Key Insights

The North America Retail Bags Market is poised for significant expansion, projected to reach USD 19.3 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 7% through 2033. This growth is driven by escalating consumer demand for convenient and portable retail packaging across diverse sectors, including grocery and food service. A strong emphasis on sustainability fuels this trend, with manufacturers prioritizing eco-friendly materials like recycled paper and compostable plastics in response to consumer preferences and regulatory mandates. Leading companies are innovating to meet evolving market needs. The United States, Canada, and Mexico are expected to lead market dominance, supported by mature retail infrastructure and high consumer spending power.

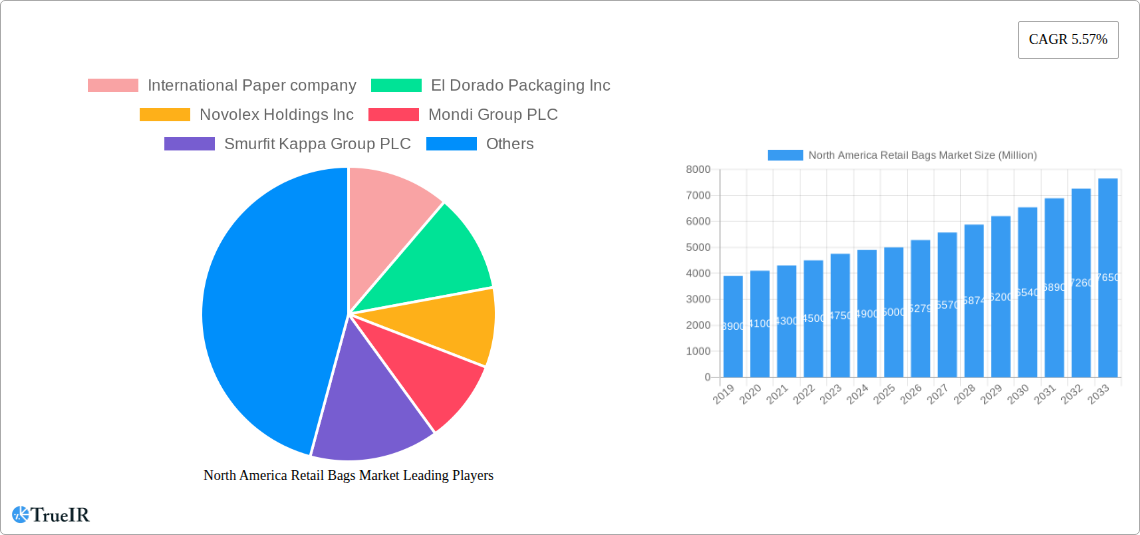

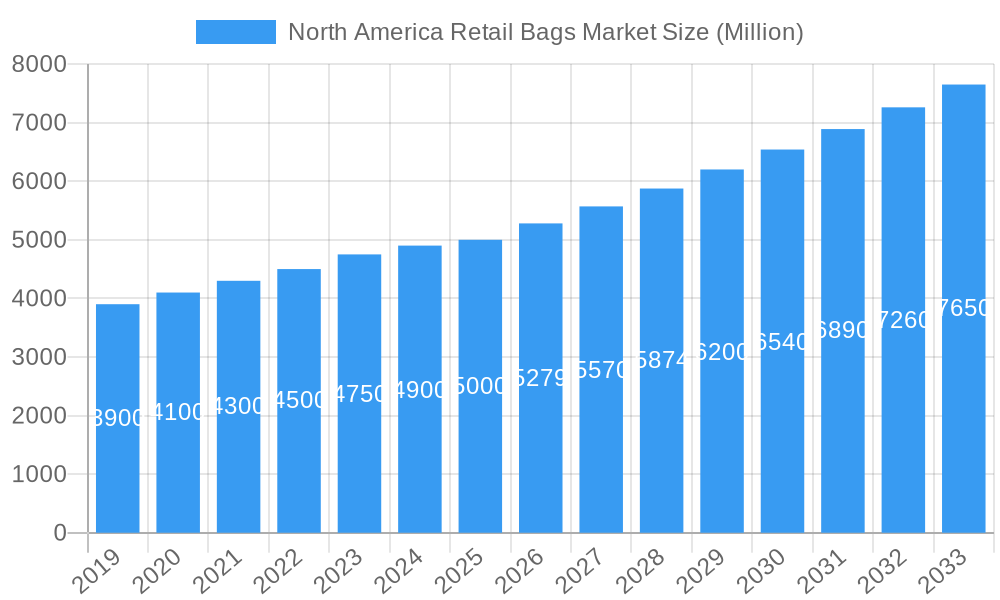

North America Retail Bags Market Market Size (In Billion)

Evolving consumer behaviors and the digital transformation of retail further influence market dynamics. While disposable bags remain prevalent, the adoption of durable and aesthetically pleasing reusable bags is increasing. The food service industry presents considerable opportunities, driven by the surge in takeout and delivery services requiring efficient packaging. Potential restraints include volatile raw material prices for paper and plastic, impacting production costs. Stringent environmental regulations in some North American regions may also necessitate greater adoption of biodegradable and recyclable alternatives. However, the continued growth of e-commerce and the focus on premium unboxing experiences are anticipated to sustain positive market momentum.

North America Retail Bags Market Company Market Share

This comprehensive report offers a dynamic, SEO-optimized analysis of the North America retail bags market, utilizing high-volume keywords for enhanced search visibility. Covering the historical period 2019-2024, with 2025 as the base year and a forecast extending to 2033, this report delivers in-depth insights into market structure, emerging trends, key segments, product innovations, and influential players shaping the future of retail packaging.

North America Retail Bags Market Market Structure & Competitive Landscape

The North America retail bags market exhibits a moderately concentrated structure, with key players vying for market share through product innovation, strategic partnerships, and supply chain optimization. The competitive landscape is significantly influenced by evolving consumer preferences for sustainable packaging solutions and stringent environmental regulations across the US and Canada. Innovation drivers are primarily focused on developing biodegradable, compostable, and recyclable bag materials, alongside advancements in manufacturing processes to improve efficiency and reduce environmental impact. Regulatory impacts, such as single-use plastic bag bans and extended producer responsibility schemes, are reshaping market dynamics, compelling manufacturers to invest in alternative materials and reusable bag options. Product substitutes, including reusable cloth bags, cardboard boxes, and other innovative packaging formats, present a growing challenge, necessitating continuous product development and differentiation by retail bag manufacturers. The end-user segmentation reveals the dominance of grocery stores and food service sectors, which represent substantial demand for various types of retail bags. Mergers and acquisitions (M&A) trends indicate a consolidation phase, with larger entities acquiring smaller players to expand their product portfolios and geographical reach. For instance, in the historical period, an estimated 20 M&A deals were recorded, totaling an estimated USD 1,500 Million in transaction value, signaling a strong appetite for consolidation and strategic growth. Concentration ratios, particularly for the top 5 players, are estimated to be around 65%, highlighting a significant, yet not fully monopolized, market structure.

North America Retail Bags Market Market Trends & Opportunities

The North America retail bags market is poised for significant expansion, projected to reach an estimated USD 25,000 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 6.5% from the base year of 2025. This robust growth is fueled by a confluence of factors, including the increasing demand for convenient and portable packaging solutions across various retail sectors, coupled with a heightened consumer awareness regarding the environmental impact of traditional packaging materials. Technological shifts are at the forefront of market evolution, with a pronounced emphasis on the development and adoption of sustainable alternatives. Innovations in paper manufacturing, such as enhanced water resistance and improved recyclability, alongside the increasing use of compostable bioplastics derived from renewable resources, are reshaping product offerings.

Consumer preferences are demonstrably leaning towards eco-friendly options, driving demand for bags made from recycled content, biodegradable materials, and those that are easily recyclable. This shift is particularly evident in the grocery and food service segments, where consumers are actively seeking out retailers that provide sustainable packaging choices. Competitive dynamics are intensifying, with companies differentiating themselves through sustainable product portfolios, transparent supply chains, and investments in advanced manufacturing technologies. The rise of e-commerce has also created new avenues for growth, necessitating specialized shipping and retail bags that are both durable and environmentally conscious. Opportunities abound for market players to innovate in areas such as smart packaging, personalized printing, and the development of highly durable and reusable bag systems. The penetration rate of sustainable retail bags is projected to reach an estimated 60% by 2033, indicating a substantial market shift. Furthermore, the integration of advanced digital printing technologies allows for enhanced branding and customization, appealing to a wider range of retailers seeking to align their packaging with their corporate social responsibility initiatives. The market is also witnessing opportunities in the development of closed-loop recycling systems and the promotion of bag reuse programs, further contributing to a circular economy.

Dominant Markets & Segments in North America Retail Bags Market

The North America retail bags market is characterized by distinct regional and segment-specific dominance. The United States unequivocally holds the position of the largest market, driven by its substantial consumer base, robust retail infrastructure, and a diverse range of end-user industries. Canada follows as a significant contributor, with a growing emphasis on sustainable packaging initiatives and increasing consumer adoption of eco-friendly alternatives. Within the end-user segmentation, Grocery Stores represent the most dominant segment, accounting for an estimated 45% of the total market share in 2025. This dominance is attributed to the sheer volume of daily transactions and the critical need for reliable, cost-effective, and increasingly sustainable bagging solutions for a wide array of products.

The Food Service segment is the second-largest contributor, estimated at 30% market share in 2025. This includes restaurants, fast-food chains, cafes, and catering services, all of which rely heavily on retail bags for takeout, delivery, and packaging of food items. The growing trend of food delivery services further amplifies the demand from this segment. The Other End-users segment, encompassing various retail categories such as apparel, electronics, pharmacies, and general merchandise, collectively accounts for the remaining 25% of the market share. While individually smaller, this segment presents diverse opportunities for specialized bag designs and materials.

Key growth drivers in the dominant Grocery Stores segment include the continuous expansion of supermarket chains, the increasing demand for pre-packaged goods, and the ongoing consumer shift towards reusable and recyclable shopping bags. Government policies promoting waste reduction and plastic bag bans in several states and provinces directly impact this segment, pushing retailers to adopt compliant alternatives. For the Food Service segment, growth is propelled by the burgeoning food delivery and takeout market, the adoption of new packaging materials that maintain food quality and temperature, and the increasing influence of environmental consciousness among diners. Infrastructure development, such as the proliferation of ghost kitchens and the integration of advanced order management systems, further fuels demand. The "Other End-users" segment's growth is driven by evolving retail experiences, the demand for branded and aesthetically pleasing packaging, and the increasing focus on product protection during transit. The adoption of sustainable practices across all retail sectors is a universal growth driver, creating a dynamic and evolving market landscape.

North America Retail Bags Market Product Analysis

The North America retail bags market is characterized by a constant stream of product innovations aimed at enhancing sustainability, functionality, and consumer appeal. Key advancements include the development of highly durable and recyclable paper bags with improved strength and resistance to moisture, often achieved through specialized coatings and manufacturing techniques. Compostable bags made from plant-based materials are gaining significant traction, offering an environmentally friendly alternative to conventional plastics, particularly for food service applications. The competitive advantage lies in offering a diverse product range that caters to specific end-user needs, such as grease-resistant bags for food service, premium aesthetic options for high-end retail, and robust designs for bulkier items. Technological advancements in material science and manufacturing processes are enabling the creation of bags with enhanced barrier properties, extended shelf life for packaged goods, and improved recyclability, all while maintaining cost-effectiveness.

Key Drivers, Barriers & Challenges in North America Retail Bags Market

Key Drivers: The North America retail bags market is propelled by several key drivers. Technologically, the development of advanced biodegradable and compostable materials, alongside innovative paper-based solutions with enhanced durability and water resistance, is a primary growth catalyst. Economically, the increasing consumer spending on retail goods and the continuous expansion of the food service industry, especially with the surge in takeout and delivery services, fuel consistent demand. Policy-driven factors, such as government mandates promoting plastic bag reduction and encouraging the use of sustainable alternatives, are significant growth enablers. The growing consumer awareness and preference for eco-friendly products also play a crucial role.

Barriers & Challenges: Despite the positive outlook, the market faces significant challenges. Supply chain disruptions, including the availability and cost of raw materials, can impact production volumes and pricing. Regulatory complexities and varying implementation timelines for environmental policies across different states and provinces can create compliance hurdles. Competitive pressures from alternative packaging solutions, such as reusable bags and innovative container designs, necessitate continuous adaptation and innovation. The initial higher cost of some sustainable alternatives compared to traditional plastic bags can also be a barrier to widespread adoption, especially for price-sensitive businesses. Overcoming these challenges requires strategic investments in R&D, efficient supply chain management, and effective communication of the long-term value proposition of sustainable packaging.

Growth Drivers in the North America Retail Bags Market Market

The growth of the North America retail bags market is significantly influenced by several key drivers. Technologically, the continuous innovation in developing sustainable materials like biodegradable plastics and advanced recyclable paper products is a primary catalyst. Economically, the sustained growth of the retail and food service sectors, coupled with the increasing consumer demand for convenience and portability, directly translates into higher bag consumption. Regulatory initiatives, such as bans on single-use plastic bags and incentives for eco-friendly packaging, actively promote the adoption of alternative bag solutions, thereby driving market expansion. Furthermore, a growing consumer consciousness towards environmental sustainability is a powerful driver, compelling businesses to offer and promote greener packaging options.

Challenges Impacting North America Retail Bags Market Growth

The North America retail bags market growth faces several impacting challenges. Regulatory complexities and the varying implementation of environmental policies across different jurisdictions can create operational hurdles and compliance costs for businesses. Supply chain disruptions, including fluctuations in the availability and cost of raw materials like paper pulp and bioplastics, can affect production and pricing strategies. Competitive pressures from alternative packaging solutions, such as reusable bags, cardboard boxes, and innovative, multi-use containers, pose a significant restraint, demanding continuous product differentiation and value addition. The initial investment required for transitioning to certain sustainable packaging technologies can also be a barrier for smaller businesses, impacting the pace of adoption.

Key Players Shaping the North America Retail Bags Market Market

- International Paper Company

- El Dorado Packaging Inc

- Novolex Holdings Inc

- Mondi Group PLC

- Smurfit Kappa Group PLC

- Jet Paper Bags

Significant North America Retail Bags Market Industry Milestones

- May 2022: Smurfit Kappa developed AquaStop sustainable water-resistant paper as part of Smurfit Kappa's new TechniPaper portfolio because of a special coating added to it during the manufacturing process without compromising the recyclability of the product.

- May 2022: Eco-Products, part of Novolex, introduced a new compostable wrap ideal for swaddling sandwiches and snacks. With more restaurants seeking carryout and delivery options made from wax paper, it is ASTM D6868 compliant and is certified by the Biodegradable Products Institute.

Future Outlook for North America Retail Bags Market Market

The future outlook for the North America retail bags market is exceptionally bright, driven by an unyielding commitment to sustainability and evolving consumer demands. Strategic opportunities lie in the continued development and scaling of advanced biodegradable and compostable materials, offering viable alternatives to traditional plastics. The market potential is further amplified by the increasing integration of circular economy principles, encouraging the design of more recyclable and reusable bag solutions. Investments in advanced manufacturing technologies that enhance efficiency, reduce environmental impact, and enable greater customization will be crucial for sustained growth. As regulatory landscapes continue to favor eco-friendly packaging, and consumer awareness deepens, the demand for innovative and sustainable retail bags is set to accelerate, positioning the market for robust expansion in the coming years.

North America Retail Bags Market Segmentation

-

1. End-User

- 1.1. Grocery Stores

- 1.2. Food Service

- 1.3. Other Emd-users

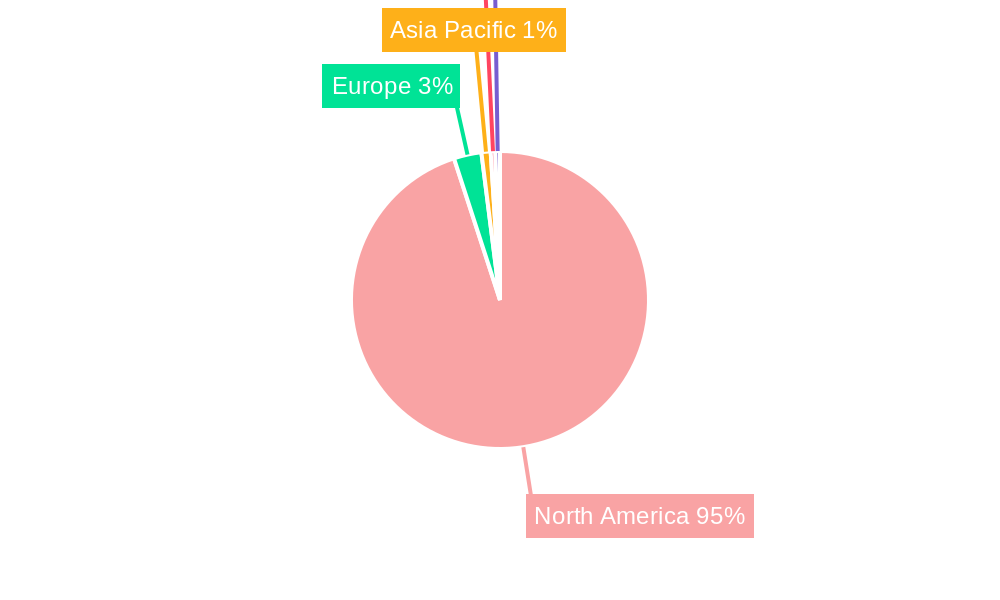

North America Retail Bags Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Retail Bags Market Regional Market Share

Geographic Coverage of North America Retail Bags Market

North America Retail Bags Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Sustainable Packaging Alternatives in the Retail Sector; Stringent Government Regulations Against the Use of Single Use Plastic bags

- 3.3. Market Restrains

- 3.3.1. Fluctuating Raw Material Prices and Supply Chain Disruptions

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Sustainable Packaging Alternatives in the Retail Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Retail Bags Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Grocery Stores

- 5.1.2. Food Service

- 5.1.3. Other Emd-users

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 International Paper company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 El Dorado Packaging Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Novolex Holdings Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mondi Group PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Smurfit Kappa Group PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jet Paper Bags*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 International Paper company

List of Figures

- Figure 1: North America Retail Bags Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Retail Bags Market Share (%) by Company 2025

List of Tables

- Table 1: North America Retail Bags Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 2: North America Retail Bags Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: North America Retail Bags Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 4: North America Retail Bags Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States North America Retail Bags Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada North America Retail Bags Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico North America Retail Bags Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Retail Bags Market?

The projected CAGR is approximately 7%.

2. Which companies are prominent players in the North America Retail Bags Market?

Key companies in the market include International Paper company, El Dorado Packaging Inc, Novolex Holdings Inc, Mondi Group PLC, Smurfit Kappa Group PLC, Jet Paper Bags*List Not Exhaustive.

3. What are the main segments of the North America Retail Bags Market?

The market segments include End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Sustainable Packaging Alternatives in the Retail Sector; Stringent Government Regulations Against the Use of Single Use Plastic bags.

6. What are the notable trends driving market growth?

Increasing Demand for Sustainable Packaging Alternatives in the Retail Sector.

7. Are there any restraints impacting market growth?

Fluctuating Raw Material Prices and Supply Chain Disruptions.

8. Can you provide examples of recent developments in the market?

May 2022 - Smurfit Kappa developed AquaStop sustainable water-resistant paper as part of Smurfit Kappa's new TechniPaper portfolio because of a special coating added to it during the manufacturing process without compromising the recyclability of the product.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Retail Bags Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Retail Bags Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Retail Bags Market?

To stay informed about further developments, trends, and reports in the North America Retail Bags Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence