Key Insights

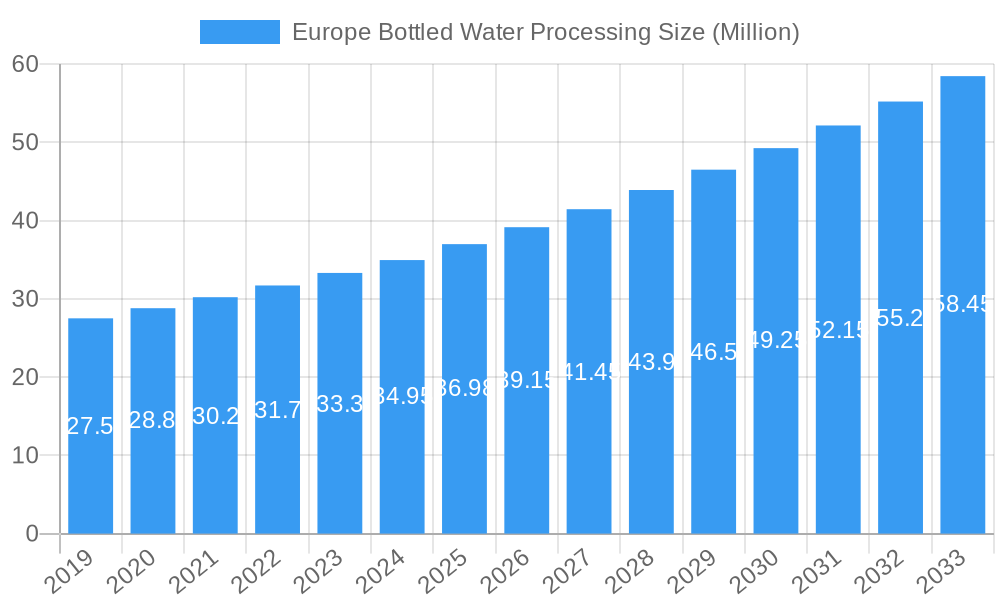

The Europe bottled water processing market is poised for significant expansion, projected to reach a substantial 36.98 million value unit by 2025. This growth trajectory is underpinned by a robust Compound Annual Growth Rate (CAGR) of 5.42%, indicating sustained demand and investment within the sector. Key drivers fueling this upward trend include escalating consumer preference for convenient and healthy beverage options, a rising global population, and increasing disposable incomes across European nations. Furthermore, advancements in processing technologies, such as sophisticated filtration methods like Reverse Osmosis (RO) and Microfiltration (MF), alongside efficient bottling and capping solutions, are enhancing product quality, safety, and shelf-life, thereby stimulating market demand. The demand for still water continues to dominate, but a notable surge is observed in sparkling and flavored water segments, reflecting evolving consumer tastes and a desire for premium and varied hydration experiences. Leading companies like Nestlé SA, PepsiCo Inc., and The Coca-Cola Company are actively investing in innovative solutions and expanding their production capacities to cater to this dynamic market.

Europe Bottled Water Processing Market Size (In Million)

The market's positive outlook is further bolstered by the strategic importance of Europe as a developed region with a mature consumer base and stringent quality standards. Countries like the United Kingdom, Germany, France, and Italy are expected to remain key contributors to market revenue. While market growth is generally strong, potential restraints such as increasing environmental concerns regarding plastic waste from bottled water packaging and evolving regulatory landscapes could influence future market dynamics. Innovations in sustainable packaging and a greater emphasis on recycled materials are becoming crucial differentiating factors for market players. The competitive landscape is characterized by the presence of both multinational corporations and specialized equipment manufacturers, each vying for market share through product innovation, strategic partnerships, and geographical expansion. The forecast period of 2025-2033 anticipates a continuous upward trend, driven by ongoing technological advancements and a persistent consumer shift towards bottled water as a reliable and accessible source of hydration.

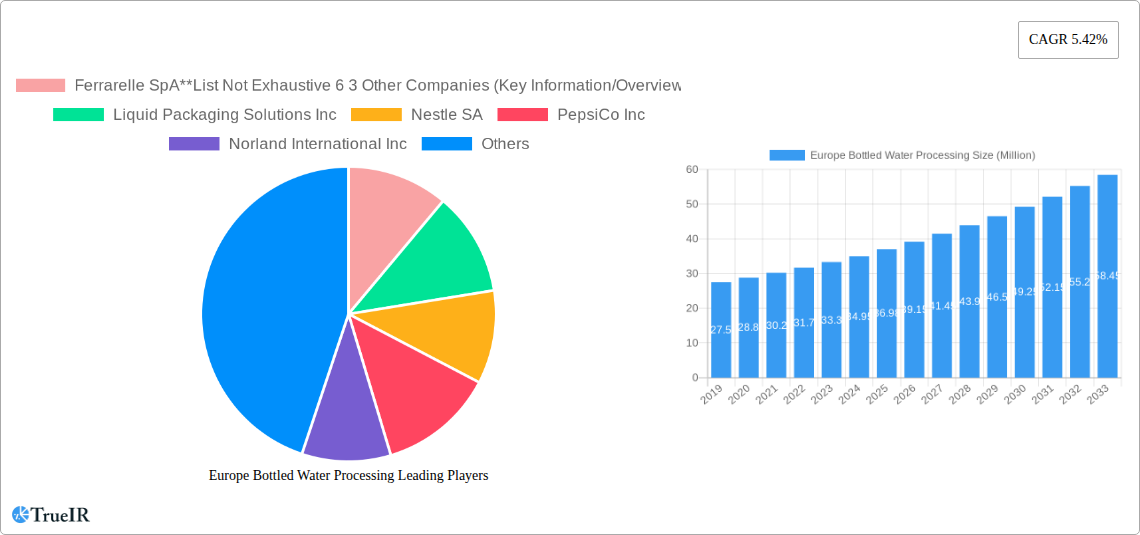

Europe Bottled Water Processing Company Market Share

Europe Bottled Water Processing Market: Comprehensive Analysis and Future Outlook (2019-2033)

This report provides an in-depth analysis of the Europe Bottled Water Processing market, covering market structure, competitive landscape, trends, opportunities, dominant segments, product innovations, key drivers, challenges, and future outlook. Leveraging high-volume keywords such as "bottled water machinery," "water purification technology," "beverage processing equipment," and "European beverage market," this SEO-optimized report targets industry professionals, investors, and decision-makers seeking actionable insights. The study period spans from 2019 to 2033, with a base year of 2025.

Europe Bottled Water Processing Market Structure & Competitive Landscape

The Europe Bottled Water Processing market exhibits a moderate to high concentration, with several global giants alongside regional specialists. Innovation drivers are primarily focused on enhanced water quality, energy efficiency in processing, and sustainable packaging solutions. Regulatory impacts are significant, with stringent European Union directives on food safety and water standards shaping operational requirements and investment in advanced processing technologies. Product substitutes, while present in the broader beverage sector, remain limited for pure bottled water due to its perceived health benefits and natural sourcing. End-user segmentation reveals a strong demand for still water, followed by sparkling and flavored variants, influencing the type of processing equipment and technologies employed. Merger and acquisition (M&A) trends are indicative of market consolidation and strategic expansion. Over the historical period (2019-2024), a reported volume of $100 million in M&A activities has been observed, signaling a drive for enhanced market share and technological integration. The competitive landscape is characterized by continuous product development and strategic alliances aimed at capturing a larger share of this multi-billion Euro market.

Europe Bottled Water Processing Market Trends & Opportunities

The Europe Bottled Water Processing market is poised for substantial growth, projected to reach a market size of $15 Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 5.2% during the forecast period (2025-2033). This growth is fueled by evolving consumer preferences that increasingly favor healthier hydration options over sugary beverages. The demand for premium, naturally sourced, and functional bottled waters is on the rise, creating opportunities for processors to invest in advanced filtration and purification technologies such as Reverse Osmosis (RO) and advanced Microfiltration (MF). Technological shifts are evident in the adoption of smart manufacturing solutions, automation, and energy-efficient equipment, leading to optimized operational costs and reduced environmental impact. Opportunities also lie in the development of innovative packaging solutions, including recyclable materials and lightweight designs, catering to growing environmental consciousness among consumers. The competitive dynamics are intensifying, with companies focusing on brand differentiation through unique water sources, specialized processing techniques, and targeted marketing campaigns. Market penetration rates for bottled water remain high across key European nations, with significant potential for further penetration in emerging markets within the region. The increasing popularity of flavored and functional waters presents a lucrative avenue for processors to diversify their product portfolios and capture a larger market share. The market is also witnessing a growing interest in plant-based water alternatives, though traditional bottled water processing remains dominant. The overall market opportunity is estimated to be worth $12 Billion for the forecast period, driven by increasing per capita consumption and a growing emphasis on health and wellness.

Dominant Markets & Segments in Europe Bottled Water Processing

The European Bottled Water Processing market is dominated by a few key regions and segments, driven by a confluence of infrastructure, policies, and consumer demand.

Leading Region: Western Europe, particularly countries like Germany, France, the UK, and Italy, consistently holds the largest market share due to established economies, high disposable incomes, and a deeply ingrained consumer culture of bottled water consumption. The infrastructure for bottled water production and distribution is highly developed in these nations.

Dominant Equipment Types:

- Filler and Capper: This segment is crucial for high-volume production and maintains a dominant position. The demand for efficient, high-speed filling and capping machines is constant across all bottled water categories.

- Filter: With increasing scrutiny on water purity, advanced filtration systems, including Reverse Osmosis (RO) and Microfiltration (MF), are experiencing significant growth. Investment in these technologies is a key differentiator for processors aiming to meet stringent quality standards and consumer expectations.

- Blow Molder: Essential for the in-house production of plastic bottles, blow molders are vital for cost-efficiency and flexibility in packaging, especially for large-scale producers.

Dominant Technologies:

- Reverse Osmosis (RO): Widely adopted for its effectiveness in removing impurities, minerals, and contaminants, RO is a cornerstone technology for producing pure and safe bottled water.

- Microfiltration (MF): Increasingly employed for its ability to remove finer particles and microorganisms, MF technologies are vital for ensuring water quality and shelf life, often used in conjunction with other purification methods.

Dominant Applications:

- Still Water: This segment continues to be the largest by volume and value, reflecting its universal appeal as a healthy and accessible beverage.

- Sparkling Water: The demand for sparkling water is on a robust upward trajectory, driven by consumer trends favoring refreshing beverages and an increasing preference for naturally carbonated options. This has led to investments in specialized carbonation and bottling equipment.

- Flavoured Water: This segment represents a significant growth opportunity, driven by innovation in natural flavorings and functional ingredients. Processors are investing in versatile filling and blending equipment to cater to this demand.

Key growth drivers include robust economic growth in established European markets, supportive government policies promoting public health and safe drinking water, and continuous innovation in processing technologies that enhance efficiency and product quality. The market penetration for still water is estimated at over 80% in developed European countries, while sparkling and flavored water segments show a CAGR of approximately 6% and 7% respectively.

Europe Bottled Water Processing Product Analysis

Product innovations in the Europe Bottled Water Processing market are primarily driven by the pursuit of enhanced water quality, extended shelf life, and improved sustainability. Processors are increasingly adopting advanced filtration technologies like nano-filtration and ultra-filtration alongside traditional Reverse Osmosis (RO) to achieve higher purity levels and remove a broader spectrum of contaminants. Innovations in bottle washing technologies focus on energy efficiency and reduced water consumption. The development of intelligent filling and capping systems with integrated quality control mechanisms ensures product integrity and reduces waste. Competitive advantages are being carved out through the adoption of energy-efficient blow molding machines and the integration of smart sensors for real-time process monitoring.

Key Drivers, Barriers & Challenges in Europe Bottled Water Processing

Key Drivers:

The Europe Bottled Water Processing market is propelled by several key drivers, including increasing consumer awareness regarding the health benefits of pure water, a growing preference for convenient and portable hydration solutions, and a rising demand for premium and functional bottled water variants. Technological advancements in water purification and processing equipment are also significant contributors, leading to improved efficiency and product quality. Favorable regulatory frameworks promoting safe drinking water standards further bolster market growth.

Barriers & Challenges:

Key challenges impacting the Europe Bottled Water Processing market include intense competition from tap water infrastructure in some regions and the significant capital investment required for state-of-the-art processing facilities. Fluctuations in raw material costs, particularly for PET resin used in bottle manufacturing, can impact profitability. Stringent environmental regulations concerning plastic waste and recycling place pressure on processors to adopt sustainable packaging solutions. Furthermore, supply chain disruptions, as experienced in recent years, can affect the availability of critical components and finished goods. The market faces a challenge in educating consumers about the quality and safety of bottled water compared to other beverage options, with a reported decline of 5% in the adoption of single-use plastic bottles in some markets due to environmental concerns.

Growth Drivers in the Europe Bottled Water Processing Market

The growth drivers in the Europe Bottled Water Processing market are multifaceted, stemming from evolving consumer health consciousness and a demand for convenient, high-quality hydration. Technologically, the adoption of advanced purification systems like Reverse Osmosis (RO) and Microfiltration (MF) is a significant driver, ensuring superior water quality. Economically, rising disposable incomes in key European nations support the purchase of premium bottled water products. Regulatory support for safe drinking water standards also plays a crucial role. The increasing popularity of flavored and functional waters, driven by consumer desire for added benefits and taste variety, is creating new market avenues and stimulating innovation in processing and bottling technologies.

Challenges Impacting Europe Bottled Water Processing Growth

Several challenges significantly impact the growth of the Europe Bottled Water Processing market. Regulatory complexities surrounding water sourcing, treatment, and packaging materials, particularly concerning single-use plastics and sustainability mandates, necessitate continuous adaptation and investment. Supply chain issues, including the availability and cost of raw materials like PET resin and energy, can lead to increased operational expenses. Intense competitive pressures from established brands and the proliferation of private-label offerings require processors to focus on differentiation and cost-efficiency. Furthermore, negative perceptions related to environmental impact and the availability of potable tap water in certain regions pose ongoing challenges to market expansion. The cost of advanced processing equipment is also a barrier for smaller players, limiting their ability to scale.

Key Players Shaping the Europe Bottled Water Processing Market

- Ferrarelle SpA

- Liquid Packaging Solutions Inc

- Nestle SA

- PepsiCo Inc

- Norland International Inc

- Dow Chemical Co

- Danone SA

- Pall Corporation

- The Coca-Cola Company

- Velocity Equipment Solutions Inc

Significant Europe Bottled Water Processing Industry Milestones

- October 2023: Kosovo-based food and drinks manufacturer Uje Rugove invested EUR 6 million (USD 6.3 million) in expanding water production in the country. This expansion highlights regional growth and investment in bottling capacity.

- August 2023: See (Sealed Air) entered into a Definitive Agreement to Acquire Liquibox. Liquibox is a leader in bag-in-box sustainable solutions. This acquisition is poised to significantly impact the flexible packaging sector for beverages, complementing SEE's Fluids and Liquids business, which has an estimated market opportunity of USD 7 billion with an attractive annual growth rate (ARR) of approximately 6%.

Future Outlook for Europe Bottled Water Processing Market

The future outlook for the Europe Bottled Water Processing market is overwhelmingly positive, driven by sustained consumer demand for healthy and convenient hydration. Strategic opportunities lie in expanding product portfolios to include a wider range of functional and enhanced waters, catering to specific health and wellness trends. Investment in sustainable packaging solutions, such as recycled PET and alternative materials, will be crucial for long-term market success and regulatory compliance. The integration of Industry 4.0 technologies, including automation and data analytics, will further enhance operational efficiency and traceability. Emerging markets within Europe and the ongoing shift towards premiumization present significant growth catalysts, promising continued expansion and innovation in the bottled water processing sector. The market is projected to witness a steady increase in the adoption of advanced water treatment technologies, ensuring the highest standards of purity and safety.

Europe Bottled Water Processing Segmentation

-

1. Equipment Type

- 1.1. Filter

- 1.2. Bottle Washer

- 1.3. Filler and Capper

- 1.4. Blow Molder

- 1.5. Other Equipment Types

-

2. Technology

- 2.1. Reverse Osmosis (RO)

- 2.2. Microfiltration (MF)

- 2.3. Chlorination

- 2.4. Other Technologies

-

3. Application

- 3.1. Still Water

- 3.2. Sparkling Water

- 3.3. Flavoured Water

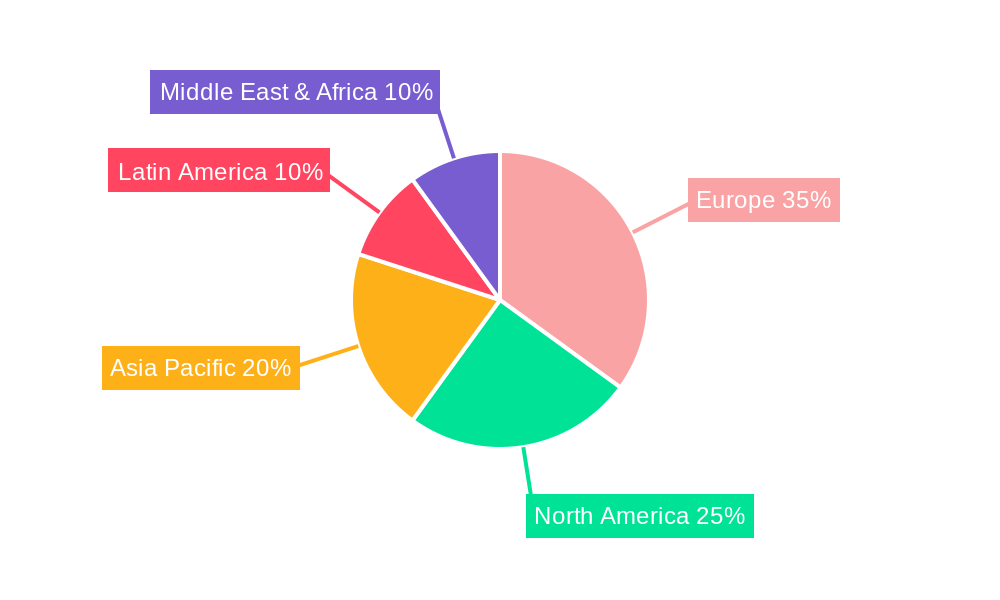

Europe Bottled Water Processing Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Bottled Water Processing Regional Market Share

Geographic Coverage of Europe Bottled Water Processing

Europe Bottled Water Processing REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing awareness among consumers4.; Environment concerns and sustainability

- 3.3. Market Restrains

- 3.3.1. 4.; The cost of production and transportation4.; Regulations and quality standards

- 3.4. Market Trends

- 3.4.1. Expanding sparkling water segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Bottled Water Processing Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 5.1.1. Filter

- 5.1.2. Bottle Washer

- 5.1.3. Filler and Capper

- 5.1.4. Blow Molder

- 5.1.5. Other Equipment Types

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Reverse Osmosis (RO)

- 5.2.2. Microfiltration (MF)

- 5.2.3. Chlorination

- 5.2.4. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Still Water

- 5.3.2. Sparkling Water

- 5.3.3. Flavoured Water

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ferrarelle SpA**List Not Exhaustive 6 3 Other Companies (Key Information/Overview

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Liquid Packaging Solutions Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nestle SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PepsiCo Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Norland International Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dow Chemical Co

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Danone SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Pall Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 The Coca-Cola Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Velocity Equipment Solutions Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ferrarelle SpA**List Not Exhaustive 6 3 Other Companies (Key Information/Overview

List of Figures

- Figure 1: Europe Bottled Water Processing Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Bottled Water Processing Share (%) by Company 2025

List of Tables

- Table 1: Europe Bottled Water Processing Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 2: Europe Bottled Water Processing Revenue Million Forecast, by Technology 2020 & 2033

- Table 3: Europe Bottled Water Processing Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Europe Bottled Water Processing Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Bottled Water Processing Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 6: Europe Bottled Water Processing Revenue Million Forecast, by Technology 2020 & 2033

- Table 7: Europe Bottled Water Processing Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Europe Bottled Water Processing Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Bottled Water Processing Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Bottled Water Processing Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Bottled Water Processing Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Bottled Water Processing Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Bottled Water Processing Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Bottled Water Processing Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Bottled Water Processing Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Bottled Water Processing Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Bottled Water Processing Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Bottled Water Processing Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Bottled Water Processing Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Bottled Water Processing?

The projected CAGR is approximately 5.42%.

2. Which companies are prominent players in the Europe Bottled Water Processing?

Key companies in the market include Ferrarelle SpA**List Not Exhaustive 6 3 Other Companies (Key Information/Overview, Liquid Packaging Solutions Inc, Nestle SA, PepsiCo Inc, Norland International Inc, Dow Chemical Co, Danone SA, Pall Corporation, The Coca-Cola Company, Velocity Equipment Solutions Inc.

3. What are the main segments of the Europe Bottled Water Processing?

The market segments include Equipment Type, Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 36.98 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing awareness among consumers4.; Environment concerns and sustainability.

6. What are the notable trends driving market growth?

Expanding sparkling water segment.

7. Are there any restraints impacting market growth?

4.; The cost of production and transportation4.; Regulations and quality standards.

8. Can you provide examples of recent developments in the market?

October 2023: Kosovo-based food and drinks manufacturer Uje Rugove was to invest EUR 6 million (USD 6.3 million) in expanding water production in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Bottled Water Processing," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Bottled Water Processing report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Bottled Water Processing?

To stay informed about further developments, trends, and reports in the Europe Bottled Water Processing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence