Key Insights

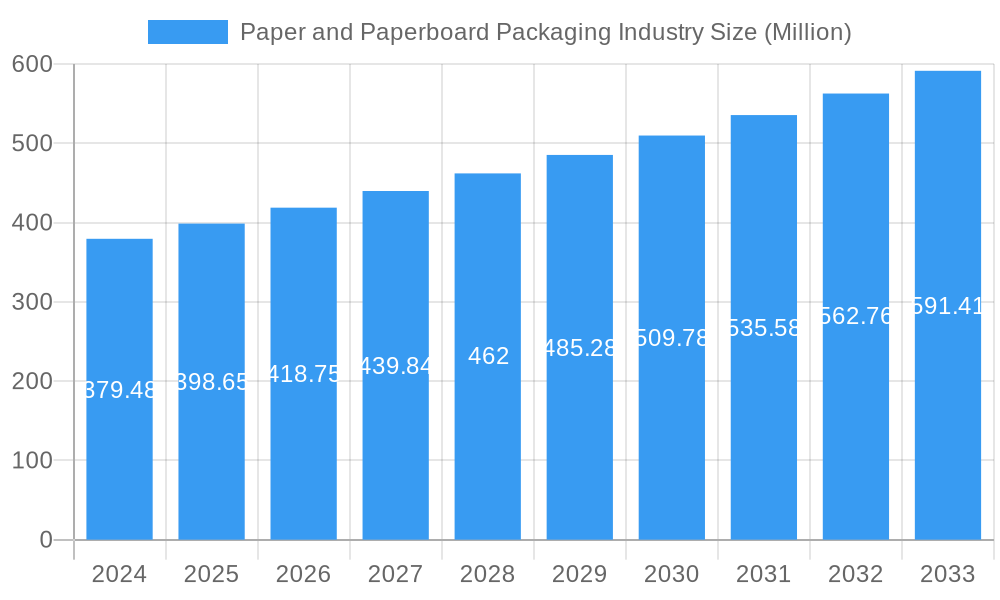

The Paper and Paperboard Packaging market is projected to reach USD 398.65 Million by 2025, demonstrating a robust Compound Annual Growth Rate (CAGR) of 4.68% during the forecast period of 2025-2033. This sustained growth is underpinned by a confluence of factors, most notably the increasing consumer preference for sustainable and eco-friendly packaging solutions. As global environmental consciousness rises, paper and paperboard packaging, being renewable and recyclable, are gaining significant traction over traditional plastic alternatives. This shift is further propelled by stringent government regulations worldwide aimed at curbing plastic pollution and promoting circular economy principles. The burgeoning e-commerce sector also acts as a significant growth driver, necessitating efficient, protective, and often customizable packaging for a vast array of products. Furthermore, advancements in paperboard technology, leading to enhanced strength, barrier properties, and printability, are expanding its application across diverse industries, including food and beverages, pharmaceuticals, and consumer goods.

Paper and Paperboard Packaging Industry Market Size (In Million)

However, the market is not without its challenges. Fluctuations in raw material prices, particularly wood pulp, can impact manufacturing costs and profitability. Intense competition from alternative packaging materials and the high initial investment required for advanced paper recycling infrastructure also pose considerable restraints. Despite these hurdles, the industry is witnessing innovative trends such as the development of lightweight yet durable paperboard, antimicrobial coatings for food packaging, and the integration of smart technologies for enhanced traceability and consumer engagement. Key players like WestRock Company, Smurfit Kappa Group, Mondi Group, and International Paper Company are actively investing in research and development to innovate and expand their product portfolios, focusing on sustainability and customized solutions. The market's trajectory suggests a continued upward trend, driven by a strong demand for responsible packaging and ongoing technological advancements.

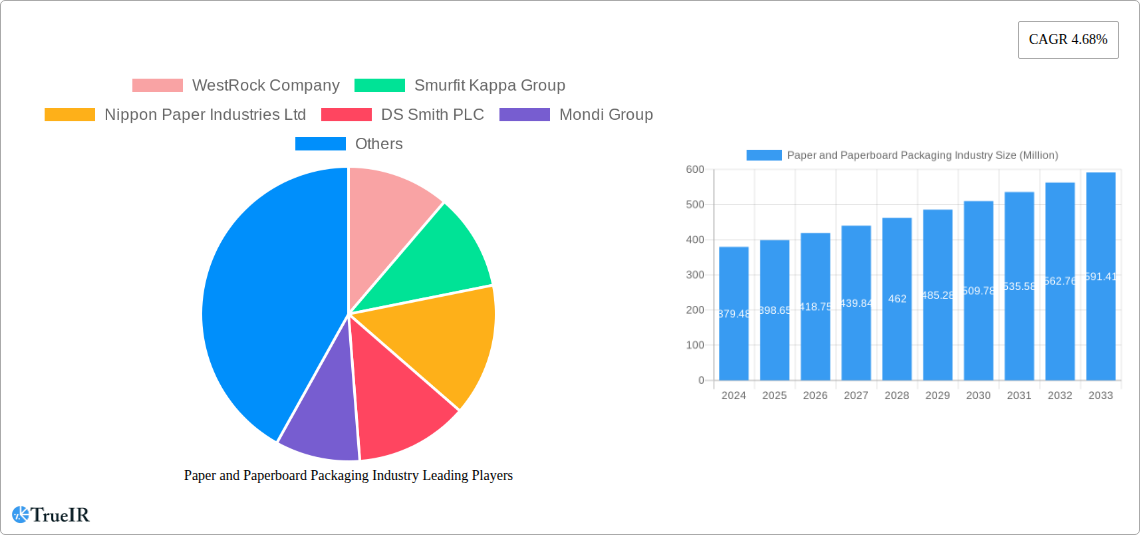

Paper and Paperboard Packaging Industry Company Market Share

This comprehensive report delves into the dynamic paper and paperboard packaging market, a critical sector experiencing significant growth driven by sustainability trends and evolving consumer demand. With a detailed analysis spanning 2019 to 2033, including a base year of 2025 and a robust forecast period of 2025-2033, this report offers unparalleled insights for industry stakeholders. Leveraging high-volume keywords such as sustainable packaging solutions, corrugated cardboard market, paper packaging growth, containerboard demand, and flexible packaging alternatives, this research is designed to enhance search rankings and engage a broad audience of manufacturers, suppliers, investors, and industry analysts.

The report provides an in-depth examination of key market segments, including Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis. Furthermore, it scrutinizes significant Industry Developments, highlighting strategic moves by major players like WestRock Company, Smurfit Kappa Group, Nippon Paper Industries Ltd, DS Smith PLC, Mondi Group, International Paper Company, Eastern Pak Limited, Packaging Corporation of America, Sonoco Products Company, Cascades Inc, and others (list not exhaustive).

Paper and Paperboard Packaging Industry Market Structure & Competitive Landscape

The global paper and paperboard packaging market exhibits a moderately consolidated structure, with leading companies like International Paper, Smurfit Kappa, and WestRock holding significant market share. Innovation drivers are primarily centered around the development of sustainable, recyclable, and biodegradable packaging materials, responding to increasing environmental regulations and consumer pressure for eco-friendly alternatives. Regulatory impacts, such as extended producer responsibility schemes and bans on single-use plastics, are actively reshaping market dynamics. Product substitutes, including rigid plastic packaging and flexible pouches, present ongoing competition, though paper-based solutions are gaining traction due to their inherent sustainability. End-user segmentation reveals robust demand from the food and beverage packaging, e-commerce packaging, and consumer goods packaging sectors. Mergers and acquisitions (M&A) are a consistent feature, facilitating market expansion and consolidation. For instance, in December 2022, WestRock Company's acquisition of Grupo Gondi for USD 970 million significantly boosted its presence in Latin America. This strategic move, along with other consolidation activities, underscores the industry's drive for scale and integrated supply chains. The market's competitive landscape is characterized by a balance between large multinational corporations and agile regional players, all vying for market dominance through product innovation and strategic partnerships.

Paper and Paperboard Packaging Industry Market Trends & Opportunities

The paper and paperboard packaging market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 4.5% from 2025 to 2033. This upward trajectory is fueled by a confluence of interconnected trends and emerging opportunities. A primary growth catalyst is the burgeoning global demand for sustainable packaging solutions. As governments worldwide implement stricter regulations on plastic waste and consumers become increasingly environmentally conscious, paper and paperboard packaging, with its inherent recyclability and biodegradability, is emerging as the preferred choice across numerous industries. The e-commerce boom continues to be a significant driver, with the rapid expansion of online retail necessitating efficient, protective, and increasingly sustainable shipping solutions. Paper-based corrugated boxes are perfectly positioned to meet this demand, offering durability, customization, and a positive unboxing experience. Technological advancements are also playing a crucial role, with innovations in paper coatings, barrier technologies, and digital printing enhancing the functionality and aesthetic appeal of paper packaging. These advancements are enabling paper to compete more effectively with traditional plastic packaging, offering improved moisture resistance and extended shelf life for sensitive products. Consumer preferences are shifting towards brands that demonstrate a commitment to sustainability, making eco-friendly packaging a key differentiator and a significant marketing advantage. This presents a golden opportunity for companies to invest in and promote their sustainable packaging offerings. Furthermore, the development of high-graphic packaging and specialty paperboards for premium applications, such as luxury goods and cosmetics, is creating niche markets with higher profit margins. The growing emphasis on circular economy principles is also driving opportunities in recycled paper and paperboard, fostering closed-loop systems and reducing reliance on virgin resources. Companies that can effectively integrate sustainability into their core business strategy, coupled with innovative product development and efficient supply chain management, will be well-positioned to capitalize on the vast opportunities within this evolving market. The market penetration of advanced paper-based packaging for traditionally plastic-dominated sectors, such as fresh produce and single-serve food items, represents a substantial untapped potential.

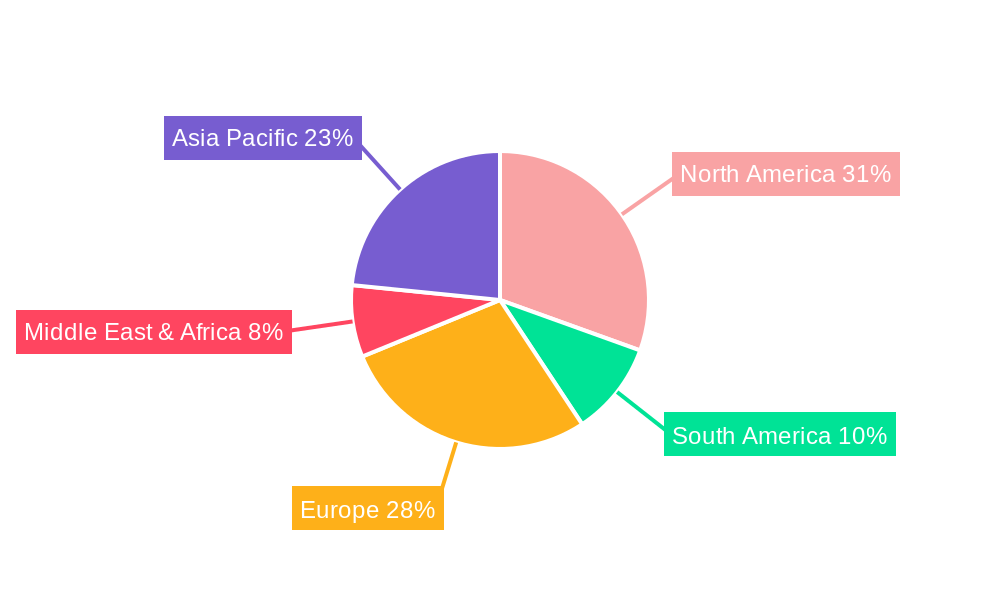

Dominant Markets & Segments in Paper and Paperboard Packaging Industry

The paper and paperboard packaging industry is dominated by several key regions and segments, driven by robust economic activity, evolving consumer habits, and supportive industrial policies. In terms of Production Analysis, North America and Europe currently lead, owing to well-established manufacturing bases and high levels of industrial output. However, Asia-Pacific, particularly China and India, is witnessing the most rapid growth in production capacity, fueled by massive domestic demand and export-oriented manufacturing. Consumption Analysis mirrors production trends, with these same regions being the largest consumers of paper and paperboard packaging. The food and beverage sector represents the largest end-use segment, driven by the increasing global population and rising disposable incomes leading to higher consumption of packaged food and beverages. The e-commerce sector is a rapidly growing consumer, with a substantial increase in online retail driving demand for corrugated boxes and protective paper packaging.

The Import Market Analysis (Value & Volume) is significantly influenced by regional trade agreements and the availability of raw materials. North America and Europe are major importers of specialized paper grades and recycled fibers, while emerging economies often import finished packaging products to meet immediate demand. Conversely, in the Export Market Analysis (Value & Volume), regions with strong pulp and paper production capabilities, such as Scandinavia and North America, are key exporters of paper and paperboard products. Asia-Pacific is increasingly becoming a significant exporter of finished packaging goods, leveraging its competitive manufacturing costs. Price Trend Analysis is subject to fluctuations in raw material costs, primarily pulpwood and recycled fiber, as well as energy prices and global supply-demand dynamics. Environmental regulations and sustainability initiatives are also indirectly influencing prices by driving demand for certified and sustainably sourced materials. Key growth drivers for market dominance include:

- Infrastructure Development: Robust logistics and warehousing infrastructure facilitate efficient distribution and accessibility of paper packaging products.

- Government Policies: Favorable policies promoting recycling, sustainable sourcing, and investments in the pulp and paper industry.

- Urbanization and Middle-Class Growth: Rising disposable incomes and changing lifestyles in emerging economies increase the demand for packaged goods.

- E-commerce Penetration: The exponential growth of online retail directly translates into increased demand for shipping and protective packaging.

- Sustainability Mandates: Growing global emphasis on environmental protection and plastic reduction drives the adoption of paper-based alternatives.

The corrugated packaging segment consistently demonstrates strong performance due to its versatility and cost-effectiveness in shipping and product protection. Specialty paperboards for premium applications are also carving out significant market share.

Paper and Paperboard Packaging Industry Product Analysis

Innovations in the paper and paperboard packaging industry are continuously enhancing product functionality and sustainability. Advancements in barrier coatings are providing improved moisture, grease, and oxygen resistance, expanding the application of paper packaging for sensitive food items and electronics. Lightweighting initiatives are reducing material usage without compromising structural integrity, leading to cost savings and environmental benefits. High-graphic printing capabilities are transforming paper packaging into a powerful branding and marketing tool, enhancing shelf appeal and consumer engagement. Biodegradable and compostable paper-based solutions are gaining traction as viable alternatives to conventional plastics, addressing growing environmental concerns. The competitive advantage lies in offering customizable, aesthetically pleasing, and demonstrably sustainable packaging that meets diverse end-user requirements.

Key Drivers, Barriers & Challenges in Paper and Paperboard Packaging Industry

Key Drivers, Barriers & Challenges in Paper and Paperboard Packaging Industry

Key Drivers: The paper and paperboard packaging market is propelled by several influential factors. The escalating global demand for sustainable packaging solutions is a paramount driver, with increasing consumer and regulatory pressure to reduce plastic waste favoring paper-based alternatives due to their recyclability and biodegradability. The explosive growth of e-commerce directly translates into higher demand for robust and protective corrugated packaging for shipments. Technological advancements, including improved barrier coatings and printing technologies, are expanding the applicability of paper packaging into new sectors. Government incentives supporting the circular economy and investments in the pulp and paper industry further bolster market growth.

Key Barriers & Challenges: Despite the positive outlook, the industry faces significant challenges. Fluctuations in the cost and availability of raw materials, particularly pulpwood and recycled fibers, can impact profitability and supply chain stability. Stringent environmental regulations, while driving sustainability, can also impose compliance costs and necessitate significant investment in new technologies. Intense competition from alternative packaging materials, such as plastics and flexible films, remains a persistent challenge, especially in specific product categories. Supply chain disruptions, exacerbated by global events, can lead to production delays and increased logistics costs, affecting the overall cost-effectiveness of paper packaging. Furthermore, the energy-intensive nature of paper production poses a challenge in an era of rising energy prices and climate change mitigation efforts.

Growth Drivers in the Paper and Paperboard Packaging Industry Market

The paper and paperboard packaging market is experiencing robust growth fueled by a strategic alignment with global megatrends. The accelerating shift towards sustainability is a primary engine, as consumers and regulators increasingly favor eco-friendly, recyclable, and biodegradable packaging options over plastics. This trend directly benefits paper and paperboard, positioning it as a preferred material across various industries. The relentless expansion of the e-commerce sector is another significant growth driver. The surge in online retail necessitates efficient, protective, and often customizable shipping solutions, with corrugated cardboard boxes at the forefront. Technological advancements are also contributing, with innovations in barrier technologies, digital printing, and lightweighting enabling paper packaging to compete effectively in more demanding applications. Furthermore, evolving consumer preferences for brands that demonstrate environmental responsibility are pushing companies to adopt more sustainable packaging, creating a strong market pull.

Challenges Impacting Paper and Paperboard Packaging Industry Growth

The growth of the paper and paperboard packaging industry is not without its obstacles. A significant challenge lies in the volatility of raw material prices, particularly pulpwood and recycled fiber, which can impact production costs and profit margins. Supply chain disruptions, ranging from logistics bottlenecks to fiber shortages, can lead to production delays and increased operational expenses. While regulatory shifts favor paper, navigating complex and sometimes divergent environmental regulations across different regions can pose compliance challenges and necessitate substantial investment in new technologies and processes. The competitive pressure from alternative packaging materials, especially advanced plastics and flexible films, continues to be a considerable restraint, particularly in segments where performance characteristics like extreme barrier properties are paramount. Additionally, the energy-intensive nature of paper manufacturing presents ongoing challenges in an era of increasing energy costs and a global focus on carbon footprint reduction.

Key Players Shaping the Paper and Paperboard Packaging Industry Market

- WestRock Company

- Smurfit Kappa Group

- Nippon Paper Industries Ltd

- DS Smith PLC

- Mondi Group

- International Paper Company

- Eastern Pak Limited

- Packaging Corporation of America

- Sonoco Products Company

- Cascades Inc

Significant Paper and Paperboard Packaging Industry Industry Milestones

- December 2022: WestRock Company announced it successfully acquired Grupo Gondi's remaining interest for USD 970 million plus debt assumption. The Grupo Gondi acquisition includes four paper mills, nine corrugated packaging facilities, and six high graphic facilities throughout Mexico. These facilities produce sustainable packaging for a variety of regional end markets. The company's dominant position in the expanding corrugated packaging, consumer goods, paperboard, and containerboard markets in Latin America will be strengthened by this acquisition.

- September 2022: Mondi concluded merging its Mondi Tire Kutsan and Mondi Olmuksan companies. The transaction created a new company called Mondi Turkey Oluklu Mukavva to Mondi's corrugated packaging business area. The company has nine corrugated packaging facilities, a containerboard mill in Tire, Turkey, and a wastepaper collection facility in Adana, Turkey, and it is traded on the Istanbul Stock Exchange (BIST). Mondi owns an 84.65% ownership in Mondi Turkey Oluklu Mukavva, which has around 1,600 workers.

Future Outlook for Paper and Paperboard Packaging Industry Market

The future outlook for the paper and paperboard packaging industry is exceptionally promising, driven by a continued emphasis on sustainability and the persistent growth of e-commerce. Strategic opportunities abound for companies that can innovate in biodegradable materials, enhance recycling infrastructure, and develop advanced barrier properties for paper-based packaging. The increasing adoption of circular economy principles will further stimulate demand for recycled content and closed-loop systems. Market potential lies in penetrating sectors traditionally dominated by plastics, such as flexible food packaging and beverage containers, through technological advancements. Investment in sustainable forestry and efficient production processes will be critical for long-term success and to meet the escalating demand for eco-friendly packaging solutions worldwide.

Paper and Paperboard Packaging Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Paper and Paperboard Packaging Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Paper and Paperboard Packaging Industry Regional Market Share

Geographic Coverage of Paper and Paperboard Packaging Industry

Paper and Paperboard Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.68% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from the Food and Beverage Sector; Regulations on Plastic-based Packaging Products Contribute to Higher Demand; Increasing Growth of E-commerce Creates Demand for Various Paper and Paperboard Packaging Types

- 3.3. Market Restrains

- 3.3.1. Concerns Regarding the Environment and Recycling

- 3.4. Market Trends

- 3.4.1. Increase in Demand from the Food and Beverage Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Paper and Paperboard Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Paper and Paperboard Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Paper and Paperboard Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Paper and Paperboard Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Paper and Paperboard Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Paper and Paperboard Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 WestRock Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Smurfit Kappa Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nippon Paper Industries Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DS Smith PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mondi Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 International Paper Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Eastern Pak Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Packaging Corporation of America

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sonoco Products Company*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Cascades Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 WestRock Company

List of Figures

- Figure 1: Global Paper and Paperboard Packaging Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Paper and Paperboard Packaging Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 3: North America Paper and Paperboard Packaging Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Paper and Paperboard Packaging Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 5: North America Paper and Paperboard Packaging Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Paper and Paperboard Packaging Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Paper and Paperboard Packaging Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Paper and Paperboard Packaging Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Paper and Paperboard Packaging Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Paper and Paperboard Packaging Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Paper and Paperboard Packaging Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Paper and Paperboard Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Paper and Paperboard Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Paper and Paperboard Packaging Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 15: South America Paper and Paperboard Packaging Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America Paper and Paperboard Packaging Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 17: South America Paper and Paperboard Packaging Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America Paper and Paperboard Packaging Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America Paper and Paperboard Packaging Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America Paper and Paperboard Packaging Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America Paper and Paperboard Packaging Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America Paper and Paperboard Packaging Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 23: South America Paper and Paperboard Packaging Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America Paper and Paperboard Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Paper and Paperboard Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Paper and Paperboard Packaging Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 27: Europe Paper and Paperboard Packaging Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe Paper and Paperboard Packaging Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 29: Europe Paper and Paperboard Packaging Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe Paper and Paperboard Packaging Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe Paper and Paperboard Packaging Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe Paper and Paperboard Packaging Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe Paper and Paperboard Packaging Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe Paper and Paperboard Packaging Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe Paper and Paperboard Packaging Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe Paper and Paperboard Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Europe Paper and Paperboard Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa Paper and Paperboard Packaging Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa Paper and Paperboard Packaging Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa Paper and Paperboard Packaging Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa Paper and Paperboard Packaging Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa Paper and Paperboard Packaging Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa Paper and Paperboard Packaging Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa Paper and Paperboard Packaging Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa Paper and Paperboard Packaging Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa Paper and Paperboard Packaging Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa Paper and Paperboard Packaging Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa Paper and Paperboard Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East & Africa Paper and Paperboard Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Paper and Paperboard Packaging Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific Paper and Paperboard Packaging Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific Paper and Paperboard Packaging Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific Paper and Paperboard Packaging Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific Paper and Paperboard Packaging Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific Paper and Paperboard Packaging Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific Paper and Paperboard Packaging Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific Paper and Paperboard Packaging Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific Paper and Paperboard Packaging Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific Paper and Paperboard Packaging Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific Paper and Paperboard Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 61: Asia Pacific Paper and Paperboard Packaging Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Paper and Paperboard Packaging Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Paper and Paperboard Packaging Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Paper and Paperboard Packaging Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Paper and Paperboard Packaging Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Paper and Paperboard Packaging Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Paper and Paperboard Packaging Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global Paper and Paperboard Packaging Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Paper and Paperboard Packaging Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Paper and Paperboard Packaging Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Paper and Paperboard Packaging Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Paper and Paperboard Packaging Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Paper and Paperboard Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States Paper and Paperboard Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada Paper and Paperboard Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico Paper and Paperboard Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Paper and Paperboard Packaging Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 17: Global Paper and Paperboard Packaging Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global Paper and Paperboard Packaging Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Paper and Paperboard Packaging Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global Paper and Paperboard Packaging Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global Paper and Paperboard Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Brazil Paper and Paperboard Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Argentina Paper and Paperboard Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America Paper and Paperboard Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Paper and Paperboard Packaging Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Global Paper and Paperboard Packaging Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global Paper and Paperboard Packaging Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global Paper and Paperboard Packaging Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global Paper and Paperboard Packaging Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global Paper and Paperboard Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: United Kingdom Paper and Paperboard Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Paper and Paperboard Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: France Paper and Paperboard Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Italy Paper and Paperboard Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Spain Paper and Paperboard Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Russia Paper and Paperboard Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Benelux Paper and Paperboard Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Nordics Paper and Paperboard Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Paper and Paperboard Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global Paper and Paperboard Packaging Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 41: Global Paper and Paperboard Packaging Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global Paper and Paperboard Packaging Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global Paper and Paperboard Packaging Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global Paper and Paperboard Packaging Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global Paper and Paperboard Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Turkey Paper and Paperboard Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Israel Paper and Paperboard Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: GCC Paper and Paperboard Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: North Africa Paper and Paperboard Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: South Africa Paper and Paperboard Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa Paper and Paperboard Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Global Paper and Paperboard Packaging Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 53: Global Paper and Paperboard Packaging Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global Paper and Paperboard Packaging Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global Paper and Paperboard Packaging Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global Paper and Paperboard Packaging Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global Paper and Paperboard Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 58: China Paper and Paperboard Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: India Paper and Paperboard Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Japan Paper and Paperboard Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: South Korea Paper and Paperboard Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: ASEAN Paper and Paperboard Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 63: Oceania Paper and Paperboard Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific Paper and Paperboard Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Paper and Paperboard Packaging Industry?

The projected CAGR is approximately 4.68%.

2. Which companies are prominent players in the Paper and Paperboard Packaging Industry?

Key companies in the market include WestRock Company, Smurfit Kappa Group, Nippon Paper Industries Ltd, DS Smith PLC, Mondi Group, International Paper Company, Eastern Pak Limited, Packaging Corporation of America, Sonoco Products Company*List Not Exhaustive, Cascades Inc.

3. What are the main segments of the Paper and Paperboard Packaging Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 398.65 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from the Food and Beverage Sector; Regulations on Plastic-based Packaging Products Contribute to Higher Demand; Increasing Growth of E-commerce Creates Demand for Various Paper and Paperboard Packaging Types.

6. What are the notable trends driving market growth?

Increase in Demand from the Food and Beverage Sector.

7. Are there any restraints impacting market growth?

Concerns Regarding the Environment and Recycling.

8. Can you provide examples of recent developments in the market?

December 2022: WestRock Company announced it successfully acquired Grupo Gondi's remaining interest for USD 970 million plus debt assumption. The Grupo Gondi acquisition includes four paper mills, nine corrugated packaging facilities, and six high graphic facilities throughout Mexico. These facilities produce sustainable packaging for a variety of regional end markets. The company's dominant position in the expanding corrugated packaging, consumer goods, paperboard, and containerboard markets in Latin America will be strengthened by this acquisition.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Paper and Paperboard Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Paper and Paperboard Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Paper and Paperboard Packaging Industry?

To stay informed about further developments, trends, and reports in the Paper and Paperboard Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence