Key Insights

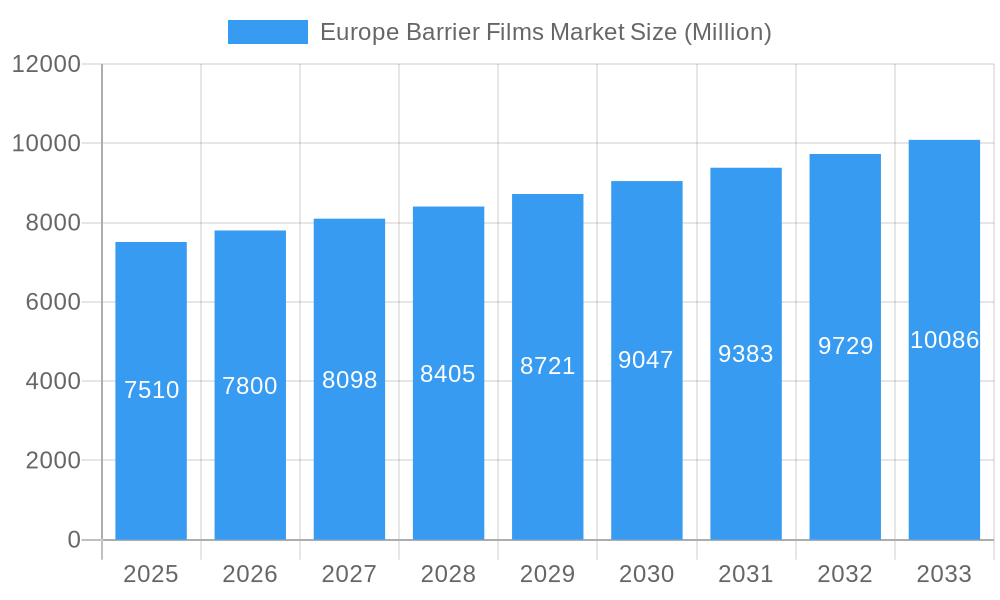

The Europe Barrier Films Market is poised for significant expansion, currently valued at an estimated 7510 Million in 2025. This growth is propelled by a projected Compound Annual Growth Rate (CAGR) of 3.84% over the forecast period of 2025-2033, indicating a robust and sustained upward trajectory. A primary driver for this market is the escalating demand for enhanced product protection and extended shelf life across various end-user industries. The increasing consumer awareness regarding food safety and the need for superior packaging solutions in the pharmaceutical and medical sectors are further fueling this demand. Furthermore, the burgeoning trend towards sustainable and eco-friendly packaging materials, coupled with advancements in film technology that offer superior barrier properties against moisture, oxygen, and light, are key enablers of market growth. The shift towards flexible packaging solutions, offering cost-effectiveness and versatility, is also a substantial contributor to the market's positive outlook.

Europe Barrier Films Market Market Size (In Billion)

The market is segmented across a diverse range of packaging products, including essential items like bags and pouches, stretch and shrink wrap films, and tray lidding films, which are critical for preserving product integrity. Material innovation plays a crucial role, with polyethylene, BOPET, and polypropylene (including CPP and BOPP) being dominant. Polyvinyl chloride and other advanced materials like EVOH, polystyrene (PS), and nylon are also gaining traction for specialized applications requiring high barrier performance. The food and pet food industry remains the largest consumer, followed closely by the beverage sector. However, the pharmaceutical and medical, and personal and home care industries are demonstrating substantial growth due to stringent regulatory requirements and the need for sterile, protective packaging. Europe, with its strong emphasis on quality, innovation, and regulatory compliance, represents a key region for barrier film manufacturers and suppliers, with countries like the United Kingdom, Germany, and France leading the adoption of advanced barrier film technologies.

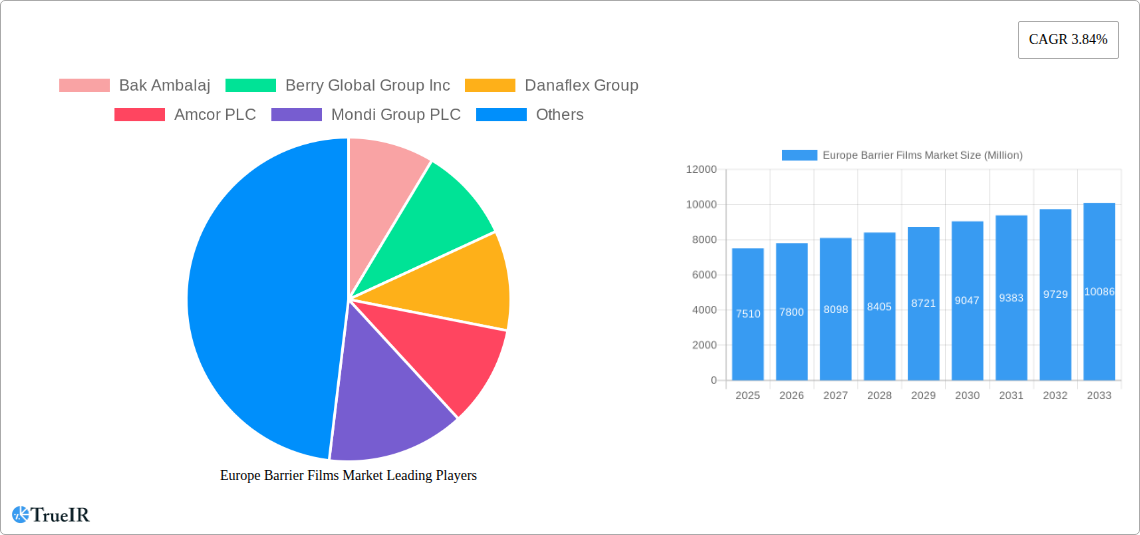

Europe Barrier Films Market Company Market Share

Europe Barrier Films Market: Comprehensive Analysis and Future Outlook (2019–2033)

Gain unparalleled insights into the dynamic Europe barrier films market with this in-depth report. Covering the period from 2019 to 2033, with a base year of 2025, this report provides a detailed analysis of market structure, trends, opportunities, and competitive landscape. We delve into critical segments including packaging products, materials, and end-user industries, offering a strategic roadmap for stakeholders navigating this evolving sector. The global barrier films market is projected to reach $xx billion by 2033, with Europe representing a significant share driven by increasing demand for extended shelf-life products and sustainable packaging solutions.

Europe Barrier Films Market Market Structure & Competitive Landscape

The Europe barrier films market exhibits a moderately concentrated structure, with a few large players holding significant market share, alongside a robust presence of specialized manufacturers. Innovation remains a key differentiator, fueled by advancements in material science and processing technologies aimed at enhancing barrier properties, reducing material usage, and improving recyclability. Regulatory frameworks, particularly those focusing on food safety, medical device packaging, and environmental sustainability, play a crucial role in shaping product development and market entry strategies. Product substitutes, such as rigid packaging and metal cans, are present but are increasingly challenged by the versatility and performance of advanced barrier films. End-user segmentation reveals a strong reliance on the food and beverage sector, followed by pharmaceuticals and personal care, each with distinct barrier requirements. Mergers and acquisitions (M&A) are active, indicating a consolidation trend as companies seek to expand their product portfolios, geographical reach, and technological capabilities. For instance, recent M&A activities have focused on integrating flexographic printing capabilities and expanding into niche pharmaceutical packaging solutions. The estimated M&A volume in the past two years has been approximately $xxx million, underscoring the strategic importance of inorganic growth in this market.

Europe Barrier Films Market Market Trends & Opportunities

The Europe barrier films market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately xx% from 2025 to 2033. This growth is propelled by several overarching trends. Firstly, the increasing consumer demand for convenience, longer shelf-life products, and reduced food waste is a primary market driver. Barrier films play a pivotal role in extending the freshness and safety of packaged goods, making them indispensable across the food and beverage industries. Secondly, technological advancements in material science are leading to the development of high-performance barrier films with enhanced oxygen, moisture, and aroma barrier properties. These innovations enable the use of thinner films, reducing material consumption and costs, while also improving product protection. The rise of sustainable packaging solutions, including recyclable and compostable barrier films, presents a significant opportunity. Regulatory pressures and growing environmental awareness are pushing manufacturers to invest in and adopt these eco-friendly alternatives. The European Union's Circular Economy Action Plan, for example, is accelerating the transition towards more sustainable packaging materials.

Moreover, the pharmaceutical and medical sectors are witnessing increased adoption of barrier films for sterile packaging, drug delivery systems, and medical devices, driven by stringent quality and safety standards. The personal and home care segments also contribute to market growth, with demand for aesthetically pleasing and functional packaging that protects product integrity. The competitive landscape is characterized by intense innovation, with companies focusing on developing multi-layer films, specialized coatings, and advanced printing technologies to meet specific end-user needs. Opportunities also lie in the development of smart and active packaging solutions that can monitor product freshness or extend shelf life through embedded technologies. The market penetration rate for advanced barrier films is expected to rise significantly as end-users increasingly recognize their value proposition in terms of product preservation, cost savings, and brand differentiation. The estimated market size for Europe's barrier films is expected to reach over $xx billion by 2033.

Dominant Markets & Segments in Europe Barrier Films Market

The Europe barrier films market is characterized by distinct regional and segmental dominance. Geographically, Germany emerges as a leading market, driven by its robust industrial base, high consumer spending, and stringent quality standards across its key end-user industries. The food and beverage industry holds the largest share in terms of end-user applications, consistently demanding high-performance barrier films for products ranging from fresh produce and dairy to processed foods and beverages. Within this segment, Bags and Pouches are the dominant packaging product, offering flexibility, convenience, and excellent barrier protection for a wide array of consumer goods.

Material-wise, Polyethylene (PE) and Polypropylene (CPP and BOPP) collectively represent the most utilized materials due to their cost-effectiveness, versatility, and good barrier properties, especially when used in multi-layer structures. However, BOPET films are gaining traction for their excellent stiffness, clarity, and gas barrier capabilities, particularly in demanding applications. The increasing focus on sustainability is also boosting the demand for Other Materials like EVOH (Ethylene Vinyl Alcohol) for their superior gas barrier properties in oxygen-sensitive applications, and recyclable mono-material solutions.

In terms of end-user industries, the Food and Pet Food sector is the primary consumer, followed by the Beverages segment. The Pharmaceutical and Medical industry, while smaller in volume, represents a high-value segment due to the critical need for advanced barrier properties to ensure product safety, sterility, and efficacy. The Personal and Home Care sector also contributes significantly, driven by demand for visually appealing and protective packaging.

Key growth drivers for dominance include:

- Infrastructure: Advanced manufacturing facilities and efficient logistics networks within key European countries.

- Policies: Favorable government regulations supporting food safety, medical device packaging standards, and the push towards a circular economy, encouraging sustainable barrier film solutions.

- Consumer Preferences: Growing demand for convenience, longer shelf-life products, and sustainable packaging options.

- Technological Advancements: Continuous innovation in multi-layer extrusion, co-extrusion, and coating technologies to enhance barrier performance and recyclability.

Europe Barrier Films Market Product Analysis

Product innovation in the Europe barrier films market centers on enhancing barrier performance, sustainability, and functionality. Manufacturers are continuously developing advanced multi-layer films and coatings to achieve superior protection against oxygen, moisture, and aroma permeation, crucial for extending product shelf life in the food, beverage, and pharmaceutical sectors. The integration of recyclable mono-material structures, replacing traditional multi-material laminates, is a significant trend, addressing the growing demand for environmentally friendly packaging. Furthermore, innovations in active and intelligent barrier films, which can actively extend shelf life or monitor product freshness, are gaining traction, offering competitive advantages through enhanced product safety and consumer engagement.

Key Drivers, Barriers & Challenges in Europe Barrier Films Market

Key Drivers:

- Technological Advancements: Innovations in material science and processing, leading to improved barrier properties, thinner films, and enhanced recyclability.

- Growing Demand for Extended Shelf Life: Consumer preference for longer-lasting food and beverage products, reducing waste and increasing convenience.

- Stringent Food Safety and Medical Regulations: The need for high-performance barrier films to comply with strict regulatory requirements for product integrity and safety.

- Sustainability Initiatives: Increasing focus on eco-friendly packaging solutions, driving demand for recyclable, compostable, and biodegradable barrier films.

Barriers & Challenges:

- Supply Chain Volatility: Fluctuations in raw material prices and availability, particularly for specialized polymers and additives, can impact production costs and lead times.

- Regulatory Complexity: Navigating diverse and evolving environmental and food contact regulations across different European countries can be challenging for manufacturers.

- Competitive Pressures: Intense competition from both established players and new entrants, leading to price pressures and the need for continuous innovation.

- Investment in Recycling Infrastructure: The need for significant investment in advanced recycling technologies and infrastructure to effectively handle complex multi-layer barrier films.

Growth Drivers in the Europe Barrier Films Market Market

The Europe barrier films market is propelled by several key growth drivers. Technological innovation in multi-layer co-extrusion and advanced coating techniques allows for the creation of films with superior barrier properties against oxygen and moisture, essential for extending the shelf life of food and pharmaceutical products. This directly addresses the growing consumer and industry demand for reduced spoilage and waste. Furthermore, the increasing emphasis on sustainability, driven by stringent EU regulations and consumer preference for eco-friendly packaging, is fostering the development and adoption of recyclable and compostable barrier films. Economic factors, such as rising disposable incomes and a growing middle class in certain European regions, contribute to higher consumption of packaged goods, thereby boosting demand for barrier films.

Challenges Impacting Europe Barrier Films Market Growth

Several challenges impact the growth of the Europe barrier films market. Regulatory complexities, particularly regarding food contact materials and the upcoming EU directives on packaging waste and single-use plastics, necessitate continuous adaptation and investment in compliance. Supply chain disruptions, influenced by global geopolitical events and raw material availability, can lead to price volatility and affect production schedules. Competitive pressures are intense, with both global conglomerates and specialized niche players vying for market share, often leading to pricing challenges. Furthermore, the transition to a circular economy requires substantial investment in advanced recycling technologies and infrastructure to handle the complex material compositions of many barrier films, a hurdle that needs to be overcome for true sustainability.

Key Players Shaping the Europe Barrier Films Market Market

- Bak Ambalaj

- Berry Global Group Inc

- Danaflex Group

- Amcor PLC

- Mondi Group PLC

- Wipak Oy (Wihuri Oy)

- adapa Holding GsembH

- Gualapack

- Di Mauro Officine Grafiche SpA

- Coveris Holdings

- Sudpack Verpackungen

- CDM Sp z o o

- Cellografica Gerosa SpA

- Constantia Flexibles

- UFLEX Limited

- Sealed Air Corporation

- Huhtamaki Oyj

- Toppan Inc

Significant Europe Barrier Films Market Industry Milestones

- March 2023: Constantia announced the acquisition of Drukpol Flexo, a well-established player in the flexible packaging market. This acquisition enhances Constantia's flexo printing capabilities and expands its customer base and cost-competitiveness.

- March 2023: Toppan established a new facility in Most, Czech Republic, intending to begin mass production of transparent barrier films by the end of 2024. This move strengthens Toppan's global supply capacity with manufacturing bases in Japan, North America, and Europe.

- April 2023: Gualapack Spa announced the acquisition of Print & Packaging Farma, a strategic move to expand its product and service portfolio for pharmaceutical and nutraceutical clients.

Future Outlook for Europe Barrier Films Market Market

The future outlook for the Europe barrier films market is exceptionally positive, driven by sustained demand for high-performance, sustainable packaging solutions. Growth catalysts include ongoing innovation in advanced materials that offer superior barrier properties while being recyclable, aligning with circular economy goals. The expanding pharmaceutical and medical sectors, coupled with the continuous need for extended shelf-life in the food and beverage industries, will further fuel market expansion. Opportunities lie in the development of smart and active packaging technologies that enhance product safety and consumer experience. Strategic collaborations and investments in R&D focused on material science and processing technologies will be crucial for market leaders to maintain a competitive edge and capitalize on the evolving landscape. The market is poised for robust growth, with an estimated CAGR of xx% between 2025 and 2033, reaching a projected market value of $xx billion by the end of the forecast period.

Europe Barrier Films Market Segmentation

-

1. Packaging Product

- 1.1. Bags and Pouches

- 1.2. Stretch and Shrink Wrap Films

- 1.3. Tray Lidding Films

- 1.4. Wrapping Films and Forming Webs

- 1.5. Blister Base Films

-

2. Material

- 2.1. Polyethylene

- 2.2. BOPET

- 2.3. Polypropylene (CPP and BOPP)

- 2.4. Polyvinyl Chloride

- 2.5. Other Material (EVOH, Polystyrene (PS), and Nylon)

-

3. End user Industry

- 3.1. Food and Pet Food

- 3.2. Beverages

- 3.3. Pharmaceutical and Medical

- 3.4. Personal and Home Care

- 3.5. Other End-user Industries

Europe Barrier Films Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

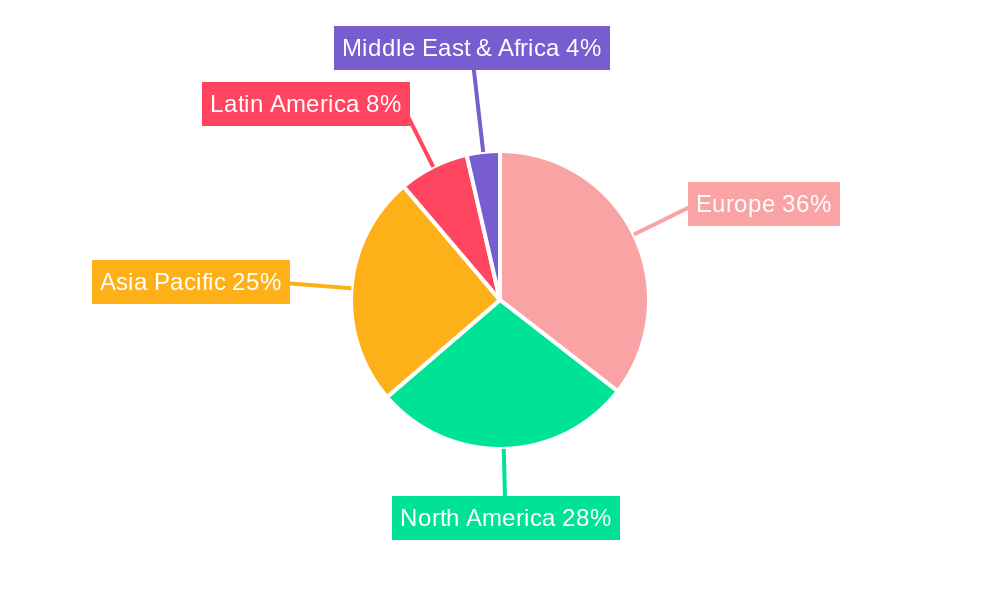

Europe Barrier Films Market Regional Market Share

Geographic Coverage of Europe Barrier Films Market

Europe Barrier Films Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Replacement of Rigid Packaging Formats; Increasing Biodegradable Barrier Films

- 3.3. Market Restrains

- 3.3.1. Environmental Legislation for Recycling

- 3.4. Market Trends

- 3.4.1. Food and Pet Food Markets to Register Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Barrier Films Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Packaging Product

- 5.1.1. Bags and Pouches

- 5.1.2. Stretch and Shrink Wrap Films

- 5.1.3. Tray Lidding Films

- 5.1.4. Wrapping Films and Forming Webs

- 5.1.5. Blister Base Films

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Polyethylene

- 5.2.2. BOPET

- 5.2.3. Polypropylene (CPP and BOPP)

- 5.2.4. Polyvinyl Chloride

- 5.2.5. Other Material (EVOH, Polystyrene (PS), and Nylon)

- 5.3. Market Analysis, Insights and Forecast - by End user Industry

- 5.3.1. Food and Pet Food

- 5.3.2. Beverages

- 5.3.3. Pharmaceutical and Medical

- 5.3.4. Personal and Home Care

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Packaging Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bak Ambalaj

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Berry Global Group Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Danaflex Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amcor PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mondi Group PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Wipak Oy (Wihuri Oy)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 adapa Holding GsembH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Gualapack

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Di Mauro Officine Grafiche SpA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Coveris Holdings

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Sudpack Verpackungen

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 CDM Sp z o o

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Cellografica Gerosa SpA

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Constantia Flexibles

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 UFLEX Limited

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Sealed Air Corporation

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Huhtamaki Oyj

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Toppan Inc *List Not Exhaustive

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.1 Bak Ambalaj

List of Figures

- Figure 1: Europe Barrier Films Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Barrier Films Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Barrier Films Market Revenue Million Forecast, by Packaging Product 2020 & 2033

- Table 2: Europe Barrier Films Market Revenue Million Forecast, by Material 2020 & 2033

- Table 3: Europe Barrier Films Market Revenue Million Forecast, by End user Industry 2020 & 2033

- Table 4: Europe Barrier Films Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Barrier Films Market Revenue Million Forecast, by Packaging Product 2020 & 2033

- Table 6: Europe Barrier Films Market Revenue Million Forecast, by Material 2020 & 2033

- Table 7: Europe Barrier Films Market Revenue Million Forecast, by End user Industry 2020 & 2033

- Table 8: Europe Barrier Films Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Barrier Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Barrier Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Barrier Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Barrier Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Barrier Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Barrier Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Barrier Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Barrier Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Barrier Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Barrier Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Barrier Films Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Barrier Films Market?

The projected CAGR is approximately 3.84%.

2. Which companies are prominent players in the Europe Barrier Films Market?

Key companies in the market include Bak Ambalaj, Berry Global Group Inc, Danaflex Group, Amcor PLC, Mondi Group PLC, Wipak Oy (Wihuri Oy), adapa Holding GsembH, Gualapack, Di Mauro Officine Grafiche SpA, Coveris Holdings, Sudpack Verpackungen, CDM Sp z o o, Cellografica Gerosa SpA, Constantia Flexibles, UFLEX Limited, Sealed Air Corporation, Huhtamaki Oyj, Toppan Inc *List Not Exhaustive.

3. What are the main segments of the Europe Barrier Films Market?

The market segments include Packaging Product, Material, End user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.51 Million as of 2022.

5. What are some drivers contributing to market growth?

Replacement of Rigid Packaging Formats; Increasing Biodegradable Barrier Films.

6. What are the notable trends driving market growth?

Food and Pet Food Markets to Register Significant Growth.

7. Are there any restraints impacting market growth?

Environmental Legislation for Recycling.

8. Can you provide examples of recent developments in the market?

March 2023: Constantia announced that it had acquired the Clean organization Drukpol Flexo. Drukpol Flexo is a well-established player in the Clean, flexible packaging market. This acquisition further enhanced the Gathering's flexo printing capabilities following the acquisitions of Propak and FFP. In addition, it expands the Group's local customer base and increases its cost-competitiveness.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Barrier Films Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Barrier Films Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Barrier Films Market?

To stay informed about further developments, trends, and reports in the Europe Barrier Films Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence