Key Insights

The global Primary Healthcare Packaging market is poised for significant growth, driven by increasing demand for secure and effective drug delivery and medical device containment. The market is projected to reach approximately $153.79 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 5.9% through 2033. Key growth drivers include the rising incidence of chronic diseases, an aging global population, and rapid advancements in pharmaceutical innovation, particularly in biopharmaceuticals and personalized medicine. Stringent regulatory mandates for pharmaceutical packaging, prioritizing patient safety and product integrity, are stimulating investment in advanced materials and innovative designs. The growing demand for sterile and tamper-evident packaging solutions across pharmaceutical and medical device sectors further bolsters market expansion. Emerging economies, with their developing healthcare infrastructure and escalating healthcare spending, offer substantial growth opportunities.

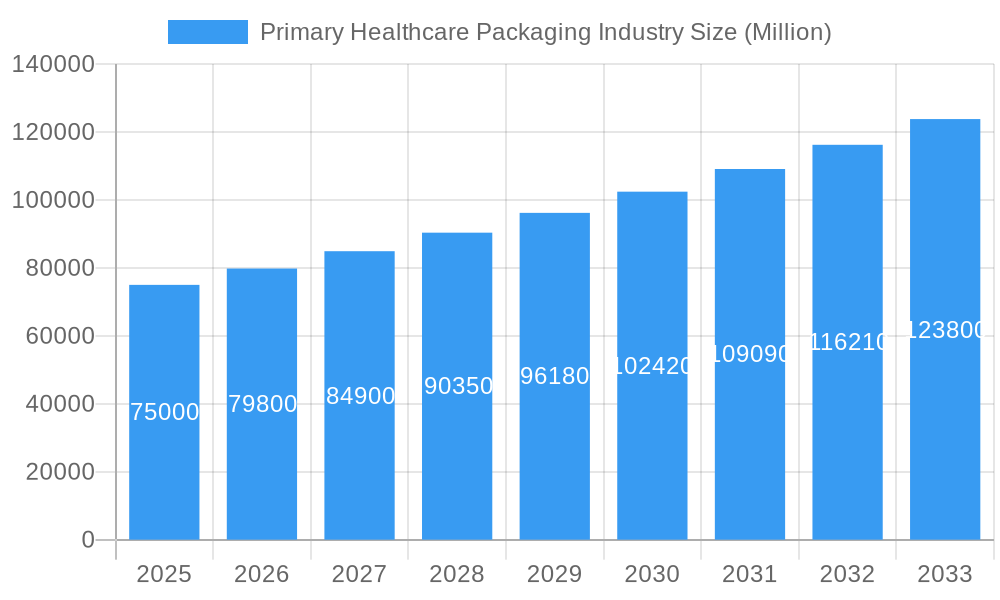

Primary Healthcare Packaging Industry Market Size (In Billion)

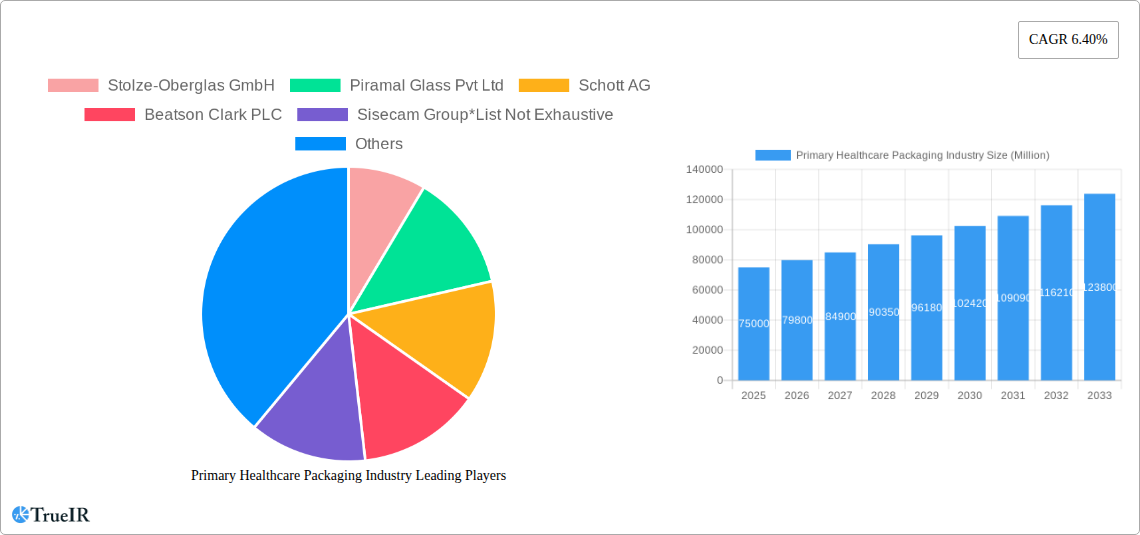

The market encompasses a diverse array of product types, including bottles and containers, vials and ampoules, cartridges and prefilled syringes, and pouches and bags, serving a broad spectrum of healthcare applications. Material innovation, especially in advanced polymers and specialized glass, is a significant trend, enhancing barrier properties, durability, and safety. Potential restraints include rising raw material costs and increasing production expenses, which may affect profit margins. Supply chain complexities and the requirement for specialized manufacturing infrastructure also present challenges. Nevertheless, the consistent demand for high-quality, dependable primary healthcare packaging solutions indicates a favorable market outlook. Leading companies such as Gerresheimer AG, Schott AG, and Piramal Glass Pvt Ltd are pioneering innovation and addressing the evolving requirements of the pharmaceutical and medical device industries.

Primary Healthcare Packaging Industry Company Market Share

Primary Healthcare Packaging Industry Market Analysis: Forecast to 2033 – Market Size, Trends, Opportunities, and Key Players

This comprehensive report provides an in-depth analysis of the global Primary Healthcare Packaging Industry, covering the historical period from 2019 to 2024 and projecting growth through 2033, with a base year of 2025 and an estimated year of 2025. Leveraging high-volume SEO keywords such as "healthcare packaging market size," "pharmaceutical packaging trends," "medical device packaging solutions," and "primary packaging industry growth," this report is meticulously designed for industry stakeholders seeking strategic insights, market intelligence, and competitive analysis. The report offers a deep dive into market dynamics, technological advancements, regulatory landscapes, and the competitive environment, crucial for navigating the evolving healthcare packaging sector.

Primary Healthcare Packaging Industry Market Structure & Competitive Landscape

The Primary Healthcare Packaging Industry is characterized by a moderately concentrated market structure, with a significant presence of both multinational corporations and specialized regional players. Innovation drivers are largely propelled by stringent regulatory requirements, the increasing demand for advanced drug delivery systems, and the growing emphasis on patient safety and product integrity. Regulatory impacts, such as evolving Good Manufacturing Practices (GMP) and serialization mandates, are shaping packaging design and material choices. Product substitutes, while present, often face limitations in meeting the critical performance standards required for pharmaceutical and medical applications. End-user segmentation reveals a dominant Pharmaceutical sector, followed closely by Medical Devices, each with distinct packaging needs. Mergers and acquisitions (M&A) trends are observed as key players seek to expand their product portfolios, geographic reach, and technological capabilities. The volume of M&A activities in the historical period (2019-2024) is estimated to be in the range of xx to xx million USD, indicating strategic consolidation efforts. Concentration ratios (CR4) for key product segments are estimated to be between 50-70%, highlighting the influence of major players.

- Innovation Drivers:

- Enhanced barrier properties for extended shelf-life.

- Development of sustainable and eco-friendly packaging materials.

- Advancements in tamper-evident and child-resistant closures.

- Integration of smart packaging technologies for track-and-trace capabilities.

- Regulatory Impacts:

- Stricter compliance with FDA, EMA, and other global regulatory bodies.

- Increased demand for sterile and aseptic packaging solutions.

- Serialization and track-and-trace requirements driving demand for specialized labels and primary containers.

- End-User Segmentation:

- Pharmaceuticals (e.g., generics, biologics, vaccines)

- Medical Devices (e.g., diagnostics, surgical instruments, implantables)

- M&A Trends:

- Acquisition of niche technology providers to enhance specialized offerings.

- Consolidation to achieve economies of scale and broader market access.

- Strategic partnerships for joint R&D and product development.

Primary Healthcare Packaging Industry Market Trends & Opportunities

The Primary Healthcare Packaging Industry is projected for robust growth over the forecast period (2025–2033), driven by escalating healthcare expenditure, an aging global population, and the continuous development of new pharmaceutical drugs and medical devices. The market size is estimated to grow at a Compound Annual Growth Rate (CAGR) of xx% from an estimated xx Billion USD in 2025 to reach over xx Billion USD by 2033. Technological shifts are transforming the industry, with a significant move towards advanced materials offering superior protection and sustainability. The rise of biologics and specialty drugs necessitates highly specialized primary packaging solutions, creating significant opportunities for innovation. Consumer preferences are increasingly leaning towards convenience, ease of use, and environmentally responsible packaging. This trend is influencing the development of pre-filled syringes, unit-dose packaging, and recyclable materials. Competitive dynamics are intensifying, with companies focusing on differentiating through specialized product offerings, superior quality, and robust supply chain management. The increasing prevalence of chronic diseases and the demand for home healthcare solutions are further fueling the need for safe, reliable, and user-friendly primary packaging. Market penetration rates for advanced packaging solutions are steadily increasing, particularly in developed economies, while emerging markets present substantial growth potential due to expanding healthcare infrastructure and rising disposable incomes.

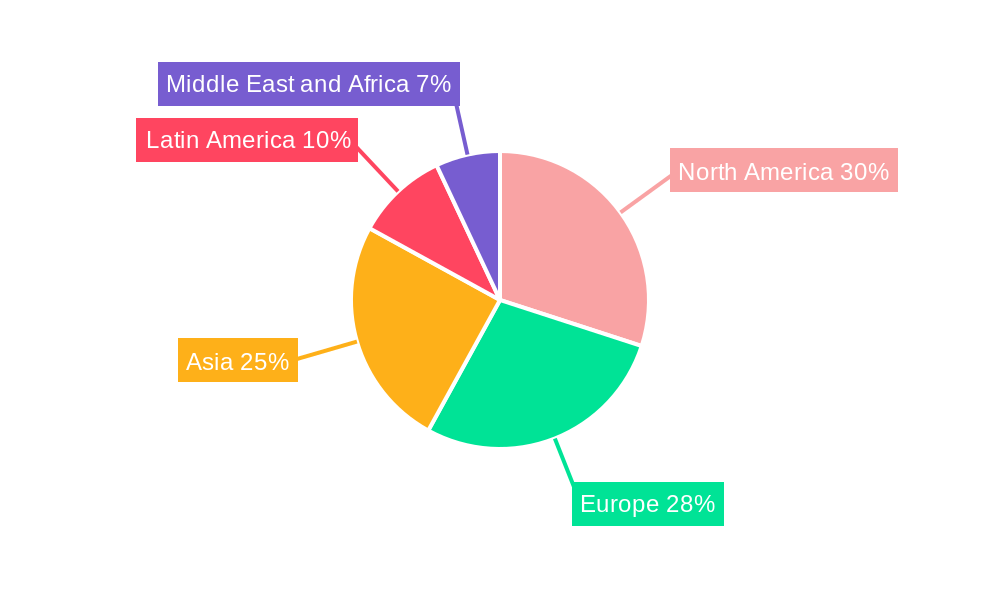

Dominant Markets & Segments in Primary Healthcare Packaging Industry

The Pharmaceutical end-use vertical is the dominant market segment within the Primary Healthcare Packaging Industry, accounting for an estimated xx% of the market share in 2025. Within the Pharmaceutical sector, the demand for Glass as a material for primary packaging remains exceptionally strong, especially for high-value drugs and injectables, due to its inertness and excellent barrier properties. The Vials and Ampoules product type holds a significant market position, essential for sterile drug delivery. Emerging markets in Asia-Pacific, particularly China and India, are expected to be the fastest-growing regions due to expanding pharmaceutical manufacturing capabilities, increasing healthcare access, and supportive government policies aimed at boosting domestic production. The Plastic material segment is witnessing substantial growth, driven by its versatility, cost-effectiveness, and adoption in a wide range of applications, including bottles and containers for oral medications and medical device components. The Cartridges and Prefilled Syringes product type is also experiencing accelerated growth, fueled by the increasing use of biologics and biosimilars, and the demand for convenient, ready-to-use drug delivery systems. Infrastructure development, including the establishment of new pharmaceutical manufacturing plants and cold chain logistics, is a key growth driver in these dominant regions. Policies promoting domestic manufacturing and stringent quality control standards further bolster the growth of these segments.

- Dominant End-use Vertical: Pharmaceutical

- Key Growth Drivers: Increasing global pharmaceutical R&D, rising prevalence of chronic diseases, growing demand for vaccines, and expansion of biologics market.

- Dominant Material: Glass

- Key Growth Drivers: Inertness and chemical stability for sensitive formulations, high-end aesthetics, and regulatory preference for certain drug classes.

- Dominant Product Type: Vials and Ampoules

- Key Growth Drivers: Critical for parenteral drug administration, sterile filling requirements, and increasing demand for injectable medicines.

- Dominant Region: Asia-Pacific

- Key Growth Drivers: Rapidly growing pharmaceutical industry, expanding healthcare infrastructure, favorable government initiatives, and a large patient population.

- Key Policies: Incentives for pharmaceutical manufacturing, investments in healthcare, and focus on quality compliance.

Primary Healthcare Packaging Industry Product Analysis

Product innovations in the Primary Healthcare Packaging Industry are heavily focused on enhancing drug stability, ensuring patient safety, and improving user convenience. Advancements in material science are leading to the development of advanced barrier plastics and specialized glass formulations offering superior protection against moisture, oxygen, and light. The growing demand for biologics has spurred innovation in pre-filled syringes and vials with integrated safety features and specialized coatings. Competitive advantages are being gained through the development of tamper-evident closures, child-resistant designs, and packaging solutions that facilitate aseptic filling. The market fit for these innovations is driven by stringent regulatory requirements and the increasing complexity of pharmaceutical formulations, demanding packaging that guarantees product integrity from manufacturing to patient administration.

Key Drivers, Barriers & Challenges in Primary Healthcare Packaging Industry

Key Drivers, Barriers & Challenges in Primary Healthcare Packaging Industry

The Primary Healthcare Packaging Industry is propelled by several key drivers including the escalating global demand for pharmaceuticals and medical devices, driven by an aging population and the increasing prevalence of chronic diseases. Technological advancements in materials science and manufacturing processes enable the development of more sophisticated and functional packaging solutions. Favorable regulatory frameworks promoting patient safety and product integrity also act as significant growth catalysts. Furthermore, the growing focus on sustainable packaging solutions is creating new market opportunities.

However, the industry faces several barriers and challenges. Stringent and evolving regulatory requirements across different regions can pose compliance hurdles and increase development costs. Supply chain disruptions, as seen in recent global events, can impact raw material availability and lead times, affecting production schedules. Intense competition among established players and emerging manufacturers can lead to price pressures. Furthermore, the high cost associated with adopting advanced packaging technologies can be a restraint for smaller players.

Growth Drivers in the Primary Healthcare Packaging Industry Market

The Primary Healthcare Packaging Industry's growth is underpinned by several critical factors. The continuous pipeline of new drug development, particularly in areas like oncology and biologics, necessitates innovative and specialized primary packaging. The expanding global healthcare infrastructure, especially in emerging economies, is increasing the demand for essential pharmaceutical and medical packaging. Moreover, a growing emphasis on patient convenience and adherence is driving the adoption of user-friendly packaging formats like pre-filled syringes and unit-dose systems. Government initiatives promoting domestic manufacturing and stringent quality standards further support market expansion.

Challenges Impacting Primary Healthcare Packaging Industry Growth

The Primary Healthcare Packaging Industry grapples with significant challenges. Navigating the complex and fragmented global regulatory landscape, which varies considerably by region, adds complexity and cost to market entry and product approval. Supply chain volatility, including the availability and pricing of raw materials like specialized resins and high-quality glass, can disrupt production and impact profitability. Intense competitive pressures, both from established global players and agile regional manufacturers, often lead to price erosion and necessitate continuous innovation to maintain market share. The capital-intensive nature of investing in advanced manufacturing technologies also presents a barrier, particularly for smaller and medium-sized enterprises.

Key Players Shaping the Primary Healthcare Packaging Industry Market

- Stolze-Oberglas GmbH

- Piramal Glass Pvt Ltd

- Schott AG

- Beatson Clark PLC

- Sisecam Group

- Nipro Corporation

- Arab Pharmaceutical Glass Co

- Bormioli Pharma SRL

- Shandong Medicinal Glass Co Ltd

- SGD SA

- Gerresheimer AG

- Corning Incorporated

Significant Primary Healthcare Packaging Industry Industry Milestones

- May 2022: SGD SA Pharma announces the launch of Type I 100mL Ready-to-Use (RTU) molded glass vials for aseptic filling and finishing of parenteral medicines. This solution is groundbreaking as it is the first product of its kind in an EZ-Fill tray configuration, enabling global companies to accelerate time-to-market for high-quality parenteral medicines with high-volume, suitable RTU primary packaging solutions.

- May 2022: Gerresheimer AG significantly expands India's glass and plastic production capacity. A new modern plant for producing high-quality plastic containers and closures has been built in Cosambasite, and glass production has received new sustainable furnace technology. Gerresheimer will secure continuous supply to critical pharmaceutical and healthcare facilities and support the increasing demand for packaging and public health by expanding production capacity in India.

Future Outlook for Primary Healthcare Packaging Industry Market

The future outlook for the Primary Healthcare Packaging Industry is exceptionally promising, driven by sustained demand from the pharmaceutical and medical device sectors. Key growth catalysts include the increasing adoption of sustainable packaging materials, the continued rise of biologics and personalized medicine requiring specialized containment, and the integration of smart technologies for enhanced traceability and patient engagement. Strategic opportunities lie in expanding into rapidly growing emerging markets, focusing on niche segments like vials for gene and cell therapies, and investing in advanced manufacturing capabilities to meet evolving regulatory and market demands. The market is poised for continued innovation and expansion, with an estimated market value exceeding xx Billion USD by 2033.

Primary Healthcare Packaging Industry Segmentation

-

1. Material

- 1.1. Glass

- 1.2. Plastic

- 1.3. Other Materials (Paper and Metal)

-

2. Product Type

- 2.1. Bottles and Containers

- 2.2. Vials and Ampoules

- 2.3. Cartridges and Prefilled Syringes

- 2.4. Pouches and Bags

- 2.5. Blister Packs

- 2.6. Tubes

- 2.7. Paper Board Boxes

- 2.8. Caps and Closures

- 2.9. Labels

- 2.10. Other Product Types

-

3. End-use Vertical

- 3.1. Pharmaceutical

- 3.2. Medical Devices

Primary Healthcare Packaging Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Spain

- 2.4. Italy

-

3. Asia

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia and New Zealand

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. United Arab Emirates

Primary Healthcare Packaging Industry Regional Market Share

Geographic Coverage of Primary Healthcare Packaging Industry

Primary Healthcare Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Emphasis on Convenience and Environmental Issues; Rise In Medicine Counterfeiting Leading to Advanced Packaging and Labeling

- 3.3. Market Restrains

- 3.3.1. Increased Relevance of Alternate Material

- 3.4. Market Trends

- 3.4.1. Blister Packs are Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Primary Healthcare Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Glass

- 5.1.2. Plastic

- 5.1.3. Other Materials (Paper and Metal)

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Bottles and Containers

- 5.2.2. Vials and Ampoules

- 5.2.3. Cartridges and Prefilled Syringes

- 5.2.4. Pouches and Bags

- 5.2.5. Blister Packs

- 5.2.6. Tubes

- 5.2.7. Paper Board Boxes

- 5.2.8. Caps and Closures

- 5.2.9. Labels

- 5.2.10. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by End-use Vertical

- 5.3.1. Pharmaceutical

- 5.3.2. Medical Devices

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America Primary Healthcare Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Glass

- 6.1.2. Plastic

- 6.1.3. Other Materials (Paper and Metal)

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Bottles and Containers

- 6.2.2. Vials and Ampoules

- 6.2.3. Cartridges and Prefilled Syringes

- 6.2.4. Pouches and Bags

- 6.2.5. Blister Packs

- 6.2.6. Tubes

- 6.2.7. Paper Board Boxes

- 6.2.8. Caps and Closures

- 6.2.9. Labels

- 6.2.10. Other Product Types

- 6.3. Market Analysis, Insights and Forecast - by End-use Vertical

- 6.3.1. Pharmaceutical

- 6.3.2. Medical Devices

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. Europe Primary Healthcare Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Glass

- 7.1.2. Plastic

- 7.1.3. Other Materials (Paper and Metal)

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Bottles and Containers

- 7.2.2. Vials and Ampoules

- 7.2.3. Cartridges and Prefilled Syringes

- 7.2.4. Pouches and Bags

- 7.2.5. Blister Packs

- 7.2.6. Tubes

- 7.2.7. Paper Board Boxes

- 7.2.8. Caps and Closures

- 7.2.9. Labels

- 7.2.10. Other Product Types

- 7.3. Market Analysis, Insights and Forecast - by End-use Vertical

- 7.3.1. Pharmaceutical

- 7.3.2. Medical Devices

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Asia Primary Healthcare Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Glass

- 8.1.2. Plastic

- 8.1.3. Other Materials (Paper and Metal)

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Bottles and Containers

- 8.2.2. Vials and Ampoules

- 8.2.3. Cartridges and Prefilled Syringes

- 8.2.4. Pouches and Bags

- 8.2.5. Blister Packs

- 8.2.6. Tubes

- 8.2.7. Paper Board Boxes

- 8.2.8. Caps and Closures

- 8.2.9. Labels

- 8.2.10. Other Product Types

- 8.3. Market Analysis, Insights and Forecast - by End-use Vertical

- 8.3.1. Pharmaceutical

- 8.3.2. Medical Devices

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Latin America Primary Healthcare Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Glass

- 9.1.2. Plastic

- 9.1.3. Other Materials (Paper and Metal)

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Bottles and Containers

- 9.2.2. Vials and Ampoules

- 9.2.3. Cartridges and Prefilled Syringes

- 9.2.4. Pouches and Bags

- 9.2.5. Blister Packs

- 9.2.6. Tubes

- 9.2.7. Paper Board Boxes

- 9.2.8. Caps and Closures

- 9.2.9. Labels

- 9.2.10. Other Product Types

- 9.3. Market Analysis, Insights and Forecast - by End-use Vertical

- 9.3.1. Pharmaceutical

- 9.3.2. Medical Devices

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Middle East and Africa Primary Healthcare Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Glass

- 10.1.2. Plastic

- 10.1.3. Other Materials (Paper and Metal)

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Bottles and Containers

- 10.2.2. Vials and Ampoules

- 10.2.3. Cartridges and Prefilled Syringes

- 10.2.4. Pouches and Bags

- 10.2.5. Blister Packs

- 10.2.6. Tubes

- 10.2.7. Paper Board Boxes

- 10.2.8. Caps and Closures

- 10.2.9. Labels

- 10.2.10. Other Product Types

- 10.3. Market Analysis, Insights and Forecast - by End-use Vertical

- 10.3.1. Pharmaceutical

- 10.3.2. Medical Devices

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Stolze-Oberglas GmbH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Piramal Glass Pvt Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Schott AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Beatson Clark PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sisecam Group*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nipro Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Arab Pharmaceutical Glass Co

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Bormioli Pharma SRL

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Shandong Medicinal Glass Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SGD SA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Gerresheimer AG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Corning Incorporated

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Stolze-Oberglas GmbH

List of Figures

- Figure 1: Global Primary Healthcare Packaging Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Primary Healthcare Packaging Industry Revenue (billion), by Material 2025 & 2033

- Figure 3: North America Primary Healthcare Packaging Industry Revenue Share (%), by Material 2025 & 2033

- Figure 4: North America Primary Healthcare Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 5: North America Primary Healthcare Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Primary Healthcare Packaging Industry Revenue (billion), by End-use Vertical 2025 & 2033

- Figure 7: North America Primary Healthcare Packaging Industry Revenue Share (%), by End-use Vertical 2025 & 2033

- Figure 8: North America Primary Healthcare Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Primary Healthcare Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Primary Healthcare Packaging Industry Revenue (billion), by Material 2025 & 2033

- Figure 11: Europe Primary Healthcare Packaging Industry Revenue Share (%), by Material 2025 & 2033

- Figure 12: Europe Primary Healthcare Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 13: Europe Primary Healthcare Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: Europe Primary Healthcare Packaging Industry Revenue (billion), by End-use Vertical 2025 & 2033

- Figure 15: Europe Primary Healthcare Packaging Industry Revenue Share (%), by End-use Vertical 2025 & 2033

- Figure 16: Europe Primary Healthcare Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Primary Healthcare Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Primary Healthcare Packaging Industry Revenue (billion), by Material 2025 & 2033

- Figure 19: Asia Primary Healthcare Packaging Industry Revenue Share (%), by Material 2025 & 2033

- Figure 20: Asia Primary Healthcare Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 21: Asia Primary Healthcare Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Asia Primary Healthcare Packaging Industry Revenue (billion), by End-use Vertical 2025 & 2033

- Figure 23: Asia Primary Healthcare Packaging Industry Revenue Share (%), by End-use Vertical 2025 & 2033

- Figure 24: Asia Primary Healthcare Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Primary Healthcare Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Primary Healthcare Packaging Industry Revenue (billion), by Material 2025 & 2033

- Figure 27: Latin America Primary Healthcare Packaging Industry Revenue Share (%), by Material 2025 & 2033

- Figure 28: Latin America Primary Healthcare Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 29: Latin America Primary Healthcare Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Latin America Primary Healthcare Packaging Industry Revenue (billion), by End-use Vertical 2025 & 2033

- Figure 31: Latin America Primary Healthcare Packaging Industry Revenue Share (%), by End-use Vertical 2025 & 2033

- Figure 32: Latin America Primary Healthcare Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Latin America Primary Healthcare Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Primary Healthcare Packaging Industry Revenue (billion), by Material 2025 & 2033

- Figure 35: Middle East and Africa Primary Healthcare Packaging Industry Revenue Share (%), by Material 2025 & 2033

- Figure 36: Middle East and Africa Primary Healthcare Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 37: Middle East and Africa Primary Healthcare Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Middle East and Africa Primary Healthcare Packaging Industry Revenue (billion), by End-use Vertical 2025 & 2033

- Figure 39: Middle East and Africa Primary Healthcare Packaging Industry Revenue Share (%), by End-use Vertical 2025 & 2033

- Figure 40: Middle East and Africa Primary Healthcare Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Primary Healthcare Packaging Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 2: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by End-use Vertical 2020 & 2033

- Table 4: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 6: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by End-use Vertical 2020 & 2033

- Table 8: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Primary Healthcare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Primary Healthcare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 12: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 13: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by End-use Vertical 2020 & 2033

- Table 14: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Primary Healthcare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Primary Healthcare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Primary Healthcare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Primary Healthcare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 20: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 21: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by End-use Vertical 2020 & 2033

- Table 22: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 23: China Primary Healthcare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Japan Primary Healthcare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: India Primary Healthcare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Australia and New Zealand Primary Healthcare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 28: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 29: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by End-use Vertical 2020 & 2033

- Table 30: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Mexico Primary Healthcare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Brazil Primary Healthcare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 34: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 35: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by End-use Vertical 2020 & 2033

- Table 36: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 37: South Africa Primary Healthcare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Saudi Arabia Primary Healthcare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: United Arab Emirates Primary Healthcare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Primary Healthcare Packaging Industry?

The projected CAGR is approximately 5.9%.

2. Which companies are prominent players in the Primary Healthcare Packaging Industry?

Key companies in the market include Stolze-Oberglas GmbH, Piramal Glass Pvt Ltd, Schott AG, Beatson Clark PLC, Sisecam Group*List Not Exhaustive, Nipro Corporation, Arab Pharmaceutical Glass Co, Bormioli Pharma SRL, Shandong Medicinal Glass Co Ltd, SGD SA, Gerresheimer AG, Corning Incorporated.

3. What are the main segments of the Primary Healthcare Packaging Industry?

The market segments include Material, Product Type, End-use Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 153.79 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Emphasis on Convenience and Environmental Issues; Rise In Medicine Counterfeiting Leading to Advanced Packaging and Labeling.

6. What are the notable trends driving market growth?

Blister Packs are Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Increased Relevance of Alternate Material.

8. Can you provide examples of recent developments in the market?

May 2022 - SGD SA Pharma announces the launch of Type I 100mL Ready-to-Use (RTU) molded glass vials for aseptic filling and finishing of parenteral medicines. Neville and More recognize that this solution is groundbreaking as it is the first product of its kind in an EZ-Fill tray configuration. This enables global companies to accelerate time-to-market for high-quality parenteral medicines with high-volume, suitable RTU primary packaging solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Primary Healthcare Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Primary Healthcare Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Primary Healthcare Packaging Industry?

To stay informed about further developments, trends, and reports in the Primary Healthcare Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence