamper-evident Protection to Drive Market Growth.

6. What are the notable trends driving market growth?

The Food and Beverage Industry is one of the Significant Factors for Market Growth.

7. Are there any restraints impacting market growth?

; Strict Regulations regarding Single Use Plastics.

8. Can you provide examples of recent developments in the market?

February 2022: The federal government of Canada mandated the use of recycled plastics in shrink and stretch films and other products. The Federal Environment Agency, Environment and Climate Change Canada (ECCC), issued a notice that it plans to draft a minimum recycling content regulation, perhaps by the end of 2022. Overall, the government of Canada plans to require 50% recycled content in plastic packaging by 2030.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Shrink and Stretch Film Market in North America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Shrink and Stretch Film Market in North America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Shrink and Stretch Film Market in North America?

To stay informed about further developments, trends, and reports in the Shrink and Stretch Film Market in North America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence