Key Insights

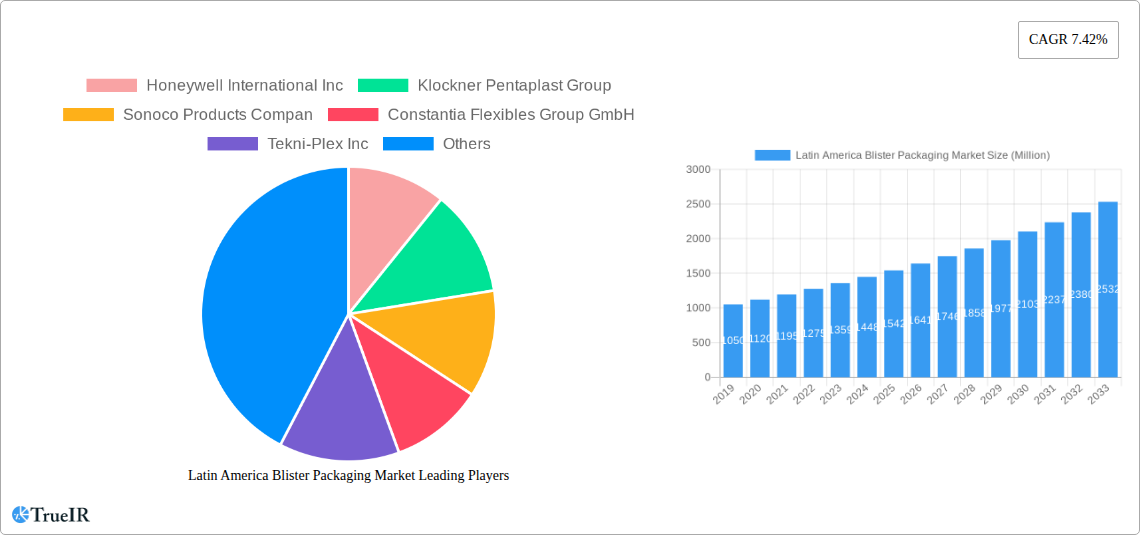

The Latin America Blister Packaging Market is poised for significant expansion, projected to reach approximately USD 1.47 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.42% expected throughout the forecast period ending in 2033. This growth trajectory is primarily fueled by the increasing demand for convenient and safe packaging solutions across a multitude of end-user industries, particularly consumer goods and pharmaceuticals. The pharmaceutical sector, driven by an aging population, rising healthcare expenditure, and the growing prevalence of chronic diseases, necessitates highly protective and tamper-evident packaging, making blister packs a preferred choice. Similarly, the expanding consumer goods market, encompassing everything from personal care items to small electronics, benefits from the product visibility and protection offered by blister packaging. Technological advancements in forming processes, such as sophisticated thermoforming techniques, are also contributing to market growth by enabling more efficient and cost-effective production of intricate blister designs.

Latin America Blister Packaging Market Market Size (In Billion)

The market dynamics are further shaped by evolving consumer preferences for sustainable and user-friendly packaging. While the widespread use of plastic films will continue to dominate material segments, there's a growing interest in exploring sustainable alternatives like paper and paperboard, and advancements in recycling technologies for aluminum. However, certain factors could pose challenges to the unhindered growth of the Latin America blister packaging market. Escalating raw material costs, particularly for plastics, could impact profit margins for manufacturers. Additionally, stringent environmental regulations regarding plastic waste management in some Latin American countries might necessitate investment in alternative materials or improved recycling infrastructure. Nonetheless, the inherent advantages of blister packaging in terms of product protection, shelf appeal, and hygiene, coupled with continuous innovation in design and materials, are expected to sustain its strong market position and drive future growth across key economies like Brazil, Mexico, and Colombia.

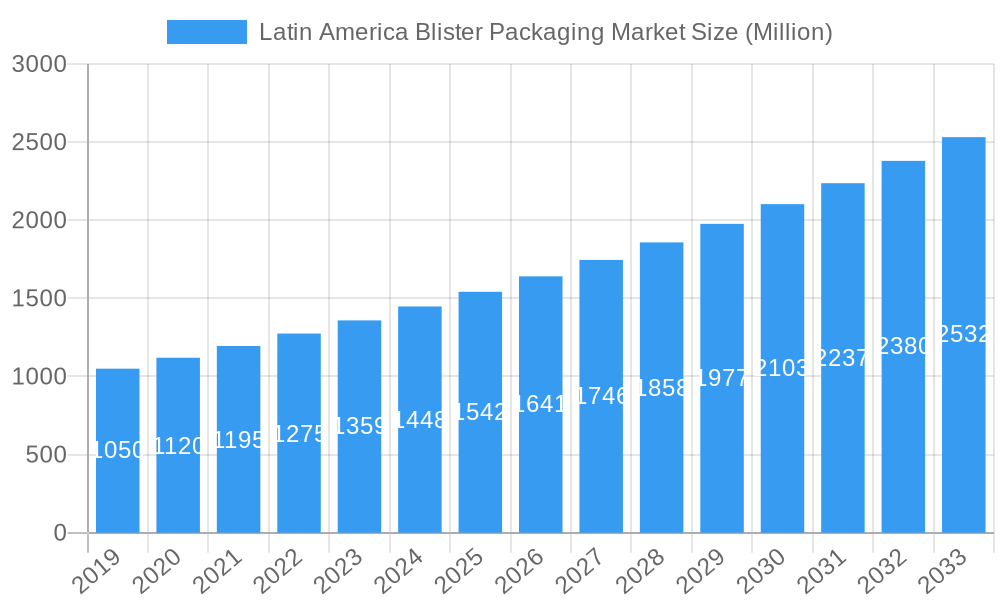

Latin America Blister Packaging Market Company Market Share

Latin America Blister Packaging Market: Navigating Growth and Innovation in Pharmaceutical & Consumer Goods

This comprehensive report offers an in-depth analysis of the Latin America Blister Packaging Market, a sector experiencing robust expansion driven by increasing demand for safe, convenient, and sustainable packaging solutions. We provide a detailed examination of market dynamics, key trends, opportunities, and challenges, offering invaluable insights for stakeholders. The study encompasses a forecast period from 2025 to 2033, with 2025 serving as the base year.

Latin America Blister Packaging Market Market Structure & Competitive Landscape

The Latin America Blister Packaging Market exhibits a moderately concentrated structure, with a few key global players alongside a growing number of regional manufacturers. Innovation is a significant driver, fueled by the perpetual need for enhanced product protection, extended shelf life, and improved tamper-evidence, particularly within the pharmaceutical sector. Regulatory landscapes, while evolving, present both opportunities and challenges, with an increasing emphasis on sustainability and recyclability influencing material choices and packaging designs. Product substitutes, such as pouches and sachets, exist, but blister packaging retains a strong foothold due to its inherent product visibility, protection, and unit-dose convenience. The end-user segmentation reveals a dominant presence of the pharmaceutical industry, followed by consumer goods. Mergers and acquisitions (M&A) are a notable trend, with companies strategically consolidating to expand their geographical reach, enhance their technological capabilities, and diversify their product portfolios. For instance, the acquisition of Seisa Medical by TekniPlex Healthcare underscores the trend of companies bolstering their expertise in specialized materials and medical device solutions. While precise concentration ratios are proprietary, the presence of major international entities suggests a moderate level of competition. The market is characterized by a continuous drive for cost-efficiency and a responsiveness to evolving consumer and industry demands for more sustainable packaging alternatives.

Latin America Blister Packaging Market Market Trends & Opportunities

The Latin America Blister Packaging Market is on a significant growth trajectory, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033. This expansion is underpinned by a confluence of factors, including the burgeoning pharmaceutical industry across countries like Brazil, Mexico, and Argentina, driven by an aging population, rising healthcare expenditure, and an increasing prevalence of chronic diseases. The demand for over-the-counter (OTC) medications and dietary supplements is also a substantial contributor to market growth. In tandem, the consumer goods sector, encompassing personal care products, electronics, and household items, is increasingly adopting blister packaging for its ability to offer product visibility, tamper-evidence, and user convenience. Technological advancements are playing a pivotal role, with a discernible shift towards more sustainable and eco-friendly packaging materials. This includes the exploration and adoption of bioplastics, recycled content, and paper-based alternatives, spurred by both consumer preference and evolving environmental regulations. The February 2024 initiative by Sanofi Consumer Healthcare, partnering with PA Consulting and PulPac’s Blister Pack Collective to develop recyclable fiber-based blister packs, exemplifies this critical trend. This move aims to eliminate problematic plastics and integrate pharmaceutical packaging into the paper waste stream, signaling a significant industry pivot. Furthermore, advancements in thermoforming and cold-forming processes are enabling manufacturers to produce more intricate and customized blister designs, catering to specific product requirements and enhancing brand differentiation. Cold forming, in particular, is gaining traction for moisture-sensitive pharmaceuticals due to its superior barrier properties. The competitive landscape is dynamic, with established players investing heavily in research and development to introduce innovative solutions and expand their market share. Opportunities abound for companies that can offer customized packaging solutions, leverage advanced materials science, and demonstrate a strong commitment to sustainability, thereby aligning with the evolving demands of both industry clients and end-consumers in the Latin American region. The increasing penetration of e-commerce also presents a unique opportunity for blister packaging designed for safe and efficient shipping.

Dominant Markets & Segments in Latin America Blister Packaging Market

Within the Latin America Blister Packaging Market, Brazil consistently emerges as the dominant market, driven by its large population, a robust pharmaceutical manufacturing base, and substantial consumer goods industry. Mexico follows closely, with its strong manufacturing sector and growing pharmaceutical exports. The pharmaceutical end-user industry holds a commanding position, accounting for over 60% of the market share. This dominance is attributed to the critical need for sterile, tamper-evident, and child-resistant packaging for a wide array of prescription drugs, OTC medications, and medical devices. The increasing prevalence of chronic diseases and an expanding elderly population in the region further bolster this segment.

- Leading Region: Brazil

- Growth Drivers: High population density, significant pharmaceutical production capacity, robust consumer spending, and government initiatives supporting healthcare access.

- Market Dominance Factors: A well-established distribution network for pharmaceuticals and consumer goods, a growing middle class, and increasing adoption of advanced packaging technologies by local manufacturers.

The thermoforming process is the most widely adopted method for blister packaging in Latin America, accounting for an estimated 75% of the market. Its versatility, cost-effectiveness, and ability to produce a wide range of shapes and sizes make it ideal for high-volume production of pharmaceutical and consumer goods packaging.

- Dominant Process: Thermoforming

- Key Growth Drivers: Efficiency in high-volume production, ability to accommodate diverse product shapes, lower tooling costs compared to cold forming, and rapid cycle times.

- Market Penetration: Widely used for blister packs for tablets, capsules, cosmetics, and small electronic components.

In terms of material, plastic films, particularly PVC (Polyvinyl Chloride) and PET (Polyethylene Terephthalate), represent the largest segment. These materials offer excellent clarity, rigidity, and barrier properties, making them suitable for protecting a wide range of products from moisture, oxygen, and physical damage. However, there is a significant and growing trend towards sustainable materials, including paper and paperboard-based solutions, driven by environmental concerns and regulatory pressures.

- Dominant Material: Plastic Films (PVC, PET)

- Key Growth Drivers: Excellent transparency, good barrier properties against moisture and oxygen, cost-effectiveness, and versatility in forming.

- Market Influence: Dominates pharmaceutical and consumer goods packaging due to product visibility and protection.

The pharmaceutical segment's demand for blister packaging remains paramount, encompassing both prescription and over-the-counter medications, vitamins, and dietary supplements. The inherent need for unit-dose packaging, shelf-life extension, and child-resistant features drives this segment's growth. The consumer goods sector is the second-largest, including packaging for electronics, personal care items, toys, and stationery.

- Dominant End-User Industry: Pharmaceutical

- Key Growth Drivers: Increasing healthcare access, rising prevalence of chronic diseases, demand for unit-dose packaging, and stringent regulatory requirements for drug safety and integrity.

- Market Significance: Essential for protecting sensitive medications, ensuring sterility, and providing tamper-evident seals.

Latin America Blister Packaging Market Product Analysis

Blister packaging in Latin America is characterized by continuous product innovation focused on enhancing product protection, user convenience, and sustainability. Advancements in thermoforming and cold-forming technologies enable the creation of intricate blister designs that precisely conform to product shapes, offering superior protection against shock and vibration. The growing adoption of advanced plastic films with improved barrier properties extends product shelf life, particularly for sensitive pharmaceuticals and food items. Furthermore, there's a notable trend towards the integration of sustainable materials, including recycled plastics and paper-based substrates, to meet environmental regulations and consumer demand for eco-friendly packaging. These innovations provide competitive advantages by offering customized solutions, improved tamper-evidence, and enhanced branding opportunities.

Key Drivers, Barriers & Challenges in Latin America Blister Packaging Market

Key Drivers: The Latin America Blister Packaging Market is propelled by the robust growth of the pharmaceutical industry, driven by an aging population and increasing healthcare expenditure. The escalating demand for convenient and safe packaging for over-the-counter medications and consumer goods further fuels market expansion. Technological advancements in materials and manufacturing processes, alongside a growing emphasis on product visibility and tamper-evidence, are significant growth catalysts. Additionally, favorable government policies promoting local manufacturing and healthcare access contribute positively.

Barriers & Challenges: Supply chain disruptions and fluctuations in raw material prices, particularly for plastics, pose significant challenges. Stringent regulatory requirements, especially for pharmaceutical packaging, necessitate continuous investment in compliance and quality control. The increasing competition from alternative packaging formats, alongside the growing pressure to adopt more sustainable materials, presents a complex landscape. Economic volatility and currency fluctuations in some Latin American countries can impact investment decisions and market growth.

Growth Drivers in the Latin America Blister Packaging Market Market

Growth in the Latin America Blister Packaging Market is primarily driven by the expanding pharmaceutical sector, fueled by an increasing prevalence of chronic diseases and an aging population across the region. The rising disposable incomes and growing middle class in countries like Brazil and Mexico are boosting demand for consumer goods, which also heavily utilize blister packaging. Technological advancements in thermoforming and cold-forming processes enable greater customization and efficiency, catering to specific product needs. Furthermore, a heightened consumer awareness regarding product safety and hygiene, particularly for pharmaceuticals and personal care items, makes blister packaging an attractive choice for its tamper-evident features and unit-dose convenience.

Challenges Impacting Latin America Blister Packaging Market Growth

The Latin America Blister Packaging Market faces several challenges that could impede its growth. Fluctuations in the cost and availability of key raw materials, especially plastic resins, can impact manufacturing costs and profit margins. Stringent regulatory compliances, particularly within the pharmaceutical industry, require significant investment and adherence to evolving standards. The increasing consumer and regulatory pressure for sustainable packaging solutions necessitates a shift towards eco-friendly materials, which may involve higher initial costs and technological adaptation. Moreover, intense competition from alternative packaging formats and the presence of established global players can create market saturation and price pressures for local manufacturers.

Key Players Shaping the Latin America Blister Packaging Market Market

- Honeywell International Inc

- Klockner Pentaplast Group

- Sonoco Products Company

- Constantia Flexibles Group GmbH

- Tekni-Plex Inc

- West Rock Company

- Amcor Group GmbH

- Huhtamaki Oyj

Significant Latin America Blister Packaging Market Industry Milestones

- February 2024: Sanofi Consumer Healthcare partnered with PA Consulting and PulPac’s Blister Pack Collective to create recyclable fiber-based blister packs, aiming to eliminate problematic plastics from pharmaceutical packaging and enable recycling through the paper waste stream.

- December 2023: TekniPlex Healthcare completed the acquisition of Seisa Medical, expanding its portfolio of medical technology solutions and bolstering expertise in materials science and process technologies for minimally invasive and interventional therapy devices.

Future Outlook for Latin America Blister Packaging Market Market

The future outlook for the Latin America Blister Packaging Market remains exceptionally positive, with continued strong growth anticipated. The increasing focus on sustainable packaging solutions will be a key determinant of success, driving innovation in materials like biodegradable plastics and recycled paperboard. The pharmaceutical sector's persistent demand for high-quality, tamper-evident packaging, coupled with the growth in consumer goods, will ensure a steady demand. Strategic investments in advanced manufacturing technologies, particularly in thermoforming and cold-forming, will be crucial for companies to maintain a competitive edge. Furthermore, the evolving e-commerce landscape presents an opportunity for specialized blister packaging designed for secure and efficient online distribution. Partnerships and acquisitions are expected to continue as companies seek to expand their market reach and technological capabilities in this dynamic region.

Latin America Blister Packaging Market Segmentation

-

1. Process

- 1.1. Thermoforming

- 1.2. Cold Forming

-

2. Material

- 2.1. Plastic Films

- 2.2. Paper and Paperboard

- 2.3. Aluminum

-

3. End-user Industry

- 3.1. Consumer Goods

- 3.2. Pharmaceutical

Latin America Blister Packaging Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Blister Packaging Market Regional Market Share

Geographic Coverage of Latin America Blister Packaging Market

Latin America Blister Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing Geriatric Population and Prevalence of Diseases; Product Innovations such as Downsizing

- 3.2.2 Coupled with Relatively Low Costs

- 3.3. Market Restrains

- 3.3.1. Government Regulation for Plastic Usage

- 3.4. Market Trends

- 3.4.1. The Pharmaceutical Segment to be the Fastest-growing End-user Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Blister Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Process

- 5.1.1. Thermoforming

- 5.1.2. Cold Forming

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Plastic Films

- 5.2.2. Paper and Paperboard

- 5.2.3. Aluminum

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Consumer Goods

- 5.3.2. Pharmaceutical

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Process

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Klockner Pentaplast Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sonoco Products Compan

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Constantia Flexibles Group GmbH

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tekni-Plex Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 West Rock Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Amcor Group GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Huhtamaki Oyj

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: Latin America Blister Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Blister Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Blister Packaging Market Revenue Million Forecast, by Process 2020 & 2033

- Table 2: Latin America Blister Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 3: Latin America Blister Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Latin America Blister Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Latin America Blister Packaging Market Revenue Million Forecast, by Process 2020 & 2033

- Table 6: Latin America Blister Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 7: Latin America Blister Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Latin America Blister Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Brazil Latin America Blister Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Argentina Latin America Blister Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Chile Latin America Blister Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Colombia Latin America Blister Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico Latin America Blister Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Peru Latin America Blister Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Venezuela Latin America Blister Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Ecuador Latin America Blister Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Bolivia Latin America Blister Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Paraguay Latin America Blister Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Blister Packaging Market?

The projected CAGR is approximately 7.42%.

2. Which companies are prominent players in the Latin America Blister Packaging Market?

Key companies in the market include Honeywell International Inc, Klockner Pentaplast Group, Sonoco Products Compan, Constantia Flexibles Group GmbH, Tekni-Plex Inc, West Rock Company, Amcor Group GmbH, Huhtamaki Oyj.

3. What are the main segments of the Latin America Blister Packaging Market?

The market segments include Process, Material, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.47 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Geriatric Population and Prevalence of Diseases; Product Innovations such as Downsizing. Coupled with Relatively Low Costs.

6. What are the notable trends driving market growth?

The Pharmaceutical Segment to be the Fastest-growing End-user Industry.

7. Are there any restraints impacting market growth?

Government Regulation for Plastic Usage.

8. Can you provide examples of recent developments in the market?

February 2024: Sanofi Consumer Healthcare partnered with PA Consulting and PulPac’s Blister Pack Collective to create recyclable fiber-based blister packs to eliminate 'problem plastics' from pharmaceutical packaging and enable recycling through the paper waste stream.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Blister Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Blister Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Blister Packaging Market?

To stay informed about further developments, trends, and reports in the Latin America Blister Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence