Key Insights

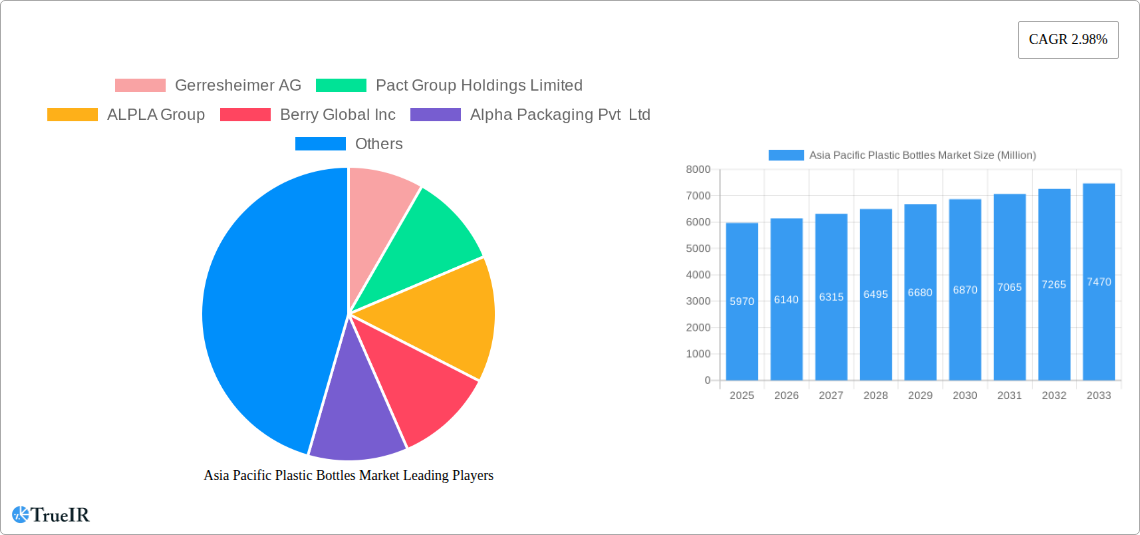

The Asia Pacific plastic bottles market is poised for steady growth, with a projected market size of $5.97 Billion in 2025. The market is expected to expand at a Compound Annual Growth Rate (CAGR) of 2.98% during the forecast period of 2025-2033, reaching a significant value of approximately $7.52 Billion by 2033. This growth is fueled by the robust demand from key end-user industries such as food and beverages, pharmaceuticals, and personal care. The beverage sector, in particular, with its sub-segments including bottled water, carbonated soft drinks, and juices, will remain a primary driver. Rising disposable incomes across emerging economies within the region, coupled with increasing urbanization and a growing preference for convenient and hygienic packaging solutions, are significant contributing factors. The market's dynamism is also shaped by ongoing innovations in plastic resin technology, leading to the development of more sustainable and high-performance bottles, catering to evolving consumer preferences and stringent environmental regulations.

Asia Pacific Plastic Bottles Market Market Size (In Billion)

The competitive landscape of the Asia Pacific plastic bottles market is characterized by the presence of both established global players and emerging regional manufacturers. Key resins dominating the market include Polyethylene Terephthalate (PET), Polyethylene (PE), and Polypropylene (PP), with ongoing research into alternative and recycled materials to address sustainability concerns. While the market benefits from strong demand drivers, it also faces certain restraints. These include increasing environmental scrutiny and regulations surrounding single-use plastics, along with the fluctuating prices of raw materials, which can impact manufacturing costs. However, the inherent advantages of plastic bottles, such as their lightweight nature, durability, and cost-effectiveness, continue to ensure their widespread adoption. Strategic collaborations, technological advancements in recycling, and the development of bio-based plastics are expected to shape the future trajectory of this vital market segment.

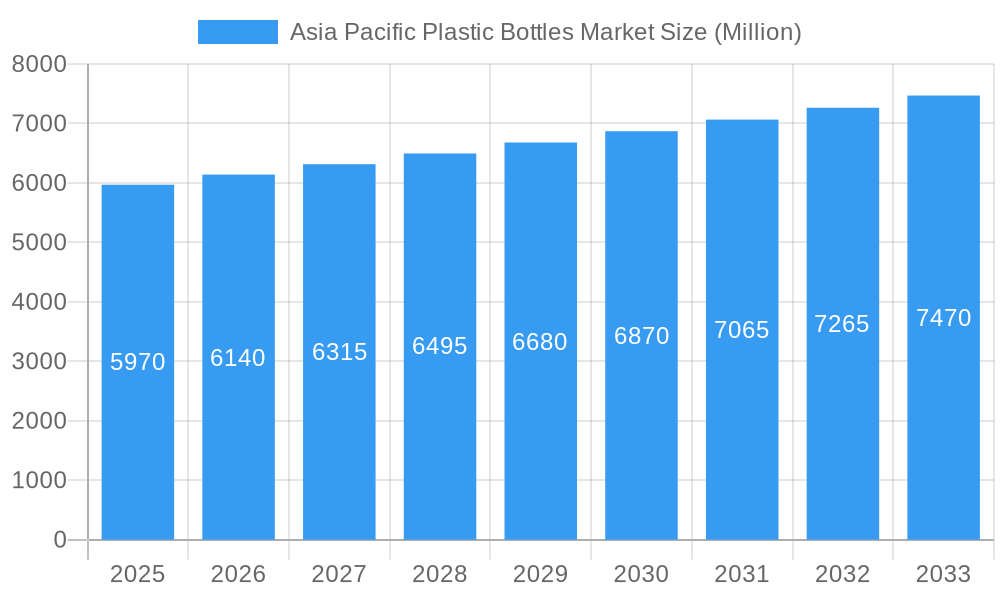

Asia Pacific Plastic Bottles Market Company Market Share

Asia Pacific Plastic Bottles Market: Comprehensive Market Intelligence Report (2019-2033)

This in-depth report provides a definitive analysis of the Asia Pacific plastic bottles market, encompassing market structure, competitive landscape, prevailing trends, growth opportunities, dominant segments, product innovations, key drivers, challenges, and a detailed outlook for the period 2019-2033. With a base year of 2025, the report offers strategic insights essential for stakeholders navigating this dynamic and rapidly evolving sector. Leveraging high-volume keywords such as "plastic bottle market Asia," "PET bottles APAC," "bottled water packaging," and "pharmaceutical plastic containers," this report is meticulously designed for maximum SEO impact and to engage industry professionals, investors, and decision-makers seeking a comprehensive understanding of the plastic packaging industry in the region.

Asia Pacific Plastic Bottles Market Market Structure & Competitive Landscape

The Asia Pacific plastic bottles market exhibits a moderately concentrated structure, characterized by the presence of both large, established global players and numerous regional manufacturers. Innovation drivers are largely fueled by demand for sustainable packaging solutions, advancements in material science for enhanced barrier properties and lightweighting, and the increasing adoption of smart packaging technologies. Regulatory impacts, particularly concerning plastic waste management and single-use plastic bans, are significant, prompting a shift towards recycled content and alternative materials. Product substitutes, such as glass bottles and aluminum cans, pose a competitive challenge, especially in premium segments.

End-user segmentation reveals a strong reliance on the food and beverage sector, followed by pharmaceuticals and personal care. Mergers and acquisitions (M&A) trends are observed as companies seek to expand their geographical reach, diversify their product portfolios, and enhance their manufacturing capabilities. Quantitative data suggests a steady increase in M&A volumes over the historical period (2019-2024) as major players consolidate their market positions and acquire innovative technologies or smaller competitors. Qualitative insights highlight the strategic importance of vertical integration and partnerships to secure raw material supply and optimize distribution networks.

Asia Pacific Plastic Bottles Market Market Trends & Opportunities

The Asia Pacific plastic bottles market is on an upward trajectory, driven by robust economic growth, a burgeoning middle class, and increasing urbanization across the region. The market size for plastic bottles in Asia Pacific is projected to witness substantial growth, estimated to reach $XX Billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of approximately X.X% from 2025 to 2033. This expansion is underpinned by several key trends.

Technological shifts are playing a pivotal role, with manufacturers increasingly investing in advanced production techniques such as injection stretch blow molding (ISBM) for PET bottles, which allows for greater design flexibility and improved material efficiency. The adoption of lighter-weight bottles, driven by cost-saving and environmental considerations, is a significant trend. Furthermore, the integration of Industry 4.0 principles, including automation and data analytics in manufacturing processes, is enhancing operational efficiency and product quality.

Consumer preferences are evolving, with a growing demand for convenience, durability, and aesthetically pleasing packaging. The rising health consciousness among consumers is boosting the demand for bottled water and functional beverages, directly impacting the plastic bottle market. Simultaneously, a heightened awareness of environmental issues is fueling the demand for sustainable and recyclable packaging options. This presents a significant opportunity for market players to innovate in areas such as recycled PET (rPET) bottles and bioplastics.

Competitive dynamics within the APAC plastic packaging market are intensifying. Companies are focusing on product differentiation through innovative designs, enhanced barrier properties for extended shelf life, and the incorporation of features like tamper-evident seals. Strategic partnerships and collaborations are becoming crucial for market penetration and technology sharing. The untapped potential in emerging economies within Asia Pacific offers substantial growth opportunities for both established and new entrants. The increasing penetration of e-commerce also presents new distribution channels and packaging requirements, pushing for more resilient and tailored solutions.

Dominant Markets & Segments in Asia Pacific Plastic Bottles Market

The Asia Pacific plastic bottles market is characterized by the dominance of specific regions and end-user industries. Geographically, countries like China, India, and Southeast Asian nations represent the largest and fastest-growing markets due to their large populations, rapid industrialization, and increasing consumer spending. Within these regions, robust infrastructure development, supportive government policies promoting manufacturing, and a growing middle class are key growth drivers.

In terms of resin type, Polyethylene Terephthalate (PET) holds the largest market share, primarily due to its widespread use in the beverage and food industries owing to its clarity, strength, and recyclability. The demand for PET bottles in bottled water and carbonated soft drinks remains exceptionally high. Polyethylene (PE) and Polypropylene (PP) are also significant, with PE widely used for household chemicals and personal care products, while PP finds applications in a broader range of packaging needs due to its versatility and chemical resistance.

The Food and Beverage sector is unequivocally the largest end-user industry for plastic bottles in Asia Pacific. Within this segment, Bottled Water and Carbonated Soft Drinks lead the consumption, driven by evolving lifestyles and increased disposable incomes. However, significant growth is also witnessed in Juices and Energy Drinks, reflecting changing consumer tastes and a focus on health and wellness. The Pharmaceuticals sector represents a critical and growing segment, demanding high-purity, chemically inert, and tamper-evident plastic bottles for medications and healthcare products. The Personal Care and Toiletries segment also contributes substantially, with increasing demand for innovative and visually appealing packaging.

Market dominance in the Industrial sector is driven by the need for durable and chemically resistant containers for various chemicals, lubricants, and cleaning agents. The Household Chemicals and Paints and Coatings segments also represent substantial markets, where plastic bottles offer a cost-effective and safe packaging solution. The "Other Beverages" category, encompassing dairy products and ready-to-drink teas, is also experiencing steady growth. Government initiatives promoting domestic manufacturing, coupled with increasing foreign direct investment, further bolster the dominance of these segments and regions within the APAC plastic packaging market.

Asia Pacific Plastic Bottles Market Product Analysis

Product innovation in the Asia Pacific plastic bottles market is heavily focused on sustainability, functionality, and cost-effectiveness. Advancements in material science have led to the development of lightweight yet durable PET bottles that reduce material usage and transportation costs. The introduction of multi-layer bottles with enhanced barrier properties extends product shelf life, particularly crucial for sensitive food and beverage products. Increased adoption of recycled PET (rPET) content is a major trend, driven by both consumer demand for eco-friendly options and regulatory pressures. Hot-fill and cold-fill capabilities are being refined for diverse liquid products, expanding the application range of plastic bottles. Competitive advantages are being gained through innovative designs that improve grip, dispensing, and aesthetics, appealing to modern consumer preferences. The integration of smart features, such as QR codes for traceability and authentication, is also emerging as a differentiator in premium segments.

Key Drivers, Barriers & Challenges in Asia Pacific Plastic Bottles Market

Key Drivers:

- Growing Population and Urbanization: A rising population and increasing urbanization in Asia Pacific fuel the demand for packaged goods, especially beverages, food, and personal care products.

- Economic Growth and Rising Disposable Incomes: Improved economic conditions lead to higher consumer spending on a wider range of products requiring convenient packaging.

- Demand for Convenience and Portability: Plastic bottles offer lightweight, durable, and portable packaging solutions that align with modern lifestyles.

- Technological Advancements in Manufacturing: Innovations in materials and production processes enable the creation of lighter, stronger, and more sustainable plastic bottles.

- Growth in Key End-User Industries: Expansion in the food & beverage, pharmaceutical, and personal care sectors directly drives the demand for plastic bottles.

Barriers & Challenges:

- Environmental Concerns and Regulations: Growing public and governmental focus on plastic waste management, single-use plastic bans, and recycling mandates pose significant challenges.

- Fluctuating Raw Material Prices: Volatility in crude oil prices, the primary feedstock for plastic production, impacts manufacturing costs and profitability.

- Competition from Alternative Materials: Glass, metal, and paper-based packaging offer substitutes, particularly in specific applications or for brands emphasizing premium or eco-friendly positioning.

- Supply Chain Disruptions: Geopolitical events, logistics challenges, and trade policies can impact the availability and cost of raw materials and finished goods.

- Consumer Perception and Greenwashing Scrutiny: Negative consumer perception regarding plastic waste and increased scrutiny over "green" claims necessitate genuine sustainable practices.

Growth Drivers in the Asia Pacific Plastic Bottles Market Market

The Asia Pacific plastic bottles market is propelled by a confluence of technological, economic, and regulatory factors. Economically, the burgeoning middle class across countries like India and China is increasing the demand for packaged food and beverages, directly benefiting the plastic bottle sector. Technological advancements in PET bottle manufacturing, such as lightweighting and enhanced barrier properties, contribute to cost savings and product quality. Regulatory initiatives in some Asian nations are also focusing on promoting the use of recycled plastics, thereby driving demand for rPET bottles. Furthermore, the significant growth in the pharmaceutical sector, driven by an aging population and increasing healthcare spending, necessitates high-quality and safe plastic packaging solutions, acting as a major growth catalyst.

Challenges Impacting Asia Pacific Plastic Bottles Market Growth

The Asia Pacific plastic bottles market faces considerable hurdles. Increasing regulatory pressure concerning plastic pollution and single-use plastics, with some countries implementing bans or stringent recycling mandates, poses a significant challenge. Supply chain volatility, influenced by geopolitical tensions and fluctuating petrochemical prices, can lead to increased production costs and unpredictable market dynamics. Fierce competitive pressures among a large number of regional and international players can lead to price wars and reduced profit margins. The ongoing negative consumer perception surrounding plastic waste necessitates a proactive approach towards sustainable solutions, including investing heavily in recycling infrastructure and the development of truly circular economy models.

Key Players Shaping the Asia Pacific Plastic Bottles Market Market

- Gerresheimer AG

- Pact Group Holdings Limited

- ALPLA Group

- Berry Global Inc

- Alpha Packaging Pvt Ltd

- Greiner Packaging international GmbH

- Retal Industries Limited

- Zhejiang Xinlei Packaging Co Ltd

- Shenzhen Zhenghao Plastic & Mold Co Ltd

- Manjushree Technopack Limited

Significant Asia Pacific Plastic Bottles Market Industry Milestones

- June 2024: PepsiCo India debuted its iconic hydration brand, Gatorade, in Jammu and Kashmir, India. Gatorade is dedicated to motivating the youth toward active lifestyles, emphasizing the crucial role of hydration in realizing their full potential. Consumers in Jammu and Kashmir can enjoy all three Gatorade flavors (Blue Bolt, Orange, and Lemon). As Gatorade enters Jammu and Kashmir, PepsiCo India aims to amplify the region's 'Sweat Makes You Shine' campaign.

- December 2023: Zhenghao Plastic & Mold Co. Ltd introduced a new sandblasting material called HDPE, which features a double-layer bottle construction. The final bottle boasts a matte, soft-touch finish, allowing for custom logo printing through silk-screen or hot stamping. Clients predominantly utilize this material for premium and luxury cosmetics and personal care packaging. The HDPE sandblasting plastic bottle showcases a completely matte finish, even under direct light, devoid of shine.

Future Outlook for Asia Pacific Plastic Bottles Market Market

The Asia Pacific plastic bottles market is poised for continued robust growth in the forecast period, driven by ongoing economic development and shifting consumer lifestyles. Strategic opportunities lie in the increasing demand for sustainable packaging solutions, particularly rPET bottles, and the development of innovative biodegradable or compostable alternatives. Market players are expected to focus on enhancing their recycling capabilities and investing in technologies that reduce the environmental footprint of plastic bottles. The expansion of e-commerce will also necessitate specialized packaging solutions, creating new avenues for growth. Investments in advanced manufacturing techniques and smart packaging technologies will be crucial for maintaining a competitive edge, ensuring the market's resilience and long-term potential.

Asia Pacific Plastic Bottles Market Segmentation

-

1. Resin

- 1.1. Polyethylene (PE)

- 1.2. Polyethylene Terephthalate (PET)

- 1.3. Polypropylene (PP)

- 1.4. Other Re

-

2. End-user Industries

- 2.1. Food

-

2.2. Beverage

- 2.2.1. Bottled Water

- 2.2.2. Carbonated Soft Drinks

- 2.2.3. Alcoholic Beverages

- 2.2.4. Juices and Energy Drinks

- 2.2.5. Other Beverages

- 2.3. Pharmaceuticals

- 2.4. Personal Care and Toiletries

- 2.5. Industrial

- 2.6. Household Chemicals

- 2.7. Paints and Coatings

- 2.8. Other End-user Industries

Asia Pacific Plastic Bottles Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Plastic Bottles Market Regional Market Share

Geographic Coverage of Asia Pacific Plastic Bottles Market

Asia Pacific Plastic Bottles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.98% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Lightweight Plastic Bottles; Changing Demographic and Lifestyle Factors

- 3.3. Market Restrains

- 3.3.1. Increasing Adoption of Lightweight Plastic Bottles; Changing Demographic and Lifestyle Factors

- 3.4. Market Trends

- 3.4.1. Polyethylene Terephthalate (PET) To Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Plastic Bottles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 5.1.1. Polyethylene (PE)

- 5.1.2. Polyethylene Terephthalate (PET)

- 5.1.3. Polypropylene (PP)

- 5.1.4. Other Re

- 5.2. Market Analysis, Insights and Forecast - by End-user Industries

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.2.1. Bottled Water

- 5.2.2.2. Carbonated Soft Drinks

- 5.2.2.3. Alcoholic Beverages

- 5.2.2.4. Juices and Energy Drinks

- 5.2.2.5. Other Beverages

- 5.2.3. Pharmaceuticals

- 5.2.4. Personal Care and Toiletries

- 5.2.5. Industrial

- 5.2.6. Household Chemicals

- 5.2.7. Paints and Coatings

- 5.2.8. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Gerresheimer AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Pact Group Holdings Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ALPLA Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Berry Global Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Alpha Packaging Pvt Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Greiner Packaging international GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Retal Industries Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Zhejiang Xinlei Packaging Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shenzhen Zhenghao Plastic & Mold Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Manjushree Technopack Limited7 2 Heat Map Analysis7 3 Competitor Analysis - Emerging vs Established Player

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Gerresheimer AG

List of Figures

- Figure 1: Asia Pacific Plastic Bottles Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Plastic Bottles Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Plastic Bottles Market Revenue Million Forecast, by Resin 2020 & 2033

- Table 2: Asia Pacific Plastic Bottles Market Volume Billion Forecast, by Resin 2020 & 2033

- Table 3: Asia Pacific Plastic Bottles Market Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 4: Asia Pacific Plastic Bottles Market Volume Billion Forecast, by End-user Industries 2020 & 2033

- Table 5: Asia Pacific Plastic Bottles Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Asia Pacific Plastic Bottles Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Asia Pacific Plastic Bottles Market Revenue Million Forecast, by Resin 2020 & 2033

- Table 8: Asia Pacific Plastic Bottles Market Volume Billion Forecast, by Resin 2020 & 2033

- Table 9: Asia Pacific Plastic Bottles Market Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 10: Asia Pacific Plastic Bottles Market Volume Billion Forecast, by End-user Industries 2020 & 2033

- Table 11: Asia Pacific Plastic Bottles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Asia Pacific Plastic Bottles Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: China Asia Pacific Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: China Asia Pacific Plastic Bottles Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Japan Asia Pacific Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Japan Asia Pacific Plastic Bottles Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: South Korea Asia Pacific Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: South Korea Asia Pacific Plastic Bottles Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: India Asia Pacific Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: India Asia Pacific Plastic Bottles Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Australia Asia Pacific Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Australia Asia Pacific Plastic Bottles Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: New Zealand Asia Pacific Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: New Zealand Asia Pacific Plastic Bottles Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Indonesia Asia Pacific Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Indonesia Asia Pacific Plastic Bottles Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Malaysia Asia Pacific Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Malaysia Asia Pacific Plastic Bottles Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Singapore Asia Pacific Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Singapore Asia Pacific Plastic Bottles Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Thailand Asia Pacific Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Thailand Asia Pacific Plastic Bottles Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Vietnam Asia Pacific Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Vietnam Asia Pacific Plastic Bottles Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Philippines Asia Pacific Plastic Bottles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Philippines Asia Pacific Plastic Bottles Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Plastic Bottles Market?

The projected CAGR is approximately 2.98%.

2. Which companies are prominent players in the Asia Pacific Plastic Bottles Market?

Key companies in the market include Gerresheimer AG, Pact Group Holdings Limited, ALPLA Group, Berry Global Inc, Alpha Packaging Pvt Ltd, Greiner Packaging international GmbH, Retal Industries Limited, Zhejiang Xinlei Packaging Co Ltd, Shenzhen Zhenghao Plastic & Mold Co Ltd, Manjushree Technopack Limited7 2 Heat Map Analysis7 3 Competitor Analysis - Emerging vs Established Player.

3. What are the main segments of the Asia Pacific Plastic Bottles Market?

The market segments include Resin, End-user Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.97 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Lightweight Plastic Bottles; Changing Demographic and Lifestyle Factors.

6. What are the notable trends driving market growth?

Polyethylene Terephthalate (PET) To Witness Growth.

7. Are there any restraints impacting market growth?

Increasing Adoption of Lightweight Plastic Bottles; Changing Demographic and Lifestyle Factors.

8. Can you provide examples of recent developments in the market?

June 2024: PepsiCo India debuted its iconic hydration brand, Gatorade, in Jammu and Kashmir, India. Gatorade is dedicated to motivating the youth toward active lifestyles, emphasizing the crucial role of hydration in realizing their full potential. Consumers in Jammu and Kashmir can enjoy all three Gatorade flavors (Blue Bolt, Orange, and Lemon). As Gatorade enters Jammu and Kashmir, PepsiCo India aims to amplify the region's 'Sweat Makes You Shine' campaign.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Plastic Bottles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Plastic Bottles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Plastic Bottles Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Plastic Bottles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence