Key Insights

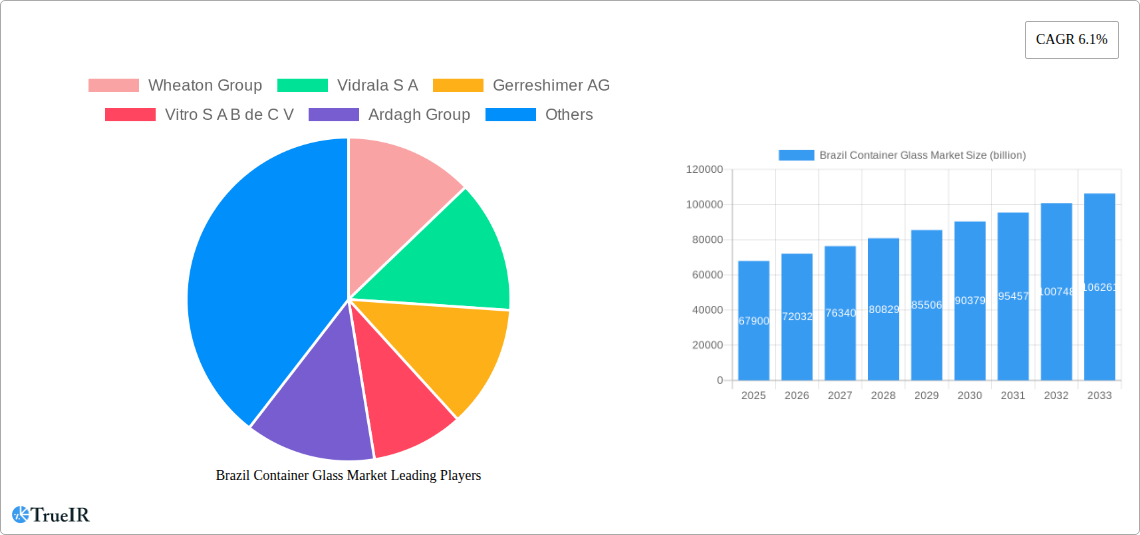

The Brazil container glass market is poised for robust expansion, projected to reach an estimated USD 67.9 billion in 2025, with a compelling Compound Annual Growth Rate (CAGR) of 6.1% anticipated throughout the forecast period of 2025-2033. This growth is primarily propelled by the burgeoning demand from the beverage sector, encompassing both alcoholic and non-alcoholic segments. Wines and spirits, beer and cider, carbonated drinks, juices, and water are key contributors, driven by evolving consumer preferences for premium packaging and an increasing focus on sustainable consumption. Furthermore, the food industry's consistent need for glass packaging for preservation and presentation, alongside the expanding applications in pharmaceuticals and cosmetics, further fuel this upward trajectory. Brazil's expanding middle class and a growing emphasis on health and wellness products are also significant drivers.

Brazil Container Glass Market Market Size (In Billion)

While the market exhibits strong growth potential, certain restraints may influence its pace. Fluctuations in raw material prices, particularly soda ash and silica sand, can impact manufacturing costs. Intense competition from alternative packaging materials like plastic and metal also presents a challenge, although the inherent sustainability and inertness of glass are increasingly recognized by consumers and regulators. Technological advancements in glass manufacturing, focusing on lightweighting and enhanced durability, alongside innovative designs and customizable solutions, will be crucial for market players to maintain a competitive edge. The growth is also bolstered by a strong emphasis on eco-friendly packaging solutions, where glass excels due to its recyclability.

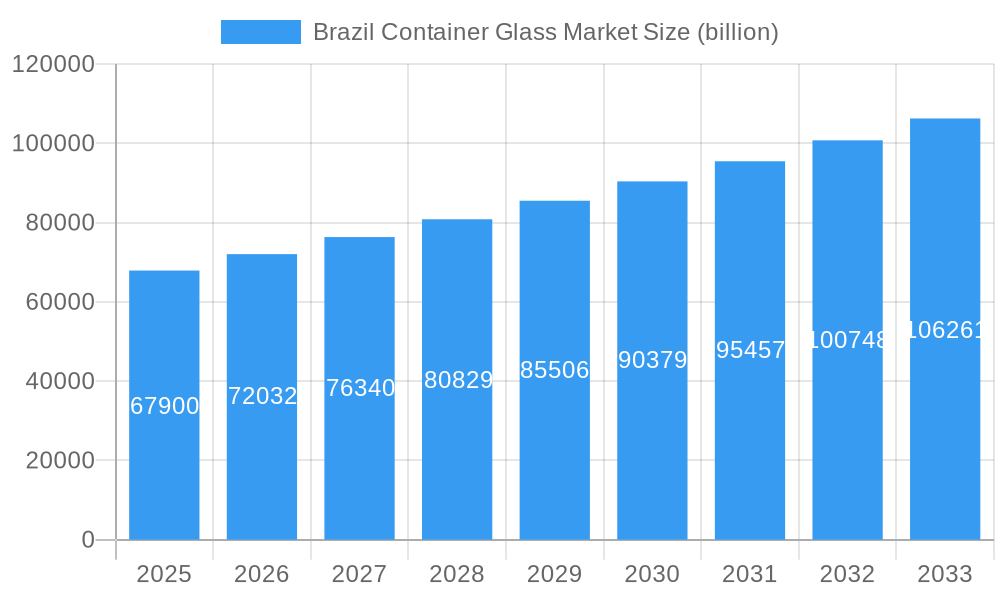

Brazil Container Glass Market Company Market Share

This in-depth report provides a detailed examination of the Brazil Container Glass Market, offering critical insights into its current state and future trajectory. Covering the historical period of 2019-2024, the base year of 2025, and a robust forecast period extending to 2033, this analysis is designed for industry stakeholders seeking to understand market dynamics, competitive landscapes, and emerging opportunities in one of South America's largest economies. With an estimated market size projected to reach USD XX billion by 2025, and a compound annual growth rate (CAGR) of XX% during the forecast period, the Brazil Container Glass Market presents significant growth potential driven by evolving consumer preferences, technological advancements, and strategic industry developments.

Brazil Container Glass Market Market Structure & Competitive Landscape

The Brazil Container Glass Market is characterized by a moderately concentrated structure, with key players vying for market share through strategic investments in production capacity, innovation, and sustainability initiatives. The market's competitive intensity is influenced by factors such as high capital expenditure requirements for manufacturing facilities, the importance of established distribution networks, and the increasing demand for specialized glass packaging solutions across various end-user industries. Innovation drivers are primarily focused on enhancing the sustainability of glass production, including the adoption of renewable energy sources and increased recycled content, as well as developing lightweight and aesthetically appealing packaging designs. Regulatory impacts, while present, are largely supportive of market growth, particularly concerning environmental standards and recycling mandates. Product substitutes, such as plastic and metal packaging, pose a competitive challenge, but the inherent advantages of glass, including its inertness, recyclability, and premium appeal, continue to secure its position. End-user segmentation plays a crucial role, with the beverage industry holding a dominant share. Mergers and acquisitions (M&A) are strategic tools employed by major players to expand their product portfolios, gain access to new markets, and consolidate their market position. For instance, the year 2025 saw XX significant M&A deals, totaling an estimated USD XX billion, reflecting ongoing consolidation and strategic realignments within the industry. Concentration ratios, such as the HHI (Herfindahl-Hirschman Index), are estimated to be around XXX for the overall market, indicating a moderate level of competition.

Brazil Container Glass Market Market Trends & Opportunities

The Brazil Container Glass Market is experiencing robust growth, projected to reach USD XX billion by 2025 and sustain a healthy CAGR of XX% through 2033. This expansion is underpinned by a confluence of dynamic market trends and emerging opportunities. A significant trend is the escalating consumer preference for sustainable and eco-friendly packaging solutions. As environmental consciousness grows among Brazilian consumers, glass, with its inherent recyclability and inert properties, is witnessing renewed interest, particularly in segments like premium beverages and organic foods. This shift presents a substantial opportunity for glass container manufacturers to innovate and market their products as environmentally responsible choices, potentially increasing their market penetration rates beyond the current XX% for certain product categories.

Technological advancements are playing a pivotal role in shaping the market. Manufacturers are investing in energy-efficient furnace technologies, advanced forming processes for lighter-weight containers, and decorative printing techniques that enhance product appeal. The integration of Industry 4.0 principles, such as automation and data analytics, is also optimizing production processes, reducing operational costs, and improving product quality. The burgeoning e-commerce sector in Brazil is another significant opportunity. While traditionally less common for glass packaging due to fragility concerns, advancements in protective packaging and logistics are paving the way for increased use of glass containers for e-commerce deliveries, especially for high-value food and beverage products.

Furthermore, the "premiumization" trend across various consumer goods sectors is benefiting the glass container market. Consumers are increasingly willing to pay a premium for products packaged in visually appealing and high-quality glass, which conveys a sense of luxury and quality. This is particularly evident in the wine, spirits, and craft beer segments. Opportunities also lie in the diversification of product offerings, with manufacturers exploring innovative shapes, sizes, and functionalities for glass containers to cater to niche market demands and evolving consumption patterns. The increasing health consciousness among the population is also driving demand for glass packaging in the pharmaceutical and nutraceutical sectors due to its inertness and barrier properties. The competitive landscape, while intense, also offers opportunities for collaboration and strategic partnerships, especially in areas like supply chain optimization and the development of circular economy models for glass recycling.

Dominant Markets & Segments in Brazil Container Glass Market

The Brazil Container Glass Market's dominance is largely dictated by the Beverage end-user industry, which accounts for a substantial portion of the overall demand. Within this broad category, Alcoholic Beverages consistently lead, driven by strong consumption patterns for Wines and Spirits and Beer and Cider. The significant cultural importance of wine and spirits consumption in Brazil, coupled with the growing popularity of craft beers and ciders, fuels continuous demand for high-quality glass bottles. The Non-Alcoholic Beverages segment also presents considerable growth potential, with a strong performance from Water and Juices. As Brazilians increasingly opt for healthier lifestyle choices, the demand for bottled water and natural juices, predominantly packaged in glass, is on the rise. The presence of major beverage manufacturers with extensive production capacities and distribution networks further solidifies the dominance of this sector.

Beverage (Dominant Segment):

- Alcoholic:

- Wines and Spirits: High consumer spending and a growing appreciation for premium and artisanal spirits and wines drive consistent demand for glass bottles of various shapes and sizes. The market for these products is estimated to be worth USD XX billion in 2025.

- Beer and Cider: The expanding craft beer movement and the enduring popularity of traditional beers contribute significantly to glass container demand. The beer and cider market is projected to reach USD XX billion by 2025.

- Other Alcoholic Beverages: This includes liqueurs, aperitifs, and ready-to-drink (RTD) alcoholic beverages, which are increasingly seeking glass packaging for their unique brand identity.

- Non-Alcoholic:

- Carbonated Drinks: While plastic is a strong competitor, premium carbonated beverages and artisanal sodas often opt for glass bottles to enhance their perceived value. The carbonated drinks market is estimated at USD XX billion in 2025.

- Juices: Growing demand for natural and freshly squeezed juices, coupled with health consciousness, is a key driver for glass juice bottles. The juice market is projected to reach USD XX billion by 2025.

- Water: The increasing consumption of bottled water, both still and sparkling, is a substantial contributor to the glass container market, especially for premium and infused water brands. The water market is valued at USD XX billion in 2025.

- Dairy-Based: A niche but growing segment, particularly for premium milk-based beverages, yogurts, and dairy alternatives, where glass offers a clean and hygienic packaging solution.

- Flavored Drinks: Including iced teas, sports drinks, and functional beverages, where glass packaging can convey a sense of quality and natural ingredients.

- Other Non-Alcoholic Beverages: A miscellaneous category encompassing everything from plant-based milk alternatives to functional shots, often utilizing glass for its inertness and aesthetic appeal.

- Alcoholic:

Food: The food industry represents another significant segment, driven by demand for jams, sauces, pickles, and gourmet food products that benefit from the inert and protective properties of glass packaging. The overall food segment is estimated to be worth USD XX billion in 2025.

Cosmetics: Glass containers are highly favored in the cosmetics industry for their luxurious appearance and ability to preserve the integrity of formulations. Perfumes, skincare, and makeup products contribute to this segment, valued at USD XX billion in 2025.

Pharmaceuticals: Due to its chemical inertness and barrier properties, glass is indispensable for packaging medicines, vials, and laboratory reagents, ensuring product safety and efficacy. This critical segment is estimated to be USD XX billion in 2025.

Other End User Verticals: This includes diverse applications such as household chemicals, lighting, and decorative items, which contribute smaller but consistent demand for various types of glass containers.

The dominance of the beverage sector is further amplified by favorable government policies promoting local production and consumption, coupled with robust infrastructure supporting the distribution of these products across the vast Brazilian territory.

Brazil Container Glass Market Product Analysis

The Brazil Container Glass Market is characterized by a focus on product innovations that enhance sustainability, functionality, and aesthetic appeal. Manufacturers are actively developing lightweight glass containers that reduce material usage and transportation costs without compromising strength. Advancements in decorative printing and coating technologies allow for sophisticated branding and product differentiation, crucial for premium segments like spirits and cosmetics. Applications range from traditional bottles and jars for beverages and food to specialized vials and ampoules for the pharmaceutical industry. Competitive advantages are derived from superior glass quality, consistent product performance, and the ability to offer customized solutions that meet specific client needs. Technological advancements in furnace design and melting processes are also improving energy efficiency and reducing the carbon footprint of glass production, aligning with growing environmental concerns and creating market opportunities.

Key Drivers, Barriers & Challenges in Brazil Container Glass Market

Key Drivers:

- Growing Consumer Preference for Sustainability: Increasing environmental awareness is driving demand for recyclable and eco-friendly packaging like glass.

- Premiumization of Consumer Goods: The trend towards higher-value products in food, beverages, and cosmetics boosts demand for premium glass packaging.

- Growth of the Beverage Industry: The strong and diversified beverage sector, including alcoholic and non-alcoholic drinks, remains a primary demand driver.

- Technological Advancements: Innovations in lightweighting, energy efficiency, and decorative techniques enhance the competitiveness of glass containers.

- Government Support for Recycling and Circular Economy: Policies encouraging glass recycling and the use of recycled content are beneficial for the market.

Barriers & Challenges:

- Competition from Alternative Packaging: Plastic, metal, and carton packaging pose significant price and convenience competition.

- High Capital Investment: Establishing and upgrading glass manufacturing facilities requires substantial financial investment.

- Energy Costs and Volatility: The glass manufacturing process is energy-intensive, making it susceptible to fluctuations in energy prices.

- Logistics and Transportation Costs: The weight of glass containers can lead to higher transportation expenses, particularly for long-distance distribution.

- Recycling Infrastructure and Efficiency: While improving, the efficiency and reach of glass recycling infrastructure across Brazil can still be a limiting factor in increasing recycled content.

Growth Drivers in the Brazil Container Glass Market Market

The Brazil Container Glass Market is propelled by several key growth drivers. Technologically, the development of advanced glass formulations and manufacturing processes that enable lightweighting and enhanced durability is a significant catalyst. Economically, the steady growth of the Brazilian middle class and their increasing disposable income directly translates to higher consumption of packaged goods, particularly in the beverage and food sectors. Regulatory factors, such as stricter environmental regulations and incentives for using recycled materials, are also pushing manufacturers towards more sustainable glass production. For example, potential government incentives for increased use of post-consumer recycled (PCR) glass could significantly boost demand for recycled feedstocks. The expansion of the craft beverage industry, with its inherent demand for premium and visually appealing packaging, is another crucial economic driver.

Challenges Impacting Brazil Container Glass Market Growth

Several challenges are impacting the growth of the Brazil Container Glass Market. Regulatory complexities, particularly concerning waste management and extended producer responsibility schemes, can create compliance burdens for manufacturers. Supply chain issues, including the availability and cost of raw materials like silica sand and cullet, can affect production efficiency and pricing. Competitive pressures from lower-cost alternatives like PET bottles, especially in the mass-market beverage segment, remain a constant threat. Furthermore, ensuring consistent and high-quality glass recycling across the vast geographical expanse of Brazil is a logistical and operational challenge that can limit the volume of recycled content used, impacting sustainability claims and costs. For instance, inconsistent collection rates for glass packaging in certain regions can inflate the cost of sourced cullet.

Key Players Shaping the Brazil Container Glass Market Market

- Wheaton Group

- Vidrala S A

- Gerreshimer AG

- Vitro S A B de C V

- Ardagh Group

- Owens-Illnois Inc

- Verallia Packaging

Significant Brazil Container Glass Market Industry Milestones

- April 2024: Linde Plc announced that its subsidiary, White Martins, is set to construct and operate a second electrolyzer dedicated to producing green hydrogen for Brazil's southeast region. Upon commencing operations in 2025, White Martins' plant will provide green hydrogen to Cebrace, a glass manufacturer, to reduce emissions from their Jacareí glass melting furnaces. Situated adjacent to White Martins' current air separation facility in Jacareí, São Paulo, the new five-megawatt pressurized alkaline electrolyzer plant will harness renewable energy from nearby solar and wind projects, ensuring the production of independently certified green hydrogen. This initiative signals a strong move towards decarbonization within the glass manufacturing supply chain.

- March 2024: O-I Brazil has launched a new initiative, "Recycle and Make a Goal," to boost glass recycling during soccer matches. This endeavor seeks to curtail waste and diminish emissions in the glass manufacturing process. In collaboration with São Paulo’s Municipal Department of Urban Cleaning, the startup Grupo Seiva, and the "Queen of Recycling" Work Cooperative, O-I Brazil has collected over 8,000 glass bottles for recycling. Further, the company highlighted plans to expand the initiative to cities housing O-I's factories, streamlining project logistics. This highlights a commitment to enhancing recycling rates and fostering community engagement in sustainable practices.

Future Outlook for Brazil Container Glass Market Market

The future outlook for the Brazil Container Glass Market is overwhelmingly positive, driven by several key growth catalysts. The increasing global and domestic emphasis on circular economy principles will continue to favor glass due to its infinite recyclability. Innovations in smart packaging, incorporating features like traceability and enhanced safety, are expected to open new avenues for application. Strategic opportunities lie in further developing lightweight glass technology to mitigate cost disadvantages and expand into e-commerce packaging. The continued growth of premium segments within the beverage, food, and cosmetics industries will sustain demand for aesthetically pleasing and high-quality glass containers. Furthermore, the ongoing commitment of industry players to sustainability, as evidenced by initiatives like green hydrogen adoption and enhanced recycling programs, positions the Brazil Container Glass Market for sustained and responsible growth, with an estimated market potential projected to reach USD XX billion by 2033.

Brazil Container Glass Market Segmentation

-

1. End-user Industry

-

1.1. Beverage

-

1.1.1. Alcoholi

- 1.1.1.1. Wines and Spirits

- 1.1.1.2. Beer and Cider

- 1.1.1.3. Other Alcoholic Beverages

-

1.1.2. Non-Alco

- 1.1.2.1. Carbonated Drinks

- 1.1.2.2. Juices

- 1.1.2.3. Water

- 1.1.2.4. Dairy-Based

- 1.1.2.5. Flavored Drinks

- 1.1.2.6. Other Non-Alcoholic Beverages

-

1.1.1. Alcoholi

- 1.2. Food

- 1.3. Cosmetics

- 1.4. Pharmaceuticals

- 1.5. Other End user verticals

-

1.1. Beverage

Brazil Container Glass Market Segmentation By Geography

- 1. Brazil

Brazil Container Glass Market Regional Market Share

Geographic Coverage of Brazil Container Glass Market

Brazil Container Glass Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Sustainable and Consumer Preferences to Drive the Market; Demand for Premium and Recyclable Packaging

- 3.3. Market Restrains

- 3.3.1. Rising Demand for Sustainable and Consumer Preferences to Drive the Market; Demand for Premium and Recyclable Packaging

- 3.4. Market Trends

- 3.4.1. Pharmaceutical Sector is Expected to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Container Glass Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Beverage

- 5.1.1.1. Alcoholi

- 5.1.1.1.1. Wines and Spirits

- 5.1.1.1.2. Beer and Cider

- 5.1.1.1.3. Other Alcoholic Beverages

- 5.1.1.2. Non-Alco

- 5.1.1.2.1. Carbonated Drinks

- 5.1.1.2.2. Juices

- 5.1.1.2.3. Water

- 5.1.1.2.4. Dairy-Based

- 5.1.1.2.5. Flavored Drinks

- 5.1.1.2.6. Other Non-Alcoholic Beverages

- 5.1.1.1. Alcoholi

- 5.1.2. Food

- 5.1.3. Cosmetics

- 5.1.4. Pharmaceuticals

- 5.1.5. Other End user verticals

- 5.1.1. Beverage

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Wheaton Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vidrala S A

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gerreshimer AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vitro S A B de C V

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ardagh Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Owens-Illnois Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Verallia Packaging*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Wheaton Group

List of Figures

- Figure 1: Brazil Container Glass Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Brazil Container Glass Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Container Glass Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 2: Brazil Container Glass Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Brazil Container Glass Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Brazil Container Glass Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Container Glass Market?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the Brazil Container Glass Market?

Key companies in the market include Wheaton Group, Vidrala S A, Gerreshimer AG, Vitro S A B de C V, Ardagh Group, Owens-Illnois Inc, Verallia Packaging*List Not Exhaustive.

3. What are the main segments of the Brazil Container Glass Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 67.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Sustainable and Consumer Preferences to Drive the Market; Demand for Premium and Recyclable Packaging.

6. What are the notable trends driving market growth?

Pharmaceutical Sector is Expected to Witness Growth.

7. Are there any restraints impacting market growth?

Rising Demand for Sustainable and Consumer Preferences to Drive the Market; Demand for Premium and Recyclable Packaging.

8. Can you provide examples of recent developments in the market?

April 2024: Linde Plc announced that its subsidiary, White Martins, is set to construct and operate a second electrolyzer dedicated to producing green hydrogen for Brazil's southeast region. Upon commencing operations in 2025, White Martins' plant will provide green hydrogen to Cebrace, a glass manufacturer, to reduce emissions from their Jacareí glass melting furnaces. Situated adjacent to White Martins' current air separation facility in Jacareí, São Paulo, the new five-megawatt pressurized alkaline electrolyzer plant will harness renewable energy from nearby solar and wind projects, ensuring the production of independently certified green hydrogen.March 2024: O-I Brazil has launched a new initiative, "Recycle and Make a Goal," to boost glass recycling during soccer matches. This endeavor seeks to curtail waste and diminish emissions in the glass manufacturing process. In collaboration with São Paulo’s Municipal Department of Urban Cleaning, the startup Grupo Seiva, and the "Queen of Recycling" Work Cooperative, O-I Brazil has collected over 8,000 glass bottles for recycling. Further, the company highlighted plans to expand the initiative to cities housing O-I's factories, streamlining project logistics.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Container Glass Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Container Glass Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Container Glass Market?

To stay informed about further developments, trends, and reports in the Brazil Container Glass Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence