Key Insights

The Asia Pacific Plastic Packaging Market is projected for substantial growth, reaching an estimated market size of 111.6 billion by 2025. This expansion is driven by a Compound Annual Growth Rate (CAGR) of 3.6% from the base year 2025 through 2033. Key growth drivers include a rising middle class, increasing urbanization, and escalating demand for packaged goods across diverse sectors, particularly food and beverages. Innovations in flexible and rigid plastic packaging, including pouches, films & wraps, and bottles & jars, are enhancing product shelf-life, safety, and convenience. The market is also witnessing a growing adoption of sustainable materials like Bi-orientated Polypropylene (BOPP) and Polyethylene Terephthalate (PET), influenced by environmental consciousness and regulatory mandates.

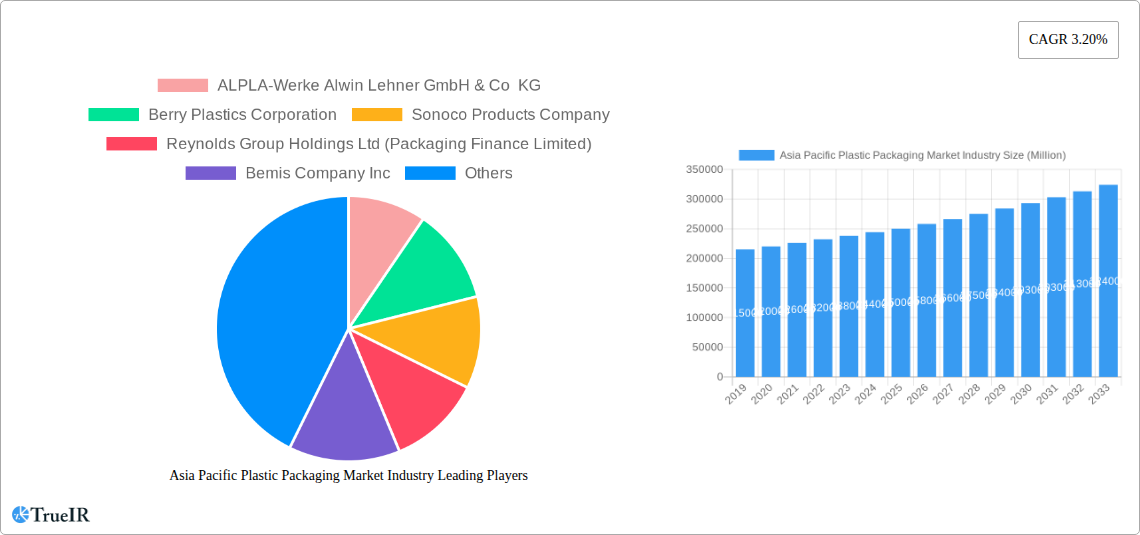

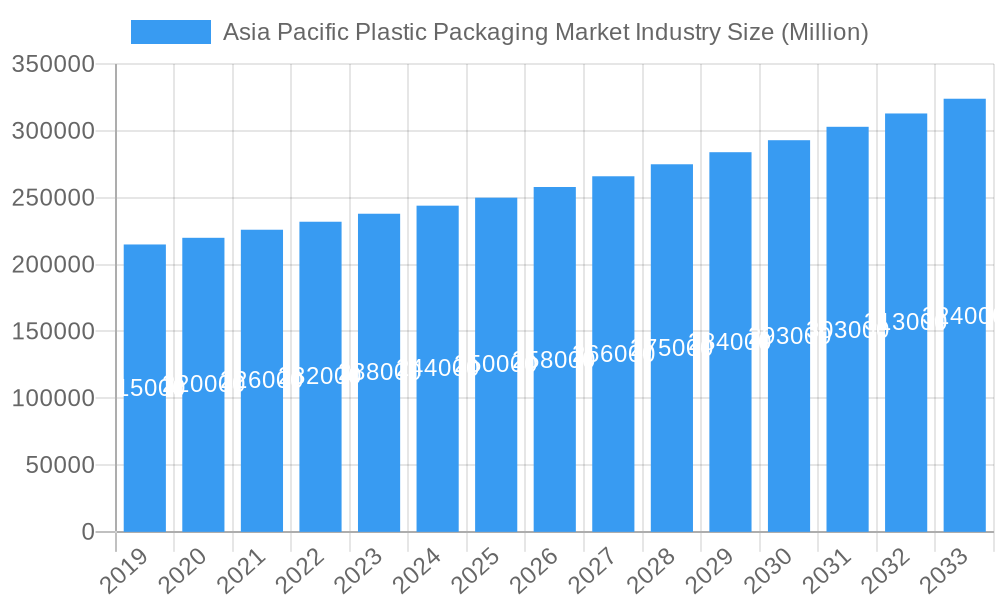

Asia Pacific Plastic Packaging Market Industry Market Size (In Billion)

Challenges such as rising raw material costs and regulations on single-use plastics are prompting a strategic shift towards reusable and recyclable packaging solutions. The competitive landscape features major global and regional manufacturers actively investing in R&D for innovative, sustainable packaging. The growth of e-commerce further bolsters demand for robust plastic packaging for logistics. As the Asia Pacific region continues its economic development, the plastic packaging market will focus on balancing growth with sustainability and evolving regulatory requirements.

Asia Pacific Plastic Packaging Market Industry Company Market Share

Asia Pacific Plastic Packaging Market Industry Report: Dynamic Analysis & Growth Projections (2019-2033)

This comprehensive industry report provides an in-depth analysis of the Asia Pacific Plastic Packaging Market Industry, offering strategic insights and data-driven forecasts from 2019 to 2033. Explore the market's structure, key trends, dominant segments, and competitive landscape, with a focus on growth drivers, challenges, and future outlook. Leverage high-volume keywords like "Asia Pacific plastic packaging," "flexible packaging Asia," "rigid packaging market," "PET packaging," "food packaging solutions," and "beverage packaging trends" to enhance search visibility.

Asia Pacific Plastic Packaging Market Industry Market Structure & Competitive Landscape

The Asia Pacific plastic packaging market exhibits a moderately consolidated structure, characterized by a mix of large multinational corporations and a substantial number of regional and local players. Innovation drivers are primarily fueled by the increasing demand for sustainable packaging solutions, advancements in material science, and the pursuit of enhanced functionality and aesthetics. Regulatory impacts, particularly concerning environmental sustainability and plastic waste reduction, are significant forces shaping market entry and product development strategies. Product substitutes, such as paper-based packaging and glass, present competition, especially in specific end-user segments and regions with stringent environmental policies. End-user segmentation reveals a strong reliance on the food and beverage industries, followed by healthcare and cosmetics. Merger and acquisition (M&A) trends are evident, with companies strategically acquiring capabilities and market share to expand their product portfolios and geographical reach. For instance, the acquisition of Hitesh Plastics by Manjushree Technopack signifies a consolidation trend aimed at strengthening specific market segments. The market's competitive landscape is dynamic, with key players investing in R&D, capacity expansion, and sustainable practices to maintain and enhance their market positions. Concentration ratios are influenced by the presence of major players like Amcor Limited, Berry Plastics Corporation, and Sonoco Products Company, who collectively hold a significant portion of the market share.

Asia Pacific Plastic Packaging Market Industry Market Trends & Opportunities

The Asia Pacific plastic packaging market is poised for robust growth, driven by burgeoning economic development, increasing disposable incomes, and a rapidly expanding middle-class population across key economies. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.5% from the base year of 2025 through to 2033, indicating sustained expansion. Technological shifts are a major trend, with a significant emphasis on the development and adoption of advanced materials such as bioplastics and recyclable polymers. The evolution of flexible plastic packaging, particularly pouches and films, is a key area of innovation, offering improved barrier properties, extended shelf life, and enhanced convenience for consumers. Rigid plastic packaging, including bottles, jars, and containers, also continues to evolve with a focus on lightweighting and design optimization. Consumer preferences are increasingly leaning towards sustainable, convenient, and aesthetically appealing packaging solutions. This shift is creating significant opportunities for manufacturers that can offer eco-friendly alternatives, such as recycled content packaging and biodegradable options. The rising awareness surrounding environmental issues is propelling the demand for plastic packaging that is easily recyclable or compostable, driving investment in circular economy initiatives. The growing e-commerce sector is another significant catalyst, demanding robust and protective packaging solutions that can withstand the rigors of transportation. Furthermore, the expanding food and beverage industry, particularly the demand for processed and ready-to-eat meals, directly fuels the need for sophisticated plastic packaging. The healthcare sector's requirement for sterile, safe, and tamper-evident packaging further contributes to market growth. The cosmetics and personal care industries are also driving innovation with a focus on premium and sustainable packaging designs. The competitive dynamics are intensifying, with companies vying for market share through product differentiation, strategic partnerships, and investment in sustainable manufacturing processes. Opportunities lie in exploring untapped rural markets, developing customized packaging solutions for niche applications, and embracing digital technologies for enhanced supply chain management and customer engagement. The market penetration rate for plastic packaging remains high, but there is a clear trend towards higher-value, specialized packaging solutions.

Dominant Markets & Segments in Asia Pacific Plastic Packaging Market Industry

The Asia Pacific plastic packaging market is characterized by a dynamic interplay of dominant regions and segments. Among the types, Flexible Plastic Packaging is projected to maintain its leading position throughout the forecast period, driven by its versatility, cost-effectiveness, and suitability for a wide range of applications, particularly in food and beverage packaging. The demand for convenience and portability in consumer goods further bolsters the growth of flexible options like pouches and bags.

Within materials, Polyethylene (PE) and Polyethylene Terephthalate (PET) are the most dominant.

- Polyethylene (PE): Its widespread use in films, bags, and containers, coupled with its cost-effectiveness and excellent barrier properties, makes it a cornerstone material. The growing demand in the food and beverage, healthcare, and consumer goods sectors fuels its dominance.

- Polyethylene Terephthalate (PET): This material is particularly prominent in the production of bottles and jars for beverages, food, and personal care products due to its clarity, strength, and recyclability. The beverage industry's significant reliance on PET bottles for water, soft drinks, and juices is a key growth driver.

In terms of products, Bottles and Jars and Pouches are leading the market.

- Bottles and Jars: Dominated by PET and PE, these are essential for the beverage, food, and personal care industries, benefiting from the rise of packaged goods and the demand for single-serve options.

- Pouches: A key component of flexible packaging, pouches, including stand-up pouches and retort pouches, are experiencing rapid growth due to their convenience, shelf-life extension capabilities, and suitability for a wide array of food products.

The Food and Beverage end-user industries are the most significant contributors to the market's volume and value.

- Food Industry: This segment benefits from the increasing demand for packaged convenience foods, frozen foods, dairy products, and snacks. The need for enhanced food safety, extended shelf life, and attractive presentation drives the adoption of various plastic packaging formats.

- Beverage Industry: As a primary consumer of PET bottles and various flexible packaging solutions, this sector's growth is intrinsically linked to the plastic packaging market. The demand for bottled water, juices, and other beverages continues to surge across the region.

Key growth drivers for these dominant segments include:

- Rising Disposable Incomes and Urbanization: Leading to increased consumption of packaged goods.

- Growth of E-commerce: Driving demand for protective and convenient packaging.

- Government Initiatives and Policies: Supporting the growth of domestic manufacturing and export of packaged goods.

- Technological Advancements: Leading to lighter, stronger, and more sustainable packaging materials.

- Demand for Convenience and Extended Shelf Life: Particularly in the food and beverage sectors.

- Focus on Food Safety and Hygiene: Elevating the importance of high-quality packaging solutions.

The dominance of these segments is underpinned by extensive infrastructure, favorable government policies promoting manufacturing, and a large consumer base actively seeking packaged products. The widespread adoption of technologies enabling efficient production of PE, PET, and flexible packaging formats further solidifies their market leadership.

Asia Pacific Plastic Packaging Market Industry Product Analysis

Product innovation in the Asia Pacific plastic packaging market centers on enhancing sustainability, functionality, and consumer appeal. Advancements in bioplastics and the incorporation of recycled content are prominent, addressing environmental concerns. Innovations in barrier properties for flexible packaging extend product shelf life, while lightweighting in rigid packaging reduces material usage and transportation costs. The development of advanced multilayer films and specialized coatings caters to the unique needs of industries like healthcare and food. Competitive advantages are gained through superior product design, cost-efficiency, and compliance with stringent international quality and safety standards.

Key Drivers, Barriers & Challenges in Asia Pacific Plastic Packaging Market Industry

Key Drivers: The Asia Pacific plastic packaging market is propelled by a confluence of powerful forces. Economically, rising disposable incomes and a burgeoning middle class are driving increased consumer spending on packaged goods, particularly in food, beverages, and personal care. Technologically, advancements in material science are yielding more sustainable, durable, and functional packaging solutions, including lightweight plastics and improved recycling technologies. Government initiatives and supportive policies in many Asian countries aim to bolster manufacturing sectors and promote the adoption of advanced packaging, creating a favorable business environment. The expanding e-commerce sector also demands robust and efficient packaging, further fueling market growth.

Barriers & Challenges: Despite its growth trajectory, the market faces significant challenges. Regulatory hurdles, particularly concerning plastic waste management and single-use plastic bans in certain countries, can impact market expansion and necessitate significant adaptation. Supply chain disruptions, influenced by geopolitical factors and raw material price volatility, pose a constant threat to cost stability and production efficiency. Intense competitive pressures from both global players and a vast number of local manufacturers can lead to price wars and squeezed profit margins. Furthermore, negative consumer perceptions regarding plastic pollution and the ongoing push for alternative materials require continuous innovation and robust communication strategies to maintain market share.

Growth Drivers in the Asia Pacific Plastic Packaging Market Industry Market

The Asia Pacific plastic packaging market's growth is primarily fueled by several key drivers. Economic expansion across the region, characterized by increasing per capita income and urbanization, significantly boosts consumer demand for packaged goods. Technological advancements in polymer science are leading to the development of innovative, high-performance, and increasingly sustainable packaging materials. Favorable government policies in several key markets, including incentives for local manufacturing and investment in infrastructure, further support market expansion. The burgeoning e-commerce industry necessitates efficient and protective packaging, creating sustained demand for a variety of plastic packaging formats.

Challenges Impacting Asia Pacific Plastic Packaging Market Industry Growth

Several challenges impact the growth of the Asia Pacific plastic packaging market. Increasing global scrutiny and stricter regulations surrounding plastic waste and its environmental impact are creating significant pressure. Supply chain volatility, influenced by raw material availability and fluctuating global prices, can disrupt production and impact profitability. Intense competition from a fragmented market, including numerous local manufacturers, can lead to price erosion. Moreover, evolving consumer preferences towards environmentally friendly alternatives and growing awareness of plastic pollution necessitate continuous innovation and a proactive approach to sustainability.

Key Players Shaping the Asia Pacific Plastic Packaging Market Industry Market

- ALPLA-Werke Alwin Lehner GmbH & Co KG

- Berry Plastics Corporation

- Sonoco Products Company

- Reynolds Group Holdings Ltd (Packaging Finance Limited)

- Bemis Company Inc

- DS Smith PLC

- Mondi Group

- Consolidated Container Compan

- NatureWorks LLC

- Amcor Limited

Significant Asia Pacific Plastic Packaging Market Industry Industry Milestones

- August 2022: Manjushree Technopack's acquisition of Hitesh Plastics' business operations and manufacturing facilities. This strategic move aimed to bolster its caps and closures market and strengthen its rigid plastic packaging business, catering to diverse FMCG, F&B, home care, personal care, agrochemicals, pharmaceutical, and liquor industries. With a manufacturing capacity of 1,90,000 MT per annum and an annual turnover of USD 250 million, Manjushree cemented its position as a prominent rigid plastics packaging company in India.

- June 2022: Coca-Cola India's announcement of its commitment to achieve 100% recovery and recycling of post-consumer packaging, primarily bottles, within the next two to three years. This initiative aligns with the company's global "World Without Waste" campaign, aiming to collect and recycle every bottle sold by 2030. This development highlights the growing industry focus on recyclability and sustainability, particularly within the rigid plastic packaging segment.

Future Outlook for Asia Pacific Plastic Packaging Market Industry Market

The future outlook for the Asia Pacific plastic packaging market remains exceptionally positive, driven by persistent demand from key end-user industries and ongoing technological advancements. Strategic opportunities lie in the continued development of innovative, sustainable packaging solutions, including advanced bioplastics, compostable materials, and enhanced recycling technologies. The growing emphasis on the circular economy will necessitate further investment in collection, sorting, and reprocessing infrastructure. Market players that can effectively navigate the evolving regulatory landscape, embrace digital transformation for supply chain optimization, and cater to the increasing consumer demand for eco-friendly packaging will be well-positioned for sustained growth and market leadership in the coming years. The overall market is expected to see continued expansion, with a strong focus on environmentally conscious product development and production.

Asia Pacific Plastic Packaging Market Industry Segmentation

-

1. Type

- 1.1. Rigid Plastic Packaging

- 1.2. Flexible Plastic Packaging

-

2. Material

- 2.1. Bi-orientated Polypropylene (BOPP)

- 2.2. Cast polypropylene (CPP)

- 2.3. Ethylene Vinyl Alcohol (EVOH)

- 2.4. Polyethylene (PE)

- 2.5. Polyethylene Terephthalate (PET)

- 2.6. Polypropylene (PP)

- 2.7. Polystyrene (PS) and Expanded Polystyrene (EPS)

- 2.8. Polyvinyl Chloride (PVC)

- 2.9. Other Materials

-

3. Product

- 3.1. Bottles and Jars

- 3.2. Trays and containers

- 3.3. Pouches

- 3.4. Bags

- 3.5. Films & Wraps

- 3.6. Other Products

-

4. End-user Industry

- 4.1. Food

- 4.2. Beverage

- 4.3. Healthcare

- 4.4. Cosmetics and Personal Care

- 4.5. Other End-user Industries

Asia Pacific Plastic Packaging Market Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Plastic Packaging Market Industry Regional Market Share

Geographic Coverage of Asia Pacific Plastic Packaging Market Industry

Asia Pacific Plastic Packaging Market Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Cost-Effectiveness & Increased Shelf-Life Of The Product; Downsizing Of Packaging

- 3.3. Market Restrains

- 3.3.1. Stringent Environmental Regulations

- 3.4. Market Trends

- 3.4.1. Cost-effectiveness & increased shelf-life of the product to drive the growth of the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Plastic Packaging Market Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Rigid Plastic Packaging

- 5.1.2. Flexible Plastic Packaging

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Bi-orientated Polypropylene (BOPP)

- 5.2.2. Cast polypropylene (CPP)

- 5.2.3. Ethylene Vinyl Alcohol (EVOH)

- 5.2.4. Polyethylene (PE)

- 5.2.5. Polyethylene Terephthalate (PET)

- 5.2.6. Polypropylene (PP)

- 5.2.7. Polystyrene (PS) and Expanded Polystyrene (EPS)

- 5.2.8. Polyvinyl Chloride (PVC)

- 5.2.9. Other Materials

- 5.3. Market Analysis, Insights and Forecast - by Product

- 5.3.1. Bottles and Jars

- 5.3.2. Trays and containers

- 5.3.3. Pouches

- 5.3.4. Bags

- 5.3.5. Films & Wraps

- 5.3.6. Other Products

- 5.4. Market Analysis, Insights and Forecast - by End-user Industry

- 5.4.1. Food

- 5.4.2. Beverage

- 5.4.3. Healthcare

- 5.4.4. Cosmetics and Personal Care

- 5.4.5. Other End-user Industries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ALPLA-Werke Alwin Lehner GmbH & Co KG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Berry Plastics Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sonoco Products Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Reynolds Group Holdings Ltd (Packaging Finance Limited)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bemis Company Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DS Smith PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mondi Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Consolidated Container Compan

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 NatureWorks LLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Amcor Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ALPLA-Werke Alwin Lehner GmbH & Co KG

List of Figures

- Figure 1: Asia Pacific Plastic Packaging Market Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Plastic Packaging Market Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Plastic Packaging Market Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Asia Pacific Plastic Packaging Market Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 3: Asia Pacific Plastic Packaging Market Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 4: Asia Pacific Plastic Packaging Market Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 5: Asia Pacific Plastic Packaging Market Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia Pacific Plastic Packaging Market Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 7: Asia Pacific Plastic Packaging Market Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 8: Asia Pacific Plastic Packaging Market Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 9: Asia Pacific Plastic Packaging Market Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 10: Asia Pacific Plastic Packaging Market Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: China Asia Pacific Plastic Packaging Market Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Japan Asia Pacific Plastic Packaging Market Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: South Korea Asia Pacific Plastic Packaging Market Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: India Asia Pacific Plastic Packaging Market Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Australia Asia Pacific Plastic Packaging Market Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: New Zealand Asia Pacific Plastic Packaging Market Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Indonesia Asia Pacific Plastic Packaging Market Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Malaysia Asia Pacific Plastic Packaging Market Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Singapore Asia Pacific Plastic Packaging Market Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Thailand Asia Pacific Plastic Packaging Market Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Vietnam Asia Pacific Plastic Packaging Market Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Philippines Asia Pacific Plastic Packaging Market Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Plastic Packaging Market Industry?

The projected CAGR is approximately 3.6%.

2. Which companies are prominent players in the Asia Pacific Plastic Packaging Market Industry?

Key companies in the market include ALPLA-Werke Alwin Lehner GmbH & Co KG, Berry Plastics Corporation, Sonoco Products Company, Reynolds Group Holdings Ltd (Packaging Finance Limited), Bemis Company Inc, DS Smith PLC, Mondi Group, Consolidated Container Compan, NatureWorks LLC, Amcor Limited.

3. What are the main segments of the Asia Pacific Plastic Packaging Market Industry?

The market segments include Type, Material, Product, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 111.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Cost-Effectiveness & Increased Shelf-Life Of The Product; Downsizing Of Packaging.

6. What are the notable trends driving market growth?

Cost-effectiveness & increased shelf-life of the product to drive the growth of the market.

7. Are there any restraints impacting market growth?

Stringent Environmental Regulations.

8. Can you provide examples of recent developments in the market?

August 2022: Manjushree Technopack entered an agreement to acquire the business operations and manufacturing facilities of Hitesh Plastics. The acquisition will enhance the company's caps and closures market and strengthen its rigid plastic packaging business. Manjushree caters to packaging requirements across FMCG, F&B, home care, personal care, agrochemicals, pharmaceutical, and liquor industries. With its current manufacturing capacity of 1,90,000 MT per annum and an annual turnover of USD 250 million, Manjushree is one of India's prominent rigid plastics packaging companies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Plastic Packaging Market Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Plastic Packaging Market Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Plastic Packaging Market Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Plastic Packaging Market Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence