Key Insights

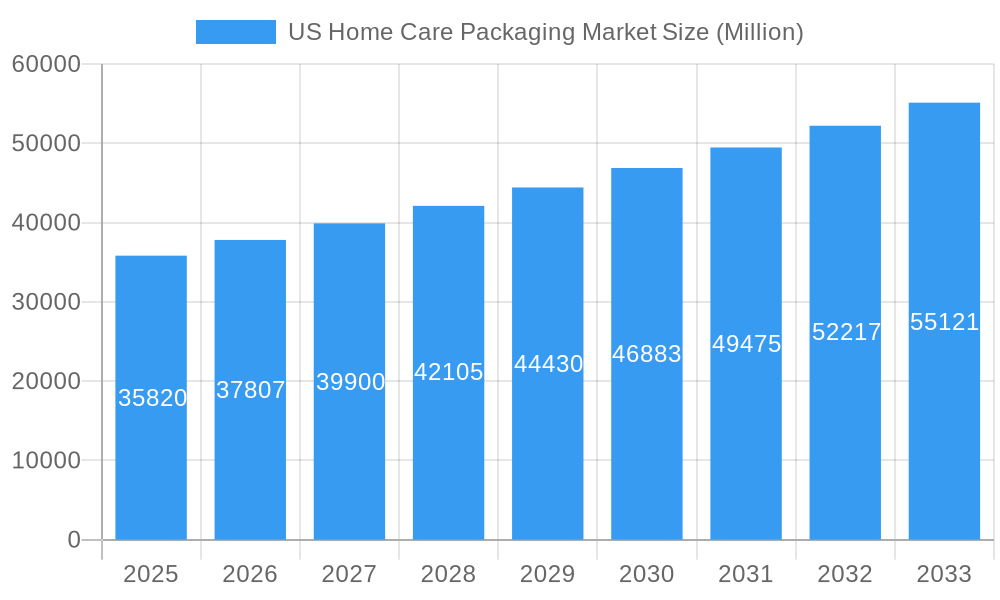

The US Home Care Packaging Market is poised for significant growth, projected to reach an estimated $35.82 billion in 2025. This expansion is fueled by a robust Compound Annual Growth Rate (CAGR) of 5.47%, indicating sustained demand and innovation within the sector. Key growth drivers include the increasing consumer preference for convenient and aesthetically pleasing packaging, a rising demand for sustainable packaging solutions, and the consistent innovation in product formulations that necessitate specialized packaging to maintain product integrity and shelf life. The market's dynamism is further shaped by evolving consumer lifestyles, with a greater emphasis on hygiene and cleanliness driving demand for home care products. Material innovation, particularly in plastics and paper-based solutions, is also a critical factor, offering manufacturers more versatile and environmentally conscious options.

US Home Care Packaging Market Market Size (In Billion)

The US Home Care Packaging Market encompasses a diverse range of product types and segments, reflecting the broad spectrum of home care needs. Bottles and cartons remain dominant product types, catering to liquid detergents, cleaning solutions, and air fresheners. However, pouches are gaining traction for their flexibility and reduced material usage, especially for concentrated products. Within home care products, dishwashing, laundry care, and insecticides represent substantial segments, with ongoing product development and new product launches stimulating packaging demand. Toiletries and polishes, while smaller segments, also contribute to the overall market expansion. Key players like Amcor PLC, Berry Global, and Winpak are actively investing in research and development to offer advanced packaging solutions, including child-resistant closures, barrier properties for extended shelf life, and premium designs that enhance brand appeal. This competitive landscape fosters innovation and ensures the market's ability to adapt to changing consumer preferences and regulatory requirements.

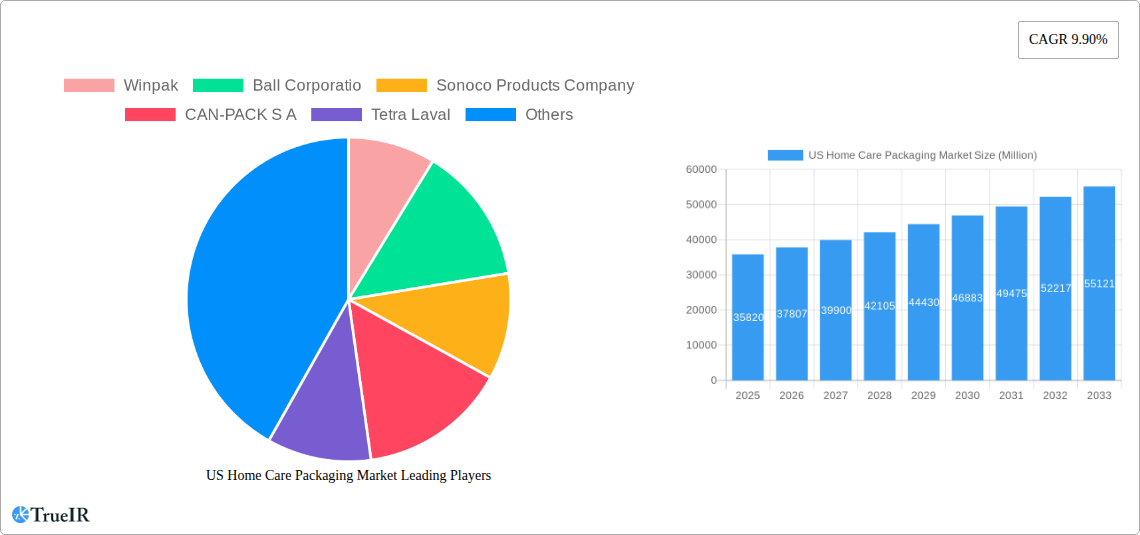

US Home Care Packaging Market Company Market Share

Here's the SEO-optimized report description for the US Home Care Packaging Market, designed for immediate use and maximum impact:

US Home Care Packaging Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the US Home Care Packaging Market, a critical sector supporting the daily needs of American households. With a market size projected to reach over $30 billion by 2025, this study delves into the intricate dynamics shaping its present and future. Covering the historical period from 2019 to 2024, the base year of 2025, and an extensive forecast period extending to 2033, this report is an indispensable resource for stakeholders seeking to understand market penetration, growth trajectories, and competitive strategies within this multi-billion dollar industry.

US Home Care Packaging Market Market Structure & Competitive Landscape

The US Home Care Packaging Market exhibits a moderately concentrated structure, with key players like Winpak, Ball Corporation, Sonoco Products Company, CAN-PACK S.A., Tetra Laval, Mondi Group, Amcor PLC, Prolamina Packaging, DS Smith Plc, Aptar Group, Berry Global, and Silgan Holdings vying for market share. Innovation remains a significant driver, fueled by advancements in sustainable materials and smart packaging solutions designed to enhance consumer experience and product safety. Regulatory impacts, particularly concerning environmental sustainability and material safety, are increasingly influencing manufacturing processes and material choices. The market also faces pressure from evolving product substitutes, such as concentrates and refillable systems, which can alter packaging demand. End-user segmentation reveals distinct packaging requirements across Dishwashing, Insecticides, Laundry Care, Toiletries, Polishes, and Air Care product categories. Mergers and acquisitions (M&A) are a notable trend, with an estimated volume of $5 billion in M&A activities over the historical period, indicating strategic consolidation and portfolio expansion. Concentration ratios in key sub-segments are estimated to be between 50% and 65%, highlighting the influence of dominant players.

US Home Care Packaging Market Market Trends & Opportunities

The US Home Care Packaging Market is poised for robust growth, with an estimated Compound Annual Growth Rate (CAGR) of 5.8% from 2025 to 2033, pushing the market value beyond $45 billion by the end of the forecast period. This expansion is driven by a confluence of evolving consumer preferences, technological advancements, and a dynamic competitive landscape. Consumers are increasingly prioritizing eco-friendly and sustainable packaging solutions, leading to a surge in demand for materials like recycled plastics, bio-based plastics, and responsibly sourced paperboard. This trend presents significant opportunities for packaging manufacturers to innovate and offer biodegradable, compostable, and recyclable options.

Technological shifts are revolutionizing packaging design and functionality. The integration of smart technologies, such as QR codes for enhanced product information and traceability, and anti-counterfeiting features, is gaining traction. Furthermore, advancements in material science are enabling lighter, more durable, and more efficient packaging formats, reducing material usage and transportation costs. The rise of e-commerce also necessitates specialized packaging that can withstand the rigors of shipping and handling while maintaining product integrity and shelf appeal.

The competitive dynamics within the US Home Care Packaging Market are characterized by a strong focus on product differentiation, cost optimization, and supply chain efficiency. Companies are investing heavily in research and development to create innovative packaging that not only protects the product but also enhances brand visibility and consumer convenience. Opportunities abound for players that can effectively address the growing demand for personalized and premium packaging experiences, particularly in segments like Toiletries and Air Care. The market penetration of sustainable packaging solutions is expected to exceed 70% by 2033, representing a significant shift from current levels.

Dominant Markets & Segments in US Home Care Packaging Market

The US Home Care Packaging Market is a vast and multifaceted sector, with certain segments demonstrating significant dominance and growth potential. In terms of material, Plastic packaging commands the largest market share, estimated to be over 60% of the total market value in 2025, driven by its versatility, durability, and cost-effectiveness. This dominance is particularly pronounced in the packaging of Dishwashing, Laundry Care, and Insecticides. Paper packaging, especially paperboard cartons and boxes, is a strong contender, projected to capture approximately 25% of the market share, owing to its recyclability and appeal for certain product categories like Toiletries and Air Care.

Among product types, Bottles are the most prevalent format, accounting for over 35% of the market value, largely due to their widespread use in liquid-based home care products such as detergents and cleaners. Pouches are experiencing rapid growth, with an estimated market share of 15% and a projected CAGR of 6.5%, driven by their convenience and reduced material usage for products like fabric softeners and dishwashing gels. Metal Cans hold a niche but significant share, particularly for aerosolized products like Insecticides and Polishes.

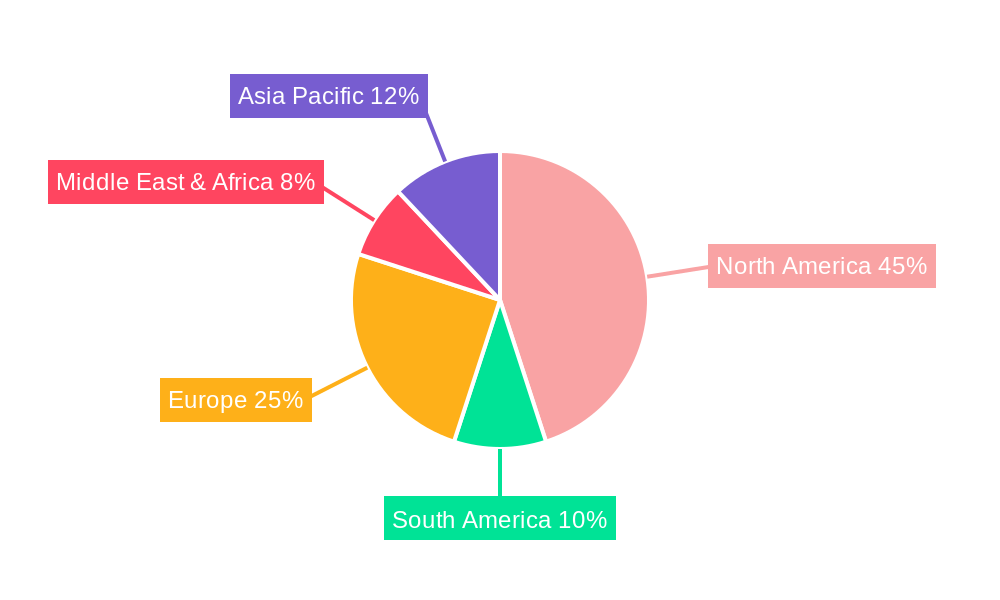

Geographically, the US East Coast and Midwest regions are anticipated to be the dominant markets, driven by high population density, robust retail infrastructure, and substantial consumer spending on home care products. Key growth drivers in these regions include an expanding middle class, increasing urbanization, and a strong emphasis on household cleanliness and hygiene. Government policies promoting recycling and waste reduction also play a crucial role in shaping material preferences and driving demand for sustainable packaging.

The Laundry Care and Dishwashing segments represent the largest end-use applications, collectively accounting for over 50% of the total home care packaging market value. This is attributed to the high volume of consumption for these essential household products. Toiletries, a segment characterized by a higher demand for premium and aesthetically pleasing packaging, is also a significant contributor, projected to grow at a CAGR of 5.5%. The Insecticides segment, while smaller, is critical and often relies on specialized packaging for safety and efficacy.

US Home Care Packaging Market Product Analysis

Product innovations within the US Home Care Packaging Market are primarily focused on enhancing sustainability, convenience, and functionality. The development of lighter-weight plastics with high recycled content, alongside advanced barrier properties, offers improved product protection and reduced environmental impact. Innovations in dispensing mechanisms, such as child-resistant closures and precision applicators, are crucial for product safety and user experience, particularly in Insecticides and Toiletries. Furthermore, advancements in paper-based packaging, including moisture-resistant coatings and innovative folding designs, are expanding its application scope beyond traditional uses. The competitive advantage lies in packaging that not only preserves product integrity but also actively communicates brand values of sustainability and innovation to the discerning consumer.

Key Drivers, Barriers & Challenges in US Home Care Packaging Market

The US Home Care Packaging Market is propelled by several key drivers. Technological advancements in material science and manufacturing processes are enabling the creation of more sustainable, cost-effective, and user-friendly packaging solutions. Growing consumer awareness and demand for eco-friendly products are pushing manufacturers towards recyclable, biodegradable, and compostable packaging options. Economic growth and rising disposable incomes in the US fuel higher consumption of home care products, directly impacting packaging demand. Policy-driven initiatives, such as extended producer responsibility schemes and plastic reduction targets, are also a significant impetus for change.

However, the market faces notable challenges. Stringent regulatory frameworks surrounding material safety, labeling, and recyclability can impose compliance costs and complexities for manufacturers. Fluctuations in raw material prices, particularly for plastics and metals, can impact production costs and profit margins. Supply chain disruptions, exacerbated by global events, pose a constant threat to the timely delivery of packaging materials and finished goods. Intense competitive pressure from both established players and new entrants necessitates continuous innovation and cost optimization. Furthermore, consumer perception and behavior regarding the disposal and recycling of packaging continue to be a barrier to achieving circular economy goals.

Growth Drivers in the US Home Care Packaging Market Market

The US Home Care Packaging Market is experiencing significant growth driven by several interconnected factors. Technological innovation is at the forefront, with advancements in sustainable materials like bio-plastics and recycled polymers, as well as the development of smart packaging with embedded traceability features. Economic factors, including consistent disposable income growth and an increasing demand for convenience and efficacy in household products, directly translate to higher packaging requirements. Regulatory tailwinds, such as government mandates promoting circular economy principles and single-use plastic reduction, are accelerating the adoption of eco-friendly packaging solutions. The growing awareness among consumers about environmental impact is a crucial driver, compelling brands to adopt packaging that aligns with their values, thus creating opportunities for companies offering sustainable alternatives.

Challenges Impacting US Home Care Packaging Market Growth

Despite the positive growth trajectory, the US Home Care Packaging Market confronts several impediments. The complexity and evolving nature of environmental regulations, including those related to recycling infrastructure and material composition, present significant compliance challenges and potential cost increases for manufacturers. Supply chain volatility, marked by raw material shortages and transportation bottlenecks, continues to disrupt production and delivery schedules, leading to increased operational costs and potential delays. Intense competition within the market, characterized by a drive for lower pricing and product differentiation, exerts constant pressure on profit margins. Furthermore, the significant upfront investment required for adopting new, sustainable packaging technologies and infrastructure can be a substantial barrier for smaller players.

Key Players Shaping the US Home Care Packaging Market Market

- Winpak

- Ball Corporation

- Sonoco Products Company

- CAN-PACK S.A.

- Tetra Laval

- Mondi Group

- Amcor PLC

- Prolamina Packaging

- DS Smith Plc

- Aptar Group

- Berry Global

- Silgan Holdings

Significant US Home Care Packaging Market Industry Milestones

- 2019: Increased investment in biodegradable and compostable packaging solutions by major manufacturers, driven by growing consumer environmental consciousness.

- 2020: Launch of innovative, lightweight plastic bottles with higher post-consumer recycled (PCR) content, reducing virgin plastic usage.

- 2021: Significant M&A activity, with several large players acquiring smaller, specialized sustainable packaging firms to expand their portfolios and technological capabilities.

- 2022: Introduction of advanced smart packaging features, including QR codes for enhanced product traceability and consumer engagement in cleaning product lines.

- 2023: Growing adoption of refillable and concentrated packaging formats across various home care product categories, signaling a shift towards waste reduction.

- 2024 (Expected): Further advancements in paper-based packaging, including improved moisture resistance and barrier properties, expanding their applicability in traditionally plastic-dominated segments.

Future Outlook for US Home Care Packaging Market Market

The US Home Care Packaging Market is set for continued expansion, driven by an unwavering focus on sustainability, technological innovation, and evolving consumer demands. The forecast period anticipates a substantial increase in the adoption of advanced materials, including biodegradable polymers and high-percentage recycled content plastics, alongside continued innovation in paper-based and composite packaging solutions. Opportunities will flourish for companies that can offer integrated solutions, encompassing smart packaging features for enhanced consumer interaction and supply chain efficiency. The market's future will be defined by its ability to navigate evolving regulatory landscapes and capitalize on the growing consumer preference for environmentally responsible products, projecting sustained growth and market value exceeding $50 billion by 2033.

US Home Care Packaging Market Segmentation

-

1. Material

- 1.1. Plastic

- 1.2. Paper

- 1.3. Metal

- 1.4. Glass

-

2. Product Type

- 2.1. Bottles

- 2.2. Metal Cans

- 2.3. Cartons

- 2.4. Jars

- 2.5. Pouches

-

3. Homecare Products

- 3.1. Dishwashing

- 3.2. Insecticides

- 3.3. Laundry Care

- 3.4. Toiletries

- 3.5. Polishes

- 3.6. Air Care

US Home Care Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Home Care Packaging Market Regional Market Share

Geographic Coverage of US Home Care Packaging Market

US Home Care Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.47% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Product Innovation

- 3.2.2 Differentiation

- 3.2.3 and Branding; Rising Per Capita Income Positively Impacting Purchase Power

- 3.3. Market Restrains

- 3.3.1. Fluctuating Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Increased Demand for Household Cleaning Products Owing to the Pandemic

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Home Care Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.2. Paper

- 5.1.3. Metal

- 5.1.4. Glass

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Bottles

- 5.2.2. Metal Cans

- 5.2.3. Cartons

- 5.2.4. Jars

- 5.2.5. Pouches

- 5.3. Market Analysis, Insights and Forecast - by Homecare Products

- 5.3.1. Dishwashing

- 5.3.2. Insecticides

- 5.3.3. Laundry Care

- 5.3.4. Toiletries

- 5.3.5. Polishes

- 5.3.6. Air Care

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America US Home Care Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Plastic

- 6.1.2. Paper

- 6.1.3. Metal

- 6.1.4. Glass

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Bottles

- 6.2.2. Metal Cans

- 6.2.3. Cartons

- 6.2.4. Jars

- 6.2.5. Pouches

- 6.3. Market Analysis, Insights and Forecast - by Homecare Products

- 6.3.1. Dishwashing

- 6.3.2. Insecticides

- 6.3.3. Laundry Care

- 6.3.4. Toiletries

- 6.3.5. Polishes

- 6.3.6. Air Care

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. South America US Home Care Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Plastic

- 7.1.2. Paper

- 7.1.3. Metal

- 7.1.4. Glass

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Bottles

- 7.2.2. Metal Cans

- 7.2.3. Cartons

- 7.2.4. Jars

- 7.2.5. Pouches

- 7.3. Market Analysis, Insights and Forecast - by Homecare Products

- 7.3.1. Dishwashing

- 7.3.2. Insecticides

- 7.3.3. Laundry Care

- 7.3.4. Toiletries

- 7.3.5. Polishes

- 7.3.6. Air Care

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Europe US Home Care Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Plastic

- 8.1.2. Paper

- 8.1.3. Metal

- 8.1.4. Glass

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Bottles

- 8.2.2. Metal Cans

- 8.2.3. Cartons

- 8.2.4. Jars

- 8.2.5. Pouches

- 8.3. Market Analysis, Insights and Forecast - by Homecare Products

- 8.3.1. Dishwashing

- 8.3.2. Insecticides

- 8.3.3. Laundry Care

- 8.3.4. Toiletries

- 8.3.5. Polishes

- 8.3.6. Air Care

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Middle East & Africa US Home Care Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Plastic

- 9.1.2. Paper

- 9.1.3. Metal

- 9.1.4. Glass

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Bottles

- 9.2.2. Metal Cans

- 9.2.3. Cartons

- 9.2.4. Jars

- 9.2.5. Pouches

- 9.3. Market Analysis, Insights and Forecast - by Homecare Products

- 9.3.1. Dishwashing

- 9.3.2. Insecticides

- 9.3.3. Laundry Care

- 9.3.4. Toiletries

- 9.3.5. Polishes

- 9.3.6. Air Care

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Asia Pacific US Home Care Packaging Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Plastic

- 10.1.2. Paper

- 10.1.3. Metal

- 10.1.4. Glass

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Bottles

- 10.2.2. Metal Cans

- 10.2.3. Cartons

- 10.2.4. Jars

- 10.2.5. Pouches

- 10.3. Market Analysis, Insights and Forecast - by Homecare Products

- 10.3.1. Dishwashing

- 10.3.2. Insecticides

- 10.3.3. Laundry Care

- 10.3.4. Toiletries

- 10.3.5. Polishes

- 10.3.6. Air Care

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Winpak

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ball Corporatio

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sonoco Products Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CAN-PACK S A

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Tetra Laval

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mondi Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Amcor PLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Prolamina Packaging

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DS Smith Plc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Aptar Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Berry Global

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Silgan Holdings

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Winpak

List of Figures

- Figure 1: Global US Home Care Packaging Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America US Home Care Packaging Market Revenue (undefined), by Material 2025 & 2033

- Figure 3: North America US Home Care Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 4: North America US Home Care Packaging Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 5: North America US Home Care Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America US Home Care Packaging Market Revenue (undefined), by Homecare Products 2025 & 2033

- Figure 7: North America US Home Care Packaging Market Revenue Share (%), by Homecare Products 2025 & 2033

- Figure 8: North America US Home Care Packaging Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America US Home Care Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America US Home Care Packaging Market Revenue (undefined), by Material 2025 & 2033

- Figure 11: South America US Home Care Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 12: South America US Home Care Packaging Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 13: South America US Home Care Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: South America US Home Care Packaging Market Revenue (undefined), by Homecare Products 2025 & 2033

- Figure 15: South America US Home Care Packaging Market Revenue Share (%), by Homecare Products 2025 & 2033

- Figure 16: South America US Home Care Packaging Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: South America US Home Care Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe US Home Care Packaging Market Revenue (undefined), by Material 2025 & 2033

- Figure 19: Europe US Home Care Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 20: Europe US Home Care Packaging Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 21: Europe US Home Care Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Europe US Home Care Packaging Market Revenue (undefined), by Homecare Products 2025 & 2033

- Figure 23: Europe US Home Care Packaging Market Revenue Share (%), by Homecare Products 2025 & 2033

- Figure 24: Europe US Home Care Packaging Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Europe US Home Care Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa US Home Care Packaging Market Revenue (undefined), by Material 2025 & 2033

- Figure 27: Middle East & Africa US Home Care Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 28: Middle East & Africa US Home Care Packaging Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 29: Middle East & Africa US Home Care Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Middle East & Africa US Home Care Packaging Market Revenue (undefined), by Homecare Products 2025 & 2033

- Figure 31: Middle East & Africa US Home Care Packaging Market Revenue Share (%), by Homecare Products 2025 & 2033

- Figure 32: Middle East & Africa US Home Care Packaging Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East & Africa US Home Care Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific US Home Care Packaging Market Revenue (undefined), by Material 2025 & 2033

- Figure 35: Asia Pacific US Home Care Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 36: Asia Pacific US Home Care Packaging Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 37: Asia Pacific US Home Care Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Asia Pacific US Home Care Packaging Market Revenue (undefined), by Homecare Products 2025 & 2033

- Figure 39: Asia Pacific US Home Care Packaging Market Revenue Share (%), by Homecare Products 2025 & 2033

- Figure 40: Asia Pacific US Home Care Packaging Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Asia Pacific US Home Care Packaging Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Home Care Packaging Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 2: Global US Home Care Packaging Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 3: Global US Home Care Packaging Market Revenue undefined Forecast, by Homecare Products 2020 & 2033

- Table 4: Global US Home Care Packaging Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global US Home Care Packaging Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 6: Global US Home Care Packaging Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 7: Global US Home Care Packaging Market Revenue undefined Forecast, by Homecare Products 2020 & 2033

- Table 8: Global US Home Care Packaging Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States US Home Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada US Home Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico US Home Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global US Home Care Packaging Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 13: Global US Home Care Packaging Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 14: Global US Home Care Packaging Market Revenue undefined Forecast, by Homecare Products 2020 & 2033

- Table 15: Global US Home Care Packaging Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Brazil US Home Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Argentina US Home Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America US Home Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global US Home Care Packaging Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 20: Global US Home Care Packaging Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 21: Global US Home Care Packaging Market Revenue undefined Forecast, by Homecare Products 2020 & 2033

- Table 22: Global US Home Care Packaging Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 23: United Kingdom US Home Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Germany US Home Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: France US Home Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Italy US Home Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Spain US Home Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Russia US Home Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Benelux US Home Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Nordics US Home Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe US Home Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global US Home Care Packaging Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 33: Global US Home Care Packaging Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 34: Global US Home Care Packaging Market Revenue undefined Forecast, by Homecare Products 2020 & 2033

- Table 35: Global US Home Care Packaging Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Turkey US Home Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Israel US Home Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: GCC US Home Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: North Africa US Home Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: South Africa US Home Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa US Home Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Global US Home Care Packaging Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 43: Global US Home Care Packaging Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 44: Global US Home Care Packaging Market Revenue undefined Forecast, by Homecare Products 2020 & 2033

- Table 45: Global US Home Care Packaging Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: China US Home Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: India US Home Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Japan US Home Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: South Korea US Home Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: ASEAN US Home Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 51: Oceania US Home Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific US Home Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Home Care Packaging Market?

The projected CAGR is approximately 5.47%.

2. Which companies are prominent players in the US Home Care Packaging Market?

Key companies in the market include Winpak, Ball Corporatio, Sonoco Products Company, CAN-PACK S A, Tetra Laval, Mondi Group, Amcor PLC, Prolamina Packaging, DS Smith Plc, Aptar Group, Berry Global, Silgan Holdings.

3. What are the main segments of the US Home Care Packaging Market?

The market segments include Material, Product Type, Homecare Products.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Product Innovation. Differentiation. and Branding; Rising Per Capita Income Positively Impacting Purchase Power.

6. What are the notable trends driving market growth?

Increased Demand for Household Cleaning Products Owing to the Pandemic.

7. Are there any restraints impacting market growth?

Fluctuating Raw Material Prices.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Home Care Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Home Care Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Home Care Packaging Market?

To stay informed about further developments, trends, and reports in the US Home Care Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence